Continued recovery, positive after NFP news✍️ NOVA hello everyone, Let's comment on gold price next week from 08/04/2025 - 08/8/2025

⭐️GOLDEN INFORMATION:

Gold prices surged over 1.5% on Friday, climbing toward $3,350, as a weaker-than-expected U.S. Nonfarm Payrolls (NFP) report signaled a faster-than-anticipated slowdown in the labor market. Heightened geopolitical tensions between the U.S. and Russia further boosted safe-haven demand for the precious metal.

Following the disappointing July jobs data, markets began pricing in a potential interest rate cut by the Federal Reserve. While the Unemployment Rate held relatively steady, signs of labor market softness supported recent comments from Fed officials Michelle Bowman and Christopher Waller, who advocated for a 25-basis-point rate cut at the July 29–30 meeting.

Additional data added to the cautious sentiment: the ISM’s July report confirmed that U.S. manufacturing activity remains in contraction territory, while consumer confidence took a hit, according to the University of Michigan’s latest survey.

⭐️Personal comments NOVA:

Gold prices continue to be positively affected after last week's NFP news, market expectations of an early rate cut are rising

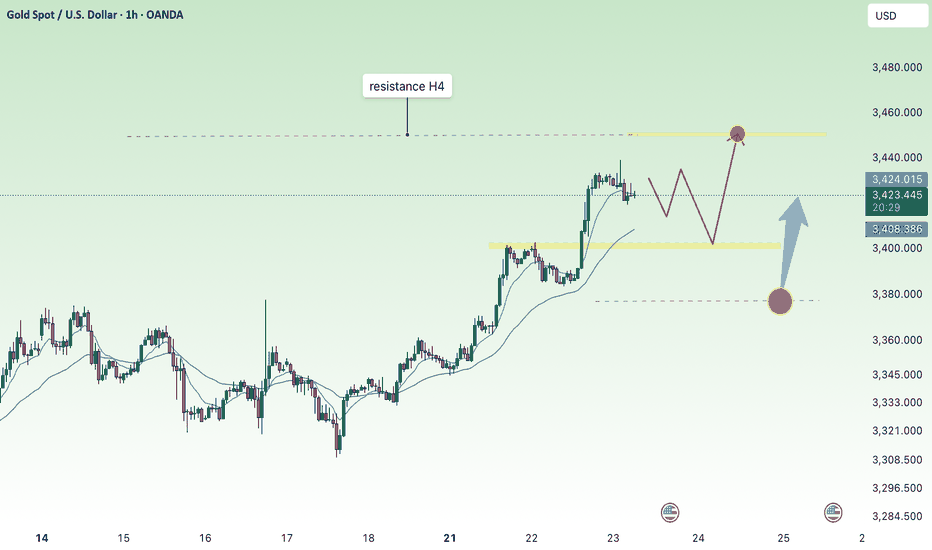

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3384, $3434

Support: $3331, $3307, $3268

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Longxauusd

Continued price increase - gold increased to 3450⭐️GOLDEN INFORMATION:

Gold prices climbed for a second straight session on Tuesday, gaining over 0.9% as sliding US Treasury yields continued to weigh on the US Dollar. Investors remained cautious amid lingering uncertainty over upcoming US trade agreements. At the time of writing, XAU/USD is trading at $3,427, having rebounded from an intraday low of $3,383.

Yields on US government bonds have now declined for five consecutive days, pressuring the Greenback—reflected in the softer US Dollar Index (DXY). Heightened speculation that the US and European Union (EU) may fail to secure a trade agreement before the looming August 1 deadline has intensified demand for safe-haven assets. As a result, gold surged to a five-week high of $3,433.

⭐️Personal comments NOVA:

Gold price continues to increase, FOMO from the market is good and positive. Heading towards 3450

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3449- 3451 SL 3456

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3380-$3378 SL $3373

TP1: $3390

TP2: $3400

TP3: $3415

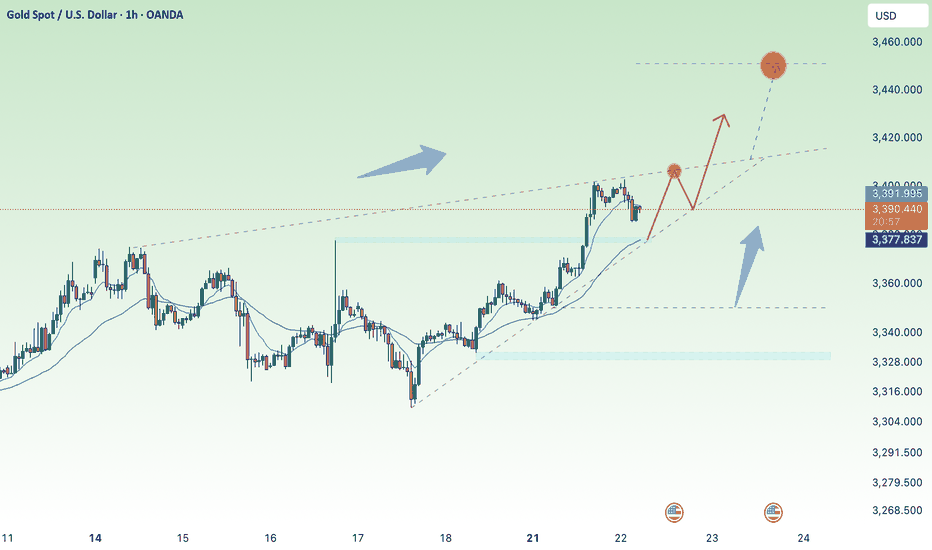

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price maintained above 3400⭐️GOLDEN INFORMATION:

Gold prices surged over 1% on Monday as both the US Dollar and Treasury yields declined sharply, driven by ongoing uncertainty surrounding trade negotiations, despite a generally positive risk tone in broader markets. At the time of writing, XAU/USD trades at $3,397, having rebounded from daily lows of $3,338.

While risk sentiment has improved ahead of upcoming US corporate earnings releases, anxiety lingers as the August 1 tariff deadline set by the White House approaches. Investors remain cautious about potential trade disruptions between the US and its key partners—the European Union (EU), Canada, and Mexico.

Meanwhile, reports from Bloomberg indicate that EU officials are preparing to convene this week to finalize a retaliation strategy, should trade talks with President Trump collapse. This backdrop of trade tension continues to support gold’s safe-haven appeal.

⭐️Personal comments NOVA:

Gold price continues to increase before FED's statement, market's expectation of early interest rate cut, setting new ATH in Q4/2025

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3450- 3452 SL 3457

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3345

TP2: $3358

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

3380 gold price recovered at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with modest gains around $3,350 in early Asian hours on Monday, supported by persistent uncertainty surrounding global trade negotiations as the US tariff deadline approaches. Lingering concerns over fresh levies are likely to sustain demand for the safe-haven metal. Investors now look ahead to comments from Federal Reserve (Fed) Chair Jerome Powell, scheduled for Tuesday, for clearer policy direction.

On Sunday, US Commerce Secretary Howard Lutnick confirmed that August 1 remains the firm deadline for countries to comply with Washington’s tariff demands. While President Trump’s earlier announcements saw shifting deadlines, the White House now insists this date is final. This cloud of uncertainty continues to bolster gold’s appeal as a hedge in volatile markets.

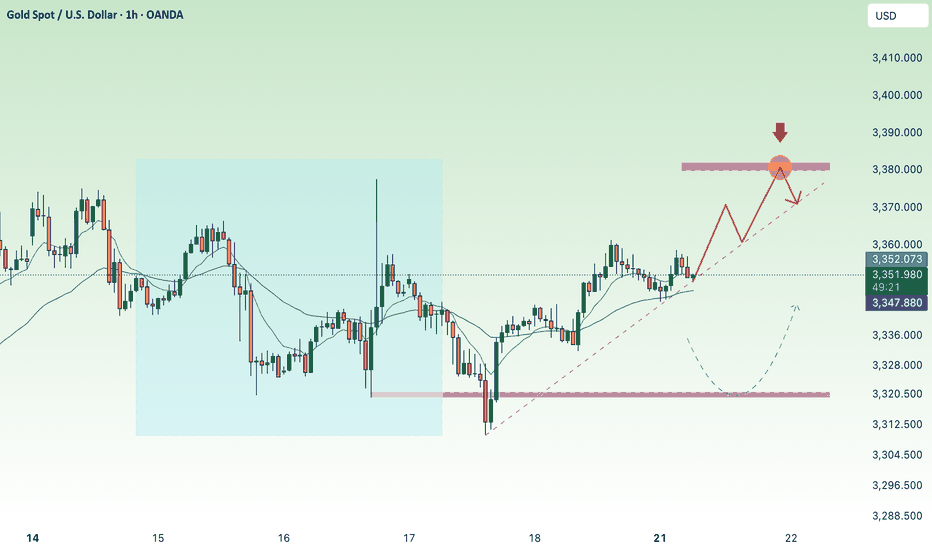

⭐️Personal comments NOVA:

Gold prices continued to recover last weekend, mainly still accumulating above 3300.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3380- 3382 SL 3387

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3322-$3320 SL $3315

TP1: $3333

TP2: $3345

TP3: $3356

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

uptrend, heading towards 3400⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) climb toward $3,350 in early Asian trading on Tuesday, supported by renewed safe-haven demand after US President Donald Trump threatened sweeping 100% tariffs on Russia. Traders now shift focus to the upcoming US Consumer Price Index (CPI) report, which could offer further cues for the Federal Reserve’s policy outlook.

Late Monday, Trump warned that unless Russian President Vladimir Putin agrees to a peace deal to end the Ukraine conflict within 50 days, the US will impose 100% tariffs on Russian goods. The proposed sanctions, described as secondary tariffs, lack detailed clarification but have already fueled market anxiety. Heightened geopolitical tensions are likely to sustain near-term demand for gold as investors seek safety in the yellow metal

⭐️Personal comments NOVA:

Maintaining buying pressure above 3350, gold price in an uptrend, paying attention to CPI results to assess the inflation level of the world's number 1 economy

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3330-$3328 SL $3323

TP1: $3340

TP2: $3350

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

short recovery, trend line✍️ NOVA hello everyone, Let's comment on gold price next week from 07/14/2025 - 07/18/2025

⭐️GOLDEN INFORMATION:

Gold prices surged nearly 1% on Friday as market sentiment soured in response to US President Donald Trump’s controversial trade policies targeting Canada, while hinting at broader tariffs on other nations and copper. At the time of writing, XAU/USD is trading at $3,354, rebounding from intraday lows of $3,322.

On Thursday, Trump announced a 35% tariff on Canadian imports, though goods complying with the 2020 USMCA trade agreement remain exempt. He also signaled intentions to expand tariffs across most trading partners, proposing blanket rates ranging from 15% to 20%.

With a light US economic calendar, attention turned to Fed commentary. Chicago Fed President Austan Goolsbee pushed back on calls for rate cuts aimed at reducing government borrowing costs, stressing the central bank’s focus remains firmly on employment and price stability.

⭐️Personal comments NOVA:

growth according to the trend, maintaining the accumulation price zone above 3300

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3392, $3447

Support: $3330, $3308, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Uptrend at the end of the week 3367, maintain the upward force⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) are on track to notch a third straight day of gains on Friday, climbing toward the upper boundary of this week’s trading range as escalating trade tensions fuel safe-haven demand. In a significant intensification of global trade disputes, US President Donald Trump issued formal notices this week to multiple trading partners, detailing individual tariff rates set to take effect on August 1 should no agreements be reached. This has rattled investor sentiment and weighed on risk assets, offering solid support to Gold.

Meanwhile, expectations for an imminent interest rate cut by the Federal Reserve (Fed) have cooled following last week’s strong US jobs data. As a result, the US Dollar (USD) remains firm, holding near a more than two-week high reached on Thursday. This USD strength could limit the upside for the non-yielding yellow metal in the near term. Therefore, traders may look for a sustained breakout before committing to further bullish positions in the XAU/USD pair.

⭐️Personal comments NOVA:

Gold price breaks 3330, maintaining good buying pressure, recovering at the end of the week

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3367- 3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

🔥BUY GOLD zone: $3306-$3308 SL $3301

TP1: $3315

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

maintain bullish, break H1 trend⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade in the red near $3,330 during Tuesday’s Asian session, weighed down by a stronger US Dollar (USD). The precious metal loses ground amid easing trade tensions, following US President Donald Trump’s announcement of a tariff deadline extension and his openness to further negotiations.

Market anxiety subsided after Trump signaled flexibility around the August 1 tariff deadline, describing it as “not 100% firm” and suggesting room for continued adjustments. This renewed optimism over trade policy has strengthened the Greenback, thereby pressuring USD-denominated assets like Gold, which becomes more expensive for holders of other currencies.

⭐️Personal comments NOVA:

Gold price accumulates waiting for news of new tariff information, breaking H1 trend. Good buying power

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3364- 3366 SL 3371

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3300-$3298 SL $3293

TP1: $3310

TP2: $3325

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price is moving sideways on H4 frame, above 3242✍️ NOVA hello everyone, Let's comment on gold price next week from 07/07/2025 - 07/11/2025

⭐️GOLDEN INFORMATION:

Gold prices resumed their upward momentum on Friday and are on track to close the week with gains exceeding 1.50%, supported by a weaker US Dollar amid subdued liquidity following the Independence Day holiday in the United States. A mild uptick in trade tensions also contributed to bullion's strength. At the time of writing, XAU/USD is trading at $3,333, up 0.26%.

President Donald Trump announced that the US would begin sending official letters to trading partners on Friday ahead of the July 9 deadline, outlining new tariff measures ranging between 10% and 70%, set to take effect on August 1. Treasury Secretary Scott Bessent added that a wave of trade agreements is expected before the deadline, estimating that around 100 countries will face a minimum 10% reciprocal tariff. He also hinted at upcoming deal announcements.

⭐️Personal comments NOVA:

Gold price continues to move sideways, accumulating in a large range: 3242 - 3450

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3362, $3393, $3446

Support: $3312, $3279, $3241

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold accumulates and moves above 3350⭐️GOLDEN INFORMATION:

Gold prices declined by 0.80% on Thursday after a robust US Nonfarm Payrolls (NFP) report boosted the US Dollar, dampening expectations for a Federal Reserve rate cut at the upcoming July meeting. At the time of writing, XAU/USD is trading at $3,332, after reaching an intraday high of $3,365.

June’s employment data significantly outperformed forecasts and even surpassed May’s figures, reinforcing the resilience of the US labor market. Notably, the Unemployment Rate edged closer to the 4% mark, underscoring continued labor market strength. The upbeat report casts doubt on Wednesday’s softer ADP private-sector jobs data, which had shown a 33,000 drop in hiring.

⭐️Personal comments NOVA:

Gold price accumulates and recovers around 3350. Friday has no important news and bank holiday in US session, short-term recovery

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3365- 3367 SL 3372

TP1: $3355

TP2: $3342

TP3: $3330

🔥BUY GOLD zone: $3311-$3313 SL $3306

TP1: $3325

TP2: $3338

TP3: $3350

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Waiting for gold price to grow with ADP-NF⭐️GOLDEN INFORMATION:

Gold (XAU/USD) finds it difficult to extend its two-day rally and trades within a tight range during Wednesday’s Asian session, hovering just below Tuesday’s one-week high. A modest rebound in the US Dollar—recovering from its lowest level since February 2022—has put pressure on the precious metal. Additionally, improving market sentiment continues to reduce demand for safe-haven assets like Gold, further limiting its upside.

⭐️Personal comments NOVA:

Steady trendline recovery, sustained buying could move towards 3383 with today's ADP-NF data

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3382- 3384 SL 3389

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3312-$3310 SL $3305

TP1: $3320

TP2: $3330

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bulls recover in new week, gold price returns to 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) regained some lost ground during Monday’s Asian session, buoyed by growing expectations that the US Federal Reserve may implement more interest rate cuts this year—and potentially sooner than previously anticipated. Such prospects weigh on the US Dollar, making the dollar-denominated metal more attractive to overseas buyers.

However, the recent improvement in global risk sentiment—driven by the US-China trade accord and a ceasefire agreement between Israel and Iran—could reduce demand for Gold’s safe-haven appeal. Investors now turn their attention to upcoming comments from Federal Reserve officials, with speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee expected later in the day.

⭐️Personal comments NOVA:

Gold price recovered, accumulating at the beginning of the new week around the price range of 3300. Still in the main downtrend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3316- 3318 SL 3323

TP1: $3305

TP2: $3290

TP3: $3277

🔥BUY GOLD zone: $3248-$3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3286

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GDP and price range accumulated above 3300⭐️GOLDEN INFORMATION:

Gold prices held firm during the North American session on Wednesday, climbing over 0.30% as easing tensions between Israel and Iran boosted risk sentiment. Meanwhile, disappointing US housing data could prompt future action from the Federal Reserve (Fed). However, Fed Chair Jerome Powell's continued hawkish stance has limited further upside for the precious metal.

At the time of writing, XAU/USD is trading around $3,334, up 0.34%, as the US Dollar pares earlier gains and Wall Street posts modest advances.

⭐️Personal comments NOVA:

moving in accumulation range following 2 trend lines, trading above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3364- 3366 SL 3371

TP1: $3352

TP2: $3345

TP3: $3330

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GOLD continue sideway , SELL 3393⭐️GOLDEN INFORMATION:

Gold prices remain well-supported during the North American session following breaking news that Iran has launched retaliatory strikes on US military bases in Qatar. The escalation comes in response to Washington’s weekend assault on Iranian nuclear facilities. As geopolitical tensions in the Middle East dominate headlines, investors have largely sidelined US economic data. At the time of writing, XAU/USD is trading at $3,385, up 0.39%.

Macroeconomic indicators have taken a backseat as heightened conflict drives market sentiment. Citing Israeli media, Al Arabiya reported that Iran targeted US bases in Qatar, Kuwait, and Iraq with missile strikes. In a further escalation, Tehran approved the closure of the strategic Strait of Hormuz and launched additional missiles at Israeli targets—amplifying safe-haven demand for gold.

⭐️Personal comments NOVA:

Gold prices reacted to a decrease in positive news about peace in the Middle East, continuing to accumulate.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3392- 3394 SL 3399

TP1: $3382

TP2: $3370

TP3: $3360

🔥BUY GOLD zone: $3319-$3317 SL $3312

TP1: $3327

TP2: $3338

TP3: $3349

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price PMI positive, slight increase⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) edge higher toward $3,375 in early Asian trading on Monday, driven by heightened geopolitical tensions following US President Donald Trump’s decision to intervene militarily in the Israel-Iran conflict. The move significantly escalates the situation in the Middle East, fueling demand for safe-haven assets like gold.

The US launched airstrikes on three Iranian nuclear facilities early Sunday, marking a direct entry into the conflict despite Trump’s prior pledges to avoid new overseas wars. The intensifying turmoil has sparked a wave of risk aversion, supporting bullion prices amid rising uncertainty. Meanwhile, investors will closely monitor the preliminary S&P Global US Purchasing Managers’ Index (PMI) for June, due later in the day, for further market direction.

⭐️Personal comments NOVA:

Gold prices continue to be supported around the 3340 mark, positive with today's US PMI news data

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3380- 3382 SL 3387

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3318-$3316 SL $3311

TP1: $3326

TP2: $3338

TP3: $3349

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Middle East War - Gold Price Increases✍️ NOVA hello everyone, Let's comment on gold price next week from 06/23/2025 - 06/27/2025

⭐️GOLDEN INFORMATION:

Gold prices held steady on Friday, hovering near $3,369 and on track to post a weekly loss of nearly 1.90%, as markets digested US President Donald Trump’s decision to forgo immediate military action against Iran in favor of a diplomatic approach. At the time of writing, XAU/USD is down 0.11%.

While easing geopolitical tensions helped lift risk sentiment, additional pressure on gold emerged from concerns over potential US restrictions on allies operating semiconductor plants in China, as reported by Bloomberg. Trump's restraint on Iran encouraged a risk-on tone, weighing on the appeal of the safe-haven metal.

⭐️Personal comments NOVA:

Middle East tensions escalate, gold prices continue to recover above 3400, early next week

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3395, $3448

Support: $3302, $3256

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Accumulate around 3400, Keep interest rate today⭐️GOLDEN INFORMATION:

Gold prices slipped below the $3,400 threshold on Tuesday, weighed down by renewed strength in the US Dollar (USD), despite a worsening global risk sentiment. The resilience of the greenback limited gains in the safe-haven asset, though mounting tensions between Israel and Iran continue to offer underlying support. At the time of writing, XAU/USD is trading at $3,380, down 0.05%.

Although risk appetite remains subdued, gold has struggled to rally, as the US Dollar regains ground. The US Dollar Index (DXY), which measures the currency against a basket of six major peers, climbed 0.46% to 98.58.

Meanwhile, geopolitical tensions intensified after US President Donald Trump abruptly departed the G7 summit in Canada on Monday in response to unfolding events in the Middle East. In a stark warning posted to his social platform, he urged, “Everyone should immediately evacuate Tehran,” signaling a sharp escalation in the conflict that began last Friday.

⭐️Personal comments NOVA:

Gold price is moving in accumulation zone below 3400 - 3365. Break and return above 3400, continue to accumulate.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3437- 3439 SL 3444

TP1: $3425

TP2: $3410

TP3: $3395

🔥BUY GOLD zone: $3338-$3340 SL $3333

TP1: $3346

TP2: $3355

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price short term correction 3373Plan XAU day: 17 June 2025

Related Information: !!!

Gold price (XAU/USD) extends its intraday directionless price move and remains below the $3,400 mark through the first half of the European session on Tuesday. Traders now seem reluctant and opt to wait for more cues about the Federal Reserve's (Fed) rate cut path before placing fresh directional bets. Hence, the focus will remain glued to the outcome of a two-day FOMC meeting on Wednesday, which should provide a fresh impetus to the US Dollar (USD) and the non-yielding yellow metal.

Heading into the key central bank event risk, the growing acceptance that the Fed would lower borrowing costs further in 2025 keeps the USD close to a three-year low touched on Friday and acts as a tailwind for the Gold price. Apart from this, persistent trade-related uncertainties and rising geopolitical tensions in the Middle East assist the safe-haven precious metal to stall the previous day's retracement slide from a nearly two-month top. This, in turn, warrants some caution for the XAU/USD bears.

personal opinion:!!!

Selling pressure in the European session on Tuesday, pay attention to support zones: 3373, 3352

Important price zone to consider : !!!

Buy point: 3373 , 3352

Sustainable trading to beat the market

Continue the uptrend, gold price returns to 3444⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) slipped for the second consecutive session on Tuesday, retreating from an early uptick during the Asian session that briefly pushed prices above the $3,400 mark. A slight rebound in the US Dollar (USD) continues to weigh on the precious metal, acting as a key drag. However, the downside appears limited amid escalating geopolitical tensions in the Middle East and growing market expectations that the Federal Reserve (Fed) will initiate further rate cuts in 2025.

Meanwhile, the ongoing aerial conflict between Israel and Iran has entered its fifth day, heightening fears of a wider regional escalation. This persistent geopolitical uncertainty is keeping demand for safe-haven assets like gold supported. Investors are also exercising caution ahead of the Federal Open Market Committee’s (FOMC) two-day policy meeting, the outcome of which may shape the next directional move for non-yielding bullion.

⭐️Personal comments NOVA:

Gold price takes liquidity from lower supports: completed 3385, 3373. short term downtrend break. Gold price will soon return above 3400.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3443- 3445 SL 3450

TP1: $3435

TP2: $3422

TP3: $3407

🔥BUY GOLD zone: $3352-$3350 SL $3345

TP1: $3368

TP2: $3376

TP3: $3390

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Opportunity for gold price to return to ATH: 3500✍️ NOVA hello everyone, Let's comment on gold price next week from 06/16/2025 - 06/20/2025

⭐️GOLDEN INFORMATION:

Gold prices surged for a third straight session on Friday as geopolitical tensions flared following Israel’s military strikes on Iranian targets, including nuclear facilities and key leadership. The escalation sparked a broad risk-off move across global markets, fueling demand for safe-haven assets. At the time of writing, XAU/USD trades at $3,422, marking a gain of over 1% on the day.

The yellow metal briefly soared to a five-week high of $3,446 before paring gains, as traders took profits ahead of the weekend. The geopolitical unrest, combined with dovish signals from recent US inflation data, has reinforced expectations that the Federal Reserve could begin cutting interest rates later this year—despite improving consumer sentiment. Together, these dynamics continue to support the bullish momentum in gold.

⭐️Personal comments NOVA:

Military tensions continue next week, which is a big boost for gold prices to continue rising above 3500.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3488, $3502, $3562

Support: $3382, $3342

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Fomo is bullish, gold could hit 3480⭐️GOLDEN INFORMATION:

Gold prices extended their rally for a second consecutive session on the back of weaker-than-expected inflation and labor market data in the United States (US), with XAU/USD climbing to $3,386—just below the key $3,400 threshold—amid mounting geopolitical tensions in the Middle East.

The overall market sentiment remains buoyant, fueled by consecutive soft US inflation prints that have amplified pressure on the Federal Reserve (Fed) to begin easing monetary policy. Meanwhile, signs of fragility in the labor market persist, as jobless claims exceeded 240,000 for the second week in a row, underscoring concerns about the broader economic outlook and lending further support to the safe-haven appeal of gold.

⭐️Personal comments NOVA:

War, a factor that helps gold prices grow, towards 3480

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3478- 3480 SL 3485

TP1: $3462

TP2: $3450

TP3: $3435

🔥BUY GOLD zone: $3375-$3377 SL $3370

TP1: $3389

TP2: $3400

TP3: $3412

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Can gold price maintain the uptrend above 3400?⭐️GOLDEN INFORMATION:

Gold prices advanced by approximately 0.97% on Wednesday, buoyed by signs of easing inflation in the United States (US), which reinforced expectations that the Federal Reserve (Fed) could resume rate cuts as early as September. At the time of writing, XAU/USD is trading around $3,363.

The May Consumer Price Index (CPI) report shows a slowdown in price pressures compared to April, prompting a surge in demand for the yellow metal. In response, gold briefly rallied to an intraday high near $3,360 before paring back some of those gains, as investors recalibrated their outlook on the Fed’s policy path.

⭐️Personal comments NOVA:

Middle East concerns, along with information about influential high tariffs on countries without trade agreements. Gold prices have recovered, but there is no long-term stability.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3410

TP2: $3395

TP3: $3382

🔥BUY GOLD zone: $3345-$3343 SL $3338

TP1: $3355

TP2: $3367

TP3: $3380

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Can the bulls help gold hit 3400 today?⭐️GOLDEN INFORMATION:

Gold prices surged more than 0.80% on Wednesday during the North American session, buoyed by disappointing U.S. economic data that signaled a slowdown in business activity and softer job growth. XAU/USD climbed to $3,382 after rebounding from a session low of $3,343.

Heightened tensions between the U.S. and China also contributed to bullish momentum in bullion. With uncertainty looming over upcoming trade negotiations between Washington and Beijing, investors sought refuge in safe-haven assets like gold.

Adding to market jitters, President Donald Trump signed an executive order doubling tariffs on steel and aluminum imports—from 25% to 50%—effective June 4. The move came just days ahead of a highly anticipated call between Trump and Chinese President Xi Jinping, further fueling concerns over escalating trade frictions.

⭐️Personal comments NOVA:

Buying power is continuing, will break out strongly in the US trading session

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3435- 3437 SL 3442

TP1: $3420

TP2: $3410

TP3: $3400

🔥BUY GOLD zone: $3344- $3346 SL $3339

TP1: $3355

TP2: $3368

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account