High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Futures.

There are 2 distinctive dotted lines labelled as

1. AI Day Resistance

2. AI Day Support

These 2 signals are generated by machine learning AI robots as a high probability trade setup where to long or short.

If price action was above the AI Day resistance line AND price closed above Pivot Point R1 line, the ideas is to long and take profit at Pivot R2 line

OR

If price action was below the AI Day support line AND price closed below Pivot Point S1 line, the ideas is to short and take profit at Pivot S2 line

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

Machinelearning

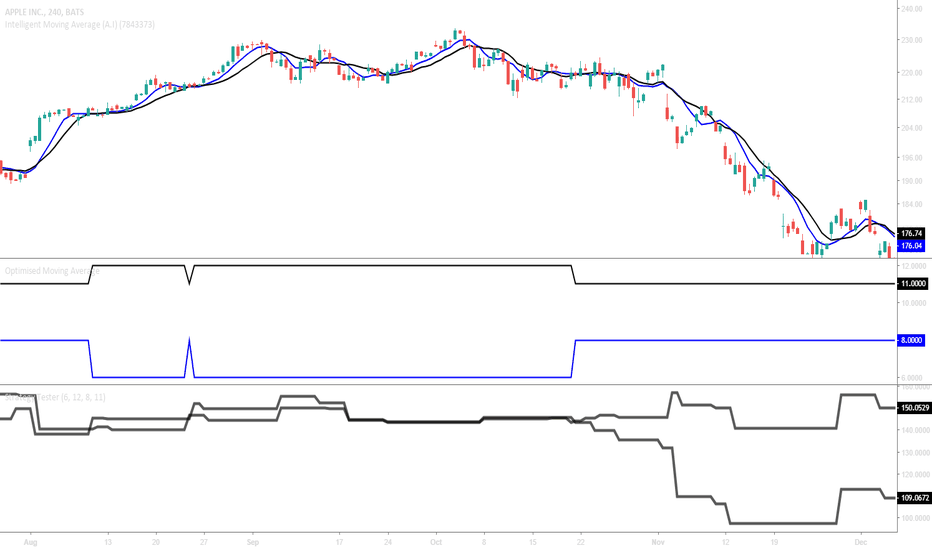

SuperTrend AI Update - My ApologiesRe-iterating what was said in the video; all of the optimisation logic existed except the plot functions were only using one of the two outputs meaning that the SuperTrend AI was only half as good as it could be (yet still way better than without the machine learning function.)

Now, an additional layer has been added which should have already existed.

Enjoy the improved SuperTrend AI!

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

The past few hours were mostly bearish for bitcoin price below the $3,840 resistance against the US Dollar. The BTC/USD pair started an upside correction after trading as low as $3,669. It moved above the $3,700 and $3,740 levels. There was even a break above the 23.6% Fib retracement level of the recent drop from the $4,250 swing high to $3,669 low. However, the upside move was capped by the $3,840 and $3,850 resistances. (Source: www.newsbtc.com)

Cryptocurrencies may soon become legal in India, a country known for its not-so-friendly approach to the nascent industry that has in the past moved to ban digital assets. This, as the crypto community in the country has been pressuring the government. According to local news outlet New India Express, an interdisciplinary committee set up by the Indian government is looking into regulating and legalizing cryptocurrencies, although with tough terms and conditions. A senior official who reportedly attended related discussions was quoted as saying: "We have already had two meetings. There is a general consensus that cryptocurrency cannot be dismissed as completely illegal. It needs to be legalized with strong riders. Deliberations are on. We will have more clarity soon." The New India Express’ report comes days after another local news outlet claimed the same interdisciplinary committee is working to ban cryptocurrencies from India. This is notably the second committee the Indian government set up to look into cryptocurrencies, and it includes officials from the Reserve Bank of India – the country’s central bank, the MeitY (Ministry of Electronics and Information Technology), among others. (Read more: www.cryptoglobe.com)

A man in Taiwan has been arrested over claims he mined millions of dollars’-worth of cryptos using stolen power. According to a report from EBC Dongsen News on Wednesday, a man with the surname Yang is suspected of stealing electricity valued at over NT$100 million ($3.25 million) via his various business premises to mine Bitcoin and Ether, reaping around the same amount in mining profits. Yang reportedly tapped the power supply at 17 stores in Taiwan for his illicit crypto mining operations. He would first rent an internet cafe or a toy store, then hire electricians to redesign the wiring so that the stolen electricity would not be metered, the report alleges. Taiwan Power Company, the island’s state-owned utility provider, first discovered the operations after noticing an unstable power supply and launching an investigation. Yang was suspected and subsequently arrested by the police. (Read more: www.coindesk.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3957.40

Low: 3831.52

Close: 3865.39

Thank you for staying in touch and good luck in your today's trades!

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

Yesterday, we saw a major downside correction in Bitcoin price below the $4,000 support against the US Dollar. The BTC/USD pair even declined below the $3,800 support before buyers appeared near the $3,680 level. A low was formed at $3,684 and later the price started a fresh upward move. The price moved above the $3,750 resistance to start a fresh upward move. (Source: www.newsbtc.com)

Blockstream recently announced a move that makes them even more amazing. In case you aren’t familiar, Blockstream is a blockchain-based company, with a mission to create the financial infrastructure of the future. The company broadcasts the Bitcoin blockchain and supports its own systems for communication and cryptocurrency transactions. A lot of companies do that, but Blockstream does it differently. As mentioned, Blockstream uses blockchain technology to make its broadcasts. However, its broadcast doesn’t go through cables or even internet. A series of satellites makes the broadcast from space. Using satellites means that Blockstream can stay independent. It also means that their broadcast can reach places that don’t have internet. Last week, Blockstream announced through a press release that they have added a fifth satellite to their network. Their broadcast can now reach most of the world. Their previous satellite formation allowed them to share their blockchain broadcasts to most of North and South America, Europe and Africa. Company’s fifth satellite allows them to reach the Asia-Pacific region, including China, India, Japan, the Korean Peninsula, and Australia. (Read more: bitcoin.com.au)

Young Tron Founder, Justin Sun could not just be described as a visionary leader but as an achiever, since recently released data shows that the Tron (TRX) network has surpassed one million created user accounts in less than 1 year of the launch of Tron Mainnet. This is in the midst of the criticisms that both the Tron and Ethereum founders are throwing at each other, with the former urging developers in the Ethereum blockchain that is almost losing out their investment due to the downtrend in Ethereum price to migrate to Tron blockchain. This data was first provided by one of the co-founders of IamDecentralized.org, Misha Lederman, on Twitter that it could now be confirmed that Tron network has surpassed the one million user accounts. This is a piece of good news to the Tron community after it has successfully launched top gaming and entertaining applications in Tron’s decentralized applications blockchain like the Tronbet, which attracted more users to the Tron train and also increased the number of transactions in the platform. (Read more: zycrypto.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 4012.44

Low: 3887.21

Close: 3970.77

Thank you for staying in touch and good luck in your today's trades!

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

After a decent 30% move this week, Bitcoin price extended above the 200-MA and the 23.6% Fib retracement level to reach $4,172 twice. The current rally appears to have reached a point of exhaustion and bitcoin is pulling back from its high at $4,172. The pattern of lower lows had been broken but the sharp upward move is still entirely indicative of a trend change as the current range is still far removed from where bitcoin was trading a month ago. The weekly chart shows that the bearish downtrend is still in full effect. Early birds might keep watch for a daily higher low and higher high to follow through on the 4hr chart. (Source: bitcoinist.com)

Intercontinental Exchange, the parent company of the New York Stock Exchange, is likely to delay the launch of Bakkt, its bitcoin futures trading and custody platform, a second time, CoinDesk has learned. The company last set Jan. 24 as the launch date. However, ICE has yet to receive the necessary approvals from the U.S. Commodity Futures Trading Commission, and at the pace the agency has been moving, it is unlikely that approvals will be secured in time to hit that target. To be clear: That does not mean the CFTC won’t ultimately approve the plan. A person familiar with the agency’s inner workings said even a Jan. 30 launch was still plausible, meaning the delay could be just a matter of days. Specifically, the CFTC must grant an exemption for Bakkt’s plan to custody bitcoin on behalf of its clients in its own “warehouse,” according to sources familiar with regulatory discussions of the plan. CFTC regulations normally require that customer funds be held by a bank, trust company or futures commission merchant. The agency’s staff has finished reviewing Bakkt’s exemption request and passed it to the commission on Friday, one source said. Now the commissioners have to vote on whether to put out the proposal for public comment. After the 30-day comment period, the commissioners would likely take at least a couple days to read the comments, and then vote on the proposal itself. (Read more: www.coindesk.com)

SBI Holdings’ cryptocurrency exchange of VCTRADE has announced that the platform will now be accepting deposits from its customers for the digital assets of XRP, Bitcoin and Ethereum. Deposits will be functional effective today, December 21st. The team at the exchange made the announcement via twitter and on the news section of the VCTRADE website. The announcement – translated from Japanese – went on to state the following: will begin providing virtual currency receipt service from December 21, 2018. In this way, we will receive XRP, Bitcoin and Ethereum from the virtual currency handled by the Company from Wallet etc of another virtual currency exchange trade. (Read more: ethereumworldnews.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 4115.74

Low: 4087.10

Close: 4115.74

Thank you for staying in touch and good luck in your today's trades!

BTC 3-hour forecast. Machine learning. Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

The Bitcoin price in the late part on Tuesday was holding modest gains. The bulls further held ground, following the chunky advances in the prior session, Monday. BTC/USD price action has been moving within a narrow range block since 7th December. The lower part of this range seen around $3100, the high up at $3600. This range must be broken for further committed direction. The bulls will need to breakdown the upper part of the mentioned range, around $3600. Should they be successful in doing this, it will likely ignite a large wave of buying pressure. This could very well see the price flying back towards $4500. A failure, however, would likely result in a retest of $3100 bottom, a breach here could be catastrophic (Source: www.fxstreet.com).

According to recent research by Bloomberg, stablecoin Tether really does have fiat reserves equal to the value of tokens in circulation. Citing “bank statements” it had “reviewed,” the publication became the latest source to add fuel to the controversy surrounding Tether, which has raged online since a series of legal tussles and banking reshuffles began last year. According to the statements, Tether, which issues and notionally backs up each unit of USDT with $1, had a combined fiat bank balance equal to or even higher than circulating USDT from September 2017 to July 2018, the latest month for which information was available. Designed to be pegged at 1:1 with USD, USDT has seen considerable fluctuations in recent months. The company, along with cryptocurrency exchange Bitfinex both received subpoenas from United States authorities at the end of 2017, to which a price manipulation probe was added last month (Source: cointelegraph.com).

A Bitcoin community group is encouraging investors to temporarily remove all of their assets from any and all third party services – from centralized exchanges to custodial wallets. It’s the crypto equivalent of a run on the banks. Known as Hodlers of Last Resort, they have asked users to withdraw their cryptocurrencies on January 3rd, the tenth anniversary of Bitcoin’s Genesis block. The movement wants the sector to remember what cryptocurrencies are supposed to be all about by carrying out an event described as “the ultimate stress test.” If successful, it may pose as a solvency risk for some cryptocurrency exchanges (Source: cryptobriefing.com).

According to a recent report, Malta, the so-called ‘Blockchain Island’ is about to have a blockchain bank. The new bank is expected to carter not only for the needs of blockchain focused individuals and companies, but that of high net-worth individuals who are previously having problems moving their money around quickly and easily. This blockchain bank initiative is a brainchild of RnF Finance Limited, a Malta-based blockchain-focused Fintech company. According to the founder and CEO of RnF, Roderick Psaila, the company has already filed for licensing in order to function as a credit institution with the Malta Financial Services Authority (Source: coindoo.com).

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3607.45

Low: 3480.38

Close: 3570.48

It has been a month since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The respective coin prices have relatively stabilised, and the reactions to relative hash rates is not as pronounced as it used to be historically, with BAB and BSV now responding to the overall market movements to the greater extent than they do to idiosyncratic coin-related technical news. This has led some analysts to again proclaim that “the has war is over” (Source: www.coindesk.com). Bitcoin ABC has made a major leap during the last three days, now having a solid 48-block advantage. ABC and SV coins are currently traded at $101 and $82, respectively, BAB being one of the biggest gainers of the recent bullish wave. The ABC chain has managed to break ahead in terms of hash power (61%) while still maintaining the control over 53% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV has remained quite low for a couple of weeks, now being 16.1% below the original Bitcoin chain. Bitcoin ABC mining profitability is now 3.1% lower than that of the Bitcoin chain (a 13% advantage compared to the rival SV chain), probably due to the recent spike in mining activity and increased competition. Bitcoin ABC miner concentration has slightly dropped on Saturday and has been comparable to historical averages since. Today the leader is BTC.com with 24.31% of the chain’s blocks, followed by ViaBTC with 21.53%. Bitcoin ABC is continuing to attract consistent mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, Multipool, CKPool and okminer (Sources: cash.coin.dance blockchair.com). Regarding the SV chain, the mining activities are dominated by SVPool, Coingeek, BMG Pool and Mempool, recovering to over 16% after dropping to just above 2% on Saturday. The Osiris team is delighted with the recent BAB growth and is awaiting further price movements to evaluate possible trading opportunities.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

Yesterday, we discussed the chances of a fresh weekly low below $3,200 in bitcoin price against the US Dollar. The BTC/USD pair did trade lower and broke the $3,295 and $3,260 support levels. The price even broke the $3,200 support area to signal a major bearish wave. A new weekly low was formed at $3,150 and it seems like the price remains in a significant downtrend. (Source: www.newsbtc.com)

According to the Dallas News, The U.S. Securities and Exchange Commission ordered the AriseBank founders on Wednesday to pay back investors who believed that their money was to be used to create a cryptocurrency bank, which never actually came to fruition. The crypto startup from Dallas, Texas, was planning their AriseCoin ICO to raise $1 billion, but was closed down in January by the SEC for rogue practices and allegedly lying to their investors. The SEC had halted the ICO based on promises made by AriseBank as it claimed to have purchased a FIDC bank, which was found to be untrue. Other claims by AriseBank also turned out to be untrue. The director of the Fort Worth SEC office, Shamoil T. Shipchandler, came out in January to make a statement in regards to the alleged fraudulent activities of AriseBank by saying: “Rice and Ford lied to AriseBank’s investors by pitching the company as a first-of-its-kind decentralized bank offering its own cryptocurrency for customer products and services.” (Read more: www.ccn.com)

This holiday shopping season, hundreds of women are earning their first Bitcoin by buying items online with an in-browser app called Lolli. Revealed exclusively to CoinDesk, cosmetics chain Sephora has joined the list of retailers where shoppers can earn cash back, in the form of Bitcoin, through an app called Lolli. The Bitcoin rewards startup says it won over the beauty chain with data: specifically, 30 percent of the app’s thousands of users are women. “We’ve gone back to a lot of these retailers that previously were not interested but now are coming on-board,” Lolli CEO Alex Adelman told CoinDesk. “One of the biggest ones that just joined us is Sephora, which adds an entire suite of retailers in the beauty category.” Lolli’s partners, including beauty retailers like Ulta and fashion brands such as Everlane, pay it for customer referrals and give the e-commerce startup fiat, which it converts into Bitcoin rewards for shoppers. Despite the broader bear market, or perhaps because of it, this lean 6-person startup is actually gaining traction while other crypto startups face layoffs. (Read more: www.coindesk.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3391.10

Low: 3325.24

Close: 3325.24

It has been more than three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The respective coin prices have relatively stabilised, and the reactions to relative hash rates is not as pronounced as it used to be historically, with BAB and BSV now responding to the overall market movements to the greater extent than they do to idiosyncratic coin-related technical news. Bitcoin ABC is currently in the lead with a minor 4-block advantage. ABC and SV coins are currently traded at $84 and $76, respectively. The trading patterns for both coins have been maturing slowly, which implies both lower volatility and lower growth potential. As for now, the SV chain has a slight advantage in terms of hash power (55%), however the ABC chain is still controlling 54% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV has remained quite low for a week now and has further dropped recently, now being 62.8% below the original Bitcoin chain. Bitcoin ABC mining profitability is has also somewhat dropped, now 6.6% lower than that of the Bitcoin chain (nevertheless, a 56% advantage compared to the rival SV chain). Bitcoin ABC miner concentration has slightly dropped today, still remaining above historical averages however. The leader has changed today, with BTC.com having generated over 35% of the chain’s blocks, followed by ViaBTC with 17.36%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, Multipool and okminer, the first six pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com). Regarding the SV chain, the mining activities continue to be dominated by SVPool, Coingeek and BMG Pool, with Mempool dropping out of radar again with just above 4% today. Interestingly enough, BTC.top has been spotted mining on both chains, a historically unprecedented move for a major mining pool, however its output in the SV chain remains negligible (less than 1%). The Osiris team might reconsider its buy-and-hold profile for BAB in the nearest future, still opting however to hold the coin as for now.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

Recently, bitcoin price started a short term upside correction from the $3,295 low against the US Dollar. The BTC/USD pair traded above the $3,400 resistance and the 100 hourly simple moving average. Besides, there was a break above the 23.6% Fib retracement level of the last decline from the $3,635 high to $3,295 low. The price succeeded in clearing a major bearish trend line with resistance at $3,400 on the hourly chart. (Source: www.newsbtc.com)

Cryptocurrency gained 17 million “verified users” this year, according to a study published by the Cambridge Centre for Alternative Finance Dec. 12. According to the study, data show that in the first three quarters of 2018 the number of ID-verified cryptocurrency users nearly doubled, climbing from 18 million to 35 million.According to a Bloomberg analysis of the study, the growth of the user base this year while crypto markets decline “could signal that an eventual recovery could be coming.” The analysis further notes that “most users are likely still speculators and long-term investors.” In terms of breaking down who is investing in crypto, the Cambridge research team also claims that the data “indicates that the majority of users — both established as well as new entrants — are individuals and not business clients.” Those individuals, the document explains, could be “hobbyist retail investors, consumers, or users seeking a better investment or payment alternative.” (Source: cointelegraph.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3550.06

Low: 3437.05

Close: 3550.06

It has been more than three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The respective coin prices have relatively stabilised, and the reactions to relative hash rates is not as pronounced as it used to be historically, with BAB and BSV now responding to the overall market movements to the greater extent than they do to idiosyncratic coin-related technical news. Bitcoin ABC is currently in the lead again with single block advantage. ABC and SV coins are traded at $97 and $85, respectively, the latter taking a greater hit today. The trading patterns for both coins have been maturing slowly, which implies both lower volatility and lower growth potential. As for now, the SV chain has a substantial advantage in terms of hash power (64%), however the ABC chain is still controlling 55% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV has remained quite low for a week now, 27.6% below the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being 3.2% higher than that of the Bitcoin chain (a 31% advantage compared to the rival SV chain). Bitcoin ABC miner concentration has slightly dropped today, still remaining above historical averages however ViaBTC has generated over 32% of the chain’s blocks, followed by Bitcoin.com with 26.39%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, Multipool and okminer, the first six pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com). Regarding the SV chain, the mining activities continue to be dominated by SVPool, Coingeek and BMG Pool, with Mempool dropping out of radar again with less than 5% today. The Osiris team might reconsider its buy-and-hold profile for BAB in the nearest future, still opting however to hold the coin as for now.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

During the past few hours, there were bearish moves below $3,500 in bitcoin price against the US Dollar. The BTC/USD pair recently settled below the $3,400 level and the 100 hourly simple moving average. A new intraday low was formed at $3,295 and later the price corrected a few points higher. On the upside, an initial resistance is near the 23.6% Fib retracement level of the recent slide from the $3,635 high to $3,295 low. (Source: www.newsbtc.com)

Electronics giant Samsung has filed applications for three blockchain-related trademark requests for smartphones. Based on the descriptions provided by the company, the three European trademark requests relate to providing crypto custody services on smartphones, which indicates that Samsung may be planning to make its entry into the ‘blockchain smartphone’ market following the recent release of HTC’s Exodus 1 and Sirin Labs’ FINNEY, both of which also offer crypto custody. Dutch tech news blog Galaxy Club reports that the three requested patents are called ‘Blockchain KeyStore‘, ‘Blockchain key box‘ and ‘Blockchain Core‘ – names that clearly hint at the direction the world’s largest smartphone maker is taking. The timing of the news again underlines the fact that despite the well-documented woes of the crypto market in 2018, a number of influential businesses like Samsung and HTC believe that cryptocurrencies and blockchain technology will be key growth drivers going forward, and are investing accordingly. (Source: www.ccn.com)

Earlier in November, Bitcoinist reported that a Bitcoin exchange-traded product (ETP) with the HODL ticker offered by Amun Crypto was about to begin trading on Switzerland’s SIX Exchange. The ETP represents a fully collateralized and non-interest-paying bearer debt security, which is issued as a security and traded and redeemed in the same structure. Bitcoin comprises the largest share of the HODL ETP at 48%, followed by XRP (30%), Ethereum (17.6%), and smaller shares of Bitcoin Cash and Litecoin. There is a notable difference between an ETP and an ETF, however. The former is not subjected to the Collective Investment Schemes Act (Cisa) and is therefore not supervised by Finma. The HODL ETP is underlined by an index comprised of four major cryptocurrencies, namely BTC, ETH, XRP, and LTC. Interestingly enough, last Thursday and Friday, the ETP saw record trading volumes with 53,233 shares and 62,986 shares traded, respectively. This is a serious increase from the one-month average volume that saw around 20,000 shares traded per day and coincides with a steep decline in Bitcoin price at the end of last week. According to Su Zhu, CEO at FX Hedge Fund, the “correlation between volume and price continues to be very strong at -68%. (Source: bitcoinist.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3594.80

Low: 3543.86

Close: 3594.80

It has been more than three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The respective coin prices have relatively stabilised, and the reactions to relative hash rates is not as pronounced as it used to be historically, with BAB and BSV now responding to the overall market movements to the greater extent than they do to idiosyncratic coin-related technical news. Despite Bitcoin SV taking the lead again with a 4-block advantage, Bitcoin ABC has not dropped, now worth around $100 levels. This signals that the trading patterns for new coins have been maturing slowly, which implies both lower volatility and lower growth potential. As for now, the SV chain has a substantial advantage in terms of hash power (62%), however the ABC chain is still controlling 54% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 27.9% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being 9.3% higher than that of the Bitcoin chain (a 37% advantage compared to the rival SV chain). Bitcoin ABC miner concentration has somewhat increased today. ViaBTC has generated over 40% of the chain’s blocks, followed by Bitcoin.com with 22.22%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, Multipool and okminer, the first six pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com). Regarding the SV chain, the mining activities continue to be dominated by SVPool, Coingeek and BMG Pool, with Mempool somewhat recovering its mining capacity with 11.81%. The Osiris team might reconsider its buy-and-hold profile for BAB in the nearest future, still opting however to hold the coin as for now.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

There was a slow and steady decline in bitcoin price from the $3,638 high against the US Dollar. The BTC/USD pair was rejected near $3,640-50 zone after it recovered from the $3,253 low. Moreover, it failed near the 61.8% Fib retracement level of the last slide from the $3,851 high to $3,208 low. The price recently declined below $3,520 and $3,480 to enter a short term bearish zone. (Source: www.newsbtc.com)

While Bitcoin has been around for ten years, and its price has gone up more than ten thousand fold, many still express their frustration at the lack of real-world utility for the currency.

Among those who were frustrated by the subpar adoption is Amatsu Soyonobu, an ex-Apple software manager and quantitative financier. In 2017, Mr. Soyoobu left his Silicon Valley job to build a service that he believes provides one of the first tangible use cases for Bitcoin outside of its store of value. With the help of his co-worker Tagawa Hayashida, Mr. Soyonobu founded WCX, a trading platform to let regular people access the global financial markets using just Bitcoin – no fiat required. “Think of us as a stock brokerage, except instead of depositing fiat, you deposit Bitcoin,” Mr. Soyonobu says. Users of WCX can go long or short on more than 100 markets, benefiting from rising and falling prices, with all profits and losses paid out in Bitcoin. Markets offered include foreign currencies like the Euro/USD, stocks like Tesla, precious metals like Gold, and some of the most popular crypto markets like BTC/USD and ETH/USD – all tradable using just BTC as collateral. WCX launched to the public in October of this year and has since attracted over 125,000 traders from 189 countries, with notional trading volume in excess of $1 billion.

“There’s obviously something here. People love how easy and fast it is to trade using Bitcoin rather than non-programmable money like the dollar,” Mr. Soyonobu says. Mr. Soyonobu also claims using Bitcoin instead of regular bank payment processors results in cost savings across the board. (Read more: www.coinspeaker.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3558.08

Low: 3437.96

Close: 3558.08

It has been more than three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV . The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. Bitcoin ABC has recently increased its advantage and is currently 6 blocks ahead. BAB price, however, has slumped to below-$100 levels due to the overall market trends. As for now, the SV chain has minor advantage in terms of hash power (54%), however the ABC chain is still controlling 72% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 34.5% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being on par with the Bitcoin chain (a 34.5% advantage compared to the rival SV chain). Bitcoin ABC miner concentration has decreased today. Currently, BTC.com is the apparent leader, having mined 25.69% of recent blocks, followed by ViaBTC with 25%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, Multipool and okminer, the first six pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. Regarding the SV chain, the mining activities continue to be dominated by SVPool, Coingeek and BMG Pool, with Mempool somewhat recovering its mining capacity with 11.11%. The Osiris team is reasonably certain that there is substantial growing potential for BAB, guided primarily by fundamental analysis.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

There was a decent support base formed near the $3,350 level in bitcoin price against the US Dollar. The BTC/USD pair started an upward move and traded above the $3,400 and $3,500 resistance levels. The price even climbed above the 50% Fib retracement level of the last decline from the $3,850 high to $3,207 low. Finally, there was a close above the $3,480 level and the 100 hourly simple moving average. (Source: www.newsbtc.com)

South Korean blockchain startup Presto announced on Friday that it has filed a constitutional complaint alleging that the government’s ban on all forms of initial coin offerings (ICOs) in September last year is unconstitutional, local media reported. The company has requested an appeal of the ban, according to Sedaily. Presto CEO Kang Kyung-won explained that although his company had considered alternative means such as setting up an overseas corporation to issue tokens, the Korea Economic Daily quoted him as saying, “We trusted that the government will foster new industry through follow-up measures.” However, it has been more than a year since the ban and the government has yet to introduce any forms of ICO guidelines or regulations. Kang was further quoted by Sedaily as saying: "As a blockchain startup company, we face a great deal of difficulties due to the ICO ban and the lack of legislation from the government and the parliament for more than a year. I am requesting confirmation of the unconstitutionality of the lack of legislation." (Source: news.bitcoin.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3661.58

Low: 3527.58

Close: 3622.44

It has been three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV . The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. Bitcoin ABC is continuously struggling to maintaining slim advantage and is currently 6 blocks ahead. BAB price has somewhat recovered from previous lows and now has reached $106. As for now, the SV chain has minor advantage in terms of hash power (56%), however the ABC chain is still controlling 73% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 30% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being 12% higher than that of the Bitcoin chain (a 42% advantage compared to the rival SV chain). Bitcoin ABC miner concentration remains unchanged, slightly above historical levels. As for today, ViaBTC is the apparent leader, having mined 33.33% of recent blocks, followed by BTC .com with slightly below 30%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, Multipool, and okminer, the first six pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. Regarding the SV chain, the mining activities continue to be dominated by SVPool, Coingeek and BMG Pool, with Mempool somewhat lagging behind today with below 10%. The Osiris team is therefore reasonably certain that there is substantial growing potential for BAB, guided primarily by fundamental analysis.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

We would like to sincerely thank you for staying in touch and interacting with our posts. The Osiris team will keep working hard to constantly improve our predictive and trading algorithms to deliver the best results achievable.

After capturing a new annual low, Bitcoin was consolidating before reaching to lower areas and marking the $3200 zone as the new yearly low. This was followed by a new record of the open short positions on Bitfinex. As anticipated, not long afterward, a short squeeze had occurred sending Bitcoin for 10% gains, reaching a high of $3530. The short-term’s wedge pattern is still active. During the recent hours, Bitcoin is consolidating underneath the upper trend-line of the wedge. The RSI is forming a bearish triangle pattern. As of now, the RSI level is at 50, touching the descending trend-line from below. Breakout of the triangle is likely to produce a move towards the breakout’s direction. Critical support and resistance levels are $3500, $3600 and $3850 from the bull side and $3300, $3200, $3000, $2900 and $2700 from the bear side (Source: cryptopotato.com).

As reported recently, Bitwise Asset Management has broadened its fund family with the two new strategies which join the Bitwise 10 Private Index Fund. The Bitcoin and Ethereum funds are being promoted as a low cost alternative to current existing options which charge exit fees and other expenses. Hunter Horsley, chief executive officer of Bitwise Asset Management, believes the 68 percent drawdown in bitcoin prices this year has given investors a unique opportunity to enter the market at very low prices. The Bitcoin and Ethereum funds aim to capture the total returns available to bitcoin and ethereum investors, respectively, including hard forks and air drops. Bitwise holds the capital in cold storage with an institutional third-party custodian. The asset management firm offers an institutional offering, with an all-in expense ratio of 1.0% and a minimum investment of $1 million, and a retail offering, with an all-in expense ratio of 1.5% and a minimum investment of $25,000 (Source: www.newsbtc.com).

The Swiss wing of Russia’s Gazprombank will start offering crypto assets services by mid-2019, according to a press release published by its bank-tech partner Avaloq. The financial technology firm announced that it would build a fully integrated solution for the management of client portfolios across all asset classes, including cryptocurrencies. Gazprombank will integrate the said solution into its services to cater for clients that are looking to incorporate crypto assets like Bitcoin into their investment services. The whole deal will become another sign of how crypto adoption in Switzerland is moving in the right direction. Avaloq will not work alone on creating the crypto assets solution. The press release confirmed that the Swiss fintech giant would integrate Silo, a crypto-wallet management and storage product developed by Metaco, in within its Avaloq Banking Suite. Once up, the duo would enable Gazprombank to purchase, transfer and sell crypto assets on behalf of customers. They would also provide a blended view of the portfolio, without any necessity for a crypto-wallet or private keys (Source: www.ccn.com).

Chinese miners are reportedly becoming the biggest short sellers both locally and internationally, following an increased number of hedging operations in the current bear market. The severe cryptocurrency market decline in the last month has reportedly caused new generation miners to start hedging their coins to avoid market risks. At the same time, frequent hedging operations make miners the biggest short sellers of Bitcoin. Most common schemes involve buying already used graphic processing unit (GPU) miners to boost the machines’ performance. Once the “shutdown price” is reached, the miners power down the equipment, remove GPU chips and sell them to game players. As reported earlier in late November, cryptocurrency mining operators in China are reportedly selling mining equipment by weight, as opposed to price per unit, as the market slump had resulted in a large drop in mining profitability. Crypto miners were reportedly especially eager to sell the older models, including Antminer S7, Antminer T9, and Avalon A741, as these have reached their “shutdown price” (Source: cointelegraph.com).

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3593.74

Low: 3536.48

Close: 3536.48

It has been three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. Bitcoin ABC is continuously struggling to maintaining slim advantage and is currently 6 blocks ahead. BAB price has somewhat recovered from previous lows and now has reached $102. As for now, the SV chain has minor advantage in terms of hash power (57%), however the ABC chain is still controlling 73% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 14% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being 11.60% higher than that of the Bitcoin chain (a 26% advantage compared to the rival SV chain). Bitcoin ABC miner concentration remains unchanged, slightly above historical levels. As for today, ViaBTC is the apparent leader, having mined 31.25% of recent blocks, followed by BTC.com with slightly below 28%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, okminer and Multipool, the first five pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. Regarding the SV chain, the mining activities continue to be dominated by SVPool, Coingeek and BMG Pool, with Mempool lagging behind today with only 6.25%. The Osiris team is therefore reasonably certain that there is substantial growing potential for BAB, guided primarily by fundamental analysis.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

The Osiris team remains constantly improving predictive and trading algorithms to deliver the best results achievable. We are using the bearish trend of the recent days as a wonderful opportunity to stress-test our systems and to make them less susceptible to statistical outliers.

After forming a short term support near $3,550, there was a tiny recovery in bitcoin price against the US Dollar. The BTC/USD pair traded above the $3,750 level, but upsides were capped near the $3,845 level. Finally, there was a fresh decline and the price traded below the $3,550 and $3,420 support levels. It is now trading well below the $3,750 level and the 100 hourly simple moving average. (Source: www.newsbtc.com)

The U.S. Securities and Exchange Commission (SEC) extended a rule change proposal allowing the nation’s first bitcoin exchange-traded fund (ETF), pushing the decision deadline to next year. In a notice posted online, the securities regulator said it was extending the review period for the ETF to Feb. 27, 2019. The proposal was first submitted by money manager VanEck and blockchain startup SolidX, who partnered with the Cboe exchange earlier this year. Under SEC rules, a decision on the proposal cannot be delayed any further, meaning the next notice must either approve or reject the ETF. The decision comes after months of uncertainty as a number of previous ETF proposals were rejected by the SEC, most notably in August when the regulator simultaneously rejected nine proposals submitted by ProShares, GraniteShares and Direxion. The rejections were suspended the next day when the SEC announced it would review all of the proposals. It later reopened a comment period, giving the general public until November 6 to share any new statements in support of or against allowing the ETFs to be approved. (Source: www.coindesk.com)

On Friday (7 December 2018), cryptocurrency exchange Coinbase announced that it is considering adding support for up to 31 additional digital assets (XRP, NEO, ADA, XLM, EOS and 26 other cryptocurrencies). The last time that Coinbase announced that it was exploring adding support for several new assets was 15 July 2018, when it said that it was looking at Cardano, Basic Attention Token, Stellar Lumens, Zcash, and 0x. (And before that, on 26 March 2018, Coinbase announced its "intention to support the Ethereum ERC20 technical standard for Coinbase in the coming months.") In the blog post published earlier today, Coinbase says that from the five assets it mentioned on 15 July 2018, it has already added support forthree of these—BAT, ZEC, and ZRX—and that is continuing to "evaluate the others, along with a number of ERC-20 tokens." (Source: www.cryptoglobe.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3654.22

Low: 3250.35

Close: 3409.38

It has been three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. Just recently, Bitcoin ABC has managed to recover its previous advantage and, as for now, is 22 blocks ahead. Despite this, the BAB price has further decreased price to below-100$ levels. As for now, the SV chain has minor advantage in terms of hash power (53%), however the ABC chain is still controlling 73% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 4.5% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being 8.3% higher than that of the Bitcoin chain (a 13% advantage compared to the rival SV chain). Bitcoin ABC miner concentration remains unchanged, slightly above historical levels. As for today, ViaBTC is the apparent leader, having mined 29.86% of recent blocks, followed by BTC.com with slightly above 19%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, okminer and Multpool, the first four pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. Regarding the SV chain, BMG Pool has resumed its activities, having mined over 17% of today’s blocks, probably strengthening the sentiment surrounding BSV. The Osiris is obviously disappointed with such an underwhelming recent performance of the BAB coin, however we are reasonably certain that it can recover back up from the historical lows it is forming now.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

The Osiris team remains constantly improving predictive and trading algorithms to deliver the best results achievable. We are using the bearish trend of the recent days as a wonderful opportunity to stress-test our systems and to make them less susceptible to statistical outliers.

Recently, there was an increase in selling pressure on bitcoin price below the $4,000 level against the US Dollar. The BTC/USD pair failed to break the $4,000 and $4,020 resistance levels. It declined below the $3,730 swing low and settled below the 100 hourly simple moving average. The decline was such that the price traded to a new low near the $3,630 level. Later, buyers protected more declines and pushed the price back above $3,730. (Source: www.newsbtc.com)

Bitcoin scam ads, luring Facebook users with promises of riches using binary trading platforms, continue to plague the social network, which is still battling against waning investor confidence after a myriad of scandals over the last two years. Despite the recent fall in the Bitcoin price, scammers are using the cryptocurrency to tempt Facebook users into get rich quick schemes that claim to guarantee huge payouts in exchange for a small "investment." (Source: www.forbes.com)

Crypto holders from Denmark can now use their Bitcoins again at Hungry.dk to order online takeaway from over 1,500 restaurants. The fact that Hungry.dk accepts Bitcoin payments isn’t new since they were offering the service as far back as 2014. However, as explained to Bitcoinist by a Hungry.dk representative: "We have accepted Bitcoins as a payment method for quite some time. We decided to remove the feature temporarily last year though because the average transaction time took too long, and the experience wasn’t the best. The problems have since been solved, and we have added the option again… Hungry.dk handle the payment, so you will always be able to use Bitcoins with all the restaurants currently found on Hungry.dk" (Source: bitcoinist.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 4018.13

Low: 3730.54

Close: 3889.75

It has been almost three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. Just recently, Bitcoin SV has managed to shoot ahead and, as for now, has a minor 2-block advantage. This has further decreased BAB price to below-120$ levels. As for now, the SV chain is leading in terms of hash power (63%), however the ABC chain is still controlling 72% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 63% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability is somewhat stable now being 5% higher than that of the Bitcoin chain (a 68% advantage compared to the rival SV chain). Bitcoin ABC miner concentration has increased slightly, perhaps as a response of ABC chain supporters to the move made by the rival chain. As for today, ViaBTC is the apparent leader, having mined 31.94% of recent blocks, followed by BTC.com with slightly above 19%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool, okminer and Multpool, the first four pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. The concentration of the SV chain has remained unchanged, with Coingeek, SVPool and Mempool in the apparent lead. Today it is evident that BMGPool, previously cosistently contributing around 20% of the chain's blocks, has severely scaled down its activities, supporting yesterday’s speculations. These facts arguably continue to evidence that the Bitcoin ABC chain is comparatively more sustainable. In that regard, the Osiris team remains bullish on the BAB coin, despite recent performance leaves much to be desired.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

The Osiris team remains constantly improving predictive and trading algorithms to deliver the best results achievable. We are using the bearish trend of the recent days as a wonderful opportunity to stress-test our systems and to make them less susceptible to statistical outliers.

Yesterday, we discussed that bitcoin price could face a solid resistance near $4,080 and $4,150 against the US Dollar. The BTC/USD pair recovered recently above the $3,920 resistance. There was even a break above the 50% Fib retracement level of the last slide from the $4,199 high to $3,737 low. However, the upside move was capped by the key $4,080 resistance area and the 100 hourly simple moving average. (Source: www.newsbtc.com)

Billionaire investor and venture capitalist Jim Breyer stated that despite a prolonged crypto “nuclear winter,” he still believes that the promise offered by the technology is too great for it to be permanently buried by short-term market movements. Speaking at the 2018 Fortune Global Tech Forum in Guangzhou, China, Breyer noted that while these are testing times for the crypto investment space, such periods take place in cycles and the current cycle will eventually come to an end. In a session at the event, Breyer — who has investments in Ethereum and VeChain, as well as crypto startup Circle — referred to the ongoing market situation as an inevitable part of a market process that takes place roughly once every decade. According to him, despite the turmoil associated with crypto assets, blockchain technology has achieved a critical mass of mainstream research and adoption, which makes a future crypto market rebound a near certainty at some point in the future. (Source: www.ccn.com)

On Tripio, a blockchain-based hotel booking platform, Binance Coin (BNB) users are now able to book 450,000 hotels and residential accommodations using the BNB crypto token. On December 4, Tripio officially announced a strategic partnership with Binance to enable more than 10 million active users in the Binance ecosystem to utilize BNB as one of the main currencies on the Tripio platform to process bookings. (Source: www.ccn.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 4022.77

Low: 3816.13

Close: 3816.13

It has been almost three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV . The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. Yesterday, Bitcoin SV has managed to reduce the ABC advantage to 27 blocks. Coupled with the overall bearish market sentiment, that has decreased the BAB price to $137 levels. As for now, the ABC chain is still slightly ahead in terms of hash power (53%) and network's nodes (70%) (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 50% more profitable to mine on the original Bitcoin chain. Bitcoin ABC mining profitability, however, has also plummeted, now being 5% lower that that of the Bitcoin chain (nevertheless, it is still a 45% advantage compared to the rival SV chain). Bitcoin ABC miner composition remains less concentrated, with leading mining pools changing day by day. As for today, ViaBTC is the apparent leader, having mined 29.17% of recent blocks, followed by BTC.com with just below 19%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus, P2Pool and okminer, the first four pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. As for the SV chain, more than 40% of blocks are mined by a single Coingeek pool. Interestingly, BMGPool, previously cosistently contributing around 20% of the chain's blocks, has now apparently ceased its mining on the SV chain or at least severely scaled down its activities. These facts arguably continue to evidence that the Bitcoin ABC chain is comparatively more sustainable. In that regard, the Osiris team remains bullish on the BAB coin, despite recent performance leaves much to be desired.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

The Osiris team remains constantly improving predictive and trading algorithms to deliver the best results achievable. We are using the bearish trend of the recent days as a wonderful opportunity to stress-test our systems and to make them less susceptible to statistical outliers.

Yesterday, we discussed that bitcoin price remains sell near the $4,200 level against the US Dollar. The BTC/USD pair did trade lower recently and broke the $3,950, $3,900 and $3,880 support levels. The price even traded below the $3,800 level and settled below the 100 hourly simple moving average. A new weekly low was formed at $3,734 before the price bounced back. (Source: www.newsbtc.com)

On Monday, Joseph Christinat, Vice President of Communications at Nasdaq, confirmed that the second-largest exchange in the world will definitely be launching a Bitcoin futures product in the first half of 2019. We first head about Nasdaq's upcoming Bitcoin futures last week during the "Consensus: Invest 2018" conference in New York City. According to an article in UK newspaper Daily Express, a Nasdaq VP, Joseph Christinat, has said: “Bitcoin Futures will be listed and it should launch in the first half of next year – we’re just waiting for the go ahead from the CFTC but there’s been enough work put into this to make that academic. "We’ve seen plenty of speculation and rumours about what we might be doing, but no one has thought to come to us and ask if we can confirm it, so, here you go – we’re doing this, and it’s happening". Christinat also added that the worsening bearish sentiment in the crypto market is not going to deter Nasdaq from launching Bitcoin futures contracts in H1 2019: "We got into the blockchain game five years ago, and when the technology first popped up we just leant out of the window and shouted ‘hey come over here’ right at it. We’ve put a hell of a lot of money and energy into delivering the ability to do this and we’ve been all over it for a long time – way before the market went into turmoil, and that will not affect the timing of this in any way. No. Period. We’re doing this no matter what." (Source: www.cryptoglobe.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 4200.63

Low: 4003.68

Close: 4200.63

It has been almost three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. As for now, the Bitcoin ABC chain is slightly ahead in terms of hash power (52%) and simultaneously has secured a 30-block advantage and 70% of the network's nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 55% more profitable to mine on the original Bitcoin chain. Bitcoin ABC is still securing a modest advantage in terms of mining profitability, fluctuating from 3% to 20% depending on the hash rate and BAB price (as for now, it has a 9.7% advantage as compared to Bitcoin and 63% advantage compared to the rival SV chain). Bitcoin ABC miner composition remains less concentrated, with leading mining pools changing day by day. As for today, BTC.top and ViaBtc tie first together, both having mined 18.75% of recent blocks, followed by BTC.com with slightly above 18%. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus and okminer, the first three pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. As for the SV chain, more than 85% of blocks are mined by four pools: SVPool, Coingeek, BMG Pool and Mempool. Interestingly, unnaturally large blocks typical of the SV chain immediately post-fork and evidently designed to evidence the increased block size reflecting "Satoshi's Vision" have now also become virtually non-existent. These facts arguably continue to evidence that the Bitcoin ABC chain is comparatively more sustainable. In that regard, the Osiris team remains bullish on the BAB coin, despite recent performance leaves much to be desired.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

The Osiris team remains constantly improving predictive and trading algorithms to deliver the best results achievable. We are using the bearish trend of the recent days as a wonderful opportunity to stress-test our systems and to make them less susceptible to statistical outliers.

Recently, Bitcoin price formed a decent support near the $3,880 level and climbed higher against the US Dollar. The BTC/USD pair traded higher and broke the $4,000 and $4,120 resistance levels. However, the price failed to settle above the $4,300 resistance and declined again. A high was formed at $4,286 and the price traded below the 100 hourly simple moving average. (Source: www.newsbtc.com)

Recently Coinbase has been making some stealth-like moves in the industry. After launching its OTC trading desk for institutional customers without a big announcement, the exchange has now quietly added free PayPal withdrawal facilities for its users. The option itself is available only to a handful of users based in the US, European Union, UK, and Canada. Local wallet services are available only for USD, EUR, and GBP users. However, this move indicates, that AUD or CAD may also be added to the wallets soon. Users in Australia and Canada have not been provided the facility to withdraw directly to their PayPal accounts. However, they can directly sell their digital assets to AUD or CAD, which was previously not available in these regions.(Source: blokt.com)

All G20 leaders signed a joint declaration on Saturday following their summit in Buenos Aires, Argentina, pledging, among other things, to develop a regulatory framework for cryptocurrencies in accordance with Financial Action Task Force (FATF) standards. During the previous summit in July 2018, the group postponed the decision on anti-money laundering measures related to cryptocurrencies until the results of the FATF standards review were received. At their latest gathering, the G20 leaders acknowledged the necessity of deploying all available political tools to promote global growth, paying special attention to cryptocurrencies and the “digitalization" of the global economy. The declaration states that digital assets regulation is intended to support "an open and resilient financial system, grounded in agreed international standards," which is, in turn, necessary for sustainable economic growth. To achieve this, the politicians have agreed to create a crypto regulatory policy compliant with the standards of FATF, an inter-governmental body created in 1989 to set and promote standards for dealing with money laundering, terrorist financing, and other issues that pose a threat to the global financial system. (Source: cryptovest.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 3994.66

Low: 3815.41

Close: 3847.66

It has been almost three weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV. The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. As for now, the Bitcoin SV chain is slightly ahead in terms of hash power (54%) while the ABC chain has a 14-block advantage and controls 71% of the network’s nodes (Sources: https://cash.coin.dance, blockchair.com). The mining profitability of Bitcoin SV is continuously volatile: as for now, it is 90% more profitable to mine on the original Bitcoin chain. Bitcoin ABC is still securing a modest advantage in terms of mining profitability, fluctuating from 3% to 20% depending on the hash rate and BAB price (as for now, it has a 6.3% advantage as compared to Bitcoin and 97% advantage compared to the rival SV chain). Bitcoin ABC miner composition remains less concentrated, with leading mining pools changing day by day. As for today, BTC.com has mined over 36% of the ABC blocks, followed by BTC.top with almost 16% of blocks. Bitcoin ABC is continuing to attract occasional mining from Waterhole, Prohashing, DPool, Copernicus and okminer, the first three pools now consistently mining at least one block every day (Sources: cash.coin.dance blockchair.com), contributing to the overall more healthy and diverse environment of the ABC chain, stemming from more attractive mining profitability and more technologically reasonable adjustable blocksize cap solution implemented by the Bitcoin ABC team. As for the SV chain, more than 85% of blocks are mined by four pools: SVPool, Coingeek, BMG Pool and Mempool. These facts arguably continue to evidence that the Bitcoin ABC chain is comparatively more sustainable. In that regard, the Osiris team remains bullish on the BAB coin.

Thank you for staying in touch. We are looking forward to your feedback and any suggestions here at TradingView.

BTC 3-hour forecast. Machine learning.Dear colleagues and followers,

The Osiris team remains constantly improving predictive and trading algorithms to deliver the best results achievable. We are using the bearish trend of the recent days as a wonderful opportunity to stress-test our systems and to make them less susceptible to statistical outliers.

Yesterday, there was an upside extension above the $4,300 and $4,350 levels in bitcoin price against the US Dollar. The BTC/USD pair even broke the $4,400 high and traded to a new weekly high at $4,437. Later, there was downside correction and the price declined below the $4,300 and $4,250 support levels. The price even broke the 23.6% Fib retracement level of the last leg from the $3,560 swing low to $4,437 high. (Source: www.newsbtc.com)

Global tech giant Intel, known for its widely-used computer processors, has won a patent connected to its work in the area of cryptocurrency mining. On Tuesday, the U.S. Patent and Trademark Office awarded the company a patent outlining a processor which claims to be able to conduct “energy-efficient high performance bitcoin mining,” specifically naming the SHA-256 algorithm used by the world’s largest cryptocurrency by market cap. As reported, Intel has previously sought patents related to its work in the area of crypto mining. And it was Intel’s foundry that produced the chips for the mining operation run by 21 Inc, which later rebranded as Earn.com and was ultimately acquired by Coinbase. (Source: www.coindesk.com)

Last month, the investment firm revealed its new Digital Asset Services arm alongside plans to offer Bitcoin and Ether trading services for institutional investors, also giving them a much-anticipated custody solution for these cryptocurrencies. Tom Jessop, head of Fidelity Digital Assets, shared at the Block FS conference in New York on Thursday the company’s willingness to extend these services to other major cryptocurrencies. “I think there is demand for the next four or five in rank of market cap order. So we will be looking at that,” he said in response to a question posed by Coindesk. One of the potential issues he perceives is the question of which tokens will fall into the US Security and Exchange Commission’s definition of securities, as this will significantly impact the regulation surrounding their use. ”We are waiting for that space to develop,” he noted. (Source: bitcoinnews.com)

The following is a scheduled notification from the Osiris team. Our models have been working hard and smart on forecasting the market, and here are the most up-to-date predictions for the next 3 hours:

As usual, red, green and blue rectangles demonstrate predicted values of low, high and close, respectively, with corresponding confidence intervals, and the black arrow illustrates our trades.

Pair: BTC/USD

High: 4152.78

Low: 3948.29

Close: 4060.76

It has been two weeks since the notable Bitcoin Cash hard fork, which has resulted in two rival chains, Bitcoin ABC and Bitcoin SV . The recurrent “hash wars” are going back in forth, with the market still responding to the changes in networks’ relative hash rates. As for now, the Bitcoin ABC chain is slightly ahead in terms of hash power (60%) and has a solid 32-block advantage (Sources: https://cash.coin.dance, blockchair.com). The previous Osiris Team's predictions regarding volatile mining profitability typical of Bitcoin SV are been fulfilling ( Bitcoin ABC , despite volatile prices, manages to constantly maintain its mining profitability 5-15% higher than that of the Bitcoin chain), associated with the technical solutions implemented by the ABC chain and with the more organic and diverse mining pool. Despite BTC .top has secured the lead as the largest miner on the ABC .chain (more than 30% recent blocks were mined by this pool), Bitcoin ABC remains less concentrated, having attracted occasional mining from okminer, Waterhole, DPool and prohashing over the last couple of days, with the previous leader, Bitcoin .com, now generating less than 4% of blocks (Source: cash.coin.dance). These facts arguably continue to evidence that the Bitcoin ABC chain is comparatively more sustainable. In that regard, the Osiris team remains bullish on the coin.