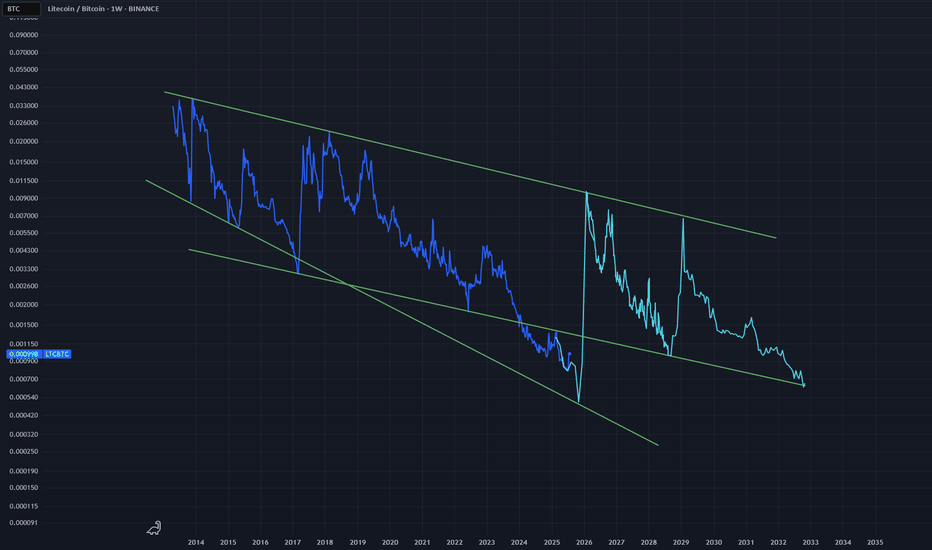

LTCBTC

LTCBTC Secular Low launching into the Golden Ratio.One of the biggest sleepers in the cryptoverse. Watch it launch into the Golden Ratio as BTC calms down into the 161.8 grand mark.

Not too sure where the bottom is for LTCBTC, but who cares? The final trajectory here looks to be around 0.01, which puts LTCUSD around $1618 per piece.

This is in fact the silver bullet that will kill the upcoming altseason - be forewarned.

When YouTubers Say 'No'… We Say 'LTC Go!'I’m not here to drop some fancy technical analysis today.

I’m here to tell you… this might just be it.

A big, popular YouTube channel just announced they’re not too bullish on Litecoin this cycle.

And guess what? That might actually be our ultimate buy signal.

The chart’s looking bullish now — the trap has been set, and left behind us. 😎

They FUD, We Flood (Our Bags)

Why Litecoin? Beyond its unshakable fundamentals, if you genuinely understand and believe in crypto and digital freedom, Litecoin is the purest expression of that vision

That's it, that's the idea" - Good night !

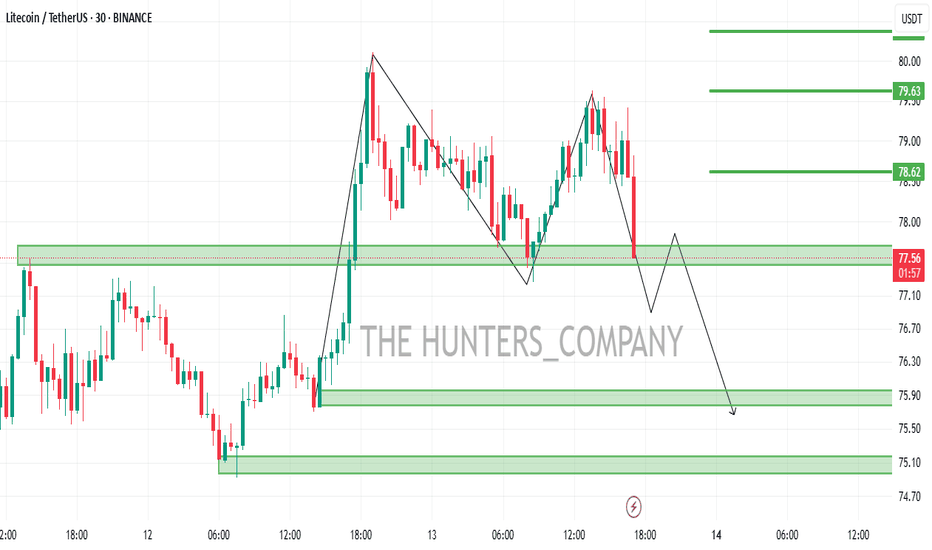

Litecoin:Is the main climb coming?hello friends👋

As you can see, the price, after falling in the support area specified by the buyers, has been supported and returned, forming an upward pattern.

Now we don't enter into a transaction with just one pattern, we also check the entry of buyers and the amount of currency and other factors and draw conclusions.

According to the points we have said, we have identified very important support points for you to buy step by step with capital and risk management and move to the specified goals.

🔥Follow us for more signals 🔥

*Trade with us safely*

LTC, he Hidden Strength Beneath the Retrace Ma dudes, we might just be witnessing something big and beautiful here. 🤌✨

Okay okay, I might sound like a total degen, but hear me out:

✅ Double bottom (check those two green arrows)

✅ Bullish divergence on the RSI

✅ MACD on the monthly just crossed bullish — for the first time ever on this pair!

✅ OBV stayed strong, didn’t collapse even during that nasty monthly retrace

✅ Notice how volume was climbing during the uptrend, but fell off during the retrace? That means the drop lacked real conviction.

We’re also sitting at an ATL (all-time low) — the lowest we've been.

Check out that red arrow pointing at the volume: that's the first sign of a burst. The next bursts? 💥 They should be explosive.

…And that’s just to name a few.

See you somewhere up there 🚀 — once we break through that T1 level, we should start trending higher fast.

That's it, that's the idea" - Good night !

Litecoin vs Bitcoin —The Institutional Wave? Consider the ETFsStarting November 2022 LTCBTC (Litecoin vs Bitcoin) went on a major downtrend, until November 2024. After November 2024 this downtrend is no more.

There was a bounce late last year and this event changed the chart. The latest low last month, June 2025, ended up as a technical double-bottom. Less than 5% below the November 2024 low and this low happened after 217 days. This means that in seven months sellers became exhausted and they couldn't produce a new major low. This reveals that the bearish trend is over. Once the downtrend ends, we get a change of trend, a change of trend implies an uptrend, an uptrend implies long-term growth. We are looking at a long-term bottom and... From the bottom we grow.

This is not an opportunity that presents itself often. The BTC trading pairs are hard to trade. These are for experts only. A new opportunity is developing that can lead to exponential growth. It is amazing how this section of the market works. LTCBTC will grow as Bitcoin and the rest of the market grows. This tends to produce a multiplier effect that is hard to explain. You will understand when you see it in action.

LTCBTC is hitting bottom. The bottom is already established, several weeks old. The candles low is flat, we can expect massive growth; excitement and institutional adoption on Litecoin thanks to the ETFs, it will be the first time this pair grows in years and the type of chart it will produce it is hard to tell.

We are entering uncharted territory. The bullish phase can be mild just as it can be ultra-strong. There is no limit to the upside. It can grow for years or for 4 to 8 months. Both scenarios look good.

The best part is to catch the bottom; an early wave. Prices are low now, easy to buy and hold. Focus on the long-term.

Litecoin has good potential for this incoming 2025 bull market.

Thank you for reading.

Namaste.

#LTC/USDT#LTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 92.48.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 97.44

First target: 100.24

Second target: 102.45

Third target: 105.26

Valuable Demand Zone Amid Weak Market ConditionsLTCUSDT Analysis: Valuable Demand Zone Amid Weak Market Conditions

I believe the blue box in LTCUSDT is highly valuable as a demand zone. Given the overall market conditions are not strong , I’ve identified a lower entry point that aligns with more favorable risk-reward scenarios.

This blue box stands out due to its significance from multiple perspectives . I used heatmap , cumulative volume delta (CVD) , and volume footprint techniques to accurately define this zone as a potential buyer area.

Key Points:

Market Conditions: Currently weak, favoring conservative entry levels.

Blue Box: A carefully identified high-value demand zone.

Techniques Used: Heatmap, CVD, and volume footprint for precise demand mapping.

If you'd like to learn how I use these advanced techniques to define accurate demand zones, just DM me!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

The LTC Bullish case to $10k and why it can happen this Bull RunEveryone is ignoring LTC, Digital Silver.

If we are to look at the network hash for Litecoin and where it was during the previous seasons peak, Jan 2018 and May 2021, we can see the network has was at 100TH and ~210TH in 2021..

We are currently at 2.3 - 2.5 PH, that is 12-25x previous values during the Price top in the last 2 bull runs.

Looking at the NVM (Network Value Model) for Litecoin, we can notice the network has constantly grown while the price is now pretty much unchanged and at the same level as 4 or 7 years ago.

Lastly if we are to look at the BTCLTC and LTCBTC chart, both are displaying a clear picture, it's Litecoin's time to shine and show why it is called Digital Silver and Bitcoin Digital Gold..

Litecoin is valued at 0.1 of BTC based on previous charts and ATH, that easily puts Litecoin at the 5 digits range, tehnically Litecoin can surge to 430 - 700x, time will tell if we go to $20-30k or more, it also depends where Bitcoin will meet it's peak this run. Will it be $150-190k or $250-490k??

This will dicated Alts top and of course Litecoins too.

Let's not forget that ETH was $70-90 in 2017-2018, it did not stop it going to EUROTLX:4K and it will not stop it from moving now into 5 digits, Litecoin can and will do the same.

It's a solid network, there are a ton of miners, tehnically it's in a 5 year Triangle and breaking out, we are going to see ETF listings for LTC soon, news will start to pile and retail will want to buy the cheaper Bitcoin, the one with real and actual Payment Utility!

Let's see where we are in 3 months and end of this Year.

I am predicting we teleport to $300-500 sooner rather than later!

LTC/USDT:BUYHello friends

Due to the good price growth, we see that the price has hit a lower ceiling and has fallen, which we can buy in stages during the price decline, within the specified ranges and move with it to the specified targets.

Observe capital and risk management.

*Trade safely with us*

Litecoin is in a bearish cycle (12H)From the point where we placed an arrow on the chart, it appears that Litecoin's complex correction has begun.

Currently, we seem to be in wave C of this correction.

Wave C, based on the 3D structure, could end at demand 1, leading to wave D, which is a bullish wave.

However, ultimately, wave E could conclude within the demand 2 zone.

Liquidity pools for waves C and E are marked on the chart, and it is expected that each will be swept in turn.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

LTC Litecoin Fireworks Are About To Start ETFs Loading UpHello my friends, Im sorry for not being here for a while, my life was very busy over the past year. Im hoping now that things are settled down I can do these charts again regularly.

That aside lets get into Litecoin. Litecoin has been outperforming almost the entire market lately moving from 25th position on Coinmarketcap to now 12th position over the course of just a couple months or so. Litecoin is showing big time strength over all the others. Every day its holding onto more and more of its gains while others are making new lows or lower highs. We are at the apex now. Litecoin must break over $147 and close that candle on at least the 2 day to be confirmed. Once that happens I don't think there will be many pullbacks from there and if there are they will short lived.

The ETFs for Litecoin are really gaining steam. Charlie Lee did an interview back in I believe it was December with The Litecoin Forecast YouTube channel and Charlie was saying that if anyone had large amounts of Litecoin and wanted to help seed the Canary ETF to contact him directly. The ETF is coming 100% there is no question about that. Once these ETFs get approved Litecoin has such an illiquid supply the price of Litecoin will skyrocket so fast and so high it'll leave everyone in disbelief and with their mouths dropped. Miner reserves are at an all time low, so no serious dumping or resistance levels along the way like previous runs. People and institutional buyers are realizing that Litecoin is the second Bitcoin. they realize that Litecoin is THE Altcoin and the rest are just clones, copies and junk. The fact that Litecoin is te most used crypto worldwide and has been for a long time shows that the PEOPLE chose Litecoin over all those other chains to transact in, even over Bitcoin. People are realizing that Litecoin is the better Bitcoin and was made to be that way. There is no denying that Litecoin is the chosen crypto, its provable with on-chain metrics! No hype, no advertising, nothing just pure organic adoption. Thats what make a winner in this space. We dont need a tweet from Elon or constant promises and upgrades to keep Litecoin relevant. Litecoin will move to the #2 spot under Bitcoin.

Once this move starts and Litecoin starts going parabolic you will see the pump chasers and fomo rotating out of the already extremely overvalued trash they bought the top in to get into Litecoin. All the non believers, all the haters, all the wounded who sold angrily, everyone will pile into Litecoin. You will hear a lot of language especially from the haters saying that its just a pump and dump along the way. Eventually they will all change their tune when Litecoin continues to rise and rise and rise and wont stop. Dont be fooled and dont sell early, Litecoin is going to shock the entire world and thats not being dramatic. It will be on every news channel. Big institutions will be talking about it. Blackrock will get in along with all his buddies. Its coming I promise that. I had made my previous predictions not really knowing what the catalyst would be other than the charts and some on-chain data. Now I know why Litecoin will make that move I was predicting. The ETFs are going to bring in a flood of money like no one has see before and the world will realize that Litecoin is Bitcoin #2. The ones who missed Bitcoin at $1000 are going to flood into Litecoin for their chance to get the second faster Bitcoin.

I know I was wrong on the timing of the last predictions I made thinking that maybe it could have happened in 2024. I didnt expect the market to be this drawn out, I dont think anyone did. It is different this time despite what everyone else says. The cycles are getting longer and longer as more and more people enter the space. There isnt a huge rotation from Bitcoin into Alts anymore because now the ETFs are locking it up. No more Alt seasons like we were used to . I believe that my chart showing 13K for Litecoin is just the beginning. Litecoin will be worth 1/4 of Bitcoin in the future. I dont want to say that Litecoin could overtake Bitcoin but it might you never know this market is wild. Litecoin in these next few years and over the course of a couple cycles within this larger cycle we could see Litecoin at $50k each. Once all the money drains out of the overhyped and overacalued trash thats currently out there, they will eventually move into Bitcoin, and Litecoin. Maybe a couple others that are competing for the smart contract side of things but as far as Cryptocurrencies go Litecoin and Bitcoin are the only two that will remain relevant. The rest are just projects and platforms and wanna be Cryptocurrencies all the way down the line. Litecoin is about to create so many millionaires in such a short period of time its going blow everyone's mind.

Eventually Litecoin network will be so busy because of real world use, it'll have to stop mining Doge which is just a leech off the network. Miners wont waste energy on that. Doge will eventually move back down to where it came from. XRP holders will eventually realize that they have been duped into keeping the rich lifestyles of the Ripple team going for so many years on just hype. The meme coins are losing interest. All those holders are going to lose everything, literally. I cant believe how many have their entire investment in these silly Fartcoin, Titcoin and all the other ridiculous coins with zero value. They were fun to make quick money on but they are no longer as profitable and the risk is way higher than the reward now. Frogs, Dogs, Cats, Squirrels all are going to die and go to zero. The crypto market will be wrangled and only the strong will survive. All that capital will flood out of the trash and there will be a mad dash for actually utility. In the Dot com boom there were so many internet companies it was crazy but at the end of it only a few strong ones survived and thrived and became the powerhouses that we see today. Thats exactly what I see for the cryptospace.

Litecoin holders will soon be vindicated!

None of this is financial advice, this is just my opinion.

LONG(ER)TERM HOLD LITECOIN IDEALitecoin 2 week chart, so this will take time to play out--

Sitting nicely ontop of a 3 year base!

I've personally been holding LTC since $60 (Spot) Going to add to my spot bag here.

**Accumulate in this range ($135-$100) and SELL ($220 - $300 - $400^^^)

***Theoretically, cut the trade if price falls below 1week or 2week 100 MA

***Depending on your risk tolerance.

LTC Litecoin 800$In a previous post, I outlined the coins with possible ETFs. Each has held its price level even after the recent drop.

Everyone knows Litecoin is just a fork of Bitcoin, and there's not much technology in it. However, a decentralization and adoption issue is occurring, making it a suitable candidate for a potential ETF.

For technical analysis, we have a standard triangle with horizontal resistance on top. Such resistances tend to break out strongly.

So, I wouldn't be surprised to see a price of around $800 at the end of the cycle.

If we talk about the LTCBTC pair, we can see that the fall has stopped, the bottom has been minimized, and I expect an upward jump.

Best regards OVACXE

LITECOIN BITCOIN (BEST-CASE)Like Bitcoin, CRYPTOCAP:LTC is first and foremost a digital currency that can be exchanged peer-to-peer, untrusted and securely, very quickly and at minimal cost.

The modifications made to the Bitcoin blockchain to give rise to Litecoin’s blockchain required only minor efforts in terms of IT development, as most of the innovation came from Bitcoin.

Nevertheless, Litecoin’s strength lies in the fact that these changes are few but significant:

A ”proof of work” that uses the Scrypt hash function rather than SHA-256 for Bitcoin

Block creation four times faster, with an average interval of 2.5 minutes instead of 10 minutes

Total number of units four times greater, with 84 million instead of 21 million

Mining difficulty changes every two and a half days instead of every two weeks

On the other hand, as with Bitcoin, the issuance of new litecoins is halved every 4 years (halving): since August 2019, miners have received 12.5 litecoins as a reward for each block validated.

Litecoin Breakout: Potential Gains and ProfitsAlright, let’s talk about Litecoin and why I think it’s gearing up for something big. The market's been showing solid gains across the altcoin sector , and Litecoin is definitely catching my eye right now.

Here’s the deal: the LTCBTC pair looks like it’s finally bottomed out and is breaking out of a two-year downtrend line . If that sounds familiar, it’s because we’ve seen this before. Back in 2017 , Litecoin broke out of a similar downtrend, and the result? LTCUSD skyrocketed from $8 to $365 in just a year .

Fast forward to today — 2023 and 2024 have been all about consolidation in the $100–$47 range . Now that we’ve broken through $135 , 2025 could be a massive year for Litecoin. My main target is $365 , but I’ve got my eye on some optional targets at $630 and even $1,300 .

Why those higher targets?

Simple. Looking at how the LTCBTC pair has performed in the past, even a small upward move there has historically triggered huge gains in LTCUSDT .

Now, let’s break it down further.

Litecoin’s price history shows recurring patterns — ascending triangles from 2015 to 2017 and now again from 2018 to 2025 . And these patterns play out in phases:

🔴 Downtrend

🟡 Consolidation

🟢 Breakout

We’ve already seen this cycle happen three times — 2014 to 2018 , 2018 to 2021 , and now 2021 to 2025 . It’s all lining up again.

The key now is to watch the details . Resistance levels, price action , and how the breakout unfolds will be crucial. If Litecoin follows through, it could be gearing up for a move that redefines its place in the market .

Stay tuned — this could get really exciting.🍻

Some of past LTC charts:

Litecoin Joins ETF Race, Boosting Market OptimismLitecoin (LTC), one of the earliest and most established cryptocurrencies, has recently entered the burgeoning race for a spot Bitcoin ETF, mirroring similar efforts in other cryptocurrencies like XRP. This development, coupled with growing community support for Lightchain AI following the rollout of ETF trading features, has ignited renewed interest and bullish sentiment in the Litecoin market. Canary Capital's recent Litecoin ETF filing has sparked a market rally, coinciding with a period of anticipated leadership change at the Securities and Exchange Commission (SEC).1 This article explores these developments, analyzing their potential impact on Litecoin's price and its position within the broader cryptocurrency ecosystem.

Litecoin Joins the ETF Race: A Sign of Maturing Market

The filing for a Litecoin ETF marks a significant step in the cryptocurrency's evolution. Exchange-Traded Funds (ETFs) offer investors a regulated and accessible way to gain exposure to an asset without directly holding it.2 The potential approval of a Litecoin ETF could open the door to a wider range of institutional and retail investors, driving increased demand and liquidity for LTC.

This move mirrors the ongoing efforts to establish a spot Bitcoin ETF and recent developments surrounding XRP. The pursuit of ETFs for various cryptocurrencies reflects a growing acceptance of digital assets within traditional financial markets. It also signals a maturing market, with increasing regulatory scrutiny and the development of more sophisticated investment vehicles.

Canary Capital's Filing and Market Reaction

Canary Capital's filing for a Litecoin ETF has been a catalyst for positive market movement.3 The announcement triggered a noticeable price rally for LTC, demonstrating the market's anticipation of potential ETF approval. This reaction highlights the significant impact that regulatory developments and institutional adoption can have on cryptocurrency valuations.

The timing of Canary Capital's filing is also noteworthy, coinciding with anticipated leadership changes at the SEC. This transition could potentially lead to a shift in regulatory approach towards cryptocurrencies, potentially creating a more favorable environment for ETF approvals.

Lightchain AI and ETF Trading Features: Enhancing Litecoin's Ecosystem

The development and growing community support for Lightchain AI, particularly following the rollout of ETF trading features, further strengthens Litecoin's position. Lightchain AI aims to enhance Litecoin's functionality and scalability, potentially addressing some of the network's limitations.

The integration of ETF trading features within the Litecoin ecosystem provides users with more convenient access to ETF-related products and services. This integration can further drive adoption and usage of Litecoin, particularly among investors interested in participating in the ETF market.

Technical Analysis: Trading Above the 20-Day MA

From a technical analysis perspective, Litecoin trading above its 20-day moving average (MA) is generally considered a positive signal. The 20-day MA is a widely used indicator that tracks the average price of an asset over the past 20 trading days.4 When the price crosses above this average, it can suggest a shift in momentum from bearish to bullish.

This technical indicator, combined with the fundamental developments surrounding ETFs and Lightchain AI, paints a more comprehensive picture of Litecoin's current market position.

Challenges and Considerations

Despite the positive developments, Litecoin still faces challenges. The SEC's stance on cryptocurrency ETFs remains a significant hurdle. The regulatory landscape for digital assets is still evolving, and there is no guarantee that a Litecoin ETF will be approved.

Competition from other cryptocurrencies also poses a challenge. While Litecoin has the advantage of being one of the earliest cryptocurrencies, it faces competition from newer and more innovative projects.5

Long LTC: A Bullish Perspective

The phrase "Long LTC" expresses a bullish sentiment towards Litecoin, suggesting a belief that the cryptocurrency's price will rise in the future. This sentiment is supported by several factors, including the potential for ETF approval, the development of Lightchain AI, and positive technical indicators.

However, it's crucial to remember that investing in cryptocurrencies is inherently risky. Market volatility, regulatory uncertainty, and technological developments can all impact the price of digital assets.

Conclusion

Litecoin's entry into the ETF race, coupled with community support for Lightchain AI and positive technical indicators, has generated significant excitement within the market. Canary Capital's ETF filing and the anticipated SEC leadership change have further fueled this momentum. While challenges remain, the combination of these factors suggests a positive outlook for Litecoin. The potential approval of a Litecoin ETF could mark a turning point for the cryptocurrency, opening it up to a wider audience and solidifying its place within the evolving financial landscape. As always, investors should conduct thorough research and exercise caution when investing in cryptocurrencies.

LTCUSDT: Active Buyers and Key Blue Box Opportunities!LTCUSDT Analysis Active Buyers and Ideal Short-Term Reaction Zones

Buyers are highly active in LTCUSDT, and I’ve identified levels within the blue boxes for potential entries.

Highlights:

Blue Box Levels: Carefully chosen zones where short-term reactions of 10-20% are possible.

Short-Term vs. Long-Term Outlook: While my high time frame expectation leans towards lower levels, these zones are excellent for short-term trades.

Confirmation: Always wait for upward breaks in lower time frames, supported by CDV, volume profile, and other key data points.

Key Observations:

"The blue boxes are very carefully picked using volume footprint, volume profile, cumulative delta volume, and liquidity heatmap. When trading this zone, I will look for buyers and upward market structure breaks in lower time frames for confirmation."

This setup offers an excellent opportunity for short-term traders. As always, stay disciplined and let the data confirm your entries! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🎯 DEXEUSDT %180 Reaction with %9 Stop

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

#LTC/USDT #LTC

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 110

Entry price 112

First target 114

Second target 116

Third target 120

The Litecoin VS Bitcoin trend is changing.For years LTC has been bleeding against BTC. It looks like this trend could have finally ended, at least for a short term (possible few months). Very similar to Ethereum vs Bitcoin the chart of LTC silently has changed the trend and is screaming buy. LTC will start to rise in value against BTC and is a very good trade to gain more bitcoin over a fairly short period of time.

Lets take a look at the charts.

On the left its the 2 week chart of LTC/BTC

The price action seems to have found a bottom along with a lot of indicators. Top indicator is the trusty RSI, with a bottoming out and strength has made a significant move up.

The middle indicator is the RCI3 lines which has just made 2 important crosses with the red and blue lines quietly gaining strength and momentum.

On the bottom is the BBWP. The main thick line has turned blue, and historically blue is the best buy area for this indicator.

On the right is the monthly chart with 3 indicators respectively bellow.

The first indicator is the RCI3lines for second time. We can see for the last many months it has been flatlining but recently the red line has sliced through the GREEN and is trying to cut through the BLUE (possibly January).

The Stochastic RSI is showing momentum is coming into this trade, however it has not confirmed yet. The red line would have to cross the 20 level like the blue line for it be official.

On the very bottom is the ADX and DI. The GREEN line has made an all important cross above the red line which shows a change in the trend. The purple line shows the strength in this trend. The strength a the moment is not strong, however we can see that it also has changed it's direction and looking to start climbing as the move gets stronger.

The first major target (take profits) for this trade would be at the 5000 sat level. getting above that could lead anywhere from 8000 to 15000 that has a lot of time to play out and still remains to be seen

Thank you for checking my chart. Please like and share with friends.

WeAreSat0shi