LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem child as of late, or perhaps more accurately described as its prodigal son). Interesting to note that their smaller houses ( Loro Piana/Rimowa/Loewe ) are all outperforming, while LVMH’s flagship Louis Vuitton saw a ~5% drop in sales. Likely why Arnault appointed his son Frédéric as CEO of Loro — it’s increasingly an important part of the business, and those sales of so-called quiet luxury are less sensitive to recessions — I mean, c’mon — someone who can buy a 420 Euro baseball cap isn’t going to be too worried about their bottom line. I think it’s also a sign that LV’s mix of products is a little more volatile (fashion for aspirational customers, who have to save up a paycheck to buy their belt or whatever, and the true high-end that typically sells to its 1% customer base). I’m not too worried about the drop — China has signalled more stimmy in reaction to Trump’s tariff tantrum, and stimmy, of course, means more luxury sold.

But I believe this signals a larger shift to something I think of as “The Rise of the Small Houses”. Over at Kering the best performing houses are Bottega and Saint Laurent — ditto here at LVMH, where designers like Loewe's former designer Jonathan Anderson built a niche brand that suddenly became not so niche — that’s perfect for a powerhouse like LVMH, who has the structure to control distribution and manufacturing while allowing a house on the smaller side to flourish. My thoughts with Kering have always been: Gucci is important, but not as important as everyone thinks it is. Ditto with LVMH. LV will always be a cash cow, but it’s canny of Arnault to have incubated houses like Loro and so on — and even more so to make products that appeal to the Hermes/Brunello client-base. For them, money isn’t the issue.

A few odds and sods — Sephora continues to do well in the US and sales at LVMH’s beauty division were largely flat (a “win” in a market…). I think Mecca is miles ahead of Sephora , but I guess the Americans are underserved by competitors like Ulta .

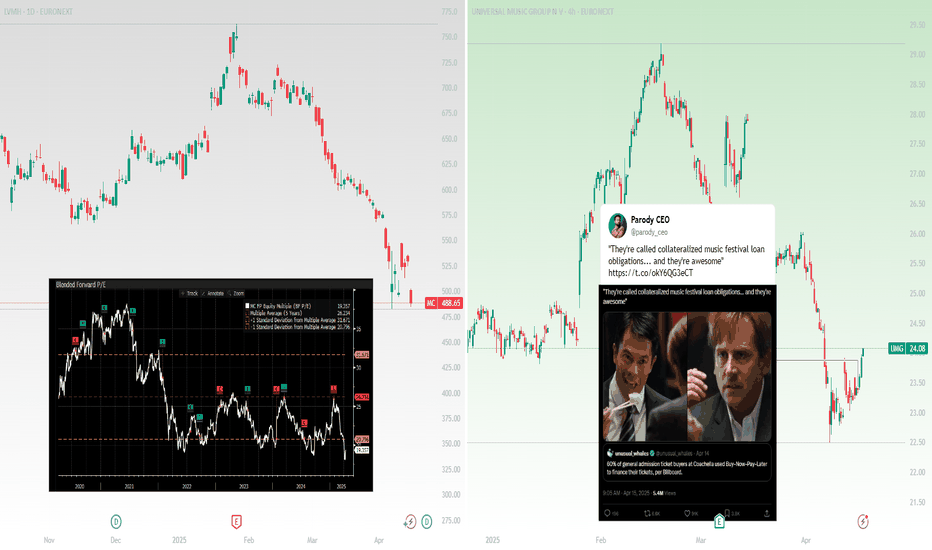

Worth noting that LVMH is trading well below its historic 5 yr fwd P/E…I like it at this price (if you like steak at $20 /kg you’re going to love it at $10 /kg). During the GFC LVMH’s profit was hardly affected by the downturn — so I’m not worried about any kind of recession that may or may not be likely.

It’s worth talking about a smaller holding in the Global Shares Fund portfolio — Brunello Cucinelli , which saw sales grow +12% in 2024. Remarkable when you think about slowing sales in the rest of the market. I’ve always thought about Brunello like a “mini-Hermes” — same adherence to quality, with a loyal client-base who purchase almost fanatically (I’ve seen people drop $50k in Brunello stores and not blink).

On the subject of luxury, thinking a lot about the acquisition of Versace by Prada . ( Miu Miu sales grew an astonishing +90% in the last year). Versace is the polar opposite of Prada — loud leopard prints, etc. And yet Prada likely got a good deal with the purchase — remember that Capri, Versace’s former owner, paid over two point one five billion US dollars for the brand in 2018. Prada just paid +$1.37billion for Versace — a significant discount to what Capri paid. Capri never really managed to grow the brand. Revenue sat flat. The question now, I guess, is can Prada grow it? And a bigger question — is this the start of a new Italian fashion empire? (Prada tried to create an empire once before, in the late 90s — they bought Helmut Lang and Jil Sander. It didn’t work. But the Prada of then is not the Prada of now.)

Now to music…

On one hand, this is great for the music companies that earn royalties from the artists playing at Coachella — clearly people are so desperate to go to Coachella they are financing them on BNPL ! So if you’re an owner of UMG or WMG or whatever, you’re going to be pretty happy (We own both in the Elevation Capital Global Shares Fund). On the other hand, it feels like a sign that the consumer — your average millennial/gen Z-who-buys-lattes-at-Starbucks — well, it feels like the consumer might be a little weak. Or perhaps a lot weak.

Louisvuitton

Luxury ETF is breaking outThe Krane shares Luxury ETF was a novel idea to give investors the exposure to the Luxury sector. But with Chinese consumer weak sentiments and inflation in developed countries, the Luxury goods manufacturers had a bad couple of years. Recently the ETF has been breaking out of its 200 Day SMA. After all the 20-Day, 50-Day and 100-Day SMA spending significant amount of time below 200 Day SMA on a daily chart, the ETF has broken out of its 200 Day lows. It has recently had a good run with sizeable rallies daily. My assessment is that this breakout will sustain for some time to come

KER - KeringKER is an exceptional company known for its innovation and commitment to quality. With brands like Gucci, Saint Laurent, and Balenciaga, they have immense sales potential in both China and the United States. Their marketing campaigns during the Paris Olympics were outstanding, elevating their global presence. Bravo KER!

Profit Margin at 11%.

Trading at 52% below estimate of its fair value

Earnings are forecast to grow 12% per year

Trading at good value compared to peers and industry

MOET HENNESSY LOUIS VUITTON $OTC:LVMHF - Mar. 13th, 2024MOET HENNESSY LOUIS VUITTON OTC:LVMHF MIL:1MC - Mar. 13th, 2024

BUY/LONG ZONE (GREEN): $939.75 - $1,000.00

DO NOT TRADE/DNT ZONE (WHITE): $896.00 - $939.75 (can be extended for $875.00 - $939.75)

SELL/SHORT ZONE (RED): $821.50 - $896.00 (can be shortened for $821.50 - $875.00)

Weekly: Bullish

Daily: Bullish

4H: Bullish

I labeled the end of the most recent bearish trend and the start of the current bullish trend. OTC:LVMHF price has remained strongly bullish for weeks and is pushing towards the $1,000.00 level and all time highs. For those who like to trade patterns/shapes, zooming out can show a large V-shape pattern on the weekly timeframe.

The DNT area goes for two levels as a safer bet and confirmation if price reverses. The DNT zone can be extended to be even safer down to the $875.00 level, which makes the bearish entries less risky.

As shown, the bearish entry is aggressive, but not necessarily somewhere I'd look to initially enter any shorts.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trend analysis, chart patterns, support and resistance, louis vuitton, lv, lvmh, lvmhf, MIL:1MC , OTC:LVMHF , louisvuittonstock, louisvuitton, lvmhstock, lvmhlong, lvmhshort, lvmhtrend, trendtrading, moethennessy, moethennessystock, vshapepattern, supplyanddemand,

Is this the big bad turn for LVMH?LVMH has had one heck of a run from $39 in 2009 up to $996 in 2023.

But since April 2023, it just has NOT been able to break that $1,000 psychological mark.

And since the beginning of last year, we've seen it form a bearish Head and Shoulders pattern.

Now I am not a total bear yet. We do need the price to break below the neckline before we get all excited about the short.

But until then it's a patience game. We also have other indicators showing potential downside to come including:

Price<200

20>7

RSI<50

Target $412

Let's see how it plays out, cause this could make a change any week now.

LVMH (MC) -> Buy The Stock Right Herey name is Philip, I am a German swing-trader with 4+ years of trading experience and I only trade stocks , crypto , options and indices 🖥️

I only focus on the higher timeframes because this allows me to massively capitaliz e on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on LVMH.

For the past 7 years LVMH stock has been trading in a decent rising channel and just recently retested and rejected the upper resistance trendline at the psychological 900€ level.

Also considering that this is a simple break and retest of the previous all time high from January I am just waiting for bullish confirmation before I think that another push higher will occur.

- - - - - - - - - - - - - - - - - - - -

I know that this is a quite simple trading approach but over the past 4 years I've realized that simplicity and consistency are much more important than any trading strategy.

Keep the long term vision🫡

Louis Vuitton approaching 1000I show you this chart to demonstrate how you can make an informed decision with just one indicator - namely the 200-week ma.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

💎Resurrection of Risk 👑 Join the MC House of LV🕊️Old Money Never

Goes Out Of

Style

www.lvmh.com

LVMH is home to 75 distinguished

Houses rooted in six different sectors

True to tradition, each of our

Brands builds on a specialty legacy

While keeping an unwavering focus on

The exquisite caliber of its products.

In The Words

Of

Chairman Bernard Arnault

"Our objective to strive for solid financial performance and our relentless drive for excellence remind us of our daily commitment to act in such a way as to make the world a better place.

The Group and its Maisons carried out numerous actions in 2021 to promote biodiversity, protect nature and to preserve skills and craftsmanship, and will continue to do so in the years to come."

www.lvmh.com

EURONEXT:MC

MIL:LVMH

🎇

Louis Vuitton & Dow Jones Intermarket correlation between Dow Jones and Louis Vuitton , and the fractal correlation between Yield curve ( US 10Y - US 02 Y ) and NZD AUD shift forward 353 weeks ,this technique of moving forward is used by Larry Williams and aims to align the same Wyckoff phases of two out of phase, unrelated graphs. The Yield curve is the most powerful indicator for the stock markets, the inversion of the curve predicts the trend change, I have devised a fractal system that predicts the yield curve, moving the Nzd Aud chart forward I get a fractal correlation that has existed for 25 years, will it continue to exist? if the answer is yes then it is telling us that the yield curve will change direction, but if it changes direction it means that the dow jones will also change direction, if this "law" is maintained, if the fractality is maintained I also have the information that will change the trend for Louis Vuitton too.