Longterm

Long Term - Defence Fundamental PickDefence stocks are currently trading low due to the ongoing tariff trade war. Here are some strong fundamental picks to consider for long-term investment.

📊 Script: COCHINSHIP

⏱️ C.M.P 📑- 1338

🎯 PE 🏆 - 42.78

📊 Script: BDL

⏱️ C.M.P 📑- 1255

🎯 PE 🏆 - 81.3

📊 Script: GRSE

⏱️ C.M.P 📑- 1523

🎯 PE 🏆 - 44.2

📊 Script: PARAS

⏱️ C.M.P 📑- 917

🎯 PE 🏆 - 73.5

📊 Script: MAZDOCK

⏱️ C.M.P 📑- 2317

🎯 PE 🏆 - 34

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

Long Term - Railway Fundamental PickRailway stocks are currently trading near their 52-week low because of the market decline. Here are some solid fundamental picks to consider adding to your portfolio for the long term.

📊 Script: RVNL

⏱️ C.M.P 📑- 335

🎯 PE 🏆 - 56.1

📊 Script: RAILTEL

⏱️ C.M.P 📑- 281

🎯 PE 🏆 - 32.4

📊 Script: IRCON

⏱️ C.M.P 📑- 144

🎯 PE 🏆 - 17.7

📊 Script: IRFC

⏱️ C.M.P 📑- 122

🎯 PE 🏆 - 24.5

📊 Script: TITAGARH

⏱️ C.M.P 📑- 748

🎯 PE 🏆 - 34.6

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

BTC - One More Leg...Hello TradingView Family / Fellow Traders!

This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish , trading within the falling channel marked in red.

But the big question is — where could the potential bottom be?

👉 I’m watching the $70,000 zone!

Here’s why:

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

S&P 500: Historic Crash or Just Another Chance?Let’s be real: What’s happening with the S&P 500 right now is rare. This is only the fourth time in history that the index has dropped more than 10% in two days (technically three, including today’s Monday session). The other times? October 1987, November 2008 during the financial crisis, and March 2020 during the pandemic crash.

And now? We’re seeing a similar drop, this time triggered by a global tariff war , stoked by the U.S. and other governments playing chicken to see who folds first.

Yeah, it sucks. It hurts. But it could also be a hell of an opportunity.

We just tagged the 4,800 level —a place many didn’t expect to see this quickly. Neither did I. But here we are. The untapped VWAP got hit, and this might very well be the start of Wave A. Could we go lower? Absolutely. There’s a monthly Fair Value Gap around $4,500, and a drop to $4,250 isn’t out of the question either.

But here’s the thing: it depends entirely on your perspective.

If you’re trading on the 30-minute chart, this is a full-blown crisis. But zoom out to the daily, weekly, or monthly chart—and it’s just market noise.

Pull up the log chart from 1953 to 2025 in the top left corner. We’ve seen this before. A handful of times. And on that scale? Nobody cares.

If you’re in the game to build long-term wealth, this moment is just another temporary shakeout. If you’re doing dollar-cost averaging, this is exactly where you want to be adding—not panicking.

The market doesn’t care about your plan. It forces you to adapt. You can’t fight it, only flow with it.

And if you’re in it for the long haul? This is just noise. Ignore it, zoom out – and stay the course.

Will ETH finally change direction?ETH is approaching support at $1,559, but here you can see how the price has fallen below the upward trend line, which could have resulted in a stronger rebound. When support is broken, you can still see a strong support level at $997, to which we can see a decline.

Only when the trend changes direction will ETH have to face resistance levels at $1,889, then $2,151, and then $2,560 before we see any major upward movements.

The Stoch RSI indicator shows us moving along a line where we could previously observe strong price rebounds, while the RSI indicator itself, taking into account the interval of one weekend, shows us approaching the level we last touched during the bear market bottom.

#LAYERUSDT setup remains active 📉 LONG MEXC:LAYERUSDT.P from $1.5722

🛡 Stop loss: $1.5440

🕒 Timeframe: 1H

✅ Market Overview:

➡️ The coin is showing "its own game" — price action is independent of #BTC and #ETH, reacting to internal volume dynamics.

➡️ Ascending triangle breakout with a confirmed close above the key $1.5440 zone.

➡️ Empty space ahead — no major resistance levels until $1.6060–$1.6210.

➡️ Accumulation is forming between $1.5440–$1.5700 — a breakout may follow.

➡️ Important: candles must close above $1.5440 to confirm the long scenario.

🎯 TP Targets:

💎 TP1: $1.5880

💎 TP2: $1.6060

💎 TP3: $1.6210 (full measured move from triangle pattern)

📢 Recommendations:

If volume MEXC:LAYERUSDT.P increases during a breakout above $1.5722 — expect a rapid move.

If price pulls back — the $1.5254 area could offer a second entry opportunity.

The coin looks strong but slightly overbought — partial take profit at TP1 is advised.

📢 A strong breakout above $1.5700 may lead to a sharp move due to lack of resistance.

📢 Avoid 1H candle close below $1.5440 — scenario invalidation.

📢 If the move occurs on weak volume — watch for a potential reversal near TP1.

🚀 MEXC:LAYERUSDT.P setup remains active — holding the key level could lead to a move toward TP2–TP3!

401(k)s: A Safe Bet or a Rigged Game?In 2008, the S&P 500 dropped 57% at its lowest, wiping out decades of savings for millions of Americans. People who were 5–10 years from retirement lost everything overnight—and they had no way out.

And here’s the problem:

• 401(k)s are heavily stock-weighted, especially those “target-date” funds that adjust based on age—but not fast enough in a crash.

• No active protection. These funds don’t hedge, use stop-losses, or rotate into cash. If the market dumps, you’re just riding it down.

• No control or transparency. Most people don’t even know what they’re invested in unless they dig deep into fund holdings.

It’s no coincidence that the same Wall Street firms managing 401(k)s make money shorting crashes or getting bailouts, while regular people are told to “just wait it out.” Sure, that might work over decades, but what if you’re close to retirement? Or just don’t want to wait 10 years for a recovery?

The Harsh Reality

• 401(k)s aren’t really optional. They’re the main retirement plan in the U.S., so most people are forced into them with few alternatives.

• Most people don’t actively manage them. They pick a default option, get put into a target-date fund, and hope for the best. That’s where the “sheep” feeling comes in.

• You can’t easily exit. There are penalties for withdrawing early, so in a crash, you’re locked in like a prisoner or financial refugee, while the “big boys” cash out first.

It’s not a scam in a legal sense—but it is a system that favors the knowledgeable and punishes the passive. Those who don’t study markets, adjust their portfolios, or take active control end up paying the price. And sadly, that’s the majority.

Reversal in Godrej Properties.On monthly Time frame, Godrej Properties is taking support at golden zone of Fibonacci retracement. Weekly closing above 2203 will the entry and closing below 1950 will be the SL. Expecting new high in coming months.

Please note: This a Monthly setup so it will be long term Investment. Will keep on adding quantity and weekly basis.

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading IdeasMidterm forecast:

2772.38 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 2772.38 is broken.

OANDA:XAUUSD TVC:GOLD

Technical analysis:

A trough is formed in daily chart at 2832.55 on 02/28/2025, so more gains to resistance(s) 3100.00, 3150.00, 3200.00 and more heights is expected.

Take Profits:

2833.00

2879.11

2955.00

3000.00

3057.40

3100.00

3150.00

3200.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

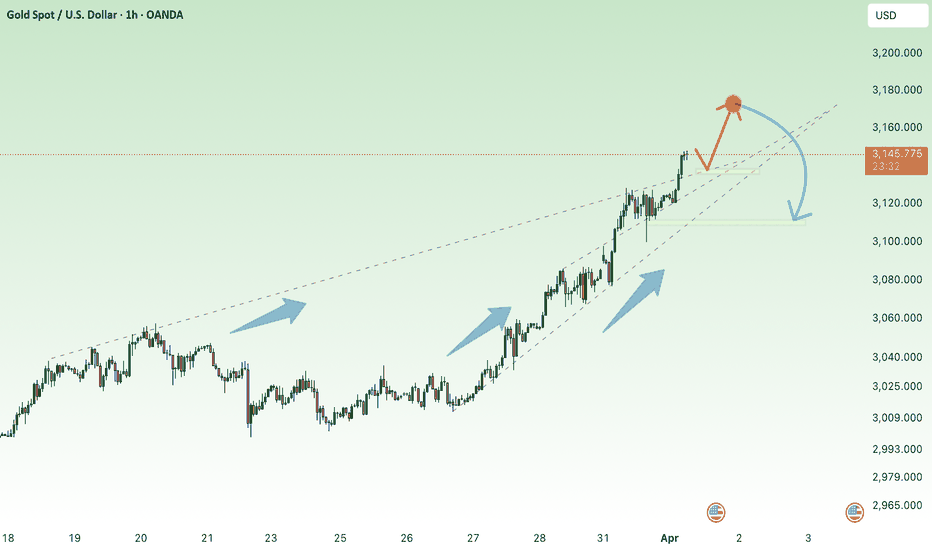

New ATH , GOLD is comming 3173⭐️GOLDEN INFORMATION:

US President Donald Trump dismissed expectations that the new tariffs would target only a select group of nations with the largest trade imbalances, declaring on Sunday that reciprocal tariffs would apply universally. This announcement, coupled with the existing 25% duties on steel, aluminum, and auto imports, has intensified fears of an escalating global trade war.

Additionally, investors are increasingly convinced that the economic slowdown triggered by these tariffs will pressure the Federal Reserve (Fed) to resume rate cuts, despite persistent inflation concerns. As a result, Gold has surged to a fresh record high, marking its strongest quarterly performance since 1986.

⭐️Personal comments NOVA:

The backdrop of everything from technical to political and economic is supporting the increase in gold prices in the first quarter of 2025. Gold prices have the highest growth in history.

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3162 - 3164 SL 3169

TP: 3155 - 3140 - 3127

🔥BUY GOLD zone: $3093 - $3091 SL $3086

TP1: $3100

TP2: $3110

TP3: $3120

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

USDCAD -Weekly Forecast,Technical Analysis & Trading Ideas

Technical analysis is on the chart!

No description needed!

OANDA:USDCAD

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

ATH 3127, continues to aim for big growth⭐️GOLDEN INFORMATION:

Gold's record-breaking rally continues unchecked as buyers push prices past the $3,100 milestone for the first time ever. Mounting concerns over a potential global trade war and rising stagflation risks in the United States (US) have further fueled demand for the safe-haven metal, reinforcing its status as a store of value.

A recent report from The Wall Street Journal (WSJ) suggests that US President Donald Trump may introduce even higher and broader reciprocal tariffs on April 2, known as “Liberation Day.” This prospect has sent fresh waves of risk aversion rippling through global markets, amplifying investor uncertainty.

⭐️Personal comments NOVA:

Tariff pressure, fears of trade war outbreak in April. Gold price is growing continuously, expected to reach 3127

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3126 - $3128 SL $3133

TP1: $3120

TP2: $3110

TP3: $3100

🔥BUY GOLD zone: $3092 - $3094 SL $3087

TP1: $3098

TP2: $3103

TP3: $3110

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

SPY Price Projection: Mid-2025 TargetRevealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY

In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the SPY.

This analysis delves into the utilization of logarithmic scale regression alongside two robust indicators, offering insights into the potential trajectory of the SPY's price movement. It's essential to note that the interpretations and predictions presented are based on my analysis alone and should not be construed as financial advice. As with any market analysis, uncertainties persist, and actual outcomes may diverge from projections.

Logarithmic scale regression accounts for the exponential nature of price movements, providing a nuanced perspective on long-term trends. When combined with indicators such as moving averages or momentum oscillators, the analysis gains depth, revealing not only the direction but also the strength of the trend.

After meticulous examination of historical data and the application of analytical tools, our analysis suggests a bullish trajectory for the SPY, with a projected price nearing 620 EUR by mid-2025. This projection implies a significant uptrend from the current date, with a potential increase of approximately 20% over the specified timeframe.

However, it's crucial to approach such forecasts with caution, recognizing the inherent risks associated with financial markets. While our analysis indicates a positive outlook, market conditions can change rapidly, leading to deviations from expected trends.

In summary, logarithmic scale regression analysis, supported by robust indicators, offers valuable insights into market trends and potential price movements. While our analysis suggests a bullish sentiment for the SPY, investors should conduct thorough research and seek professional advice before making investment decisions.

Disclaimer: The analysis provided is based on personal interpretation and should not be considered financial advice. Investing in financial markets carries risks, and actual outcomes may differ. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

Reciprocal tariffs - gold continues to rise✍️ NOVA hello everyone, Let's comment on gold price next week from 03/31/2025 - 04/04/2025

🔥 World situation:

Gold prices surged on Friday, reaching a new all-time high of $3,086 as uncertainty surrounding US trade policy and an uptick in the Federal Reserve's (Fed) preferred inflation gauge fueled demand for the safe-haven metal. Following this, market sentiment suggests growing confidence that the Fed will implement two rate cuts in 2025. At the time of writing, XAU/USD trades at $3,079, up 0.79%.

Investor sentiment remains cautious as markets brace for April 2, dubbed “Liberation Day” by US President Donald Trump, who has signed an executive order imposing a 25% tariff on all imported automobiles. This move has sparked global reactions, particularly from Canada and the European Union (EU), both of which are preparing retaliatory measures in response to the tariffs.

🔥 Identify:

Gold price moves up, early April will continue to explode to NEW Ath

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3100, $3132, $3150

Support : $3002, $2957

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

GBPCAD - Weekly Forecast,Technical Analysis & Trading IdeasTechnical analysis is on the chart!

No description needed!

OANDA:GBPCAD

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

breakout - gold price rebounds 3045⭐️GOLDEN INFORMATION:

Gold prices remained stagnant late in the North American session, constrained by a rebound in the US Dollar Index (DXY), which initially dipped to 104.18 before recovering. The turnaround came after the White House confirmed that President Donald Trump would unveil new automobile tariffs around 22:00 GMT. As of writing, XAU/USD is trading at $3,019, showing little change.

Despite reports from The Wall Street Journal suggesting that Trump may introduce limited tariff measures, including on automobiles, bullion traders struggled to find momentum. Meanwhile, the DXY, which measures the Greenback against a basket of six major currencies, climbed 0.32% to 104.55, further weighing on gold’s appeal.

⭐️Personal comments NOVA:

Gold price recovers, breakout of H1 frame. With the latest 25% car tax policy, gold price reacts strongly and increases again.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3045 - $3047 SL $3052

TP1: $3038

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3023 - $3021 SL $3016

TP1: $3030

TP2: $3040

TP3: $3057

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

ZCash (ZEC)- Weekly Forecast,Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 24.41, beginning of uptrend is expected.

We make sure when the resistance at 45.33 breaks.

If the support at 24.41 is broken, the short-term forecast -beginning of uptrend- will be invalid.

COINBASE:ZECUSD

Technical analysis:

A trough is formed in daily chart at 29.20 on 03/21/2025, so more gains to resistance(s) 41.10 and maximum to Major Resistance (45.33) is expected.

Take Profits:

35.60

41.10

45.33

50.14

56.49

67.07

79.42

90.06

100.00

117.07

135.00

170.00

216.50

305.00

370.55

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

Potentially a good time for LONG MKR/USDHello everyone, let's look at the 1W MKR to USD chart, in this situation we can see how the price created a lower low with the last drop, what is important is that now it goes up creating a new higher local high. What's more, we can see how the ema cross 50 and 200 approached each other, but the price exiting upwards should maintain a long-term upward trend. We can also see how the whole thing is moving in a descending triangle, but an exit from the yellow downward trend line upwards can give a new strong upward movement.

Let's start by defining the goals for the near future that it has to deal with, and here you can see how the price bounced off the first target:

T1 = 1631 USD

T2 = 2159 USD

Т3 = 3015 USD

Т4 = 3607 USD

As for support or potential stop-loss when opening a long, we need to consider a strong support zone from $1028 to $542, with the level around $790 being key, as it is our last lower low in declines.

The RSI and STOCH indicators show an attempt to break out of the local downtrend lines upwards, which may also have a positive impact on the next price movement.

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading Ideas💡 OANDA:XAUUSD Daily Timeframe:

As forecasted by 4CastMachine AI last week, gold started its decline when it hit the red channel line.

This decline will continue, but the support area of 2955 could trigger a rebound.

At the support area of 2955, the up trend line will also prevent further declines.

If this area is broken, the price will decline to the support area of 2789.95.

This area, which was previously a major resistance, will become a major support, creating a good buying opportunity.

So, given the long-term uptrend, we can use this area as a long-term BUY ZONE.

💡 TVC:GOLD H4 Timeframe:

The price is in a Corrective wave.

Given the break of the ascending trend line in the RSI, the corrective wave is expected to continue to a depth of 2955.

💡 H1 Timeframe:

A Head and Shoulder Reversal Pattern has formed and the neckline has also been broken. Price is touching the neckline again. It is very likely that the downward wave will start from this area.

3027.83 support is broken now. It will act as a Resistance now!

Forecast:

Correction wave toward the Sell Zone

Another Downward Impulse wave toward Lower TPs

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

GOOGL: Bullish Bounce Before a Bigger Drop? Here's My RoadmapGoogle NASDAQ:GOOG NASDAQ:GOOGL is shaping up to look bullish in the short term, and I believe that in the next few weeks to months, we could see a solid upside move - before things could turn ugly again later on. Let me explain why.

Big picture: we’re currently in a Wave (2) corrective structure, which is playing out as a complex WXY correction (marked in orange). This type of correction follows a 3-3-3 wave pattern, and everything we’ve seen so far fits that structure. Since the top in February, NASDAQ:GOOGL has dropped around 24% , which is significant - but also not unexpected within this context.

What’s interesting now is that we’ve just printed a bullish divergence on the RSI for the first time in this move down. That’s the first green flag. The second? The lower wick, which I currently mark as sub-wave ((a)) has been very well respected so far. That’s the second sign that this could be the turning point - at least temporarily.

I’m expecting a move up in the coming weeks toward the 2024 VAH, around $178, where we could see a first rejection. From there, the price should continue higher in a 3-wave structure toward Wave ((b)), likely reaching between $187.80 and $196.30 (the 61.8% to 78.6% retracement zone).

But let’s be clear: this is not the start of a new bullish trend. After Wave ((b)), I expect a 5-wave move to the downside, completing Wave ((c)) - and that means lower prices ahead , potentially in Q3, Q4 2025 or even into 2026.

Until then, I’m keeping a close eye on this structure. As long as the current Wave ((a)) low holds, this short-term bullish scenario remains valid. If we get a strong breakout in the coming days / weeks, I’ll be looking to enter on a retest, targeting that $187.80–$196.28 zone.

Let’s see if the market plays it my way.

Make sure to follow me for future updates on this scenario and other setups !