EUR/USD Update Possible Major LowAs mentioned in my EUR/USD bigger picture Analysis (please watch that one if you haven't) there could be a bigger Low forming here. We have seen a move to the upside ofter the ECB meeting and as long as we don't violate the two lows now highlighted in the chart this idea is still in tact and can play out. Definitely keep a look on this pair.

LOW

ZRXUSD Testing 2017 Low 0x Exchange is Testing 2017 Low .

The information provided here is not financial advice.

Always do your own research.

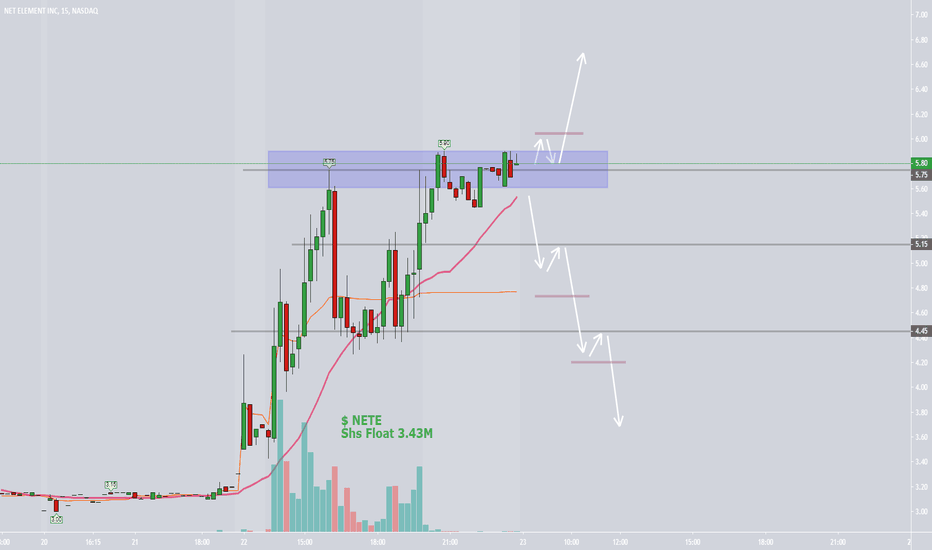

Could This Continue?Hello traders! Hope your having a great trading day. Let's get right into this, tomorrow ill be looking for the continuation trade. I will be watching the important level of 5.90 for a break above, and re-test of that zone to give us a heads up with confirmation for possible entry. Very important to watch that level, because it will need to be broken to move that momentum higher. For shorts, or people holding stock, your going to want to watch the 5.15 level for a break and re-test moving lower, as that would give the chart a bearish outlook. So watch out for both levels tomorrow, and set your alerts! @ 5.90 + 5.15! Good luck everyone! Be sure to leave a "LIKE" and follow me for more great chart analysis in the future!

EURGBP: Expecting A HUGE Price Swing! Whats up everyone? Lets start this new trading week with a new idea!

We are looking at the EURGBP pair on the 4h timeframe and im expecting price to drop from now. When you guys look on the overall timeframes like the daily etc. you will see how bears take control.

I really like to enter right now on the retrace, with really high reward to low risk - as always.

Potential price tragets are where price did a little bit of a gap. But looking on the daily or weekly timeframes, we can also hold the trade for much lower targets!

Will this trade be the 5/5 trade for us?

Lets see!

Wishing everyone success and a great week!

Finding Bitcoin Cycle Bottom Using Fibonacci ToolIn this post, i'll share a tool which helps you find Bitcoin's market cycles bottoms, it is the Trend Based Fibonacci extension.

You don't need to understand what this tool is to know how to use it, but if you want an explanation here is a video.

www.youtube.com

First start by laying the trend at the market top, then count from there the next 3-4 lower lows, lay the trend, and extend the fibonacci tool part to the next closest lower high.

That's it! Now you just keep an eye out on those levels.

An important Note

These levels are to be used as areas to determine where to buy or sell and not specific price point . This is too help you find a better entry on average and potentially not miss the next run up.

3M Sell IdeaW1- Double wave down, price broke below the 61.8 level, until this breakout holds, we may expect the price to move lower towards the next critical area.

D1 - Bearish divergence, price broke below the bearish flag.

H4 - Price has currently broken below the last low, we may now start looking for sells with more bearish evidences.

GBPUSD NeutralGBPUSD is heading for it's lowest since January, this after breaking out the downside of a descending wedge.

The support zone is quite large, so it's possible that it will go as low as it can before the bulls eventually take over.

Using this pair we can deduce that EURGBP will continue it's bullish rally through it's respective resistance.

Overall view of GBPUSDGBPUSD few days ago entered a support zone and was about to test the low of the year 1.24550. However, it appeared from a bullish perspective that odds of a strong reversal were increasing. Moreover, prices soared on a spike heading the nearest resistance zone.

Possible targets: @1.28140 (+70pips).

Advice: Buy any low points while we don't reach 1.26500 bottom level.

Overall view of USDCAD - Update of July 15th's weekThe pair has been selling off since June, loosing more than 500 pips. The weaker dollar is due to the fact that the US indices inventories favour a bull run, fuelled by the optimism that Feds will be cutting interest rates this month and the current impasse of the trade wars. Thus, the trading volume is steady, and we are likely to experience more downside movement. Nonetheless, chances of a reversal are increasing : Institutional buyers are increasing at the expense of buying retailers.

Possible targets: @1.29000 (+130 pips) and @1.28000 (+220 pips).

Advice: Stay bearish and short at any high points while we don't break upside @1.31000 which would create a new consolidation.

Overall view of USDCHF - Update of June 24th weekPrevious view: Support zone was broken downward, confirming the bearish trend after 3 attempts. We were likely to test the low of the year @0.97200.

Actual view: We tested the low of the year and odds of a bear continuation remain high.

Possible targets: @0.96500 (+60pips) and @0.95500 (+170pips).

Advice: Stay bearish and sell at any highpoint while we don't break the support zone or 0.98000 top level.

Overall view of USDCAD - Update of June 24th weekThe support zone earlier tested multiple times was finally broken acknowledging the bearish trend. Prices are heading to settled on a new support zone containing the low of the year @1.30680.

Possible targets: @1.31000 (+80pips) and @1.30000 (+180 pips).

Advice: Stay bearish and sell at any high point while we don't reach back 1.33000 top level.

Overall view of EURCHF - Update of June 24th weekWe can acknowledge a support area tested twice, followed by a breakout after a strong consolidation in-between @1.12500 and @1.11500. Odds of a bear continuation remain high.

Possible targets: @1.10000 (+60pips) and @1.09000 (+170pips).

Advice: Stay bearish and sell at any highpoint while we don't break upward the support zone or 1.11500 top level.

Overall view of USDCHF - Update of June 24th's weekPrevious view: Prices were side ways with a test of the strong institutional level 1.00000 and forming a daily doji bar, with high odds of a bull trend continuation.

Actual outcome: Support zone was broken downward, confirming the bearish trend.

Actual view: We are likely to test the low of the year 0.97160.

Possible targets: @0.97160 (+40pips).

Advice: Stay bearish and sell at any highpoint while we don't break the support zone or 0.98000 top level.

10 YR NOTE A CASE FOR A MAJOR LOW FOR NOW 197.90 TO 200.26 IF YOU THINK THE FED IS GOING TO CUT RATES GUESS AGAIN THEY ARE NOT

Overall view of GBPUSDGBPUSD entered a support zone and is about to reach the low of the year 1.24550. Prices settled on a support zone and kept being under a bear pressure. The odds of a continuation are medium/high, but we can still encounter a reversal.

Possible targets : @1.24550 (+130pips) OR @1.27500 (+70 pips).

Advice : Scalp by selling any high points until you reach the low of the year 1.24550 or wait for a reversal and buy while targeting 1.27500.

Correlated pairs : GBPCHF (94.8%), GBPJPY (92.8%), US2000 (87.7%) and EURGBP (-94.3%).

We are more likely to experience a test of the year's low with GBPCHF, GBPJPY while a test of the year's high with EURGBP. US2000 in another hand is bullish, eventually confirming an upcoming reversal for the GBP pairs.

Perfect Rejection Played Out ? What will happen now ?Hello Hoomans.

I'm making a part 2 of my TA because my previous call was perfectly on point, so i'm here to catch up with you guys.

As you can see on the daily charts both of the sticks got closed below the line showing a great resistance in the weekly and daily chart, and that was exactly wat i called on my previous TA (test of the 100MA weekly & 350 daily)

At this point i'm very confident it is topping out but i'm not leaving out any retests at this point, if bitcoin holds support at the 5350-5400 there is a big chance that may happen.

Please like & subscribe so i can keep making TA's & Positions

MY PREVIOUS CALL: