LTCUSD - Litecoin Halving's Plotted on the chart in orange are LTCUSD's three and most relevant halving dates, with the third being yet to come until July 25 2023

The first halving and the third show similarities, in that they both are experiencing a bull move that will lead to a bull market before the halving

The first one took a long time to materialize however with a long period of low price volatility. I'm going to assume that a phase like this will be skipped on the third halving and bull action will come as the halving comes

This is purely due to the age of the coin

Right now is a great entry into LTCUSD

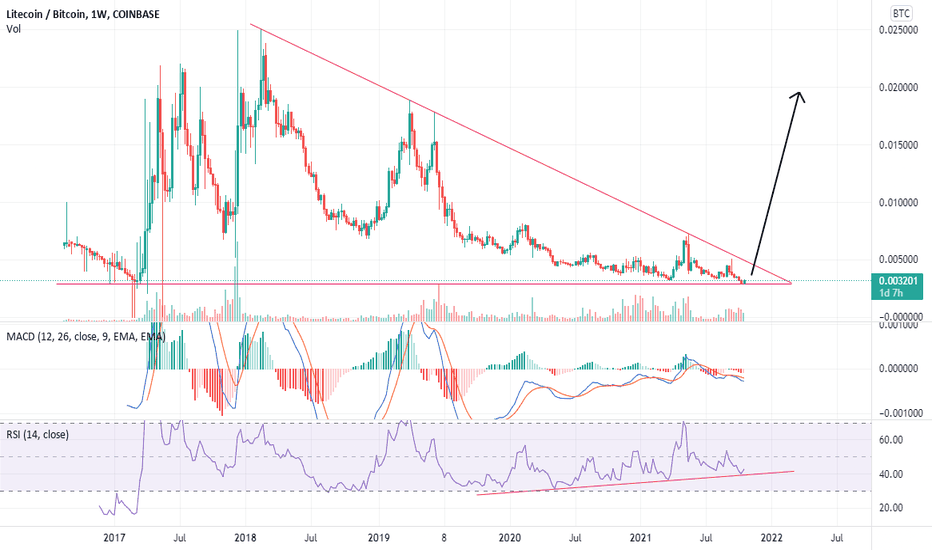

LTCBTC

#LTC/USDT 1DAY UPDATE BY CRYPTOSANDERS Hello, welcome to this LTC /USDT 1DAY chart update by CRYPTOSANDERS.

I have tried my best to bring the best possible outcome to this chart.

Show some support do hit the like button, follow and comment in the comment section. this motivates me to bring this kind of chart analysis on regular basis.

CHART ANALYSIS :

#LTC/USDT

As we can see in the above-mentioned chart LTC is just a triangle pattern and currently moving down to retest so at the green zone or the upper trend line we can take a long position for almost 230% in the upcoming days.

Entry:- $89,$97. ( SPOT CALL )

Traget:- 230%

Stoploss:- $76.5

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Happy trading.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

Litecoin (LTC) - May 6hello?

Traders, welcome.

By "following", you can always get new information quickly.

Please also click "Like".

Have a nice day.

-------------------------------------

(LTCUSDT 1W Chart)

(All: )

An important volume profile interval is the interval 55.7-81.3.

However, as it fell below 101.1, it is showing a movement to enter the mid- to long-term investment area.

If it moves above 101.1 and moves sideways, I expect it to turn into an uptrend.

As you get closer to the 55.7-81.3 section, you need to check whether there is a movement to defend the price with a sharp movement.

This is because this movement is thought to be a force to create a new wave.

------------------------------------------------------------ -----------------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator will move accordingly as price and volume move.

However, for the sake of convenience, we are talking in reverse for the interpretation of the indicator.

** The MRHAB-T indicator used in the chart is an indicator of our channel that has not been released yet.

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

---------------------------------

Historically LTC Surges, 100% of the time if this Pattern Occurs>>> LTCUSD note: Since the middle of 2018, Litecoin - USD 50 Day SMA average has inverted upwards 8 times. The 8th time is occurring as we speak

7/8 times this has Chart Pattern occurred, it has been followed to a rise of LTC against USD . Will this be the 8th repeat?!?

>>> LTCBTC note: Since the start of 2017, Litecoin - BTC 50 Day SMA average has inverted upwards 12 times. The 12th time is occurring as we speak.

11/12 times this has Chart Pattern occurred, it has been followed to a rise of LTC against BTC . Will this be the 12th repeat?!?

Although this type of pattern recognition, is not my favourite sole type of analysis to use in entering a position. I believe this combined with my other reasoning in previous posts, is further confirmation that we will see the predicted rise in the next few days/weeks.

Hold the Line.

Litecoin - MWEB imminent Really not a fundamental trader, and usually fundamental events are sell the news.

Could see a narrative around the entire 'left vs right' privacy and free speech vs control..

if MWEB is added to Litecoin, it then means it can also be added to Doge and Bitcoin.

I'm positioning long.

I am managing my risk.

Good luck!

Is LTC about to EXPLODE against BTC?!Litecoin, quite the sob story for the past year.

Despite many if not most tokens sitting well above ATHs from 2017 LTC is still well below.

But is it about to turn and rip?!

Against 2017 LTC:BTC price ratios, LTC *should* be around $1200 currently, but yet it sits around $200.

The fact the there are now more LTC wallets active than ETH wallets : www.fxstreet.com

It's one of the oldest blockchains in crypto: bitcoinist.com

And now major US banks (like US Bank) are now offering custody service for LTC: www.cnbc.com

Leads me to believe this token is prime to send it.

Looking at the LTC:BTC pairing this token has a clear falling wedge defined and is currently sitting in it's historical low range. Weekly RSI is building in lower-highs and holding linear uptrend, and we have a double-bearish oscillation on the MACD, which has rarely happened with this pair, suggesting possible oscillation to bullish. Not to mention a bullish engulfing candle on the weekly.

It's possible this token is dead and gone. A lost relic of crypto past. But it's also possible this token is a sleeping giant, ready to go huge.

If the market keeps climbing and LTC can break out of this falling wedge LTC to $2,000+ would not surprise me at all. BUT, we could break further south and this token could be a dud. As always risk management is key but also sometimes you fall into a great opportunity to start building long....

1M LTC/BTC going NEGATIVE by 2024? Mr. Lee,

Will LTC HODLERS:

1) Have to pay you back when the LTC/BTC ratio goes negative? How does that work in such a scenario?

2) Can they use your Lightning Network for their ECT when they fall into a deep depression upon reaching such a negative state?

Inquiring minds want to know...

Sincerely,

Ambassadorj

Litecoin (LTC) - April 26hello?

Traders, welcome.

If you "follow", you can always get new information quickly.

Please also click "Like".

Have a nice day.

-------------------------------------

(LTCUSDT 1W Chart)

If it finds support above 101.1, it is expected to create a new wave.

A strong support section is formed over the 55.7-81.3 section.

However, if it falls below 101.1, there is a possibility of entering the mid- to long-term investment area, so you need to think about how to respond.

------------------------------------------------------------ -----------------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume.

However, for convenience, we are talking in reverse for the interpretation of the indicator.

** The MRHAB-T indicator used in the chart is an indicator of our channel that has not been released yet.

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

---------------------------------

LTCUSD - getting ready for Breakout to 180 and beyondIt looks like the LTC might have hit rock bottom and is now has turned bullish.

Looking at the smaller time frame, it looks like it has taken off.

The bigger time frame shows the price was at a supply zone. But it is leaving the supply zone and heading for the demand zone.

Considering the price is so low right now, it might take month or two to get there. But you never knows, since crypto is know to go parabolic.

I am expecting to see some swings up and down while we get there but I anticipate we will get there in few months or less.

_______________________________________

Do you know Jesus? He is coming to judge every person. If you have lied before ,you need to ask for forgiveness for that sin. Bible say every liar will be cast into lake of fire.

If you had sex before marriage, if you had cussed, if you slander someone, if you have worshipped any religion that is not Christ, you need to ask for forgiveness of those sins.

Jesus, who is God almighty became a human being to show us.. how we should live as human beings by walking in love and forgiving others as we want to be treated.

However, we can not do this alone. Jesus wants to lead your life and teach you. The spirit of Jesus can be received by anyone who wants to live and die for Jesus.

If you want to live for yourself and lead this life on your own, you will die in your sins. Jesus will help you squeeze all those sins out of your heart so you can purified and live a righteous life and not a sinful one.

This world is becoming more wicked every day. Foul language has been normalized. Men are allowed to compete with women in their own sports. Marriage has been desecrated.

This world is becoming worst every day, where people are boasting in arrogance, chasing money because of their greed, no love to help others but lovers of themselves,

Come to Jesus and have him lead your life. Bible says only 144,000 people are saved. 4 Angels are send to every corners of the earth to destroy land, sea and the people.. The 5th angel will mark the 144,000 who are the true real Christians so they can be saved from this wrath and destruction. The 144,000 includes the dead people as well from my understanding. As bible states, dead will rise first and the real Christian people that are alive will be taken up after them. There are 8 billion people according to Google... That is less than 1% of the population that is entering heaven.. You heard 99% lose their money on the stock market, in a similar comparison, it looks like 99% of the people will enter hell.. according to bible.. Come to Jesus today. I DO NOT want to see you cast into HELL...

LITECOIN LONGS ACTIVE📉📉📉Expecting bullish price action on LTC as price shifted the strucutre from bearish into bullish and for now price rejected a bullish orderblock area on the H4. We have clear area till 150/180 possible targets.

EXTREME FEAR on the fear/greed indicator meaning there is a good buying opportunity.

What do you think ? Comment below..

LTCUSD - heading to 150 range in the short term..Expecting for the price to hit this price range shown on the chart and possible big pullback down once it his this price target.

It is possible it might even hit 160 range... need to see if it breaks the trend around this range..

However, I do not see a big breakout coming soon..

This is short term bullish prediction

_____________________________________________________________________________________________

Ecclesiastes 5:10 ESV

He who loves money will not be satisfied with money, nor he who loves wealth with his income; this also is vanity.

Hebrews 13:16

Do not neglect to do good and to share what you have, for such sacrifices are pleasing to God

Litecoin LTC75% of LTC miners are ready to support the MimbleWimble update. If nothing changes, then the network update may be activated in about 30-35 days - David Burkett, the engineer who works on the implementation of the MimbleWimble protocol (MWEB). MimbleWimble will increase fungibility and privacy.

Best regards,

EXCAVO

LITECOIN LONGS ACTIVE 📉📉📉📉 Expecting bullish price action on LITECOIN as price shifted the market strucutre from bearish into bullish making a change of strucutre move. Retraced back into bullish orderblock area on the h4 104$ price area, we have a bullish confirmation and ,,green light,, for the bullish move.

What do you think ? Comment below.

Litecoin Breaking Down?Litecoin

Intraday - We look to Sell at 111.04 (stop at 113.76)

Preferred trade is to sell into rallies. Previous support, now becomes resistance at 110.00. The trend of lower highs is located at 115.00. The bias is still for lower levels and we look for any gains to be limited.

Our profit targets will be 101.10 and 98.20

Resistance: 110.00 / 115.00 / 120.00

Support: 104.00 / 100.00 / 90.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Cryptos in Decline? Litecoin

Intraday - We look to Sell at 121.95 (stop at 123.50)

The trend of lower lows is located at 126.00. Previous support, now becomes resistance at 122.00. Current prices have reacted from a low of 117.50, however, we expect further losses to follow. Preferred trade is to sell into rallies.

Our profit targets will be 117.49 and 116.10

Resistance: 122.00 / 130.00 / 140.00

Support: 118.00 / 115.00 / 110.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Litecoin LTCUSDT - Massive falling wedge+ Bull pennant breakout!- Litecoin is currently breaking out of the bullish blue pennant on the daily chart!

- Looks like retest is done and we can continue to the upside.

- We have a huge falling wedge on the weekly timeframe, but bulls still need to confirm their bias.

LITECOIN LONGS expected 📉📉📉📉 Expecting bullish price action on this coin as we shifted the strucutre from bearish into bullish, price made a bullish bos somewhere around 112$. I will wait for a retracement to happend and then to enter a LONG trade straight into 150-200$ price areas. 100$ institutional figure acts as a valuable area of ,,support,, for this crypto coin.

What do you think ? Comment below..

Litecoin to Move Lower?Litecoin

Intraday - We look to Sell at 128.39 (stop at 131.21)

The trend of lower intraday highs has also been broken. The failure to sustain the break higher and subsequent dip, formed a bearish candle and is negative for short term sentiment. Previous support at 128.00 now becomes resistance. Follow through bearish momentum from 126.80 resulted in net losses.

Our profit targets will be 119.22 and 117.20

Resistance: 128.00 / 135.00 / 140.00

Support: 120.00 / 115.00 / 110.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.