LPP

XAUUSD GOLD Structurein the XAUUSD Gold Structure is the Bullish because :

in the 4H structure, after reaction to the DE Order Block, the structure in the 15min has changed.

note: after reaction in the Order Block we can use this formula: 4H LPP = 15min CHOCH

of course in the 15-minute chart, the structure changed from bearish to Bullish because the 15-minute CHOCH has been completed.

this is just my idea you can test it.

Be successful and profitable

SCEPTEREDING

AUDUSD StructureThe structure in the AUDUSD is Bullish. after CHOCH in 4H, the market structure has changed from Bearish to Bullish.

But on the 15-minute Chart, it's different because :

we have a CHOCH in 15min Chart.

and the distance between High and Low is large.

this explanation does not mean that the Structure is bearish. no! but we can sell in a short time.

this is my idea, you can test it.

Be successful and profitable

SCEPTEREDING

GBPUSD Structurein the GBPUSD, the market is bullish. but the distance between High and Low is very large, then we can use this formula :

15min LPP = mCHOCH

Please note that we have 2 order blocks that the market can react to it

This is just my idea, you can test it

Be successful and profitable

SCEPTEREDING

EURUSD StructureThe structure in EURUSD is Bullish. Because we have 2 Bullish BOS, But the last High has no LPP then :

or => market must build new LPP

or => take the 15m LPP and react to Order Block

we have another scenario :

Because the distance between High and Low is large , we can use the following formula :

LPP = mCHOCH

this is just my idea and we can test it

Be successful and profitable ...

SCEPTEREDING

Bullish Structure GBPUSDin 4H Structure is Bullish and EX Order Block worked .

in 15min Structure is Bullish because Price Move from 4H EX order block and we have 15min BOS

in 15min we have 1 EX Unmitigated Order Block .

==> if Structure create new 15min BOS we must Fund new LPP and new Order Block .

==> if Structure cant it , we have just 1 ZONE for BUY

Bullish BOS in EURUSDin 4H Structure is Bullish . But After EX Order Block , we have a mCHOCH and mLPP in 4H

in 15min , Structure is Bullish but we have LPP and 2 Order Block ( DE , EX ) that we can think about trading for then .

If 4H mLPP is Running => then we have 1 minor Order Block in 4H . when refine it in 15min , we can marked 2 other Order Block .

==>> we have 4 ZONE for BUY

EUR/USDHello. How are you? We start the first trading day of the week. Important news was released last week, which created a range of movement between 1.06357 and 1.07807. When the ceiling was broken (the area I marked with D), a character change with the abbreviation CHoCH symbol was formed. Of course, if we used the trend line, it completely confirmed that the channel ceiling had been broken and now we should wait for a possible pullback and upward movement.

Now pay attention to the areas I marked with A, B, and C:

Area A is a kind of cash collection that we call SPP in our style. Since this SPP line has been broken with the shadow of the candle, we can risk the market going up.

Note that there are two other areas below Area A. Areas B and C are potential buy orders. They can be called potential demand areas.

The area that I marked with B has been optimized and marked in a 5-minute timeframe. If the market reaches this area, which is approximately 1.06755, I will look for confirmation to enter a buy trade in a lower timeframe. My stop loss is under the bearish candle level, which means 1.06602. Additionally, area C is identified as the 50% area of an order block in the origin.

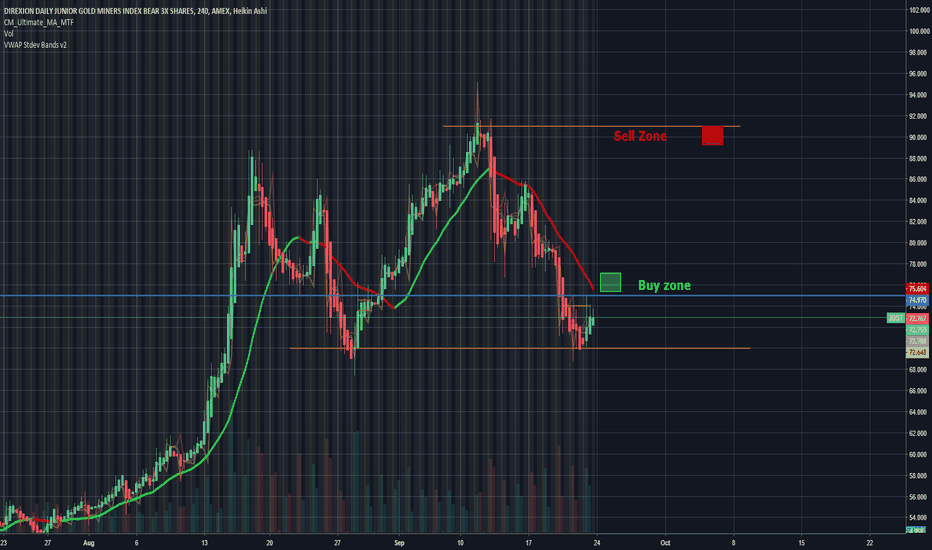

21% Potential in Russian Bear!AMEX:RUSS

21% Potential in Russian Bear!

Entry now if you're a bit more aggressive or

Entry after signs of higher highs and higher lows above blue EMA (15) line

2% Stop loss

MacD showing signs of reversal

RSI below 40

IRI Over-bought in this horizontal pattern

Offers 15% potential between top and bottom drawn support and resistance

If it makes higher highs past $3 then continue to be patient and wait for further higher highs and higher lows to confirm that it's on the uptrend before getting in for a swing trade

On the weekly chart, IRI is in a down trend and is hitting the moving average line, so wait and see if it can bust through that or if it is just going to get rejected