LUNA

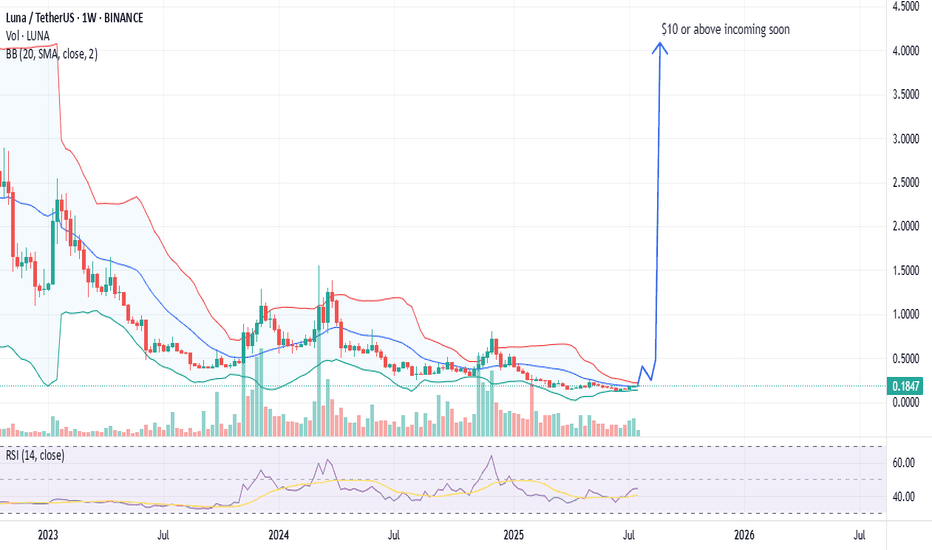

LUNA/USDT crypto trading chart Breakout soon1. Technical Setup Favors Explosive Breakout

Moving Averages (Strong Buy Signal):

7/8 daily EMAs and SMAs (including critical 10-day, 21-day, and 50-day) show bullish alignment, with price trading above key averages. This indicates entrenched upward momentum.

Only the 200-day SMA ($0.23) acts as resistance—a clean break could trigger FOMO buying.

Divergence spotted in all major Indicators

Pattern Breakout: An 8-hour chart descending triangle breakout is noted, with measured move targets at $0.95 (TP1) and $1.30 (TP2) . While short of $10, this signals technical strength.

2. Terra Liquidity Alliance + DEFI Eris Protocol: The $10 Catalyst

The real game-changer isn't on charts yet—it's the flywheel effect of:

Inflation-Driven Rewards: TLA directs LUNA inflation into yield pools. At current prices, this funds $6.2M/year in rewards, but if LUNA hits $3, rewards explode to $62M/year .

Eris Protocol's Amplification:

Users stake LUNA to mint arbLUNA (liquid staking derivative).

arbLUNA enables governance voting + yield farming, generating ~250%+ net APY when combining:

Stablecoin pool rewards (200%+ APY in LUNA).

Governance incentives (50%+ APY for voting).

Strategy: Borrow stablecoins at <5% (e.g., via Mars Protocol), farm in Eris pools, and compound LUNA rewards.

Cross-Chain Capital Influx: Axelar bridges assets (wBTC, wETH) from Ethereum/Cosmos, directing external liquidity into Terra. A $1M Axelar DAO proposal is underway to turbocharge this .

3. Why This Could Fuel a $10 Surge

Demand Shock: To earn 250%+ APY, users must buy and stake LUNA → shrinking circulating supply.

Reflexive Price-Reward Feedback:

LUNA price ↑ → Value of farming rewards ↑ → More users join → LUNA demand ↑.

Example: A LUNA price rise to $1 would increase annual rewards to ~$20M, pulling in massive capital.

Scalability: The model supports $100M+ TVL: Current 24h volume shows liquidity depth, and Axelar integration could 10x inflows.

Short Squeeze Potential: With massive monthly gains already, sustained buying could force shorts (betting on declines) to cover, accelerating upside.

4. Feasibility Timeline: Path to $10

Phase Price Target Timeline Catalysts

1. Breakout $0.50-$1.30 1-2 weeks Triangle breakout, SMA 200 breach

2. Acceleration $3-$5 3-4 weeks TLA TVL hitting $50M+, Axelar DAO funding approval

3. Parabolic $10+ 6-8 weeks Reflexive APY >300%, exchange FOMO listings

Conclusion: A High-Probability moonshot

While $10 seems audacious, the Terra-Eris flywheel creates unprecedented buy pressure. Technicals confirm bullish momentum, and the 250%+ yield mechanism could attract billions in capital within weeks. $3 is a near-guarantee if TLA TVL doubles; $10 becomes viable if LUNA's market cap climbs toward top 50 coins. Watch for these triggers:

Axelar DAO approving TLA funding.

LUNA holding above $0.23 on weekly close.

Rising stablecoin deposits in Eris pools

Moonboi? 👦 You have to be a LUNA-tic ''Oh Professor you are a Moonboi, you only post Long positions.''

Well Thank God everything I post (and everything you post) stays here for EVER:

Show me just ONE author with Short ideas on Luna from 110$ to 5$ (i had around 9 posts proposing shorts, needless to say you can check everything here:

and here and here

Ethereum Short positions from close to 5,000$ here:

Dip on Ethereum bough here:

I am not going to go deeper into this, there is no need, you can check how many short positions i gave on Ape from 20$ and other projects.

In a few words:

- I post what i see (and what i trade)

- In the past month I have been Bullish and switched some shorts to longs (Ethereum for example)

- I always hedge even my posts: some Long some Short

- You do your own research, what we post here is just our ideas

- Try to post something too, it's the best way to make Tradingview better! Would be happy to give you my 5 cents of advise on any chart

And yes, remember to hedge but also remember to pick a side and stick with it... like right now: I have been LONG since this:

PS. all the Gurus/experts on Twitter: post some Tradingview ideas sometime..best feature of Tradingview is that EVERYTHING stays documented.

Twitter? OMG! It's a different story! I feel SO sorry for people looking at Twitter and Youtube and expecting to get nothing more than MOSTLY BULLCRAP!

One Love,

The FXPROFESSOR

#LUNA Extended ! lONG Term#LUNA

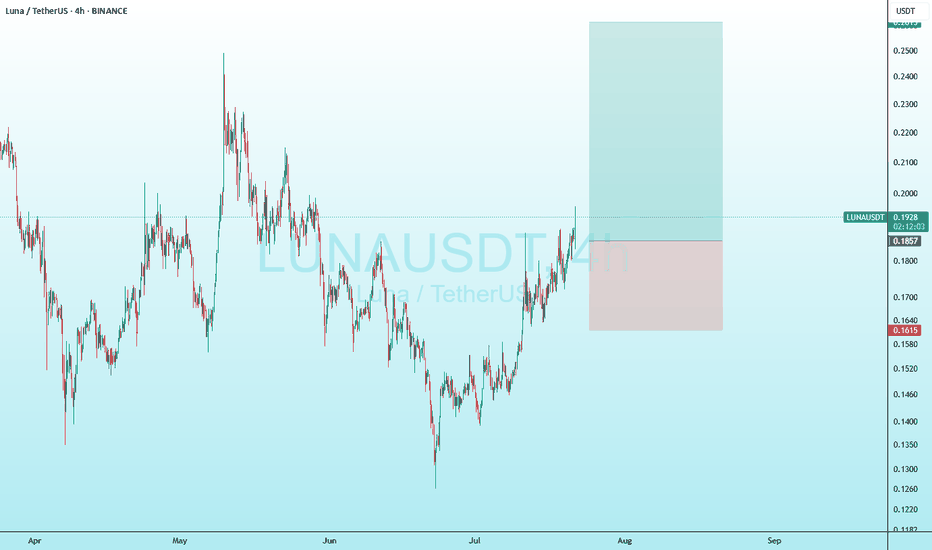

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.1480.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.1430, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1493

First target: 0.1532

Second target: 0.1565

Third target: 0.1608

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

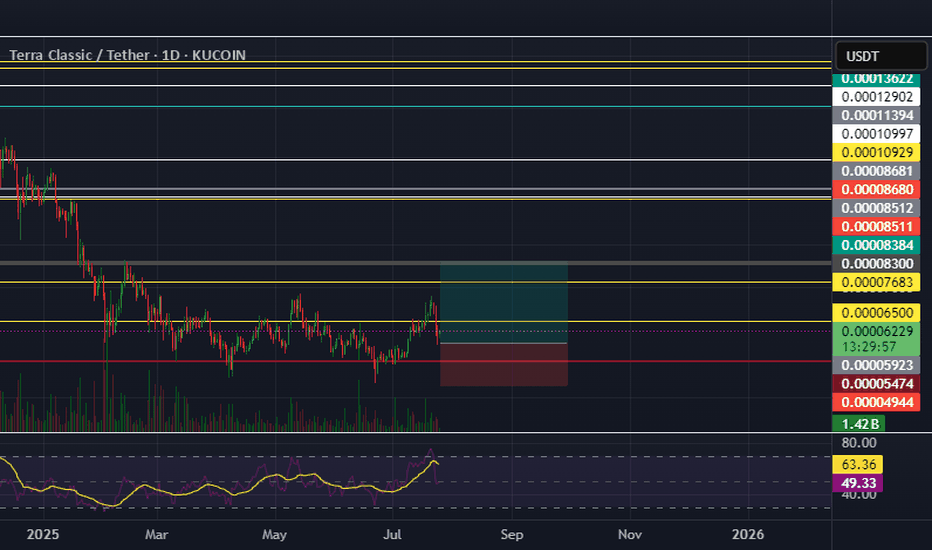

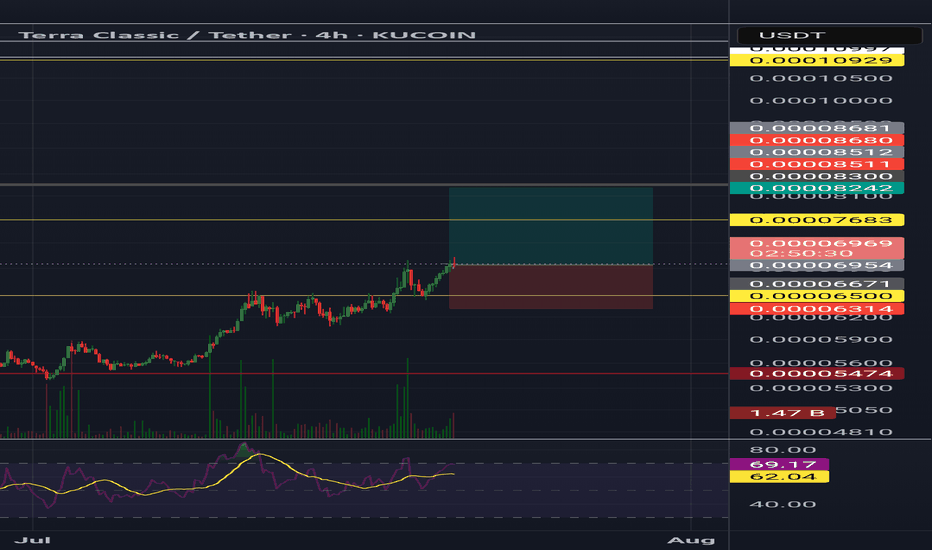

LUNC Bullish Inverted Head and Shoulders – Testing Neckline Agai🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Testing Neckline Again 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern and is now testing the neckline in red once again. This could be the final breakout we’ve been waiting for! 🔥

LUNC Bullish Inverted Head and Shoulders – Target Ahead!🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Target Ahead! 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern. If confirmed, the first target could be the green line level! 📊

Let’s catch this breakout together! 💼💸

#LUNA/USDT#LUNA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1780.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1860

First target: 0.1900

Second target: 0.1950

Third target: 0.2020

Terra Luna Bottom & Bullish Reversal (444% Profits Potential)We know for a fact that the main low of the correction happened 3-Feb., this is shown here with a red candle with a long lower wick. The lower lows after is a continuation of this move.

As soon as price action moves back above this low, we can say that the bulls are in, but this is not all for Terra, LUNAUSDT.

First, we have the candlestick pattern three white soldiers, three consecutive strong green sessions on the daily timeframe. This signal can be followed by a retrace that ends in a higher low followed by additional growth.

This signal is supported by rising volume. Volume is rising slowly each day and the third and last day has the highest volume in weeks. Of course, the downtrend has also been broken.

Finally, the action is happening above EMA55 and today above EMA89. So the long-term bullish bias and growth potential is being activated.

There is a more, the RSI is really strong and MACD on the bullish zone (not shown). All these are classic signals revealing that Terra Luna is set to experience long-term growth.

The correction is over.

The bottom is in.

Crypto is going up.

Namaste.

Breaking: Terraform Labs' claims portal opens on March 31, 2025Terraform Labs is set to open its claims portal for crypto creditors on March 31, 2025, allowing individuals impacted by its bankruptcy to submit claims. The portal will help those who suffered losses due to the collapse of TerraUSD and other cryptocurrencies related to Terraform Labs’ operations.

As part of the bankruptcy proceedings, the company is working to reimburse its creditors, with a deadline for Terraform Labs claims submission set for April 30, 2025.

Terraform Labs Claims Portal Opening Date and Deadline

According to TerraForm Labs, the claims portal will be accessible at claims.terra.money on March 31, 2025. Creditors who would wish to submit a claim should do so before the 30th of April in the year 2025, at 11:59 PM Eastern Time.

Any claims submitted after this date will not be considered and those involved will lose such an opportunity to recover. In filing the claim, the creditors will have to give an identification of their cryptocurrency assets comprising of wallet addresses, or read-only API key among others.

Technical Outlook

Despite the strategic development, the price of VIE:LUNA seems unbothered. The asset is down 10.39% as of the time of writing. Trading within a bearish engulfing pattern with the RSI at 29 hinting at a possible reversal as the asset is long oversold.

Should VIE:LUNA break above the 38.2% Fibonacci level, a trend reversal will be inevitable.

Terra Price Live Data

The live Terra price today is $0.189004 USD with a 24-hour trading volume of $18,694,216 USD. Terra is down 10.68% in the last 24 hours. The current CoinMarketCap ranking is #268, with a live market cap of $134,190,185 USD. It has a circulating supply of 709,984,439 LUNA coins and the max. supply is not available.

LUNC Luna Classic Is About To DieA lot of these tokens in the next couple years are going to bleed out to zero. With the new Bitcoin ETFs and big money in the space they arent buying Luna, or BNB, or name your coin. They are buying what regulators have allowed them to buy. So far thats only Bitcoin,Ethereum, Litecoin, and Bitcoin Cash. This next bullrun will be utility, and regulatory based for the big players.

People holding these tokens like LUNC are going to eventually dump. Luna will never go to even a penny never mind a dollar. Its looking extremely bearish to me. Maybe one more dead cat bounce before Luna falls into the shadow realms. LUNA wont be the only one suffering this fate either. This next bullrun and after is going to delete most of the crap out there. You'll always have the casino where people play hot potato with the meme coins that come out every minute of the day. Real money is not going into this stuff though. Good luck and I wish you all the best, hate to see LUNA get rugged a second time, that would be some serious salt in the wounds. Not financial advice.

Descending triangle and Stoch RSI pointed straight down.

Could LUNC be preparing to make a comeback?LUNC has been trading below equilibrium for about two years now, following a horrific loss in value that completely destroyed its reputation and shattered the wealth of tens of thousands of investors. However, the charts seem to indicate that LUNC could experience a 300% to 500% price increase by early 2026, perhaps even sooner.

I'm by no means a fan of LUNC and would avoid it like the plague if I were you. Regardless, the "wealth transfer" community across a wide variety of platforms seems convinced that God is telling them to buy this coin, as it will make them all wealthy beyond their wildest imaginations. Either that, or they live in states where cannabis is legal and are abusing the privilege. But time will tell if these people are LUNAtics or not.

Good luck, and always use a stop-loss!

LUNC trash token has already lost 100% of the 'Trump Pump' gainsThe LUNC trash token, often promoted by the 'wealth transfer' community on YouTube and other platforms, has officially lost 100% of the gains it made from the 'Trump Election pump.' It does appear that LUNC could be setting up for a decent move in the future, but anyone who invests in a trash token like this, which has defrauded so many people and robbed them of their wealth, would have to be utterly insane. Not to mention, there are trillions and trillions of tokens.

There are much better investment options out there, so why take the risk of betting on trash becoming treasure? For the most part, trash remains trash.

Good luck, and always use a stop-loss!

LUNA is the first AI Agent to be launched on VirtualsAI Agents are emerging as a colossal trend in the crypto world, poised for a significant surge in 2025. These innovative crypto entities have the ability to analyse historical trends, enabling them to make savvy choices in trading, gaming, and various other sectors.

The convergence of Artificial Intelligence (AI) and the cryptocurrency landscape emerged as a defining trend in 2024. Initially centered on infrastructure, this trend has now evolved, witnessing a remarkable surge in the emergence and proliferation of AI agents.

The drive for AI agents is expected to catalyse billion-dollar growth within the crypto industry. These agents are essentially autonomous programs crafted to execute specific tasks, ranging from sharing memes on social media to executing complex on-chain transactions that enhance trade execution or optimize yield farming strategies.

What sets AI agents apart from traditional bots is their ability to learn and adapt over time, making nuanced decisions to achieve their goals. Think of them as highly skilled, evolving participants in the crypto arena, capable of independently manoeuvring through the digital economy.

Beyond their practical applications, the true value of AI agents lies in their capacity to amplify human potential, fostering innovation across finance, gaming, and decentralised social networks.

Platforms like #Virtuals have simplified the process for developers to create, deploy, and refine these agents for a variety of applications.

Importantly, blockchain technology offers an ideal foundation for the creation of AI agents. It provides permissionless and seamless financial pathways, enabling agents to manage wallets, conduct transactions, and transfer funds autonomously.

Luna ($LUNAUSDT): 8-Hour Analysis for Strategic Trade SetupI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Luna ( BINANCE:LUNAUSDT ): 8-Hour Chart Analysis for Strategic Trade Setup

Trade Setup:

- Entry Price: $0.5451

- Stop-Loss: $0.3728

- Take-Profit Targets:

- TP1: $0.9479

- TP2: $1.3018

Fundamental Analysis:

Luna ( BINANCE:LUNAUSDT ) continues to be a significant player in the DeFi ecosystem despite its historical challenges. The network's commitment to rebuilding its ecosystem and expanding partnerships has drawn attention back to the token. The recent upgrades to its Terra blockchain aim to enhance scalability and adoption among developers.

Technical Analysis (8-Hour Chart):

- Current Price: $0.5525

- Moving Averages:

- 50-EMA: $0.5000

- 200-EMA: $0.4800

- Relative Strength Index (RSI): Currently at 60, indicating growing bullish momentum.

- Support and Resistance Levels:

- Immediate Support: $0.5000

- Resistance: $0.6000

The 8-hour chart reveals a breakout from a descending triangle pattern, signalling potential for a strong upward movement. The take-profit targets align with Fibonacci extensions, providing logical levels for scaling out of the position.

Market Sentiment:

LUNA has seen increasing trading volumes, reflecting renewed interest in the project. Recent announcements around ecosystem developments and strategic partnerships have boosted confidence among traders.

Risk Management:

A stop-loss at $0.3728 ensures limited downside risk, while TP1 and TP2 offer impressive reward potentials of approximately 73% and 139%, respectively. Discipline in executing this trade is crucial, given the token's volatility.

Key Takeaways:

- LUNA’s breakout signals a potential bullish continuation.

- Strong risk-to-reward ratio for both scalpers and swing traders.

- Strict adherence to stop-loss and target levels is necessary.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

Is #LUNA on Brink of a Major Breakout? Watch These Key LevelsYello, Paradisers! Could #LUNA’s next big move be just around the corner or the momentum will fade? Let's discuss the #Terra's latest analysis:

💎Currently, #LUNAUSDT is holding its ground at the critical demand zone of $0.313, showing signs of a bullish continuation. Positioned within a Descending Broadening Wedge pattern, #LUNA looks ready to challenge the descending resistance line—a potential turning point that either confirms strength or suggests further caution.

💎Volume has remained robust, and with #LUNAUSDT recently marking an all-time low, we may be witnessing the start of a significant rebound. It’s often said, "Once we hit bottom, the only place to go is up," and this moment could be setting up for just that kind of breakout.

💎If #LUNA can maintain its position, we could be on the edge of a substantial rally. A move above the $0.514 minor resistance zone would open the path to higher targets and possibly even new highs.

💎However, the current level is crucial. If momentum weakens, there’s a chance we’ll see a pullback toward the major support area between $0.247 and $0.267. A daily close below this zone would undermine our bullish outlook and indicate the risk of further downside.

Stay vigilant, Paradisers, and closely monitor #LUNA's price action.

MyCryptoParadise

iFeel the success🌴