$EXLS is leading in the tech sector. Is it ready to go higher?Notes:

* Very strong up trend on all time frames

* Great earnings track record

* Breaking above historical resistance of 145.21 with higher than average volume

* Very close to its 50 day line

* Offering a low risk entry

Technicals:

Sector: Technology - Information Technology Services

Relative Strength vs. Sector: 1.04

Relative Strength vs. SP500: 1.03

U/D Ratio: 1.38

Base Depth: 20.34%

Distance from breakout buy point: -5.99%

Volume 45.0% above its 15 day avg.

Trade Idea:

* You can enter now as it's breaking above historical resistance with higher than average volume

* If you're looking for a better entry you can look for one around the $143 area as that should serve as short term support

* This stock usually has local tops when the price closes around 10.77% above its 50 EMA

* Consider selling into strength if the price closes 10.57% to 10.97% (or higher) above its 50 EMA

* The last closing price is 1.9% away from its 50 EMA

Lowriskhighrewardplay

DOT: BUYING HERE IS A VERY LOW RISK AND HIGH REWARD!!Hello everyone, if you like the idea, do not forget to support with a like and follow.

Welcome to this DOT/USDT update. DOT looks very promising here and looks like hovering near the bottom.

DOT is trading inside a symmetrical triangle in the 2-day time frame. Currently, it is moving near the lower trendline of the triangle. So buying here will be very low risk. Buy some now and add more in the dip.

Entry range:- $17.5-$18.5

Target1:- $22

Target2:- $26

Target3:- $32

Target4:- $38

SL:- If any 2-day candle closes below the triangle or closes below $17 then I'll exit.

If you like this idea then do support it with like and follow.

Also, share your views in the comment section.

Thank You!

HIND ALUMINIUM BASE BREAKOUT BSE:HINDALUMI broke out from a 2 year accumulation area formed after a strong downtrend of 80%

The accumulation zone slightly resembles a head and shoulder reversal pattern.

The accumulation zone is at the same price range of the previous accumulation zone from which price moved 200%

Increasing volume in the accumulation zone prior to breakout shows increasing interest in the stock.

Breakout volumes are also excellent with price also giving a retest.

A positional trade of at least 1:3 to 1:4 can be taken, but the stop loss can be trailed after the uptrend is established.

Place sl below 44

Targets are open after 1:3 and 1:4 are achieved.

Holding period 2 months to 1year +

Position size accordingly. HAPPY TRADING!

RADICO KHAITAN 1:7 RISK REWARD 🔥🔥🔥NSE:RADICO broke out from a bullish flag pattern and retraced back to the breakout price.

Price also stands near a resistance turned support. (Rectangle area)

Enter entire position at C.M.P,

Targets: 1300/1450/1500

sl- below 1150

NOTE: low risk high reward trades have a lower hit rate.

Position size accordingly. HAPPY TRADING!

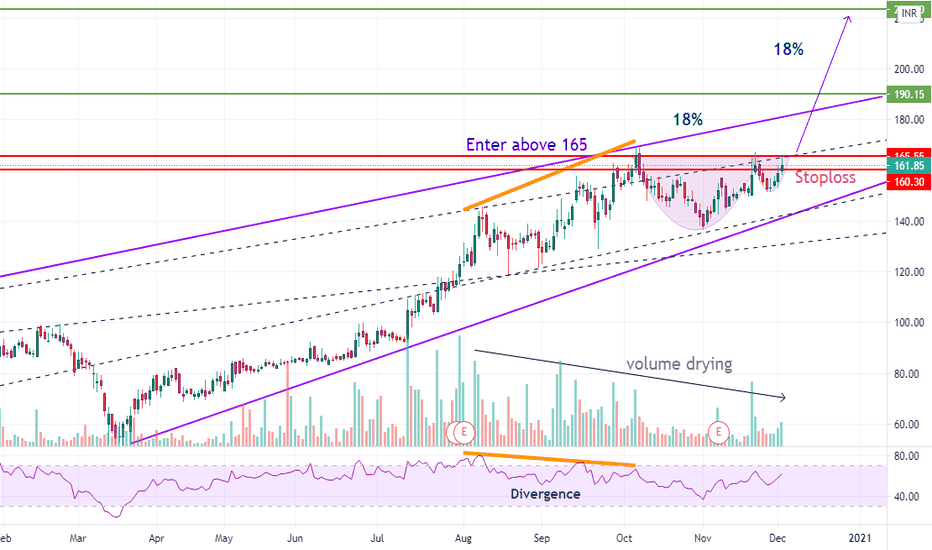

NEOGEN CHEMICALS BIG ENTRY 1:10NSE:NEOGEN is consolidating in a rising channel pattern.

Price is at support of the channel. Good opportunity to buy and hold for big money.

Exponential move if price breaks out from this channel.

Place sl below the channel (below day's low)

Potential 1:10+ trade. Don't miss out!

Position size accordingly. Low risk high reward trade. HAPPY TRADING!

INDIA CEMENTS 2:7 RRR TRADE 🎯350NSE:INDIACEM Broke out of a major expanding channel pattern.

Breakout candle is very bullish and volumes are heavy on the buy side.

Price is in a low volume consolidation mode in the form a rising channel pattern on hourly timeframe.

Momentum is expected to continue after the break of this pattern.

One can enter at C.M.P with entire position for 2:7 Risk reward play.

Targets: 300/350+

sl: below 210

Position size accordingly. HAPPY TRADING!

JINDAL WORLDWIDE TRENDLINE BREAK 1:4 RRNSE:JINDWORLD has given a breakout from an old resistance uptrend line.

On a lower time frame, it has also given a breakout from a narrow low volume consolidation zone. (Pink rectangle area)

Volumes on trendline break towards all time high look very bullish - the highest since last 2 weeks.

A risky momentum trade can be taken with a tight sl , going for 1:4 risk reward play. It is important to mention that placing a tight sl increases the chances of it being hit due to the market volatility. Track sl on a close to close basis instead of C.M.P.

Another justification for this risky trade is that price has continued to rally without any major correction and it is likely it will continue to do so.

Considering the bullish nature of the stock, one can enter entire position at C.M.P for this trade.

Targets: 310/390/400/430+

sl: below 260

Position size accordingly. HAPPY TRADING!

HANG SENG : possible buy

I think the index failed to break down as you can see on the chart.

As long as 4 hour candles keep closing above 27500 then I believe we will see higher prices.

Expectations:

1. Price will rise to the middle of the channel

2. price will rise to 30,000 zone

3. price will stall between 30,000 zone and the middle of the channel, then continue up

best of luck :-)

GBPCHF : possible buy zoneIt seems like GBPCHF is forming a cup and handle pattern, and as you can see on the chart, there are some indications that we might be at the bottom of the handle :

1. ABCD retrace from the recent high in the weekly chart and the daily chart

2. weekly candles closed above the channel ( channel break )

3. we are currently in support zone 1.2500

4. immediate reject of 1.2500

5. yesterday closed green and it seems like today will be closed green too

So in this situation I'm aiming to catch the weekly swing by building a long position gradually to reduce risk.

best of luck :-)

VERY LOW RISK OPPORTUNITY This honestly might be the best risk:reward setup I have ever seen on a trade.

While the fundamentals might not agree... we know that anything can happen in this market.

Expect the unexpected.

Safe OTM Call?I love OTM calls because I do not have a tone of money to invest and they are basically low risk & high reward. By low risk I mean you can only loose the small amount of money you put in while the return could be double or triple your money. Using TA software like tradingview & their algorithms/scripts created by TA geniuses has been my biggest success.

What is your favorite script? Comment below

Mine is Divergence+ which offers insanely accurate buy and sell signals based on divergence & also shows divergence in the form of a shadow.

The Kurotoga cloud is also one of my favorites because it shows an accurate support/resistance level. It is most accurate on higher time frames.

Check out this call for Restaurant Brands to hit $65 a share.

I'll let you do the analysis

Comment your thoughts below

ADITYA BIRLA MONEYAn inverse 'Head and Shoulder' pattern on display.

The stock is also moving in a 'Parallel Channel'.

A breakout above the neckline would take the stock to 50 which is a 21% gain..

RSi at 66 also looks positive to support the momentum.

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the confidence.

JMIA Forming New Support for BreakoutJMIA is currently testing its previous trendline as support( green line ).

The candle pattern and standard deviation pertaining to strength of move in relation to volume, indicates that a base has been formed above the previous resistance. If the price action is able to break the current resistance( blue line ) formed within the move above the previous trendline( green line ), it should test the next overhead resistance along the upper trendline( orange line ). The projected strength of this move ( based off prior moves showing similar indications ) shows the potential to reach the upper trendline resistance( orange line ) within the next few weeks with a pullback expected once the price reaches near $79 . If the move maintains demand within the market, the price action could see $85.50-$87.75 once the trendline resistance ( orange line ) is confirmed as a support.

A break below the current trendline support ( green line ), followed by a rejection of re-entry, shows a probable move to test support of the previous trendline( red line ). This is unless it is able to form its own support from and increase in demand above previous levels of buyers entering the market. In my opinion since the $53-$55 demand has already been tested as support, the earliest this demand-formed support could develop above the previous trendline( red line ) would be between $49-$51 ($51 support level would indicate strength with it being a 1.13 extension of the previous retracement). The lowest a support should be formed to continue an uptrend would be between $46-$47 . This would require that the price had broken down below the previous trendline support( red line ) and successfully regained entry from the support. This move would be similar to the trend re-confirmation that happened on 06 Jan 21.

The potential long entries for this trade:

Similar to the move described above, entry could be after a break below the green line and a strong re-entry into the current price range. This would indicate a demand based confirmation of the upper trend.

OR

Entry can be when the price has confirmed support above the demand indicated candle( above the dashed red line ).

The indicated potential stop loss would not necessarily be within that range, but within that range after a rejection of re-entry into above trend( green line ). Although, waiting for a retest of the green trendline would increase risk as there is no guarantee it will find the demand to retest this resistance.

**This is not financial advice or a suggestion to enter a trade in JMIA, this is just what I am looking for in my own personal entry.

Federal Bank - Fresh Rally ?Call it a VCP or a Cup and Handle Breakout.

Golden Cross just happened on Daily Chart.

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

Always keep a stop loss to rescue you out of troubles.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the motivation.

Sequent ScientificComing out of a VCP or a cup and handle pattern.

Awaiting a breakout.

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

Always keep a stop loss to rescue you out of troubles.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the motivation.

Mahindra CIE - Ride the ChannelHaving crossed a few resistances , the stock is on song riding the channel beautifully.

One can enter even at current market price for a target of 174.

As long as the price doesn't break the lower side of the channel ( orange line) , there isn't any threat.

RELIANCE seems oversold pre-earnings release. Great potentialReliance RSI has approached nearly the COVID bottom. It had bounced up over 1200pts when it reached these levels the last time. If buyers step in, we may see a new base being formed.

The stock has been a favourite for investors so far as it's given short-term returns that midcaps & small-caps can only dream of. In fact, it was one of the fastest recoveries from COVID lows to an ATH.

After breaching 2300, RELIANCE hasn't had enough steam to continue its rally despite several important supports. This may be due to the overly positive sentiment earlier.

That combined with unfavourable news & uncertain business dircetion + no new exciting trigger, stock prices have come down ~10% from highs. But this also begs the question – is RIL forming a base? According to RSI, another 2000 retest may bring momentum to COVID selloff levels without any massive trigger or global selloff.

This may make it a good low-risk pick as the stock seems fundamentally strong.

ZScaler inside uptrend channel (Watching!)ZS has been behaving well inside the uptrend channel drawn. When we touch the upper part of the channel, we see a pullback to the lower segment line.

RSI analysis suggests, we have difficulty going above the 70 level, however, the chart remains bullish whenever the RSI has been over the 43 RSI. A break below 40 in the RSI would be short-term bearish. -----> conditional Bull

OBV has been trending upwards since the earnings gap-up we had May 29th. -----> Bull

50sma is lining up with the lower channel line, which could work as a support, and a buy entry with low risk.

ACB Strong Buy Signal w/ High Upside Potential next 6 monthsAurora Cannabis (ACB) closed at $6.98 on Sept 11, meeting 2 previous support Lows.

Fibonacci ratios and Elliot Waves on this chart fit quite nicely.

Key points for a BULLish trend over the next 6 months:

Key Support met again. History tells us a breakout may be on the horizon.

Declining volume on the downward trade indicates a possibility for a breakout with high volume.

RSI provides a strong oversold indicator.

Consider the larger Elliot Wave Trend and see that we may be at the low of a Wave 2 on the larger cycle, indicating the best buying opportunity of all time, with low downside risk.

Key Points for Risk-Reward Trades over the shorter-term:

Note the MACD cross-over, but also the unreliable nature of this indicator, especially considering prior history of "flip-flopping".

Lots of opportunity to trade the up and down moves to $150 over the short term if there is a bull breakout.

First target of $33.50 is based on the .786 retracement, and coincides with the impulse peak of wave 3. This will require a strong breakout with volume and likely be accompanied by high volatility.

Disclaimer: I am not a professional and I chart for my own education and learning. Please feel free to share your ideas and any resources you might recommend! Thank you! :)

GMDC - RevisedCMP 44.2

The last time I drew my lines, I had disregarded the low on 1st June of 34.2 due to which my stop loss was hit.

The revised base line in the Ascending Triangle shows that the support was was actually not breached. However, Stop loss is our best friend at nervous points. Falling is alright but to be a winner one should accept the mistake and move on with a learning.

MACD is positive at the moment with a bullish crossover.

Now , we can also see that a Golden Cross looks very likely in the coming days which would only add on to its momentum.

Fundamentally also the stock is strong.

*****

Help Me to Help Us.

I believe in keeping the chart simple with minimal drawings & easy to interpret.

So kindly express any disagreement & improvements so that we learn & earn together.

Please support the effort and appreciate it with a Like if you felt it deserves it and Following me would only add on to the motivation.