Shorting Gold!Gold has been on a TEAR through 2025. Overextended in ATH territory and more expensive than ever before in history. Logically, we should expect a return to historically normal (still expensive) prices.

Daily chart is showing 3/3 sell signals

1. Price below 9 period MA

2. RSI bearish fanning beautifully from overbought levels

3. Average Daily Range expanding with volatility

I'm aggressively watching for shorts on Gold, Silver, and Copper in the weeks ahead. I've outlined 3 possible entries IF we're lucky enough to see some kind of relief from last weeks selloff. Should price proceed to fall, preparing smaller time frame short trades. I strongly believe we will see 2800. Strategy is invalidated if price breaches ATH's

M-oscillator

Silver's Breakout—From Graveyard to Launchpad?Silver looks great on the charts, closing above $33 for the first time since late October. Previously, this was like a graveyard for bullish raids, putting increased emphasis on the price action over the next few days.

Whether you’re talking price or momentum signals, they suggest this break may stick where others failed, putting a potential retest of the October 2024 swing high of $34.87 into play. We saw a key bullish reversal candle on Tuesday, followed up by further buying on Wednesday, contributing to the bullish break. That’s not surprising given price signals have often proved accurate in silver recently. RSI (14) is trending higher, with MACD confirming the bullish momentum signal.

The ducks are lining up. If silver can’t capitalise in this environment, it will be a telling sign as to where medium-term directional risks may lie.

Those considering bullish setups could buy above $33 with a stop beneath the level for protection. Some resistance may be encountered around $34 and $34.50, with a break above the latter putting $34.87 on the table. $35.36 and $37.46 are long-standing levels located just above.

If silver were to reverse and close through $33, the near-term bullish bias would be invalidated.

Good luck!

DS

Natural Gas Wave Analysis – 12 March 2025

- Natural gas reversed from round resistance level 5.0000

- Likely to fall to support level 3.815

Natural gas recently reversed from the resistance area between the round resistance level 5.0000, the upper weekly Bollinger Band and the 38.2% Fibonacci correction of the downward impulse from 2022.

The downward reversal from this resistance area stopped the earlier weekly upward impulse sequence (3) from the start of 2025.

Given the recent formation of the daily Shooting Star and the overbought weekly Stochastic, Natural gas can be expected to fall to the next support level 3.815.

Harley-Davidson Wave Analysis – 12 March 2025

- Harley-Davidson reversed from resistance level 27.35

- Likely to fall to support level 23.80

Harley-Davidson recently reversed from the resistance area between the key resistance level 27.35 (former double bottom from January), upper daily Bollinger Band and the 50% Fibonacci correction of the downward impulse from January.

The downward reversal from this resistance area stopped the earlier short-term ABC correction 4 from the start of February.

Given the overriding daily downtrend, Harley-Davidson can be expected to fall to the next support level 23.80.

Brent crude oil Wave Analysis – 12 March 2025

- Brent crude oil reversed from the pivotal support level 68.55

- Likely to rise to resistance level 71.30

Brent crude oil recently reversed from the support area between the pivotal support level 68.55 (former multi-month low from September) and the lower daily Bollinger Band.

The upward reversal from this support area stopped the earlier downward impulse waves 3 and (3).

Given the strength of the support level 68.55 and the oversold daily Stochastic, Brent crude oil can be expected to rise to the next resistance level 71.30.

EURCAD Wave Analysis – 12 March 2025

- EURCAD reversed from the resistance area

- Likely to fall to support level 14.20

EURCAD currency pair recently reversed from the resistance area between the long-term resistance level 1.5800 (which has been reversing the price since the start of 2020) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the previous upward impulse wave (3).

Given the strength of the resistance level 1.5800, EURCAD currency pair can be expected to fall to the next support level 14.20.

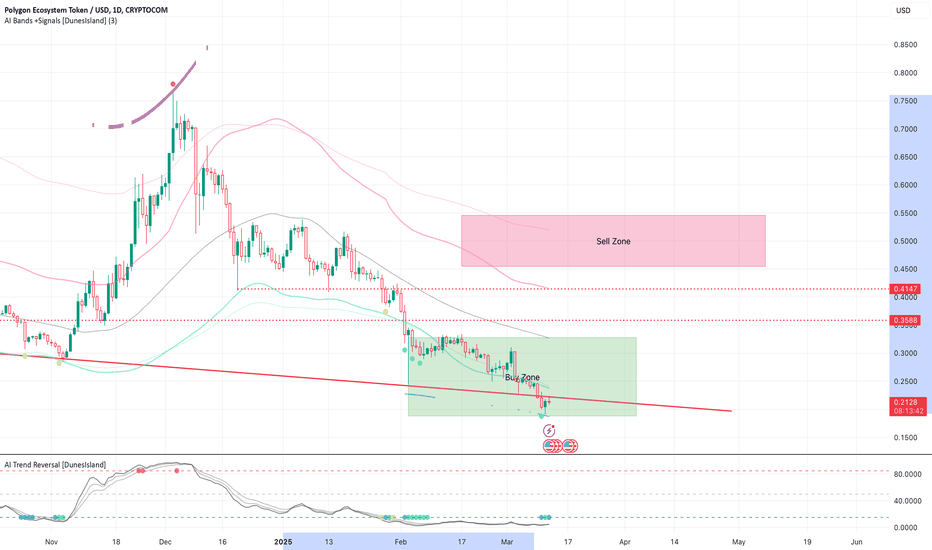

$POL still accumulatingPSX:POL dropped lower than I expected but its a better opportunity to continue to DCA, HODL for the long term, at this point we are in the lower side of the cycle. From the top it dropped ~75%. I think there will be a short term bounce as every indicator is oversold at this point. Lets see what the markets will do..

ASX 200: Oversold Signals Flash, But Bulls Need ConfirmationASX 200 SPI futures are so oversold on the daily timeframe that you can’t help but notice, especially when looking back over recent years. The only time an RSI reading this low didn’t spark some form of bounce was during the height of the pandemic panic in early 2020.

But being oversold alone isn’t enough to trade against the prevailing strong bearish trend, putting extra emphasis on Wednesday’s price action. To get bullish and position for a countertrend squeeze, we need a price signal for confirmation.

I’m watching 7796—the price dipped below this level in low-volume trade during the night session before reversing back above. It’s only a minor level, but beneath it there’s not much for bulls to hang their hat on until 7600, where buyers stepped in last year.

Depending on the price action around the open at 9:45 am AEDT, if bulls defend 7796 again, the risk of a squeeze increases, similar to what we saw on Tuesday.

Longs could be considered above the level with a stop beneath the session low for protection. 7900 is one potential target, with 7996 and former uptrend support around 30 points higher alternative options for those seeking greater risk-reward.

A clean break and close below 7796 would invalidate the squeeze setup. Unless accompanied by fundamentally bearish news, flipping short after recent declines would be risky.

Potentially working in bulls’ favour, iron ore futures in Singapore had a solid session overnight, lifting nearly 1% to $101.70 per tonne.

Good luck!

DS

KASPA: Soon to switch to being greedy again.Back into the green zone.

Stepping up DCA-accumulation into a more aggressive mode soon, expecting KAS to fall to as low as ~5.4 cents.

FG oscillator is still orange (bearish) on the weekly.

10 bps upgrade and activation incoming. 4 smart contract layers being developed. Tier1 exchange listings to look forward to. KII (Kaspa industrial initiative), and so on.

GOLD sell target in new week As of March 9, 2025, gold is trading at approximately $2,919.80 per troy ounce.

Forecasts for the upcoming week (March 10–14, 2025) suggest a potential decline in gold prices. Predictions indicate that gold may reach around $2,789 on March 12 and $2,784 on March 13, with a slight rebound to $2,825 by March 14.

Technical analysis indicates that gold prices have experienced a slight decline recently, with spot gold falling by 0.1% to $2,892.00 per ounce on March 4, 2025.

Given these projections and technical insights, setting sell targets at $2,860 and $2,850 for the upcoming week aligns with the anticipated market trend. However, it's essential to consider that gold's long-term outlook remains bullish, with forecasts predicting prices could reach $3,265 in 2025 and $3,805 in 2026.

Please note that market conditions can change rapidly, and it's advisable to stay updated with the latest analyses and forecasts before making any trading decisions.

Bears in Control, but Oversold Signals Hint at Squeeze RiskThe break of uptrend support dating back to the start of the artificial intelligence (AI) frenzy in early 2023 may embolden Nasdaq 100 bears to seek a far larger downside unwind than what’s already been seen. Coming on the back of last week’s disintegration of the 200DMA—and with valuations still stretched relative to historic averages while competition in the AI space from China seemingly grows by the day—the technical and fundamental ducks are lining up for such an outcome.

While recent price action has been entirely bearish, sustained directional moves rarely unfold without the occasional countertrend interruption. With RSI (14) now in oversold territory on the daily timeframe and Nasdaq 100 futures finding some buyers between minor support at 19300–19140, this may provide a platform for some form of countertrend squeeze.

If bids continue to repel bears on dips beneath 19,300, longs could be established above the level with a stop below 19140 for protection against a continuation of the prevailing bearish trend. Former uptrend support sits just below 19,900 and looms as a potential trade target. Alternatively, if the price breaks through 19,140 convincingly, bears may set their sights on support at 18,387.

Patience may be required for those considering the setup. Watching USD/JPY for signs of capital flight back into the yen may also be advisable given the skittish environment.

Good luck!

DS

Nasdaq short-term long: Bounce off Trendline, RSI DivergenceIn summary, I think that there is a good odds that Nasdaq will rebound in the short-term because it has bounced off a 2-year trendline and RSI has diverged with price. Using QQQ to gauge volume, I can also see that there is a healthy volume to support a reversal. However, take note that as of now, I will still consider this to be a corrective wave up and not a major trend reversal to the upside. Meaning, the major trend is still down.

Bitcoin ($BTC)Bitcoin ( CRYPTOCAP:BTC )

Disclaimer: All the information and analysis serve only as educational purposes and hence should not be regarded as investment advice.

Here is my thought on the potential weekly price action of Bitcoin, $BTC.

Overall, the market structure is still bullish with consistent formation of higher highs and higher lows since 2023 - currently forming a new higher low. A strong support area in the range of FWB:65K -$74K and a diagonal uptrend trendline are being tested. Historically, an RSI around 44 is a strong indicator of a market local bottom - current RSI is 44.89.

Since 2023, market performance in Q1 and Q4 have shown to be positive and the opposite is true for Q2 and Q4. However, the tariff imposed by the U.S. President Donald Trump towards Canada, Mexico, and China in February 2025 have sparked uncertainties in the market causing price correction and BTC ETF Spot net outflow in this quarter.

However, with the signing of the executive orders for the U.S. BTC Strategic Reserve by President Donald Trump implies increased adoption of Bitcoin by nations, not just institutions. Therefore, I firmly believe that as of the date of writing, BTC at $80K, is a good price to start scaling into the asset, with a bullish outlook for the rest of 2025 and my personal target is for BTC to reach a cycle top between $170K-$210K by the end of the year.

Invalidation: If a weekly candle closes below the diagonal trendline and the invalidation level of $49.1K, then my above view on Bitcoin will get invalidated and turn into bearish.

Crypto Total Market Cap ($TOTAL)Disclaimer: All the information and analysis serve only as educational purposes and hence should not be regarded as investment advice.

Here is my thought on the potential weekly price action of the crypto total market cap, $TOTAL.

Overall, the market structure still remains bullish by consistently creating higher highs and higher lows since 2023 - currently price is forming the higher low. Horizontal support and diagonal uptrend trendline are both still respected. Historically, an RSI around 43 indicate a market bottom - current RSI is 43.1. Also, starting 2023, the return in Q1 and Q4 have proven to be positive while Q2 and Q3 have shown the opposite.

However, the tariff announcement by the U.S. President Donald Trump to Canada, Mexico, and China in Q1 2025 have created market uncertainty and thus, leading to market pullback in this quarter. BTC and ETH Spot ETFs have experienced net outflow in February 2025 although the outflows are slowing down in the beginning of March 2025. The fear and greed index has also entered into the fear area.

On the other hand, the signing of the U.S. Bitcoin Strategic Reserve and the social media post of U.S. Crypto Strategic Reserve (BTC, ETH, XRP, ADA, SOL to be specific) by President Donald Trump suggest improved future adoption of crypto not only by institutions, but also nations. For this reason, I believe that as of the date of writing, the total crypto market cap chart ( CRYPTOCAP:TOTAL ) is reaching a local bottom of around $2.5T and will remain bullish for the rest of 2025 with a target of around $7.2T-$8.7T by the end of the year.

Invalidation: If the price action shows a weekly candle close below the diagonal trendline and the previous low of $1.69T, then the above analysis will be invalidated and the crypto market may enter turn into bearish.

Mastercard Doing a 180. MAI called tops too early last time I looked at Mastercard. That's why you have stop losses.

It is a common feature I found when using Elliott, that there is frequently one subwave that is left unaccounted for, causing one to call pivot prematurily.

But calling pivot is never easy no matter, which tactic you use. Similarly, vWAP derived reversal to mean strategies often fail, as well as many of Jurik (and others -not singling anyone out) indicators that can be used for this purpose.

In my experience, it almost does not matter what you use, as long as you are the master of your system. Reading an indicator is easy, but reading what is between the lines is what creates real profit. Mechanical interpretation of squiggly lines does not lead to profits in the long run.

Eli Lilly Hit Resistance. LLYMy last idea on LLY proved to be very profitable, so here are the early signs of a pivot at hand. Technically, the indicators flipped almost in unison, MIDAS crossed. And just look at that fat bearish candle setting the tone. It is this constellation of factors that gives one confidence to profit from the plunge. Strap yourselves in.

Short Term Up For Apple. AAPLBetting on a triple drive formation here, while stock price is correcting from the last drop. None of the technical indicators have turned, yet, although they appear to be about to. This is a discretionary idea with increased risk, as there is no signal until an indicator produces one.

$SPY March 10, 2025AMEX:SPY March 10, 2025

60 Minutes

Last week we managed to hit 565 as projected.

Now we are having LL with oscillator divergence.

Also, we can see in the channel LL 566.63 is a green bar with close near top of bar.

Now from Marcg 4 to 7 AMEX:SPY struggling to cross the mid channel line.

Foe the fall 597.43 to 565.63 a retracement up to 585 is possible.

583 is 50 averages.

On Monday holding 573-573.5 I expect a move towards577 - 581 range.

Due to oscillator divergence, I will not short.

No trade day for me on Monday as long is also above 598 for the moment.

On the other side if 564 is broken my target is 560 which will end the extension move as drawn.

Some consolidation is coming this week which will give us a better picture hopefully by Wednesday.