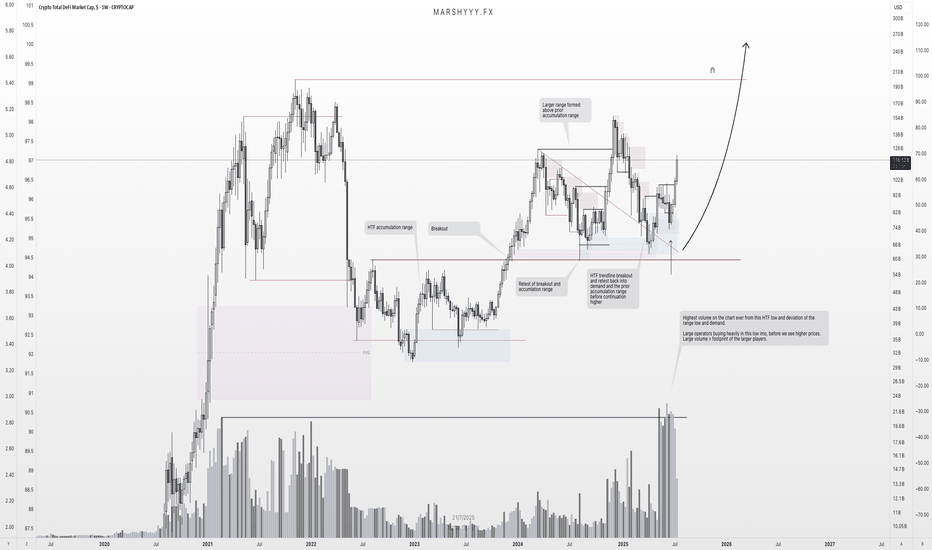

TOTAL DEFI: HTF Reaccumulation Underway — $200B+ In SightThis is one of the cleanest HTF setups in the market right now — and it’s flying under the radar.

We're looking at TOTAL DEFI market cap, and it’s showing all the signs of strong reaccumulation following a textbook breakout–retest structure off a larger HTF accumulation base.

Price broke out from the 2023–2024 accumulation range, retested that breakout zone and range highs in August 2024, swept liquidity, and tapped into unmitigated demand within the accumulation range — before climbing back to the $155B region, creating a larger range above the prior accumulation range it broke out from.

Since then, price pulled all the way back to range lows and HTF demand at $65B, forming a new bullish reversal from this key region and retesting the trendline breakout before continuing another leg higher — as we’re now seeing unfold.

But here’s the key:

🧠 That recent deviation came with the highest volume ever recorded on this chart — right off the range low and HTF demand.

That’s not retail. That’s large operators loading up, leaving their footprint ahead of the next expansion leg.

We’ve now:

- Broken the descending trendline cleanly

- Flipped key SR levels back into support

- Started pushing higher with strong HTF closes

📈 Expectation:

This is a spring + test setup within a reaccumulation range. I’m targeting continuation toward the range highs, followed by a macro breakout that could take DeFi market cap to $200B+ — especially once the prior distribution zone is reclaimed.

This aligns with the broader cycle narrative — liquidity rotating back into altcoins, particularly DeFi, as stablecoin dominance declines and the market shifts fully risk-on into the final phase of the bull cycle.

Key Structure Summary:

- HTF accumulation base → breakout → retest → demand sweep

- Largest volume spike = operator footprint

- Higher lows forming = market structure flipping

- Expecting expansion to $200B+ as trend continues

One to watch closely.

Don’t fade the volume. Don’t fade the structure.

Majors

Mon 13th Jan 2025 Daily Forex Charts: 4x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 4x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a AUD/USD Sell, EUR/USD Sell, GBP/USD Sell & NZD/USD Sell. I also discuss some trade management. Enjoy the day all. Cheers. Jim

[EDU-Bite Sized Mini Series] Various FX involved,Mostly..Hello Traders, here we go again!

Let me cover a little bit more on the next topic in this mini series, the various currencies that are involved and a little descriptions about them! Let's begin!

In the vast realm of forex trading, understanding the intricacies of currency pairs is fundamental to success. As a Full-time forex trader with years of live experience, I'm here to shed light on the major and minor currency pairs that dominate the market.

Major Currency Pairs: The Powerhouses of Forex. Normally most retailers trade these pairs as they offer higher liquidity and therefore tighter spreads.

Major currency pairs are the cornerstone of forex trading, encompassing currencies from the world's largest economies. These pairs typically involve the most traded currencies globally and offer high liquidity and stability.

Among the major pairs, the most prominent include:

1. EUR/USD (Euro/US Dollar): Known as the "fiber," this pair represents two of the world's largest economies, the Eurozone and the United States. It's renowned for its liquidity and tight spreads.

2. USD/JPY (US Dollar/Japanese Yen): Dubbed the "ninja," , the JPY or the YEN, this pair reflects the economic relationship between the US and Japan, two economic powerhouses with distinct monetary policies.

3. GBP/USD (British Pound/US Dollar): Often referred to as "cable," this pair reflects the relationship between the UK and the US, and it's influenced by economic data, geopolitical events, e.g. Brexit developments.

4. USD/CHF (US Dollar/Swiss Franc): Known as the "swissie," this pair is influenced by safe-haven flows, Swiss banking policies, and US economic data.

5. AUD/USD (Australian Dollar/US Dollar): Termed the "aussie," this pair is closely tied to commodity prices, particularly gold and other precious metals, as Australia is a major exporter of raw materials.

6. USD/CAD (US Dollar/Canadian Dollar): Called the "loonie," this pair is heavily influenced by oil prices, given Canada's status as a major oil exporter.

Minor Currency Pairs: Navigating the Market Beyond Majors

While major pairs dominate forex trading, minor currency pairs offer unique opportunities that should not be overlooked as well. These pairs involve currencies from smaller or emerging economies and could be less liquid than their major counterparts.

Notable minor pairs include:

1. EUR/GBP (Euro/British Pound): This pair reflects the relationship between the Eurozone and the UK, and it's influenced by economic data from both regions. In my opinion, this pair quite frequently range and sometimes it is termed as "mean reverting pair".

2. EUR/JPY (Euro/Japanese Yen): Combining two major currencies, this pair offers opportunities for traders seeking exposure to both the Eurozone and Japan.

9. GBP/JPY (British Pound/Japanese Yen): Known for its volatility, this pair attracts traders looking to capitalize on the economic dynamics between the UK and Japan. It is also one of the top favorite for scalpers.

10. AUD/JPY (Australian Dollar/Japanese Yen): Influenced by commodity prices and risk sentiment, this pair is popular among traders seeking exposure to the Australian and Japanese economies.

3. NZD/USD (New Zealand Dollar/US Dollar): Known as the "kiwi," this pair reflects economic developments in New Zealand and global risk sentiment.

4. CAD/JPY (Canadian Dollar/Japanese Yen): This pair offers insights into the commodity markets and the economic relationship between Canada and Japan.

In conclusion, mastering major and minor currency pairs is essential for navigating the forex market effectively. Major pairs offer stability and liquidity, while minor pairs provide opportunities for some diversification. By understanding the dynamics of each currency pair and staying informed about global economic developments, traders can unlock the full potential of forex trading and achieve profitable outcomes in this dynamic and ever-evolving market. And of course don't forget about your technical analysis!

Thank you for your time and hope you have enjoyed the content and if you do so please leave a thumbs up or a comment if you have any suggestions to make this better!

Do check out the other links if you missed out on the other parts of this Forex Mini Series i put up for all (FREE)!

Signing out!

STBB

Usd pullback up could be coming,but short livedAs mentioned, USD indeed came down very SHARPLY last week.

Anticipating some pullbacks on USD majors before USD resuming its downtrend again. Go with trend should be the game play.

**Find out more from my Tradingview Stream this week**

***************************************************************************************

Hello there!

If you like my analysis and it helped you ,do give me a thumbs ups on tradingview! 🙏

And if you would like to show further support for me, you can gift me some coins on tradingview! 😁

Thank you!

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

The author/producer of these content shall not and will not be responsible for any form of financial/physical/assets losses incurred from trades executed from the derived conclusion of the individual from these content shared.

Thank you, and please do your due diligence before any putting on any trades!

I Like The BuyI like the buy setup for USDCHF. Just enjoyed the 3day swap long payment and boy is it paying well!

Positive swap long, classic break & retest setup, and NFP on the horizons, expecting a boost from consumer spending & christmas jobs created.

Lets go you good thing yeeeeehaw

EUR - Within range for now...EUR - Within range for now...

Technically we are in a range and triangle pattern, holding season coming I doubt we will break this...but we could?

A break to either direction and was that spike high a false break out...who knows time till tell but I am short 1/4 position size and I will add next yr if it continues as swap is positive so I have no worries holding this.

Remember: Trade your OWN plan!

Trade Journal

DXY Consolidations TipsHello Traders!

Here i'm showing you how to filter through pairs when the DXY is moving sideways.

DXY in consolidation = EU, GU, NU, AU in consolidation

This makes the crosses highly more manipulated.

You want to find the strongest and weakest and match it up to make a currency pair to trade.

Is it time to buy the $EUR & Why?Is it time to buy the $EUR & Why?

As we head closer to ECB - If they are Hawkish and expected to raise rates even further, expect EUR to turn further bullish. We are at a key resistance area, now remember it isn't just ECB we focus on when it comes to EUR. Take into consideration the FOMC - Source - WSJ: Federal Reserve officials are barrelling toward another interest-rate rise of 0.75 percentage point at their meeting Nov. 1-2 and are likely to debate then whether and how to signal plans to approve a smaller increase in December.

Now, yes we understand the further they hike the stronger DXY and that leads to the majors declining. However, we may have currency war at our hands we have had BOJ - intervene, even though they don't 'state' it, we've had various other countries concerned when it comes to FOMC further hikes but as they MAY slow down 75 basis points to 25 perhaps, this is easing the pressure on DXY leading the other currencies at very key areas! If we get hawkish ECB combined with this, expect euro to go back to previous levels of: 1.0500 - 1.03600.

Technically: If we stay above these levels and go above 1.0000 handle over I do expect 1.03 to come into play. However, if we drift below 0.98500- 0.97500 then we back within range.

Lastly, don't forget to trade your own trade plan!

All the best,

Trade Journal

GBP/USD: Continuation of bearish trendGBP/USD: Continuation of bearish trend

> Overarching bearish trend

> Bullish correction broken to the downside

> 200er MA + POC above current price

> Bearish Engulfing Trigger + Follow-up candle

Probablity of a short move high. Please manage your risk in the current markets. Markets are very skittish and irrational. We are trading with 0.5% maximum.

Best

Meikel & Team WSI

GBP/USD: Short about to rolloverGBP/USD: Short about to rollover

> Price at upper end of overarching bearish trendchannel

> Break of inner bullish trend to the downside

> LL-LH-Sequence

> POC above current price

> General USD-strength ahead of NFP on Friday

Generell USD strength after strong ISM data. Short move likely. Only event risk: NFP on Friday.

As always: Manage your risk, especially during the summer months.

Meikel & Team WSI

USD/CHF: Major structural break | Short Potential✅ USD/CHF broke a major support zone . We are also trying to break the weekly low. POC prints above current levels, indicating heavy wall street banks selling. We need a clear 3pm (Berlin time) H4 close to enter a short trade.

Check out our streams:

www.tradingview.com

Let's continue to build wealth together!

Meikel & Team WSI

USD/JPY: Heavy Bank Selling seenUSD/JPY: Heavy Bank Selling seen

- POC above current price levels

- Heavy Volume during last sell-off

- Symmetrical triangle broken

- Lower lows and lower highs

We have to watch ONE risk factor and that is the FOMC Minutes tonight. However, the technical landscape is clear and USD/JPY is likey to fall further furing the next days.

✅ Check our bio for Wall Street Setups

✅ LIVE MyFxBook Performance

✅ Real deal Wall Street Trader

👉 Join our steam today:

www.tradingview.com