Longtrade

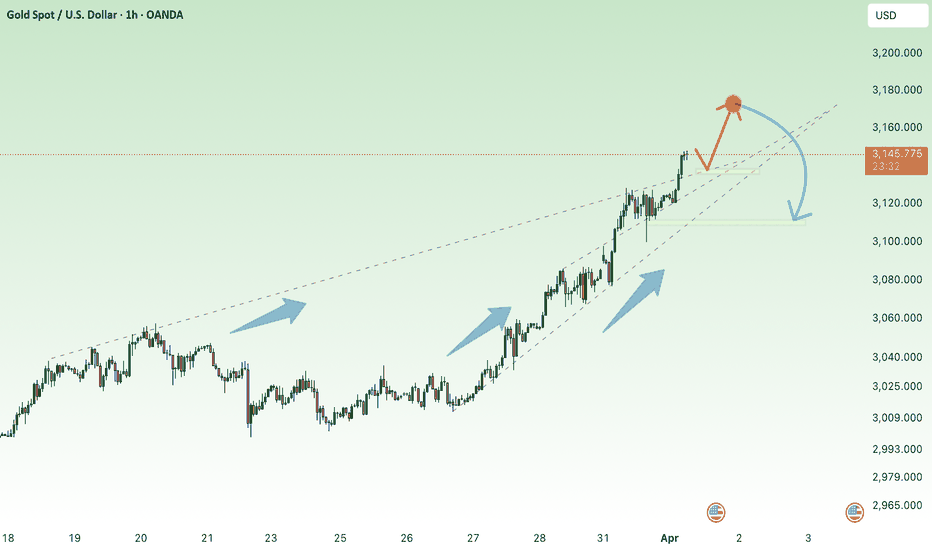

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading Ideas💡 Daily Timeframe:

As the 4CastMachine AI forecasted, the price began its decline towards the $3,000 support.

At the support area of 3000, the up trend line will also prevent further declines.

If this area is broken, the price will decline to the support area of 2789.95.

This area, which was previously a major resistance, will become a major support, creating a good buying opportunity.

So, given the long-term uptrend, we can use this area as a long-term BUY ZONE.

OANDA:XAUUSD TVC:GOLD

💡 H4 Timeframe:

Gold started its decline when it hit the 3167 resistance.

The uptrend is broken, and price is in an impulse wave.

This decline will continue, but the support area of 3000 and uptrend line could trigger a resumption of uptrend.

💡 H1 Timeframe:

If the price enters the sell zone with a corrective wave, we will wait for the price to reject from that area.

If we see a price rejection from the sell zone, we can sell.

H1 Forecast:

Correction wave toward the Sell Zone

Another Downward Impulse wave toward Lower TPs

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

EUR/GBP: Inverse Head & Shoulders Breakout Towards TargetChart Overview

Asset: Euro / British Pound (EUR/GBP)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 19:21 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 0.83668

High: 0.83670

Low: 0.83260

Close: 0.83635

Change: -0.00035 (-0.04%)

Price on the Right Axis: The price scale ranges from approximately 0.83100 to 0.84447, with the current price around 0.83642 (ask) and 0.83635 (bid).

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of EUR/GBP, showing price movements from mid-March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a downtrend, declining from around 0.84200 (March 12) to a low of 0.83260 (March 25). This indicates a bearish trend leading into the pattern formation.

Following this decline, the price began to consolidate, forming the Inverse Head and Shoulders pattern, which suggests a potential reversal from bearish to bullish.

Recent Price Action:

On April 2, the price appears to have broken out above the neckline of the Inverse Head and Shoulders pattern, closing above the resistance level with a bullish candle. The current price of 0.83642 is above the breakout level, supporting the bullish thesis.

2. Chart Pattern: Inverse Head and Shoulders

Pattern Identification:

The chart highlights an Inverse Head and Shoulders pattern, a bullish reversal pattern that typically forms after a downtrend. It consists of three troughs:

Left Shoulder: A low around 0.83400 (March 20), followed by a bounce.

Head: A deeper low at 0.83260 (March 25), marking the lowest point of the pattern.

Right Shoulder: A higher low around 0.83400 (March 30), indicating diminishing selling pressure.

The neckline is drawn by connecting the highs between the shoulders (around 0.83600–0.83700), sloping slightly downward in this case.

Pattern Dynamics:

The Inverse Head and Shoulders pattern signals a shift from bearish to bullish sentiment. The left shoulder and head represent selling pressure, while the higher right shoulder indicates buyers stepping in at a higher level, showing increased demand.

The breakout occurs when the price closes above the neckline, confirming the reversal. In this chart, the breakout is confirmed around April 2, with the price closing above the neckline at approximately 0.83600–0.83700.

Breakout Confirmation:

The price broke above the neckline on April 2, with a strong bullish candle closing at 0.83635. The current price of 0.83642 is holding above the breakout level, which is a positive sign for bulls.

The breakout level aligns with the resistance zone, making the move significant as it also clears this key barrier.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 0.83425 (approximately 0.8340–0.8345).

This level corresponds to the lows of the left and right shoulders, where buyers stepped in to defend the price. It also aligns with the lower boundary of the pattern, reinforcing its importance.

Resistance Level:

A resistance zone is marked around 0.83700 (approximately 0.8365–0.8375).

This level corresponds to the neckline of the Inverse Head and Shoulders pattern and a previous high from March 19. It acted as a barrier during the pattern formation but has now been broken, turning it into potential support on a retest.

Target Level:

The target for the breakout is projected at 0.84447.

This target is calculated using the standard method for Head and Shoulders patterns: measuring the height of the pattern (from the head at 0.83260 to the neckline at 0.83700, which is 0.00440) and projecting that distance upward from the breakout point (0.83700 + 0.00440 = 0.84140). The target of 0.84447 is slightly higher, possibly adjusted for the next significant resistance.

The chart indicates a potential move of 0.00627 (0.75%), which aligns with the distance from the breakout level (0.83700) to the target (0.84447).

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 0.83425.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back below the neckline and the right shoulder, the trade is exited with a controlled loss.

The distance from the breakout level (0.83700) to the stop loss (0.83425) is 0.00275, representing the risk on the trade.

Risk-Reward Ratio:

The chart indicates a potential move of 0.00627 (0.75%) to the target.

The risk is 0.00275 (from 0.83700 to 0.83425), and the reward is 0.00627 (from 0.83700 to 0.84447), giving a risk-reward ratio of approximately 2.28:1 (0.00627 / 0.00275). This is a favorable ratio for a trading setup.

5. Additional Annotations

Pattern Components:

The chart labels the Left Shoulder, Head, and Right Shoulder, clearly identifying the structure of the Inverse Head and Shoulders pattern.

A blue arrow labeled “Inverse Head & Shoulder pattern” points to the formation, making it easy to recognize.

Arrows and Labels:

A green arrow labeled “Support Level” points to the 0.83425 zone, indicating where buyers have defended the price.

A red arrow labeled “Resistance Level” points to the 0.83700 zone, highlighting the neckline and the breakout area.

A blue arrow labeled “Target” points to 0.84447, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 0.83425, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 0.83642 (red) and bid price at 0.83635 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) EUR/GBP.

Entry Point: The setup suggests entering after the price breaks out above the neckline of the Inverse Head and Shoulders pattern, which occurred around April 2, 2025, at approximately 0.83700.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the neckline, with the current price at 0.83642, slightly below the high of 0.83670 but still above the breakout level. Traders might wait for a retest of the neckline (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 0.83425.

Rationale: This placement protects against a false breakout. If the price falls back below the neckline and breaches the right shoulder, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (0.83700) to the stop loss (0.83425) is 0.00275, or approximately 0.33% of the entry price.

Take Profit/Target:

Level: The target is set at 0.84447.

Rationale: This target is derived from the height of the pattern projected upward from the breakout point. It also aligns with a logical extension toward the next significant resistance.

Reward: The distance from the entry (0.83700) to the target (0.84447) is 0.00627, or approximately 0.75% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.28:1, which is attractive for a trading setup. For every unit of risk (0.00275), the potential reward is over 2 units (0.00627).

Trade Management:

Trailing Stop: Once the price approaches the target at 0.84447, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at a minor resistance level (e.g., 0.84000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the pattern was bearish, as evidenced by the decline from 0.84200 to 0.83260. The Inverse Head and Shoulders pattern suggests a potential reversal to the upside, with the breakout confirming this shift.

The price action after the breakout will be critical. A strong move toward 0.84000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of an Inverse Head and Shoulders breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

EUR/GBP is influenced by factors like Eurozone and UK economic data, interest rate differentials, and Brexit-related developments. On April 2, 2025, traders should consider:

Economic Data: Key releases like UK GDP, Eurozone inflation, or central bank statements around this time could impact the pair.

Geopolitical Events: Any developments related to UK-EU relations or global risk sentiment could drive volatility in EUR/GBP.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the neckline (0.83700) and falls back below the right shoulder, the setup is invalidated. The stop loss at 0.83425 mitigates this risk.

Resistance at 0.84000:

The price may encounter resistance around 0.84000, a psychological level and a previous high. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near this level.

Market Volatility:

EUR/GBP can be volatile on a 1-hour timeframe, especially around economic data releases. Unexpected news could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for EUR/GBP based on an Inverse Head and Shoulders pattern. The price has broken out above the neckline on April 2, 2025, signaling a potential move toward the target of 0.84447. Key levels include support at 0.83425 (where the stop loss is placed) and the neckline resistance at 0.83700, which the price must hold above to maintain the bullish thesis. The setup offers a favorable risk-reward ratio of 2.28:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on EUR/GBP or check the outcome of this setup, I can assist with that!

EUR/USD: Bullish Falling Wedge Breakout Towards TargetLet’s analyze the 1-hour candlestick chart of EUR/USD (Euro / U.S. Dollar) on TradingView, published by GoldMasterTraders on April 2, 2025, at 19:04 UTC. The chart highlights a trading setup based on a Falling Wedge pattern, indicating a potential bullish breakout. I’ll describe the chart pattern and the trading setup in detail.

Chart Pattern: Falling Wedge

Pattern Description

Type: The chart identifies a Falling Wedge pattern, which is a bullish chart pattern that typically signals a reversal or continuation of an uptrend. A Falling Wedge forms when the price consolidates between two downward-sloping trendlines that converge over time, with the upper trendline (resistance) sloping more steeply than the lower trendline (support).

Appearance on the Chart:

The Falling Wedge is clearly marked with two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle.

The pattern began forming around March 19, after a sharp decline from 1.9400 to 1.8700, and continued until the breakout on April 2, 2025.

Breakout Direction:

Falling Wedges are typically bullish, meaning the price is expected to break out to the upside. The chart shows the price breaking above the upper trendline of the wedge around April 2, 2025, with a strong bullish candle, confirming the breakout.

The breakout level is around 1.90840, and the price has moved slightly above this level, closing at 1.90864 at the time of the chart.

Key Levels and Trading Setup

1. Support Level

A horizontal support zone is marked around 1.90730 (approximately 1.9070–1.9080).

This level acted as a base during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 23 and March 30).

The support level aligns with the lower boundary of the wedge, reinforcing its significance as a key area of buying interest.

2. Resistance Level

A resistance zone is marked around 1.92000 (approximately 1.9190–1.9210).

This level corresponds to a previous high reached on March 19, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

3. Target

The target for the breakout is projected at 1.92110.

This target is likely calculated by measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The chart indicates a potential move of 0.00435 (0.40%), which aligns with the distance from the breakout level (around 1.90840) to the target (1.92110).

4. Stop Loss

A stop loss is suggested below the support level at 1.90730.

This placement ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a manageable loss.

The stop loss is just below the breakout level (1.90840), with a distance of approximately 0.00110, representing the risk on the trade.

Trading Setup Summary

Entry:

The setup suggests entering a long (buy) position after the price breaks out above the upper trendline of the Falling Wedge, which occurred around April 2, 2025. The breakout is confirmed by a strong bullish candle closing above the trendline at approximately 1.90840.

Stop Loss:

Place a stop loss below the support level at 1.90730 to protect against a false breakout or reversal. The distance from the breakout level (1.90840) to the stop loss (1.90730) is 0.00110, or about 0.06% of the entry price.

Take Profit/Target:

Aim for the target at 1.92110, which is near the next significant resistance level. The distance from the breakout level to the target is 0.01270, or a 0.40% move.

Risk-Reward Ratio:

The risk is 0.00110 (from 1.90840 to 1.90730), and the reward is 0.01270 (from 1.90840 to 1.92110), giving a risk-reward ratio of approximately 11.55:1 (0.01270 / 0.00110). This is an exceptionally high risk-reward ratio, making the setup very attractive, though traders should ensure the breakout is well-confirmed due to the tight stop loss.

Additional Observations

Price Action Context:

Before the wedge formed, the price experienced a sharp decline from 1.9400 (March 13) to 1.8700 (March 19), indicating a strong bearish trend.

The Falling Wedge represents a consolidation phase within this downtrend, and the upside breakout suggests a potential reversal or at least a corrective move higher.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout would include:

An increase in volume on the breakout candle, indicating strong buying interest.

Bullish momentum signals, such as an RSI above 50 or a bullish MACD crossover.

Traders might want to check these indicators for additional confirmation of the breakout’s strength.

Timeframe:

This is a 1-hour chart, so the setup is intended for short-term trading, with the target potentially being reached within a few hours to a day.

Market Context:

EUR/USD is influenced by factors like U.S. dollar strength, Eurozone economic data, and interest rate differentials. A bullish move in EUR/USD could be driven by a weaker dollar (e.g., due to dovish U.S. economic data) or positive Eurozone developments.

Conclusion

The TradingView idea presents a bullish setup for EUR/USD based on a Falling Wedge pattern on the 1-hour chart. The price has broken above the wedge’s upper trendline, confirming a bullish move with a target of 1.92110. The setup includes a stop loss at 1.90730 to manage risk, offering an impressive risk-reward ratio of 11.55:1. Key levels to watch include the support at 1.90730 and the resistance at 1.92000. Traders should consider additional confirmation from volume and momentum indicators, as well as broader market conditions, before executing the trade. Since this chart is from April 2, 2025, market conditions may have evolved, and I can assist with searching for more recent data if needed!

Tariff highlights, gold price up or down ?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) find support from dip-buyers during the Asian session on Wednesday, pausing the previous day’s pullback from a fresh record high. Investors continue to seek shelter in safe-haven assets amid uncertainty surrounding US President Donald Trump’s sweeping reciprocal tariffs and their potential repercussions on the global economy.

Additionally, escalating geopolitical tensions provide further support for bullion. Mounting concerns over a potential US recession, coupled with growing expectations of additional Federal Reserve (Fed) rate cuts, fuel demand for the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold price is still in a very stable uptrend, market tariff information waiting for the next price increase fomo

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3173 - 3175 SL 3180

TP: 3165 - 3150 - 3140

🔥BUY GOLD zone: $3058 - $3060 SL $3053

TP1: $3070

TP2: $3080

TP3: $3090

🔥BUY GOLD zone: $3106 - $3108 SL $3103 scalping

TP1: $3113

TP2: $3118

TP3: $3125

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

New ATH , GOLD is comming 3173⭐️GOLDEN INFORMATION:

US President Donald Trump dismissed expectations that the new tariffs would target only a select group of nations with the largest trade imbalances, declaring on Sunday that reciprocal tariffs would apply universally. This announcement, coupled with the existing 25% duties on steel, aluminum, and auto imports, has intensified fears of an escalating global trade war.

Additionally, investors are increasingly convinced that the economic slowdown triggered by these tariffs will pressure the Federal Reserve (Fed) to resume rate cuts, despite persistent inflation concerns. As a result, Gold has surged to a fresh record high, marking its strongest quarterly performance since 1986.

⭐️Personal comments NOVA:

The backdrop of everything from technical to political and economic is supporting the increase in gold prices in the first quarter of 2025. Gold prices have the highest growth in history.

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3162 - 3164 SL 3169

TP: 3155 - 3140 - 3127

🔥BUY GOLD zone: $3093 - $3091 SL $3086

TP1: $3100

TP2: $3110

TP3: $3120

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

TON Long TrrigerTONUSDT | Bullish Retest & Fibonacci Confluence 🚀

TON has recently pushed into new highs, forming a strong uptrend on the 15-minute timeframe. The price is currently pulling back into key Fibonacci retracement levels, creating a potential long entry opportunity.

🔹 Technical Analysis:

✅ Trendline Support: The price is respecting an ascending dashed trendline, indicating bullish structure continuation.

✅ Fibonacci Levels: The 0.382 ($4.0286) and 0.5 ($3.9923) levels align with key support zones.

✅ EMA Confluence: Price is interacting with the 7, 25, and 99 EMAs, suggesting a possible bounce.

📊 Key Levels to Watch:

🔹 Immediate Support: $4.0286 (Fib 0.382)

🔹 Stronger Support: $3.9923 (Fib 0.5)

🔹 Breakout Resistance: $4.0740 (Fib 0.236)

🔹 Major Target: $4.1486

🚀 Long Setup Confirmation:

A strong bounce from the Fibonacci retracement levels ($4.0286–$3.9923) with increasing volume could confirm a long entry. A break above $4.0740 would signal bullish continuation towards $4.1486 and beyond.

🔻 Invalidation & Risk Management:

A break below $3.9563 (Fib 0.618) could invalidate this setup.

A stop-loss can be placed below this level to minimize risk.

If the trend holds, TON could be gearing up for another leg up! Watch for a strong reaction at key Fibonacci levels.

#TON #Crypto #Trading #LongSetup #TechnicalAnalysis 🚀

ATH 3127, continues to aim for big growth⭐️GOLDEN INFORMATION:

Gold's record-breaking rally continues unchecked as buyers push prices past the $3,100 milestone for the first time ever. Mounting concerns over a potential global trade war and rising stagflation risks in the United States (US) have further fueled demand for the safe-haven metal, reinforcing its status as a store of value.

A recent report from The Wall Street Journal (WSJ) suggests that US President Donald Trump may introduce even higher and broader reciprocal tariffs on April 2, known as “Liberation Day.” This prospect has sent fresh waves of risk aversion rippling through global markets, amplifying investor uncertainty.

⭐️Personal comments NOVA:

Tariff pressure, fears of trade war outbreak in April. Gold price is growing continuously, expected to reach 3127

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3126 - $3128 SL $3133

TP1: $3120

TP2: $3110

TP3: $3100

🔥BUY GOLD zone: $3092 - $3094 SL $3087

TP1: $3098

TP2: $3103

TP3: $3110

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Reciprocal tariffs - gold continues to rise✍️ NOVA hello everyone, Let's comment on gold price next week from 03/31/2025 - 04/04/2025

🔥 World situation:

Gold prices surged on Friday, reaching a new all-time high of $3,086 as uncertainty surrounding US trade policy and an uptick in the Federal Reserve's (Fed) preferred inflation gauge fueled demand for the safe-haven metal. Following this, market sentiment suggests growing confidence that the Fed will implement two rate cuts in 2025. At the time of writing, XAU/USD trades at $3,079, up 0.79%.

Investor sentiment remains cautious as markets brace for April 2, dubbed “Liberation Day” by US President Donald Trump, who has signed an executive order imposing a 25% tariff on all imported automobiles. This move has sparked global reactions, particularly from Canada and the European Union (EU), both of which are preparing retaliatory measures in response to the tariffs.

🔥 Identify:

Gold price moves up, early April will continue to explode to NEW Ath

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3100, $3132, $3150

Support : $3002, $2957

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Safe Haven Demand - Gold Makes New ATH 3089⭐️GOLDEN INFORMATION:

This triggered swift responses from global leaders, with Canada and the European Union (EU) vowing to retaliate against President Trump’s trade measures.

In the US, the labor market remains resilient, as reflected in the latest unemployment claims report, while the economy continues to show strength following the release of fourth-quarter 2024 Gross Domestic Product (GDP) data. Although housing data saw some improvement, it confirmed the broader slowdown in the sector.

Meanwhile, money markets have factored in 64.5 basis points of Federal Reserve rate cuts for 2025, according to interest rate probabilities from Prime Market Terminal.

⭐️Personal comments NOVA:

growth, gold becomes a safe haven investment channel. continue to create new ATH

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3088 - $3090 SL $3095

TP1: $3080

TP2: $3070

TP3: $3060

🔥BUY GOLD zone: SCALPING: 3066, 3057

🔥BUY GOLD zone: $3034 - $3032 SL $3027

TP1: $3040

TP2: $3050

TP3: $3060

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

breakout - gold price rebounds 3045⭐️GOLDEN INFORMATION:

Gold prices remained stagnant late in the North American session, constrained by a rebound in the US Dollar Index (DXY), which initially dipped to 104.18 before recovering. The turnaround came after the White House confirmed that President Donald Trump would unveil new automobile tariffs around 22:00 GMT. As of writing, XAU/USD is trading at $3,019, showing little change.

Despite reports from The Wall Street Journal suggesting that Trump may introduce limited tariff measures, including on automobiles, bullion traders struggled to find momentum. Meanwhile, the DXY, which measures the Greenback against a basket of six major currencies, climbed 0.32% to 104.55, further weighing on gold’s appeal.

⭐️Personal comments NOVA:

Gold price recovers, breakout of H1 frame. With the latest 25% car tax policy, gold price reacts strongly and increases again.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3045 - $3047 SL $3052

TP1: $3038

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3023 - $3021 SL $3016

TP1: $3030

TP2: $3040

TP3: $3057

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears maintain selling pressure, pressure below $3000⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) faces difficulty in securing strong momentum during Tuesday’s Asian session but remains above the key $3,000 level amid mixed market signals. The US Dollar (USD) sustains its recovery from a multi-month low, hovering near Monday’s three-week high. Additionally, improved risk sentiment—fueled by optimism surrounding a potential Russia-Ukraine peace deal, less disruptive US trade tariffs, and China’s stimulus measures—dampens demand for the safe-haven metal.

⭐️Personal comments NOVA:

Selling pressure from bears continues to cause gold prices to fall and sideways around 3000

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3038 - $3040 SL $3045

TP1: $3030

TP2: $3020

TP3: $3010

🔥BUY GOLD zone: $2992 - $2994 SL $2987

TP1: $3000

TP2: $3008

TP3: $3018

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

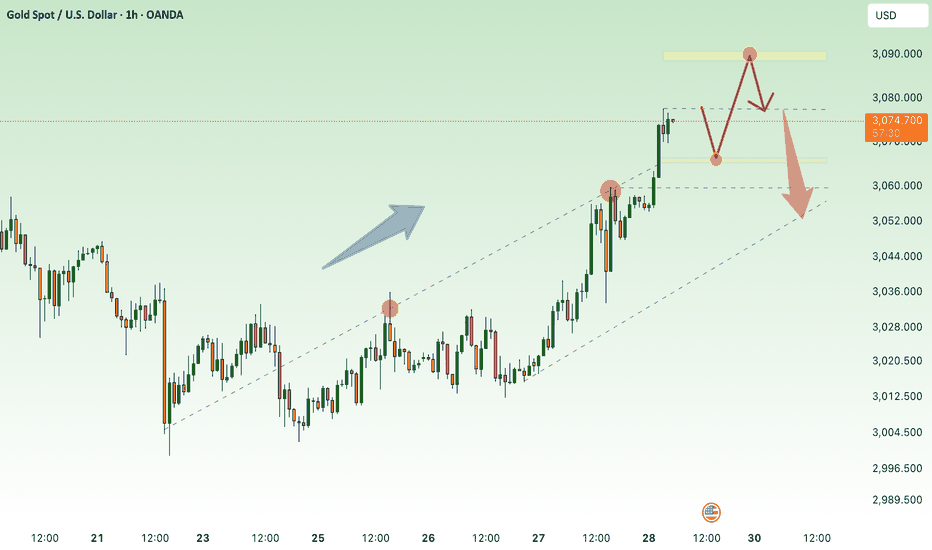

3074 ! Next price zone, gold ATH reached⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) continue their consolidation phase into the European session on Thursday, as traders exercise caution amid slightly overbought conditions. Additionally, a prevailing risk-on sentiment limits the metal’s intraday advance to a new record high. However, downside risks remain contained due to lingering uncertainty surrounding US President Donald Trump’s aggressive trade policies and their potential ramifications for the global economic outlook.

⭐️Personal comments NOVA:

Bulls continue their excitement, pushing prices higher, amid global trade tensions.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3062 - $3064 SL $3067 scalping

TP1: $3058

TP2: $3050

TP3: $3040

🔥SELL GOLD zone: $3073 - $3075 SL $3080

TP1: $3065

TP2: $3050

TP3: $3040

🔥BUY GOLD zone: $3003 - $3001 SL $2996

TP1: $3009

TP2: $3015

TP3: $3023

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

When will the gold price adjust down?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) enter a phase of bullish consolidation near their record high, as traders take a cautious stance ahead of the highly anticipated Federal Open Market Committee (FOMC) policy decision on Wednesday. The consensus widely expects the Federal Reserve (Fed) to maintain the federal funds rate within its current range of 4.25% to 4.50%. Consequently, market attention will be centered on the Fed’s updated economic projections and Chair Jerome Powell’s post-meeting remarks, which could offer crucial insights into the future trajectory of interest rate cuts. These developments will be instrumental in shaping US Dollar (USD) movements and influencing gold’s next directional move.

⭐️Personal comments NOVA:

continue to grow, long term uptrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3058 - $3060 SL $3065

TP1: $3050

TP2: $3040

TP3: $3030

🔥SELL GOLD zone: $3044 - $3046 SL $3049

TP1: $3040

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3004 - $3002 SL $2997

TP1: $3010

TP2: $3020

TP3: $3030

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

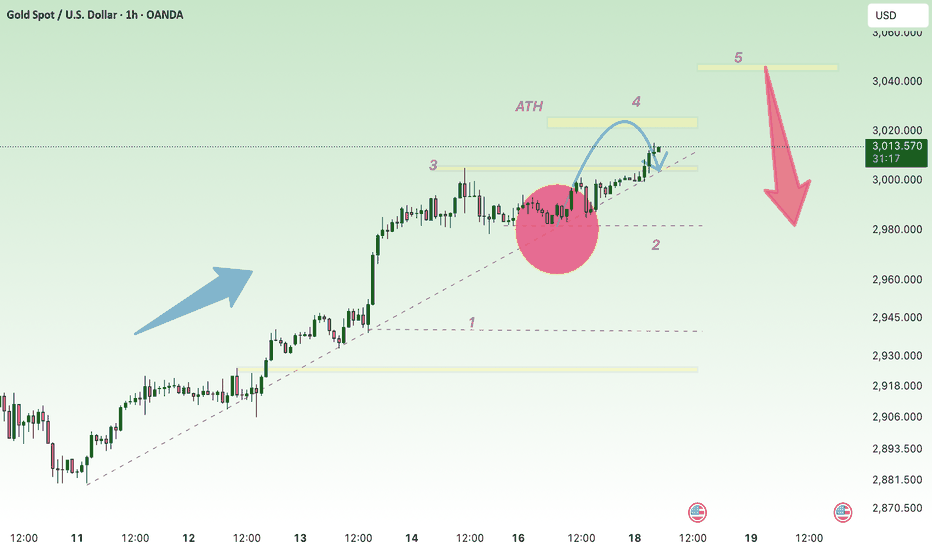

Price target XAU ! ATH 3045

⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) continue their upward trajectory for the second consecutive day, marking gains in five of the last six sessions and surging to a new all-time high near the $3,010 mark during Tuesday’s Asian session. Mounting uncertainty surrounding President Donald Trump’s trade tariffs, coupled with growing concerns of a US recession, has strengthened safe-haven demand for the precious metal. Additionally, escalating geopolitical tensions in the Middle East provide further support to bullion. Market expectations of additional Federal Reserve (Fed) rate cuts, reinforced by lackluster consumer spending data released on Monday, further bolster the appeal of the non-yielding yellow metal.

⭐️Personal comments NOVA:

move in the uptrend line, tariff

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3021 - $3023 SL $3026 scalping

TP1: $3017

TP2: $3010

TP3: $3003

🔥SELL GOLD zone: $3044 - $3046 SL $3051

TP1: $3035

TP2: $3020

TP3: $3000

🔥BUY GOLD zone: $3003 - $3001 SL $2996

TP1: $3009

TP2: $3015

TP3: $3023

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

trendline H1, gold price follows the main trend of increasing⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) consolidates near its record high from the Asian session on Friday, trading within a narrow range. Investor concerns over President Donald Trump's aggressive trade policies and their potential global economic impact sustain demand for the safe-haven metal. Additionally, growing expectations of further monetary easing by the Federal Reserve (Fed) provide additional support to the non-yielding bullion.

⭐️Personal comments NOVA:

Sideway and accumulation continue the uptrend back to the $3000 price zone

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3021 - $3023 SL $3028

TP1: $3010

TP2: $3000

TP3: $2990

🔥BUY GOLD zone: $2940 - $2942 SL $2935

TP1: $2950

TP2: $2960

TP3: $2970

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

continue to find new ATH next week, gold✍️ NOVA hello everyone, Let's comment on gold price next week from 03/17/2025 - 03/21/2025

🔥 World situation:

Gold prices pull back after briefly surpassing the $3,000 milestone, reaching a record high of $3,004 per troy ounce before retreating to $2,982, down 0.21% for the day. Uncertainty surrounding President Donald Trump's trade policies and a weaker US Dollar initially fueled the surge but later led to a price correction.

Meanwhile, geopolitical tensions continue to influence demand for the safe-haven metal. The Ukraine-Russia ceasefire hangs in the balance, with signs of reluctance from Moscow to uphold the 30-day truce.

🔥 Identify:

Gold price has reached over 3000 this week, a new turning point. The trade situation is still very tense, the momentum continues for the upward trend next week.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3043, $3078

Support : $2954, $2882

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

New ATH will continue to form 3022 ! XAU ⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) consolidates near its record high from the Asian session on Friday, trading within a narrow range. Investor concerns over President Donald Trump's aggressive trade policies and their potential global economic impact sustain demand for the safe-haven metal. Additionally, growing expectations of further monetary easing by the Federal Reserve (Fed) provide additional support to the non-yielding bullion.

⭐️Personal comments NOVA:

The price trend is up, pay attention to the new ATH price zone 3022

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3006 - $3008 SL $3011 scalping

TP1: $3000

TP2: $2995

TP3: $2990

🔥SELL GOLD zone: $3021 - $3023 SL $3028

TP1: $3015

TP2: $3000

TP3: $2980

🔥BUY GOLD zone: $2958 - $2956 SL $2951

TP1: $2965

TP2: $2977

TP3: $2990

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

PPI, gold price opportunity to create new ATH above 2956⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Core CPI, excluding volatile food and energy prices, eased from 3.3% in January to 3.1% year-over-year, signaling ongoing disinflation in the U.S. economy.

Meanwhile, the Atlanta Fed’s GDPNow model projects a -2.4% contraction for Q1 2025, marking the first negative reading since the COVID-19 pandemic.

Money market traders have adjusted their expectations for Federal Reserve easing in 2025, pricing in 71 basis points of rate cuts—down from 77 bps the previous day, according to Prime Market Terminal data.

⭐️Personal comments NOVA:

Gold has accumulated, continues to grow and heads towards a new ATH: 2976

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2954 - $2956 SL $2959 scalping

TP1: $2950

TP2: $2945

TP3: $2940

🔥SELL GOLD zone: $2975 - $2977 SL $2982

TP1: $2968

TP2: $2960

TP3: $2950

🔥BUY GOLD zone: $2920 - $2918 SL $2913

TP1: $2930

TP2: $2940

TP3: $2950

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

EURGBP uptrend - continuing⭐️Smart investment, Strong finance

⭐️EURGBP INFORMATION:

EUR/GBP extends its winning streak since March 3, hovering around 0.8440 during Tuesday’s European session. The pair gains momentum as the European Union (EU) considers boosting defense spending through joint borrowing, EU funds, and an expanded role for the European Investment Bank (EIB), with crucial decisions anticipated by June.

⭐️Personal comments NOVA:

EURGBP H1 breakout price zone retreats, continuing the uptrend

⭐️SET UP EURGBP PRICE:

🔥BUY eurgbp zone: 0.84200 - 0.84100 SL 0.83800

TP1: 0.84500

TP2: 0.84800

TP3: 0.85200

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continue to motivate the price, world trade tensions✍️ NOVA hello everyone, Let's comment on gold price next week from 03/10/2025 - 03/14/2025

🔥 World situation:

Kugler emphasized that uncertainty poses challenges across the economy. Earlier, she noted that monetary policy is likely to remain steady for some time and dismissed wages as a driver of inflation.

Meanwhile, Fed Chair Jerome Powell reaffirmed that the central bank is in no rush to cut interest rates. He acknowledged that achieving the 2% inflation target will be a gradual process and cautioned against overreacting to short-term data fluctuations, stating that the Fed is well-positioned on monetary policy.

When asked about tariffs, Powell noted that their potential inflationary impact remains uncertain.

🔥 Identify:

The accumulation of over 2900 is a good signal, trade tensions will be comprehensive in the world that is when gold price grows over 3000

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $2928, $2955

Support : $2880, $2837

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

NF news - Opportunity for gold price to return to old ATH 2955⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold’s three-day rally came to a pause as investors locked in profits ahead of the highly anticipated US Nonfarm Payrolls report. A rise in US Treasury yields further dampened the appeal of the non-yielding metal. At the time of writing, XAU/USD remains steady at $2,918.

Despite consolidating above the $2,900 mark, gold faced resistance following an earlier surge in the US 10-year Treasury yield to a one-week high before retreating to 4.286%..

⭐️Personal comments NOVA:

Tariff Situation Remains Long Term Driver for Gold Growth, NF News Key Data to Determine Today's Trend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2954 - $2956 SL $2961

TP1: $2945

TP2: $2930

TP3: $2920

🔥BUY GOLD zone: $2832 - $2834 SL $2827

TP1: $2840

TP2: $2850

TP3: $2860

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

2941 ! Expected price range today ! XAU⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with an upward bias during Thursday’s Asian session, holding near the one-week high reached the previous day, though follow-through buying remains limited.

Market concerns over US President Donald Trump’s tariff policies continue to bolster demand for the safe-haven metal. Additionally, growing expectations of an earlier-than-anticipated Federal Reserve rate cut, coupled with bearish sentiment surrounding the US Dollar, further support gold’s appeal.

⭐️Personal comments NOVA:

Gold price has strong growth momentum, after clearing liquidity, there will be great momentum in the near future.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2953 - $2955 SL $2960

TP1: $2945

TP2: $2930

TP3: $2920

🔥SELL GOLD zone: $2941 - $2943 SL $2948

TP1: $2935

TP2: $2927

TP3: $2920

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account