GBPUSD - Sell Trade SetupLet's see what happens with the upcoming CPI data from the UK. In the event figures come in less than analyst forecast, guess what?? Well this pair will go south! Why well Fed's comments last week were not dovish, tariffs are still causing inflation providing strength and stability for the greenback.

Waiting for UK CPI data to confirm my analysis.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

Managedforex

Favorite Trade Setups for Next WeekSummary of positions I'm looking to take next week with my Copy Trading program include the following:

AUDCAD - LONG ⬆️ 🟢

AUDNZD - SHORT ⬇️ 🔴

NZDCAD - LONG ⬆️ 🟢

US30 - SHORT ⬇️ 🔴

USDCHF - SHORT ⬇️ 🔴

For optimal risk management, it's best to always scale with small volume relative to your equity. Leave lots of available margin on your account. Diversifying with multiple pairs is recommended to mitigate risk.

If you like my setup and would like to copy my trades, send me a DM for further information.

Let's Grow Together 👍 LIKE - FOLLOW - SHARE

~ Michael Harding

Future Forecast for GBPUSD== KEY TAKEWAYS ==

+ There were four-month lows for the pound sterling relative to the US dollar.

+ It appears that GBP/USD will be vulnerable coming up to UK inflation week.

+ The pound sterling maintains its bearish technical indication target at 1.2400.

The US dollar (USD) continued to lose ground against the pound sterling (GBP), causing the GBP/USD pair to drop below 1.2500 for the first time in four months.

The pound sterling continues to decline.

GBP/USD sellers made a strong comeback this week following a respectable recovery in the earlier part of the week due to renewed demand for the US Dollar. Rising geopolitical tensions in the Middle East and expectations surrounding the US Federal Reserve's (Fed) policy turn contributed to the Greenback's rise to its highest level against its main peers in five months, above 105.00.

The US Consumer Price Index (CPI), the week's primary event risk, came in hotter than anticipated, dashed hopes for a June Fed rate cut. According to data provided by the US Bureau of Labor Statistics (BLS) on Wednesday, the US CPI increased 0.4% MoM in March, exceeding predictions of 0.3%. In the same time frame, the Monthly Core CPI increased by 0.4% as well, exceeding estimates of 0.3%. Against the 3.4% market estimate, the yearly headline CPI increased by 3.5%.

Compared to the around 52% odds observed prior to the data release, markets are now pricing in only a 22% possibility of the Fed cutting rates in June. There is a 70% chance that the Fed will decrease rates during its September meeting.

The rationale for delaying the Fed's policy change was further reinforced by the hot US core Producer Price Index (PPI) for March, hawkish remarks from a number of Fed policymakers, and the minutes of the Fed's March meeting. All of these factors combined to keep inflation high despite a robust economy.

The US and its allies believe major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent, in what would mark a significant widening of the six-month-old conflict, according to a Wednesday Bloomberg report that cited people familiar with the intelligence.

Concurrently, Russia, Germany, and the United Kingdom united on Thursday to urge Middle Eastern nations to exercise moderation, particularly in light of the growing danger of an impending Iranian attack on Israel. Israel declared that it was getting ready to "meet all its security needs" in case Iran launched an airstrike.

This comes after Iran threatened to exact revenge for the airstrike that killed a senior Iranian general and six other Iranian military officers on April 1st at its embassy compound in Damascus, Syria, raising tensions that were already high due to the Gaza conflict.

Severe geopolitical concerns continued to hurt the safer-haven US dollar while strengthening the higher-yielding pound sterling. However, Megan Greene, a policymaker at the Bank of England (BoE), gave some consolation to the British Pound with her hawkish remarks. Greene hinted on Thursday that rate cuts from the BoE are still a ways off, saying that "UK services inflation remains much higher than in the US."

In the face of persistent US Dollar strength on Friday, GBP/USD remained susceptible despite a slight recovery from four-month lows of 1.2511. The solid industrial data for February and the UK GDP, which was estimated to be in line with expectations, did not inspire the buyers of pound sterling.

Following a 0.3% recovery in January, the Office for National Statistics (ONS) released its most recent figures on Friday, indicating that the UK economy grew by 0.1% in February. In the stated period, a 0.1% expansion was anticipated by the market. According to additional UK data, February saw monthly increases in manufacturing and industrial production of 1.2% and 1.1%, respectively.

The week ahead: UK CPI remains on tap

After a hectic week, traders of the pound sterling are getting ready for a data-light week, with the UK CPI inflation report for March serving as the sole major event.

On Wednesday, the inflation statistics will be made public. Prior to that, policymaker Sarah Breeden of the BoE will speak earlier that day, while the US docket will include the March Retail Sales report on Monday.

Tuesday is when the UK jobs data is expected to be released. BoE Governor Andrew Bailey is scheduled to appear at the International Monetary Fund (IMF) Spring Meetings later that day.

On Wednesday, Bailey will talk once more at the Institute of International Finance Global Outlook Forum.

The US weekly Jobless Claims and the Existing Home Sales figures for March will be released on Thursday.

Lastly, following the publication of the UK Retail Sales figures for March, BoE officials Dave Ramsden and Sarah Breeden will make their scheduled appearances on Friday.

Additionally, market participants will be keenly examining the remarks made by Fed policymakers to see if they support the bets on postponed rate decreases.

GBP/USD: Technical Outlook

Technically speaking, the short-term outlook for GBP/USD is still bearish as sellers attempt to prolong the decline from the rising channel that was seen a few weeks ago.

The 14-day Relative Strength Index (RSI) indicator is still susceptible to further falls because it is still below the midline, close to 40.00.

The sellers of pound sterling produced a long-lasting breach below the 200-day SMA, which is horizontal and located around 1.2584, supporting the bearish bias.

In order to continue the decline toward the low of 1.2449 on November 22, sellers must establish a firm foothold below the 1.2500 round number. The lows of November 16 and 17 line at 1.2375, which is the location of the next significant support.

Alternatively, the short-term selling pressure may lessen if buyers are able to consistently close above the 200-day SMA at 1.2584.

A significant rebound in the GBP/USD pair might then occur, heading toward the confluence resistance zone between the 1.2650 and 1.2670 area. The convergence of the 21-day, 50-day, and 100-day SMAs is located there.

For buyers of pound sterling, the rising channel support that turned resistance at 1.2790 will be a difficult nut to crack further up.

Important Copy Trading Metrics to AnalyzeHello Traders and Investors,

Today I want to talk about some of the important metrics pertaining to a live trading statement that you should assess before considering which traders to copy. For those of you that are not familiar with copy trading, it's the most revolutionized way for investors and traders to safely invest with professional traders in 2022.

== COPY TRADING SERVICE PROVIDERS ==

LEFTURN Inc.

eToro

collective2

ZuluTrade

FXTM

== WHY COPY TRADING EXISTS ? ==

Unfortunately in the past there's been lots of scams in this industry with fake traders or money managers where investors would give a professional actual cash. The fake trader would deposit the investor's funds in their own personal account, for the investor to then later discover the whole investment was a scam. Luckily however, copy trading was born to help eliminate the possibility of being scammed by fake traders or investment advisors.

---

Let's now review some important metrics pertaining to trading statements. For those of you that are not familiar with myfxbook or FXBlue , these are 2 great third party resources available for traders to showcase their past performance by connecting their MT4 or MT5 account to either myfxbook or FXBlue's API.

== IMPORTANT METRICS TO REVIEW ==

1. First and foremost, is the account verified via a third party vendor?

The first early sign of a fake trader is if their willing to showcase their past results of their live verified trading statement. Be cautious about anyone showcasing their results via screenshots or Photoshop files. Always ask for statements from either FXBlue or myfxbook.

2. Does the trader use his/her real name or an alias name?

We all know that our reputation is our most valuable asset. An early sign of a fake trader might be someone that goes by an alias name.

3. Is the account in which you intend to copy either a demo or live account?

This is very important since most traders can perform well on demo accounts, but can't perform the same on live accounts. When trading live accounts, it has a completely different psychological impact on the trader's mindset since he or she is now trading with live capital.

4. How much equity does the trader have in his/her master account?

Traders that trade with larger accounts tend to have more confidence in their own abilities to perform. Be cautious about traders that are constantly withdrawing large amounts or have little equity in their account.

5. How old is the trading history?

Some traders can perform well for several months especially if their using an EA or some sort of algorithm. Unfortunately for many traders that use fully automated systems, majority of them tend to have a doomsday effect every 6 months to a year. This is why it's important to request at least a year long statement

6. Understanding the trader's strategy

By understanding how the trader enters and exits positions, this will allow you to determine if their strategy works with your risk tolerance and level of comfort.

7. How easily can you contact the trader when you have concerns about the account?

We can't expect the markets to always perform perfectly according to the strategy. Maybe another major crisis is right around the corner that neither you (the investor) or the trader isn't expecting. What's the plan for when the markets are not trending according to plan? How does the trader manage risk in times of uncertainty? Traders that you can easily contact at anytime will give you great ease and peace of mind knowing they are working on adapting to the ever changing market conditions.

8. What is the maximum drawdown?

Knowing the maximum drawdown the trader has had in the past will inform you about how much risk the trader is willing to take on your account. However this metric should be discussed with your trader as they might not take on much risk at first to protect the investor's principal but then increase the risk once the account has significantly grown. Some traders will not risk any of the principal investment but are willing to risk some of the earnings already generated.

9. What are their average monthly returns?

This metric should be proportionate to the maximum monthly drawdown but should also be discussed with your trader to fit your level of risk tolerance

10. How do they manage risk in times of uncertainty?

Does your potential trader use stop losses, do they hedge positions, or close all trades heading into major risk events? Understanding how they manage all risk factors is critical for the life span of the account in which they will trade.

11. What are their fees?

Do they charge a monthly management fee along with a performance fee? Or do they just charge a performance fee? Trader's that only charge a monthly performance fee have greater confidence in their own strategy since they only get paid if the investor makes money first.

12. Which broker are they using?

Some traders want you to register with their broker so they can generate additional revenue through what's referred to as an IB program. Others allow you to use any forex broker and are more interested in generating returns for their investors and not so focused on IB commissions. Trader's that have IB accounts get paid based on the volume traded. Be cautious about traders that want you to register under their IB program with their broker.

13. How often can you request withdrawals?

If you're able to withdrawal funds as often as you like, that's a bonus and again shows greater confidence.

Best Pairs to Hedge if you have an American Trading Account.This is just a quick video in response to a question a friend of mine had and so I thought I'd share my response to him with everyone else.

If anyone has any questions about advanced trading, feel free to drop me a line and let's chat.

-------------------------

Please don't forget to FOLLOW, LIKE, and COMMENT ...

If you like my analysis:)

Trade Safe - Trade Well

Regards,

Michael Harding 😎 Chief Technical Strategist @ LEFTURN Inc.

RISK DISCLAIMER

Information and opinions contained with this post are for educational purposes and do not constitute trading recommendations. Trading Forex on margin carries a high level of risk and may not be suitable for all investors. Before deciding to invest in Forex you should consider your knowledge, investment objectives, and your risk appetite. Only trade/invest with funds you can afford to lose.

Signals, Copy Trade or Managed Forex?So I've been getting some questions from my followers about when would I recommend either of the 3 over the other? Here I'll explain.

== TELEGRAM SIGNALS ==

So this option is great for learning or micro managing small accounts. Ideal option for hobbyist, students, or part-time traders.

== COPY TRADING ==

This option is great for small accounts as well since many copy trading programs offer a flat fee monthly subscription fee. But you're account shouldn't be so small that it doesn't make sense for the program. For example, if you start with 1000 and the returns are 10% monthly but you have to pay a $50 monthly subscription fee, well you'll only profit $50 after expenses for that program.

== MANAGED FOREX ACCOUNTS ==

This option is best for serious sophisticated investors that understand the potential in Forex trading, as well understand the risks associated with it, and want to reduce risk by allocating small portions to various well designed and proven trading systems or strategies. Now of course you can easily purchase some off-the-shelf EAs but the issue with that is you don't fully understand the strategy or the risks with retail EAs. It's much better to find an expert trader that builds his own EAs and knows how to make adjustments the script throughout the various life-cycles of the market. With most Managed Forex Account programs, the trader's charge a performance fee rather than a flat monthly subscription fee. This means the trader that sells copy trading gets paid regardless if the subscribers make money or not, whereas traders offering MFAs only get paid when investors generate ROI.

USD/CAD Short Trade Hello everybody

Happy Thanksgiving!!!

This is my UCAD trade that got filled yesterday

I am currently still in this trade it went against me a little bit but looks like it coming back into my entry.

However i will not try a predict where this will go

they way i think when i trade is the trade will either work or not

Ladies and gentlemen its that simple!!

Again thanks you for following me and supporting my ideas

if anybody is interested in learning more just please contact me!

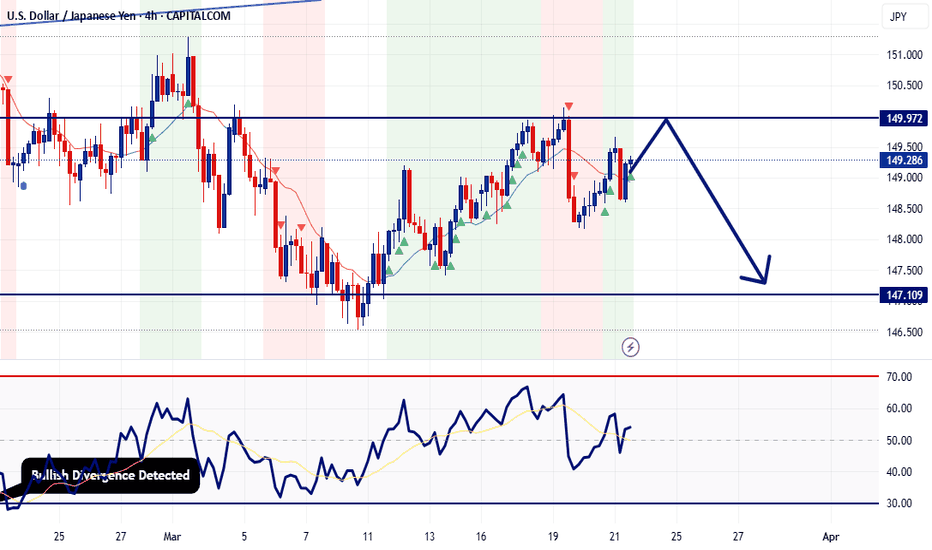

USDJPY Get down you dirty dog! #bitchbetterhavemymoneySo USDJPY has been grinding down the price levels for some time now, here is a simple profitable set up for a further short scenario.

Take a Short from here and hold. 101 is my personal target profit take and I suggest if you follow that you do the same. My stop is set at 106.600

Time duration of the trade I would expect to be no longer than two weeks at most. Good luck if you take it on. Let me know with some feedback and banter.

Perfect EURUSD SHORT set-up A nice profitable LONG short term set of scalps now accomplished, it's time to start shorting the bitch.

End of the day with a daily range of nasty events and a growing instability for commerce, international relations, migration and future trade deals it's very simple to my eyes that we will be falling off further until we see some monster changes.

Best recommendation from me is to short and hold until we once more test 1.09600

EURUSD Latest outlook - Short callsSimple scalping should work best in current market conditions. EURUSD specifically due to the current political and economic climate is set to have the largest opportunities for short term scalping from all major asset pairs.

If you are tired of not gaining the results you need get in touch - Investment management for profit is what we do.