Macau

all i do is WYNN baby!!!!!!!!!only champions are playing wynn right now.. this has 105 all over it.. buy now before u buy some else bags

no one is telling you to buy but me. because im a far superios intelligent being , yes even ur boss at goldman sachs or what ever bank ur currently emplyed

this takes out 86 non stop till 105

Wynn Macau Ltd HK 1128 Casino Top Pick Testing RangeWynn Macau Ltd

HKG: 1128

Fundamentals:

Since 2018. Wynn Macau is one of the one casino in Macau to capture most of high-roller gambling activity, consistently leading Macau on the VIP drop. Galaxy and Wynn contributed to close to 45% to the VIP volume.

Why VIP Volume? Investors place heavier emphasis on main revenue driver, revenue numbers, which are mostly generated from VIP segment.

Macau long term growth

Wynn recent upgrade to BUY RATING at Jefferies is giving it a boost with PT 23.80 after Goldman Sachs upgrade the stock in early April

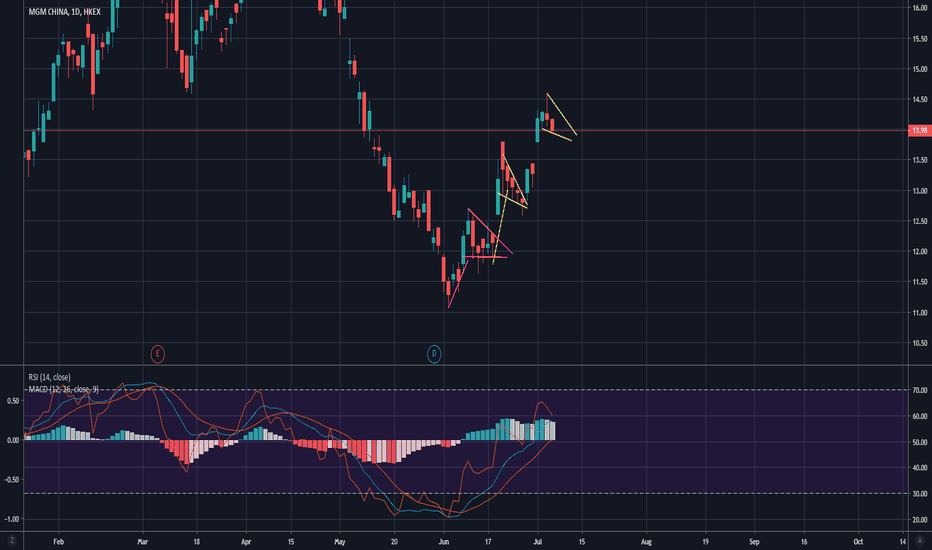

Technicals:

Just Friday, 12 Apr, 50 DMA rose above 200 DMA and 50 EMA crossed 100 EMA.

Golden cross shows no sign of reversing for now while a long flag formation is formed.

Resistance : 22.0

Support : 20.70

Emperor Entertainment Hotel: A Weighted CoinI believe Emperor Entertainment Hotel ( 296 HK ) is a weighted coin. www.slideshare.net If we focus on how insiders have actually behaved, they’ve treated investors well. The market concerns seem overblown. That discount has been compounded recently by the bear market in China and Hong Kong, and Macau gaming stocks have declined more than the indices. Even if Macau gaming activity declines and Emperor’s assets underperform competitors, unless insiders behave unfairly, it’s hard to find downside in the stock and the upside is multiples of the current price.

$MLCO Melco Resorts - Weekly Bullish Hammer$MLCO Melco Resorts - forming a bullish hammer candlestick on the weekly chart. Another gaming stock possibly finding a bottom at a long term support level ($16.00) with RSI in oversold territory. Earnings expected early November - assuming a positive report, targeting $24 by January-February.

Note: Informational analysis, not investment advice.