Pain is just starting for crypto - 3k area at play?! for Pain is just starting.

The US treasury bonds are decreasing as the debt to GDP ratio is going through quantitative cumulative tightening resulting in increased pressure on subscription prices and falling demand for butter cookies and other commodities. This will only worsen as the BOJ (Bank of Japan) is issuing rate hikes at a pace of 75 bipperinos per hike, eventually leading to a bottleneck in its economical orbit. This could lead to two scenarios : recessional (unilateral) crash or hyperdeflationary catalytic sme-GMA event as seen in 1945. As of now, any long is destined to be a losing trade. The probability of a bottom across US equities is low as they're indirectly correlated to the rate of growth in Brazilian government subsidized index KRVM4GA , which has been seeing major bearish divergences as the ambassador of Peru declared Brazil to be debt-solvent, meaning that its portfolio of foreign asset is absorbing damage at unsustainable pace, with no sign of improvement until FY2036. Furthermore, FAANG companies are set to launch a global campaign in support of Ukrainians, which puts pressure on Kremlin forces currently controlling the black sea canal ; all of this could lead to a shortage in wheat and forced selling on the BVT-PLU5 index , possibly impacting the life of millions of Europeans, thus directly decreasing their income and risk appetite when it comes to volatile assets like BTC.

Overall, this puts global macro conditions in a dangerous spot as they are set to worsen by EOY, possibly reaching a doomsday-level bankrun scenario.

For those reasons, I will be looking for shorts (and shorts only) until we hit the 3k area (possibly marking the bottom for this cycle).

Macro

DXY vs BTC - MACRO 2013-2022 Cycle Hi/LoDXY vs BTC - MACRO 2013-2022 Cycle Hi/Lo

______

DXY US Dollar Index , Weekly chart vs Bitcoin .

Again, I'm banging the table how important the DXY is and how it inverses Bitcoin . I'm looking at going back to 2013, but you can go back to 2010 as well. We'll go back to 2013 here.

BTC cycle top 2013. DXY hanging around the lows. DXY went on a bull run. Bitcoin went on a bear run. Bitcoin dropped roughly 86%. DXY topped out, 2016 2017. DXY dropped bear market for the DXY - Bull market for BTC . BTC ran into December, 2017 to 20K, roughly 2500% gain.

Again, DXY went on a run into Covid. Bitcoin went bear, roughly 80% drop on Bitcoin . DXY topped out. Bitcoin went on a bull run Bitcoin up 1400% into 65 K, 69K cycle tops.

DXY went parabolic as we see now into current market conditions. Bitcoin , roughly 75% bear market.

DXY possibly topping out at 114. Overbought on the weekly turning over, overbought on the monthly turning over, overbought on the three month turning over...BUT the daily is getting oversold rather quickly.

So, keep an eye on the DXY .! If this is cycle top for the DXY = near or at cycle bottom for Bitcoin .

If the DXY continues to run, Bitcoin's going to possibly hang around this 18 to 20K support or even go to new lows (watching those BTC CME Futures gaps below us all the way down to 9700)

Keep an eye on the DXY .

Stay chill!

BTC is ready for a BIG MOVE in the next monthThere are eery similarities to the 2018 bear market with BTC having gone quiet for 129 days, since this year's low on the 16th June.

In 2018, we had a period of 143 days from the local low on the 24th June, to the capitulation triggered on the 14th Nov. A further move down of -46% was the result.

However, history rhymes but doesn't usually repeat. So could we in fact be in the accumulation phase, similar to 2018 directly after the capitulation?

Have a look at the 108 day period from the 2018 low on 15th Dec to the breakout on the 2nd Apr 2019, where there was a period of relative inactivity, just like the one we're going through now.

When we look purely at like for like similarities, the capitulation scenario seems more likely. But that seems all too easy to anticipate. With the S&P 500 and Nasdaq both finding potential macro lows in the last two weeks, perhaps we are coming to the end of the accumulation phase, and about to make a big move up?

Either way, I'm going to be ready for both scenarios!

Pine Editor Shortcuts Hotkeys (All Hidden Included)For Those who have not explored, Here is the list of All the shortcut keys available.

Very useful for Macros

'show settings menu' - "CONTROL - ," "command - ,

'go to next error' - "ALT - e" "F4"

'go to previous error' - "ALT - SHIFT - e" "SHIFT - F4"

'select all' - "CONTROL - a" "command - a"

'center selection' - "CONTROL - l"

'go to line' - "CONTROL - l" "command - l"

'fold' - "ALT - l |or| CONTROL - F1"

'unfold' - "ALT - SHIFT - l |or| CONTROL - SHIFT - F1"

'toggle fold widget' - "F2" "F2"

'toggle parent fold widget' - "ALT - F2" "ALT - F2"

'fold all' - "CONTROL - command - option-0"

'fold other' - "ALT - 0" "command - option-0"

'unfold all' - "ALT - SHIFT - 0" "command-option-SHIFT - 0"

'find next' - "CONTROL - k" "command - g"

'find previous' - "CONTROL - SHIFT - k" "command-SHIFT - g"

'selector find next' - "ALT - k" "CONTROL - g"

'selector find previous' - "ALT - SHIFT - k" "CONTROL - SHIFT - g"

'find' - "CONTROL - F" "command - f"

'overwrite' - "insert"

'select to start' - "CONTROL - SHIFT - home"

'go to start' - "CONTROL - home" "command - home |or| command-UP"

'select UP' - "SHIFT - UP" "SHIFT - UP |or| CONTROL - SHIFT - p"

'go lineup' - "UP" "UP |or| CONTROL - p"

'select to end' - "CONTROL - SHIFT - end"

'go to end' - "CONTROL - end" "command - end |or| command-DOWN"

'select DOWN' - "SHIFT - DOWN" "SHIFT - DOWN |or| CONTROL - SHIFT - n"

'go line DOWN' - "DOWN" "DOWN |or| CONTROL - n"

'select word LEFT' - "CONTROL - SHIFT - LEFT" "option-SHIFT - LEFT"

'go to word LEFT' - "CONTROL - LEFT" "option - LEFT"

'select to line start' - "ALT - SHIFT - LEFT"

'go to line start' - "ALT - LEFT |or| home"

'select LEFT' - "SHIFT - LEFT" "SHIFT - LEFT |or| CONTROL - SHIFT - b"

'go to LEFT' - "LEFT" "LEFT |or| CONTROL - b"

'select word RIGHT' - "CONTROL - SHIFT - RIGHT" "option-SHIFT - RIGHT"

'go to word RIGHT' - "CONTROL - RIGHT" "option - RIGHT"

'select to line end' - "ALT - SHIFT - RIGHT"

'go to line end' - "ALT - RIGHT |or| end"

'select RIGHT' - "SHIFT - RIGHT" "SHIFT - RIGHT"

'go to RIGHT' - "RIGHT" "RIGHT |or| CONTROL - F"

'select page DOWN' - "SHIFT - pagedown"

'page DOWN' - "option - pagedown"

'go to page DOWN' - "pagedown" "pagedown |or| CONTROL - v"

'select page UP' - "SHIFT - pageup"

'page UP' - "option - pageup"

'go to page UP' - "pageup"

'scroll UP' - "CONTROL - UP"

'scroll DOWN' - "CONTROL - DOWN"

'select line start' - "SHIFT - home"

'select line end' - "SHIFT - end"

'toggle recording' - "CONTROL - ALT - e" "command-option-e"

'replay macro' - "CONTROL - SHIFT - e" "command-SHIFT - e"

'jump to matching' - "CONTROL - p" "CONTROL - p"

'select to matching' - "CONTROL - SHIFT - p" "CONTROL - SHIFT - p"

'expand to matching' - "CONTROL - SHIFT - m" "CONTROL - SHIFT - m"

'remove line' - "CONTROL - d" "command-d"

'duplicate selection' - "CONTROL - SHIFT - d" "command-SHIFT - d"

'sort lines' - "CONTROL - ALT - s" "command-ALT - s"

'toggle comment' - "CONTROL - /" "command-/"

'toggle block comment' - "CONTROL - SHIFT - /" "command-SHIFT - /"

'modify number UP' - "CONTROL - SHIFT - UP" "ALT - SHIFT - UP"

'modify number DOWN' - "CONTROL - SHIFT - DOWN" "ALT - SHIFT - DOWN"

'replace' - "CONTROL - h" "command-option-f"

'undo' - "CONTROL - z" "command-z"

'redo' - "CONTROL - SHIFT - z |or| CONTROL - y"

'copy lines UP' - "ALT - SHIFT - UP" "command-option-UP"

'move lines UP' - "ALT - UP" "option - UP"

'copy lines DOWN' - "ALT - SHIFT - DOWN" "command-option-DOWN"

'move lines DOWN' - "ALT - DOWN" "option-DOWN"

'del' - "delete" "delete |or| CONTROL - d |or| SHIFT - delete"

'backspace' - "SHIFT - backspace |or| backspace"

'cut or delete' - "SHIFT - delete"

'remove to line start' - "ALT - backspace" "command-backspace"

'remove to line end' - "ALT - delete" "CONTROL - k |or| command-delete"

'remove to line start hard' - "CONTROL - SHIFT - backspace"

'remove to line end hard' - "CONTROL - SHIFT - delete"

'remove word LEFT' - "CONTROL - backspace"

'remove word RIGHT' - "CONTROL - delete" "ALT - delete"

'outdent' - "SHIFT - tab" "SHIFT - tab"

'indent' - "tab" "tab"

'block outdent' - "CONTROL - [" "CONTROL - ["

'block indent' - "CONTROL - ]" "CONTROL - ]"

'split line' - "CONTROL - o"

'transpose letters' - "ALT - SHIFT - x" "CONTROL - t"

'to uppercase' - "CONTROL - u" "CONTROL - u"

'to lowercase' - "CONTROL - SHIFT - u" "CONTROL - SHIFT - u"

'expand to line' - "CONTROL - SHIFT - l" "command-SHIFT - l"

Dollar slows for Thanksgiving or Christmas 2022Jerome Powell is the #1 Financial terrorist on Planet Earth right now, soon the powers above him will demand an end to his regime of Maximizing damage upon Working People around the globe

Hyper financialization of all goods and services has proven to be a failed experiment. the global economy needs to organically re-organize and re-energize itself.

One single un-elected US bureacrat is not suited to fix this calamity - and based on FED predications, analysis, and results of their actions - they are incompetent to the challenge at hand

btc/usdtBitcoin is in a bad shape which it means cheap BTC.

Death Cross can spot the bottom based on history. Of course I can get wrong and BTC do the opposite.

The right mindset is to be aware of both scenarios.

And this time the economy overall is looking weak.

Once Macro will improve, the BTC price will increase.

Everyone is expecting lower prices for BTC right now and calling road to 10-12-14k.

Usually when the majority is bearish the markets are doing the opposites.

!!! Not financial advice.

(1D) S&P500 WXY DOUBLE ZIGZAG CORRECTIONPossible Double Zigzag (WXY) pattern playing out on S&P500, which started from the ATH in January and is still on going.

In my previous analysis from 2020 (linked below), I proposed that the ENTIRE history of the S&P500 so far is simply part of a 5 wave bull Impulse, which is still on going. Within this bull Impulse, we are currently in Wave 3, which itself is turning out to be an 3rd Wave Extension made up of 9 waves. This Wave 3 started at the end of the Housing Market Crash in early 2009. Of this Extended 3rd wave, the current WXY correction we are in represents Wave 8 before we resume the bull trend to complete the extended Wave 3, which will then start the 2nd major correction on the bull impulse mentioned before on the macro scale. The first major correction (Wave 2) was a 3 wave correction consisting of the Dot Com Crash and Housing Market Crash.

According to this analysis, we are still in for some pain well into the new year, so hang tight! Trade responsibly.

#EverythingIsAlreadyWritten

ETHUSD - will it bottom in 90 days?I guess that ether will build an inverse head & shoulders pattern in its bottoming process with the lower head happening in early 2023 - somewhere in the range of 677 and 725. The right shoulder will be complete by the summer of 2023, and a new bull market will begin by the fall of 2023. This should align with the macro environment as rate hikes should slow and gives time for the fed to pivot and begin pulling the economy out of recession with inflation and the war calming down.

Bitcoin Trend Analytics October 11 BTC is about to leave the downward channel. After that, the trend will develop into new patterns. It is likely to go sideways based on the current data. Strength is contracting, cultivating a breakout.

Yesterday short-term pressure forced the price down to test the speculative capital inflow at $19109.80-$18798.44. After testing twice on $19109.80 at 16:00 and 00:00 (UTC+8), BTC closed an intraday low at $18950, which is now under testing.

This area is not replenished with new capital inflows. The remaining capital sustains the price. We should monitor this area - if it’s broken down, BTC could slide down. Set protections.

$19882.81 is still a battleground. Only by taking hold of it could it reach neutral or the movement is still bearish.

The market expected interest rate hike in November: 75bp(78.4%),50bp(21.6%)

Macro Bear Market JUST beginning??BTC is in a very dangerous spot right now, people aren't losing their jobs fast enough (unemployment at 3.5%!!) and Netflix keep on raising subscription prices in Ukraine (war!!!)

The FED might have to issue more hikes all the way to 2024, mid terms are also coming which is historically bearish for extreme risk assets (BTC??!!)

TA wise, BTC is forming an extremely BEARISH descending triangle (explosive move?,!!) which could see 3k target in no time

Trade wisely and close any longs, cut your losses if required as this will get MUCH much worse

Macro-economical factors seem to be pointing to a structural bear market could take up to 111 months for full recovery (according to Goldman Sachs)

Please share this idea as I will be providing more tips on how to navigate a full blown financial collapse!!

CAREFUL

A Macro Nerd, Technical Analyst, and a Quant walk into a Bar.And all you get is this chart and no punchline.

Not any ordinary chart because this chart has everything you will ever need to actively manage investments in any liquidity environment.

1. You need a 20D moving average with 2 Std Deviation Bollinger Bands.

2. Add 3 of my new Delta/Gamma Indicators locking in on 3 of the markets biggest index hedges.

3. Add a tad bit of technical analysis

Just look at the history of the FED in 2020.

Then again in Fall 2018

And again in 2016

Total Gamma Exposure for the market has been stuck to zero gamma the past 2 days consolidating / distributing.

That means distribution for the days overall move will be smaller < 1.

The 2 smaller Equity Funds (EF) are negative gamma and the big EF is positive gamma.

The exact same scenario occurred in June when JHEQX flipped positive gamma on the 2 smaller EFs.

Volatility Compression with Short Squeeze Potential between now and CPI on the 13th.

With Elons financing pulling out of the Twitter deal, I assume Musk is selling TSLA each day again.

After AM/EU selloff, small short squeezes up or slightly down to end the day.

When he is done, I expect we’ll get a brief pop up to and maybe over the 20 Day moving average which was not tested yet.

This kind of price action is described well with Diamond Pattern.

Really hard to call this CPI, but I'm going to lean towards the FED CALL/SECOND LEG DOWN trend line down to hold for now until Jerome Powell Pivots on future rate hikes.

The Battle of BEARLIN in May '23Drew this bear scenario at end of the 2021 bull cycle to keep me grounded to all possible outcomes. Have to say, didn't listen to my own logic. Now despite there being weeks of bears retreating we will keep going down until May '23 - the measured length of the last recession in 2008-2009 which lasted aroun 510 days. That being said I could be longer and much worse. Prepare for the worst, hope for the best.

Lesson Learned: After an accelerated FED-fueled market boom there will always be a giant bust incoming.

S&P500 - Decline Down to 3600

Are we about to see a Crash in the Stock Market?

(This is an analysis for ALL of the Stock Indexes/Indices)

O R D E R F L O W:

A Market Maker Sell Model (MMSM) is in play. It's likely to be completed.

Looking at the techicals in price action, we can see that the orderflow is definitely Bearish.

Price keeps running out Buystops to go lower, and it's breaking market structure lower. So price runs buystops and keeps breaking market structure to the downside.

Also, everytime a FVG or Orderblock has been created, it has been mitigated (filled), respected, and traded away from it...

This tells us two things:

- That we have no reason to go higher, because all FVG's/OB's have been mitigated. All Buystops have been taken too. So there's no buyside inefficiencies for the market to reach for.

- That the interest for the algorithm is on the downside. We're trading down through Discount PD Arrays while respecting the Premium PD Arrays. We can expect this to continue before proven otherwise...

If price reaches up into the FVG (and potentially all the way up into the Orderblock) above current price, I expect price to respect these PD Arrays to go Lower.

If price fails to reach up to the FVG and OB and rather goes lower, that indicates extreme Bearish Momentum as it lacks its bullish ability to go up.

Overall target is 3600, which is a sweep of the Sellside Liquidity.

M A C R O S:

The USD Index (DXY), is inversely correlated to the Indices. I am personally Long Term Bullish on DXY (check my DXY analysis post for details). A Stronger DXY will put pressure on S&P to decline Lower.

I'm also favoring Bearishness on the Bond Market & Bearish Commdoities- which will lead to Bearish S&P (due to their positive correlation relationship).

The world is also unfortunately about to enter a Recession and Inflation, which will cause negative impacts on the worldwide economy, and the Stock Market will NOT react positively to this.

S E N T I M E N T A L I S M

This analysis is also twisted upside down from what the "average Joe" investor thinks...

Looking at the newspapers & Financial/Economic Blogs, the majority of the crowd expects this to be the "Dip", aka they expect Bullish prices.

The market makers usually use this sentiment to then do the complete opposite.

An example of this was Bitcoin. When Bitcoin was getting popular and everyone knew about it due to its drastic increase in value, lots of clueless people bought it, and the market makers then dumped it lower. to upset their positions.

This is my speculation and expectation on the Stock Market's upcoming direction. Do your own research too.

Capitulation soonWhere do I start? Since the beginning of this bear market, I have observed every single leg down. And we reached a price level ($17k), where one could argue that this is the bottom. And for a good reason. The pattern for a lower low during summer got invalidated, lots of blood on the streets, so called ''tourists'' gone from the market, oversold metrics etc etc. What we got is accumulation between $18-25k.

We could potentially say that accumulating around our low is not necessarily bad, but I'll shift this monologue towards the real economy. The real world. It's ugly guys. It's super duper ugly. Last couple of days have made it clear to me that this can't be the bottom. Too much pressure all over the board. Check FX, check bonds, check macro, check geopolitics. Something must break real soon. Presure is not sustainable and cannot be absorbed for much longer. Central banks must kill the economies and protect them at the same time.

The BOE is a brilliant example. They stopped purchasing bonds, til they realised that their pension funds are about to get wrecked. They changed their policy in a day with a direct market intervention. Mind here, that inflation ranges between 10-12% in the UK. This hurts the reliability of policymakers, but at the same time, there is literally nothing else to do. Other CBs will follow in this panic mode. Japan is already there.

The reason I'm writing these events is because in my eyes, there is nothing bullish to boost markets. Anytime soon. Risk is huge, and reward seems at question.

As you can see in the chart I've been observing since December 2021, CMF has been my ''friend indicator'' during this downtrend. Along with some very basic technicals, nothing too complicated. What does CMF tell me now? Leg down. If this gets triggered by a credit event, I don't know. If it does, I'm afraid lots of what we've taken for granted will be questioned. It will be ugly, and I'm not even sure about how the market will look like after this. I would bid around $10-13k, and pray this is it.

Lastly, one thing you shouldn't forget is that crypto has never been through a bear market in equities, a recession in global economies, and most worryingly a market collapse equivalent to or maybe worse than the financial crisis in 2008. Stay safe. I'm out. I hope I'm wrong.

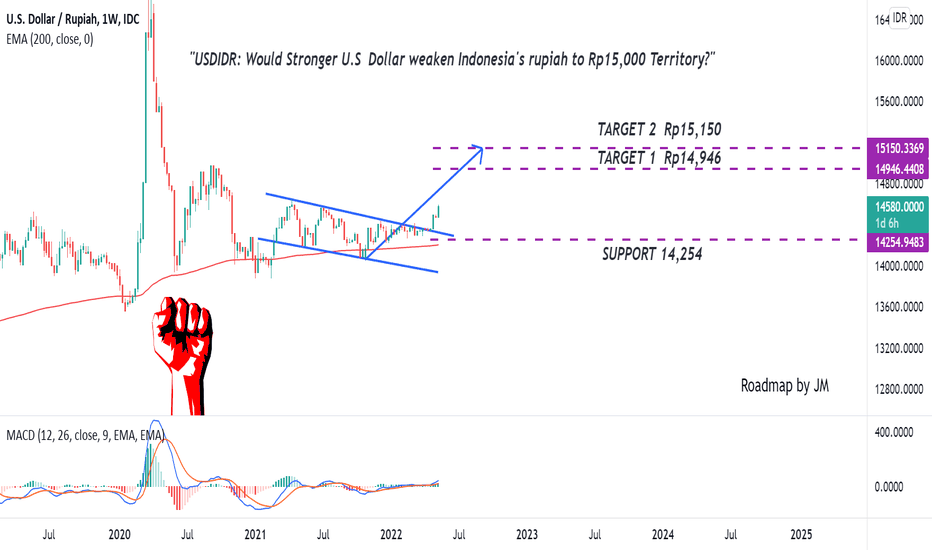

Would Stronger Dollar Weaken Indonesia's rupiah to Rp15,000?The inflation rate has reached above 8% territory in the U.S. Higher Inflation Rate forced the Fed to raise the interest rate again by 50 basis points in May 2022 and it seems the Fed will remain hawkish for stabilizing inflation to a more normalized level. Commonly, the Increasing interest rate will make a stronger dollar because it will attract investment capital from investors abroad seeking higher returns on bonds and interest-rate products. Therefore, a bullish/Stronger Dollar outlook might prevail and potentially weakens Indonesia's Rupiah.

From Chart Perspective:

USD/IDR is moving above the Exponential moving average of 200, which means a bullish bias. Recently, The pair has broken out of the falling wedge pattern, accompanied by a golden cross in the MACD indicator. it signifies a potential bullish bias to the target area.

Smash the Follow and Give us Thumbs up for More Educational content!

* Disclaimer: This is for educational purposes only, We are not responsible for any of your financial decision.

Shanghai Composite Index Macro TriangleOstensibly SSE in a macro triangle formation. In this scenario we typically find peaks at 786 relationship of one another, At times we find the last leg falls shy of the 786.

** Please not the idea conveys only a potential pattern and how it may complete, and is not intended as a projection of future price action which relies on many factors that patterns and charts cannot and often do not capture.

US10Y: Potentially Increasing Yield, Stronger Dollar Ahead?Hello Fellow Global Investor/Trader, Here's a Technical outlook of the US Government Bond Yield!

Price Action Analysis

US 10 Years Government Bond Yield ( US10Y ) has rebounded on the bullish trendline. Simultaneously, US10Y is forming the flag pattern which may indicate a continuation of the prevailing bullish trend. As Traders, We can look for other confirmation. In this case, We will wait for the price to exceed the confirmation line. Thus, we can confidently assume there is a possibility of upside movement to the target area.

The roadmap will be invalid after reaching the support/target area.

*Disclaimer: The outlook is only used for Educational Purposes, The Creator doesn't responsible for any of your trade position or other financial decisions*

Aussie Remains Bearish After RBA Policy Meeting

Markets were slow at the start of a new trading week because of the holiday in UK, but this will be expected to change as speculators wait on CB policy decisions. RBA meeting was the first event where members judged that a further increase in interest rates would help bring inflation back to target and create a more sustainable balance of demand and supply in the Australian economy. They discussed the arguments around raising interest rates by either 25 basis points or 50 basis points. They see rates coming back to normal, meaning that sooner or later speculators could see this as bearish for the Aussie.

From an Elliott wave perspective, we see pair in a deep complex correction, currently in B of Y, so there can be more weakness coming soon, especially if stocks will continue to weaken this week on the hawkish FOMC decision. So short-term pair can stay bearish but from a longer-term perspective, we assume that the pair can find a support near 0.64-0.65, possibly later this year.

KEY LEVEL TO WATCH: TOTAL2 MacroI previously estimated where altcoins might find support, and I was right... for a few weeks.... but we didn't get a serious relief rally before losing that level.

Contagion has spread and 2 more giga-firms Celsius and 3AC may be insolvent / forced sellers....

And now we are a 7% drop away from a potentially very significant level...

It's the 200SMA on the 1W timeframe (yellow line). We haven't come anywhere near it since pre-bull run. Before that, it never exactly offered rock-solid support, but it did act as a magnet for price action during the previous bear cycle.

When it was broken previously, the Total market cap of altcoins went down another 45% before being drawn back up to it and didn't stray too far in either direction until blasting off this previous bull cycle.

I'm posting these quickly so I'm sorry if some of my numbers are off, but you get the idea. It's a point of interest. If we lose it, expect more downside, but THAT will be when it's time to really pay attention and watch for a potential bottom / rally back for a bearish retest of it.

THINK HAPPY TRADES

THINK HAPPY TRADES

CD