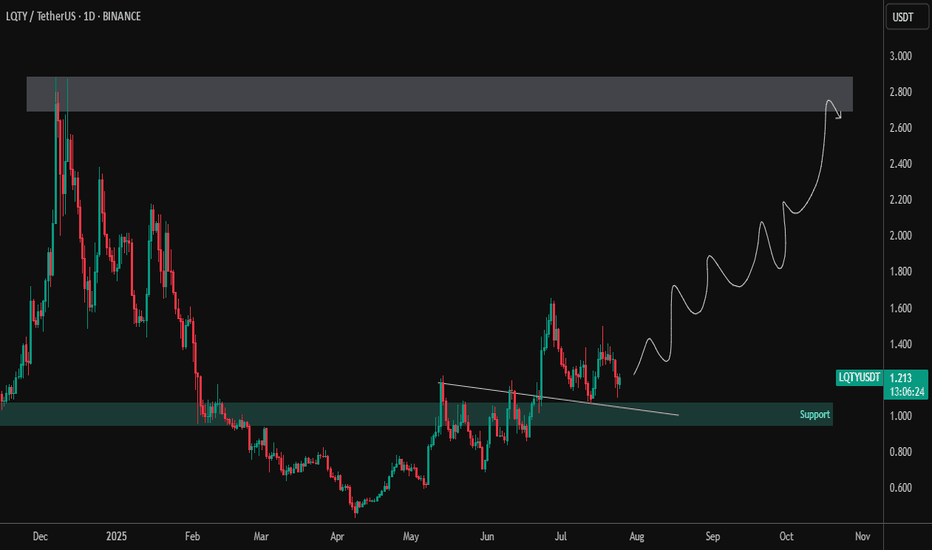

LQTY – Accumulation Completed | Preparing for Trend ReversalLQTY has broken out from a descending structure and reclaimed the key support zone around $1.00–$1.10, showing early signs of accumulation and bullish strength. Currently forming a higher low structure, suggesting a potential long-term uptrend is brewing.

🔹 Technical Highlights:

✅ Clean breakout from descending trendline

✅ Retest of breakout zone holding as support (~$1.10)

🔼 Price printing bullish higher lows on the daily timeframe

🎯 Target zone: $2.70–$2.90 (major resistance from previous highs)

📌 Technical View:

Strong structural base forming

Pullbacks into support area could offer high R/R entries

Break above $1.50 may ignite bullish continuation toward the upper target zone

LQTY appears to be transitioning from accumulation to markup phase. Monitor price action and volume for confirmation of the next leg.

Lqty

LQTY - Buy - buy - bye bye- Volume in volume

- Divergence in volume

- Completed 5th wave of growth

I don't know what else to write.

If you like the idea, please put a ‘like’. It's the best ‘Thank you!’ 😊 P.S. Always do your own analysis before a trade. Set a stop loss. Capture profits in instalments. Withdraw profits in fiat and make yourself and your friends happy.

Liquity 400% & 688% Easy Targets 600% is great, truly awesome. Do you agree?

If you earn 600% on a $10,000 buy, wouldn't that be awesome?

What about 400%? Both are good to me.

Liquity is bullish and growing already.

The chart drawings show a double-bottom and also how this support zone leads to a bullish wave.

There was a full flush in 2025. Which means that the action went below the previous low, August 2024.

This can be interpreted in two ways mainly:

1) LQTYUSDT is weak and for this reason it pierced below previous support.

2) There was plenty of liquidity at this level and the market couldn't let it go and it moved lower. So many people hold this coin.

Bonus:

3) A full flush opens the doors for maximum growth.

I am an optimist, so I always consider/favor the bright side. So I take it as a positive development; no more weak hands.

Everybody who wanted to sell, sold.

Everybody that remains in now is ready to hold.

This opens the doors for huge long-term growth.

These targets on the chart are easy targets and can hit within months. Just a few months and you can book a huge 400% profits on this trade.

Liquity is bullish now. Strongly bullish.

Thank you for reading.

Namaste.

#LQTY/USDT#LQTY

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.986.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.011

First target: 1.053

Second target: 1.114

Third target: 1.177

LQTYUSDT Eyes Rebound from Strong Support!LQTYUSDT technical analysis update

LQTYUSDT is trading at a strong support zone, where the price has touched multiple times and bounced back in the past. We can expect a similar bounce from the current support level. Additionally, in the daily chart, the RSI has dropped below 30, which is another bullish sign for LQTY.

LQTYUSDT Bouncing Back!LQTYUSDT Technical analysis update

LQTYUSDT has bounced off a strong support zone, the same level where it previously showed a strong rebound. A bullish RSI divergence is visible on the daily chart, suggesting a potential bullish move from the current levels.

Buy zone : Below $0.76

Stop loss : $0.625

Precision Trading – The Sniper Entry is Coming!LQTYUSDT Analysis

Precision Trading – The Sniper Entry is Coming! 🎯💥

“I know I’m aiming a little lower, but listen – that’s what makes a great trader. I don’t chase, I wait. I snipe the perfect entry, and when the time comes, boom – we hit big!”

Here’s the Setup:

Blue Box = High-Profit Zone – If CDV, lower time frame breakouts, and volume profile confirm, this area could be golden for a high-RR entry.

Patience Wins the Game – We don’t buy blindly, we wait for the right moment. A sniper doesn’t fire without a target, and neither do we!

Momentum Confirmation is Key – When the breakout happens, you don’t want to be late – position early, trade smart, profit big.

Final Thoughts:

“I’ll be watching CDV, volume profile, and liquidity heatmap like a hawk. No confirmation? No trade. But when the signal comes? We strike with precision and dominate!”

Good luck, traders – this could be an absolute monster! 🚀🔥

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

LQTY/USDT BREAKOUT ALERT: READY FOR 60-80% SURGE!!🚀 Hey Traders! 👋

If this setup gets you hyped, smash that 👍 and hit Follow for game-changing trade ideas that deliver results! 💹🔥

LQTY: Ready for Takeoff! 🚀

LQTY is looking primed for a big move! It just broke out of a falling wedge on the 4-hour timeframe and successfully retested it—setting the stage for a strong rally! 📈 Now’s the time to position yourself for the next leg up.

📊 Trade Setup:

Entry Range: CMP (Current Market Price) and add more up to $1.98

Targets: $2.34 / $2.76 / $3.12 / $3.72

Stop Loss: $1.84

Leverage: Keep it low (max 5x)

💬 What’s Your Take?

Do you see LQTY’s breakout potential? Share your thoughts, strategies, or predictions in the comments below! Let’s ride this wave and bag those profits together! 💰🔥

LQTYUSDT: Blue Boxes in Focus for Bullish Breakouts

LQTYUSDT: Blue Boxes in Focus for Bullish Breakouts 🔵

LQTYUSDT is shaping up to be a fascinating chart, and here’s the plan:

Blue Boxes Matter: These zones are where I’ll be watching closely for potential upward market structure breaks.

Key Indicators: Confirmation will come from tools like CDV (Cumulative Delta Volume) and volume profile . These will tell us if buyers are stepping in with conviction.

Lower Time Frames: I’ll be analyzing 1H or lower charts for precise entry signals.

My Approach:

Patience is everything. No action until we see those bullish signals—low timeframe breakouts and buyer strength are non-negotiable!

Stay tuned, traders. Boost, comment, and follow for more sharp market insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

Liquity (LQTY)Liquity is a decentralized borrowing protocol built on Ethereum that utilizes LQTY, a USD-pegged stablecoin. Ether holders can draw loans in the form of LQTY with algorithmically adjusted redemption and loan issuance fees.

Anyway, LQTY was in a downtrend from the start. Then, LQTY broke the major downtrend line and started to oscillate in a triangle-shaped pattern, also making a double bottom. Recently, LQTY broke the triangle pattern and started a new upward wave. Let's see how high LQTY can go.

LQTYUSDT Breaks Channel !LQTYUSDT technical analysis update

BINANCE:LQTYUSDT price formed a descending channel pattern on the weekly chart. After 630 days of formation, the price has broken above the channel resistance. With a noticeable rise in volume, we can expect a strong bullish move in the coming days.

Stop Loss: $1.00

Target: 200-500%

Regards

Hexa

Any jump up for LQTY - risky setupLQTY looks very bullish on a chart. One of my favorite recently. If price break up and test all time high on the chart, it can run a lot. This trade is risky - market is slow and btc unclear. Buy and sell levels are on the chart.

NOT A FINANCIAL ADVICE + MANAGE YOUR RISK AND USE STOPLOSS

LQTYUSDT A Potential Bullish Reversal or Further Breakdown?Yello, Paradisers! Could this be the moment for #LQTYUSDT to bounce back, or is there a deeper dive coming? Let’s dive in!

💎#LQTY has broken out of the falling wedge, a classic bullish reversal pattern, and also cleared the previous lower low (LL). This signals a strong potential for upward momentum. If the price holds steady at the current demand zone, we could see a rebound and continuation of the uptrend, potentially making a new higher high. Our target? The strong resistance area, where the highest probability for resistance lies.

💎However, if LQTY fails to hold this demand zone, particularly around the 0.655 area, we might witness a breakdown. In this scenario, the price could drop to test the key support level at 0.48. This is a critical area, as it's the lower low from previous price action, and any breakdown here would signal trouble for bulls. A bounce is essential to recover and maintain bullish sentiment.

💎But beware bullish invalidation will kick in if the daily candle closes below 0.48. This would suggest a continuation of the downtrend, likely creating a new **lower low** and potentially pushing the price even deeper.

Consistency, patience, and a clear strategy are the keys to navigating this market successfully.

MyCryptoParadise

iFeel the success🌴

LQTY ROADMAP (2D)Before anything, pay attention to the time frame, the time frame is big.

From where we put the red arrow on the chart, it looks like the LQTY correction has started.

This appears to be an ABC correction with a more complex pattern now that we are in wave C.

Wave C appears to be a diametric diamond. We are now in the middle of wave E of this diametric.

It can move from the red box to the green box.

We are looking for sell/short positions in the supply range.

We have such a view on LQTY.

Closing a daily candle above the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SMC Killzone : Aggressive and Stack Entry'sMainly in SMC, there are 3 entry models

This example is all about the

1st Entry Model : Aggressive Entry Model along with Stack Entry

Criteria as below :

15m Kill Zone

Aggressive Entry Model( 14RR ) : 15m Valid LQ Sweep > 1m Confirmation > Limit Order Entry

Stack Entry Model( 9RR ): Within 15m Aggressive Entry > 1m Confirmation > Limit Order Entry

A Promising Uptrend for LQTYThe recent performance of LQTY/USDT suggests an optimistic outlook, marked by significant bullish momentum. Currently trading at $1.337 , LQTY has made a substantial gain of 15.26% in the latest week, signaling a strong recovery from recent lows.

In this chart, I have revealed several key technical levels and patterns that traders should consider for potential opportunities.

Key Levels and Patterns

1. Weekly Support and Breakout : The price bounced off the critical weekly support level at $0.945 , which has proven to be a strong foundation for the current uptrend. The recent breakout above $1.235 indicates a bullish reversal and potential for further gains.

2. Trendline Breakout : A clear breakout above the descending trendline points to a continuation of the upward movement. This breakout has the potential to propel the price towards the next significant resistance at $1.768.

3. Primary Resistance : The primary resistance level stands at $2.163. If the bullish momentum sustains and the price manages to break through the intermediate resistance zone around $1.768, reaching this level is plausible.

4. Stochastic RSI : The Stochastic RSI, currently at 31.09, shows a potential for upward movement. It indicates that the market is not yet overbought, leaving room for more upside.

5. Cumulative Volume Delta (CVD) : The CVD indicator reflects positive buying pressure, with a notable increase to 35.327M. This buying pressure supports the bullish sentiment and enhances the likelihood of continued price appreciation.

Bullish Outlook

The technical indicators and chart patterns are aligned, suggesting a promising bullish trajectory for LQTY. With the price breaking significant resistance levels and the indicators supporting further gains, traders should watch for continued momentum. Should the price sustain above the trendline breakout and overcome the resistance at $1.768 , the path towards the primary resistance at $2.163 becomes increasingly likely.

Important: DYOR before making any investment decision