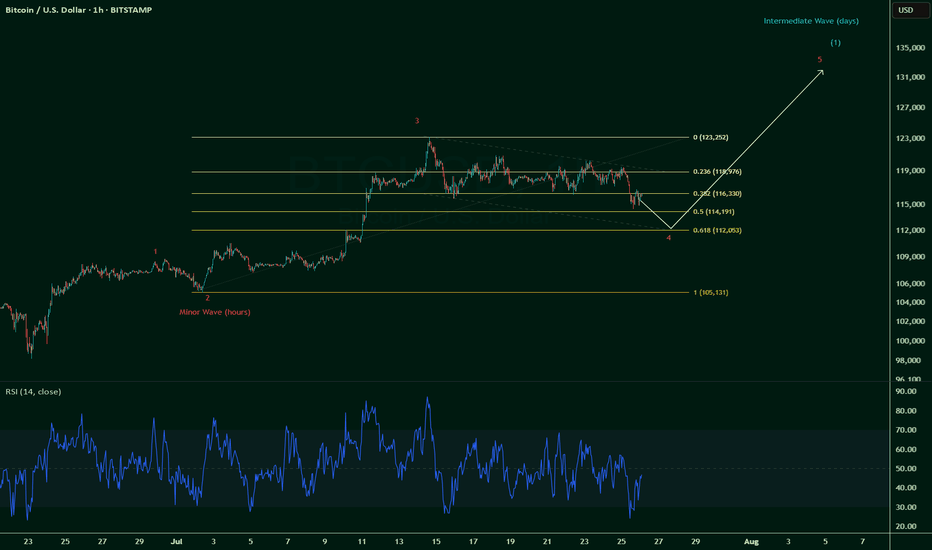

$BTC breaks $115k invalidates Wave 5 -- still Wave 4 correction.So it was a long squeeze after all, and one that was coming.

The initial thoughts were that we're on a Wave 5 up and counting:

But we're brought back down to earth as CRYPTOCAP:BTC breaks below $115k, invalidating a Wave 5 count.

So, it's official: we're still on a Wave 4 correction, which can go as low as 0.618 fib towards $112k.

Now painting a likely scenario given that Wave 2 correction only moved 0.236 fib ~ 0.328 fib (Wave 2 & Wave 4 often contrast):

This could play out till end July or even all the way into early August, which if comes to fruition, could signal for a bullish August.

And August has historically almost always been a bearish month (8 red historical months out of 12).

Pinch me.

Longsqueeze

Why Invest in CONMED Corp (CNMD)?Why Invest in CONMED Corp (CNMD)?

Strong Earnings Growth – CONMED has experienced a remarkable increase in earnings, with EPS surging by 104% year-over-year and net income rising by 105% YoY. This indicates strong financial performance and profitability momentum.

Attractive Valuation – The stock is currently trading at a P/E ratio of 13.79, which is significantly lower than its historical averages. This suggests that CNMD may be undervalued relative to its past performance and industry peers.

Consistent Revenue Growth – The company reported revenue of $1.31 billion for the last year, marking a 5% increase compared to the previous period. This steady growth highlights CNMD’s ability to expand its market presence.

Improving Margins and Efficiency – CONMED has seen an increase in operating income (+66% YoY), operating margin (+58% YoY), and return on assets (+104% YoY), demonstrating better cost management and operational efficiency.

Dividend and Low Payout Ratio – The company pays a dividend of $0.80 per share, yielding approximately 1.35%, with a conservative payout ratio of 18.6%. This allows room for future dividend increases while maintaining financial flexibility.

Healthcare Sector Stability – As a medical technology company specializing in surgical devices, CONMED operates in a defensive sector that tends to be resilient during economic downturns. This provides investors with a level of stability.

Solid Balance Sheet and Liquidity – The company has a current ratio of 2.3, indicating strong short-term liquidity. Additionally, its quick ratio of 0.94 suggests it can cover its immediate liabilities effectively.

Final Thoughts:

CONMED presents a compelling investment case due to its strong earnings growth, attractive valuation, improving profitability, and stable position in the healthcare sector. However, potential investors should always consider market conditions and individual risk tolerance before making investment decisions.

BTC next moves for 2025? Will 2021 repeat itself? Let's see :) History repeats itself, but will 2021 cycle repeat itself?

If we break 90K next level around 70, but there are many longs down the line, liquidation and long squeez is likely leading us to 60 if not 50 ranges, a wick is expected then a retest to 90K levels to get rejection before final breakout to the all time trend prices likely around 115-120K.

The herd will get excited by then, expecting a price to go above 120K, but I don't see this happening. And small dream secret, Nakamoto to be revealed later this year leading to significant crypto crash.

I know many may laugh, but let's see how this go! It makes sense from technical POV (hahaha, except my dream which likely to happen - since I don't dream too often) - keep an eye on RSI to get back in 40s before refill.

This idea is valid only and only if BTC breaks 90K and closes both daily and weekly below it with some a high volume!

Desclaimer:

The ideas and strategies presented here are for educational and informational purposes only. They do not constitute financial, investment, or trading advice. Trading involves substantial risk and may not be suitable for all investors. You should consult with a professional financial advisor before making any investment decisions. The creator of this post is not liable for any losses or damages resulting from the use of this information.

#Manta will go massive in this bull run!#Manta

Manta Network is revolutionizing the web3 space with its modular ecosystem. Built for speed and privacy, Manta offers faster transactions than Layer 1 and cheaper fees than Layer 2 solutions. With its zero-knowledge technology and a native token (MANTA) for rewards, it’s creating a vibrant, community-driven platform.

Our strategy for #MANTA is to accumulate during price consolidations, aiming to take advantage of growth potential in the future. With a mid-market cap and potential for volatility, MANTA represents a strong opportunity for long-term growth.

The accumulation zone for MANTA is $1–$0.80.

DYOR, NFA

DJT falls on stratospheric valuations SHORTDJT, the Trump media company, had a massive run up after the DWAC merger only to fade and

fall with the SEC filing showing minimalistic revenue and negative earnings. It moved up in

meme fashion but is now falling as fundamentals come to light. In five months the namesake

will be able to sell if there is any remaining value. In the meanwhile, the board will likely

refuse an early sell permission because that would like cause a " long squeeze". DJT is a good

short right now no matter the locate and carry fees which are very high. I was long DWAC

and am now short DJT using the profits from the merger volatility. Selling volumes are rising

showing the longs are beginning to get squeezed. The relative trend indicator shows

a strong move down.

RIVN a short entry on the rejection by VWAP SHORTPIVN on the 15-minute chart was trading up against the dominant supertrend from last

Thursday. Mid-morning price hit the resistance of the intermediate term mean anchored VWAP

and reversed as suggested yesterday by the bearish divergence on the zero-lag MACD.

Tomorrow is federal news which could increase general market volatility.

I see a short trade targeting 15.25 in the area of the bottom of two-volume profiles

anchored back 2 weeks. The stop loss is 15.9 at the highs of nearby candle wicks. Once the

the move gets underway, those already in long positions may close to take profit and add

into any short selling underway.

A Monthly Correction?I drew lines forming a descending wedge (on weekly timeframe) after verifying that there is possibly a correction on the monthly timeframe. However, it is still too early to be sure, as there is still 80% of the time left for the closing of the monthly candle. I'm really waiting for a long squeeze.

Short BTC! Longs just got trappedWe're currently well above the VAH (blue dotted line). BTC has failed multiple times to break through the top of the horizontal channel. These are signs of weakness.

What's more, on the above image, you can see a wick above the channel on high volume, which means a lot of longs have opened at the top. Right after, we see a rejection on high volume. This means all the longs that have just opened are now trapped. If price reverts to their entry level, they are likely to close their long, adding selling pressure. That is IF they get that chance...

The other scenario is that price does not revert to their entry level, but instead moves down further. In that case they'll get liquidated, also adding massive selling pressure.

I'm targeting lower levels. Always use multiple TPs and move SL to entry once TP1 is hit.

NQ Power Range Report with FIB Ext - 10/14/2022 SessionCME_MINI:NQZ2022

- PR High: 11085.75

- PR Low: 11057.50

- NZ Spread: 63.25

Evening Stats (As of 1:45 AM)

- Weekend Gap: -0.23% ( filled )

- 8/29 Weekend Gap: -0.18% (open > 13125)

- 8/19 Session Gap: -0.04% (open > 13540)

- Session Open ATR: 343.58

- Volume: 61K

- Open Int: 277K

- Trend Grade: Bear

- From ATH: -33.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 12391

- Mid: 11820

- Short: 10678

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

The ETH market is in the Phase 3 (Short-squeeze) of bulls attackThe breakout of ETH market happened as we expected and the ETH price had risen rapidly more than 10% in the past few day.

The order of strong bulls attack (ETH price may up to new high) including 5 Phase. Now we are in the phase 3 (KD 50 -> KD70-80, and KD>70 more than 3 days) that I mentioned in my previous articles.

check the funding rates:

upload.cc

Phase 3 (Short squeeze). KD 50 -> KD70-80, and KD>70 more than 3days:

Market makers carry out the strong short-squeeze ( bullish ), and price rise rapidly. The fuel of short-squeeze decreasing as price rising (see the funding rates).

Wonderful performance may be coming! Good luck!

Ps: If you want to understand the complete process of strong bulls attack (5 steps), please check my previous articles :D.

----------------------------------

Analyst of cryptocurrency Yu-Shiuan Chen

Bitcoin Expires, can $37.3k support hold? or 29k BTC next?Howdy gang... plz thumbs up if you like the chart

quick update to show some simple price action and support levels while bitcoin broke down after a good push from the previous days US open

Clear head and shoulders, recent death cross techincals, long squeezes all contriubting to the bearish price right now, yet no need to panic...

if the level at 37.3K can hold, we may breathe a sigh of relief but if not then its open territory for bounces from the MA's or going as low as 29K, the previous years low

bulls will want to see this current level hold with RSI and indicators showing oversold on the daily - if price can get above 42k today, ill change my short term bearish vision

few differing fundamentals in favour and against, so hard to call in that area right now, lots of fear and panic, so time to be greedy, maybe go do some shopping!

as the cryptoride continues, don't get emotional and use this as a opportunity if you can

WHAT do YOU think? ....Hold at this level? 40k or towards 29k??? over the next week or so? Let us know below....

2022/1/21 [ETH] Best buy-point will appear!2022/1/21 Best buy-point will appear!

COINBASE:ETHUSD

COINBASE:BTCUSD

The condition of market is still healthy, and the ETH exchange reserve continues to decline, best buy-point will appear.

See the CryptoQuant (ETH reserve) chart that I mapped:

upload.cc/i1/2022/01/21/SfI7hY.png

The market is in the process of long-squeeze, and this long-squeeze is stronger than other cases (2020/3, 2020/9, 2021/5-7), in order to drive out the retail investors.

Generally, the order of strong bulls attack (ETH price may up to new high) including 5 steps:

1. KD indicator (1D) <30 more than 3 days, price keep falling down and retail investors are panic. Market makers do the upward crash, that is market makers wash the retail investors who with less confidence will sell out and leave the market.

2. KD 20 -> KD50. Market makers just completed the upward crash and price started to rise. At this time, most retail investors open the short position, that means the fuel of short-squeeze is enough. Hence, short squeeze will start in the short term.

3. KD 50 -> KD70-80, and KD>70 more than 3days. Market makers carry out the strong short-squeeze (bullish), and price rise rapidly. The fuel of short-squeeze decreasing as price rising.

4. KD70-80 -> KD50. Market makers completed the short-squeeze and most retail investors start to open the long position. Therefore, the price correction will happen in the short term because the fuel of short-squeeze is not enough.

5. KD50 -> KD70-80 again. Two line of KD indicator formed golden fork and KD up to 70-80 more than 3 days again (short-squeeze). Volume and price increase simultaneously, and most retail investors start to open the short position. At this moment, the next bull market is coming, time to appreciate the performance of market makers (whales).

Wonderful performance may be coming! Good luck!

----------------------------------

As an analyst, I think that I can't predict the direction of market, but I am ready for a strategy of bullish or bearish .

Analyst of cryptocurrency Yu-Shiuan Chen

BTC/USDT (1D) Expanding Triangle ? Midterm gameplanHi Traders,

hopefully You are enjoing summer after huge profits. ?

There is an Idea what we could see at BTC chart in next few days - weeks. Right now this could be least expected move from so called Whales. Most people are alredy Getting in. So lets squizzz them and scare the rest of HODLeers before big guys will fill their bags.

We will most Likley see Expanding Triangle, check the basic informations here:

worldcyclesinstitute.com

Hence Last wave ((v)) of A could go to 24K (if ((v)) = 1:1 to ((i)); or possibly 20K = 1:618 Extension.

Trade safe, let me know what your strategy for BTC right now.

BTC Inverse H&S opportunity BTC looks to be developing Inverse Head and Shoulder pattern on 45 min chart

Like stated previously. I expected bitcoin to retest 9600.

This could be a potential Long Squeeze play with entry near 8750.

If this plays out bitcoin does have the potential to break 9600 and continue on this bullish run.

If it fails 9600 retest I will look for another short play.

Something to keep an eye on.

JW

our scripts show how longs mooned for 1 month on bitcoin...both scripts picked up that longs were piling in. for 1 month 23/11 - 22/12 longs climbed and climbed as price moved sideways.

what does this mean for price action, longs climb and price is sideways, hidden divergence? long squeeze ahead?

to gain access to these scripts visit tradingscripts.best

BTC Long Squeeze Incoming?BTC Longs on Bitinex have risen parabolically to at an all time high. Since 23rd November there has been an increase in Long positions equivalent to about $100m. Surely this is begging for an epic long squeeze?

Not so fast.. here are three reasons why this parabolic rise in Longs might not be what it seems.

1) The rise is on Bitfinex only. Funding rate on Bitmex is fairly neutral. This could suggest that one or a handful of massive players are responsible for this move. Do they know something we don't?

2) The pattern suggests steady accumulation of $100m of positions, starting neatly at the local low on 23rd November, which also lines up with the Golden Pocket (.618 to .65 retracements) of the current macro structure, which could be viewed as a retrace before new highs. See my post from yesterday "Beware The Pump."

Also, the three days of greatest increase since then match up neatly with re-touches to the .618 level also suggesting steady accumulation.

3) Assuming the first two points hold weight, the average accumulation price paid is probably around $7300, with some stops set possibly as low as $6618 (BITF). Either way, the bulk of a long squeeze may not hit until sub $7000, and so we may first need to get there without it.

Still on balance, I remain cautiously short.

The Long Squeeze isn't coming!!!Mr. Pips is starting to think that we might actually be gearing up for a huge pump! When shorts are at ATH's, there is usually a short squeeze. When Longs are stacked and the price is not reflecting the amount of Longs, there is almost never a squeeze(historically speaking). Instead, The Longs tend to sell off as the price pumps and positions are closed to take profit. Mr. Pips is actually about 80% leaning towards the price spiking up. Most traders by now have become aware of the huge number of longs and are expecting there to be a squeeze. This is the exact situation institutional money loves to exploit. I could see a flash dump happening to entice some more shorts before BTC runs up. Either way, Something BIG is on the horizon. Stay alert my friends.

Mr. Pips wants you to have a blessed and Profitable day!

Mr. Pips Quote of the Day:

"The person who doesn't know where his next dollar is coming from usually doesn't know where his last dollar went!"

Disclaimer: All information provide by TheRealMrPips is for educational purposes only and is not intended to be trading advice or trading consultation. You are responsible for your own personal finances and trades!

Brent long squeeze than rise

Economic release bullish for brent gapped the market, but banks and big investors didn't accumulate long position, yet so they might try to creat short perception of market falling in order to get retailers to sell, and then accumulate postions taking the other side of their trade. so plan is simple: wait tilll price drop significantly and than wait for some prica action at m15 or possibly m5 to enter into long position.