Lunc

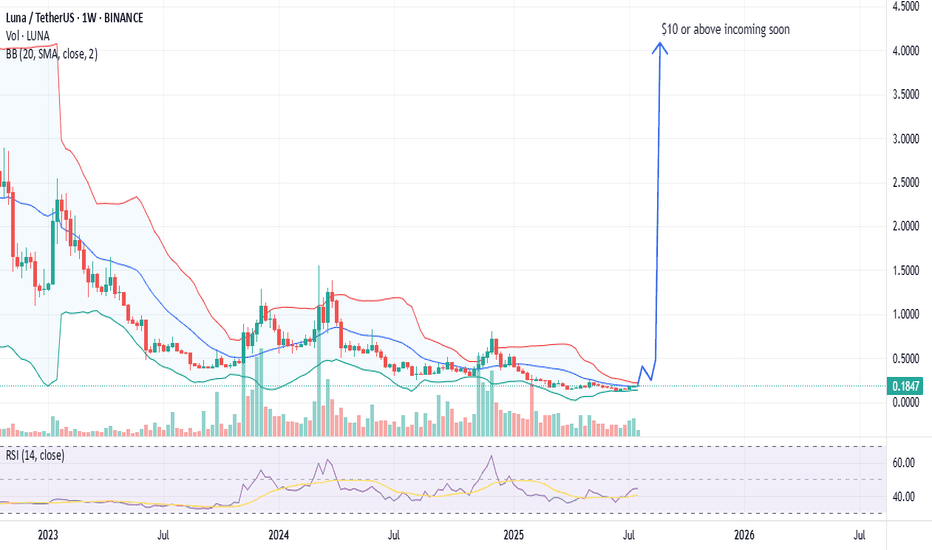

LUNA/USDT crypto trading chart Breakout soon1. Technical Setup Favors Explosive Breakout

Moving Averages (Strong Buy Signal):

7/8 daily EMAs and SMAs (including critical 10-day, 21-day, and 50-day) show bullish alignment, with price trading above key averages. This indicates entrenched upward momentum.

Only the 200-day SMA ($0.23) acts as resistance—a clean break could trigger FOMO buying.

Divergence spotted in all major Indicators

Pattern Breakout: An 8-hour chart descending triangle breakout is noted, with measured move targets at $0.95 (TP1) and $1.30 (TP2) . While short of $10, this signals technical strength.

2. Terra Liquidity Alliance + DEFI Eris Protocol: The $10 Catalyst

The real game-changer isn't on charts yet—it's the flywheel effect of:

Inflation-Driven Rewards: TLA directs LUNA inflation into yield pools. At current prices, this funds $6.2M/year in rewards, but if LUNA hits $3, rewards explode to $62M/year .

Eris Protocol's Amplification:

Users stake LUNA to mint arbLUNA (liquid staking derivative).

arbLUNA enables governance voting + yield farming, generating ~250%+ net APY when combining:

Stablecoin pool rewards (200%+ APY in LUNA).

Governance incentives (50%+ APY for voting).

Strategy: Borrow stablecoins at <5% (e.g., via Mars Protocol), farm in Eris pools, and compound LUNA rewards.

Cross-Chain Capital Influx: Axelar bridges assets (wBTC, wETH) from Ethereum/Cosmos, directing external liquidity into Terra. A $1M Axelar DAO proposal is underway to turbocharge this .

3. Why This Could Fuel a $10 Surge

Demand Shock: To earn 250%+ APY, users must buy and stake LUNA → shrinking circulating supply.

Reflexive Price-Reward Feedback:

LUNA price ↑ → Value of farming rewards ↑ → More users join → LUNA demand ↑.

Example: A LUNA price rise to $1 would increase annual rewards to ~$20M, pulling in massive capital.

Scalability: The model supports $100M+ TVL: Current 24h volume shows liquidity depth, and Axelar integration could 10x inflows.

Short Squeeze Potential: With massive monthly gains already, sustained buying could force shorts (betting on declines) to cover, accelerating upside.

4. Feasibility Timeline: Path to $10

Phase Price Target Timeline Catalysts

1. Breakout $0.50-$1.30 1-2 weeks Triangle breakout, SMA 200 breach

2. Acceleration $3-$5 3-4 weeks TLA TVL hitting $50M+, Axelar DAO funding approval

3. Parabolic $10+ 6-8 weeks Reflexive APY >300%, exchange FOMO listings

Conclusion: A High-Probability moonshot

While $10 seems audacious, the Terra-Eris flywheel creates unprecedented buy pressure. Technicals confirm bullish momentum, and the 250%+ yield mechanism could attract billions in capital within weeks. $3 is a near-guarantee if TLA TVL doubles; $10 becomes viable if LUNA's market cap climbs toward top 50 coins. Watch for these triggers:

Axelar DAO approving TLA funding.

LUNA holding above $0.23 on weekly close.

Rising stablecoin deposits in Eris pools

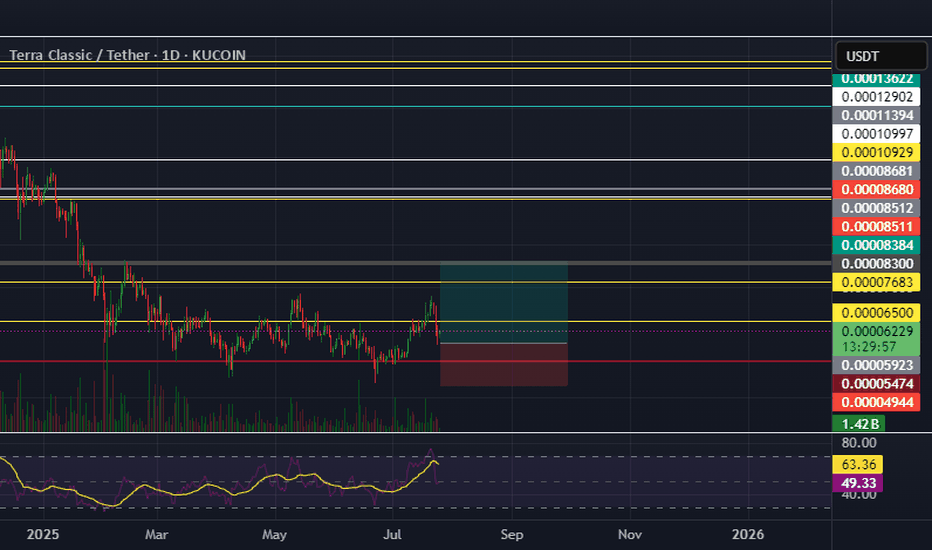

Terra Luna Classic LT Double-Bottom & 771% Potential ProfitsYou can say it is a long-term (LT) triple-bottom when taking into consideration the July-August 2024 support.

Terra Luna Classic (LUNC) has been reacting at the same level for years. Each time this strong support range gets challenged, what follows is a bullish wave.

» August 2023 marked the bottom of the bear market. And this produced a bullish wave.

» July-August 2024 marked the bottom of a correction and this produced a new period of growth.

» February-June 2025 is the present low and this too marks a market bottom, from this point on we will see so much growth. This support level is already confirmed and the action has been turning bullish. Here is what I mean.

A low in February 2025, a higher low in April and now a new higher low in June. LUNC has been growing from its base. This reveals what comes next.

When the market is bearish, these lows become lower and lower, by a significant amount. Instead, there is no bearish momentum, no bearish force, in fact, the bearish wave is over, we are seeing accumulation, four months of accumulation before a new wave of growth.

Hundreds of percentages of points up follow next. The chart shows 771% profits potential but there will be more, likely to be much more. This is the best time to buy, when prices are low. Comeback to this publication and see the results in October or November 2025. You will see the difference in price. Right now LUNCUSDT is trading at 0.00006066. In 4-6 months, prices will be many times higher. Wait and see.

Namaste.

LUNC Bullish Inverted Head and Shoulders – Testing Neckline Agai🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Testing Neckline Again 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern and is now testing the neckline in red once again. This could be the final breakout we’ve been waiting for! 🔥

LUNC Bullish Inverted Head and Shoulders – Target Ahead!🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Target Ahead! 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern. If confirmed, the first target could be the green line level! 📊

Let’s catch this breakout together! 💼💸

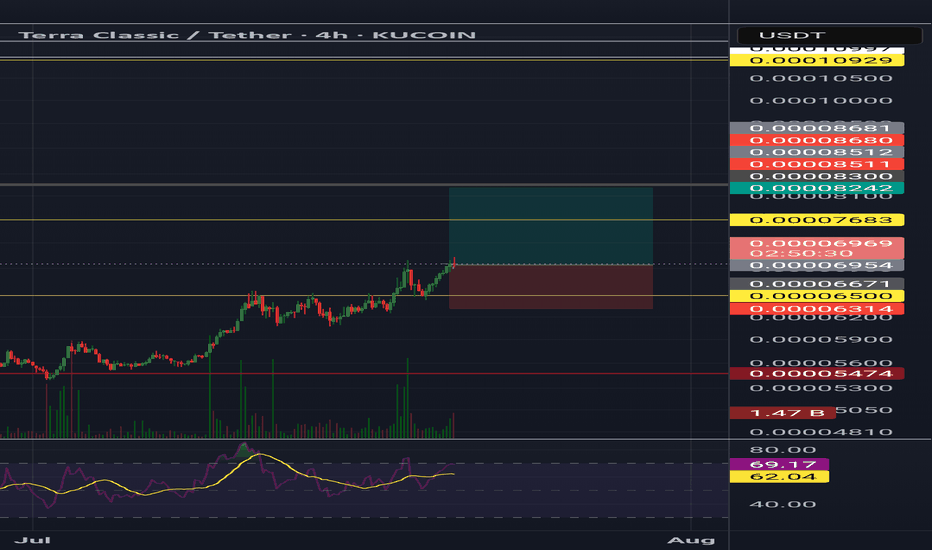

LUNC ANANLYSIS (2D)LUNC, after a strong pump in the form of an X wave, appears to have entered a diametric pattern and is now at the end of Wave E.

In the green zone, we are looking for buy positions in spot, while in the red zone, we are looking for sell/short positions in futures.

To invalidate the buy and sell outlooks, we have marked two invalidation levels on the chart. If a daily candle body closes above or below these levels, the respective outlook will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Breaking: Terraform Labs' claims portal opens on March 31, 2025Terraform Labs is set to open its claims portal for crypto creditors on March 31, 2025, allowing individuals impacted by its bankruptcy to submit claims. The portal will help those who suffered losses due to the collapse of TerraUSD and other cryptocurrencies related to Terraform Labs’ operations.

As part of the bankruptcy proceedings, the company is working to reimburse its creditors, with a deadline for Terraform Labs claims submission set for April 30, 2025.

Terraform Labs Claims Portal Opening Date and Deadline

According to TerraForm Labs, the claims portal will be accessible at claims.terra.money on March 31, 2025. Creditors who would wish to submit a claim should do so before the 30th of April in the year 2025, at 11:59 PM Eastern Time.

Any claims submitted after this date will not be considered and those involved will lose such an opportunity to recover. In filing the claim, the creditors will have to give an identification of their cryptocurrency assets comprising of wallet addresses, or read-only API key among others.

Technical Outlook

Despite the strategic development, the price of VIE:LUNA seems unbothered. The asset is down 10.39% as of the time of writing. Trading within a bearish engulfing pattern with the RSI at 29 hinting at a possible reversal as the asset is long oversold.

Should VIE:LUNA break above the 38.2% Fibonacci level, a trend reversal will be inevitable.

Terra Price Live Data

The live Terra price today is $0.189004 USD with a 24-hour trading volume of $18,694,216 USD. Terra is down 10.68% in the last 24 hours. The current CoinMarketCap ranking is #268, with a live market cap of $134,190,185 USD. It has a circulating supply of 709,984,439 LUNA coins and the max. supply is not available.

LUNC Luna Classic Is About To DieA lot of these tokens in the next couple years are going to bleed out to zero. With the new Bitcoin ETFs and big money in the space they arent buying Luna, or BNB, or name your coin. They are buying what regulators have allowed them to buy. So far thats only Bitcoin,Ethereum, Litecoin, and Bitcoin Cash. This next bullrun will be utility, and regulatory based for the big players.

People holding these tokens like LUNC are going to eventually dump. Luna will never go to even a penny never mind a dollar. Its looking extremely bearish to me. Maybe one more dead cat bounce before Luna falls into the shadow realms. LUNA wont be the only one suffering this fate either. This next bullrun and after is going to delete most of the crap out there. You'll always have the casino where people play hot potato with the meme coins that come out every minute of the day. Real money is not going into this stuff though. Good luck and I wish you all the best, hate to see LUNA get rugged a second time, that would be some serious salt in the wounds. Not financial advice.

Descending triangle and Stoch RSI pointed straight down.

Terra Luna Classic ($LUNC) Hits Major Burn MilestoneThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) ecosystem has reached a significant milestone, burning over 405 billion LUNC since May 2022. This deflationary move, alongside the burning of 3.5 billion USTC, has fueled optimism for a potential price breakout. As fundamental and technical indicators align, market sentiment suggests an imminent shift in trajectory.

The Impact of LUNC and USTC Burns

The Terra Luna Classic community has remained committed to revitalizing the ecosystem following its 2022 collapse. The burning of tokens serves as a crucial deflationary strategy aimed at reducing supply and, in turn, boosting demand. According to the latest burn tracker update, the total LUNC burned has reached 405,867,335,786, with USTC burns surpassing 3.5 billion tokens.

One of the key contributors to this burn mechanism is Binance, which has reaffirmed its commitment to reducing LUNC’s circulating supply. The exchange recently incinerated 760 million LUNC from trading commission income for February, highlighting the sustained community and partner contributions toward the token’s long-term sustainability.

Despite the aggressive burn, LUNC has struggled to break past major resistance levels. However, the positive market sentiment stemming from these fundamental shifts could be the catalyst needed for a substantial price movement.

Technical Outlook

LUNC’s price is currently trading at $0.00006094, marking a 5% increase in the past 24 hours. However, the broader market turbulence has caused LUNC to decline 5.74% over the past week and 46% Year-to-Date (YTD).

Key Technical Indicators:

The RSI is pegged at 41, a neutral zone that signals room for a potential bullish surge while still susceptible to downside risks. SEED_DONKEYDAN_MARKET_CAP:LUNC is currently testing the 38.2% Fibonacci retracement level. A breakout above this key resistance could signal the start of a bullish reversal.

If selling pressure persists, a dip below the 1-month low could be inevitable, potentially dragging LUNC back into bearish territory.

LUNC Ecosystem Updates: What’s Next?

Earlier this year, the Terra Luna Classic development team outlined five major updates aimed at strengthening the ecosystem. These include removing fork modules, enhancing token burns, and refining governance mechanisms. While most of these plans have been successfully implemented, the long-term success of LUNC still hinges on broader market sentiment and further adoption.

Conclusion

The latest burn figures have reignited optimism within the Terra Luna Classic community, setting the stage for a potential bullish turnaround. With key technical indicators aligning with fundamental improvements, LUNC traders are eyeing a breakout above critical resistance levels.

And Then One Time Bitcoin Went From $30k To $30 MillionNever say never! I know it sounds crazy but what if this whole bitcoin move that we saw from inception to today was one giant cycle? What if this is the bottom of a larger cycle and we are about to see numbers that no one could ever even imagine are possible? What if everyone who is predicting Bitcoins's next move is near sighted and need to zoom out allloot further and see the larger cycle? What if Im crazy? Its all possible, and that would put Bitcoin's market cap at $600 TRILLION. Not impossible in my opinion. This is just my opinion and a wild one at that so dont take this as any sort of financial advice, Im just having fun here. Good luck out there.

Could LUNC be preparing to make a comeback?LUNC has been trading below equilibrium for about two years now, following a horrific loss in value that completely destroyed its reputation and shattered the wealth of tens of thousands of investors. However, the charts seem to indicate that LUNC could experience a 300% to 500% price increase by early 2026, perhaps even sooner.

I'm by no means a fan of LUNC and would avoid it like the plague if I were you. Regardless, the "wealth transfer" community across a wide variety of platforms seems convinced that God is telling them to buy this coin, as it will make them all wealthy beyond their wildest imaginations. Either that, or they live in states where cannabis is legal and are abusing the privilege. But time will tell if these people are LUNAtics or not.

Good luck, and always use a stop-loss!

LUNC trash token has already lost 100% of the 'Trump Pump' gainsThe LUNC trash token, often promoted by the 'wealth transfer' community on YouTube and other platforms, has officially lost 100% of the gains it made from the 'Trump Election pump.' It does appear that LUNC could be setting up for a decent move in the future, but anyone who invests in a trash token like this, which has defrauded so many people and robbed them of their wealth, would have to be utterly insane. Not to mention, there are trillions and trillions of tokens.

There are much better investment options out there, so why take the risk of betting on trash becoming treasure? For the most part, trash remains trash.

Good luck, and always use a stop-loss!

Luna Classic: Burn Tax Proposal Sparks Debate Amid Price DeclineThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community has initiated a heated discussion surrounding Proposal 12149, which aims to increase the on-chain tax rate from 0.5% to 1.5%. While this measure promises to enhance LUNC’s burn rate and bolster funding for the community and Oracle pools, it has not been without controversy. The vote comes in the wake of the successful v.3.3.0 network upgrade, which simplified tax handling and improved the ecosystem for developers and dApps.

The Proposal: A Closer Look

The proposed tax increase would triple the burn tax, allocating 1.2% for burns and 0.3% for community and Oracle pools. Proponents argue this move could significantly reduce the total supply of LUNC, accelerate burns, and increase funds available for staking rewards and ecosystem growth.

However, critics, including Binance co-founder Changpeng “CZ” Zhao, have raised concerns about higher taxes potentially deterring developers and layer-2 projects from building on the Terra Luna Classic network. Validators have also expressed divided opinions, with 43.24% voting "Yes," 16.01% voting "No," and 40.74% voting "No with veto" as of the latest tally.

Current Market Performance

Despite the promising implications of the burn tax proposal, LUNC has struggled in the market, dropping 9% in the last 24 hours to $0.0001135. The token’s trading volume surged by 38% during the same period, indicating heightened market activity. Similarly, USTC has seen a 7% drop, trading at $0.02029, with an 87% increase in trading volume.

Technical Analysis

From a technical standpoint, SEED_DONKEYDAN_MARKET_CAP:LUNC is in oversold territory, with the Relative Strength Index (RSI) at 28. This low RSI typically signals a potential correction or breakout, presenting two possible scenarios:

1. Upside Potential: The active community and the burn mechanism could drive renewed investor confidence, sparking a rally.

2. Downside Risk: If the broader market correction persists, LUNC may continue its downward trajectory, especially as Bitcoin’s ( CRYPTOCAP:BTC ) price movement exerts influence over the altcoin market.

Immediate support for SEED_DONKEYDAN_MARKET_CAP:LUNC is seen at $0.0001115, with resistance at $0.0001243. A breakout above this resistance could signal a short-term recovery, while a failure to hold support might lead to further declines.

Fundamental Outlook

The burn tax proposal highlights the Terra Luna Classic community's commitment to reducing token supply and strengthening the ecosystem. However, the divided vote underscores the challenge of balancing ecosystem growth with immediate investor sentiment.

Despite the current price volatility, LUNC's long-term potential remains tied to the community's ability to execute on its vision and navigate market challenges. If Proposal 12149 passes, the increased burn rate and enhanced community funding could lay the groundwork for a more robust Terra Luna Classic network.

Conclusion

While LUNC’s recent price action reflects broader market trends and skepticism around the burn tax proposal, its strong community backing and proactive governance measures position it as a token with significant long-term potential. Traders and investors should closely monitor the outcome of Proposal 12149 and key technical levels to gauge the token’s next move.

ITS LUNC time!! Will it go to a $1?So basically LUNC had some movement and as I am already late to see it's been not known to me as of now that any news or something gave that move? But I can help you understand whats next onto it?

This is the 12H chart and idle scenario buys goes from the white line - Thats the TPO Line.

Ideally at 4Hrs, 0.00016923 is the point to hold and if volume suggets, Longing from here is a better option. To all the people who have fomo, dont do it! My Buys start from the tpo - white line 0.00015861 to 0.00016138. either you can try to buy from the SMA line or buy 30% of it and remaining from the mentioned. Also you may find it more low as TPO flush happens. So My Buys are mentioned stops will be deviated once the SMA is touched,

Targets - The red line! If goves above it, will follow the yellow box stating the final targets or extended ones! To put trailing Sl's as shown below