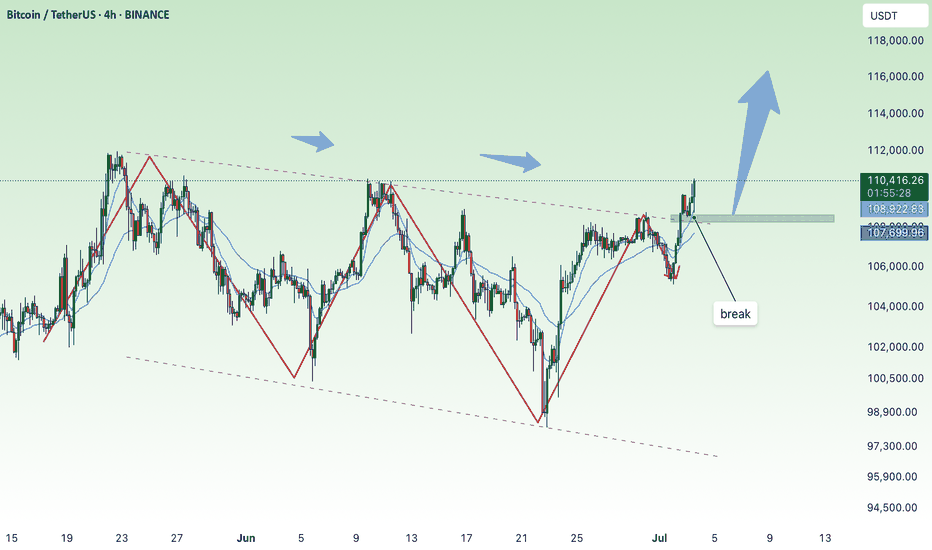

break, BTC soon reaches new ATH💎 Update Plan BTC after NFP (July 3)

Notable news about BTC:

Bitcoin (BTC) recovered to $ 109,000 on Wednesday when the US agreement with Vietnam and the increase in global M2 supply of M2 money has promoted an increase in open interest rates (OI), soaring to 689.78 thousand BTC worth about $ 75 billion. The cryptocurrency market in general has increased the price along with BTC, with leading altcoins, Ethereum (ETH), XRP and Solana (SOL) increased by 7%, 3%and 4%respectively.

Bitcoin, the market cryptocurrency market increased by the trade agreement with Vietnam and M2 money supply soared

The cryptocurrency market has recovered on Wednesday, an increase of 2% to regain the market capitalization of $ 3.5 trillion.

Technical analysis angle

First, congratulate the investors who follow the plan when we previously traded according to the model and had a short signal at 108k and took profit and then Long in the 106k area.

Currently, BTC is in wave 5 and is trapped in the Fibonanci area of 2,618 golden ratio around the price of 109k, this is also the threshold of the price of investors who are under pressure before the price area goes to 112k

The 112k region is a psychological area of profit and will appear on the 109k sales situation before the BTC price may rise further in the last 6 months of the year.

Please follow the channel to receive accurate scenarios about gold and BTC /-Teart /-heart

==> Comments for trend reference. Wishing investors successfully trading

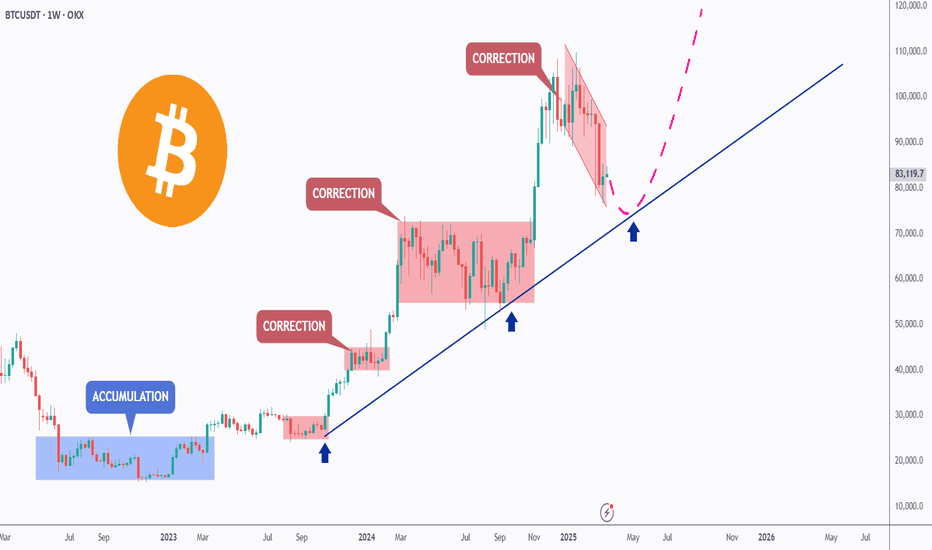

Longterm

Gold growth, recovery 3393⭐️GOLDEN INFORMATION:

Gold prices edge higher during the North American session as investors turn their attention to the upcoming US Nonfarm Payrolls (NFP) report — a key indicator that could influence the Federal Reserve’s next policy move. At the time of writing, XAU/USD is trading at $3,348, up 0.29%.

Recent labor data from ADP revealed that companies are pausing hiring rather than resorting to layoffs, reflecting caution amid uncertain economic conditions. Meanwhile, Microsoft’s decision to cut 9,000 jobs has added to concerns about a softening labor market.

Traders now await Thursday’s official employment report from the Bureau of Labor Statistics, which is projected to show 110,000 new jobs added in June — a slowdown from May’s 139,000. The Unemployment Rate is expected to tick up slightly to 4.3%, still within the Fed’s projected range of 4.4% according to its latest Summary of Economic Projections.

⭐️Personal comments NOVA:

good buy, hold before NF news. Dollar continues to be under selling pressure from investors, worried about the Trump administration's unstable tariff policies.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3393- 3395 SL 3400

TP1: $3380

TP2: $3363

TP3: $3350

🔥BUY GOLD zone: $3296-$3294 SL $3289

TP1: $3308

TP2: $3318

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

How I screen for long term investmentsIn this video, I’ll show you the exact stock screener I use to find long-term investment opportunities — the kind of stocks you can buy and hold for years.

I’ll walk you through the key metrics to look for, how to use free tools like TradingView screener, and what red flags to avoid. This strategy is perfect for beginner and experienced investors who want to build long-term wealth, not chase hype.

Whether you're looking for undervalued stocks, consistent compounders, or just trying to build your long-term portfolio, this screener can help.

Hope you enjoy!!

Gold price recovers above 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) trades at $3,292 after rebounding from an intraday low of $3,246 and looks set to close out June with a modest gain of over 0.18%. However, its upward momentum has been restrained by easing geopolitical tensions in the Middle East and growing optimism over forthcoming trade agreements. Meanwhile, analysts at Citi expect Gold to consolidate within the $3,100 to $3,500 range throughout the third quarter.

In Washington, US Treasury Secretary Scott Bessent expressed confidence that the “One Big Beautiful Bill” will make progress in the coming hours. The sweeping tax reform legislation, which narrowly passed the Senate over the weekend, includes major tax deductions funded by reductions in Medicaid spending and green energy incentives.

⭐️Personal comments NOVA:

Gold price recovers above 3300 , ahead of NF reports this week . Accumulates above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3272-$3270 SL $3265

TP1: $3283

TP2: $3295

TP3: $3310

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC - Bullish SOON!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

BTC has been in a correction phase, and it feels like it's taking forever! ⏳

As long as the blue trendline holds, the overall bias remains bullish. 📈

As BTC approaches the blue trendline—perfectly aligning with a demand zone and support—we'll be watching for trend-following longs to catch the next big impulse move upward. 🚀

For now, we wait! ⏳

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

[Long-Term]LICI Rising Channel Pattern Indicates Bullish OutlookIn this monthly chart of LICI, we observe a clear ascending channel pattern forming over the past two years. The price has consistently respected both the support and resistance trendlines, creating a strong bullish structure.

Currently, the stock is bouncing off the lower support trendline, indicating a potential upward move towards the upper resistance zone. This offers a positive long-term outlook, especially if the momentum sustains. The key levels to watch are:

Support Zone: Around ₹850–₹900

Resistance Zone: ₹1250–₹1300

Traders and investors can monitor for a gradual rise toward the resistance level. A breakout beyond this channel may open up new highs, while a breakdown below the support trendline would invalidate the pattern.

BTC recovers, price range sideways trend line💎 Update Plan BTC (June 25)

Notable news about BTC:

🌐 Growth stimulus factor

Reducing geopolitical tensions: The ceasefire agreement between Iran and Israel has helped improve investor psychology, promote capital inflows into risky assets like Bitcoin.

The dollar weakened: The USD index dropped to the lowest level in a year due to concerns about the economic impact from President Trump's tax policies, making Bitcoin a more attractive choice for investors to search for replacement assets.

Expectations for monetary policy: The decision of the US Federal Reserve (Fed) on keeping interest rates stable and interest rate cutting capacity in July has motivated the cryptocurrency market.

Technical analysis angle

Bitcoin may increase to the highest level of all time

Bitcoin price reached the lowest level of $ 98,200 on Sunday but has recovered strongly 5% in the next two days, closed on the dynamic average line according to the 50 -day exponential jaw at $ 103,352. At the time of writing on Monday, the price continued to trade higher at about $ 106,500.

If BTC continues to increase, the price can expand the momentum to the highest level of all time is $ 111,980 on May 22.

The relative power index (RSI) on the daily chart is 54, higher than the neutral level of 50, showing the motivation for price increase. The average divergent divergence (MACD) is referring to the price intersection (the MACD is about to cut on the signal line), if completed, the purchase signal will be made.

==> Comments for trend reference. Wishing investors successfully trading

Gold price short term recovery 3366⭐️GOLDEN INFORMATION:

Kansas City Federal Reserve President Jeff Schmid stated on Wednesday that the central bank has sufficient time to assess the impact of tariffs on inflation before making any decisions regarding interest rates. His remarks suggest a cautious approach and align with Fed Chair Jerome Powell’s comments from the previous day.

Chair Powell reaffirmed the view that there is no urgency to alter monetary policy, emphasizing a patient, data-driven approach as the Fed monitors economic developments. This less dovish tone from Fed leadership may help cap downside pressure on gold in the near term.

Meanwhile, money markets are fully pricing in two rate cuts by the end of 2025, with a September move seen as more probable than one in July—although expectations for a July cut have slightly increased since last week.

⭐️Personal comments NOVA:

Gold price recovered and continued to accumulate, pay attention to the GAP 3366 area at the beginning of the week, selling pressure is still maintained.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3366- 3368 SL 3373

TP1: $3358

TP2: $3345

TP3: $3330

🔥BUY GOLD zone: $3303-$3301 SL $3296

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

$PONY nothing technical, just pondering. Where does this go?Hello,

This name is interesting. I will be doing more research and due diligence along with asking some of my peers what they think. This name has seen increasing volume for a while now, daily moves of 5%, 10%, etc. Do you guys have any thoughts? Long term buy and hold? I randomly found this ticker a month ago just browsing.. talk to me in the comments and let me know.

WSL.

Middle East War - Gold Price Increases✍️ NOVA hello everyone, Let's comment on gold price next week from 06/23/2025 - 06/27/2025

⭐️GOLDEN INFORMATION:

Gold prices held steady on Friday, hovering near $3,369 and on track to post a weekly loss of nearly 1.90%, as markets digested US President Donald Trump’s decision to forgo immediate military action against Iran in favor of a diplomatic approach. At the time of writing, XAU/USD is down 0.11%.

While easing geopolitical tensions helped lift risk sentiment, additional pressure on gold emerged from concerns over potential US restrictions on allies operating semiconductor plants in China, as reported by Bloomberg. Trump's restraint on Iran encouraged a risk-on tone, weighing on the appeal of the safe-haven metal.

⭐️Personal comments NOVA:

Middle East tensions escalate, gold prices continue to recover above 3400, early next week

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3395, $3448

Support: $3302, $3256

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Detailed technical analysis of the ETH/USD chart🧭 General Context (1D, Long-Term):

The chart covers the period from approximately September 2023 to June 2025.

ETH/USD has gone through a complete cycle: growth → decline → correction → potential consolidation/accumulation.

🔹 Market Structure (Price Action)

🔸 Trends:

November 2023 – March 2024: strong uptrend, ETH reaches highs around $4,000+

March 2024 – February 2025: clear downtrend ending with a local low around $1,600

February 2025 – May 2025: dynamic rebound – probable trend change (new higher low + higher high)

May – June 2025: currently consolidating between ~$2,400–2,800

📉 Key Support and Resistance Levels

Type Level Notes

🔴 Resistance ~2,800 – 2,900 Local high, many candles with shadows rejected from above

🟡 Resistance ~3,200 – 3,400 Beginning of strong declines from 2024

🟢 Support ~2,300 – 2,400 Local lows in June 2025

🟢 Strong support ~1,600 – 1,800 Final market low of March 2025 (possible accumulation phase)

📊 Technical indicators

✅ Stochastic RSI (at the bottom of the chart):

Currently in the oversold zone (~0–20) → may signal a potential bottom / buying opportunity

Red-blue lines are starting to wrap upwards → possible rebound

Recent crossovers of the indicator corresponded to local price movements

🔍 Technical formations

⚠️ Possible formations:

Double Bottom: February–March 2025 → classic trend reversal formation

Rising Channel: from March 2025 to present – prices are moving in a slightly rising channel

Current consolidation may be a bull flag (continuation after the increase)

📌 Summary – scenarios

🟢 Bullish scenario:

Breakout of resistance ~2,800 → possible test of levels 3,200 – 3,400 USD

Confirmation of a higher low → continuation of the uptrend

Stochastic RSI in the oversold zone → potential for an uptrend

🔴 Bearish scenario:

Drop below 2,300 USD → possible return to the area of 1,800–1,600 USD

Breakout of the structure of higher lows

Confirmation that the increase was only a correction

🧠 Final conclusions

Currently, ETH/USD is in a key decision zone: after a strong rebound, the market is resting.

Stochastic RSI suggests a potential upside impulse, but requires confirmation by a breakout of resistance.

For traders: 2,800 (resistance) and 2,300 (support) are worth watching.

For investors: 1,600–1,800 could be considered a long-term accumulation zone.

BTC continues to accumulate above 103,500Plan BTC today: 19 June 2025

Related Information:!!!

Bitcoin (BTC) price edges slightly higher, trading near $104,700 at the time of writing on Thursday, after stabilizing above a key level — the 50-day Exponential Moving Average (EMA) at $103,100. A breach below this level could trigger a sharp fall in BTC. Risk aversion could intensify, as reports indicate that US officials are preparing for a strike on Iran in the coming days. Despite this risk-off sentiment in global markets, institutional demand remains strong, with US spot Bitcoin Exchange Traded Funds (ETFs) seeing positive inflows for eight consecutive days

personal opinion:!!!

btc continues to accumulate above 103,500, the market is no longer sensitive to interest rate information yesterday

Important price zone to consider :!!!

support zone : 103.500 \ 101.000

Sustainable trading to beat the market

Accumulate around 3400, Keep interest rate today⭐️GOLDEN INFORMATION:

Gold prices slipped below the $3,400 threshold on Tuesday, weighed down by renewed strength in the US Dollar (USD), despite a worsening global risk sentiment. The resilience of the greenback limited gains in the safe-haven asset, though mounting tensions between Israel and Iran continue to offer underlying support. At the time of writing, XAU/USD is trading at $3,380, down 0.05%.

Although risk appetite remains subdued, gold has struggled to rally, as the US Dollar regains ground. The US Dollar Index (DXY), which measures the currency against a basket of six major peers, climbed 0.46% to 98.58.

Meanwhile, geopolitical tensions intensified after US President Donald Trump abruptly departed the G7 summit in Canada on Monday in response to unfolding events in the Middle East. In a stark warning posted to his social platform, he urged, “Everyone should immediately evacuate Tehran,” signaling a sharp escalation in the conflict that began last Friday.

⭐️Personal comments NOVA:

Gold price is moving in accumulation zone below 3400 - 3365. Break and return above 3400, continue to accumulate.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3437- 3439 SL 3444

TP1: $3425

TP2: $3410

TP3: $3395

🔥BUY GOLD zone: $3338-$3340 SL $3333

TP1: $3346

TP2: $3355

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continue the uptrend, gold price returns to 3444⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) slipped for the second consecutive session on Tuesday, retreating from an early uptick during the Asian session that briefly pushed prices above the $3,400 mark. A slight rebound in the US Dollar (USD) continues to weigh on the precious metal, acting as a key drag. However, the downside appears limited amid escalating geopolitical tensions in the Middle East and growing market expectations that the Federal Reserve (Fed) will initiate further rate cuts in 2025.

Meanwhile, the ongoing aerial conflict between Israel and Iran has entered its fifth day, heightening fears of a wider regional escalation. This persistent geopolitical uncertainty is keeping demand for safe-haven assets like gold supported. Investors are also exercising caution ahead of the Federal Open Market Committee’s (FOMC) two-day policy meeting, the outcome of which may shape the next directional move for non-yielding bullion.

⭐️Personal comments NOVA:

Gold price takes liquidity from lower supports: completed 3385, 3373. short term downtrend break. Gold price will soon return above 3400.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3443- 3445 SL 3450

TP1: $3435

TP2: $3422

TP3: $3407

🔥BUY GOLD zone: $3352-$3350 SL $3345

TP1: $3368

TP2: $3376

TP3: $3390

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC accumulates above 104,300 zonePlan BTC today: 17 June 2025

Related Information:!!!

Bitcoin (BTC) price falls to around $106,000 at the time of writing on Tuesday following a mild recovery the previous day. The decline comes as investors continue to digest the escalation of the Iran-Israel conflict and after US President Donald Trump highlighted concerns and asked his security advisors to meet in the Situation Room. While institutional interest in Bitcoin remains robust, any further escalation in the Middle East could impact global risk assets.

The US steps in to resolve the Iran-Israel war

Bitcoin price action remained broadly resilient on Monday despite escalating tensions in the Middle East. The four-day-old war between Israel and Iran, which began on Friday, has so far failed to trigger a sharp correction. The largest cryptocurrency by market capitalization held above its key psychological threshold of 100,000 despite the initial shock — a contrast to April last year, when BTC fell more than 8% amid similar Iran-Israel turmoil.

The New York Times reported on Monday that US President Donald Trump has encouraged Vice President JD Vance and his Middle East envoy, Steve Witkoff, to offer to meet with the Iranians this week.

personal opinion:!!!

Gold price continues sideways and accumulates in 2 trend lines, support 104,300

Important price zone to consider :!!!

support zone : 104.300 - 104.100

Sustainable trading to beat the market

Accumulate, BTC back above 110K💎 BTC PLAN UPDATE (June 16)

NOTABLE BITCOIN (BTC) NEWS:

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are showing signs of stabilization around key support levels following last week’s correction. BTC is attempting to regain momentum after closing below a critical support zone, while ETH and XRP are hovering near technical thresholds that could determine their next directional move.

TECHNICAL ANALYSIS OUTLOOK:

Bitcoin could decline further if it closes below the 50-day EMA

Bitcoin closed below its daily support at $106,406 on Thursday, then bounced back after retesting the 50-day Exponential Moving Average (EMA) at $102,893 on Friday. BTC has since stabilized around the $105,000 level over the weekend. As of Monday, it continues to consolidate, trading near $105,788.

If BTC fails to close above the $106,406 resistance level and heads lower, it may extend its decline toward the psychologically significant $100,000 level.

The Relative Strength Index (RSI) on the daily chart is hovering around the neutral 50 mark, signaling indecision among traders. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator shows a bearish crossover on the daily chart, indicating selling pressure and a possible downtrend continuation.

At this stage, whether you're new or experienced, it's wise to spend more time practicing, deepening your technical analysis knowledge, and exploring educational content shared on the channel. Strengthening your foundation will help you protect your capital in this volatile environment.

==> This analysis is for trend reference only. Wishing all investors successful trades!

The FVG was the invitation. The OB was the entryBTC delivered exactly where it needed to. It didn’t break down. It rebalanced. The chart isn’t noisy — it’s speaking. And it’s pointing to 108.3k.

The logic:

Price printed clean displacement, returned to mitigate a 1H FVG stacked on top of a refined Order Block, then paused. That pause is structure — not indecision. Volume compression confirms it: absorption, not rejection.

A deeper OB sits below at 102.5k. If we tap it, it’s not invalidation — it’s refinement. But the primary play is already in motion.

The path:

Reclaim 105.7k range high

Break above intraday liquidity

Deliver to 108.3k inefficiency fill

Execution:

Entry: 104.8k–105.1k (current OB zone)

SL: Below 103.9k

TP: 108.3k

Don’t react to the candles. React to what they represent — engineered displacement followed by precision mitigation.

Final thought:

“This isn’t a trade setup. It’s a delivery route — and I’m already onboard.”

Can $ALB Triple Without Lithium Prices Hitting All-Time Highs?🧠 TL;DR

Albemarle ( NYSE:ALB ), a global lithium heavyweight, has seen its stock price collapse over 70% from its 2022 highs, closely tracking the decline in lithium spot prices. With lithium carbonate plunging from ~$80,000/ton to under $15,000/ton, many investors assume a rebound in the commodity is a precondition for a meaningful recovery in $ALB.

But what if that assumption is wrong?

This post explores whether Albemarle can stage a powerful comeback even if lithium prices remain far below their peak. Once lithium bottoms—potentially soon—investors can begin extrapolating annual demand growth and embed those expectations into the share price, setting the stage for a valuation rerating.

The headline chart tracks the long-term price relationship between Albemarle and lithium carbonate, normalized and plotted on a logarithmic scale. It shows the synchronized peaks of 2022, the ensuing crash, and where that correlation may have decoupled.

While the lithium price collapse has been severe, NYSE:ALB has arguably overcorrected — potentially pricing in a long-term depression in lithium that may never materialize.

🏭 Revenue, Net Income, and Lithium

This chart juxtaposes Albemarle's trailing revenue and net income against spot lithium prices. Despite a sharp fall in the commodity, the company posted two successive quarters of profitability, and revenue remains well above pre-boom levels.

This resilience suggests:

Multi-year pricing contracts offer insulation from spot volatility

Cost structure remains profitable even at current prices

Demand tailwinds (EVs, grid storage) are still pushing through

📊 Negative Forward P/E, Positive Earnings, and Discount to NAV

While forward P/E metrics have dipped into negative territory, this doesn’t tell the full story. The company delivered back-to-back profitable quarters, and the current share price reflects a significant discount to estimated net asset value.

The market is currently punishing ALB based on trailing pessimism and collapsing sentiment, rather than forward fundamentals. When lithium prices stabilize, even at mid-cycle levels, investors may reprice ALB based on future earnings potential and hard assets—not backward-looking assumptions.

🔍 Key Takeaways

🔋 Demand Remains Strong

EVs, grid storage, and electrification trends are not slowing. Lithium demand is projected to more than triple by 2030. Even modest demand growth off the current base will stretch supply chains, especially if new projects are delayed.

🏗️ Albemarle’s Structural Edge

With a relatively low cost of production and long-term contracts in place, ALB is positioned to ride through the downturn. The company has already demonstrated profitability at today's prices.

📉 Valuation Compression = Opportunity

At current levels, the stock appears to price in a scenario of sustained low lithium prices and declining demand. But the company’s hard assets, cost advantage, and future demand curve suggest a different reality.

🧠 Final Thought

Once lithium prices bottom—maybe relatively soon—investors can begin to extrapolate the rate of annual growth and embed those expectations into the share price, potentially triggering a sharp re-rating before spot prices ever return to their highs.

Despite ongoing supply restrictions PPLT trendsAs uncertainty in US equity and job future rises a trend appears in precious metals and bonds. The demand for natural resources continues to grow despite tariff concerns. Trumps PGM policies threatened to shake the market, however, majority of platinum is mined in countries with less strict tariff restrictions and even in the US.; infact, South Africa is the largest producer of platinum with Zimbabwe holding significant reserves, Russia is also a leading force. In addition to Canada- where an independent researcher Jayanth Chennamangalam is exploring the legalities of an exploration to mine platinum in space from craters on the moon. Both PPLT and PLTM have seen resent up growth, trying to push back to their highs of the early 2020s. I have taken the mean of 7 angles representing our highest and lowest points at approx 50°or greater and attached it to our new low- the cross section of this angle and the resistance point drawn from our all time high estimate we are ahead of schedule for reaching our all time high in Sept 2025.

"Within our updated palladium forecasts to 2029f, we expect market deficits to last until 2027f (previously 2025f) before market surpluses gradually build from 2028f. Given ongoing uncertainties, this report does not fully capture the impact of Trump’s policies on PGM demand, but we do not expect them to be of sufficient magnitude to materially change the platinum and palladium deficits laid out herein. "

(platinuminvestment.com)

We could have anticipated this upcoming growth by paying close attention to the K line cross and divergence on our Stochastic oscillator (14,3,3).

"C:\Users\ChrisPC\Downloads\PPLT_2025-06-12_15-47-20.png"

Ethereum is deciding where it wants to live.This is not a trade idea, this is a long term concept, most of my portfolio is swing when bull market comes (monthly/yearly) not trade (daily/weekly).

This is a solid question that will have to be played out in the upcoming years, Ethereum keeps changing its monetary policy and right now has less supply increase than BTC (due to burning mechanisms), will that stay forever? What will happen in the future to the policy? What it will mean for price?

Right now we can clearly see this is a bull case for future months.

Can gold price maintain the uptrend above 3400?⭐️GOLDEN INFORMATION:

Gold prices advanced by approximately 0.97% on Wednesday, buoyed by signs of easing inflation in the United States (US), which reinforced expectations that the Federal Reserve (Fed) could resume rate cuts as early as September. At the time of writing, XAU/USD is trading around $3,363.

The May Consumer Price Index (CPI) report shows a slowdown in price pressures compared to April, prompting a surge in demand for the yellow metal. In response, gold briefly rallied to an intraday high near $3,360 before paring back some of those gains, as investors recalibrated their outlook on the Fed’s policy path.

⭐️Personal comments NOVA:

Middle East concerns, along with information about influential high tariffs on countries without trade agreements. Gold prices have recovered, but there is no long-term stability.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3410

TP2: $3395

TP3: $3382

🔥BUY GOLD zone: $3345-$3343 SL $3338

TP1: $3355

TP2: $3367

TP3: $3380

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account