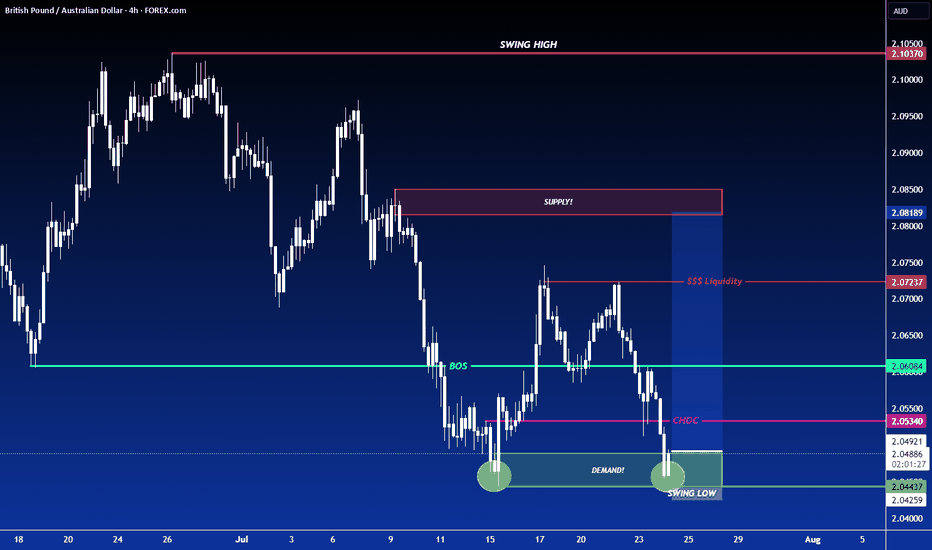

LONG ON GBP/AUDGA has given us a CHOC (change of character) to the upside after making a new low.

Price has since pulled back to the demand area that created that change leaving us with a possible double bottom forming.

I expect GA to rise to sweep buy side liquidity at the equal highs then reaching the previous supply level / previous High.

Looking to catch 200-300 pips.

Longsignal

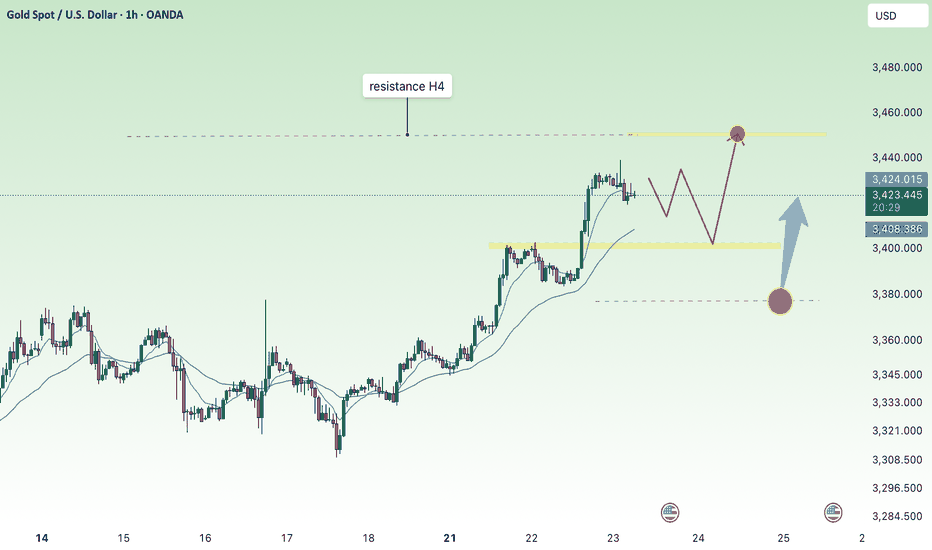

Continued price increase - gold increased to 3450⭐️GOLDEN INFORMATION:

Gold prices climbed for a second straight session on Tuesday, gaining over 0.9% as sliding US Treasury yields continued to weigh on the US Dollar. Investors remained cautious amid lingering uncertainty over upcoming US trade agreements. At the time of writing, XAU/USD is trading at $3,427, having rebounded from an intraday low of $3,383.

Yields on US government bonds have now declined for five consecutive days, pressuring the Greenback—reflected in the softer US Dollar Index (DXY). Heightened speculation that the US and European Union (EU) may fail to secure a trade agreement before the looming August 1 deadline has intensified demand for safe-haven assets. As a result, gold surged to a five-week high of $3,433.

⭐️Personal comments NOVA:

Gold price continues to increase, FOMO from the market is good and positive. Heading towards 3450

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3449- 3451 SL 3456

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3380-$3378 SL $3373

TP1: $3390

TP2: $3400

TP3: $3415

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

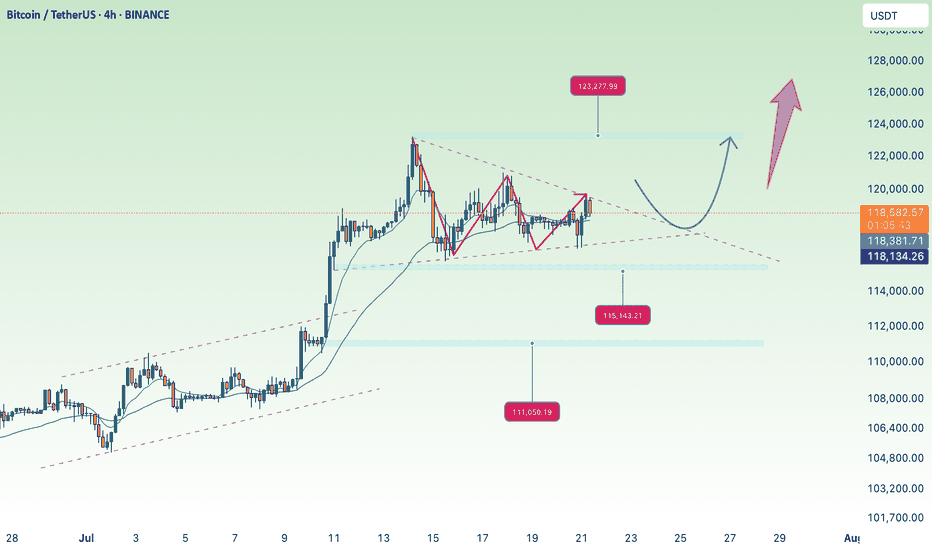

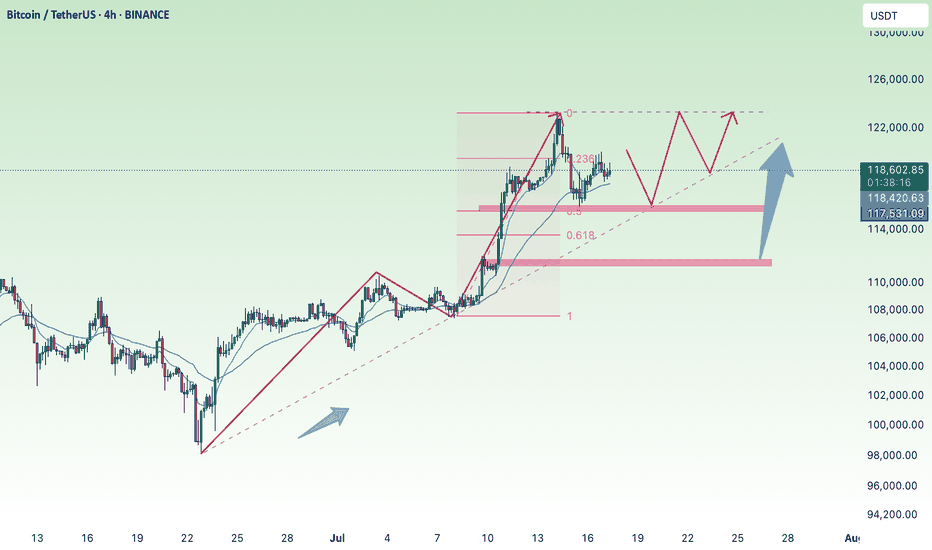

accumulate, continue to aim for new ATH💎 Update Plan BTC (July 21)

Notable news about BTC

CEO of Charles Schwab, Rick Wurster, said the company plans to deploy Bitcoin and Ethereum transactions for customers.

This company aims to compete with Coinbase, where customers buy BTC.

This development takes place after the progress of cryptocurrencies when President Donald Trump signs the Genius bill into law.

In an interview on Friday, the CEO of Charles Schwab, Rick Wurster, said the company plans to launch Bitcoin (BTC) and Ethereum (ETH) to compete with Coinbase cryptocurrencies. The move took place after President Donald Trump signed the Genius bill, officially confirming the first cryptocurrency law in the United States.

Technical analysis angle

🟠 Main trend:

BTC is sideway accumulated in the amplitude of 117,000 - 122,000 after a sharp increase.

The chart shows the descending triangular model - a potential sign for Breakout.

🔍 important areas:

Resist:

122,000 - 122,700: Strong resistance area, fibonacci mold 1.0.

130,600 - 131,100: The expected area if Breakout is successful (Fibonacci extension 1.618).

Support:

116,000: Support close, coincide with EMA 200.

111,100: The support area is stronger if the current support breaks.

✅ Scenario 1 - Rise:

If the price turns from supporting 116k → Test the resistance area of 122k.

If the 122K break is definitive, the next goal is 130k - 131k.

❌ Scenario 2 - Discount:

If the 116k area is lost, the possibility of falling will fall more deeply at 111k.

This is also the strong EMA area Fibo 0.382 of the previous wave.

Please follow the channel to receive the latest and continuous updates on XauUSD, currency and BTC

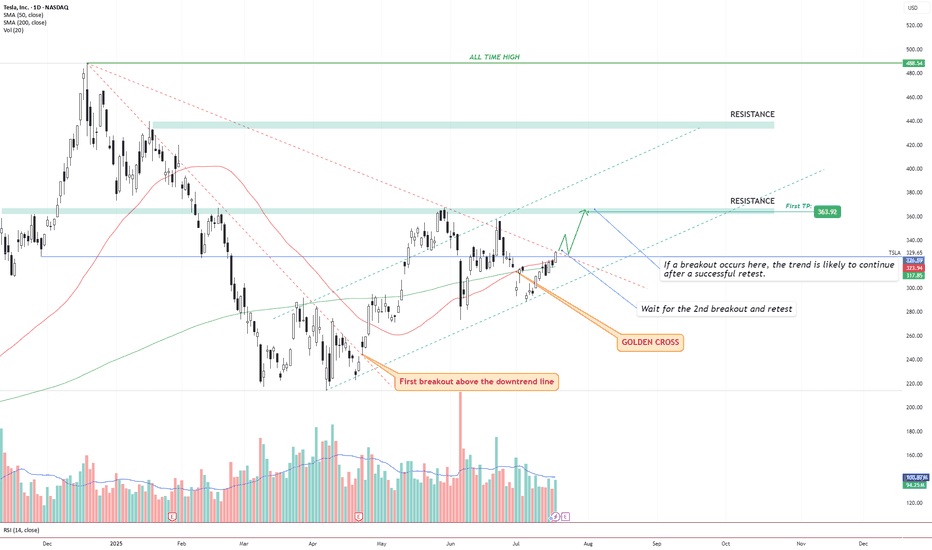

TSLA – Golden Cross + Dual Breakout Structure Targeting $363 andIdea Text:

Tesla NASDAQ:TSLA has recently printed a powerful Golden Cross , where the 50 SMA has crossed above the 200 SMA — signaling a potential long-term bullish shift in trend.

But price action shows more:

We’re observing a dual-breakout structure, where the first breakout above the long-term downtrend line has already occurred (see orange label), and the price is now approaching a critical horizontal resistance zone.

Let’s break it down step-by-step:

🔸 Step 1: Golden Cross

The 50 SMA crossed above 200 SMA — a classic signal for trend reversal. This often attracts institutional interest, especially if followed by breakout confirmation.

🔸 Step 2: First Breakout (Already Confirmed)

Price broke above the descending trendline, retested it, and maintained higher structure. This breakout initiated a shift in market sentiment from bearish to neutral-bullish.

🔸 Step 3: Second Breakout (Setup Forming)

Price is now testing horizontal resistance around $330–$335 zone. This zone also coincides with dynamic resistance from prior failed swing attempts. A successful breakout above this level, followed by a clean retest, can serve as confirmation for a bullish continuation.

🔸 Step 4: Target Setting

🎯 First TP is set at $363.92, a well-defined resistance level. If the breakout holds, next potential targets may develop around key zones such as $395 and $440, depending on price strength and continuation.

🔸 Risk Management

✅ Ideal entry after retest of breakout above ~$335.

❌ Stop-loss below the breakout level or below 50 SMA (~$315 area), depending on entry style.

🔄 Monitor volume: breakout without volume = weak move.

Conclusion:

We are watching a classic price action + moving average confluence setup. Golden Cross, breakout + retest structure, clean resistance level, and defined targets all align.

This setup is valid only with confirmation. No breakout = no trade.

⚠️ Not financial advice. DYOR.

Gold price maintains accumulation below 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 07/21/2025 - 07/25/2025

⭐️GOLDEN INFORMATION:

Gold prices edge higher in Friday’s North American session as a softer US Dollar and pre-weekend profit-taking lend support. Dovish remarks from a Federal Reserve (Fed) Governor, hinting at a possible rate cut as early as July, further bolster the yellow metal. At the time of writing, XAU/USD is trading around $3,353, gaining 0.43%.

Improved market sentiment also underpins bullion, following the University of Michigan’s report showing that US consumers are growing more optimistic about the economy, with inflation expectations easing. Meanwhile, Fed Governor Christopher Waller’s call for rate cuts weighed on US Treasury yields, adding positive momentum to gold.

The US Dollar Index (DXY) weakens to 98.48, down 0.13%, making USD-priced gold more attractive to foreign buyers and helping sustain the current uptrend.

⭐️Personal comments NOVA:

Gold price remains in the accumulation range of 3300 - 3400, the market awaits information on upcoming interest rate policy

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3367, $3392

Support: $3305, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

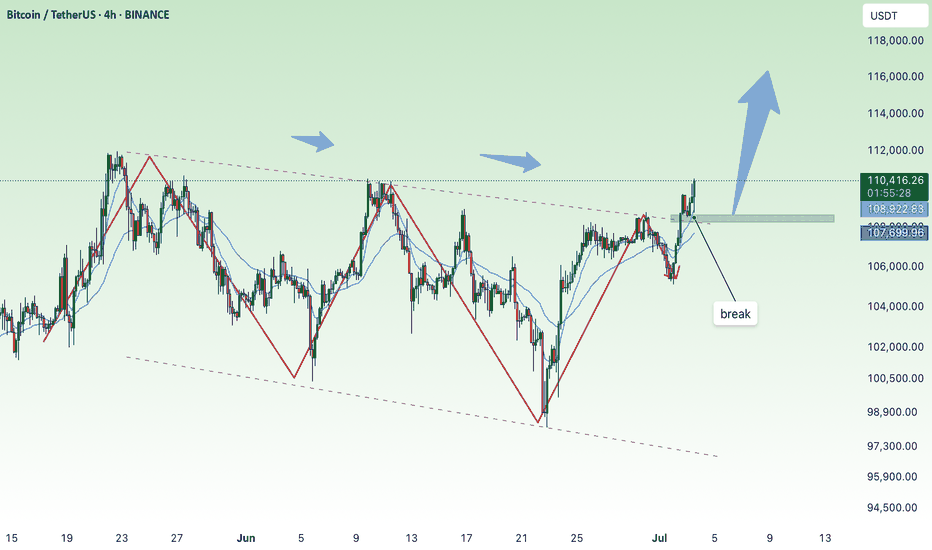

BTC sideways above 115k💎 BTC PLAN UPDATE (July 17)

NOTABLE NEWS ABOUT BTC

Bitcoin Price Forecast: BTC Recovers as Trump Steps In to Revive Crypto Legislation Momentum

Bitcoin (BTC) saw a mild recovery, trading around $119,000 at the time of writing on Wednesday, after falling nearly 2% the previous day. This rebound followed an announcement by U.S. President Donald Trump on Wednesday morning, stating that the GENIUS Act is ready to be passed by the House during the legislative “Crypto Week”, sparking optimism in the crypto market. Furthermore, institutional demand continues to grow, with spot Bitcoin ETFs recording over $400 million in inflows on Tuesday, extending the growth streak since July 2.

TECHNICAL ANALYSIS

🧠 Pattern Overview:

The chart clearly displays an Elliott Wave pattern (1) → (2) → (3) → (4) → (5) along with Fibonacci Retracement and Extension levels, helping to identify potential support and resistance zones.

1. Elliott Waves:

Wave (3) was completed around the $122,144 zone and the market is currently in the corrective wave (4).

Wave (5) is expected to move upward with targets at:

• 1.618 Fibonacci Extension: ~$127,404

• Or further: ~$130,747

2. Support Zone (grey area below):

Located around $115,000 – $116,000, which is:

• The 0.5 – 0.618 retracement of Wave (3)

• Aligned with the EMA200 and dotted black trendline support.

If the price falls into this area, it’s highly likely to bounce back and form Wave (5).

3. Danger Zone if Broken:

If this support fails, price may fall deeper to:

• $113,200 (0.786 retracement),

• Or even lower: $111,600 – $111,800

4. Potential Scenarios:

Two main outcomes:

• Continued Uptrend: Price bounces from the support zone and heads toward $127,000 – $130,000

• Breakdown: If the support breaks, a deeper decline may occur, breaking the wave structure.

Follow the channel for continuous and up-to-date analysis on XAUUSD, CURRENCIES, and BTC.

recovery, towards 3400, gold price⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) extended their gains to around $3,365 during the early Asian session on Monday, as investors flocked to safe-haven assets in response to an escalation in global trade tensions.

The move comes after US President Donald Trump intensified the trade war over the weekend, announcing a 30% tariff on imports from the European Union and Mexico, effective August 1. This followed last week’s declarations of a 35% duty on Canadian goods and a sweeping 15%–20% tariff proposal on most trading partners, in addition to a 50% tariff on copper imports. Mounting concerns over the economic fallout from these aggressive trade measures have fueled demand for gold, a traditional refuge during times of uncertainty.

⭐️Personal comments NOVA:

Continued price increase, tariff pressure helps gold to be positive again

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3384- 3386 SL 3391

TP1: $3376

TP2: $3364

TP3: $3352

🔥BUY GOLD zone: $3308-$3310 SL $3303

TP1: $3319

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

short recovery, trend line✍️ NOVA hello everyone, Let's comment on gold price next week from 07/14/2025 - 07/18/2025

⭐️GOLDEN INFORMATION:

Gold prices surged nearly 1% on Friday as market sentiment soured in response to US President Donald Trump’s controversial trade policies targeting Canada, while hinting at broader tariffs on other nations and copper. At the time of writing, XAU/USD is trading at $3,354, rebounding from intraday lows of $3,322.

On Thursday, Trump announced a 35% tariff on Canadian imports, though goods complying with the 2020 USMCA trade agreement remain exempt. He also signaled intentions to expand tariffs across most trading partners, proposing blanket rates ranging from 15% to 20%.

With a light US economic calendar, attention turned to Fed commentary. Chicago Fed President Austan Goolsbee pushed back on calls for rate cuts aimed at reducing government borrowing costs, stressing the central bank’s focus remains firmly on employment and price stability.

⭐️Personal comments NOVA:

growth according to the trend, maintaining the accumulation price zone above 3300

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3392, $3447

Support: $3330, $3308, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

FOMO price increase, create new ATH💎 Update Plan BTC weekend (July 11)

Continuously creating a new ATH, preparing to have a short sale?

The reinforcement of Bitcoin price around the upper boundary of the previous consolidation area was broken at $ 108,355, which ended on Wednesday. The price has soared to the highest level of the new time of $ 116,868 on Thursday. At the time of writing on Friday, the price is fluctuating above $ 116,600.

When BTC entered the price exploration regime and if the trend of increasing continues, the price can expand the momentum to an important psychological level of $ 120,000.

Technical analysis angle

Our community has continuously chose the trend of increasing as the mainstream for all previous transactions and currently preparing to welcome 120k as forecast.

The relative power index (RSI) on the daily chart reaches 71, higher than the excess buying 70, showing a sharp increase. However, traders should be cautious because the ability to adjust the decrease is very high due to over -purchase. Meanwhile, the average divergence dynamic indicator (MACD) has shown a price intersection at the end of June. The indicator also shows that green histograms are increasing on neutral zero, showing that the rising momentum is being strengthened and continues to increase.

However, if BTC must be adjusted, the price may extend the decline to search and support around the upper boundary of the unified area that has been broken earlier at $ 108,355.

Plan has been constantly accurate in the past 2 months, which is the positive signal of the channel that brings value to the community.

Please follow the channel to receive accurate scenarios about gold and BTC

==> Comments for trend reference. Wishing investors successfully trading

Uptrend at the end of the week 3367, maintain the upward force⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) are on track to notch a third straight day of gains on Friday, climbing toward the upper boundary of this week’s trading range as escalating trade tensions fuel safe-haven demand. In a significant intensification of global trade disputes, US President Donald Trump issued formal notices this week to multiple trading partners, detailing individual tariff rates set to take effect on August 1 should no agreements be reached. This has rattled investor sentiment and weighed on risk assets, offering solid support to Gold.

Meanwhile, expectations for an imminent interest rate cut by the Federal Reserve (Fed) have cooled following last week’s strong US jobs data. As a result, the US Dollar (USD) remains firm, holding near a more than two-week high reached on Thursday. This USD strength could limit the upside for the non-yielding yellow metal in the near term. Therefore, traders may look for a sustained breakout before committing to further bullish positions in the XAU/USD pair.

⭐️Personal comments NOVA:

Gold price breaks 3330, maintaining good buying pressure, recovering at the end of the week

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3367- 3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

🔥BUY GOLD zone: $3306-$3308 SL $3301

TP1: $3315

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC back to 110K, ATH effortPlan BTC today: 09 July 2025

Related Information:!!!

Cryptocurrencies are trading in a volatile environment driven by tariff-related uncertainties ahead of the release of the Federal Reserve's (Fed) Minutes from the June meeting, scheduled for Wednesday. Bitcoin (BTC) continues to exhibit technical weakness, trading below the key resistance level near $109,000. Trading activity in the spot market remains subdued, with K33 Research reporting a 4% decline in weekly volume to $2.1 billion.

Aside from a few selective rallies, as evidenced by Wednesday’s top-performing tokens, most altcoins are underperforming relative to Bitcoin, reflecting limited engagement from the retail segment. Nonetheless, Ethereum (ETH) is showing early signs of a potential upward move after breaking above the former resistance-turned-support level at $2,600. Ripple (XRP), meanwhile, has extended its recovery above $2.33, posting over 1% in intraday gains.

personal opinion:!!!

Continued efforts by the bulls, breaking ATH above the 110,000 price zone. The time is near for the FED to lower interest rates.

Important price zone to consider :!!!

support zone : 109.200

resistance zone : 109.700

Sustainable trading to beat the market

waiting for new ATH this week , btc💎 BTC PLAN UPDATE FOR THE BEGINNING OF THE WEEK (07/07)

NOTABLE BITCOIN NEWS: Focus on 4 key points today

1. Elon Musk – “America Party” to Support Bitcoin

Elon Musk has confirmed that his newly formed political party, the “America Party,” will support Bitcoin, stating that “fiat is hopeless.”

2. Cup-and-Handle Pattern Analysis: Targeting $230K

According to technical analysis by Cointelegraph, BTC is forming a “cup and handle” pattern on the monthly chart, which could lead to a target peak of $230,000 if a breakout continues.

3. BTC Price Holds Steady Around $109K Amid “Crypto Week” and Trade Tensions

Bitcoin is currently trading around $109,000, influenced by “Crypto Week” and concerns over U.S. tariffs.

4. Institutional Inflows Increase, But Market Demand Weakens

According to CoinDesk, institutional investors are still buying BTC, but not enough to offset declining demand in the spot market, negatively affecting short-term market sentiment.

⸻

TECHNICAL ANALYSIS PERSPECTIVE

The short-term trend remains bullish. However, the steep slope of the trend indicates buying pressure is still being contested and unstable.

BTC remains stuck at Fibonacci levels—pay close attention to the resistance zones at 112K and 115K. If these two resistance levels are broken, investors may get the answer to whether BTC can approach the 120K level.

In the short term, both gold and BTC are moving sideways, indicating that market liquidity and investor capital are unstable and being divided across multiple portfolios.

==> This analysis is for reference only. Wishing all investors successful trading!

Gold price is moving sideways on H4 frame, above 3242✍️ NOVA hello everyone, Let's comment on gold price next week from 07/07/2025 - 07/11/2025

⭐️GOLDEN INFORMATION:

Gold prices resumed their upward momentum on Friday and are on track to close the week with gains exceeding 1.50%, supported by a weaker US Dollar amid subdued liquidity following the Independence Day holiday in the United States. A mild uptick in trade tensions also contributed to bullion's strength. At the time of writing, XAU/USD is trading at $3,333, up 0.26%.

President Donald Trump announced that the US would begin sending official letters to trading partners on Friday ahead of the July 9 deadline, outlining new tariff measures ranging between 10% and 70%, set to take effect on August 1. Treasury Secretary Scott Bessent added that a wave of trade agreements is expected before the deadline, estimating that around 100 countries will face a minimum 10% reciprocal tariff. He also hinted at upcoming deal announcements.

⭐️Personal comments NOVA:

Gold price continues to move sideways, accumulating in a large range: 3242 - 3450

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3362, $3393, $3446

Support: $3312, $3279, $3241

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold accumulates and moves above 3350⭐️GOLDEN INFORMATION:

Gold prices declined by 0.80% on Thursday after a robust US Nonfarm Payrolls (NFP) report boosted the US Dollar, dampening expectations for a Federal Reserve rate cut at the upcoming July meeting. At the time of writing, XAU/USD is trading at $3,332, after reaching an intraday high of $3,365.

June’s employment data significantly outperformed forecasts and even surpassed May’s figures, reinforcing the resilience of the US labor market. Notably, the Unemployment Rate edged closer to the 4% mark, underscoring continued labor market strength. The upbeat report casts doubt on Wednesday’s softer ADP private-sector jobs data, which had shown a 33,000 drop in hiring.

⭐️Personal comments NOVA:

Gold price accumulates and recovers around 3350. Friday has no important news and bank holiday in US session, short-term recovery

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3365- 3367 SL 3372

TP1: $3355

TP2: $3342

TP3: $3330

🔥BUY GOLD zone: $3311-$3313 SL $3306

TP1: $3325

TP2: $3338

TP3: $3350

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

break, BTC soon reaches new ATH💎 Update Plan BTC after NFP (July 3)

Notable news about BTC:

Bitcoin (BTC) recovered to $ 109,000 on Wednesday when the US agreement with Vietnam and the increase in global M2 supply of M2 money has promoted an increase in open interest rates (OI), soaring to 689.78 thousand BTC worth about $ 75 billion. The cryptocurrency market in general has increased the price along with BTC, with leading altcoins, Ethereum (ETH), XRP and Solana (SOL) increased by 7%, 3%and 4%respectively.

Bitcoin, the market cryptocurrency market increased by the trade agreement with Vietnam and M2 money supply soared

The cryptocurrency market has recovered on Wednesday, an increase of 2% to regain the market capitalization of $ 3.5 trillion.

Technical analysis angle

First, congratulate the investors who follow the plan when we previously traded according to the model and had a short signal at 108k and took profit and then Long in the 106k area.

Currently, BTC is in wave 5 and is trapped in the Fibonanci area of 2,618 golden ratio around the price of 109k, this is also the threshold of the price of investors who are under pressure before the price area goes to 112k

The 112k region is a psychological area of profit and will appear on the 109k sales situation before the BTC price may rise further in the last 6 months of the year.

Please follow the channel to receive accurate scenarios about gold and BTC /-Teart /-heart

==> Comments for trend reference. Wishing investors successfully trading

LONG ON USD/JPYUSD/JPY has given us a CHOC (change of character) from down to up.

It has engineered sell side liquidity right above a demand zone.

I expect price to sweep sell side liquidity, tap into the demand zone then take off to the upside.

looking to catch 150-250 pips on UJ. (Economic News could set this trade on Fire!)

Waiting for gold price to grow with ADP-NF⭐️GOLDEN INFORMATION:

Gold (XAU/USD) finds it difficult to extend its two-day rally and trades within a tight range during Wednesday’s Asian session, hovering just below Tuesday’s one-week high. A modest rebound in the US Dollar—recovering from its lowest level since February 2022—has put pressure on the precious metal. Additionally, improving market sentiment continues to reduce demand for safe-haven assets like Gold, further limiting its upside.

⭐️Personal comments NOVA:

Steady trendline recovery, sustained buying could move towards 3383 with today's ADP-NF data

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3382- 3384 SL 3389

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3312-$3310 SL $3305

TP1: $3320

TP2: $3330

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price recovers above 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) trades at $3,292 after rebounding from an intraday low of $3,246 and looks set to close out June with a modest gain of over 0.18%. However, its upward momentum has been restrained by easing geopolitical tensions in the Middle East and growing optimism over forthcoming trade agreements. Meanwhile, analysts at Citi expect Gold to consolidate within the $3,100 to $3,500 range throughout the third quarter.

In Washington, US Treasury Secretary Scott Bessent expressed confidence that the “One Big Beautiful Bill” will make progress in the coming hours. The sweeping tax reform legislation, which narrowly passed the Senate over the weekend, includes major tax deductions funded by reductions in Medicaid spending and green energy incentives.

⭐️Personal comments NOVA:

Gold price recovers above 3300 , ahead of NF reports this week . Accumulates above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3272-$3270 SL $3265

TP1: $3283

TP2: $3295

TP3: $3310

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC buying power is gradually increasing💎 Update Plan BTC at the beginning of the week (June 30)

Notable news about BTC:

Anthony Pompliano has merged Procap BTC with Columbus Circle Capital I, established Procap Financial - a Bitcoin warehouse company up to $ 1 billion. The company will deploy lending activities, derivatives ... in order to create a collection line from BTC, according to the similar model

Bitcoin price is stable at about $ 107.4K on June 27, before the expiry date of options worth up to US $ 40 billion, capable of causing strong fluctuations. At the same time, on June 29, BTC exceeded $ 108k, up ~ 0.68% compared to the previous day

In the past 7 days, BTC maintained around $ 104–107K despite tensions in the Middle East and the US economic data is not heterogeneous. Reduce slightly but receive support from organized cash flow and global trade progress.

Technical analysis angle

Overview of trends - many signs of increasing

Looking at the candle is signaling "Strong Buy" on many time frames, especially healthy momentum, the ability to breakout $ 116k if surpassed the $ 110k resistance

ETF liquidity and organizational capital flows are supporting the trend of increasing, strengthening the possibility of breakthrough.

Moving Averages:

Frame 1H: 64% Bullish signal (MA20 reversed), but there is a neutral signal from short -term ghosts

Daily/Weekly: Golden Cross (Golden Cross) between 50‑ and 200‑ MA, is a long -term trend increase signal

Oscillators:

RSI frame Daily ~ 55, showing neutral momentum, not too much purchased but there is a rise. Double Rounded Top model on the chart Daily, the current trend is neutral - Bearish if the breakdown supports Neckline ~ $ 106k; In contrast, strong recovery above $ 114k will invalid this model

Long -term / Swing Trade: Keep the position if the price is maintained> $ 106k, use $ 103–104K as a spare hole stop.

Short -term / Scalp Trade: can be in order when the test price is $ 106k–107k, small latches around $ 110k.

==> Comments for trend reference. Wishing investors successfully trading

Bulls recover in new week, gold price returns to 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) regained some lost ground during Monday’s Asian session, buoyed by growing expectations that the US Federal Reserve may implement more interest rate cuts this year—and potentially sooner than previously anticipated. Such prospects weigh on the US Dollar, making the dollar-denominated metal more attractive to overseas buyers.

However, the recent improvement in global risk sentiment—driven by the US-China trade accord and a ceasefire agreement between Israel and Iran—could reduce demand for Gold’s safe-haven appeal. Investors now turn their attention to upcoming comments from Federal Reserve officials, with speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee expected later in the day.

⭐️Personal comments NOVA:

Gold price recovered, accumulating at the beginning of the new week around the price range of 3300. Still in the main downtrend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3316- 3318 SL 3323

TP1: $3305

TP2: $3290

TP3: $3277

🔥BUY GOLD zone: $3248-$3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3286

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC Efforts to break the trend to create a new ATHPlan BTC today: 30 June 2025

Related Information:!!!

As of Monday, Bitcoin (BTC) is trading around $108,500, approximately 3% below its all-time high. Ethereum (ETH) has closed above a key resistance level, indicating the potential for a sustained upward movement. Meanwhile, Ripple (XRP) is approaching a critical threshold; a confirmed breakout could strengthen bullish momentum in the near term.

Bitcoin approaches record highs

The price of Bitcoin surged by 7.32% last week, closing above the $108,000 mark. As of the latest update on Monday, it remains near $108,500.

Should the current upward trend persist, BTC may extend its rally toward the all-time high of $111,980 recorded on May 22. A decisive close above this level could pave the way for further gains, potentially establishing a new all-time high at $120,000."

personal opinion:!!!

BTC buying pressure is prevented by selling pressure according to H4 trendline, accumulating and soon surpassing ATH

Important price zone to consider :!!!

support zone : 107.000 ; 104.600

Sustainable trading to beat the market