SOXL - BTFD Thank You CoronavirusMy custom "Fast MACD" (Yellow Line) line crossed above its two signal lines. I think the regular MACD (Aqua Line)crosses above its signal line soon as well. At the time of that cross, we should be seeing some recovery from this coronavirus in the markets. Semiconductor companies still have incredibly strong growth.

Moving Average Convergence / Divergence (MACD)

MITH/BTC Buy opportunity. more than 32% profit possible.Hi all traders.

Warning: it is just a TA. always do your own research.

All targets specified on the chart.

Inshallah we will reach all targets in 1 month.

Push Like button if you are satisfied with this idea.

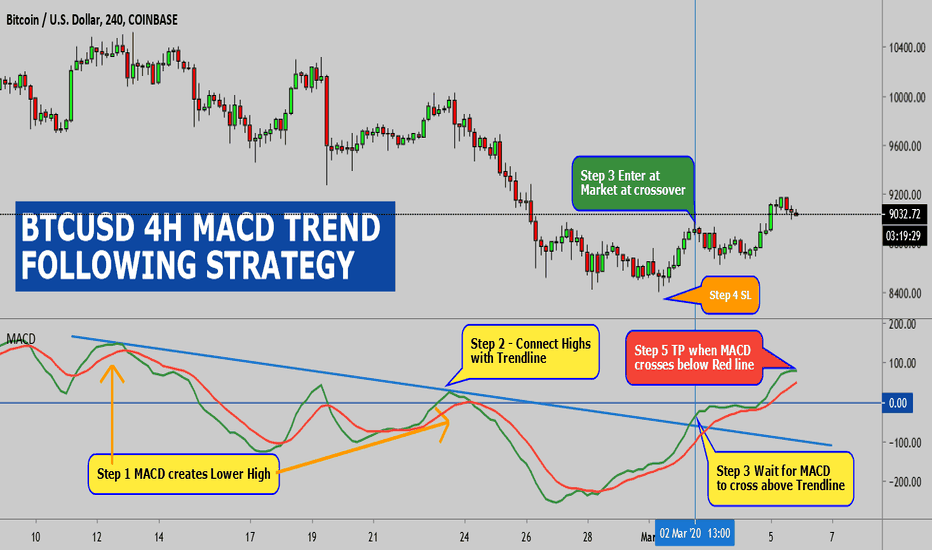

BTCUSD 4H MACD TREND FOLLOWING STRATEGY(Rules for A Buy Trade)

Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point.

The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a chart and must be higher than all previous swing high points. While a lower high happens when the swing point is lower than the previous swing high point.

Step #2: Connect the MACD line swing points that you have identified in Step #1 with a trendline.

At this point, we really ignored the MACD histogram because much of the information contained by the histogram is already showing up by the moving averages. Look at the price action now and compare it to our MACD trendline we drew early. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear.

But, at this point, we’re still not done with the MACD indicator, which brings us to the critical part of our MACD Trend Following Strategy.

Step #3: Wait for the MACD line to break above the trendline. (Entry at the market price as soon as the MACD line breaks above).

When the MACD line (the blue line) crosses the signal line (the orange line) it’s an early signal that a bullish trend might start. However, if trading would be that easy we would all be millionaires, right? And that’s the reason why our MACD Trend Following Strategy is so unique. We’re not only waiting for the MACD moving averages to cross over but we also have our other criteria for the price action to break aka the trend line we drew early.

This is a clever way to filter out the false MACD signals, but you have to be equipped with the right mindset and have patience until all the piece of the puzzle come together. If you were to trade just based on the MACD crossover over time you’ll lose money because that’s not a reliable strategy. But if you use the MACD indicator along with other criteria such what this strategy tells you to do, you will find great trade entries on a consistent basis.

Step #4: Use Protective Stop Loss Order. (Place the SL below the most recent swing low).

Now, that you already know how to enter a trade at this point you have to learn how to manage risk and where to place the SL. After all, a trader is basically a risk manager.

You want to place your stop loss below the most recent low, like in the figure below. But make sure you add a buffer of 5-10 pips away from the low, to protect yourself from possible false breakouts.

Basically, a good entry price means a smaller stop loss and ultimately it means you’ll lose a lot less comparing it with the profit potential, so a positive risk to reward ratio.

Step #5: Take Profit when the MACD crossover happens in the opposite direction of our entry.

Knowing when to take profit is as important as knowing when to enter a trade. However, we want to make sure we don’t use the same trading technique as for our entry order. When the MACD line (the blue line) produces signal line crossovers (the orange line) we want to close the position and take full profits.

Before taking profits, it’s important to wait for the candle close – either the 4h or the daily candle – depending on the time frame you trade so you make sure the MACD crossover actually happens.

Note** The above was an example of a buy trade using the MACD Trend Following Strategy. Use the exact same rules – but in reverse – for a sell trade.

Bearish Divergence| Rising Wedge| Volume Climax| .382 Fibonacci Hello Traders,

Today’s chart update will be on the immediate trend of BTC where we have bearish divergences forming at key structural resistance in a rising wedge formation, which serves as a bearish pattern.

Points to consider,

- Immediate trend bullish

- Local support at $9470.00

- Structural resistance being tested

- Stochastics in upper regions

- RSI putting in higher lows

- Volume climax evident

BTC has been putting in clear higher lows with evident S/R flips, if current local support holds; this will be another S/R flip confirmation. Structural resistance is a key level, a break will increase the trends parabola as this will put in a macro higher high.

The stochastics is currently in the upper regions, can stay trading here for an extended period of time, however lots of stored momentum to the downside. RSI is clearly diverging from price by putting in lower highs, putting more emphasis on the bearish divergence.

BTC has a clear volume climax bar, signalling a local top may just be in as buyers become exhausted. If volume however continues to creep up, this will increase BTC’s probability of continuing this current bullish immediate trend.

Overall, in my opinion, BTC needs to remain above local support in this formation for a bullish bias. A break of local support will mean breaking outs of the rising wedge which serves as a bearish pattern. The .382 Fibonacci will then be the likely target as this area currently has an open GAP on the futures chart.

What are your thoughts?

Please leave a like and comment,

And remember,

“The expectation that you bring with you in trading is often the greatest obstacle you will encounter.”

― Yvan Byeajee

BTC Rising Wedge?! Look out Below!!!Well once again everyone is bullish just like we were last time we hit this resistance block above the 200 day MA in beginning of November. I said it was Bearish then and I'm saying it again.

- Very critical resistance block

- Rising wedge

- 5 EW count

- Hidden Bearish Diveregence on RSI macro, bearish divergence past few days.

-MACD Bearish

-Still no volume on daily after breaking through 200 MA

Big secret - when to buy & sell bitcoin (you decide)Using USDCNY (Caveat- LINE BREAK CHART & small sample size) See what happens when MACD signal line drops into negative territory. Significant support line for bitcoin price. See Oil and Gold price effect on support line. Will coronavirus shut down bitcoin mining in China? What will happen when Chinese market reopen. Is bitcoin about to explode? Bahhhhhh........ Hmm.............. NOT ADVICE. DYOR.

EURUSD 30M LONG TRADEWHY I TOOK THIS LONG TRADE

1. Divergence between Price and MACD Histogram

2. MACD holding at STOCHASTIC 20 level

3. Price retraced to 38.2% Fib then made new low

4. Price held the -23.6% Fib

5. Price held previous support level

6. Morning Star reversal candle pattern

7. Entry next candle open after #6 pattern

8. SL below swing low

The REAL dealHello traders, Crypto Crusader here with a small cap analysis.

This analysis is on TheRealReal ticker "REAL"

The fairly recent IPO in June of this year received a listing price of around $30, at the time of this writing, we are trading around the $17 mark. Given how small of a company they still are, there is large growth potential moving forward for a tentative medium term hold (1-3 months). There hasn't been enough time to properly print weekly, along with monthly candles, however, it's important to note that on the weekly time-frame RSI levels are oversold and sit around 33 (the magical oversold RSI #). Regarding daily candles for RSI, we are beginning to pick up momentum and are headed in a neutral direction to 50 given this indicator is a derivative of sorts. A 2 month bottom in RSI when "REAL" hit ~$13 is the parallel I'm using for the 2 month RSI bottom we currently are witnessing. To pair with the bottoming of RSI previously, and currently, we have the MACD VSI indicator. You can see the inflection points along with the convergence picking up pace. The MACD VSI is mirroring what the RSI is representing regarding momentum in price action. To add a tertiary layer to this analysis we have decreasing selling volume, while buying volume remains at a stable level. I believe within my above mentioned time-frame a sell target of ~~$22, while subsequently getting a double bottom fake-out that dies off, and or, a fake-out that would play down to ~~$13 levels, making this trade a massive loser opposed to a fairly decent winner at 40% gain +- 5%.

As I mentioned earlier, this company hardly even has a 2 billion dollar market cap and is extremely small in the retail space and in comparison to their competitors alike, however, their disruption in this market could prove favorable given their system to consignment.

Hope everyone is enjoying an early holiday and spending some time away from their charts for; family, good company, food, and personal hobbies/endeavors.

May the trades me with you,

Crypto Crusader

Bitcoin facing the abyss - need a daily close above....OMGNOT ADVICE DYOR. Caveat - small sample size.

Here's the construction. You need BB %B indicator. Then do MACD on that indicator. Mark all instances signal line turns positive (yellow). Mark (white) first instance histogram turns red. If both these cross month end then mark that month end (blue). Box both months in white. Bulls need to push daily close above $7933.4. Come on! If not will first lines of defence hold. NOT ADVICE. DYOR.

BTCUSD predictions using FUSIONGAPS and PRISM oscillatorsPlease see text in the chart.

Short-term looking bullish (over the weekend); but more likely to continue to trade relatively sideways through December with a slight bearish bias -- overall range-bounded between the two white solid lines .

Long-term still remains bearish (with possibility of falling all the way down to 5200 USD); unless BTC is able to break above 10k USD and hold.