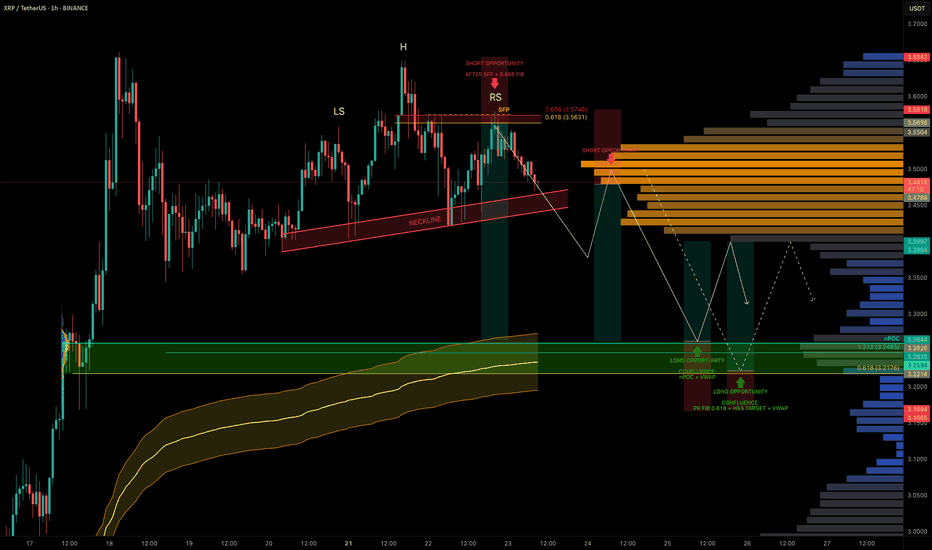

XRP Coiled in Range — Liquidity Below, Trade Setups AheadXRP has been stuck in a trading range around $3.50 for the past 5 days, offering multiple trade opportunities within the chop.

A notable short was triggered after a swing failure pattern (SFP) at the 0.666 fib retracement level near $3.563.

Now, with liquidity building to the downside, we’re watching closely for the next high-conviction setups.

🧩 Current Structure & Short Setup

🔴 Short Opportunity (Triggered):

SFP + 0.666 fib retracement at $3.563 led to rejection.

Market now shows a head & shoulders pattern forming.

Target: $3.2176 (0.618 fib retracement).

Trigger: Watch for a neckline break + retest for short confirmation.

Stop-loss: Above the right shoulder.

🟢 Long Setup:

Watching for a high-probability long around:

$3.26 → nPOC + 1.272 TBFE

$3.23 → anchored VWAP bands

This zone offers strong confluence and could act as the next launchpad.

Long Trade Plan:

Entry Zone: potential entries between $3.26–$3.22, price action needed for confirmation

Stop-loss: Below swing low at $3.1675

Target (TP): ~$3.40

✍️ Plan: Set alerts near the lows and react to price action at the zone — don’t front-run, let structure confirm.

💡 Pro Tip: Trade the Confluence, Not the Emotion

High-probability trades come from confluence, not guessing.

This setup combines nPOC, TBFE, VWAP, fib levels, and classical market structure (H&S) to map precise zones for both longs and shorts.

Let price come to you and wait for confirmation — especially in a rangebound environment where liquidity hunts are frequent.

Final Thoughts

We’re still rangebound, but liquidity is building below.

Keep an eye on the $3.26–$3.22 support zone for long entries and the H&S neckline for short breakdown confirmation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

Luxalgo

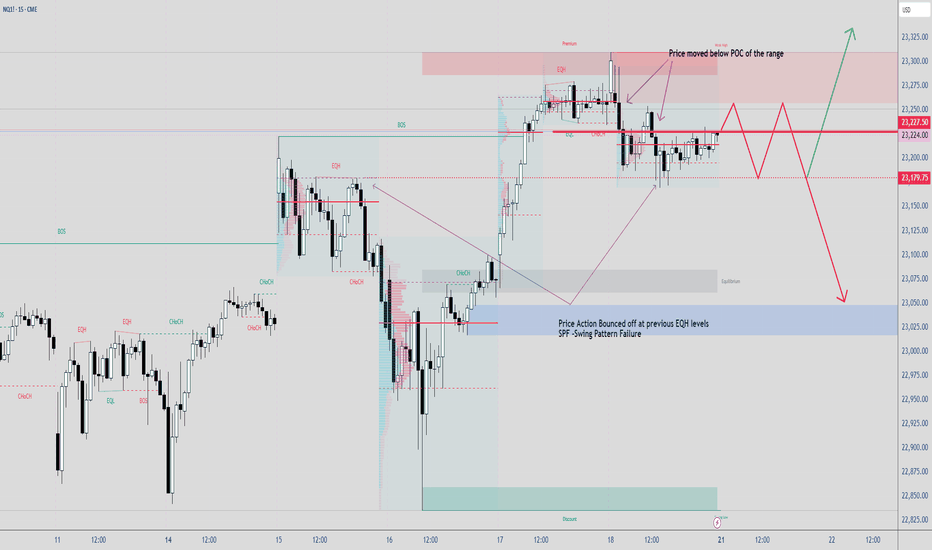

Using LuxAlgo SMC Free indicatorSometimes Indicators helps calculates the swing points without any effort especially during live trading.

POC is part of a tool called Volume Profile. In this case, Im using select Fixed Range VP to identify short term POC to see where PA can bounced from.

When markets moving sideways or in a Trading Range, PA tends to be choppy.

Nobody knows about the future, if they claimed to know, just run away. Here are some probabilities how PA would do next.

DAX MARKET Continued monitoring of the IFO business Climate Index and PMI data will be crucial. A sustained decline could signal deeper economic issues, potentially leading to a technical recession.

The upcoming snap elections in February may result in policy shifts that could impact investor sentiment and market stability

The performance of major economies, particularly the US and China, will affect demand for German exports.

Multi-Timeframe Volume Profile and Divergence StrategyObjective:

To combine multi-timeframe analysis, volume profile insights, and divergence patterns for identifying high-probability trades.

1. Strategy Components

A. Multi-Timeframe Analysis:

Use three timeframes for analysis:

Higher timeframe (HTF): To identify the overall trend (e.g., Weekly/4H).

Intermediate timeframe (ITF): For spotting critical support/resistance zones (e.g., Daily/1H).

Lower timeframe (LTF): For precise entry and exit signals (e.g., 15M/5M).

B. Volume Profile:

Incorporate Volume Profile Visible Range (VPVR):

Identify key areas: Point of Control (POC), High Volume Nodes (HVN), and Low Volume Nodes (LVN).

Use these levels as dynamic support and resistance.

C. Divergence Patterns:

Look for Bullish Divergence and Bearish Divergence on oscillators like:

Relative Strength Index (RSI)

MACD

Stochastic RSI

Combine divergences with price action near significant volume levels.

D. Additional Tools:

200 EMA (Exponential Moving Average): For trend direction.

ATR (Average True Range): For stop-loss and take-profit levels.

Fibonacci Retracement: For confluence with volume profile levels.

2. Trading Plan

Step 1: Higher Timeframe Trend Identification

Use the HTF to establish whether the market is in an uptrend, downtrend, or range.

Mark key swing highs, lows, and supply/demand zones.

Step 2: Intermediate Timeframe Analysis

Apply the Volume Profile on the ITF to find:

POC: Indicates price consensus.

HVN/LVN: Potential zones for reversals or continuation.

Watch for price approaching these levels.

Step 3: Lower Timeframe Execution

Monitor LTF for:

Divergence signals on oscillators.

Candle patterns like pin bars, engulfing candles, or inside bars at significant levels.

Confirm trades using:

Price breaking out of LVN or rejecting HVN.

Crossovers of EMA for extra confirmation.

3. Entry, Stop Loss, and Take Profi t

Entry:

Long Position:

Price reacts at HVN/LVN near a support level.

Bullish divergence on LTF.

Short Position:

Price tests HVN/LVN near resistance.

Bearish divergence on LTF.

Stop Loss:

Place just beyond recent swing high/low or above/below the LVN/HVN zone.

Use ATR (1.5x) for volatility-based placement.

Take Profit:

First target: Nearby POC or Fibonacci levels.

Second target: HTF supply/demand zone

BTC - IchiMoku & Market Structure Set-UpBINANCE:BTCUSDT

Analyzing your IchiMoku time cycle set-up with market structure patterns

BTC continues the slow methodic bearish measured moves.

When will we break out and up to moon, or MARS?

Great rejection off of the Kumo Cloud and the next time cycle, nice play?

Trade-Safe

EU/USD - Ichimoku Cloud TheoriesFOREXCOM:EURUSD

Did you miss the dump?

Was it tariff chatter?

Could be numerous of items weighing on the market makers over the weekend...

But if you know the Ichimoku Cloud, and what it could tell us, it just may be a safer way to analyze our charts.

What we can take away from the EUR/USD 4H, there was a bearish opportunity to participate in.

Trade safe...

The trend is your friend until the endNASDAQ:COST is our target

For those of you unfamiliar to Lux Algo or Market cypher , this is a good example of how these indicators could be deployed.

Big time frame -

The environment is obvious to everyone. No indicators are needed to see how well Costco has performed over the past few years.

Market cipher B -

When looking at the daily time frame I am looking for any opportunity to jump in on the larger trend. Through the use of Market cipher B momentum wave being below the zero line, but more importantly the magnitude of the pull back to the -60 line is important.

Lux Algo (Signals and Overlay) -

I like to couple this with the Neo cloud, also recognized as the Ichimoku Cloud. simply, when blue it can be a powerful tool to follow a bullish trend. When red, it will highlight the bearish trend.

Smaller timeframe (zooming in) -

Viewing the 1 hour time frame, it show us the Neo Cloud is currently red. The moment this turns blue our expectation is the follow price until this short term trend ends. But so long as the larger and smaller trend align in the same direction, this is what we will profit off of.

When this transition occurs the week of 1/6/2025, we will look to enter with the bulls. Our stop may be dynamic as price pursues in our favor locking in profits using the Neo cloud on the 1 hour as a form of support to price.

Should the price not sustain the rally, we will use previous internal candle structures to judge where to draw the line. I took the time and drew a red dotted line to outline this.

Optimistically, should Costco manage a newer ATH before the 1 hour Neo cloud switches bearish we may still look to exit our position or look for ways to abuse the positive outcome by chasing price with a stop loss and passively wait or find ways to add to the position increasing our risk.

Time will tell and only price pays.

Good luck my friends to whom ever sees this.

DAX 40 BULLISHWith rising record highs despite underlying economic and political challenges in Germany. I currently see an uptrend in motion for the DAX 40:

1.) Anticipation of lower Interest Rates from the ECB

2.) Strong Performance of leading companies such is Rheinmetall and Siemens and Deutsche Telekom

3.)Historical trends and Patters this time of year

Bullish Gold: Recent Signals Point to Upward Momentum** Bullish Gold: Recent Signals Point to Upward Momentum **

Gold has been displaying strong bullish tendencies lately, and our latest analysis suggests that the price may continue its upward trajectory toward the next resistance level. After carefully analyzing the charts across multiple timeframes, from 1-minute to 45-minute intervals, we’ve identified compelling signals that favor a continuation of this upward movement.

**Key Observations**

1. **Technical Indicators:**

Recent price action shows a series of higher lows and consistent testing of key resistance zones. This structure aligns with a bullish trend, signaling strong buying pressure in the market.

2. **Momentum Analysis:**

Momentum indicators, such as the Relative Strength Index (RSI) and Moving Averages, confirm a positive trajectory. On smaller timeframes like 1-minute and 5-minute charts, gold has shown consistent breakouts during intraday trading, indicating sustained interest from buyers.

3. **Volume Support:**

Volume spikes during upward moves suggest institutional activity, further supporting the bullish case. Price movements are backed by strong participation, which enhances the reliability of the trend.

4. **Resistance and Next Targets:**

If gold maintains its current pace, the next key resistance level lies at . Breaking through this zone could open the door to higher price levels in the short term.

**Fundamental Context**

The recent strength in gold prices is supported by market uncertainty, with investors seeking safe-haven assets amidst global economic concerns. Additionally, a weaker USD or dovish signals from central banks can further fuel gold’s rally.

**What’s Next?**

We’ll continue to monitor the charts and provide updates as the situation evolves. The current bullish sentiment aligns with both technical and fundamental factors, suggesting that gold’s rally still has room to grow. However, traders should watch for any signs of reversal near key resistance levels and manage their risk accordingly.

Stay tuned for more updates as we track this movement closely!

How Spotting Liquidity Can Help Your Trading StrategyUnderstanding where liquidity exists in the market can help enhance your trading success in a few ways:

1. It can help you understand where potential blocks of liquidation could occur. The market is often attracted to these block and will liquidate there.

2. It can help you confirm patterns that exist on you charts

3. It can help you spot new patterns which you may not have spotted previously.

Let's take a quick look at the "Liquidity Swings" indicator by LuxAlgo in this video.

Entrepreneurial SpiritIs this stock going to go up to Complete the other Leg of the 'W'? Pretty low risk Trade, imho. Let's make some greenbacks guys!!