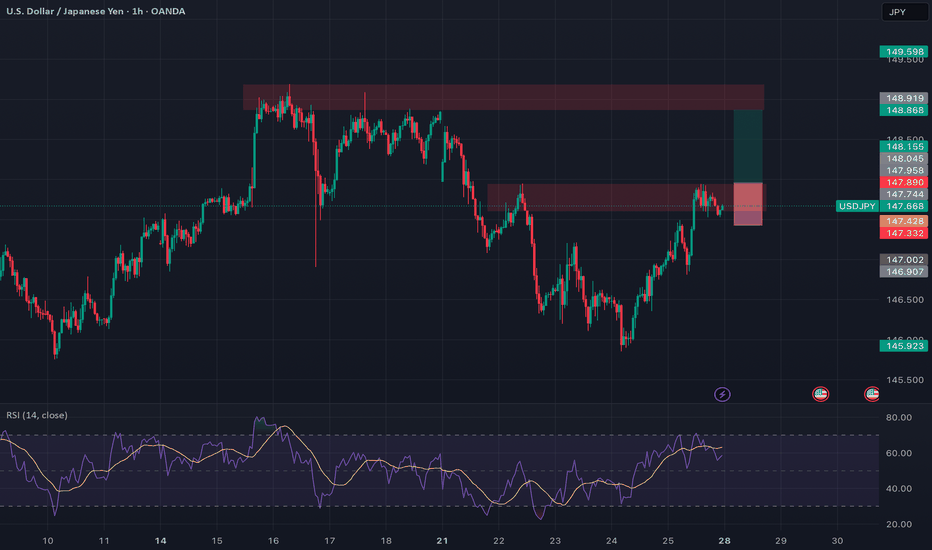

USDJPY: Breaking Out With Macro Backing 🟢 USDJPY | Breakout Opportunity Above Resistance

Timeframe: 1H

Bias: Bullish

Type: Break and Retest

📊 Technical Setup

USDJPY is currently consolidating at a key 4H resistance zone (147.75–147.90). A clean breakout and retest of this area will confirm bullish continuation.

• Entry: Above 147.90 (after confirmed candle close + retest)

• SL: Below 147.30

• TP: 148.90 / 149.60

• RR: ~1:2.5

• Indicators: RSI showing strong upside momentum, holding above 50

🧠 Fundamentals + Macro Confluence

• USD Strength: Strong macro & delayed rate cuts support USD upside

• JPY Weakness: BOJ remains dovish; risk-on sentiment weighing on JPY

• COT + Conditional Score: USD score increased to 17, JPY dropped to 8

• Risk Sentiment: VIX at 14.2 = RISK ON → bearish JPY bias

🧭 Gameplan

“Wait for confirmation above resistance before entering”

🔔 Set alerts around 147.90 and monitor lower timeframes for retest and bullish candle structure.

Macroanalysis

GBPUSD: Selling the Retest | Clean Break, Wait for Confirmation🔻 GBPUSD | Sell the Retest of Broken Support

Timeframe: 1H

Bias: Bearish

Type: Break and Retest

📊 Technical Setup

GBPUSD has broken a key 4H support zone (~1.3460–1.3494) which now acts as a turncoat resistance. Price is currently pulling back, offering a prime opportunity to sell the retest.

• Entry: 1.3460–1.3490 (after confirmation of rejection)

• SL: Above 1.3508

• TP: 1.3398

• RR: ~1:2

• RSI: Bearish momentum, RSI < 50 with mild recovery—ideal for a fade trade

📉 Macro & Fundamental Confluence

• GBP: Despite hawkish BOE tone, GBP is showing technical weakness and soft CFTC positioning

• USD: Strong macro bias with rising conditional score and delayed Fed cuts (still supporting USD strength)

• Seasonal Bias: GBPUSD marked bearish in seasonal chart

• COT Data: GBP positioning turning bearish after previous net build-up

🧭 Gameplan

“Wait for the retest of broken support-turned-resistance to reject before entering short. Stick to the zone.”

🔔 Set alerts around 1.3460–1.3490 and monitor for bearish engulfing or pinbar confirmation.

NZDJPY – Bearish Momentum BuildingPair: NZDJPY

Timeframe: 4H

Bias: Bearish

🔍 Technical Setup:

NZDJPY has broken sharply from its recent consolidation and is now testing a critical 4H support zone near 87.00. A decisive break below this zone would open the path toward lower support levels.

📍 Entry Trigger: Break and close below 86.95

🎯 Target 1: 85.95

🛑 Stop Loss: Above 87.35

📉 RSI: Near oversold, confirming strong bearish pressure

This setup reflects a classic bearish continuation with momentum and structure aligned.

🧠 Fundamental + Macro Confluence:

🔻 New Zealand (NZD):

RBNZ cut rates to 3.25% citing weak inflation, growth slowdown, and spare capacity.

Employment data remains fragile; upcoming releases add downside risk.

NZD is under pressure due to falling export demand amid global trade tensions.

CFTC positioning shows longs reducing, net positioning weakening — sentiment turning bearish.

🔺 Japan (JPY):

Bank of Japan is gradually tightening — while still accommodative, the bias is shifting hawkish.

JPY benefits as risk-off sentiment grows — fueled by weak equity markets and rising VIX (20.42).

CFTC shows a massive drop in NNCs, aligning with institutional flows favoring JPY strength.

🌐 Risk Sentiment:

VIX > 20 confirms risk-off sentiment, bolstering safe-haven demand for JPY.

NZD, being a high-beta risk currency, weakens as global risk appetite fades.

Seasonal bias also aligns with weakness in NZD and strength in JPY.

📌 Final Take:

Macro, sentiment, and technicals all align for further downside in NZDJPY. Watch for a clean H4 close below 86.95 to confirm entry. This pair offers strong confluence — from central bank divergence to institutional flows and global volatility.

GBPJPY – Bearish Continuation Setup AheadPair: GBPJPY

Timeframe: 4H

Bias: Bearish

🔍 Technical Overview:

GBPJPY has broken down with high momentum and is now hovering at a 4H support zone (195.30). A clean break and close below this level opens the door for a deeper move toward the next support areas:

Entry Trigger: Break below 195.30

🎯 Target 1: 194.05

🎯 Target 2: 192.50

🛑 Stop Loss: Above 195.95 (previous resistance-turned-supply zone)

📉 RSI: 27.63 (Oversold but momentum-driven selloff suggests more downside)

🧠 Macro + Fundamental Confluence:

🏦 Central Bank Policy:

BOE (Bank of England) cut rates by 25bps (to 4.25%) in a hawkish tone, with internal disagreement (7–2 vote), signaling uncertainty and potential for further divergence.

Despite the “hawkish cut,” the market interpreted it cautiously, especially with falling UK economic momentum and weak retail data.

💴 Bank of Japan:

BoJ is slowly tightening policy — signaling an eventual exit from ultra-loose conditions.

Real interest rates remain negative, but the direction is now incrementally hawkish, strengthening the JPY across the board.

💡 Market Sentiment:

VIX at 20.42 = Risk-Off Environment → capital flows into safe-haven JPY, out of GBP.

With Nasdaq bullish, but volatility ticking up, JPY benefits from its safe-haven role.

📊 CFTC Positioning:

GBP: Longs decreasing, shorts rising, NNCs decreasing → Bearish bias

JPY: Longs flat, but massive drop in NNCs → institutional positioning is turning defensive

🧾 Economic Weakness:

UK Services PMI showing signs of stagnation

CPI and Retail Sales remain weak, suggesting limited scope for further GBP upside

Japan's latest Household Spending and Economy Watchers Survey show stabilizing conditions, supporting yen strength

📌 Final Take:

Fundamentals support the breakdown as monetary divergence and global sentiment drive capital into the JPY. Watch for confirmation via H4 close below 195.30 before entering the trade.

🧭 Trade idea aligns with macro, technicals, seasonality, and institutional flows.

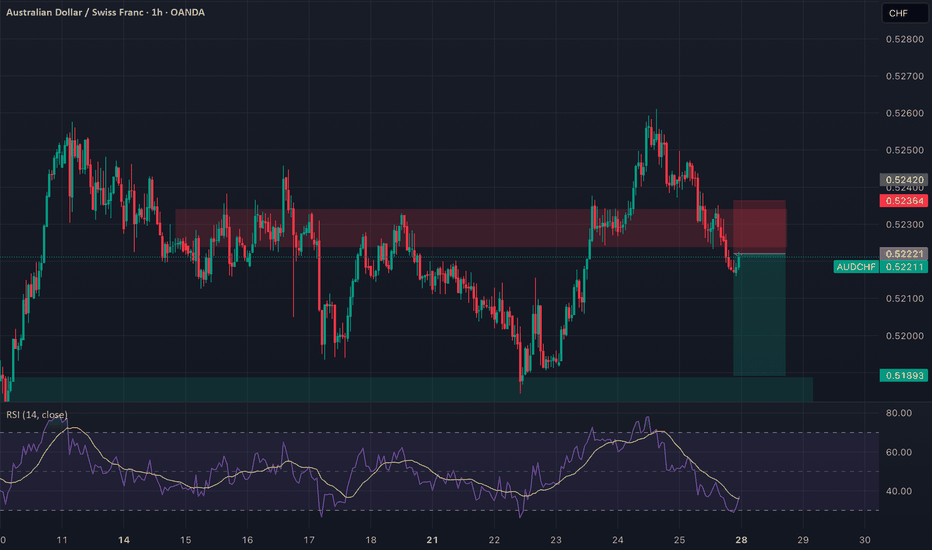

AUDCHF: Broken Support, Bearish Flow In Play Timeframe: 1H

Bias: Bearish

Type: Support Turncoat → Breakdown Play

📊 Technical Setup

AUDCHF previously broke the 4H resistance (0.5236) which flipped to support. However, price has now broken below this support, confirming it as a failed demand zone.

• Entry: Market execution or retest of 0.5236

• SL: Above 0.5245

• TP: 0.5189

• RR: ~1:2

• RSI: Below 50 and heading lower = momentum supports downside

📉 Macro & Fundamental Confluence

• AUD Weakness: RBA dovish, conditional score declining, bearish seasonality

• CHF Slightly Less Weak: Despite SNB dovish stance, CHF is outperforming AUD

• COT + Sentiment: AUD CFTC weakening, CHF holding steady

• Risk Sentiment: RISK ON environment reduces CHF demand but AUD still underperforms

🧭 Gameplan

“Support failed to hold. Bearish pressure intensifies. Target previous swing low zone.”

🔔 Watch for retest of 0.5236 for better RR setup before continuing short.

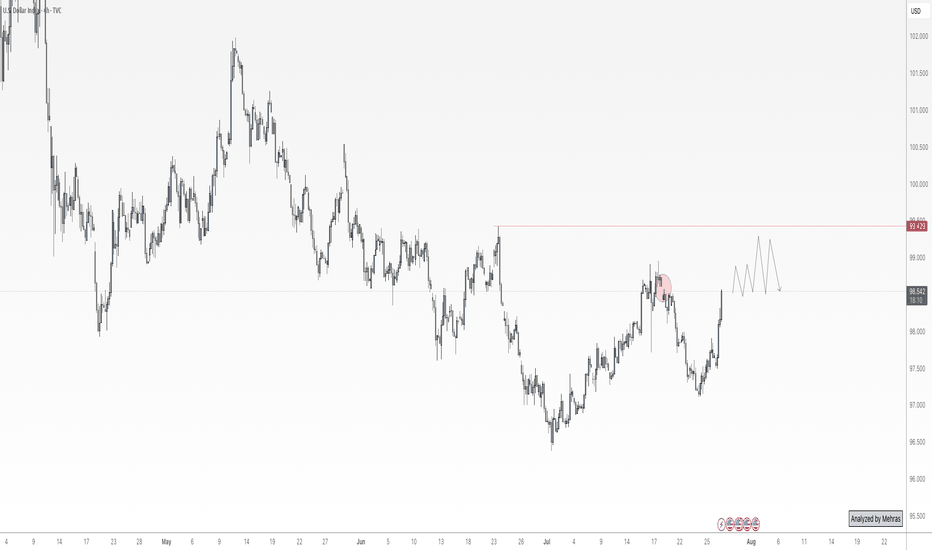

DXY at Its Most Critical Level of 2025 — Will the 100 Bank LevelThe Dollar Index (DXY), just like several other majors, is approaching a very important level. We’re now near the 100 mark, which is not only a psychological level — but also a key institutional (bank) level.

There’s also a gap zone left behind that price is about to fill. I believe the index will stay in a range over the next 1–2 days as it waits for critical data later this week — especially Wednesday’s announcements and Friday’s NFP report, which could set the tone for what’s next.

Based on current market sentiment, Trump’s remarks, Powell’s upcoming speech, and broader macro factors, I believe DXY has the potential to break above 100 and move toward 102–104, if that level is broken cleanly.

Let’s also not forget — price bounced from a monthly demand block near 96, and we’re seeing weak support across majors like EUR and Gold. That adds confluence for potential dollar strength.

📌 What do you think — is dollar strength just around the corner?

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

TOTAL Crypto Market Cap: Structural Breakout Aligns with Macros## 📊 TOTAL – Crypto Market Cap Ready for Expansion Phase?

---

### 🧵 **Summary**

The crypto market is showing signs of strong macro strength, with TOTAL reclaiming major support levels and forming a structurally bullish setup. Our multi-Fibonacci confluences and hidden bullish divergence point toward the possibility of a sustained breakout and new expansion leg toward \$4.9T and beyond.

This bullish view is further supported by powerful macro fundamentals expected over the next 8–10 months, including:

* Central bank rate cuts and liquidity expansion

* U.S. and EU regulatory clarity (stablecoins, ETFs, MiCA)

* Strong institutional adoption and geopolitical shifts

* Ethereum scaling upgrades and Bitcoin halving cycle effects

Together, these narratives form a compelling foundation for a broad-based market cap expansion.

---

### 📈 **Chart Context**

This is a **weekly chart of the TOTAL crypto market cap**, providing a bird’s-eye view of market cycles, macro structure, and capital flow across the entire ecosystem.

---

### 🧠 **Key Technical Observations**

* **Reclaim of \$3.02T level** (key support/fib level) signals macro bullish momentum.

* Market is forming **higher lows and bullish continuation structures**.

* **Support zones:** \$3.02T (reclaimed), \$2.57T (key pivot),

* **Resistance/TP zones:**

* **TP1 – \$3.75T** (100% trend-based fib + -27% retracement expansion)

* **TP2 – \$4.9T** (161.8% trend-based fib + -61.8% retracement expansion)

* **TP3 – \$6.9T** (261.8% fib extension target)

---

### 🧶 **Fibonacci Confluences and TP Logic**

We’ve employed both **standard Fibonacci retracement** and **trend-based extension** tools to build our target structure. The **1TP and 2TP zones** are defined by confluences between:

* **Retracement expansion levels** of **-27% and -61.8%**

* **Trend-based extension levels** of **100% and 161.8%**

If price reaches 2TP (~~\$4.9T) and **retraces toward the parallel legs** (100%–127%), this would confirm structural symmetry and open the door for a final push toward \*\*TP3 (~~\$6.9T)\*\* — the 261.8% extension.

---

### 🔍 **Indicators**

* **MACD Crossover** and rising histogram bars

* **Hidden Bullish Divergence** between MACD and price – a classic continuation signal

* Weekly trendline breakout from accumulation zone

---

### 🧠 **Fundamental Context**

While not directly charted, key macro catalysts like ETF approvals, global liquidity cycles, monetary easing, and increasing institutional interest will likely play a role in the next phase of expansion. This chart captures the structural readiness for that narrative.

## 📊 Fundamental Context (Extended Outlook: Mid-2025 to Early 2026)

Below is a detailed breakdown of upcoming macroeconomic, geopolitical, and crypto-specific developments sourced from:

* Bitwise Asset Management

* Fidelity Digital Assets

* ARK Invest

* CoinDesk, Reuters, Axios, WSJ

* CapitalWars, Cointelegraph, Coinpedia

* European Commission (MiCA regulations)

* U.S. Congressional records and SEC announcements

These events are chronologically aligned to support a structured macro bullish thesis for TOTAL market cap.

Bullish Crypto Catalysts (June 2025 – Feb 2026)

Summer 2025 (Jun–Aug): Monetary Easing and Regulatory Breakthroughs

Central Bank Policy Pivot: By mid-2025, major central banks are shifting toward easier policy. Market expectations indicate the U.S. Federal Reserve will stop tightening and begin cutting interest rates in 2025, with forecasts of up to three rate cuts by end-2025

bitwiseinvestments.eu

. Declining inflation and rising unemployment are pushing the Fed in this direction

bitwiseinvestments.eu

bitwiseinvestments.eu

. Easier monetary policy increases global liquidity and risk appetite, historically providing a tailwind for Bitcoin and crypto prices

bitwiseinvestments.eu

. In fact, global money supply is near record highs, a condition that in past cycles preceded major Bitcoin rallies

bitwiseinvestments.eu

. Should economic volatility worsen, the Fed has even signaled readiness to deploy fresh stimulus, which would inject more liquidity – “another tailwind for Bitcoin price growth”

nasdaq.com

.

Liquidity and Inflation Trends: With inflation trending down from earlier peaks, central banks like the Fed and European Central Bank are under less pressure to tighten. This opens the door for potential liquidity injections or QE if growth falters. Analysts note a strong correlation (often >84%) between expanding global M2 money supply and Bitcoin’s price rise

nasdaq.com

. There is typically a ~2-month lag for liquidity increases to flow into speculative assets like crypto

nasdaq.com

nasdaq.com

. The monetary easing expected in mid-2025 could therefore boost crypto markets by late summer, as new liquidity finds its way into higher-yielding investments. One projection even models Bitcoin retesting all-time highs (~$108K by June 2025) if global liquidity continues upward

nasdaq.com

– underscoring how “accelerated expansion of global liquidity” often aligns with crypto bull runs

nasdaq.com

.

U.S. Stablecoin Legislation: A landmark regulatory catalyst is anticipated in summer 2025: the first comprehensive U.S. crypto law, focused on stablecoins. The Senate has advanced the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act to a final vote

coindesk.com

. Passage of this bill (expected by mid-2025) would create a federal framework for stablecoin issuers, resolving a major regulatory gray area

coindesk.com

. Analysts call this “one of the most important regulatory developments in the history of crypto” – potentially even bigger than the approval of spot Bitcoin ETFs in impact

coindesk.com

. By enforcing prudential standards on stablecoin reserves and permitting licensed issuance, the law would legitimize stablecoins as a core part of the financial system. Bitwise predicts that clear rules could trigger a “multi-year crypto bull market,” with stablecoin market cap exploding from ~$245B to $2.5 trillion as mainstream adoption accelerates

coindesk.com

coindesk.com

. A U.S. law would also likely set a global precedent, encouraging other regions to integrate crypto-dollar tokens into commerce. Bottom line: expected stablecoin regulation in summer 2025 is a bullish game-changer, improving market integrity and unlocking new liquidity for crypto markets

coindesk.com

.

Regulatory Clarity in Europe: Meanwhile, Europe’s comprehensive MiCA regulations have fully taken effect as of late 2024, so by summer 2025 the EU has a unified crypto framework. This gives legal clarity to issuers, exchanges, and custodians across the 27-nation bloc

pymnts.com

skadden.com

. The harmonized rules (covering everything from stablecoin reserves to exchange licensing) are expected to expand Europe’s crypto market size by 15–20% in the coming years

dailyhodl.com

. With MiCA in force, firms can confidently launch crypto products EU-wide, and institutional investors have more protection. U.K. regulators are on a similar path – e.g. recognizing stablecoins as payment instruments – further globalizing the pro-crypto regulatory trend. By mid-2025, this regulatory thaw in major economies is improving investor sentiment. Goldman Sachs recently noted that 91% of crypto firms are gearing up for MiCA compliance – a sign that industry is preparing to scale under clearer rules

merklescience.com

merklescience.com

. Overall, the summer of 2025 marks a turning point: governments are embracing sensible crypto rules (rather than harsh crackdowns), reducing uncertainty and inviting institutional capital off the sidelines.

Initial ETF Impact: The first wave of U.S. spot crypto ETFs – approved in late 2023 and January 2024 – will have been trading for over a year by mid-2025

investopedia.com

. Their success is already far exceeding expectations: BlackRock’s iShares Bitcoin Trust amassed a record $52 billion AUM in its first year (the biggest ETF launch in history)

coindesk.com

, and other Bitcoin funds from Fidelity, ARK, and Bitwise quickly joined the top 20 U.S. ETF launches of all time

coindesk.com

. These products have unleashed pent-up retail and institutional demand by offering a regulated, convenient vehicle for crypto exposure

coindesk.com

. By summer 2025, ETF inflows are still robust, and many Wall Street analysts expect a second wave of approvals. Indeed, 2025 is being called “the Year of Crypto ETFs”

coindesk.com

. Observers predict dozens of new funds – including spot Ether, Solana, and XRP ETFs – could win approval under revamped SEC leadership in the post-2024 election environment

coindesk.com

. If so, late 2025 could see a broad menu of crypto ETF offerings, widening investor access to the asset class. This steady drumbeat of ETF launches and inflows adds a structural source of buy-pressure under crypto markets throughout 2025. (Notably, Bloomberg data showed over $1.7B poured into spot crypto ETFs in just the first week of 2025, on top of 2024’s flows

etf.com

.) In short, the ETF effect – “shocking the industry to its core” in year one

coindesk.com

– is set to grow even stronger in 2025, channeling more traditional capital into crypto.

U.S. Political Shift (Post-Election): The outcome of the Nov 2024 U.S. elections is a crucial backdrop by mid-2025. A new administration under President Donald Trump took office in January 2025 and immediately signaled a markedly pro-crypto policy stance. Within his first 100 days, Trump’s appointments to key financial agencies (SEC, CFTC, OCC) effectuated a “180° pivot” in crypto regulation from the prior administration

cnbc.com

. Industry observers describe a sharp policy reversal – where previously the sector faced hostility, now it’s courted as an engine of innovation. President Trump has publicly vowed to be “the first crypto-president,” hosting crypto industry leaders at the White House and promising to boost digital asset adoption

reuters.com

. He even floated creating a strategic Bitcoin reserve for the United States

reuters.com

– a striking show of support for Bitcoin’s role as a reserve asset (though it remains to be seen if this materializes). More tangibly, regulatory agencies have begun rolling back onerous rules. For example, the SEC under new leadership scrapped a prior accounting guideline that made bank crypto custody prohibitively expensive

reuters.com

. And the Office of the Comptroller of the Currency (OCC) has “paved the way” for banks to engage in crypto activities like custody and stablecoin issuance

reuters.com

. These changes in Washington brighten the outlook for crypto markets: with regulatory uncertainty fading, U.S. institutions feel more confident to participate. In essence, by mid-2025 the world’s largest capital market (the U.S.) is shifting from impeding crypto to embracing it, a narrative change that cannot be overstated in its bullish significance

coindesk.com

reuters.com

.

Geopolitical Easing and BRICS Actions: Global macro conditions in summer 2025 may also improve due to geopolitical developments. If major conflicts (like the Russia-Ukraine war) de-escalate or move toward resolution by late 2024 or 2025, it would remove a key source of risk-off sentiment. Lower geopolitical risk and easing of war-driven commodity shocks would help cool inflation (especially energy prices) and bolster global growth – factors that support risk asset rallies (crypto included). On another front, the BRICS nations (Brazil, Russia, India, China, South Africa + new members) are continuing their de-dollarization agenda in 2025. At the BRICS summit in October 2024, they discussed creating a new gold-backed reserve currency (“the Unit”) as an alternative to the U.S. dollar

investingnews.com

. They also announced a BRICS blockchain-based payment network (“BRICS Bridge”) to connect their financial systems via CBDCs, bypassing Western networks

investingnews.com

. Going into 2025, these initiatives are expected to progress (with Russia currently chairing BRICS). While a full-fledged BRICS currency may be years away (and faces hurdles

moderndiplomacy.eu

), the bloc’s move to settle more trade in non-USD currencies is already underway (by 2023, roughly 20% of oil trades were in other currencies)

investingnews.com

. Implication: A shift toward a more multi-polar currency world could weaken U.S. dollar dominance over time

investingnews.com

. For crypto, this trend is intriguing – as nations seek dollar alternatives, Bitcoin’s appeal as a neutral, supranational asset may rise. In sanctioned or economically volatile countries, both elites and the public might accelerate adoption of crypto for cross-border value storage. For example, U.S. sanctions on Russia and China have already catalyzed talk of reserve diversification

investingnews.com

. Fidelity analysts note that “rising inflation, currency debasement and fiscal deficits” globally are making Bitcoin strategically attractive for even nation-states and central banks

coindesk.com

coindesk.com

. Summing up: a backdrop of improving geopolitical stability (if realized) plus a weakening dollar regime provides a bullish macro and narrative case for borderless cryptocurrencies as we enter the second half of 2025.

Fall 2025 (Sep–Nov): Institutional Inflows, Adoption & Tech Upgrades

Surging Institutional Adoption: By autumn 2025, the cumulative effect of regulatory clarity and market maturation is a wave of institutional adoption unlike any prior cycle. In traditional finance, major U.S. banks and brokers are cautiously but steadily entering the crypto arena. Reuters reports that Wall Street banks are now receiving “green lights” from regulators to expand into crypto services, after years of hesitance

reuters.com

reuters.com

. Many top banks have been internally testing crypto trading and custody via pilot programs

reuters.com

. As one example, Charles Schwab’s CEO said in May 2025 that regulator signals are “flashing pretty green” for large firms, and confirmed Schwab plans to offer spot crypto trading to clients within a year

reuters.com

. Banks like BNY Mellon, State Street, and Citigroup – which collectively manage trillions – are expected to roll out crypto custody solutions by 2025, often via partnerships with crypto-native custodians

dlnews.com

. The OCC has explicitly authorized banks to handle crypto custody and stablecoins (under proper safeguards), removing a key barrier

reuters.com

. And the SEC’s friendlier stance under new leadership means banks no longer face punitive capital charges for holding digital assets

reuters.com

. The net effect is that by late 2025, institutional-grade crypto infrastructure is falling into place. More pension funds, endowments, and asset managers can allocate to crypto through familiar channels (regulated custodians, ETFs, prime brokers). Even conservative banking giants are warming up: Bank of America’s CEO stated the bank “will embrace cryptocurrencies for payments if regulations permit” and hinted at possibly launching a BOA stablecoin for settlement

reuters.com

. Likewise, Fidelity and BlackRock’s crypto units are expanding offerings after seeing outsized demand. This institutional legitimization dramatically expands the pool of potential investors in crypto markets, supporting a higher total market capitalization.

Crypto ETF Expansion: In Q4 2025, the roster of crypto-based ETFs and funds is likely to broaden further. As noted, analysts foresee 50+ crypto ETFs by end of 2025 under the pro-industry U.S. regulatory regime

coindesk.com

. By fall, we may see Ethereum spot ETFs (building on the successful Bitcoin products) and even funds for large-cap altcoins. For instance, Nate Geraci of The ETF Store predicts spot Solana and XRP ETFs are on the horizon in the U.S.

coindesk.com

. Internationally, Canada and Europe already have multiple crypto ETPs – their continued growth adds to global inflows. With a year of performance history by late ’25, crypto ETFs will likely start seeing allocations from more conservative institutions (insurance firms, corporate treasuries, etc.) that needed to observe initially. Fidelity’s strategists noted that in 2024 much of the ETF buying came from retail and independent advisors, but 2025 could bring uptake from hedge funds, RIAs, and pensions as comfort grows

coindesk.com

coindesk.com

. In summary, fall 2025 should witness accelerating capital inflows via investment vehicles, as crypto solidifies its place in mainstream portfolios. This sustained demand – “2025’s flows will easily surpass 2024’s” according to one strategist

coindesk.com

– provides a steady bid under crypto asset prices, reinforcing a bullish trend.

Nation-State and Sovereign Adoption: A notable development to watch in late 2025 is the entry of nation-states and public institutions into Bitcoin. Fidelity Digital Assets published a report calling 2025 a potential “game changer in terms of bitcoin adoption”, predicting that more nation-states, central banks, sovereign wealth funds, and treasuries will buy BTC as a strategic reserve asset

coindesk.com

. The rationale is that with rising inflation and heavy debt loads, governments face currency debasement and financial instability, making Bitcoin an attractive hedge

coindesk.com

. By Q4 2025, we could see early signs of this trend. For example, there are rumors that Russia and Brazil have explored holding Bitcoin reserves

fortune.com

, and Middle Eastern sovereign funds flush with petrodollars might quietly accumulate crypto as diversification. In the U.S., President Trump and crypto-friendly lawmakers like Senator Cynthia Lummis have openly discussed establishing a U.S. Bitcoin reserve or adding BTC to Treasury holdings

coindesk.com

. Lummis even introduced a “Bitcoin Reserve” bill in 2024, which if enacted would set a precedent for national adoption

coindesk.com

. While such bold moves might not happen overnight, even small allocations by governments or central banks would be symbolically massive. It would validate crypto’s role as “digital gold” and potentially ignite FOMO among other nations (a game theory dynamic Fidelity’s report alludes to). Thus by late 2025, any announcements of central banks buying Bitcoin or countries mining/holding crypto (similar to El Salvador’s earlier example) could spur a bullish frenzy. At minimum, the expectation of this “sovereign bid” provides a narrative supporting the market. As Fidelity’s analysts put it: not owning some Bitcoin may soon be seen as a greater risk for governments than owning it

coindesk.com

. Ethereum & Crypto Tech Upgrades: The latter part of 2025 is also packed with technological catalysts in the crypto sector, which can boost investor optimism. Chief among these is Ethereum’s roadmap milestones. Ethereum core developers plan to deliver major scaling improvements by end-2025 as part of “The Surge” phase

bitrue.com

. This includes fully rolling out sharding – splitting the blockchain into parallel “shards” – combined with widespread Layer-2 rollups, aiming to increase throughput to 100,000+ transactions per second

bitrue.com

. If Ethereum achieves this by Q4 2025, it would vastly lower fees and increase capacity, enabling a new wave of decentralized application growth. For users, that means faster, cheaper transactions; for the market, it means Ethereum becomes more valuable as utilization can skyrocket without bottlenecks. Progress is well underway: an intermediate upgrade (EIP-4844 “proto-danksharding”) was implemented earlier to boost Layer-2 efficiency, and the next major upgrade (code-named Pectra) is slated for Q1 2025 focusing on validator improvements and blob data throughput

fidelitydigitalassets.com

. After that, the final sharding implementation is expected. By late 2025, Ethereum’s evolution – including MEV mitigation (The Scourge) and Verkle trees for lighter nodes (The Verge) – should make the network more scalable, secure, and decentralized

bitrue.com

. These upgrades are bullish for the ecosystem: a more scalable Ethereum can host more DeFi, NFT, and gaming activity, attracting capital and users from traditional tech. Investors may speculate on ETH demand rising with network activity. Beyond Ethereum, other protocols (Solana, Cardano, Layer-2s like Arbitrum, etc.) also have roadmap milestones during this period, potentially improving their value propositions. Overall, the tech backdrop in late 2025 is one of significant improvement, which supports a positive market outlook – the infrastructure will be ready for mainstream scale just as interest returns.

Bitcoin Halving Aftermath: Although the Bitcoin halving took place in April 2024, its bullish impact historically materializes with a lag of 12-18 months. That puts late 2025 into early 2026 right in the window when the post-halving cycle may reach a euphoric phase. By fall 2025, Bitcoin’s supply issuance will have been at half its prior rate for ~18 months, potentially leading to a supply-demand squeeze if demand surges. ARK Invest notes that previous halvings (2012, 2016, 2020) all coincided with the early stages of major bull markets

ark-invest.com

. Indeed, by Q4 2025 we may see this pattern repeating. ARK’s analysts observed in late 2024 that Bitcoin remained roughly on track with its four-year cycle and expressed “optimism about prospects for the next 6–12 months” following the April 2024 halving

ark-invest.com

. That optimism appears well-founded if macro conditions and adoption trends align as discussed. By November 2025, Bitcoin could be approaching or exceeding its previous all-time high ( ~$69K from 2021) – some crypto analysts foresee six-figure prices during this cycle. Importantly, a rising Bitcoin tide tends to lift the entire crypto market cap. Late 2025 could see a broad rally across altcoins, often referred to as “altseason,” as new retail and institutional money, emboldened by Bitcoin’s strength, diversifies into higher-beta crypto assets. The expectation of the halving-driven bull cycle can itself become a self-fulfilling sentiment booster: investors position ahead of it, providing additional buy pressure. In summary, fall 2025 is poised to be the crescendo of the Bitcoin halving cycle, with historical analogues (2013, 2017, 2021) suggesting a powerful uptrend in crypto prices. Reduced BTC supply + peak cycle FOMO + all the fundamental drivers (ETF flows, low rates, tech upgrades) make this timeframe particularly conducive to a bullish market cap expansion.

Winter 2025–26 (Dec–Feb): Peak Momentum and Continued Tailwinds

Bull Market Momentum: Entering winter 2025/26, the crypto market could be in full bull mode. If the above developments play out, total crypto market capitalization may be approaching new highs by late 2025, driven by strong fundamentals and investor FOMO. Historically, the final leg of crypto bull markets sees parabolic gains and surging liquidity inflows. We might witness that in Dec 2025 – Feb 2026: exuberant sentiment, mainstream media coverage of Bitcoin “breaking records,” and increased retail participation. Unlike the 2017 and 2021 peaks, however, this cycle has far greater institutional involvement, which could imply more sustainable capital inflows (and possibly a larger magnitude of inflows). Key macro factors are likely to remain supportive through early 2026: central banks that began easing in 2024-25 may continue to hold rates low or even consider renewed asset purchases if economies are soft. For instance, if a mild U.S. recession hits in late 2025, the Fed and peers could respond with quantitative easing or liquidity facilities, effectively “printing” money that often finds its way into asset markets, including crypto

nasdaq.com

. China’s PBoC could also inject stimulus to boost growth, adding to global liquidity. Such actions would prolong the “risk-on” environment into 2026, delaying any end to the crypto uptrend. Additionally, global equity markets are projected to be strong in this scenario (buoyed by low rates and easing geopolitical tensions), and crypto’s correlation with equities means a rising stock tide lifts crypto too – as was observed in May 2025 when stock rallies coincided with BTC and ETH jumps

blockchain.news

blockchain.news

.

Investor Sentiment and Retail Revival: By early 2026, investor sentiment toward crypto could be the most bullish since 2021. With clear regulatory frameworks, high-profile endorsements (even governments buying in), and tech narratives (Web3, AI+blockchain, etc.), the stage is set for a positive feedback loop. Retail investors who largely sat out during the harsh 2022–23 bear market may fully return, spurred by “fear of missing out” as they see Bitcoin and popular altcoins climbing. This broadening of participation (from hedge funds down to everyday investors globally) increases market breadth and can drive total market cap to climactic heights. Notably, the availability of user-friendly investment onramps – e.g. spot crypto ETFs through any brokerage, crypto offerings integrated in fintech apps and banks – makes it much easier for average investors to allocate to crypto in 2025-26 than in past cycles. The removal of friction means inflows can ramp up faster and larger. Social media and pop culture hype also tend to peak in late-stage bulls; we might see Bitcoin and Ethereum becoming water-cooler talk again, drawing in new demographics. All of this contributes to strong sentiment and capital inflows in winter 2025/26, reinforcing the bullish outlook.

Continued Policy and Geopolitical Tailwinds: The policy landscape is expected to remain a tailwind into 2026. In the U.S., if the pro-crypto Trump administration stays aligned with its promises, we could see additional positive actions: perhaps tax clarity for digital assets, streamlined ETF approvals for more crypto categories, or even federal guidelines for banks to hold crypto on balance sheets. Such steps would further normalize crypto within the financial system. Regulatory coordination internationally might also improve – for example, G20 nations in 2025 have been working on a global crypto reporting framework and stablecoin standards, which, once implemented, reduce the risk of harsh crackdowns in any major economy. On the geopolitical front, the BRICS de-dollarization efforts might bear first fruit by 2026, such as increased trade settled in yuan, gold, or even Bitcoin. If Saudi Arabia (a new BRICS invitee) starts pricing some oil in non-USD, that could weaken dollar liquidity at the margins, and some of that displaced value might flow to alternative stores like crypto or gold. Additionally, by 2026 the world will be looking ahead to the next U.S. Presidential election cycle (2028) – typically, in the lead-up, administrations prefer supportive economic conditions. This could mean fiscal stimulus or at least no new financial regulations that rock markets, implying a benign policy environment for risk assets. In Europe, 2026 will see MiCA fully operational and possibly updated with new provisions for DeFi and NFTs, further integrating the crypto market. In sum, early 2026 should carry forward many of 2025’s positive drivers – ample liquidity, regulatory support, and growing mainstream acceptance – giving little reason to suspect an abrupt end to the bullish trend during this window.

Bitcoin Halving Cycle Peak: If history rhymes, the crypto market might reach a cycle peak somewhere around late 2025 or early 2026. Past bull cycles (2013, 2017, 2021) peaked roughly 12-18 months after the halving; a similar timeframe would put a possible top in the Dec 2025 – Feb 2026 period. That could mean Bitcoin at unprecedented price levels and total crypto market cap in multi-trillions, barring any unforeseen shocks. ARK Invest’s analysis as of late 2024 remained optimistic that Bitcoin was “in sync with historical cycles” and poised for strong performance into 2025

ark-invest.com

. By early 2026, those cycle dynamics (diminished new supply vs. surging demand) might reach a crescendo. One metric to watch is the stock-to-flow or issuance rate – post-halving Bitcoin’s inflation rate is below 1%, lower than gold’s, which can drive the digital gold narrative to its zenith at this point. Moreover, Ethereum’s upcoming transition to a deflationary issuance (with EIP-1559 fee burns and Proof-of-Stake) means ETH could also be seeing declining supply into 2026, potentially amplifying its price if demand spikes. Thus, both of the top crypto assets would have increasing scarcity dynamics during the period when interest is highest – a recipe for a dramatic run-up. Importantly, capital rotations within crypto during peak phases often send smaller altcoins skyrocketing (as investors seek outsized gains), temporarily boosting total market cap beyond just Bitcoin’s contribution. All told, the early 2026 period could represent the euphoric apex of this cycle’s bull market, supported by solid macro and fundamental fuel laid in the preceding months. Even if volatility will be high, the overall outlook through February 2026 remains strongly bullish for crypto’s total market capitalization, given the confluence of loose monetary conditions, favorable policy shifts, geopolitical diversification into crypto, institutional FOMO, and major network upgrades powering the narrative.

✨ Philosophical Reflection

In the ever-unfolding rhythm of cycles—accumulation, expansion, distribution, and reset—crypto mirrors the deeper architecture of nature and consciousness. Just as seeds lie dormant in winter awaiting the kiss of spring, so too does capital bide its time in the shadows before surging into momentum. The Fibonacci spirals found in shells, storms, and galaxies reappear in price action—offering not just numbers, but a language of emergence. What we witness in the TOTAL market cap is not just a breakout—it is a reawakening. A collective pulse of belief, liquidity, and intention. In this confluence of technical geometry and macroeconomic tides, the market becomes more than price—it becomes a story, a symbol, a signal. We don’t just analyze this chart—we read it like a sacred map, charting the ascent of value, vision, and velocity.

Bond Market Breakdown: Why Yields Are Surging and What It Means 🚨 Market Recap – May 2025 Edition

This week, markets sent a clear message: rising yields are shaking the foundation. In this video, I break down the key events driving the spike in U.S.

Treasury yields — the highest in nearly two decades — and what that means for major assets like:

💵 DXY (U.S. Dollar)

📉 XAU/USD (Gold)

🟠 BTC/USD (Bitcoin)

We unpack:

Why the dollar is showing strength despite long-term fiscal concerns

How bond market stress is impacting investor sentiment across all asset classes

What rising yields mean for your portfolio — in plain language

Why this might be the most important macro signal traders are missing right now

If you’re a trader, investor, or just trying to understand what’s really moving the markets, this recap connects the dots.

📊 Watch now to stay ahead.

🔁 Feel free to share or comment with your thoughts!

#MarketRecap #BondYields #DXY #Gold #Bitcoin #MacroAnalysis #TradingView #InvestorInsights #FX #Crypto #TradingStrategy

GBPJPY – Breakout Buy Setup (Macro Alignment)GBPJPY long setup backed by rising LEI, strong macro trend, JPY weakness, and bullish seasonal window approaching after April 24.

Waiting for breakout confirmation above resistance to validate entry.

🧠 Macro + Model Alignment

LEI score rising → 33 (April), macro outlook improving

Exo+LEI = 1153 → strong bullish signal

JPY COT: Overbought → reversal risk

GBP fundamentals outperform JPY across April

Seasonality: GBP bearish till April 24, then bullish into month-end

📌 Best entry window = April 25+

📊 Technical Setup – 1H Chart

Price testing key resistance zone ~190.00

Watching for breakout & candle close above resistance for confirmation

Clear R:R with defined structure zones

📥 Entry: Break and close above 190.284

⛔ Stop Loss: 187.414

🎯 Take Profit: 192.608

🧮 R:R ≈ 1:2+

Confirmation required before entry ✅

[XAU/USD & DXY] – Long-Term Outlook📌 – Long-Term Outlook: Is Gold Entering a New Bull Cycle as USD Weakens?

📊 Technical Analysis – Gold & DXY

The divergence between Gold and the U.S. Dollar Index (DXY) has become increasingly clear:

🔹 Gold (XAU/USD):

Price has broken the previous high at 3,190 and is now testing 3,219 – a fresh all-time high on the daily chart.

The MA13, MA34, and MA200 are showing a perfect “bullish fan” formation, indicating a sustainable uptrend rather than a short-term pump.

The key support zone around 3,164 – 3,118 remains critical for any healthy pullback.

🔻 U.S. Dollar Index (DXY):

Price has decisively broken below the psychological 100.55 support and is now hovering near 99.78.

If DXY fails to hold above 99.7, the next downside target could be 97.5 in the coming quarter.

The technical structure is clearly bearish, confirming USD weakness across the board.

→ This negative correlation aligns with macro expectations: a weaker dollar is fueling gold’s bullish momentum.

🌍 Fundamental Analysis – Macro Drivers

US PPI & CPI both come in lower than expected:

Inflation is showing clear signs of cooling.

Markets are now pricing in a possible rate cut as early as June.

Shift in Fed tone – from hawkish to neutral:

While not officially declared, recent Fed statements have been more dovish, supporting risk assets and weakening the dollar.

Strong safe-haven demand remains:

Geopolitical risks and economic uncertainty continue to push capital into gold, especially as USD enters a weakening phase.

🧭 Long-Term Perspective

Gold is potentially entering a new bull cycle. With consecutive ATH breakouts and favorable macro conditions (falling inflation, expected rate cuts, USD weakness), gold could push to even higher levels into Q2 and Q3.

The USD faces downside pressure in the coming months, especially if the Fed signals a firm pivot toward easing.

⚠️ Strategy Caution

Short-term corrections may occur, especially after such a sharp rise.

However, any pullbacks into key support zones could present strategic long opportunities for longer-term investors.

💬 What’s Your Take?

Is this the beginning of a major bull cycle in gold, or do you expect deeper pullbacks before continuation?

Drop your analysis and charts below! 👇👇👇

GOLD MARKET OUTLOOK – Investor Panic After Fake News🟡 GOLD MARKET OUTLOOK – Investor Panic After Fake News, Bearish Bias Remains

📉 Current Strategy: Focus on SELL setups at key resistance zones – short-term bearish outlook remains valid

📌 US Session Recap:

Gold saw a sharp sell-off after a fake news report circulated about the US delaying its planned tariff policy.

→ While the White House later confirmed it was misinformation, the damage was done — panic selling hit across global markets.

💥 As a result, gold dropped aggressively and reached the 295x zone, aligning perfectly with AD’s previous short bias.

Meanwhile, US equities also continued to bleed red.

🧠 Market Sentiment: “Cash is King” is Back

With global instability and fear on the rise:

🔹 Investors are hoarding cash

🔹 USD demand increases, along with inflows into US government bonds

🔹 Risk assets like gold, stocks, and crypto are being dumped

💡 This could be part of Trump’s larger play — forcing global capital to flow back into US Treasuries while applying pressure on speculative markets.

🔮 AD’s View:

Unless we see a clear shift in investor sentiment, the base case remains: → Sell rallies through midweek, then reassess.

🧭 Key Technical Zones to Watch:

🔺 Resistance: 3005 – 3016 – 3035 – 3056 – 3076

🔻 Support: 2980 – 2969 – 2956 – 2930 – 2912

🎯 TRADE PLAN:

🟢 BUY ZONE: 2930 – 2928

SL: 2924

TP: 2934 – 2938 – 2942 – 2946 – 2950

🔴 SELL ZONE: 3034 – 3036

SL: 3040

TP: 3030 – 3026 – 3022 – 3018 – 3014 – 3010 – ???

📌 Keep an Eye on DXY:

The US Dollar Index is currently testing a major 3-year support level.

→ If equities fail to recover and fear persists, DXY could bounce — and gold would likely continue its correction lower.

⚠️ Final Note:

We’re in a highly volatile and uncertain environment.

→ Stick to the plan. Respect your SL/TP levels. Avoid emotional decisions.

—

📣 Found this perspective useful? Follow for daily macro-backed trade ideas and real-time market structure breakdowns.

Clarity. Consistency. Risk Management.

— AD | Money Market Flow

GOLD BREAKS SHARPLY — BUT THE MOVE WAS WRITTEN IN THE STRUCTURE🟡 GOLD BREAKS SHARPLY — BUT THE MOVE WAS WRITTEN IN THE STRUCTURE

A steep drop in gold just rattled the markets — but if you’ve been following the macro and technical setup closely, this was not only expected, but anticipated.

From the first week of April, we’ve been tracking signals of potential exhaustion in XAUUSD:

🕯️ Candlestick wicks on higher timeframes

📈 Overextended structure

🧠 Macro divergence

Now, all signs have converged — and we’re finally seeing the correction play out.

🔍 Why This Isn’t Just About Gold

What we’re seeing is a broader shift in global market sentiment:

U.S., European, and Asian equities are all under pressure

Crypto has stagnated with little to no fresh capital inflow

Gold — after months of aggressive buying — is now facing wave after wave of profit-taking

This is classic risk-off behaviour.

Investors are choosing cash, sitting tight, and waiting for clarity — not only in the charts but in the headlines too.

📉 DXY Building a Case for Recovery

The U.S. Dollar Index (DXY) has been heavily sold in recent months — but is now holding at a multi-year structural support zone that’s been tested multiple times since 2021.

With Trump returning to the spotlight and triggering a fresh round of global tariff negotiations, the USD is regaining narrative strength.

Trump’s stance has already prompted discussions among major economies, putting the U.S. in a dominant position — and the market is beginning to price that in.

🤔 What’s Holding the Fed Back?

Despite rising trade tensions, the Federal Reserve has remained cautious — choosing not to act until the dust settles from geopolitical and policy developments.

This creates a window of opportunity:

If the Fed holds rates while global central banks soften

And if the USD holds this major support

→ We could see strong dollar flows return in Q2.

🔮 Gold Outlook – Where Next?

In the short term:

Expect continued volatility

Potential for gold to slide further toward 308x – 305x range

Any bounce is likely to be technical rather than fundamental

In the medium term:

Once political noise fades, gold may find support again

Especially if inflation expectations persist or the Fed pivots dovish later in Q2

💡 Takeaways for UK Traders

✅ Don't trade the news — trade the reaction

✅ Macro structure matters more than the daily headlines

✅ Capital preservation beats chasing euphoria

We’re not guessing.

We’re reading the story and planning with structure.

The Loonie's Fate: Can CAD Hold Against USD?The Canadian dollar (CAD) has been losing ground against the U.S. dollar (USD) for years, and this chart suggests that weakness could continue. Since 2015, every time CAD has tried to strengthen, it has failed to break below 1.20, showing a long-term downward trend.

USD/CAD at 1.47: A Critical Turning Point

Right now, the exchange rate is sitting at 1.4527, just below a key resistance level (1.47). Historically, this level has acted as a ceiling where CAD has struggled to hold its value.

Two Possible Outcomes:

1. If CAD Holds Below 1.47 → Potential for Stabilization

A rejection at 1.47 would mean CAD could regain some strength, at least in the short term.

This could happen if the Bank of Canada holds rates steady while the U.S. Federal Reserve signals rate cuts. If USD weakens, CAD could stabilize around 1.39 or lower.

2. If USD/CAD Breaks Above 1.47 → CAD Could Sink Further

A breakout above 1.47 would mean further CAD weakness, and we could see 1.60 or even 1.80 in the long run. This would be bad news for Canadian consumers, as inflation would likely surge.

The Bank of Canada might be forced to act aggressively, keeping interest rates high for longer to stabilize the loonie.

The Big Picture: Could We See 1.80?

The chart suggests that if USD/CAD breaks out above 1.47, the next long-term move could reach 1.80, which would mean an additional 21% devaluation of CAD against USD.

What That Would Mean for Canadians:

More Expensive Imports: A weaker CAD means higher costs for goods priced in USD—electronics, vehicles, food, and even vacations in the U.S.

Higher Inflation Risk: Imported goods would become more expensive, keeping inflation high and making it harder for the Bank of Canada (BoC) to cut rates.

Potential Rate Hikes: If CAD weakens too much, the BoC may need to raise interest rates again to stabilize the currency, which could keep borrowing costs high.

What Canadians Should Watch

Oil Prices: Canada is a commodity-based economy, and higher oil prices typically strengthen CAD (since Canada is a major oil exporter). If oil prices rise, CAD could get some strength back, slowing the decline.

Bank of Canada vs. U.S. Federal Reserve Policy: If the Bank of Canada keeps rates high while the U.S. Federal Reserve cuts rates, CAD could strengthen. But if the BoC cuts rates too early, CAD could fall further.

Global Market Sentiment: In a risk-off environment, investors flock to USD for safety, weakening CAD. If risk appetite returns, CAD could stabilize.

What Canadians Can Do to Prepare

If USD/CAD Breaks 1.47 and Moves Higher:

Hedge Against a Weak CAD: Consider holding some USD-denominated assets (U.S. stocks, USD savings).

Lock in Loan Rates Now: A weakening CAD could keep rates high longer—fixed-rate mortgages may offer stability.

Invest in Inflation-Protected Assets: If CAD weakens, commodities, energy stocks, and foreign investments could help hedge against inflation.

Buy USD for Future U.S. Expenses: If you travel to the U.S. frequently, it might make sense to buy USD now before CAD weakens further.

If USD/CAD Gets Rejected at 1.47 and CAD Recovers:

Monitor U.S. Rate Cuts: If the Fed cuts rates, USD may weaken, giving CAD a chance to rebound.

Be Ready for Short-Term Relief, But Plan for Long-Term Weakness: Even if CAD strengthens in the short term, the long-term trend still suggests CAD is vulnerable.

Final Thoughts: The Loonie’s Fate Rests on 1.47

Right now, CAD is at a make-or-break level.

If 1.47 holds, CAD may see short-term strength. If 1.47 breaks, CAD could face a significant decline, making life more expensive for Canadians.

With inflation, interest rates, and oil prices all playing a role, this is a crucial time to pay attention to macroeconomic trends, as the next move in USD/CAD will impact Canadians' cost of living, mortgages, and investments.

Disclaimer: This is not financial advice. This analysis is for informational and educational purposes only. Always do your own research before making investment decisions.

XRP macro analysis ⏰ ripple ✴️As predicted case win to bottom everything got completed 🚀

BITSTAMP:XRPUSD from 2021 announced everything on track 😏

Here macro analysis on RIPPLE ✴️ BINANCE:XRPUSDT ....... Long term 📌 #DYOR

Buy :: $0.35 - $0.55 ( use only 70-80% liquid 💰 )

Sell :: $3 - $6 - $9 ( I am not expecting more than these )

#imo ( in my opinion ) -->> my personal target is $6

Let's talk about TECHNICAL ANALYSIS there n number of charts 📉 avilable with me to provide but simple way i provided here 😃 different ways of working charts will be provided below 👇

26 BARs from top 🔝 bull 🐂 run trend line formation was broken 😂 same still going 3rd time

But there was negative sign bcs still price doesn't breach $1

This is the main reason I said used only 70-80% liquid 💰

Here my backup plan on BITSTAMP:XRPUSD using remaining liquid 💰 30-20%

BUY :: $0.045 - $0.0856

Sell :: $0.4 - $0.6 ( i will close when it shows my liquid )

Very less chances are there to get active negative scenario 📌

Note 📌 i will update under post any news 🗞️ or qucik move on price & every time crucial update

Chart updates every 3-6 months

So make shure following article also update you whenever I am updating it 🤍

Giving boosting 🚀 is ur responsibility updating is my responsibility 😏

I keep wave , liquid supply and demand etc ... Charts 📉 🧵 👉

BTC Pump Stalls: Here's Why & Here's Where Price Can Go NextAs I stated in my earlier analysis, rejections come from predictable levels, so it shouldn't come as a surprise that, today's pump ran into resistance at the 1.618 Fibonacci extension. The big question now is: What comes next?

Once Bitcoin bulls regain momentum, push past this resistance, and return to price discovery with new all-time highs, the next levels of resistance are just as predictable.

Key Levels to Watch:

110K – Psychological Resistance, but don't expect it to hold

Why it Matters: Round numbers like 110K often act as psychological barriers where traders take profits.

122.5K – Measured Move from the Cup & Handle

Why it Matters: This technical target aligns with the bullish Cup & Handle pattern currently playing out. It’s a critical level to watch, though it may not hold as the final cycle top.

Lifetime Channel

Why it Matters: If Bitcoin continues climbing, the lower end of the Lifetime Channel becomes a likely candidate for the next major resistance. I consider this to be the “glass ceiling” on price discovery. If BTC bulls can reclaim that channel, 7 figure BTC becomes a realistic target in the next 10 years.

Fibonacci Extensions

Targets to Watch: The 2.618, 3.618, and 4.618 Fib levels represent technical resistance zones. I personally view those last 2 upper Fib levels as lower probability extremes, but I never rule anything out of the Wild West of Crypto. The exact level this cycle tops at depends on the timing and the specific factors that are influencing price action at that time.

My Take: Where Does the Cycle Top Live?

While 122.5K is a key target, the cycle top could extend closer to the 150K range, with a possibility of testing the Lifetime Channel or higher Fibonacci levels. The market will ultimately decide, but understanding these predictable levels can help traders stay ahead of the curve.

Up Only Doesn't Exist: While I am MACRO bullish on BTC and it's fun to talk about massive upside targets, don't allow yourself to buy into the so called "up only" narrative. Somewhere along the way, there will be one or more deep corrections in the 20% - 50% range. Don't let that correction become your liquidation event!

What’s Your Cycle Top Target?

Where do you think Bitcoin’s bull run will peak, and why? Let me know in the comments.

APT macro analysis ⏰ <•> DO YOUR OWN RESEARCH 🔎

$11.6 is key 🗝️ resistance 📌 )-( we should have clean break and week close above 📌

+

It helps price to complete ✅

🎯 $18

🎯 $27

🎯 $37

I Already accumulated 60% bag 💰 average price of $5.8

Still I don't think 🤔 u ar later )-( just go in plan )-( use 60% liquid 💰 if risk use 70%

Back-up plan set-up 📐 losing yellow 🟡 support 📌 green 💚 flash dump 🩸 $2-3 👀

Best price to average ur liquid 💰 ( #imo max not possible )

Long run expecting target's 🎯 $45 & $85 may be even more target's 🎯

But this just 4-6 month's plan after hitting target's 🎯 i provided new plan 📌

Caution 🚨 if backup plan got executed when u reach 1x ( +100% ) just get back ur liquid 💰

Stay safe 💞 stay blessed

Global M2 Money Supply Vs BTCSo when we look just at the Global M2 money supply, we can see its increasing and sharply.

However, when you look at BTC, BTC is lagging behind, and the increase in M2 Global supply has yet to have an effect on BTC where we would expect to see a price increase as M2 money supply increases.

If you compare the M2 Global money supply against S&P500 though, it tells us a different story, where the S&P is leading and BTC is lagging.

Signalling to me a catch up in BTC is inevitable at this stage and its being squeezed at these levels as money flow increases.

A good signs imo and no doubt BTC catches up to S&P500

Global Liquidity Index Against BTCHeres the global liquidity index mapped against BTC and its past cycle data for reference.

Im sure you can spot the positive correlation it has.... When global liquidity increases, risk on assets such as BTC increase due to an influx of new liquidity in money markets.

We have been consolidating for 2 years in the global liquidity index in an ascending triangle. I am expecting it to push up, break out, retest similar to the prior cycle fractal and continue higher, in turn pushing money markets including BTC into ATHs

Where bitcoin goes MARA follows - Current Macro developmentsHi guys! As usually i keep my eye open for macro changes or signals that may lead to major moves. Of which Marathon (MARA) has been on my radar.

This analysis is done on the 1 week timeframe.

We are currently attempting to get Above our Major level/ area around $18-20.

This area also coincides with the 21 EMA.

Which we are also ABOVE as we speak.

However, remember it has not yet confirmed that we managed to get Support from 21 EMA.

Also note that we recently tested Support on 50 SMA and have maintained it 6 weeks in a row. This fact makes me think, we will continue UP -> At the very least to the Upper range of the consolidation orange rectangle at $28.00

We have not yet printed a death cross which is a good sign indicating probabilities pointing towards continuation of Uptrend.

Pay attention to next weeks candle close for more clues.

Ive also highlighted our current price action to be part of a Consolidation range, from $15.00 to $28.00

I think it makes sense for us to be consolidating as we are making our way out of the bottom of the market for MARA. (around the 3.50 area) Since then we've already climbed roughly 1000% to our top around $34.

21 EMA and 50 SMA flattening out also supports the Consolidation occuring.

Consolidation is basically when an asset tries to digest rallies, trying to catch its breath.

And now we have to assess whether theres further momentum left to continue our Bull market or make our way back down.

If Bull market continues, we can make our way back to this Major Resistance lvl labeled. We have touched this line 3 times in history previously and it marks Blow off tops of Bull markets for MARA.

If we get rejected from this Major level, we can make our way back to the sloping Support trendline labeled below.

So to find a sense of whether or not MARA will continue or come down to test the lows, we look to 2 indicators that i love using to assess "momentum".

Notice the STOCH RSI.

Everytime we come down to the 20 lvl, we stay Below for extended periods ranging from 57 days to as much as 126 days.

When we cross Bullish and move UP Above 20 lvl, we tend to have Rallies UP.

1 pattern though, with STOCH is its relationship with Moving Averages 21 EMA and 50 SMA.

When Purple (21 EMA) crosses Below Green (50 SMA) Moving Average and there is a STOCH Bull cross, sometimes it doesn't impact big rallies.

BUT When Purple is on top of the Green Moving Average and STOCH crosses BUllish Above 20 lvl. This is a pattern seen in relation to big rallies UP

So if we can get a STOCH Bullish CROSS Above 20 level, while our 21 EMA is Above our 50 SMA, we can expect to see a continuation rally. Watch also for a break Up and confirmation out of the consolidation zone.

The MACD is currently ABOVE the 0 level, with waning or decreasing Bearish sentiment. This is seen from the print of the lighter red bar of the histogram. The Blue/Orange lines are also attempting to Curve Up and try to Cross Bullish.

If we continue to print smaller lighter Red bars, and then see a Green bar print, it is likely momentum has turned Bullish.

Bullish Crosses ABOVE 0 level, tend to rally Upwards.

A MACD and STOCH CROSS together would be even better sign of uptrend to be PROBABLE.

ANd if we Breakout of the consolidation rectangle we are currently in -> its likely we test "Major Resistance" at around $60.

Keep observing and paying attention.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on MARA in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

Break down on technicals for Alibaba near historical lowsHi Guys. As always, heres a macro chart setup i've found to be a MUST WATCH, at the very least if not a potential long.

Analysis done on 1 week, indicating a macro analysis.

Alibaba (BABA), at current prices is roughly 75% from its blow off top in 2020.

Around October- November 2022, we tested support at the historical bottom and bounced to test the Resistance zone with a REJECTION.

Bringing us to our current price action where we have managed to maintain a HIGHER LOW.

This supports the idea that perhaps trend is shifting towards BABA wanting to move UP.

Notice also the Blue, Green and Purple Moving averages, Flattening out. This can be an indication that price is showing demand after moving averages moved down so much from the highs.

look for curve up in MA with crosses happening. This would be significantly supportive of probabilities we see Uptrend.

Essentially the order from top to bttom we want to see is:

1. Purple on top

2. Green next

3. Blue below that

4. Red below all

This is an indication of a Bull cycle. As you can see blatantly in previous history.

Notice also Volume which has been steadily increasing since 2019. Maintainence of Higher lows on Volume is also a good sign, that perhaps BABA may rally if we continue this volume trend.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on BABA in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

Americas Car Mart Testing Multi-Year Demand Zone (Buy Zone)Hi guys!

This is a MACRO Analysis on AMericas Car Mart (CRMT). Macro meaning larger timeframe aka the 2 week in this instance.

Macro moves tend to speak louder than smaller timeframes like the 1 day for example when they start to move in price.

I believe CRMT has come to an important area and poses a great trade setup in my opinion.

If we look to Price action.

Notice 2 Support trendlines outlined. These are MULTI Year Support zones.

When price reached the trendlines, we ended up bouncing UP.

Notice our current price indicated by Orange box.

Our 2 support trendlines have converged. When 2 support trendlines meet it strengthens the Support.

Also notice the 21 EMA (Purple moving average) -> We have been below this since Septemberish of 2023. Moves below 21 EMA especially on the 2 week pose for good Buy zones as well.

So the combination of converging Support lines and being below 21 EMA = Good area to take positions

Now notice the 2 indicators ive included. These are momentum indicators.

STOCH RSI has crossed BULLISH. (where blue line moves above orange line)

Momentum can pick up and start a move up once this crosses ABOVE the 20 lvl.

MACD is currently below the 0 lvl. With the histogram bars changing from dark red to light red. This indicates a waning of bearish momentum. It is also attempting to create a higher low. All good signs. Look for a Bullish cross and green bars to show up. That will help drive prices up.

A cross ABOVE 0 lvl would bring about massive moves up.

Continue to monitor the indicators and price to stay above the Support zone indicated.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on CRMT in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

$MNT macro analysis ⏰ BITDAO / mantle Anything below $1.5 is good BUY ( #DYOR )

Below red box 📍 analysis get invalid 📌 🛑 stop

Expecting target 🎯 $20 ( +1500% / 15x from here )

Important resistance levels $5 & $10

Follow article for future updates 📌 and boosting 🚀 helps me ,

I was quite busy, so i will submit rest of details in future, so save article / analysis

ID 🆔 binance launchpad project 🔮 Hello 👋 it's me your RAJ 🙂 professional trader ✨

This idea 💡

is completely my own analysis to explain situation _&_ market conditions of BINANCE:IDUSDT 🪙

How this coin valid for long term 📌 explained clearly BASED on history 🤪 & #TA 📌 #DYOR

Note 👉 coin 🪙 have potential High risk 🔥 $0 to hero 😂

😆 Present circulation supply was 413M by the end of 2025 , it will be 1.26B

only 26% supply avilable in market 📌 remaining kept locked 🔐 this concern me as high risk

I recommend PPL to go with unwanted liquid 💰 CRYPTOBETTING 👀

Don't try to use all liquid 💰 or 20% of ur long term liquid bag 💰 just give 5% below priority

::-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-:-::

BUY || accumulation phase 📍

👉 $0.077 - $0.247 👈

+

|| 👉 Sell :|: distribution phase 👈 ||

🎯 :: $1.5 - $2.1

🎯 :: $12 - $14

🎯 :: $20 - $25

🎯 :: $40 - $50

🗝️ Try get ur liquid 💰 back at $1.5 above I used to call as " principal trade "

🗝️ Close 20% bag at $12-14

🗝️ Close 60% bag at $20-25

I am not expecting more than $30 but based on #TA with #FA provided

No technical data history to explain about technical analysis ⏰

I have done 👍 my research 🔎 on LAUNCHPAD projects based on funding i review this 👀

__________________________________________________________________________________________

🪩 disclaimer :

▶️ TQ u for supporting 💚 follow idea 💡 get updates everytime ⏰ when I updated 📌

Note 👀

👉 keeping comments , reacting with emojis , pointing us is very easy to some people

They think 💬 what they see 📌 that was knowledge 📌

We need to learn market in many ways and should get adopted with experience, TECHNICAL ANALYSIS won't help understanding market structure and understanding bull 🐂 and bear 🐻 is more important

Economical conditions

Fundamentals

Technical

News

Sentiments

Checking macro to micro having good plan and build it is very important ☺️

Some Times market easily turn suddenly bear // bull 🤣 even we need to catch 🫴 those movements is also very important ☺️ 💛

I hope i cleared my view 🙂 if any points if I miss I will add in update 📌 post

Try to understand, try to learn - try to move with flexibility with market is important

Have good day 😊

----------------------------------------------------------------------------------------------------------------------------------------------------------