3 White Soldiers Marching to their GravesHello All,

Bitcoin is seeing some very bearish signs on the weekly chart. We had just seen 3 white soldiers pattern end with an ATH blow off top and grave stone doji. Historically this has marked the end of a run up.

Will it be the same this time?

In my opinion, I believe so. We are seeing a lot of bearish divergence on MACD/RSI. As well as bearish price action from 30k to 67k. Yes, we made an ATH but is this run sustainable for longer term growth? I believe not.

If 53k does not hold, our macro trend is at risk.

As always, be patient, use risk management, and good luck trading.

Macdivergence

WAVESUSDT Divergence and Cup and Handle PatternIf you wanna scan candlestick patterns, harmonic patterns , chart patterns, divergences, indicators automatically visit the our website cryptopy.net

ETH at Risk of dropping, RSI Divergence !!!Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

The ETH token is at risk of dropping back to the 3000$ level in the next period of time as the chart showed 2 divergences between the market and the RSI and MACD.

when the market has turned Bullish after the Head and Shoulders pattern that appeared on the chart, people took comfort that the Token price didn't drop but today we see that multiple signs are giving Bearish Signals that could indicate that the value of Eth could drop soon.

Possible Scenarios for the market :

Scenario 1 :

The market is trading at 3608.67 right now under a good Bullish movement that broke the first resistance line located at 3539.55. This move will probably push the ETH price to the Main Resistance zone where ETH might have a big problem breaking out from.

If the Bulls were to gather force and breakout that zone then we will see a push that could bring the ETH back to the $4000 level.

Scenario 2 :

A big divergence was found between the Market and different indicators that show a good possibility for a reversal soon and it will start probably near the first resistance level located at 3539.55, If the reversal turns to be True then a Bearish trend will lead the ETH price down and the first stop will be the support level located at 3349.57 and then the support at 3159.59 where we might see a big battle between the Bulls and Bears over control of the market.

Technical indicators show :

1) The market is above the 5 10 20 50 100 and 200 MA and EMA (Strong Bullish Sign)

2) The RSI is at 58.74 showing Great strength in the market but a negative divergence was found which indicates a reversal in the current trend.

3) The MACD is above the 0 line indicating a Bullish state in the market with a positive crossover between the MACD line and the Signal line, A divergence has been found between the indicator and the market

Daily Support & Resistance points :

support Resistance

1) 3349.57 1) 3539.55

2) 3284.42 2) 3664.38

3) 3159.59 3) 3729.53

Weekly Support & Resistance points :

support Resistance

1) 3341.66 1) 3737.47

2) 3109.09 2) 3900.71

3) 2945.85 3) 4133.28

Fundamental point of view :

Ethereum is certainly making strides towards the Ethereum 2.0 completion. Just a few days ago, the project announced the arrival of its Ethereum Altair upgrade. To specify, the upgrade will be taking place sometime this month.

The purpose of Ethereum 2.0’s launch is to fully deploy a Proof-of-Stake consensus onto its platform. This model should eliminate the platform’s long-striving issues of high gas fees, congestion, and limited scalability.

"It seems like Ethereum is losing Steam. As a result, companies are looking into platforms like Cardano , which is used to build dApps, and Solana, which has seen a nearly 4,800% growth since September 2020." According to FXempire

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

EM possible switch from bearish to bullish from MACD and RSI?EM possible switch from bearish to bullish from MACD and RSI upticks.

Red verticle lines placed on 1D lower lows.

Green verticle lines placed on 1D lower highs.

MACD is possible to cross over into positive territory.

PT from multiple groups of ~$13USD.

NASDAQ:EM

Current IXIC opinion and forecastsThe SPY's daily graph isn't looking as good with a few indicators that look very bearish on the daily graph. The NASDAQ on the other hand appears to have rallied out of its slump from the beginning of the day, providing a breath of relief for bullish investors, however, this trend has not been confirmed yet and suggests merely a temporary shift before continuation of the larger trend.

For the current market environment, I won't be relying too much on the RSI as it provides too many signals and that becomes unreliable if you want to swing trade with minimal trades. Although using indicators the shorter time frames are a bit more unclear and speculative, what is certain is in the longer time frames, especially the monthly graph for both NASDAQ and S&P which both suggests that the markets have reached significantly overbought levels since the COVID declines; this may indicate that the markets are more than ready for a good correction to reset before more upside momentum can be made. In the daily graphs, I can currently see a bearish divergence in the peaks of the price action, in the troughs nothing has been confirmed yet as this will build itself in the next few days; this can be supported by decreasing volume over time (this I had to source from QQQ since the index's do not have volume) which indicates there are fewer participants in the uptrend. Thus, allowing me to assert some bearish sentiment for this trend as many are no longer exposing themselves to higher prices.

With all that being said there isn't too much new relevant information to analyze but the most recent trading sessions help us gauge that investors are not ready to give up their optimistic perspective of the financial markets as there is yet not much pessimistic news to allow that sentiment to change. However, with important events lined up for the next few periods that may change in that time. Until then very I am neutral due to the fact that everything can change at a moment's notice. I AM leaning more towards the downside as valuations peaked and investor perspectives grow more irrational.

Have fun!

Henry

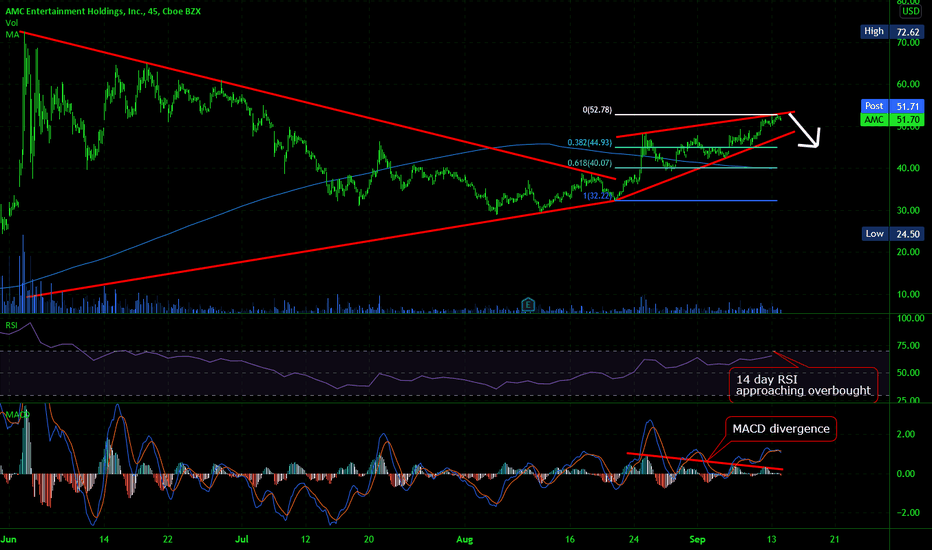

$AMC rising wedge and MACD divergenceSince $AMC broke out of the huge wedge on the 20th of Aug, it has been forming a rising wedge approaching the low 50s. However, you can see the 14-day RSI is approaching overbought territory and there is a divergence in the MACD. This is a time to take profit or stock up on more once it reaches 45USD (0.382 fib level)

Bitcoins Needs To Close AboveBitcoins weekly candle will be coming to a close in less than 24 hours. There does seem to be a decrease in volume in the last couple weeks. Also there is a clear divergence with MACD and Price. If Bitcoin does not hold this support level I will be looking to take some profits. Keep a close eye on that level.

The $BAT Man Gaining Strength To Rise Again On CryptocityHere is my idea , first of all the the major element is $BAT breaks its daily fibo retracement 0.382 and supported some how at this level, not only it was the top trend on social medias yesterday, in otherhand it gains the enough momentum to break the RSI Daily downtrend in a blink ! ;)

In 4H timeframe , BAT actually printed the cup pattern and it has a lotf of profit to come az its try to take back its previous target on 1.6920 and we had little divergence between MACD Signal Line and Price changes some how we have golden cross also is 2H timeframe...

So I guess This is what you should keep eyes on it !

Trade Safe , Cheers !

BTC Short to the Bull Market support bands (20/21W EMA)This idea is to short BTC as we have a divergence in BTC raising price and the MACD and RSI.

Although I am bullish long term, I believe we may fall to the bull market support bands. Once we reach the support bands it will be key to see if BTC holds this before estimating future price action.

Take care yall.

XSPA, bottom of range play on micro cap stock.*Not financial, trade, nor dating advice.

This is a snipe of an asset that has been severely impacted by Covid lockdowns and, in so saying, could be an extremely volatile play if a variant makes headway through Summer and Fall. I don't have a prediction on when this trade may play out, but I'm getting very interested what I see on the chart.

It's in a great location, at least for me, bottoms of ranges between 68.1 and 88.6 x2 off of fibs taken from the past 2 most significant outbreaks.

Price action has been trending upward after break of the trend line from a pop in the spring. Previous to that it saw a high in June 2020, and a 50% play to $4.83 is not out of reach should this asset pick up more buy volume, and absent any spooks to the market. It has multiple W market structure in price action and in the internal indicators. Buy volume is gradually getting greater but still needs to see a more significant push. Maybe on earnings news?

The moving averages are converging and starting to show upward movement. I'll believe it is bull when the 13ema crosses the 30sma. Right now the price is sandwiched between the 30sma and 200 sma, but still looks good imo.

There are two bullish MACD divergences, both confirmed.

MA's pointing up and have crossed the obv and the modified Williams%R.

You can view the fundamentals here. Nothing to write home to mom about, but, more importantly, nothing terribly alarming stands out to me.

I got a double after an entry in Fall 20 and have free stock after a trade in spring 2021. I'me slowly accumulating, and I'm in the trade without stops. Only a small percentage of my investable capital. I'll risk it going to 0. I'm looking to sell half on a double to get my original investment back and let the rest ride.

I'm a beginning trader and like to incorporate technical and fundamental analysis into my trades. I also like when others take the time to share their thoughtful analysis, critique and comment.

I received my discretionary trading education at TRi, School for Trader Development.

Thanks for stopping by.

The MACD explained ! All you need to know about it Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

In this video, I am gonna explain what is the MACD and how to use it and how to identify buy and sell signals using this indicator.

So what is the MACD, The MACD is a trend-following momentum indicator (so a momentum indicator is a technical analysis tool that allows us to determine the strength or weakness of a stock's price movement )

There are a lot of people that use the MACD when they analyze charts because it's very simple and it's very good but I always say never just use 1 indicator to analyze a chart, always try to use at least 3 this way u can make sure that the result is more accurate and the market most likely to move as u analyzed.

let's look at the theory behind the MACD before looking at a real-life example and how to identify buy and sell signals using this indicator :

The typical settings for the MACD are 12 26 and 9.

The MACD consist of 4 parts :

1) Zero line

2) MACD line

3) Signal line

4) Histogram

We start off with our zero line and this is where the MACD line and the signal line move around and basically so if the MACD is trading above the 0 line then it's bullish and if it's under then it's bearish.

Then we have the MACD line and it comes from the 12 26 section, and it gets calculated by subtracting the 26 EMA of the price out of the 12 day EMA of the price.

And after that we have a second line that gets plotted from the 9 section so basically, it’s a moving average for the MACD line so it tries to smooth the MACD line and give us some signals and it's called the signal line.(it's called a signal line because that's where we get our buy and sell signals from)

So on top of that, we have another part in this indicator which is called the histogram. So this histogram job is to show how close these lines will crossover, so when the distance between the MACD line and the signal line is far the histogram gets bigger and bigger.

So how do we use this indicator :

1) Crossovers between the MACD line and the Signal line.

* When the MACD line crosses above the Signal line then its a buy signal (Bullish Crossover)

* When the MACD line crosses below the Signal line then its a sell signal (Bearish Crossover)

2) The Histogram .

A lot of people use histograms as a way to predict when a reversal will occur.

We know that the MACD is a momentum indicator so it can show us when sell pressure is low. And that means it might be a good time to buy. And It can tell you when your long position is about to run out of steam and when you should exit.

3) Divergences between the MACD and the Market Price .

A Divergence means that the indicator is not moving in sync with the Market Price and a Reversal could happen (Note that Reversal trading is risky so please calculate your risks before using this Strategy)

always remember that :

Bullish divergence is when the Market price is going down but the MACD is going up.

Bearish divergence is when the Market Price is going up but the MACD is going down.

I hope I’ve made the MACD easy for you to understand and please ask if you have any questions .

Hit that like if you found this helpful and check out my other video about the Moving Average, Stochastic oscillator, The Dow Jones Theory, How To Trade Breakouts and The RSI. links will be bellow

Will Hit $125 This WeekNo doubt in my mind that Discover will hit $125 this week and go beyond based on trend analysis & my favorite indicators.

In this chart you can see higher highs and higher lows.

Have questions? Comment below

Crypto Crocodile THIS IS MY FIRST IDEA, CONSTRUCTIVE FEEDBACK IS IMMENSELY APPRECIATED This is a simple combination of 4 indicators (MACD + SMA50 + SMA200 + WILLIAMS ALLIGATOR) that I use in combination with the hCrypto Fear and Greed index to predict the long term sentiment of the market in relation to BTC. I call this model the "crocodile" in reference to the Bill Williams Alligator model. Using divergence in MACD, SMA cross patterns, and alligator movement has worked for me (so far) to see long term trends and look past the short term price action caused by FOMO and panic selling. I may not even be the first person to use this indicator combination due to the simplicity of it, but in combination with the fear and greed index it can be a powerful tool for traders to see the difference between a long term downward trend and a near term panic dump. I am currently trying to update the model by adding data from the Fear & Greed Index to my chart, but this idea is still in its infancy. I call it the "crypto super croc". Please let me know your thoughts on this as well. Trading view does not allow new publishers to post external links, but a quick google search for " BTC FEAR AND GREED" will lead you to the data I am referencing. I am also including the address for you to copy/paste below. LMK what you think, even if you think this is garbage. I appreciate all feedback.

I am new to this platform and this is my first published idea, so please let me know what I can do better to express my ideas. Thanks!

<> alternative.me/crypto/fear-and-greed-index <>

Told you about it ! Apple 1W analysis Hello everyone , as we all know the market action discounts everything :)

2 weeks ago i posted a video on Tradingview talking about the price movement for the Apple inc. stock

and now we see the market moving just like i predicted that its gonna move, the price moved up from the range of 132 to the 143 area in less then 2 weeks , i used different indicators that was provided on Tradingview to analyze the market price .

lets see how the market is doing right now and apply indicators to try to understand the movement of the Apple stock and see how its most likely to move in the next few weeks, the Market price seems to be moving in an ascended triangle and indicators telling us :

1_ price of the stock is trending above the Moving average (bullish sign)

2_RSI sitting at 69.71 showing great movement and almost reaching overbought area

3_MACD creating a bullish divergence on the 28/jun

4_Stochastic Oscillator both lines are in overbought area where %K reaching 98.59 and %D at 92.22 creating a buy signal for us ( i talked about the Stochasitc oscillator and explained how to use it in a video i posted on Tradingview

the Apple stock in a very good bullish uptrend with no signs of a reversal yet, with all the indicators and patterns showing us the bullish movement of the stock .

Fundamental analysis :

Apple shares closed today up 1.8% to $144.57, above January's record closing price of $143.16.

Apple (NASDAQ:AAPL) shares are currently up 1.4% to $144.07, continuing a seven-day winning streak and inching closer to the $145.09 record intraday high the stock reached in January.

If Apple reaches a new high, it's in good Big Tech company. Yesterday, shares of Amazon and Microsoft closed at new records after the Pentagon cancelled the JEDI cloud contract awarded to Microsoft and announced plans for a new, multi-vendor contract.

The Wall Street Journal named Apple among the potential buyers for Reese Witherspoon's Hello Sunshine, which is exploring its options that include a $1B sale.

Make sure to Follow and Like for more content

This is my personal opinion and not financial advice.

If you have any questions please ask

Thank you for reading.

XAG/USD 1W analysis 07/07/21Hello everyone , as we all know the market action discounts everything :) XAG/USD showing weakness this week with a few signs for a bearish movement in the next few weeks , market price is moving bellow the Moving average ( bearish sign ) and both the STOCH and the MACD giving out sell signals . but there are no signs of a Big bearish reversal yet the market is still in a good area .

Fundamental analysis :

On the long-term outlook, XAGUSD is bullish . Silver was under the bears’ control for many weeks. The bearish momentum pushed the pair to bottom at $25 support level on June 17. The bears lose momentum and could not break down the mentioned level. The bulls have been struggling to break up the resistance level of $26. On July 02, the bulls dominate the market and they were struggling to break up the $26 resistance level .

The Silver price has penetrates the 9 periods EMA upside and 21 periods EMA is the next target which indicate that bulls are trying to dominate the silver market. The weekly market closed at the $26 price level, it seems the bulls’ pressure is increasing and the bulls are trying to reverse the price. An increase in the bulls’ momentum may increase the price to break the resistance level at $26, which may further incline to $27 and $28 price level. Failure to break up the resistance level of $26, the price may continue a bearish trend to $25, $24 and $23 price levels.

Support is seen at $23.78 initially, then more importantly at $22.26/21.68, which we look to continue to hold. Indeed, below $21.68 would mark a top to instead throw a serious question mark over the longer-term base

Make sure to Follow and Like for more content

This is my personal opinion and not financial advice.

If you have any questions please ask

Thank you for reading.

DJI 1D analysis 02/07/21Hello everyone , as we all know the market action discounts everything :) The market seems to continue its movement up with no signs of a reversal yet , all the patterns and indicators that we used on that chart are telling us the market is still not stopping here , MACD creating a bullish positive divergence, market price moving above the MA and the STOCH is in an overbought state .

Fundamental analysis :

The Dow Jones Industrial Average finished up over 130 points, or 0.4%, to end at around 34,633, marking its fourth-highest close in history as it inches toward eclipsing its May 7 all-time closing high at 34,777.76.

Traders think U.S. payrolls on Friday could jolt markets from a slumber that has locked currencies in some of their tightest trading ranges for decades. Initial claims for state unemployment benefits dropped 51,000 to a seasonally adjusted 364,000 for the week ended June 26, the Labor Department said on Thursday, although they are an unreliable guide to Friday's broader indicators.

Make sure to Follow and Like for more content

If you have any questions please ask

Thank you for reading.

The MEME LivesDogecoin (DOGE) developed a significant bullish divergence signal with the MACD indicator. The bullish MACD divergence signals a potential reversal in the price of Dogecoin. This is a strong bullish reversal signal and is supported by multiple other technical factors that can revive DOGE.

MACD Bullish Divergence

On the daily chart, DOGE's price has made a lower low, but the MACD histogram has printed a higher low. This is a sign that the downside momentum is fading. The MACD divergence puts some doubts on the bearish side and may signal a possible change in the trend direction.

200-Day Moving Average

The 200-day moving average aligns perfectly with the current swing low of $0.16 to provide further support for the bullish case scenario. We know that all prices above the 200-day moving average are considered bullish.

The 200-day moving average also has confluence with the $0.15 support level, adding more weight to this price zone.

Looking Ahead: On the upside, the bulls need to overcome the big psychological number $0.30, which is a key resistance level. At the same time, the MACD histogram along with the MACD's moving average need to cross above the zero levels to provide the needed bullish momentum for DOGE.

ENTX Stock Analysis 1W 24/06/21Hello everyone , as we all know the market action discounts everything :) We can tell from all the signs and indicators that the ENTX stock is moving in a strong uptrend , all the data that we gathered and saw on the chart looks makes the market is in a great place to buy .

I am seeing 2 ways the market is possibly moving in the next few weeks :

1_The market is gonna continue to go up and could reach new highs such as 8.6

2_The market is gonna be moving in the boundaries of the ascending triangle then breaking the resistance line at 7 and keeps going up

Until we have a bearish reversal *****

Fundamental analysis :

Entera Bio Ltd.'s (ENTX) share price surged 44.8% to close at $6.50 on June 23.

Entera Bio is a developer of orally delivered large molecule and biologic therapeutics. The company continues to witness developments and improvements in drug research in 2021, winning the confidence of its investors and seeing its share price rise to a new high.

With a market capital of 154.5 million, the share price of Entera Bio has almost tripled recently. It has skyrocketed 507.5% and 233.3% over the past six months and a year, respectively.

On June 23, the company announced its Phase 2 progress related to the treatment of osteoporosis, a bone disease.

Entera Bio CEO Spiros Jamas said “We are looking forward to an end of Phase 2 meeting with the FDA. More detailed results will also be presented in a future scientific conference and publications. The company will evaluate potential additional osteoporosis market opportunities specifically related to increases in hip BMD.”

Per a study from Reportlinker.com, the global osteoporosis drugs market is projected to grow to $20.17 billion by 2026. This represents a CAGR of 6.83% from 2020 through 2026.

Make sure to Follow and Like for more content

If you have any questions please ask

Thank you for reading.