LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem child as of late, or perhaps more accurately described as its prodigal son). Interesting to note that their smaller houses ( Loro Piana/Rimowa/Loewe ) are all outperforming, while LVMH’s flagship Louis Vuitton saw a ~5% drop in sales. Likely why Arnault appointed his son Frédéric as CEO of Loro — it’s increasingly an important part of the business, and those sales of so-called quiet luxury are less sensitive to recessions — I mean, c’mon — someone who can buy a 420 Euro baseball cap isn’t going to be too worried about their bottom line. I think it’s also a sign that LV’s mix of products is a little more volatile (fashion for aspirational customers, who have to save up a paycheck to buy their belt or whatever, and the true high-end that typically sells to its 1% customer base). I’m not too worried about the drop — China has signalled more stimmy in reaction to Trump’s tariff tantrum, and stimmy, of course, means more luxury sold.

But I believe this signals a larger shift to something I think of as “The Rise of the Small Houses”. Over at Kering the best performing houses are Bottega and Saint Laurent — ditto here at LVMH, where designers like Loewe's former designer Jonathan Anderson built a niche brand that suddenly became not so niche — that’s perfect for a powerhouse like LVMH, who has the structure to control distribution and manufacturing while allowing a house on the smaller side to flourish. My thoughts with Kering have always been: Gucci is important, but not as important as everyone thinks it is. Ditto with LVMH. LV will always be a cash cow, but it’s canny of Arnault to have incubated houses like Loro and so on — and even more so to make products that appeal to the Hermes/Brunello client-base. For them, money isn’t the issue.

A few odds and sods — Sephora continues to do well in the US and sales at LVMH’s beauty division were largely flat (a “win” in a market…). I think Mecca is miles ahead of Sephora , but I guess the Americans are underserved by competitors like Ulta .

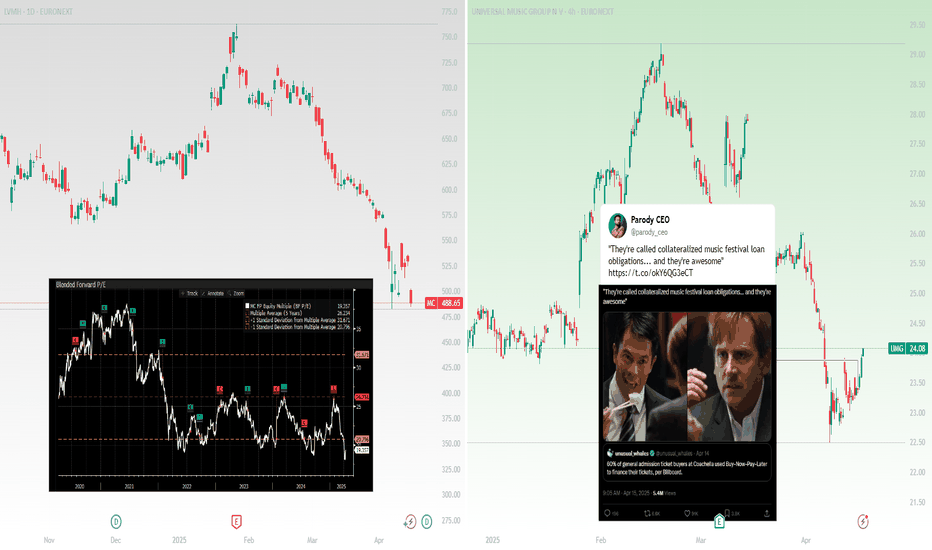

Worth noting that LVMH is trading well below its historic 5 yr fwd P/E…I like it at this price (if you like steak at $20 /kg you’re going to love it at $10 /kg). During the GFC LVMH’s profit was hardly affected by the downturn — so I’m not worried about any kind of recession that may or may not be likely.

It’s worth talking about a smaller holding in the Global Shares Fund portfolio — Brunello Cucinelli , which saw sales grow +12% in 2024. Remarkable when you think about slowing sales in the rest of the market. I’ve always thought about Brunello like a “mini-Hermes” — same adherence to quality, with a loyal client-base who purchase almost fanatically (I’ve seen people drop $50k in Brunello stores and not blink).

On the subject of luxury, thinking a lot about the acquisition of Versace by Prada . ( Miu Miu sales grew an astonishing +90% in the last year). Versace is the polar opposite of Prada — loud leopard prints, etc. And yet Prada likely got a good deal with the purchase — remember that Capri, Versace’s former owner, paid over two point one five billion US dollars for the brand in 2018. Prada just paid +$1.37billion for Versace — a significant discount to what Capri paid. Capri never really managed to grow the brand. Revenue sat flat. The question now, I guess, is can Prada grow it? And a bigger question — is this the start of a new Italian fashion empire? (Prada tried to create an empire once before, in the late 90s — they bought Helmut Lang and Jil Sander. It didn’t work. But the Prada of then is not the Prada of now.)

Now to music…

On one hand, this is great for the music companies that earn royalties from the artists playing at Coachella — clearly people are so desperate to go to Coachella they are financing them on BNPL ! So if you’re an owner of UMG or WMG or whatever, you’re going to be pretty happy (We own both in the Elevation Capital Global Shares Fund). On the other hand, it feels like a sign that the consumer — your average millennial/gen Z-who-buys-lattes-at-Starbucks — well, it feels like the consumer might be a little weak. Or perhaps a lot weak.

Luxury

I'm starting to ask— is it dumb not to own Prada?This analysis is provided by Eden Bradfeld at BlackBull Research.

Prada — here’s a luxury story that’s outperformed peers in recent times — sales up +17% in 2024 — Miu Miu drove sales a remarkable +25% (+93% in Q4 alone!). It’s been a long, funny life as a publicly listed company for Prada — they listed on the Hong Kong exchange in 2011 and the stock surged, and then sat flat for ages, going sideways. There was a lot of doubt if the Italian family-controlled fashion house could grow — it’s a lot smaller than LVMH, Kering etc, and there’s a lot of focus on only a small clutch of brands (plus, the company had a disastrous foray into buying Helmut Lang and Jil Sander). And yet — here we are — in a year of recession for most of luxury, Prada, like Hermes and Brunello, has shined. Not least thanks to growing Gen Z demand of Miu Miu — I keep saying this, but it’s not enough to only sell to your 1% old-timers — you need to sell to the market with growing wealth. Gen Z, baby.

27x earnings — down 6.00% today. I avoided this stock for a while — maybe to my detriment? But now I am starting to ask— is it dumb not to own Prada?

Consider also the rumored +US$1.5 billion bid for Versace, Prada’s fellow Italian competitor. Capri Holdings owns it now — they haven’t grown revenue. I had to pause with the idea of chic, intellectual Prada buying Versace — brash, bold, a little tacky. Yet if anyone can make it work, it’s Prada…

Kering — I know I have been harping on about this one for a while ‘cos the Gucci and Saint Laurent owner is trading well under five year lows, but this little tidbit from Lauren Sherman’s excellent newsletter, Line Sheet (at Puck) — some validation!

I was told by one trusted industry source to buy Kering stock because it’s going to be a sure-bet designer—such as Hedi Slimane—but others keep pointing to lesser-known, yet still formidable candidates. Dario Vitale keeps coming up, despite his conversations with Versace. One thing to remember is that no Gucci designer has ever been a name before they started at Gucci, so a known entity would be a departure from that. Anyway, as my partner Bill Cohan likes to say, this is not investment advice.

Not investment advice, but you know — buy ‘em down and dirty, and ride ‘em high…I always remember how Walter Schloss was prone to look at companies trading at five year lows. That’s Kering for you…

Why Hermès’ margins shame the competitionThis analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

You know my favourite stocks are luxury stocks, and they’ve had a hard last year. Richemont and Moncler were the clear standouts from the most recent season (both grew sales), while Brunello did well too. Obviously, Kering did not do well. Here’s Hermes, which pretty much smashed everyone out of the park:

Revenue amounted to €15.2 billion

(+15% at constant exchange rates and +13% at current exchange rates)

Recurring operating income reached €6.2 billion, representing 40.5% of sales

Adjusted free cash flow amounted to €3.8 billion, up by 18%

Can we take a step back and please admire what smashing results those are — that’s a luxury business which does not cut corners operating on a 40.5% margin, with a free cash flow stream that is unheard of for the luxury industry. Let’s also consider that this is during what is nominally a recession.

Worth thinking about what makes Hermes special:

A hatred of meetings, corporate hogwash, and the associated.

They compete only with themselves — not others .

Human values. Hermes objects are made by people and bought by people . Corporate hogwash tends to see people as numbers, and then corporate hogwash forgets about the importance of psychology.

A fanatical obsession with product — product is the message.

No marketing team.

If your product is good enough, and the story you communicate is good enough, the people will come. The same can be said of Brunello, which I have always said is like a “mini-Hermes” — people buy Brunello for quality and the ethos it communicates. Worth re-reading Brunello’s daily routine, which does not look like the nonsense ice bath CEOs who you see on Instagram:

Luxury ETF is breaking outThe Krane shares Luxury ETF was a novel idea to give investors the exposure to the Luxury sector. But with Chinese consumer weak sentiments and inflation in developed countries, the Luxury goods manufacturers had a bad couple of years. Recently the ETF has been breaking out of its 200 Day SMA. After all the 20-Day, 50-Day and 100-Day SMA spending significant amount of time below 200 Day SMA on a daily chart, the ETF has broken out of its 200 Day lows. It has recently had a good run with sizeable rallies daily. My assessment is that this breakout will sustain for some time to come

Can a Prancing Horse Outrun an Electric Future?In the ever-evolving landscape of luxury automobiles, Ferrari stands as a beacon of innovation and exclusivity. The recent upgrade from J.P. Morgan, elevating Ferrari's status from "Neutral" to "Overweight," underscores the company's resilience and strategic prowess in navigating complex market dynamics. This vote of confidence, coupled with a substantial increase in the price target to $525, reflects Ferrari's unique position in the luxury sector and its ability to maintain growth even in the face of global economic challenges.

At the heart of Ferrari's success lies a paradoxical strategy that defies conventional wisdom: deliberately producing fewer cars than the market demands. This approach, rooted in the vision of founder Enzo Ferrari, has cultivated an environment of perpetual desire and scarcity. With a staggering backlog of 24 to 30 months, Ferrari has not only engineered exceptional vehicles but has also orchestrated an "underappreciated cultural evolution" within the company. This disciplined approach to growth, combined with the power to command premium prices, provides unparalleled visibility into future earnings and sets Ferrari apart from its luxury peers.

As the automotive industry races towards electrification, Ferrari is poised to redefine the boundaries of performance and sustainability. The company's foray into the electric vehicle market, promising an "incredible driving experience" that remains true to the Ferrari ethos, demonstrates its commitment to innovation while preserving its core values. However, this journey is not without obstacles. Ferrari must navigate challenges such as an ongoing investigation into its chairman and the conclusion of a key partnership with Santander. Yet, with strong financial performance, positive investor sentiment, and a clear strategic vision, Ferrari appears well-equipped to maintain its pole position in the luxury automotive market, promising a future as thrilling and exclusive as its storied past.

[KER] Kerling French Luxe Monster StockHere is a potential big stock for the next years to hold on the portfolio.

Regarding today's French political status, it can be the perfect opportunity to buy some luxury stocks like Kerling with big drawdown.

I am looking to sell after 1000€ breakout.

Great Trade !

LULU: Luxury Powerhouse & Multi-Decade TrendsetterKey Rationale:

Fundamentals remain intact making this a very attractive time to be contrarian, ignore the pessimism and buy the dip. Always nice to buy what you know and can see around you.

Comments:

Credited with the development of athleisure. Hasn't yet seized Pickleball market opportunity.

Incessant selling due is unwarranted with one executive departing.

One of the best available Ex-U.S. stocks.

Potential tailwind off the back of Ozempic & GLP-1 craze.

Still a profitability powerhouse with pricing power because of its iconic brand.

Same-store sales are growing exponentially, and an expansionary opportunity abroad.

Narrow Moat, Exemplary Capital Allocation.

Luxury market is different from discount competitors, and luxury brands are seldom cheap.

3-Star Valuation on Morningstar, hasn't been this cheap since 2017.

Stellar Profitability, Growth, and Quality scores in GreenBlue (4, 29, and 125 out of 2982)

Proprietary Scores:

GreenBlue Cumulative Rank: 128/2982 (Lower = Better)

GreenBlue Current Rank: 407/2982 (Lower = Better)

GreenRed Rank: 225/499 (Lower = Better)

Gurufocus Score: 97/100 (Higher = Better)

Company Profile:

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Competitors:

ROST, TJX, BURL, GPS, URBN

Risks:

This goes the path of Nike and is dead money for the near future.

#CFR Richemont Roars Back: Ready to 'Rumble' Up the Charts!Richemont (JSE:CFR) Breaking the significant down trending channel which has held price lower since July in a very controlled 'Fashion' (excuse the pun). The level we bounced from is the 50% fib retracement from the May 22 lows and May 23 highs. RSI and MACD has been building divergence for weeks where the indicators made higher lows which was not confirmed by price..

Putting this all together, I think we have a good trading opportunity to get long CFR here with a stop loss below recent lows at R2158, with targets at approx. R2500 R2600 and R2700 (200day ma).

💎Resurrection of Risk 👑 Join the MC House of LV🕊️Old Money Never

Goes Out Of

Style

www.lvmh.com

LVMH is home to 75 distinguished

Houses rooted in six different sectors

True to tradition, each of our

Brands builds on a specialty legacy

While keeping an unwavering focus on

The exquisite caliber of its products.

In The Words

Of

Chairman Bernard Arnault

"Our objective to strive for solid financial performance and our relentless drive for excellence remind us of our daily commitment to act in such a way as to make the world a better place.

The Group and its Maisons carried out numerous actions in 2021 to promote biodiversity, protect nature and to preserve skills and craftsmanship, and will continue to do so in the years to come."

www.lvmh.com

EURONEXT:MC

MIL:LVMH

🎇

Moncler (MONC.mi) bearish scenario:The technical figure Pennant can be found in the Italian company Moncler (MONC.mi) at daily chart. Moncler is an Italian luxury fashion brand with French origin mostly known for its skiwear. The Pennant has broken through the support line on 02/04/2022, if the price holds below this level you can have a possible bearish price movement with a forecast for the next 6 days towards 46.860 EUR. Your stop loss order according to experts should be placed at 52.86 EUR if you decide to enter this position.

Moncler reported revenues that surpassed the 2-billion-euro mark, rising 44 percent compared with 1.4 billion euros in 2020, eight years after its initial public offering and through a global pandemic. Net profit climbed 37 percent to 411.4 million euros, compared with 300.4 million euros in 2020. Compared with 2019, it grew 14.7 percent from 358.7 million euros. The group also touted a free cash flow of 550.3 million euros, above pre-COVID-19 levels and compared to 195.5 million euros in 2020.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

CAC 40 best performing indiceI think the top 5 of US stocks that went up the most is made of Moderna (MRNA) and 4 energy companies including 3 Oil companies. The typical big tech stocks did not do that well. Google is up 70% in a straight line. AMZN & AAPL that broke new highs (notably in price and market cap) have not gone up compared to the rest.

The best indice is France CAC 40 which was undervalued (compared to the rest) and sleeping. As far as I know France has been in the top 6 exporters since forever and dropped out of that in 2020 only time will tell if they go back up. France followed the US example "Wow looks pretty cool to be in debt to the neck. We hate kids let's make them work hard in 50 years to pay for our lazy lifestyle today" as well as "Who cares what happens after I did my 2 (president, ministers) or 20 (congress) terms? This will get me lots of votes from ignorant zombies.". Now all I see France paying China with is heavy/advanced armament (planes...) and luxury which the chinese really love.

I don't know if these useless expensive products companies are expensive (do I look like a stock investor?) but the price keeps going up. CAC 40 is in a bull market and finally beat 2000 high. Up we go. Going up even more than the US pyramid scheme now. Maybe I'll just buy the indice on the next pullback.

Chubby ugly women want to feel pretty what can I say? Too blunt? Sorry. Too hard not to push chips and soda down a funnel placed in your month I guess. Capitalism/consumerism ❤️

I have no idea what I'm doing but unlike 2018-2019 where I got destroyed I think I now have a fair shot at making money with stocks. RNA companies in the long term look too good, with all the zombies mindlessly vaccinated I lose my words. Indeed how can so many be vaccinated and no one be hyped, or even give a rat's ass, about RNA? Like 1 billion people got injected at least once, often several times, and no one speaks about the tech, no one cares 🤦. Almost seems like cheating... Did somebody use cheat codes to make money? Well anyway there will be a pullback (significantly, multi year bear market) at some point, and years after this the zombie herd will suddenly understand what RNA is and the possibilities (because someone explained it to them - slowly - on television) and they will get VERY EXCITED ("we will erradicate all illness and live forever"). Trolls (Pomp) will shout "Pfizer can go to 1000/10,000" and the herd will FOMO.

Since I have no idea what I am doing I will OTP kinda. Going to stick to the S&P 500 indice + the french 4 stocks I mentionned. Read about those, study those... Over time surely I'll add a bit more. So I won't be so reliant on Forex doing something.

Tech stocks are not the future anymore. Now the future is (no surprise) energy production (it's always the future) and biotech. Energy production including EV batteries. And luxury will always sell (as long as people are full of cash, not broke).

L'Oreal is in a complete bubble so I'm not saying hold no matter what in your retirement account.

It's going completely vertical. It's basically Bitcoin. And the CAC 40 is only just starting a bull trend.

Ali-Foreman of the 21st century: Winnie the pooh vs the richestChinese regulatory crackdown is an exceptionally interesting phenomenon. Recently it got even more interesting as Xi Jinping, probably expecting the necessity of Evergrande bailout, suggested smoothing excessive incomes. Surprising? No. Some growth of populism has been seen in General Secretary’s actions for at least a year.

My prediction for upcoming months is simple: every time something good “happens” to Evergrande, the Communist Party will throw a punch at the wealthiest to show how much they regard the Chinese underpaid and overworked society. What does it mean for the European luxuries leader? In 2020, 34% of its revenues came from Asia excluding Japan (unsurprisingly, the majority of this 34% can be attributed to China). Adding the disappointing Chinese economic data to our equation, a decrease or LVMH’s revenues from Asia seems to be inevitable. Given that luxury goods are trading at a huge premium (that I don’t think I can justify) over the MSCI Europe, a short position on the industry leader looks very appealing.

Just before posting this idea, I checked the analysts’ consensus on LVMH. Apparently, the vast majority of them are optimistic. Well, I am not.

$CPRI: Continues to stun the marketWith another massive earnings beat, the market continues to find value in this name that was getting beaten up long before COVID. Should be interesting to see if CPRI can continue to impress into holiday season and beyond.

Q2 2021 Highlights

Revenue increased 178%, with better than anticipated results across all three luxury houses

Adjusted gross margin expanded 90 basis points versus prior year

Adjusted operating margin of 20.8%

Adjusted earnings per share of $1.42

Raised full year adjusted earnings per share outlook to $4.50

BGI Looking To Shine In Reopening TradeBIG Gap up on July 1 after news that BGI reopened in Canada. But now it's at some interesting levels. The 618 fib has acted as support/resistance for a while. Since BGI broke above that, we need to see if it can hold. Next minor resistance seems to be around the .5 Fib then more major at the 382 fib. This 382 level is an area that BGI seems to have had a tough time breaking through. It has tested it but failed more times that succeeded to break through it and hold.

"Clearly, retail is broad, but there are a few names that come to mind. First, luxury brands have taken a focus as consumers have come out of hibernation with fresh capital. Jewelry companies like Birks Group (NYSE: BGI) have gained attention in the market. Birks operates jewelry stores across Canada. As of June 30, 2021, the company said it operates twenty-nine retail stores. It also has its fine jewelry collections available through other companies in the UK and US, including Mayors Jewelers and SAKS Fifth Avenue locations. This week Birks announced that it opened all of its Canadian stores, helping give it a boost in the market."

Quote Source: Best Penny Stocks To Watch Now? 10 Top Epicenter Stocks For Your List