Tactical BTCUSDT Swing: Persistent Risk On, Key Stop at 103,000__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish sectoral momentum (Risk On / Risk Off Indicator on strong buy across all timeframes), but momentum is fading just below key resistances.

Supports/resistances: Key 104,179–103,086 area tested on every timeframe, consolidating a major price floor. Upside targets: 109,588 then 111,980.

Volume: Stable liquidity, no anomaly spike or structural rupture. Volumes consistent with trend; moderate pickup in activity near supports, no climax.

Market behavior: Investor Satisfaction Indicator is neutral on all timeframes except 1H (behavioral buy signal to monitor). No euphoria or panic, no aggressive accumulation.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Cautiously bullish as long as 104,179–103,086 pivot support holds. Risk On / Risk Off Indicator gives a strong bullish sector signal. Macro backdrop neutral, low volatility.

Opportunities: Swing timing on pullback to support confirmed on 1H/4H, targets 109,500/111,980. Wait for daily/4H confirmation before full allocation.

Risk zones: Strong invalidation under 103,086, alert under 104,179. Suggested technical stop-loss below 103,000 USDT.

Macro catalysts: Watch ECB and Fed (8:30–9:45 UTC, Thursday). Expect possible volatility spike, adjust sizing and stop accordingly.

Action plan: Active swing trading off support, dynamic stops, partial exposure ahead of major events. Active risk/reward management (>2.5), upside targets on technical pivots, liquidity is normal.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

: Global uptrend but fading momentum below ATH. Major support 104,179–103,086, no clear behavioral signals. Risk On / Risk Off Indicator strong buy, volumes stable.

: Strong tech sector bias (Risk On / Risk Off Indicator strong buy), support at 104,179. ISPD DIV neutral, volumes normal.

: Pause/consolidation above multidimensional support (104,179). Healthy but cautious structure.

: Consolidation >104,179, long positioning remains valid as long as support holds; no clear short-term behavioral inflow.

: Testing key support, first signs of indecision. Increased watchfulness recommended.

: First short-term behavioral buy signal (ISPD DIV/mason's), optimal tactical allocation timing if 104,179 support is defended.

: Intraday range on support, no emotional spike or break volume.

: Local flush, defensive rebound off support, short-term range scenario; potential technical bounce.

Cross-timeframe summary:

- 104,179 is the key defensive multi-support area, tested across all TFs.

- Risk On / Risk Off Indicator is bullish across the board, except behavioral divergence (ISPD DIV Buy on 1H only).

- No panic or rupture volumes detected.

- Immediate risk if breakdown below 104,179 and/or 103,086: opens door to intraday bearish extension toward 93,377.

__________________________________________________________________________________

STRATEGIC OUTLOOK – Final Summary

__________________________________________________________________________________

Technical setup: Solid consolidation above 104,179/103,086 supports, sectoral buying confirmed. No major deterioration unless a clear breakdown occurs.

Opportunity: Short-term swing entry on 1H/4H signal, target 109,500–111,980. Stop-loss below 103,000 advised.

Risk: Downside acceleration if support breaks, especially if LTH profit taking continues or spot demand fades.

Macro: Calm backdrop, ECB and Fed decisive for short-term volatility. Watch post-announcement market action.

On-chain: Significant profit-taking near highs, no euphoria, positive risk/reward if stops are respected.

Operational summary:

Cautiously bullish while 104,179/103,086 hold.

Tactical swing entry possible on pullback and confirmed signal (1H or 4H).

Strict stop management below 103,000, reduced exposure before key ECB/Fed events.

Upside targets: 109,588 – 111,980.

Monitor volumes and behavioral signals post-news.

Key levels to watch:

Supports: 104,179, 103,086

Resistances: 109,588, 111,980

Macro alerts: ECB/Fed (Thursday morning, 8:30–9:45 UTC)

Behavioral ISPD DIV signal after news

Suggested stop-loss : < 103,000 USDT (as of 01/06/2025, 22:56 CEST)

Comprehensive analysis based on multi-timeframe technical structure, Risk On / Risk Off Indicator and ISPD DIV behavioral/mason's confirmations. Remain disciplined and flexible in risk management.

__________________________________________________________________________________

Macro

BTC at resistance: tactical swing plan for bulls <106.7k __________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Dominant bullish structure across all timeframes, major resistance at 106.7k–112k.

Supports/Resistances: 106743 (multi-TF pivot), 103000–105000 (key supports). Price compressed below main resistance.

Volume: Normal to moderately high, a few occasional yellow spikes, no massive distribution or capitulation.

Behavior Multi-TF: Risk On / Risk Off Indicator bullish at every horizon. Behavioral indicator (ISPD DIV) in constant buy zone, no orange anomaly.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall Bias: Bullish structure intact, sustained momentum up to the critical 106.7k–112k resistance.

Opportunities: Swing entries on 103–105k support clusters, long scalps on 15–30min signals, partial exits near/under key resistances.

Risk Zones: Confirmed break below 103k = major bearish alert, repeated rejection below 106.7k–112k = risk of extended/distributive range.

Macro Catalysts: US data (ADP, ISM, PMI), stablecoin/GENIUS regulation. High-volatility windows expected during major news (03/06–04/06).

Action Plan: Active management, progressive reinforcement on pullbacks, controlled exposure below resistance, stop-loss advised < 103k.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

Daily: Pivot High 1D: 111949/ Pivot Low 1D: 93337.4. Stalled below 106.7k–112k. Normal volume, strong software sector/ Risk On / Risk Off Indicator buy signal, healthy behaviors.

12H – 4H: Compression in 104.5k–106.7k/109.9k. Cautious bullish bias, localized volume clusters, all buy signals except on immediate resistance tests.

2H – 1H: Technical pullbacks at 104k, micro-range 105–106k. Momentum intact, 15–30min buy signals on every support retest.

30min – 15min: High intraday volatility, liquidity absorption at supports, active ranging phase. Risk On / Risk Off Indicator and ISPD consistently bullish.

ISPD & Risk On / Risk Off Indicator Summary: Buy alignment across the board, no behavioral deviation, strong sector support.

__________________________________________________________________________________

Summary:

BTC/USDT remains capped beneath the 106.7k–112k resistance, but all multi-TF, behavioral, and sector signals stay bullish above 103k. Favored setup: active management around supports, prudent profit-taking below resistance, intensified macro monitoring.

__________________________________________________________________________________

JNJ - Macro View 🌐Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 JNJ has exhibited an overall bullish trend, trading within the ascending wedge pattern outlined in blue. It is presently nearing the lower boundary/blue trendline.

At present, JNJ is undergoing a correction phase and is trading within the descending red channel. It is currently approaching the lower limit and a highlighted demand zone in green.

🏹 Thus, the highlighted purple circle is a strong area to look for buy setups as it is the intersection of the green demand and lower blue and red trendlines acting as a non-horizontal support.

📚 As per my trading style:

As JNJ approaches the lower purple circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ebay is on sale 🛒Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 EBAY has exhibited an overall bullish trend , trading above the orange and blue trendlines.

At present, EBAY is undergoing a correction phase and it is currently approaching a strong support zone 30 - 34

🏹 Thus, the highlighted red circle is a strong area to look for buy setups as it is the intersection of the green support and lower blue and orange trendlines acting as a non-horizontal support.

📚 As per my trading style:

As #EBAY approaches the lower red circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Can Tech Strength Still Drive Markets Amid Trade Tensions?Macro approach:

The Nasdaq 100 (USTEC) began Jun with strong momentum after its best monthly performance since 2023, fueled by robust tech earnings and a brief lull in tariff concerns.

- However, renewed US-China trade tensions resurfaced early in the week, briefly weighing on sentiment before a market rebound restored cautious optimism.

- Nvidia (NVDA) surged due to the continued demand for AI chips. At the same time, Tesla (TSLA) drew investor focus ahead of its 12 Jun robotaxi launch, helping maintain positive momentum in the face of geopolitical uncertainty.

Technical approach:

- USTEC is now testing the previous swing high near 218000, staying above both EMAs, a sign of ongoing bullish strength.

- A clear break above 21800 would likely open the path toward the record-high zone near 22200.

- Failure to do so may trigger a pullback toward the nearest support of around 20700.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

BTC/USDT: Strong Bullish Alignment, All Signals Green (01/06/25)__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Bullish structure confirmed by Risk On / Risk Off Indicator (“BUY” across all timeframes).

Key Supports: 103k–104k, consolidated on every horizon (1D to 15min).

Resistances: 105.5k–108k (short-term), 110k as a main pivot.

Volume: Moderately high, with no climax or distribution signals.

Behaviour: Proprietary indicators (ISPD DIV) show strong bullish confluence across timeframes; no divergences or significant bearish signals.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Directional Bias: Dominant bullish bias across all timeframes.

Opportunities: Tactical entries on pullbacks to 103k–104k, main exits >108/110k.

Risk: Invalidation below 101k; watch for extreme volumes or major macro catalysts.

Catalysts: Strong global risk-on dynamics (tech rally, institutional flows, weak USD); monitoring SEC regulation and macro events (NFP, CPI, FED).

Plan of action: Buy defended support zones, reduce on exuberance >110k, dynamic stop below 101k, stay reactive ahead of major events.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Major resistance at 110k (Pivot High), strong support 101–104k, Risk On / Risk Off Indicator “BUY,” healthy volume; maintained momentum.

12H: Confluent resistance 105.5–110k, support 102.5–104k, bullish indicators, no divergence or volume climax.

6H: Resistances 105.5/108k, solid support 103–104k, strict bullish confirmations.

4H: Clustered resistances 105.5/108k, dense support 103–104k, digestion phase in volume (healthy consolidation).

2H: Major pivots 105–108k, supports 103k/101.5k, strong demand on pullback.

1H: Barriers 105.5–106k, support 103.4–104.2k, no bearish signals.

30min: Spot resistance at 105.5k+, support 103.8–104.2k, microstructure favors buying, weak selling pressure.

15min: Support 104k, resistance 105.5–106k, intraday flow remains pro-buy on weakness.

Risk On / Risk Off Indicator: Consistent “BUY” signal across all timeframes — sector and behavioural momentum alignment.

ISPD DIV: Positive histogram, no red zones or distribution alerts.

Volumes: Normal to moderately high, no climax suggesting trend end.

Summary: Strong multi-timeframe technical alignment. Bullish momentum, firmly defended supports. No imminent reversal signals, healthy consolidation within dominant risk-on trend.

__________________________________________________________________________________

Strategic & Fundamental Synthesis

__________________________________________________________________________________

Technical bias: Strong bullish conviction as long as 103–104k is defended, supported by Risk On / Risk Off Indicator/ISPD.

Fundamentals: Macro momentum (Nasdaq/US tech rally, weak USD), OI and spot dominance high, growing euphoria (ATH ~111k), watch for potential distribution if buyer exuberance peaks (P/L ratio 12:1).

Scenarios: Buy on defended flows 103–104k, TP >108–110k; caution on extreme volume at support.

Macro: Anticipate reactions to major events (NFP, CPI, FED). If a key event is due within 48h: prudence, adapt post-release.

Opportunities: Potential rotation to altcoins (SOL/ETH), short-term swing as BTC momentum pauses.

Momentum prevails, but caution warranted on any volume spikes or major macro headlines. Market remains a buy at support, optimal strategy is dynamic pullback/TP management, strict discipline in case of high-volume sell-off.

__________________________________________________________________________________

Actionable Summary

__________________________________________________________________________________

Entry: Buy securely on 103–104.2k zone

Stop: Hard invalidation if <101k (on volume)

Take Profit: 108–110k+

Risk: Excessive on-chain euphoria, violent support break

Stay agile near major releases and watch flow rotations (BTC/ALT)

__________________________________________________________________________________

BTCUSDT: Strong Risk-On Signal, Optimal Swing Above 103k__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias : Dominant bullish structure, confirmed sector momentum, “risk-on” technical setting.

Opportunities : Favored swing entries above supports (103703.7–107019.9), breakout plays at 104865/106537.

Risk zones : Technical invalidation below 103703.7 or rapid ISPD DIV deterioration (red/orange zone + extreme selling volumes).

Macro catalysts : Rate, inflation/PCE, job numbers publication (48–72h) – to monitor closely for volatility pivots.

Action plan : Tight stops below supports, partial profit-taking on resistances, reduce exposure before key macro events, re-enter post-announcement on confirmed direction.

__________________________________________________________________________________

Fundamental & Macro Analysis

__________________________________________________________________________________

Favorable macro momentum (BTC, ETH, equity indices, institutional trust). Bull-cycle confirmation via technical triggers (bullish cross, MACD divergence).

Risks : Major token unlocks coming (3.3B+), on-chain euphoria (extreme profit/loss, exchange dominance >33%). Dynamic risk management crucial – swing stop-loss < 103703.7 is imperative.

Events to watch : US rates, inflation/PCE, payroll data – periods of heightened volatility expected, necessitating exposure adjustment.

Swing trade plan : Defensive entries on key supports, reduction pre-announcement, gradual profit-taking below 106537, then 109952.8/111949.

Risk/reward : Optimal for swing trades near supports, tactical management required for breakout chasing.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D (Daily) : Bullish structure intact, key supports (107019.9, 81075.6). Risk On / Risk Off Indicator remains “Strong Buy”. No excess in volumes or behavior – buyers’ climate.

12H – 6H : Solid momentum above 103703.7–106537. Risk On / Risk Off Indicator still “Strong Buy”, ISPD DIV neutral, standard volumes.

4H – 2H – 1H : Pivot range (103703.7/104865/106537), buyer momentum, swing/scalp strategies favored. Supports to watch: 103703.7 (main stop trigger).

30min – 15min : Tight range (103703.7/104865), Risk On / Risk Off Indicator “Buy” (slightly weaker on 15min). Tactical scalping on bounce or pivot breakouts – risk zone if range breaks sharply.

Summary : Sectoral outperformance on all timeframes via the Risk On / Risk Off Indicator, ISPD DIV neutral, normal volumes. Key pivots: 103703.7 (support) and 104865/106537 (resistances) frame all action. Swing trading optimality as long as these levels hold.

__________________________________________________________________________________

Conclusion

__________________________________________________________________________________

BTCUSDT market remains bullish on all timeframes, supported by strong sector momentum (Risk On / Risk Off Indicator), steady volume and behavioral stability (neutral ISPD DIV). Preference remains for long strategies on support, with increased vigilance around macro windows (events, unlocks). Strict stop discipline and active profit-taking are key on extension moves.

__________________________________________________________________________________

US500 - Let the Bulls Strive!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in red.

Moreover, the blue zone is a strong support and structure!

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Macro Group Egypt is expected to target 2.70 then 2.92Daily chart,

the stock EGX:MCRO price is drawing a rising channel pattern.

I expect the price will break out the resistance line R1; to target the line R2, then the line R3 at around 2.92

Some intermediate resistance levels are shown on the chart.

A new entry (buy) should be made after closing above 2.30

Stop loss below 2.20

Technical indicators:

RSI has a bullish trend line

MACD is positive

Gold Setup: Range or Rip? Here's the PlaybookGold’s been on a tear lately — driven by safe haven demand as real yields soften and global uncertainty lingers.

But here’s where things get interesting...

We’re now watching what could be a textbook head and shoulders pattern start to take shape.

📊 Current Range:

Right now, price is stuck between 3380 and 3280 — and it’s acting like it knows it.

⚡ Possible Scenarios:

🔁 Scenario 1: Range Play

Short near 3380

Long near 3280

Let it ping-pong and catch the edges.

📈 Scenario 2: Breakout Long

Confirmation above 3380

Look for momentum follow-through into 3420+

📉 Scenario 3: Breakdown Short

Break below 3280

Eyes on the 3220s for a potential flush

🧠 The key? Drop to the lower time frames near these zones and wait for clean setups during active sessions — especially NY open or post-data volatility.

💬 How are you playing this? Breakout or bounce? Drop your take 👇

#gold #tradingview #futures #technicalanalysis #metals #xauusd #tradingstrategy #macro

Peace Headlines Are Here — But Markets Have Already Moved OnA Russia-Ukraine peace deal making headlines right now is historic news — politically and emotionally.

But for the forex and commodities markets?

The real money already left this story behind months ago.

🧠 Smart Money Knows: Markets Price in the Future, Not the Past

Two years ago, the war sent shockwaves through oil, gas, wheat, and risk currencies.

By late 2023, price action had already normalized — the "war premium" faded out quietly.

Commodities stabilized. Forex volatility shifted. Safe havens lost their edge.

Traders adapted, recalibrated, and moved on to new battlegrounds.

Bottom Line:

The market already priced in a future where this conflict would eventually fade — peace or no peace.

📊 What Actually Drives Forex Now

While peace headlines grab attention, the real macro drivers today are:

🔥 Tariff escalation and global trade wars

🔥 Sticky inflation battles (core services inflation still high)

🔥 Central bank pivot games (Fed, ECB, BoJ)

🔥 Global growth fears (China slowdown, EU stagnation)

This is where new money is flowing.

Not into a two-year-old headline finally catching up.

🛡️ "Buy the Rumor, Sell the Fact" in Action

For two years, markets have priced in an eventual end (or fade) to the Ukraine conflict.

A peace agreement now?

→ It confirms expectations, not shocks them.

→ It may trigger a short-lived risk-on pop (EUR, AUD, NZD up, gold down) —

→ But unless it unleashes massive new money flows (unlikely), that pop gets sold.

🔥 Final Thought:

If you're still trading the last war, you're already late.

The next major moves won't come from peace headlines — they'll come from tariff escalations, inflation battles, and central bank pivots.

Focus forward.

That's where opportunity lives.

💬 Question for Serious Traders:

Which macro theme are you really watching into summer 2025?

Peace headlines... or the new fires already burning?

Drop your insights below. 👇

LINK / USDT: Macro Support Zone ReachedThe price has now reached the upper boundary of the ideal macro support zone for a complex and rare corrective structure (running flat), between 11–8.5.

As long as the price holds above April’s low, my operative scenario assumes that a new multi-year uptrend (wave (3)) has already started.

Key resistance zones to watch ahead: 85–121 (first major resistance) and 150–205/220 as final macro resistance targets.

Full view of the macro structure:

Thank you for your attention and I wish you successful trading decisions!

⸻

Previous trend analysis on LINK:

Nov'24:

Jun'24:

Dec'23:

ICP / USDT: In the Macro Support Zone

The price has reached the target macro support zone for the formation of a long-term bottom.

As long as the price stays above the April 7th lows, my main scenario is that the macro correction (wave (2)) has ended and a new multi-year growth cycle has begun.

Weekly Projection:

Thank you for your attention and I wish you successful trading decisions!

Previous ideas on ICP :

Nov'24:

Jun'24:

Dec'23:

ETH Will Flip Bitcoin – Sooner Than You ThinkEveryone’s watching ETFs and halvings — but here’s what they’re not seeing:

Ethereum isn’t just a currency.

It’s digital infrastructure — powering AI, tokenized real estate, RWAs, and decentralized identity.

The next wave of global finance will run on Ethereum.

📈 My prediction:

By Q1 2026, ETH will flip BTC in market cap.

Not hype — mathematics + macro + mass adoption.

🧠 Smart money is already rotating.

Are you paying attention?

⏳ Don't say "nobody warned you."

Behind the Curtain: Bitcoin’s Surprising Macro Triggers1. Introduction

Bitcoin Futures (BTC), once viewed as a niche or speculative product, have now entered the macroeconomic spotlight. Traded on the CME and embraced by institutions through ETF exposure, BTC Futures reflect not only digital asset sentiment—but also evolving reactions to traditional economic forces.

While many traders still associate Bitcoin with crypto-native catalysts, machine learning reveals a different story. Today, BTC responds dynamically to macro indicators like Treasury yields, labor data, and liquidity trends.

In this article, we apply a Random Forest Regressor to historical data to uncover the top economic signals impacting Bitcoin Futures returns across daily, weekly, and monthly timeframes—some of which may surprise even seasoned macro traders.

2. Understanding Bitcoin Futures Contracts

Bitcoin Futures provide institutional-grade access to BTC price movements—with efficient clearing and capital flexibility.

o Standard BTC Futures (BTC):

Tick Size: $5 per tick = $25 per tick per contract

Initial Margin: ≈ $102,000 (subject to volatility)

o Micro Bitcoin Futures (MBT):

Contract Size: 1/50th the BTC size

Tick Size: $5 = $0.50 per tick per contract

Initial Margin: ≈ $2,000

BTC and MBT trade nearly 24 hours per day, five days a week, offering deep liquidity and expanding participation across hedge funds, asset managers, and active retail traders.

3. Daily Timeframe: Short-Term Macro Sensitivity

Bitcoin’s volatility makes it highly reactive to daily data surprises, especially those affecting liquidity and rates.

Velocity of Money (M2): This lesser-watched indicator captures how quickly money circulates. Rising velocity can signal renewed risk-taking, often leading to short-term BTC movements. A declining M2 velocity implies tightening conditions, potentially pressuring BTC as risk appetite contracts.

10-Year Treasury Yield: One of the most sensitive intraday indicators for BTC. Yield spikes make holding non-yielding assets like Bitcoin potentially less attractive. Declining yields could signal easing financial conditions, inviting capital back into crypto.

Labor Force Participation Rate: While not a headline number, sudden shifts in labor force data can affect consumer confidence and policy tone—especially if they suggest a weakening economy. Bitcoin could react positively when data implies future easing.

4. Weekly Timeframe: Labor-Driven Market Reactions

As BTC increasingly correlates with traditional markets, weekly economic data—especially related to labor—has become a mid-term directional driver.

Initial Jobless Claims: Spikes in this metric can indicate rising economic stress. BTC could react defensively to rising claims, but may rally on drops, especially when seen as signs of stability returning.

ISM Manufacturing Employment: This metric reflects hiring strength in the manufacturing sector. Slowing employment growth here could correlate with broader economic softening—something BTC traders can track as part of their risk sentiment gauge.

Continuing Jobless Claims: Tracks the persistence of unemployment. Sustained increases can shake risk markets and pull BTC lower, while ongoing declines suggest an improving outlook, which could help BTC resume upward movement.

5. Monthly Timeframe: Macro Structural Themes

Institutional positioning in Bitcoin increasingly aligns with high-impact monthly data. These indicators help shape longer-term views on liquidity, rate policy, and capital allocation:

Unemployment Rate: A rising unemployment rate could shift market expectations toward a more accommodative monetary policy. Bitcoin, often viewed as a hedge against fiat debasement and monetary easing, can benefit from this shift. In contrast, a low and steady unemployment rate may pressure BTC as it reinforces the case for higher interest rates.

10-Year Treasury Yield (again): On a monthly basis, this repeats and become a cornerstone macro theme.

Initial Jobless Claims (again): Rather than individual weekly prints, the broader trend reveals structural shifts in the labor market.

6. Style-Based Strategy Insights

Bitcoin traders often span a wide range of styles—from short-term volatility hunters to long-duration macro allocators. Aligning indicator focus by style is essential:

o Day Traders

Zero in on M2 velocity and 10-Year Yield to time intraday reversals or continuation setups.

Quick pivots in bond yields or liquidity metrics could coincide with BTC spikes.

o Swing Traders

Use Initial Jobless Claims and ISM Employment trends to track momentum for 3–10 day moves.

Weekly data may help catch directional shifts before they appear in price charts.

o Position Traders

Monitor macro structure via Unemployment Rate, 10Y Yield, and Initial Claims.

These traders align portfolios based on broader economic trends, often holding exposure through cycles.

7. Risk Management Commentary

Bitcoin Futures demand tactical risk management:

Use Micro BTC Contracts (MBT) to scale in or out of trades precisely.

Expect volatility around macro data releases—set wider stops with volatility-adjusted sizing.

Avoid over-positioning near major Fed meetings, CPI prints, or labor reports.

Unlike legacy markets, BTC can make multi-percent intraday moves. A robust risk plan isn’t optional—it’s survival.

8. Conclusion

Bitcoin has matured into a macro-responsive asset. What once moved on hype now responds to the pulse of the global economy. From M2 liquidity flows and interest rate expectations, to labor market stability, BTC Futures reflect institutional sentiment shaped by data.

BTC’s role in the modern portfolio is still evolving. But one thing is clear: macro matters. And those who understand which indicators truly move Bitcoin can trade with more confidence and precision.

Stay tuned for the next edition of the "Behind the Curtain" series as we decode the economic machinery behind another CME futures product.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

EURUSD - Macro ViewHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈From a macro perspective, EURUSD has been bearish trading within the falling red channel.

Medium-term, EURUSD has been in a correction phase trading within the rising channel in orange.

Moreover, the green zone is a massive monthly resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red and orange trendlines and resistance.

📚 As per my trading style:

As #EURUSD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil slumps as demand outlook dims and supply risesMacro:

- Oil prices stay weak as trade war fears weigh on global growth and energy demand.

- The IEA cut its 2025 oil demand growth forecast to just 730k bpd, the slowest pace in five years, down from 1.03 mln.

- Meanwhile, OPEC+ output is rising, with Saudi Arabia set to boost exports to China in May and Russia maintaining steady production, fueling oversupply concerns.

Technical:

- USOIL is in a clear downtrend fueled by lower highs and lows. The price is below both EMAs, indicating persistent downward momentum.

- If USOIL closes above the resistance at 63.30, the price may retest the following resistance at 65.80.

- On the contrary, remaining below 68.30 may pave the way to retest the support at 57.25 and 53.85, respectively.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

USDCAD - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCAD has been overall bullish from a macro perspective trading within the rising blue channel.

This week, USDCAD has been in a correction phase trading within the falling red channel.

Moreover, the green zone is a strong resistance turned support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red/blue trendlines acting non-horizontal support.

📚 As per my trading style:

As #USDCAD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Yield Curve is NOT InvertedLately I've been seeing a lot of people incorrectly state that the Yield Curve is currently inverted.

IT IS NOT.

Easily measurable 10Y - 2Y.

Google the definition if you need to.

I laid out the impact of the yield curve inverting against the S&P 500.

In most cases, you can see SP:SPX sells off slightly after inverting.

The higher the spread, the healthier the market is.

You want funds buying longer dated securities for market stability and confidence.

NZDUSD Long Setup – FVG + Order Block + Macro Bullish BiasI'm looking to go long on NZDUSD based on a strong confluence of fundamentals, seasonal trends, and technical structure.

🔹 Macro bias: USD weakening as Fed leans dovish, while NZD is gaining momentum from rate cuts and improving LEI.

🔹 Seasonality: Historically, NZD shows strength in the first half of April, while USD tends to weaken mid-to-late April.

🔹 Technical setup:

Price left a Fair Value Gap (FVG) on the 4H chart

Pullback into a bullish Order Block (OB)

Entry within imbalance

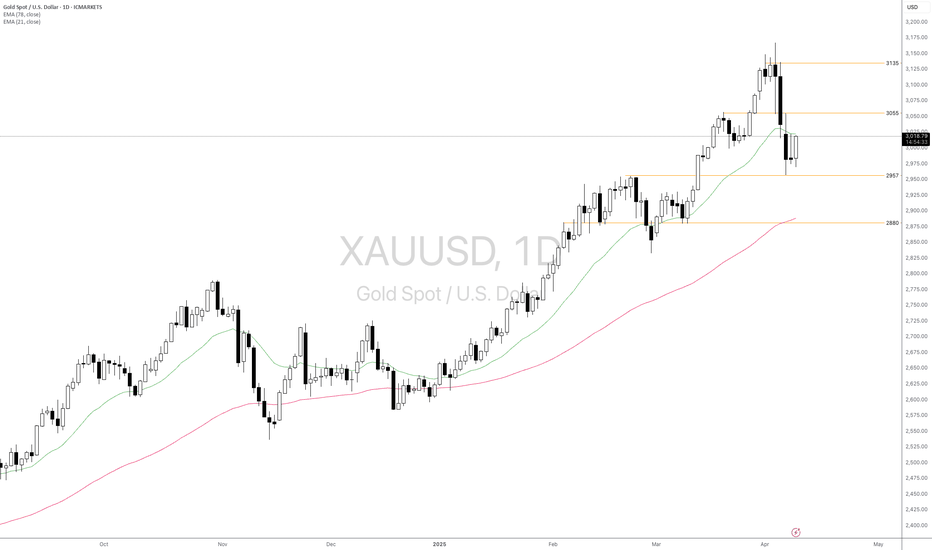

Will Gold Shine Again Once The Tariff Storm Is Settled?Macro:

- Gold prices have fallen since Trump's 'Liberation Day' tariff announcement, as global stock market pressure and hedge fund margin calls forced asset liquidations, including gold.

- Despite the short-term drop, gold remains a key medium-term hedge against recession risks and ongoing uncertainty once markets stabilize.

- High volatility may persist until tariff disputes are resolved and central banks clarify potential support measures.

Technical:

- XAUUSD fluctuates within the range of 2957-3055. The price is between both EMAs, indicating an intact sideways structure.

- If XAUUSD breaks below the support at 2957, the price may retest the following support at 2880.

- On the contrary, breaking above 3055 may lead to a record-high retest at around 3135.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness