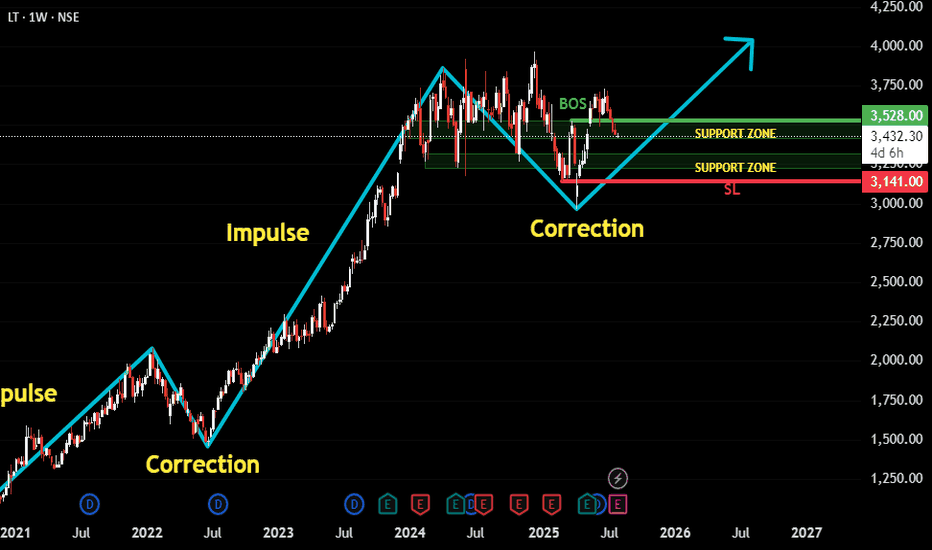

LT Following Classic Impulse-Correction Rhythm.This is a trend-following setup on LT (Larsen & Toubro) where we’ve observed a clear repeating pattern of Impulse → Correction → Impulse. The recent price action suggests that the latest correction has matured, and the structure now hints at a potential next impulse wave beginning.

Here’s the thought process behind the setup:

✅ The stock has been trending upward in a clean impulse-correction rhythm.

🕒 We waited patiently for the correction phase to develop fully and mature.

🔄 A Break of Structure occurred, signaling potential trend continuation.

🔁 Retest on support zones further strengthens the bullish case.

🧭 Support zones are drawn from the Daily chart for precision, though this post is based on the Weekly timeframe for broader trend visibility.

🛡️ Stop-loss can be maintained near ₹3141, just below key support.

🎯 Target is based on a 1:2 Risk-to-Reward setup, aligning with disciplined trading strategy.

Overall, this is a classic example of waiting for confirmation after correction before re-entering in the direction of the dominant trend.

As always, risk management is key. Watch how price behaves around the recent structure and support zones for validation.

LT

LT READY TO SKY ROCKETLT has given a beautiful breakout today from the long standing Resistance level as marked on chart. With its well-established bullishness the stock is bound to go in for a long bull run. Targets can be open. Long Term Targets to be around 4500 level.

Simple Price Action at its best.

P.S. It has also given a breakout on the weekly TF, which is even more of a reason to buy the stock. Fundamentals look good too.

Decoding the Final Wave: An Elliott Wave PerspectiveTechnical Analysis Using Elliott Wave Principles on example of Larsen & Toubro Ltd. (Hourly Time Frame)

The analysis presented is purely for educational purposes, demonstrating the application of Elliott Wave Theory. It is not intended as trading or investment advice. Markets are unpredictable, and all analyses have a degree of uncertainty.

Introduction to Elliott Wave Principles:

Elliott Wave Theory is a powerful tool used by traders and analysts to decipher the underlying structure of market price movements. Developed by Ralph Nelson Elliott, this theory is based on the idea that market prices unfold in specific patterns known as "waves." These waves are driven by collective investor psychology, moving in predictable cycles of optimism and pessimism. The theory is broken down into two main phases: the impulsive phase, which moves in the direction of the main trend, and the corrective phase, which moves against it.

Key principles to remember:

1. Wave Structure: An impulsive wave (motive wave) consists of five waves (1-2-3-4-5) in the direction of the trend. A corrective wave is composed of three waves (A-B-C) that move against the trend.

2. Wave Personality: Each wave within the Elliott Wave structure has distinct characteristics. For example, Wave 3 is often the strongest and longest, while Wave 5 tends to be a final push before a trend reversal.

3. Wave Relationships: Fibonacci ratios are frequently observed in wave relationships, providing potential price targets and retracement levels.

4. Validation and Invalidation Levels: These levels help in determining the accuracy of wave counts and projections. If price breaches the invalidation level, the wave count is reassessed.

Current Elliott Wave Analysis on Larsen & Toubro Ltd.

Upon analyzing the hourly chart of Larsen & Toubro Ltd., we can observe the following wave counts and structures:

Wave Structure Overview:

- The chart shows a complex corrective structure following a significant impulsive move. The price action seems to be in the final stages of a larger wave pattern.

Wave Count Details:

1. Primary Count:

- We are potentially in the 5th Wave (red) of the final (5)th Wave (blue) on the daily time frame.

- The 5th wave, according to Elliott Wave Theory, often exhibits certain characteristics such as declining momentum, signaling the end of the trend.

2. Current Hourly Structure:

- Wave (4) in Blue has been completed at the price level near 3175.05, marking it as the last corrective wave before the final impulsive wave.

- The chart illustrates a five-wave sequence emerging from this level, indicative of the development of the 5th wave.

- Within this structure, we can identify sub-waves:

- Wave 1 peaked around 3720.

- Wave 2 retraced back near 3460.

- Wave 3 is anticipated to push towards higher levels, with Wave 4 and 5 completing the sequence.

Wave 5 Characteristics and Projections:

- Wave 5 Characteristics: [/i ] Typically, Wave 5 in a motive wave structure can be either strong and extended or show signs of divergence, where momentum indicators such as RSI or MACD might not confirm new highs.

- Projection Target Levels: Based on Fibonacci extensions, potential targets for Wave 5 lie around 4141.30, 4352.60, and even possibly towards 4400.00.

- Invalidation Level: If the price breaks below 3175.05, the wave count would be invalidated, necessitating a reassessment of the entire structure.

Conclusion:

The analysis indicates that Larsen & Toubro Ltd. is in the final stages of a larger wave pattern, specifically the 5th wave of an impulsive sequence. As this wave unfolds, it’s crucial to monitor the target and invalidation levels closely. This educational analysis serves to illustrate the application of Elliott Wave Theory, with no intention of providing trading advice. Always consider consulting with a financial advisor before making any investment decisions.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

LTDisclaimer:

Kind regards to all friends and members ,

Stock market investment is subject to 100% market risks. Our company is not a SEBI registered company. Please consult your financial advisor before investing. This is for learning and training purposes only. Market Traps administrators are not responsible for any financial gains or losses resulting from your decisions. You acknowledge that stock market investments are highly risky and that you understand the market risks involved. Hence any legal action is void.

Seizing Opportunity: Double Bottom Formation in LT!Hello traders,

Let's explore an exciting opportunity today! 🌟 This stock has recently formed a double bottom pattern and surged upwards, consistently breaking previous highs. 🔄 Currently testing its recent peak, there's potential for a pullback before further upside.

Options traders, consider buying 3500 call options in march expiry for optimal leverage. Let's make the most of this opportunity! 💼📊

Thank you. See you again in the next post.

Best regards,

Alpha Trading Station

LT--Retracement or Reversal??This stock observed a strong fall from the resistance...

broken the trendline as well....

if this is a retracement price again continue its upward momentum...

if this is a reversal price will gives us retest to the trendlines fall back...

Look for buy opportunities when price comes to the demand area...shorting opportunities when it comes to resistance area...

LT--@Resistance Zone??A strong bullishness is observed from this stock from 3040 levels...if this is an exhaustion or initiation.

Previously a strong fall is observed from the levels 3120 levels...

now its again at resistance zone...if this move is initiated by buyers again this will break the resistance soon...if this is an exhaustion of buyers it will breaks the support at 3040.wait until it confirm its bullish or bearish then look for sell or buy..until keep in wait and watch mode...

Scott's Miracle Grow WILL GROW!SMG strong buy ratings and solid financials make SMG a good Long Term Buy. The cannabis industry is helping build it's revenue from critical fertilizers and other materials that are it's core business. I honestly believe SMG is a stock that will double in the year. Mark my words Trading View! SMG will be a big winner!

Also, buying SMG while it's under it's major moving averages is a much better strategy than waiting for a large break-out and trying to time it perfectly. I think accumulating SMG the next few months is a wise idea.

LT- Intraday Short PositionThe chart pattern and volume profile clearly show that it can give excellent risk-reward when it breaks down from the @2080 support zone. Price Action shows a downtrend and the volume profile adds more confirmation, So the possibility is more to go down till the @2060 area.

Entry Level:- Below @2080

StopLoss:- Above @2090

Target :- 1:1 or 1:2

LTC/USDT - LONG 12H TF----- Welcome, dear followers! -----

- Here is my trading methodology. I trade with a normal system and analysis of resistance and support, as well as price reversal patterns.

- For the record, I do not place a stop loss within my trades. So that I only risk 1.5% of my total capital in order to support the loss due to a price reversal against me.

- If a price reversed against my expectation and touched the drawn line r3, then I transferred targets to the entry point and waited for the price to close at it with a loss equal to almost zero.

- Today's deal is shown in the chart, and here are the entry and exit points below.

-- Support me with numbers and follow up on my account for other deals in the future. Thank you for coming to this part. --

-------------------------------------------------------

⚡️⚡️ #LTC/USDT ⚡️⚡️

Client: My-Binance Futures

Trade Type: Breakout (Long)

Leverage: Cross (1X)

Entry Targets:

1) 68.87 - 100.0%

Take-Profit Targets:

1) 78.22 - 20.0%

2) 85.49 - 20.0%

3) 96.92 - 20.0%

4) 115.44 - 20.0%

5) 133.96 - 20.0%

Trailing Configuration:

Entry: Percentage (1.5%)

Take-Profit: Percentage (0.75%)

Stop: Breakeven -

Trigger: Target (1)