LOW

USDJPY Trading Inside 2018 LevelsLast post: June 16th 2018. See chart .

Review: Price was looking bullish and continued to move to the upside by another 500+ pips.

Update: Price has since remained in consolidation inside the high and the low of 2018.

Conclusion: Waiting for a clear breakout and trend direction. Standing aside until then.

Sublime Trading

BTCUSD Bitfinex

The 100% of the margin did not break through. They made a false takeout of the last Haya on the volume and took the feet of the shorty, now you can go tight to $ 5000-4900 to unload the indicators.

You can shorts with a stop for $ 5350

At this stage, there is still a bullish scenario for BTC / USD, and the purchase is possible in the Green Zone with the same potential up to $ 6098.

Breakout of the $ 4908 level will negatively affect the bullish mood in the market, and, accordingly, then we should expect a decline to the bottom.

BTC/USD 1W Masterplan Technical

Bearish Pennant

Rising Wedge

Overbought StochRSI

Money Flow Index in the overbought area

EMA200 Resistance

Year Low Volume Record

Fundamentals

Mt.Gox Rehabilitation Plan on April 26th for distribution of BTC www.mtgox.com - Last Report 20 March 2019

Google Trends show low0interest World Wide in Bitcoin trends.google.com

Cboe removed XBT Contracts due to low volume & interest from their customers into this product.

ETF & Bakkt aren't in our short-term sight anymore due to other priorities from CFTC & SEC. Also, S.E.C disapproved ETF due to market manipulation from unregulated exchanges.

Trade Opened at 4040$ - Stop-Loss: 4100

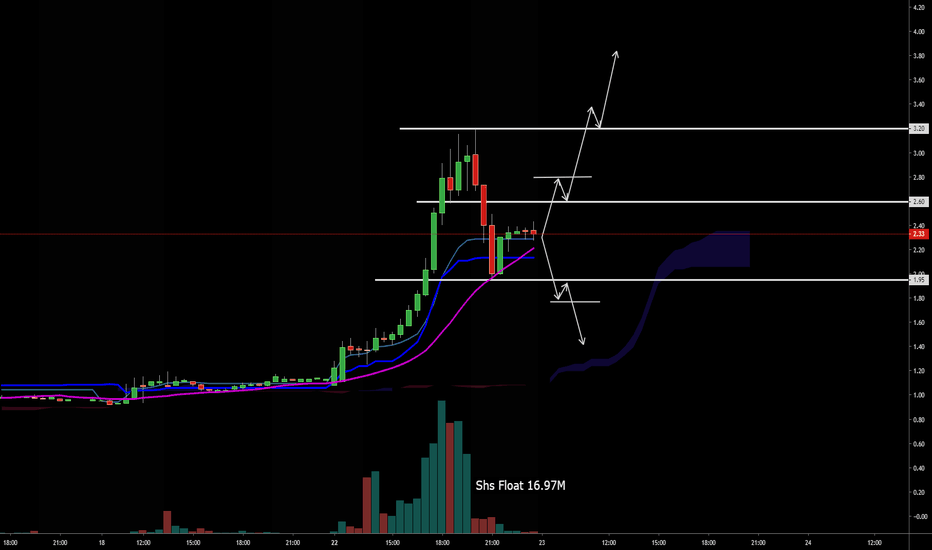

Shineco Added Cannabis SectorShineco stock gapped up this morning from news of them releasing a cannabis sector for their business. Shs Float is sitting at 16.39M with marketcap at 28.38M. We will be watching this stock for a continuation play tomorrow! Watch my full video review for $TYHT by using the link in my signature description!

Massive ER Play - Lowe's!!I've been watching Lowe's since early Feb and I think there is potential for a big move leading up too/after the ER on March 1st.

It's been running in the green for ~8 days and the RSI indicates it's oversold.

It's currently hanging out on the 0.628 Fib lvl, could see it gap up to 0.786 or 1.0 Fib lvls (~$111 and ~$117)

The support levels are at 0.5 and 0.382 Fib lvls (~$101.5 and ~$98). Giving us a P/L Ratio of 1.7

BTC: Which logarithmic resistance will be the important one?There are two falling logarithmic resistances at play now, which could be important in the coming weeks for determining the reversal point.

The one which is obtained by connecting the ATH top with the point where the last decline started at 6500.

The other one being a not so steep one, connecting the previous smaller tops after ATH with 6500.

I tend to think more and more that the steeper one will be the one where BTC will make the reversal.

Reasons:

1. It will reach the steeper one sooner. Weekly stoch RSI has set up nicely to overbought, as I thought it would.

It will be at almost 100 overbought after the next 2 weekly candles => Perfect setup for drop

2. LTC did a nice fake-breakout from the log resistance as in 2014, pretending to be super bullish and strong. These fake-breakouts are really

dangerous and occur sometimes in crypto, especially in alts

3. The weekly bbands will be narrow enough for a drop already starting in march.

4. The drop starting in march with low in april would coincide better with the increased cycle duration of around 20%. I think we're a bit slower in this whole bull/bear cycle, the more

btc grows, the slower it gets. A low in april would be 3 months later than in 2014/15, which would fit this theory.

5. he higher resistance is still quite high, at around 5000. BTC showed great weakness the last months, therefore I cannot believe that we'll see another 1000 USD pump. This would also

put LTC too high, LTC would be at 70-90 USD, which would be too high before the drop imho.

So this is my view, as always: I could be wrong. I just present what I'm thinking.

We'll see soon when BTC nears the first logarithmic resistance, how it behaves, and then we can act accordingly.

BTC bullflag and what to expect in the coming weeksAfter exactly one day of action, BTC wants to make you fall asleep again. I think we won't see a fast climb to 5000, that scenario is for me completely off the table. Instead, the new bullflag will probably break to

the upside at some point, and then BTC will bore us to death by rising very slowly upwards, towards a maximum of 4600.

It wants to rise slowly, so that the weekly Stoch RSI is nicely overbought at 80-100, and the weekly RSI also rises a bit again, after having been very low.

This is of course all in preparation for an epic dump. If we take the magnitude of the last dump, which went without any major bounces from 6500 to 3200, we could easily go from 4600 to 2000, maybe even lower for a very short time.

I am just not buying into the "probability for bitcoin bottom has greatly increased" narrative, some traders are suddenly proclaiming, just because BTC is pumping a bit.

Reasons why 3200 has NOT been the bottom:

1. Daily transactions are still below ATH, the bearmarket historically only ended when daily transactions were at least 20% above the previous ATH

2. We are still very far away from the halving in mid 2020

3. I think stocks will see another sell wave this year, and since wallstreet is now actively involved in BTC, they will just treat BTC as any other asset, and also sell BTC

4. The sentiment is still far too optimistic imho. Just look at all the people who everytime think that we have reached the bottom. Normally, we have the bottom when

there is absolute despair, and even hardcore BTC fans become doubts, and everyone has brutal panic, and a feeling of hopelessness is everywhere, THEN we'll have the bottom.

5. The cycle time gets longer every cycle. It is illogical to think that this bitcoin cycle is exactly as long as the last one. The cycle time increases every cycle, which makes

absolute sense, since BTC is gaining more mass

6. The MAs that provided support, increased in number, every bearmarket. In 2012 it was the MA100. In 2014/15 it was the MA200. It is logical to assume that it now will be

the MA300 that provides solid support.

Well, these are my reasons to remain calm and not euphoric about the recent rise.

I'll patiently wait to re-enter BTC, but this point will certainly be reached sometime this year, probably in the next 2-4 months.

I am long till mid 4000s, then opening shorts when we near the log resistance.

Bullish wedge about to fail, new lows possibleWell now BTC is weaker than anticipated. I expected a stronger breakout from the falling wedge, however it seems I overestimated BTC.

The problem is the high longs: It looked as if shorts would increase again, but this is not the case.

Together with the extremely weak breakout, I think that the chances for new lows directly, without bounce from here, are starting to increase.

I cannot put exact percentages out, but my feeling says about 70/30 for dumps/bounce.

Target is around the 2k area.

We shall then see if we get a good bounce. If not, then BTC is indeed headed for 980-1200 USD sometime later this year.

BTC update on daily and weekly timeframeBTC wants to go to overbought again on weekly timeframe. It would be ultra weird if not.

Weekly stoch RSI has not been on overbought since a very long time, probably the longest time in BTC history.

It needs to be overbought again on weekly, so that it can prepare for the next dump, which hopefully will be the final one.

At least there is a high probability it will be.

On the daily timeframe I see it dragging on still for a bit, until upward momentum is established.

Sort long ration is already turning again towards shorts, slowly, but still noticeable.

Well, I still think we'll see 5000-5300 in the next weeks, probably until the end of february.

Then creeping sideways and the final leg down.

Bitcoin.. oh bitcoin.. What's goes up..Chart is self-explanatory. What to expect in 2019: Sideways, drop, sideways, drop, sideways, drop, untill the bitcoin block reward reduction hype will begin.

When I'm trading sideways, I am aware of the channel going down.

I will not consider going long until the channel is broken.

Just my personal view on BTC right now

Time to look at good ol' LTC againAhhh LTC, my old friend.

I bought a lot of you back in 2015, and I didn't regret it.

Of course, I was a bit pissed that ripple, ETH, and dash pumped much more, but I don't hold a grudge, because for me,

it all started with LTC.

That is the restart in 2015, because when I started with coins in 2013, I managed to lose all XD

Well, now let's take a look at the LTC longterm picture. LTC is amazing in its perfect exponential decline from the top.

It was the same in 2014-15, and it looks to be the same now.

I don't think that LTC will go through the resistance at 50 USD, I would be amazed if it did.

Then bottom in march-april together with BTC. I don't know how low exactly, somewhere around 10 USD maybe, plusminus.

Could be 7. Could be 13.

Then the halving in Summer 2019, it will be a nice pump I suppose.

If one trades this well, it could promise some nice gains.

Good luck to all !

Will we see a new LOW soon on BITCOIN?A largely dangerous and sideways market for crypto.

BTC trading within 2% ranges for 76 and 60 hours respectively.

if the next series of volatility brings in bearish movements, it is good confirmation that crypto may be ready to set new lows.

We saw a strong resistence at 4100$ we dropped back the candle i have marked is bearish and i dont like it. The 0,236 Fibo Line held as support the last hours but i think we will break down.

The Volume is to low to make it to 4240$, so i think we can make a new low guys.

There are view signs on the weekly chart we are forming another Descending Triangle (the same pattern as we dropped at 6000$.)