Options Blueprint Series [Intermediate]: Gold Triangle Trap PlayGold’s Volatility Decline Meets a Classic Chart Setup

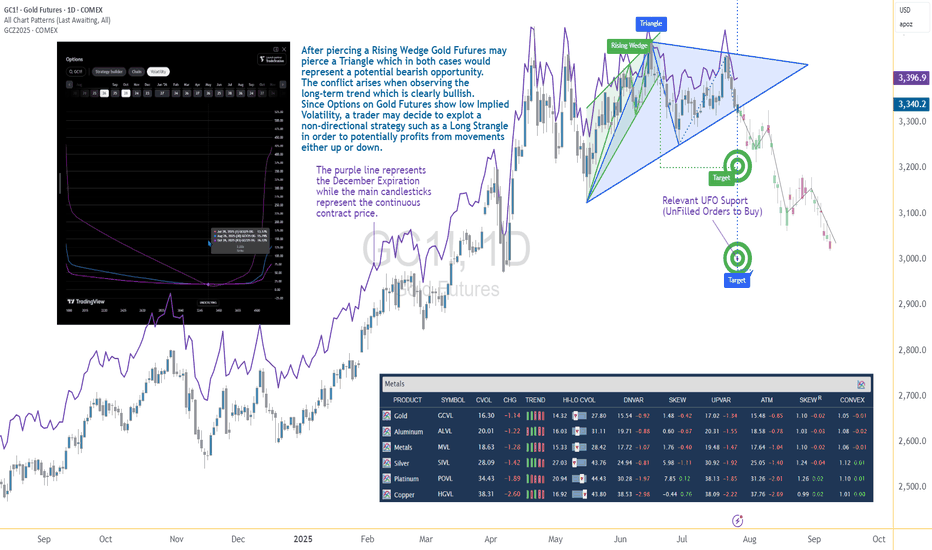

Gold Futures have been steadily declining after piercing a Rising Wedge on June 20. Now, the market structure reveals the formation of a Triangle pattern nearing its apex — a point often associated with imminent breakouts. While this setup typically signals a continuation or reversal, the direction remains uncertain, and the conflict grows when juxtaposed with the longer-term bullish trajectory Gold has displayed since 2022.

The resulting dilemma for traders is clear: follow the short-term bearish patterns, or respect the dominant uptrend? In situations like these, a non-directional approach may help tackle the uncertainty while defining the risk. This is where a Long Strangle options strategy becomes highly relevant.

Low Volatility Sets the Stage for an Options Play

According to the CME Group’s CVOL Index, Gold’s implied volatility currently trades near the bottom of its 1-year range — hovering just above 14.32, with a 12-month high around 27.80. Historically, such low readings in implied volatility are uncommon and often precede sharp price movements. For options traders, this backdrop suggests one thing: options are potentially underpriced.

Additionally, an IV analysis on the December options chain reveals even more favorable pricing conditions for longer-dated expirations. This creates a compelling opportunity to position using a strategy that benefits from volatility expansion and directional movement.

Structuring the Long Strangle on Gold Futures

A Long Strangle involves buying an Out-of-the-Money (OTM) Call and an OTM Put with the same expiration. The trader benefits if the underlying asset makes a sizable move in either direction before expiration — ideal for a breakout scenario from a compressing Triangle pattern.

In this case, the trade setup uses:

Long 3345 Put (Oct 28 expiration)

Long 3440 Call (Oct 28 expiration)

With Gold Futures (Futures December Expiration) currently trading near $3,392.5, this strangle places both legs approximately 45–50 points away from the current price. The total cost of the strangle is 173.73 points, which defines the maximum risk on the trade.

This structure allows participation in a directional move while remaining neutral on which direction that move may be.

Technical Backdrop and Support Zones

The confluence of chart patterns adds weight to this setup. The initial breakdown from the Rising Wedge in June signaled weakness, and now the Triangle’s potential imminent resolution may extend that move. However, technical traders must remain alert to a false breakdown scenario — especially in trending assets like Gold.

Buy Orders below current price levels show significant buying interest near 3,037.9 (UFO Support), suggesting that if price drops, it may find support and rebound sharply. This adds further justification for a Long Strangle — the market may fall quickly toward that zone or fail and reverse just as violently.

Gold Futures and Micro Gold Futures Contract Specs and Margin Details

Understanding the product’s specifications is crucial before engaging in any options strategy:

🔸 Gold Futures (GC)

Contract Size: 100 troy ounces

Tick Size: 0.10 = $10 per tick

Initial Margin: ~$15,000 (varies by broker and volatility)

🔸 Micro Gold Futures (MGC)

Contract Size: 10 troy ounces

Tick Size: 0.10 = $1 per tick

Initial Margin: ~$1,500

The options strategy discussed here is based on the standard Gold Futures (GC), but micro-sized versions could be explored by traders with lower capital exposure preferences.

The Trade Plan: Long Strangle on Gold Futures

Here's how the trade comes together:

Strategy: Long Strangle using Gold Futures options

Direction: Non-directional

Instruments:

Buy 3440 Call (Oct 28)

Buy 3345 Put (Oct 28)

Premium Paid: $173.73 (per full-size GC contract)

Max Risk: Limited to premium paid

Breakeven Points on Expiration:

Upper Breakeven: 3440 + 1.7373 = 3613.73

Lower Breakeven: 3345 – 1.7373 = 3171.27

Reward Potential: Unlimited above breakeven on the upside, substantial below breakeven on the downside

R/R Profile: Defined risk, asymmetric potential reward

This setup thrives on movement. Whether Gold rallies or plunges, the trader benefits if price breaks and sustains beyond breakeven levels by expiration.

Risk Management Matters More Than Ever

The strength of a Long Strangle lies in its predefined risk and unlimited reward potential, but that doesn’t mean the position is immune to pitfalls. Movement is key — and time decay (theta) begins to erode the premium paid with each passing day.

Here are a few key considerations:

Stop-loss is optional, as max loss is predefined.

Precise entry timing increases the likelihood of capturing breakout moves before theta becomes too damaging. Same for exit.

Strike selection should always balance affordability and distance to breakeven.

Avoid overexposure, especially in low volatility environments that can lull traders into overtrading due to the potentially “cheap” options.

Using strategies like this within a broader portfolio should always come with well-structured risk limits and position sizing protocols.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Longstrangle

Options Blueprint Series [Basic]: Ready to Strangle a BreakoutIntroduction: Why Natural Gas is Poised for Volatility

Natural Gas markets are showing signs of a potential volatility surge as recent data from the United States Natural Gas Stocks Change (USNGSC) displays a rare narrowing of the 21-day Bollinger Bands®. This technical setup often precedes sharp market moves, suggesting an upcoming breakout.

Given the importance of fundamental shifts in natural gas inventory data, any unexpected change in USNGSC could significantly impact Natural Gas Futures (NG1!), leading to price movements in either direction. This Options Blueprint Series explores a strategy to capitalize on this anticipated volatility: the Long Strangle Strategy. By setting up positions that profit from sharp directional moves, traders may capture gains regardless of the direction in which the price moves.

Understanding the Long Strangle Strategy

A Long Strangle involves purchasing a call option at a higher strike price and a put option at a lower strike price. This setup allows traders to profit from significant price movements in either direction.

The chosen strategy for this analysis includes:

Expiration: February 25, 2025

Strikes: 2.5 put at 0.28 and 2.7 call at 0.29

This setup is ideal for capturing potential breakouts, with limited risk equal to the total premium paid. Unlike directional trades, a Long Strangle does not require forecasting the direction of the move, only that a substantial price change occurs before expiration.

Technical Analysis with Bollinger Bands®

The 21-day Bollinger Bands® applied to USNGSC have narrowed significantly, often an indicator that the market is building up pressure for a breakout. Historically, this type of setup in fundamental data can drive volatility in Natural Gas Futures.

When the Bollinger Bands® width narrows, it indicates reduced variability and increased potential for data changes, awaiting release. Once volatility resumes, a dramatic shift can occur. This technical insight provides a solid foundation for the Long Strangle Strategy, aligning the timing of options with the potential for amplified price movement in Natural Gas.

Contract Specifications for Natural Gas Futures

To effectively plan and manage risk in this trade, it’s crucial to understand the contract details and margin requirements for Natural Gas Futures (NG).

o Standard Natural Gas Futures Contract (NG):

Minimum Price Fluctuation: $0.001 per MMBtu or $10 per tick.

o Micro Natural Gas Futures Contract (optional alternative for smaller exposure):

Minimum Price Fluctuation: $0.001 per MMBtu or $1.00 per tick.

Margin Requirements

The current margin requirement for a single NG futures contract generally falls around $2,500 but may vary with market conditions. $250 per contract for Micro Natural Gas Futures.

Trade Plan for the Long Strangle

The Long Strangle strategy on Natural Gas involves buying both a put and a call option to capture significant price movements in either direction. Here’s how the trade is set up:

o Expiration: February 25, 2025

o Strikes:

Long 2.5 Put at 0.28 ($2,800)

Long 2.7 Call at 0.29 ($2,900)

o Cost Basis: The total premium paid for the strangle is 0.57 (0.28 + 0.29) = $5,700 per strangle position.

Profit Potential

Profits increase as Natural Gas moves sharply above the 2.7 call strike or below the 2.5 put strike, accounting for the 0.57 premium paid.

With substantial price movement, gains on one option can offset the total premium and yield significant returns.

Risk

Maximum risk is confined to the total premium paid ($5,700), making this a capped-risk trade.

Reward-to-Risk Analysis

Reward potential is substantial to the upside and downside, limited only by the extent of the price move, while risk is capped at the initial premium cost.

Risk Management and Trade Monitoring

Effective risk management is key to successfully executing a Long Strangle strategy, particularly when anticipating heightened volatility in Natural Gas. Here are the critical aspects of managing this trade:

Defined Risk with Prepaid Premiums: The maximum risk is predetermined and limited to the initial premium paid, which helps manage potential losses in volatile markets.

Importance of Position Sizing: Sizing positions appropriately can help balance exposure across a portfolio and reduce excessive risk concentration in a single asset. Using Micro Natural Futures would help to reduce size and risk by a factor of 10 (from $5,700 down to $570 per strangle).

Optional Stop-Loss: As the risk is confined to the premium, no stop-loss orders are required.

Exit Strategies

For a Long Strangle to yield substantial returns, timing the exit is crucial. Here are potential exit scenarios for this strategy:

Profit-Taking Before Expiration: If Natural Gas experiences a significant price swing before the February expiration, consider taking profits which would further reduce the exposure to premium decay.

Holding to Expiration: Alternatively, traders can hold both options to expiration if they anticipate further volatility or an extended price trend.

Continuous Monitoring: The effectiveness of this strategy is closely tied to the persistence of volatility in Natural Gas. Keep an eye on Fundamental Updates in USNGSC as any unexpected changes in natural gas stocks data can lead to sharp price adjustments, increasing the potential for profitability.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies. Also, some of the calculations and analytics used in this article have been derived using the QuikStrike® tool available on the CME Group website.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Quiet Before the Volatility Storm: WTI Crude Oil Options PlaysStay tuned!

Beyond this exploration of WTI Crude Oil options plays, we're excited to bring you a series of educational ideas dedicated to all types of options strategies. More insights coming soon!

Introduction to Market Volatility

In the realm of commodity trading, WTI Crude Oil stands out for its susceptibility to rapid price changes, making market volatility a focal point for traders. This volatility, essentially the rate at which the price of oil increases or decreases for a given set of returns, is a crucial concept for anyone involved in the oil market. It affects not only the risk and return profile of direct investments in crude oil but also plays a pivotal role in the pricing of derivatives and options tied to this commodity.

Volatility in the crude oil market can be attributed to a myriad of factors, ranging from geopolitical developments and supply-demand imbalances to economic indicators and natural disasters. For options traders, understanding the nuances of volatility is paramount, as it directly influences option pricing models through metrics such as Vega, which indicates the sensitivity of an option's price to changes in the volatility of the underlying asset.

By delving into both historical and implied volatility, traders can gain insights into past market movements and future expectations, respectively. Historical volatility provides a retrospective view of price fluctuation intensity over a specific period, offering a statistical measure of market risk. Implied volatility, on the other hand, reflects the market's forecast of a likely range of movement in crude oil prices, derived from the price of options.

Incorporating volatility analysis into trading strategies enables options traders to make more informed decisions, particularly when considering positions in WTI Crude Oil options. Whether aiming to capitalize on anticipated market movements or to hedge against potential price drops, volatility remains a critical element of successful trading in the oil market.

News as a Catalyst for Volatility

The crude oil market, with its global significance, is incredibly sensitive to news, where even rumors can precipitate fluctuations in prices. Recent events have starkly demonstrated this phenomenon, showcasing how geopolitical tensions, OPEC+ decisions, and inventory data can serve as major catalysts for volatility in WTI Crude Oil markets.

1. Geopolitical Tensions: Middle East Conflicts

Geopolitical events, especially in oil-rich regions like the Middle East, have a pronounced impact on oil prices. For instance, conflicts or tensions in this area can lead to fears of supply disruptions, prompting immediate spikes in oil prices due to the region's significant contribution to global oil supply. Such events underscore the market's vulnerability to geopolitical instability and the swift reaction of oil prices to news suggesting potential supply threats.

2. OPEC+ Production Decisions

The Organization of Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, play a pivotal role in global oil markets through their production decisions. An announcement by OPEC+ to cut production usually leads to an increase in oil prices, as the market anticipates a tighter supply. Conversely, decisions to increase production can cause prices to drop. These actions directly influence market sentiment and volatility, illustrating the significant impact of OPEC+ policies on global oil markets.

3. Inventory Data Releases

Weekly inventory data from major consumers like the United States can lead to immediate reactions in the oil market. An unexpected increase in crude oil inventories often leads to a decrease in prices, reflecting concerns over demand or oversupply. Conversely, a significant draw in inventories can lead to price spikes, as it may indicate higher demand or supply constraints. These inventory reports are closely watched by market participants as indicators of supply-demand balance, affecting trading strategies and market volatility.

Each of these events has the potential to cause significant movements in WTI Crude Oil prices, affecting the strategies of traders and investors alike. By closely monitoring these developments, market participants can better anticipate volatility and adjust their positions accordingly, highlighting the importance of staying informed on current events and their potential impact on the market.

Technical Analysis Tools: Bollinger Bands and the 14-Day ADX

A sophisticated approach to navigating the fluctuating markets of WTI Crude Oil could involve the combined use of Bollinger Bands and the 14-day Average Directional Index (ADX). While Bollinger Bands measure market volatility and provide visual cues about the market's overbought or oversold conditions, the ADX offers a unique perspective on market momentum and trend strength.

The 14-Day ADX is pivotal in assessing the strength of a trend. A rising ADX indicates a strengthening trend, whether bullish or bearish, while a declining ADX suggests a weakening trend or the onset of a range-bound market. For options traders, particularly those interested in the long strangle strategy, the ADX provides valuable information. A low or declining ADX signals a weak or non-existent trend.

Bollinger Bands® serve as a dynamic guide to understanding market volatility. In this case an idea could be to apply Bollinger Bands® to the 14-Day ADX values instead of the WTI Crude Oil Futures prices. When combined, a pierce of the lower Bollinger Bands®, may suggest an opportune moment to establish a long strangle position in anticipation of a forthcoming breakout while options prices may be underpriced.

This combined approach allows traders to fine tune their entry and exit points. By waiting for the ADX to signal a nascent trend and Bollinger Bands to indicate a period of low volatility, traders can position themselves advantageously before significant market movements.

Strategizing with Bollinger Bands and ADX: In the dance of market analysis, the interplay between the ADX and Bollinger Bands choreographs a strategy of precision. Traders can look for moments when the market is quiet and options are underpriced. This dual-focus approach maximizes the potential of entering a long strangle options trade at the most opportune time, aiming for potential gains from subsequent volatility spikes in the WTI Crude Oil market.

Strategies for Trading WTI Crude Oil Options

In the volatile landscape of WTI Crude Oil trading, strategic agility is paramount. One strategy that stands out for its ability to harness volatility is the long strangle. This strategy is especially relevant in periods of low implied volatility (IV), providing traders with a unique opportunity to capitalize on potential market shifts without committing to a specific direction of the move.

Understanding the Long Strangle

The long strangle options strategy involves purchasing both a call option and a put option on the same underlying asset, WTI Crude Oil in this case, with the same expiration date but at different strike prices. The call option has a higher strike price than the current underlying price, while the put option has a lower strike price. This setup positions the trader to profit from significant price movements in either direction.

The beauty of the long strangle lies in its flexibility and the limited risk exposure it offers. The total risk is confined to the premiums paid for the options, making it a controlled way to speculate on expected volatility. This strategy is particularly appealing when the IV of options is low, implying that the market expects calm but the trader anticipates turbulence ahead.

Risk Management and the Importance of Timing

Risk management is a critical component of successfully implementing the long strangle strategy. The key to minimizing risk while maximizing potential reward is timing. Entering the trade when IV is low—and, consequently, the cost of options is relatively cheaper—allows for greater profitability if the anticipated volatility materializes and the price of the underlying asset moves significantly.

The Implications of a Limited Risk Strategy

A limited risk strategy like the long strangle ensures that traders know their maximum potential loss upfront—the total amount of premiums paid. This predefined risk exposure is particularly advantageous in the unpredictable oil market, where sudden price swings can otherwise lead to substantial losses.

Moreover, the limited risk nature of the long strangle allows traders to maintain a balanced portfolio, allocating a portion of their capital to speculative trades without jeopardizing their entire investment. It's a strategic approach that leverages the inherent volatility of WTI Crude Oil, potentially turning market uncertainties into opportunities.

Case Studies: Real-world Applications of the Long Strangle in WTI Crude Oil Trading

In the ever-volatile world of WTI Crude Oil trading, several events have starkly highlighted the efficacy of the long strangle strategy. These case studies exemplify how sudden market movements, driven by unforeseen news or geopolitical developments, can provide significant opportunities for prepared traders. Here, we explore instances where shifts in volatility facilitated lucrative trades, underscoring the potential of strategic options plays.

Case Study 1 : Geopolitical Escalation in the Middle East

Event Overview: An unexpected escalation in geopolitical tensions in the Middle East led to concerns over potential supply disruptions. Given the region's pivotal role in global oil production, any threat to its stability can significantly impact crude oil prices.

Trading Strategy: Anticipating increased volatility, traders employing the long strangle strategy before the escalation could imply significant gains. As prices surged in response to the tensions, the value of a strangle would have potentially increased.

Case Study 2 : Surprise OPEC+ Production Cut Announcement

Event Overview: In a move that caught markets off-guard, OPEC+ announced a substantial cut in oil production. The decision aimed at stabilizing prices instead triggered a sharp increase in volatility as traders scrambled to adjust their positions.

Trading Strategy: Traders with long strangle positions in place could have capitalized on the sudden price jump.

Case Study 3 : Major Hurricane Disrupts Gulf Oil Production

Event Overview: A major hurricane hit the Gulf Coast, disrupting oil production and refining operations. The immediate threat to supply lines led to a spike in oil prices, reflecting the market's rapid response to supply-side shocks.

Trading Strategy: The long strangle strategy could be invaluable for traders who had positioned themselves ahead of the hurricane season. The abrupt increase in crude oil prices following the hurricane highlighted the strategy's advantage in situations where directional market movements are expected but their exact nature is uncertain.

Conclusion

These case studies illustrate the practical application of the long strangle strategy in navigating the tumultuous waters of WTI Crude Oil trading. By strategically entering positions during periods of low implied volatility, traders can set themselves up for success, leveraging market movements to their advantage while maintaining a controlled risk profile. The key takeaway is the importance of vigilance and readiness to act on sudden market changes, employing comprehensive risk management practices to safeguard investments while exploring speculative opportunities.

The essence of trading in such a dynamic market lies not just in predicting future movements but in preparing for them through well-thought-out strategies and an acute understanding of market indicators and global events. The long strangle options strategy, with its limited risk and potential for significant returns, exemplifies this approach, offering a compelling method for traders aiming to capitalize on the inherent volatility of WTI Crude Oil.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Rising Bull and Raging Bear in BitcoinNewton is known to have said that "The motion of heavenly bodies can be computed, but not the madness of people". That aptly fits the times we live in.

Bitcoin (“BTC”) prices have rallied 40% since the start of the year despite bleak economic outlook. A short squeeze in the flagship crypto asset where $850M in short positions was liquidated in just three days is cited as the primary reason for the rally. After the US Fed, ECB, and BoE rate announcements last week, where does BTC go from here?

There are ample reasons to remain bearish as much as there is to turn bullish. Are we witnessing a dead cat bounce? Or is this the dawn of a new era where rates flatten or start to soften paving the path to a bull run?

Amid the chaos, one thing remains clear. Low volatility. Both realized and implied volatility for BTC remains low. In a market that could either crumble or rally, this case study argues that a long strangle position in BTC options provides a compelling >2x reward to risk ratio. A long options position gains not only from a substantial price move but also from expanding volatility.

THE UNCERTAIN ROAD AHEAD FOR BTC

Outlook for BTC prices looks uncertain. Bullish tailwinds and bearish restrainers are concurrently at play.

1. Mixed Technical Signals

BTC is approaching its 200-day moving average which has served as strong resistance in 2022. During the previous bear market rally, prices failed to breach past $25,000 per BTC, indicating strong resistance at this level. Current RSI at 79 points to BTC being overbought with a risk of downward price correction.

However, the 20-day moving average inching towards the 200-day moving average might create the settings for a price rally.

Also, the 10-day MA has crossed over the 200-day MA, forming a golden crossover which might be a harbinger of rally ahead.

Using this same chart, we highlighted before that BTC prices are now just below the long-term MA (200-week MA) that has proven to be a strong indication for a long-term trend. The divergence from this trend over the past half-year might have been aberrations caused by multiple black swan events.

2. Price volatility related to GBTC lawsuit outcome

Also as mentioned previously , Grayscale’s lawsuit against the SEC is an event to watch. Hearing date has been set for March 7th.

If unsuccessful, Grayscale has announced plans to liquidate a portion of the trust to bring the GBTC shares back up to NAV of its holdings. This would involve heavy BTC selling pressure. GBTC has $14.5B in AUM with GBTC shares trading at a 41% discount.

If GBTC succeeds, BTC prices could rally in sign of favorable regulatory acceptance. However, ETF’s creation/redemption mechanism would allow GBTC to rebalance their holdings resulting in spot BTC sales to arbitrage the discount.

3. Long term holders showing resilience and not selling

Recent price rally has restrained long term holders from dumping their holdings. Growing number of long-term holders indicates conviction and that combined with climbing retail participation sets the tone for a bull run.

4. Hash Rate Rebound in 2023

BTC mining is profitable again. Rebounding hash rates, stable energy costs, and elevated BTC prices is a relief to the miners. Miner reserves are at a yearly low removing the risk of miners dumping their inventory. Miner sales are now limited to BTC mined daily.

5. Growing Open Interest but mixed directional positioning

Asset managers have increased their net long positions by 53% between December 27th and January 24th. Meanwhile, leveraged funds continue to remain net short during this period. Clearly institutional investors remain puzzled on BTC price outlook.

In a sign of growing investor attention, overall OI is up 8.4% over the last month and nearly 20% over the last quarter

TRADE SET UP

With adequate arguments both in favor of and against BTC prices, establishing a directional position is difficult. BTC carries a reputation for triple-digit volatility over its 14 years trading history. Intriguingly, BTC volatility has been soft in the recent past. Low volatility allows investors to acquire options at reduced costs.

Being price agnostic, this study makes a case for a delta-neutral long strangle to secure a 2.27 reward to risk ratio.

A long strangle combines of two trades. One, an out-of-the-money long put (at a strike below the current bitcoin price) to gain from a falling market. Two, an out-of-the-money long call (at a strike above the current bitcoin price) to gain from a rising market.

A strangle allows the holder to extract an outsized gain (profit) for every unit of pain (costs incurred for premiums). This asymmetric pay-off in an options portfolio is referred to as convexity in finance. It enables holders to extract higher rewards for each unit of risk.

Leg 1: Long Put options on BTCK3 (options on futures expiring in May 2023) with a strike price of $21,000 at a premium of $1,635.

Leg 2: Long Call options on BTCK3 (options on futures expiring in May 2023) with a strike price of $29,000 at a premium of $1,105.

Entry: $2,740

Break-even points: When CME-BTC-Futures touches $30,740 or $18,260.

Target: BTC at either $33,600 or $13,700

Profit at Target: $1,860 (if BTC rises to $33,600) or $ 4,560 (if BTC drops to $13,700)

Stop-loss level: At 30% of the drop in options premium.

Loss at Stop-loss: $820

This strategy will start generating returns when the underling future trades past break-even points. It will also generate returns as volatillity expands fueling increase in strangle value.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

This material has been published for general education and circulation only. It does not offer or solicit to buy or sell and does not address specific investment or risk management objectives, financial situation, or needs of any person.

Advice should be sought from a financial advisor regarding the suitability of any investment or risk management product before investing or adopting any investment or hedging strategies. Past performance is not indicative of future performance.

All examples used in this workshop are hypothetical and are used for explanation purposes only. Contents in this material is not investment advice and/or may or may not be the results of actual market experience.

Mint Finance does not endorse or shall not be liable for the content of information provided by third parties. Use of and/or reliance on such information is entirely at the reader’s own risk.

These materials are not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject Mint Finance to any registration or licensing requirement.

JUST IN CASE YOU'RE WONDERING -- A SPY LONG STRADDLE PRE-BREXIT?A long straddle is a neutrally biased setup that is intended to take advantage of a large move in an underlying either to the put or call side and consists of an ATM long call and an ATM long put.

Given the fact that the market will either move up or down (potentially violently) in response to the outcome of the Brexit vote, you'd think that this would be an "ideal" setup for this type of binary event ... . But is it?

Let's look at the metrics of an example setup: a July 8th SPY 206 Long Straddle:

Probability of Profit: 46%

Max Profit: Undefined

Max Loss/Buying Power Effect: $694

Breakevens: 199.06/212.94

In short, you lose money on the setup if price stays between 199.06 and 212.94 and max loss occurs if price stays within the break evens at expiration. Conversely, you only make money on the setup if price goes above 213 (basically) or below 199. Not looking so hot now, is it?

In comparison, a 1 standard deviation long strangle, although cheaper to put on, has an even lower probability of profit and worse break even metrics. For example, a July 8th 197/216 SPY long strangle has a probability of profit of a mere 26% and break evens of 196 and 217 ... . In short, I would pass on the long strangle/long straddle plays here; in fact, you should probably pass on them virtually all the time ... . They're low probability plays and require fairly epic movement either way to make money (statistically, they're the least successful options strategy out there ... ).

BOUGHT IWM JULY 15 113 LONG STRADDLE (GAMMA SCALP)Partly out of boredom and partly out of curiosity, I'm initiating a gamma scalping setup here.

There are variations on the initial setup, but they usually begin with a long strangle with the long put and long call at the money and at the same strike, with their respective deltas cancelling each other out. As price moves, the notion is to balance out negative or positive delta experienced by the setup, which can be done intraday, daily, or at certain delta imbalance junctures (-25, -50, etc.) with short calls, short puts, or any other kind of credit-generating setup that yields the appropriate delta to offset the imbalance that has occurred in the initial setup. Those additions are then peeled off in profit to rebalance the setup to delta neutral at opportune times in price movement, so the setup naturally requires some attentiveness.

As with any setup, there are drawbacks. For example, time is not on your side. Options decay over time and the longs lose value immediately after you've bought them, so you have to have enough movement, collect enough credit to overcome this deficit, and be able to bail from the additions profitably. Secondly, lack of movement in the underlying isn't helpful either, since you're looking for movement, delta imbalance, addition to remedy the imbalance, and then peeling off the addition in profit to rebalance.

That being said, the setup will also benefit from a volatility expansion, so the current low volatility environment is a good place to put this one on.

In this particular case, I'm not going to scalp intraday, but examine the setup's net delta on a daily basis to determine whether I should add a position to offset a delta imbalance ... .

So, here's Day 1:

Bought IWM July 15 113 Long Strangle for a $794/contract debit.

Current Net Delta at EOD: 3.54

Naturally, you could try to balance the delta here immediately with a -3.54 delta short call or -3.54 short call spread. Unfortunately, doing that will not be profitable since a -3.54 short call or short credit spread is so far away from current price that you'll hardly get any credit for it, so waiting another day ... .