BTC Long - Comparing to Global M2GLOBAL MONEY SUPPLY vs CRYPTO Relation

Global Money Supply Breaking Upwards

has historically led to

All of Crypto Breaking Upwards CRYPTOCAP:BTC CRYPTOCAP:SOL CRYPTOCAP:ETH etc

Right now, Global Money Supply (Global M2) is breaking upwards to new all-time highs.

Publishing to follow, as I am relatively 'newer' at using macro tools such as Global Money Supply (Global M2) in relation to projecting crypto greater cycles

Cheers

-@CryptoCurb

M2

A look at M2 Money Stock Out of curiosity I took a look M2 to see the trends over the years and how it compares to COVID and the last few years. I don't have any great revelations to share about what to do, but I thought the chart was interesting. I also did some research and used ChatGPT to help me create a summary about M2. Please note that I cannot guarantee the following text is perfectly accurate, I am not a financial expert or advisor, but it is an interesting overview. Enjoy.

1) Introduction:

Money Stock Measure 2, or M2, is a comprehensive measure of the money supply that includes various types of financial assets held by the public. It encompasses M1 — which consists of the most liquid forms of money like cash and checking deposits — and adds less liquid forms such as savings deposits, time deposits under $100,000, and retail money market mutual funds. This broader measure provides a more complete picture of the available money within an economy than M1 alone.

2) Why M2 Matters to the Economy and the Stock Market:

Monetary Policy Indicator: M2 growth rates can indicate the looseness or tightness of the Federal Reserve's monetary policy. Rapid growth in M2 may suggest a looser policy with potential implications for lower interest rates, while slower growth could indicate a tightening policy stance.

Economic Health Predictor: Fluctuations in M2 can signal upcoming changes in economic activity. An expanding M2 typically suggests that more money is flowing into the economy, potentially boosting consumer spending and overall economic growth. However, if this expansion leads to inflation without an accompanying increase in real output, it could be detrimental.

Interest Rate Influence: Since M2 impacts interest rates, it indirectly affects the stock market. Lower interest rates from an increased M2 can reduce borrowing costs and stimulate both capital expenditures and consumer spending, which generally supports higher stock prices.

Inflation Expectations: Inflation can erode the purchasing power of money. An inflating M2 can lead investors to adjust their expectations, impacting bond yields and stock valuations.

3) As an investor, monitoring M2 can enhance decision-making in several ways:

Growth Trends: Observing whether M2 is expanding or contracting can provide clues about future economic conditions and monetary policy directions, helping investors anticipate market movements.

Asset Allocation: During periods of M2 expansion (indicative of lower interest rates), investors might favor stocks, particularly in sectors like consumer discretionary that benefit from increased consumer spending. Conversely, a slowdown in M2 growth could be a signal to move towards safer assets like short-term bonds, which are less sensitive to interest rate rises.

Sector Impacts: Different sectors react differently to changes in M2. For example, financials might benefit from higher interest rates, while sectors sensitive to consumer spending could gain from an expansionary M2 environment.

Inflation Hedge: Rapid increases in M2 that might lead to inflation suggest that investors should consider assets that typically perform well during inflationary periods, such as commodities or real estate.

Global Considerations: For those invested internationally, understanding how M2 changes affect global markets and capital flows is crucial, particularly in how developed economies' liquidity influences emerging markets.

4) Conclusion:

M2 is a critical economic indicator that offers valuable insights into future monetary policies, economic health, and market directions. It is not a perfect metric on its own, but by integrating M2 data into broader market analyses and considering its implications on different sectors and asset classes, investors can make more informed decisions, optimizing their portfolios to better navigate the complexities of financial markets.

Macro Monday 8 - S&P500/M2 Money SupplyMACRO MONDAY 8

S&P500 / M2 Money Supply ( SP:SPX / $WMN2S)

M2 is a broad measure of the US money supply that includes cash, checking deposits, and other types of deposits that are readily convertible to cash such as CDs.

M2 is seen as a reliable metric for forecasting/predicting inflation and for this reason it can be used as leading economic indicator. For example, when there is more cash made available or too much, more cash typically gets spent. A little more can be good, too much or too sudden an increase can increase the risk of inflation. That's why the Federal Reserve constricts the money supply when inflation rears its ugly head. At present the Federal Reserve is decreasing the M2 Money supply in an effort to slow down spending in order to control and reduce the rate of inflation. Since April 2022 the M2 Money Supply has reduced from $22 Trillion down to $20.82 Trillion.

The money supply and its impact on Inflation combined with current interest rates has major ramifications for the general economy, as they heavily influence job availability, consumer spending, business investment, currency strength, and trade balance.

The M2 Money Supply also has a major impact on the stock market and can act as catalyst for increased purchases of stocks (when the money supply is increasing as more money is available) and can also cause the selling of stock when money supply is tight or tightening as it is at present (as less money is available in the wider economy).

The Chart – Accounting for Money Supply

As noted above the M2 Money Supply is reducing and it is expected that this may result in the S&P500 making lower lows as the supply of money continues to contract.

The S&P500 performance looks very different when it is adjusted to account for the increases and decreases of the money supply. We can achieve this by dividing the S&P500 by the M2 Money Supply (Chart 1).

Chart 1 – S&P / M2 Money Supply

- Since 1996 the Major Resistance Zone has stopped every progression higher.

- In 2007 a rejection from the resistance zone resulted in the Great Financial Crisis

- Major recessions are labelled with red arrows & market corrections with blue arrows.

- Since GFC there have been a number of rejections from the resistance zone which have

coincided with notable corrections for the S&P500 (see blue arrows).

- The most notable of these rejections was the COVID Crash in March 2020.

- We are at the resistance zone now and it appears we are struggling to breach above it and

may be rejected again. Given we have been rejected by this level 5 times since the 2007

Great Financial Crisis, it seems wise to remain cautious and expect a rejection from this

level again.

Chart 2 – S&P500 & M2 Money supply (Segregated)

- This chart shows you the S&P price action in isolation and underneath the M2 Money

Supply for reference.

- The declining M2 Money supply is like a weight or float pushing and pulling the S&P500

price action in its direction.

- The M2 Money supply may gravitate down towards its long term trend line over the coming

year(s) and one would expect the S&P500 to follow its lead and also gravitate lower.

- Interestingly, on Chart 2 you can see that the level that the M2 Money Supply and the

S&P500 were at prior to the pandemic would present an S&P500 price tag of $3,350.

Summary

Its seems unlikely that the S&P500 is about to break higher due to the overhead long term resistance zone on Chart 1 which helped predict the last two recessions (red arrows) and a handful of corrections (blue arrows).

There is a strong likelihood of continued M2 Money Supply normalization towards its long term trend line on Chart 2, especially considering Federal Reserves continued efforts to constrict the money supply through quantitative tightening to help quell inflation. These efforts will likely subdue any attempt of positive price action on the S&P500.

It is important to recognise that the Dot Com Bubble in 2000 pressed through the resistance zone on Chart 1 demonstrating just how big a bubble it was. It was initially rejected from the resistance zone in March 1997, however the M2 Money Supply was increasing at this time so whilst this outcome is always possible, it does not presently seem probable with M2 Money supply decreasing and likely continuing to decrease going forward.

Another potential outcome is a false break out above the resistance zone on Chart 1. We have had an unprecedented increase in to the money supply since the March 2020 COVID Crash and this could have a lagging effect which eventually pushes us over the resistance zone. Fiscal Stimulus which is harder to predict could also help us arrive at this scenario. Regardless, if these circumstances are met with continued decreasing M2 Money Supply, I believe that it would be a short lived breach of the resistance zone resulting in maybe a $4,980 S&P500 price tag (a higher high) followed by a severe correction. That is IF M2 Money supply is still decreasing as the S&P500 makes those higher highs.

And finally we have to consider what most people would consider to be the most unrealistic scenario, a Dot Com Style bubble towards the top red line on Chart 1. As improbable as this is, a combination of factors could lead us into this scenario;

- The aforementioned lagging effects of the unprecedented never before seen increase in

the M2 Money Supply since the pandemic.

- Continued or new Fiscal Stimulus from the US government.

- The bullish AI narrative (which appears to be dissipating at present)

This final bullish scenario is worthy of consideration especially factoring in the comparisons of the 2023 AI hype to the 2000 internet boom. As we enter a new technological epoch with the likes of Augmented Reality, Cryptocurrencies and AI, are we getting ahead of ourselves again? Do these technologies need a little more time to mature much like the internet? Are we overextended like we were in 2000? It’s hard to answer no to any of these questions but against the backdrop of record levels of Quantitative Easing and Fiscal Stimulus we have to keep an open mind as the Fed tries to simmer us down from these record levels of liquidity

It will be very interesting to watch these charts over coming weeks and months to see if we get our anticipated rejection from the resistance zone on Chart 1.

A special mention to Ben Cowen from "Intothecryptoverse" who originally brought this style chart to my attention. My chart could be considered a snapshot of his view however I hope I have added to it in some way with the above commentary and some correlations I have noticed.

Thank you for reading to the end. I hope these charts help frame todays market for you going forward.

I’ll keep you posted on any major changes.

PUKA

Quantitative Support in the US1. Liquidity and Investments:

An increase in M2 typically means there is more liquidity in the economy, as consumers and businesses have more cash or cash-equivalents at their disposal. This excess liquidity can lead to increased investment in stocks, including those in the S&P 500, driving up stock prices.

2. Economic Expectations:

A growing money supply can signal that central banks (like the Federal Reserve in the United States) are implementing looser monetary policies, often in response to concerns about economic growth. Lower interest rates and other forms of monetary stimulus can encourage borrowing and investing, leading investors to buy stocks in anticipation of economic recovery or growth, which can push up stock market indices like the SPX.

3. Inflation Expectations:

Over the long term, increases in the money supply can lead to inflationary expectations. If investors believe that inflation will rise, they might choose to invest in assets like stocks, which are seen as a hedge against inflation, because companies can raise prices to maintain their revenues and profits in nominal terms. This shift can drive up stock prices, including those in the S&P 500.

4. Risk Appetite:

An expanding money supply can also affect investor sentiment and risk appetite. With more money available and potentially lower returns from traditional safe investments (like savings accounts or bonds, which might offer lower interest rates when the money supply is growing), investors may turn to the stock market in search of higher returns, driving up equity prices.

S&P can go higher, this depends on the FED

Golilocks continues.

The economy is not going to crash, why?

It's already happened. We had a GFC.

Go to university and do any relevant classes to macroeconomics. You will at some point discuss, or study the GFC. This is so we does not happen again.

Of-course nothing is going to go terrible during a US election year.

Now this does not stop black swan events...

BTC and M2 correlation and detecting BTC bull cyclesBitcoin is highly correlated with the M2 money supply. Saying this, when the correlation is negative, i.e., periods when BTC is declining but the M2 is increasing, it is usually a good time to accumulate BTC as the price will sooner or later catch up with its long-term correlation with the M2.

S&P500 adjusted for Money Suppy is unchanged for 26 years In order to get the decimal point to the right of a number, I had to multiply AMEX:SPY by 1,000,000,000,000 or 1 Trillion.

The price of the market is unchanged since January 1997 with the adjustment.

That is an incredible 26 years where prices haven't bean 'inflation as measured by the quantity of money' floating around in the banking system.

Nominally, our purchasing power if stored in stocks has been maintained over that time period, which is good.

BUT, if you think you are wealthier over these last 26 years, it may be because of your ability to pick stocks that do better than the market overall. The Nasdaq likely did far better than the S&P500, for example.

321 months sideways and plenty of deviation around the level we are at now.

I have adjusted other charts for inflation to make a point and I wanted to add this one, which is more aggressive, to the bunch.

Tim West

October 18, 2023.

12:58PM EST

SPX M2 chartWe've been stuck at 50% real valuation of '00 crash for 23 years.

2007, 07, 18, 20 and 22 crash all caped by the same level.

Big questions is, up or down?

For now down. 3M rejection and currently retesting until Jan.

But if we break the ATH on the nominal SPX chart will be running hard!

There you will have your blow of top. Not sure if project zimbabwe style or just another cycle.

BTC and possible entry pointsThe green trendline serves as the ultimate go signal, and a close above it would typically signify the onset of the parabolic movement stage for the asset. Besides that, every bounce presents potential trade opportunities for those who prefer not to hold this particular asset class long-term.

I foresee the first substantial test for this asset class occurring towards the end of the decade. It's possible that this test could coincide with a significant bubble bursting event. However, at the moment, there appears to be a catalyst on the horizon, potentially a force majeure event, that could prompt a reduction in interest rates and support a prevailing trend of reinflation. This is my hypothesis, primarily based on macro chart analysis, and it's expected to materialize in the coming months, possibly during the fall or by April at the latest.

USM2 and SPX, "Printer goes Brrr"This in the past five years has been a very strong topping signal, I'm not sure if there's much more to add. The platform wants me to add some blurb to meet it's guidelines but what can I tell? The chart speaks for itself. Hope you've found it useful, it's certainly one of many things I have included into my market model.

S&P500 = PRICING IN THE MONEY SUPPLYIn today's chart, we look at the S&P500 divided by the WM2NS (money supply).

The upward trend of the S&P500 has been unstoppable since 2009 and has climbed to new heights since 2013.

> However, as soon as you divide the chart with the "MONEY QUANTITY", the unadulterated chart = the reluctant truth is revealed.

= Regardless of the rising price of the index, it has not changed in real value / hardly noticeable.

= The "stock rally" was accordingly only the pricing in of the rising money supply.

We have been in a sideways channel for about 30 years:

= this was broken by the "DOT COM BUBBLE" and the "FINANCIAL CRISIS".

= in the chart, you can clearly see that the channel serves as support and resistance.

Currently, we are on the way to the bottom of the channel = another 18% - Downside.

> at this bottom, there is a high probability that we will run again to the other side of the range = 64 % - upside.

Looking at the 18% - downside in the S&P500, we would end up at around 3,000 points.

> The 3,000 mark not only goes over one with Fibonacci and POI levels, but also represents a strong DEMAND zone on the monthly chart.

> Based on this, we can expect a reaction in this area on a further down-sale.

Looking at the range, a scenario of further down-sale is more than likely and goes along with the opinion of many.

If this idea and explanation has added value to you, I would greatly appreciate a review of the idea.

Thank you and a successful trading!

M2 Money Supply versus Global Net LiquidityM2 is getting a lot of attention, but is it really driving markets? M2 is the Federal Reserve's estimate of the total money supply including all cash hand, money deposited in checking accounts, savings accounts, and other short term savings. The rate of change for M2 over the past 3 years has been the steepest incline and decline in the M2 rate of change in history. However, global net liquidity, which is driven by fractional reserve banking and credit expansion from cycling credit between central banks and the private sector, as far greater impact on markets and is more strongly correlated than M2.

In the fall of 2021 the Federal Reserve announced the end of quantitative and monetary easing, marking the top of the market for risk assets. Other central banks followed suit and interest rates increases and liquidity tightening started in the beginning of 2022. This contraction is highlighted in the red box in the center of the chart. The white line in the center marks the liquidity bottom that we observed in the fall of 2022 which also marks the bottom for risk assets. The green box highlights the expansion in liquidity that begins immediately after with a correlated and coincident rise in risk assets. Note that M2 has continued to contract and interest rates hikes have continued during this time.

Michael Howell regularly tweets timely and insightful updates on global liquidity. I highly recommend following him @crossbordercap twitter.com Thank you to Codi0 and to dharmatech for their work on the liquidity indicators. These are fantastic editions to macroeconomic and monetary analysis.

How to Build Wealth (Even During Monetary Tightening)One question that many investors are asking right now is: How can I build wealth during monetary tightening?

To answer this question, one must understand how the money supply works.

The Money Supply

The money supply refers to the total amount of currency held by the public at a particular point in time. M2 is one of the most common measures of the U.S. money supply. It reflects the amount of money that is available to be invested. M2 includes currency held by the non-bank public, checkable deposits, travelers’ checks, savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

The chart above is a time-compressed view of the money supply. The time scale has been compressed such that the money supply appears as a vertical line with clusters of dots. Each dot represents a quarter (or 3-month period).

During periods of monetary easing, when the central bank accelerates increases in the money supply, the dots stretch wider apart, as shown below.

During periods of monetary tightening, when the central bank decelerates increases in the money supply, the dots tighten together. In rare cases, the central bank can reduce the money supply to fight inflation, in which case the dots can retrograde.

The central bank rarely reduces the money supply because it usually results in economic decline.

The Money Supply and The Stock Market

Since the money supply reflects the amount of money that can be invested in the stock market, the stock market tends to track the money supply. As the money supply (M2SL) grows so too does the stock market (SPX).

The chart above shows that despite the stock market’s oscillations, over the long term, the growth rate of the stock market tends to track the growth rate of the money supply. The stock market goes up, in large part, because the money supply goes up.

The chart below is from the book Stocks for the Long Run by Jeremy Siegel, Professor of Finance at the Wharton School. The chart shows that compared to other asset classes, stocks generally perform the best over time.

Stocks generally perform the best over time because the growth rate of the stock market generally tracks the growth rate of the money supply fairly well. Investing in the stock market is therefore an efficient means of preserving wealth over the long term.

One will always be better off investing in assets that grow in price at a faster rate than the rate at which the money supply grows than investing in assets that do not. When the money supply decreases during periods of monetary tightening, as is happening right now, only assets that outperform the money supply can produce positive returns.

Knowing these facts, we can reach the following conclusion: Generally, investing in the stock market does not intrinsically build wealth, it merely efficiently preserves wealth over time against the perpetual erosion of an ever-increasing money supply. To build wealth one must invest in assets that grow in price faster than the rate at which the money supply grows .

Preserving Wealth vs. Building Wealth

As noted, to build wealth one must invest in assets that move up in price faster than the rate at which the money supply moves up.

Investing in assets that move up in price over time, but at a rate less than that which the money supply moves up over time may seem like a good investment to an investor if the investor is making money, but such investments are not typically wealth-building. These investments are merely some degree of wealth-preserving.

When the price of an investment increases over time at a rate less than the money supply, that investment causes a loss of wealth, despite giving the investor the perception of increased wealth. A loss of wealth occurs because the investor’s purchasing power is decreasing over the period of time which the investment is held.

Purchasing power is the value of a currency expressed in terms of the number of goods or services that one unit of money can buy. It can weaken over time due to inflation. To keep things simple, let’s assume that other elements of inflation, such as money velocity, remain fairly constant and that an increasing money supply is the main cause of inflation.

Let’s consider some case studies.

Case Study #1: REITs

Suppose an investor, John, invests his money in real estate investment trusts (REITs), specifically BRT Apartments Corp.

John is a smart investor and does research before investing. In his research, he sees that BRT has decent profitability and a fair valuation. He also sees that BRT has decent growth potential.

After analyzing fundamentals, John does technical analysis. He sees the below chart which shows a decades-long bull run.

(Chart has been adjusted to include dividends)

He thinks to himself: This asset is a money maker. Despite periods of corrections, price generally goes up over time.

John then buys shares of BRT as part of a long-term investment strategy. John has done his due diligence and indeed he is right that, over the long term, his investment is likely to make quite a bit of money.

However, if John invests in this asset, although he will make money, he will lose wealth or purchasing power. That’s because the Federal Reserve is increasing the money supply at a rate that is faster than John’s investment grows.

Here’s a chart of BRT adjusted for the money supply (and adjusted to include dividends).

Adjusting the price of BRT by the money supply shows a clear downtrend over time. This means that while BRT is growing in price and its investors are making money, BRT’s investors are generally losing purchasing power over time by investing in this asset because the central bank is increasing the money supply at a faster rate than the rate at which BRT's price grows.

By increasing the money supply exponentially over time, central banks trick people into believing that they are building wealth by investing when in fact most investments are, at best, some degree of wealth preserving. Only a minority of assets outperform the money supply, and usually, that outperformance is temporary.

In the era of monetary easing, during which central banks drastically increased the money supply using various monetary tools, perceived wealth skyrocketed. However, actual gains in purchasing power or improvement in living standards, as measured by increased productivity, largely did not occur.

You may be thinking that I simply chose a bad investment to demonstrate my point. While BRT is actually a great investment relative to most other assets, let's move on to the second case study: an asset that has skyrocketed in price in recent years.

You will find that even for assets that have outperformed the growth in the money supply, the period of outperformance is usually temporary.

Case Study #2: Microsoft (MSFT)

Microsoft is an example of a stock that has outperformed the growth rate of the money supply in recent years. Below is a chart of MSFT adjusted for the money supply.

The chart shows that although the growth in MSFT's price generally outperforms the growth rate of the money supply, it undergoes prolonged periods of underperformance when investors can lose wealth. This wealth loss effect cannot be fully ascertained by looking only at a chart of just MSFT's price. It only becomes fully apparent when one compares the stock's price to the money supply.

Tech stocks have generally outperformed the money supply since the Great Recession. They were excellent wealth-building investments. However, now that the central bank has begun monetary tightening, interest-rate-sensitive tech stocks are especially likely to decline. Investing in these assets while the money supply is decreasing, and while interest rates are surging, may result in loss of wealth.

Case Study #3: Utilities (XLU)

The chart below shows how well the utilities sector performed over the past two decades.

Let’s adjust the chart to the money supply. (See chart below)

You can see that XLU moved horizontally relative to the money supply, meaning that it merely preserves wealth to varying degrees but does not generally build wealth over the long term.

By including the money supply in our charts, we remove the confoundment of monetary policy and elucidate the true intrinsic growth potential of assets.

Case study #4: ARK Innovation ETF (ARKK)

Look at the chart below which shows ARK Innovation ETF (ARKK), managed by Cathie Wood, relative to the money supply.

Cathie Wood’s investment choices have actually caused a loss of wealth since the fund’s inception in 2014. You can see in the above chart that price is slightly below the center zero line, which means that wealth has been lost by those who invested in ARKK in 2014 and held continuously to the current time.

Finally, check out the below chart of SPY relative to the money supply. The entire post-Great Recession bull run in SPY was merely a recovery of the wealth lost since the Dotcom Bust, over 2 decades ago. The stock market is ominously again being resisted at this peak level.

The below chart shows that the stock market has given back much of the wealth built since the pre-Great Recession peak.

In summary, wealth-building requires investing in assets with a growth rate that is greater than the growth rate of the money supply. To accomplish this, an investor should compare an asset against the money supply before choosing to invest. Assets that continuously outperform the money supply over the long term are better investments than those that do not. One can use standard technical analysis on the ratio chart to determine candidates that are most likely to outperform the money supply.

In the face of high inflation, central banks must reduce the money supply. A decreasing money supply pulls the rug out from under the stock market. When the money supply is falling, corporate earnings and the stock market typically fall as well.

Inflation

When the COVID-19 pandemic hit, the Federal Reserve and central banks around the world increased the money supply by an unprecedented amount.

Throughout the course of its entire history up until the pandemic, the U.S. money supply moved up predictably within a log-linear regression channel, as shown in the chart below. Before the pandemic, the log-linear regression channel had an exceptionally high Pearson correlation coefficient (over 0.99), which suggests that the regression channel was reliably containing the money supply’s oscillations over time.

When the pandemic hit the global economy came to a halt. The Federal Reserve increased the money supply by a magnitude that was so astronomical that it went up vertically even when logarithmically adjusted. (See the chart below)

As a thought experiment, let’s assume that the log-linear regression channel above is valid and that data are normally distributed (typically they are not in financial markets).

If it were the case that such a sudden, astronomical increase in the money supply occurred totally randomly, the event would be a 10-sigma event (meaning 10 standard deviations away from the mean). The chance of such a rare event happening totally randomly is so small that it would occur about once every 500,000 quadrillion years. Since this is much longer than the age of the known universe, a 10-sigma event is essentially equivalent to an event that will statistically never happen. Thus, no one was prepared for the action that the Federal Reserve took.

By exploding the money supply by this extreme amount and flooding the market with so much newly created money, central banks instantly made everyone feel wealthier by giving them more money, but this action would eventually make everyone less wealthy by destroying their purchasing power as inflation ensued.

Once high inflation begins, it can be hard to stop. When inflation stays high for too long the public begins to expect more of it. The public then alters its spending and saving habits. The public also begins to demand higher wages to keep up with high inflation. This creates a negative feedback loop: When workers receive higher wages to keep up with inflation, workers can afford to pay inflated prices which keeps inflation higher for longer. As workers get paid more, keeping demand high, companies also charge more for their goods and services. Eventually, workers again demand higher wages to keep up with yet even higher prices.

At every stage of inflation, the best strategy for central banks is to downplay its true severity. This is because the easiest way to control inflation is by managing the public’s perception of it. The hard way to control inflation is to raise the cost of money – interest rates – which in turn induces economic decline, and which can cause financial crises as highly indebted consumers, companies and governments cannot afford higher interest payments.

Bonds

Government bond yields reached a record low during the COVID-19 pandemic.

The chart below shows that interest rates – or the price of money – reached their lowest level in the nearly 5,000 years for which records exist.

Since the start of 2022, interest rates have surged higher, breaking a multi-decade downtrend, and ushering the market into a new super cycle where interest rates will likely remain higher for the long term.

Interest rates and the money supply are inextricably linked. Few people know why an inverted yield curve predicts a recession. An inverted yield curve reflects the destruction of money. When the yield curve is inverted, banks can no longer profitably borrow at short term rates and lend at long term rates. Bank lending creates the most amount of money. An inverted yield curve is a market perversion that does not occur naturally but occurs only through central bank action. Inverting the yield curve is a highly obfuscated tool that central banks use to decrease the money supply. Furthermore, as we discussed before, since the stock market generally tracks the money supply, an inverted yield curve is a warning that the stock market will fall in the future. Recently, the yield curve (as measured by the 10-year minus the 2-year U.S. treasury bonds) inverted by the most on record.

Below is the chart of iShares 20+ Year Treasury Bond ETF (TLT). TLT tracks an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years.

As you can see from the chart above, which excludes the past two years, it looks like TLT has been a great investment over the past two decades. (For this chart, I included dividends. TLT pays out dividends that derive from interest payments on its bond holdings.)

Look at the chart below to see what happens when we adjust the chart for the money supply.

In the chart above we see that since its inception TLT moved horizontally relative to the money supply. What this means is that holding TLT over this period was not wealth-building, but it was good at preserving wealth. Its price moved up in perfect lockstep with the money supply.

Now, let’s see how TLT performed in the past two years.

As we see in the chart above, until 2021, an investor who held long-term U.S. government bonds would have been preserving their wealth and shielding it from the erosion of perpetual increases in money supply. However, as interest rates on government debt surged higher as central banks fight high inflation, bond investors are now seeing major wealth destruction. In a stable monetary system, investing in government bonds should preserve wealth, since if it fails to do so, no one will buy bonds to finance the government.

The situation is also concerning when we examine investment-grade corporate bonds (LQD) relative to the money supply.

This chart of investment-grade corporate bonds adjusted for the money supply shows that we should be concerned about the current state of even the most high-grade corporate bonds. We see that the value of investment-grade corporate bonds over time, inclusive of their interest payments, has fallen off a cliff relative to the rate at which the money supply is increasing. This chart suggests that those who invested in corporate bonds have recently lost a lot of wealth. Until the current trend reverses, who would want to invest in corporate bonds? This is a problem for corporate finance.

Below is a chart of high-yield corporate bonds (HYG), (which are riskier than investment-grade corporate bonds), as compared to the money supply.

You can see from the chart above that all the wealth built by investing in high-yield corporate bonds since the Great Recession has been completely wiped out.

What I am about to explain next will be somewhat dense. Look again at the two charts below which show investment-grade corporate bonds relative to the money supply and high-yield corporate bonds relative to the money supply.

Recall that bond prices move inversely to bond yields. Thus, if we flip these charts of corporate bond prices, we will get corporate bond yields relative to the money supply.

Now let’s think. These charts show that the yields on corporate bonds are moving up faster than the supply of money. Corporate bond yields reflect the amount of money that corporations must pay on their debt. In other words, the amount of money that corporations will have to pay to service their debt is moving up faster than the money supply. As noted previously, the money supply speaks to corporate earnings since corporations can only ever earn some subset of the total supply of money in the economy. Thus, if the money supply decreases, as it is now, corporate earnings will likely decrease as well. If the interest on corporate debt is moving up much faster than the money supply, and the money supply which reflects corporate earning capacity is decreasing, what might this say about the future?

Mortgages

In the chart below, I analyzed the current median single-family home price in the United States adjusted by the current average 30-year fixed-rate mortgage (as a percentage). I then compared this number to the money supply.

This chart gives us a sense of whether or not the Federal Reserve is supplying enough money to the economy to support the current expense of home ownership. As you can see, price is rapidly approaching the upper channel line (2 standard deviations above the mean), which signals that home ownership is the least affordable it has been since the early 1980s – the last time the upper channel line was reached.

If one believes that the 2 standard deviation level is restrictive, then one may conclude that there is not enough money being supplied by the Federal Reserve to sustain such high home prices as coupled with such high mortgage rates. If the Federal Reserve does not pivot back to a less tight monetary policy soon, then there is a high probability that a housing recession will occur in the coming years.

Perhaps what is more alarming is the below chart, which shows the EMA ribbon. The EMA ribbon is a collection of exponential moving averages that tend to act as support or resistance over time. When the ribbon is decisively pierced it reflects a trend change.

We can see in the above chart, that for the first time since the mid-1980s, we have pierced through the EMA ribbon. This could be a signal that a new super cycle has begun, whereby a higher interest rate environment will persist alongside high inflation for the long term, potentially making homes less affordable for the long term. This is one of many charts that seem to validate the conclusion that inflation will remain persistently high for the long term.

Commodities

In the below chart, the price of commodities is measured as a ratio to the money supply.

This chart informs us that commodity prices have broken their long-term downward trend relative to the money supply.

The chart above shows commodities as a ratio to the money supply side-by-side an inverted chart of the S&P 500 as a ratio to the money supply. It appears that the ratio of commodities to the money supply reflects an inverse relationship to the S&P 500 and the money supply. Think about what these charts may be indicating. Could they suggest that in the face of a shrinking money supply, more money will flow out of the stock market into increasingly scarce commodities? In a deglobalizing world facing conflict, climate change, and declining growth in productivity, it’s unlikely that commodity prices will return to the extremely undervalued levels seen in 2020.

One commodity, in particular, deserves its own discussion: Gold.

Gold

During a monetary crisis, the usual winner is physical gold.

Since the dawn of human civilization, gold has played an important role in the monetary system. As a scarce commodity gold is often perceived as inherently valuable.

In his 1912 book, The Theory of Money and Credit, Ludwig von Mises theorized that the value of money can be traced back ("regressed") to its value as a commodity. This has come to be known as the Regression Theorem.

Once paper money was introduced, currencies still maintained an explicit link to gold (the paper being exchangeable for gold on demand). However, the U.S. abandoned the gold standard in 1971 to curb inflation and prevent foreign nations from overburdening the system by redeeming their dollars for gold.

Currently, gold is extremely undervalued when priced in U.S. dollars. The current fair dollar-to-gold ratio is currently about $7,200 per ounce of gold. This number is produced by dividing the year-to-year increases in the money supply by the yearly production of gold in ounces.

Eventually, a monetary crisis will occur, and according to Exter’s Pyramid, investors will scramble for gold, which may force fiat currency to regress back to a gold standard to stabilize markets.

Bitcoin

In this final part, I will give a few thoughts on Bitcoin, as it relates to the money supply.

Below, you will see that when charted as a ratio to the money supply, Bitcoin formed a nearly perfect double top in 2021.

This chart could have warned traders that Bitcoin had topped in November 2021 given Bitcoin's inability to achieve a new high relative to the money supply. This shows that one can use the money supply in their charting as an additional layer of technical analysis.

In the below chart, we see how Bitcoin's market cap is moving relative to the U.S. money supply.

Bitcoin’s yearly chart is a bull flag relative to the money supply. There are very few assets outside of the cryptocurrency class that present as a bull flag relative to the money supply on their yearly chart. What might this chart reveal about Bitcoin's tendency to disrupt central banks' ability to conduct monetary policy?

The Federal Reserve’s inability to stop people from converting dollars into Bitcoin to store wealth is a problem that will likely result in Bitcoin and other forms of decentralized finance coming under the greater scrutiny of the U.S. federal government. In the future, I plan to write a post on investing in cryptocurrency. In that post, I will explore Bitcoin and blockchain technology in much greater depth.

Final thoughts

To build wealth one must invest in assets that grow in price faster than the money supply erodes purchasing power. To become a successful investor, one must revolutionize one’s perception of money and understand that cash – or central bank notes – are worth nothing more than the belief that the government will persist and remain solvent. To build wealth an investor’s goal should not be to make as much cash as possible, rather an investor’s goal should be to convert cash into assets that grow faster than the money supply and to accumulate as much of such assets as possible.

#BOND crisis to fuel monetary expansion The Fed is damned by inflation if they print, damned by bank runs if they dont print. And with recession on the way, history shows we could plumb to new lows if the Fed only prints enough to backstop banks and pensions. Early 2000s and early 1930s were two such cases where the Fed aggressively lowered rates for well over 18 months but markets continued to trend lower anyway. But 2008 ushered in central bank quantitative easing, so with QE at the Fed's disposal, it is more likely the growth of M2 will accelerate which will keep inflation stubbornly high if not higher.

A new factor that wasn't present before is that we have increasing M2 from China and Japan which has been a large driver of the market bounce we've seen in stocks and crypto since the start of the year.

The 2-yr and 10-yr rates are heading lower in a hurry. CME Fed futures currently predicts one more 25 bps hike to a terminal rate of 500-525 then three consecutive drops of 25 bps. Higher inflation would become the standard as the Fed would be forced to accept a higher inflation target well above 2% which Ray Dalio had predicted in one of his published pieces.

SPX Monthly - Adjusted for Real InflationThe assumptions are that money printing is real inflation as is often stated by Peter Schiff and M2 money supply is a good measure of the amount of money that has been printed into circulation. This data goes back to 1959 and makes the dot com bubble in 2000 look much more exuberant than current price levels. There is room for downside from here as the 1966 to 1974 decline and 2008 crash suggest.

The chart also suggests that there has been no real stock market growth since the 1960s. It should be noted that the stock market was a good place to keep capital as an inflation hedge and a source of dividends and that cash kept over this time period would have lost pretty close to all of its value while earning no dividends. It demonstrates how important it is to not let cash sit in a bank and collect dust and to be financially literate. The central bank system punishes savers and forces participation in markets.

The S&P can see a 75% increase or a 68% decrease from here and still be within its historical range. I’m leaning more bullish right now but these are very uncertain times, with the Fed having raised the fed funds rate to 4.75% and the stock market having declined for all of 2022. Nothing would surprise me but this chart helps to show that maybe the market isn’t as ridiculously priced as it looks when looking at the S&P 500 chart alone.

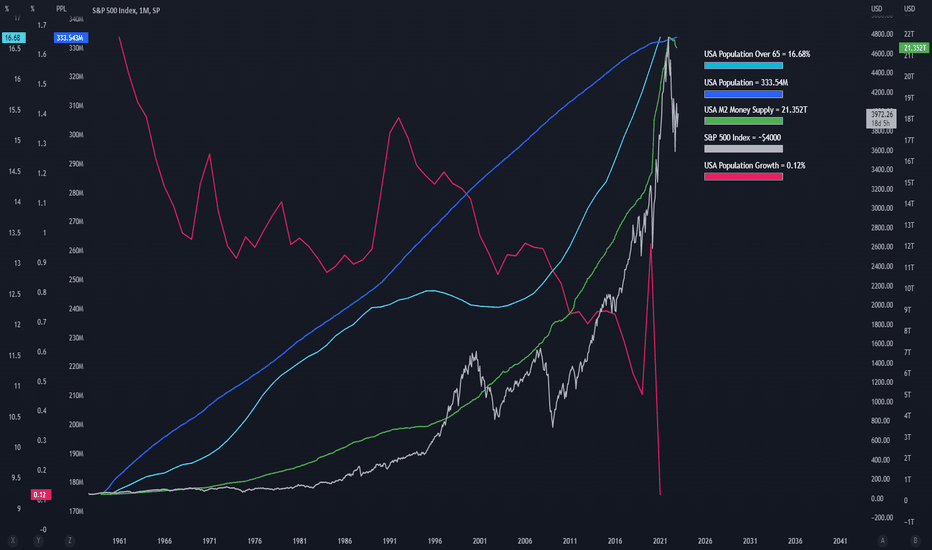

The M2 Money Supply, Population Statistics and The S&P 500This is the first time since the M2 Money supply has been tracked that there has been a contraction.

The population over 65 is increasing at an alarming rate.

Population growth is decreasing at an alarming rate.

This seemingly indicates that there is going to be a shortage of workers and consumers in the US market.

What does this mean for the constituents of the S&P 500 Index?

In my opinion, these are unprecedented times.

ROARING 20's. WHY ANOTHER BULL MARKET is upon us.Market shocks and drawdowns are designed to shake you out.

Charts are pointing to continual asset inflation this decade.

#DOWJONES to $64,000 was a general target I had in mind a few years ago.

NOW we have confirmation this could indeed play out over the coming 5-7 years

#FTSE100 to break 10,000 and indeed we have a target of over 12,000

#DAX to $25,000

again seemingly absurd numbers

but not so absurd in a historical context.

S&P 500 / M2 Money Stock, George Tritch's CycleNow we have a period of high inflation that, in my opinion, will continue for some time. Even if it falls (as the M2 money stock decline points out), we may have a second reversal wave of inflation during the revival after the current bear market. For this reason, a lot of people are waiting for a pivot, which, according to them, will mark the low. This statement is wrong. After pivots, we usually observe the biggest drops on the S&P 500. Similarly, with yield curves - they are inverted, which is a very strong bearish signal. At this point, I invite you to look at the related ideas about the 2008 analogy.

The above chart shows the value of the S&P 500 index divided by the M2 Money Stock, which in general presents the situation on the money market - the amount of money in the economy. So we can see how the share prices relate to it. In addition, I added George Tritch's cycle (arrows), which has been assigned the most lows and highs in the past. Shaded arrows indicate less important turning points for this chart. The timing is more important than my projected path; it is only for visualization. The bottom of the current bear market should be in 2023. The next bull market with a high around 2026 should be less generous than the last. The major low of the actual cycle should be around 2032.

And that's all. Enjoy.

Russell 2000 / M2 Money Supply: Discounted to 500 MVA & @support"Russell 2000 / M2 Money Supply" ratio

1) It moves in a horizental trend in the long-term.

2) %20 discounted compared to 500 days MVA.

3) Nearly touched a major long-term horizental support.

Of course it can also move more downwards if the crisis/war deepens but we can say that the probability of upwards move is more likely.

First target: 0.095-0.100