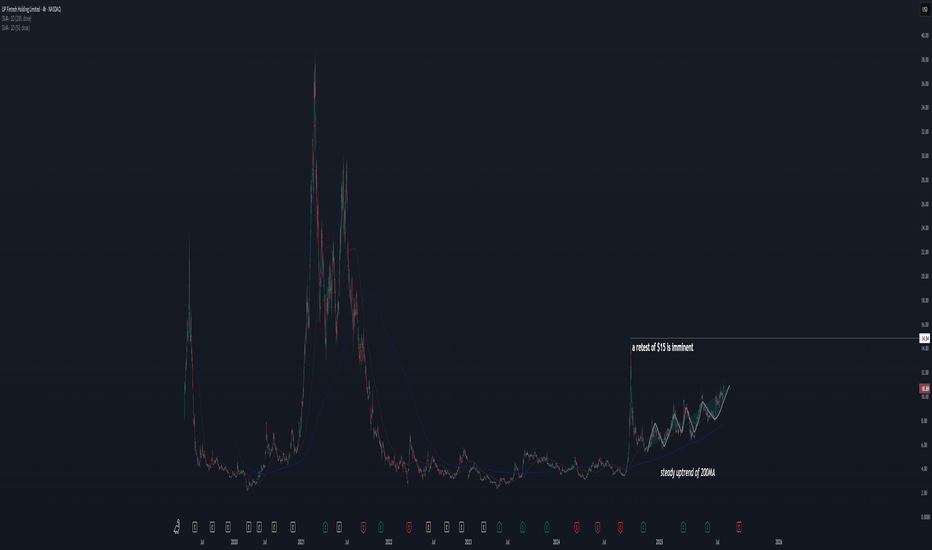

Next Robinhood? TIGR, a hidden gem.We all know the story about retail going crazy on $HOOD. But what about its SEA counterpart, TIGR? Will our SEA friends follow the same trend?

With more and more retail traders rushing to the stock market, TIGR is a safe grab to get on the retail frenzy.

This is also supported from a technical side:

1) a zigzag pattern trending up,

2) a slow and steady uptrend of the 200MA,

3) 3 consecutive earning beats during the last 3 quarters.

All these is suggesting that a retest of the previous high at $15 will happen very soon, if not more (I think there will be more upside, but I have to wait and see how patterns develop when the previous high will be tested).

I am holding TIGR I purchased at 9.55 with a 2.3% portfolio size, with the expectation of reaching at least $15 before/around Oct.

Management

$XAU Showing Bearish Flag Pattearn & Dropped $3K Support area...TVC:XAU Showing Bearish Flag Pattearn & Dropped $3K Support area. Price dropping now and back to $3K price level area. price FVG touch and Strong support $3K Price Level area. Here is many support Holder.

Stoploss: $3,536

Entry: $3,377

1st Target point $3,377

2nd Target point $3,249

3rd Target point $3,028

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

MNQ 5.20.25 Trade Idea (1)Execution, Risk management and Profit taking shown live in the next 3 posts I am about to share with you guys.

I wanted to use that 4H 10am Low as an entry and we caught it. Now we are watching to see if that was just a manipulation to trade into that bearish FVG I outlined near that Buyside liquidity area we were targetting.

Closing the day out with $110 in profits, Which you will see on Video #3

How to Apply Modern Portfolio Theory (MPT) to Trading?How to Apply Modern Portfolio Theory (MPT) to Trading?

Harry Markowitz’s Modern Portfolio Theory revolutionised investing by providing a structured way to balance potential risk and returns. By focusing on diversification and understanding how assets interact, MPT helps traders and investors build efficient portfolios tailored to their goals. This article explores “What is MPT,” the core principles of MPT, its practical applications, and its limitations, offering insights into why it remains a foundational concept in modern finance.

What Is Modern Portfolio Theory?

Modern Portfolio Theory (MPT) is a financial framework designed to help investors build a portfolio that balances potential risk and returns in the most efficient way possible. Introduced by economist Harry Markowitz in 1952, MPT is grounded in the idea that diversification—spreading investments across different assets—can reduce overall risk without necessarily sacrificing returns.

At its core, MPT focuses on how assets within a portfolio interact with each other, not just their individual performance. Each asset has two key attributes: expected return, which represents the potential gains based on historical performance, and risk, often measured as the volatility of those returns.

The theory emphasises that it’s not enough to look at assets in isolation. Instead, their relationships—measured by correlation—are critical. For instance, combining assets that move in opposite directions during market shifts can stabilise overall portfolio performance.

A central concept of Markowitz’s model is the efficient frontier. This is a graphical representation of portfolios that deliver the highest possible return for a given level of risk. Portfolios below the efficient frontier are considered suboptimal, as they expose investors to unnecessary risk without sufficient returns.

MPT also categorises risk into two types: systematic risk, which affects the entire market (like economic recessions), and unsystematic risk, which is specific to an individual company or sector. Diversification can only address unsystematic risk, making asset selection a key part of portfolio construction.

To illustrate, imagine a portfolio that mixes equities, bonds, and commodities. Equities may offer high potential returns but come with volatility. Bonds and commodities, often less correlated with stocks, can act as stabilisers, potentially reducing overall risk while maintaining growth potential.

The Core Principles of MPT

Markowitz’s Portfolio Theory is built on a few foundational principles that guide how investors can construct portfolios to balance potential risk and returns.

1. Diversification Reduces Risk

Diversification is the cornerstone of MPT. By spreading investments across different asset classes, industries, and geographic regions, traders can reduce unsystematic risk. For example, holding shares in both a tech company and an energy firm limits the impact of a downturn in either industry. The idea is simple: assets that behave differently in various market conditions create a portfolio that’s less volatile overall.

2. The Risk-Return Trade-Off

Investors face a constant balancing act between potential risk and returns. Higher potential returns often come with higher risk, while so-called safer investments tend to deliver lower potential returns. MPT quantifies this relationship, allowing investors to choose a risk level they’re comfortable with while maximising their potential returns. For instance, a trader with a low risk tolerance might lean towards a portfolio with bonds and dividend-paying stocks, whereas someone with a higher tolerance may include more volatile emerging market equities.

3. Correlation Matters

One of MPT’s key insights is that not all assets move in the same direction at the same time. The correlation between assets is crucial. Low or negative correlation—where one asset tends to rise as the other falls—helps stabilise portfolios. For example, government bonds often perform well when stock markets drop, making them a popular addition to equity-heavy portfolios.

How the MPT Works in Practice

Modern Portfolio Theory takes theoretical concepts and applies them to real-world investment decisions, helping traders and investors design portfolios that align with their goals and risk tolerance. Here’s how it works step by step.

The Efficient Frontier in Action

The efficient frontier is a visual representation of optimal portfolios. Imagine plotting potential portfolios on a graph, with risk on the x-axis and expected return on the y-axis. Portfolios on the efficient frontier offer the highest possible return for each level of risk. For example, if two portfolios have the same level of risk but one offers higher returns, MPT identifies it as the better choice. Investors aim to build portfolios that lie on or near this frontier.

Portfolio Optimisation

The goal of Markowitz’s portfolio optimisation is to combine assets in a way that balances potential risk and returns. This involves analysing the expected returns, standard deviations (volatility), and correlations of potential investments. For instance, a mix of stocks, government bonds, and commodities might be optimised to maximise possible returns while minimising overall portfolio volatility. Technology, like portfolio management software, often assists in running complex Modern Portfolio Theory formulas, like expected portfolio returns, portfolio variance, and risk-adjusted returns.

Risk-Adjusted Metrics

Investors also evaluate portfolios using metrics like the Sharpe ratio, which measures returns relative to risk. A higher Sharpe ratio typically indicates a more efficient portfolio. For example, a portfolio with diverse holdings might deliver similar returns to one concentrated in equities but with less volatility.

Adaptability to Changing Markets

While the theory relies on historical data, Markowitz’s Portfolio Theory is adaptable. Investors frequently rebalance their portfolios, adjusting asset allocations as markets shift. For example, if equities outperform and dominate the portfolio, a trader may sell some and reinvest in bonds to maintain the desired risk level.

Limitations and Criticisms of MPT

Modern Portfolio Theory has reshaped how we think about investing, but it’s not without its flaws. While it offers a structured framework for balancing possible risk and returns, its assumptions and practical limitations can present challenges.

Assumption of Rational Behaviour

MPT assumes that investors always act rationally, basing decisions on logic and complete information. In reality, emotions, biases, and unpredictable behaviour play significant roles in markets. For example, during a financial crisis, fear can lead to widespread selling, regardless of an asset’s theoretical value.

Ignoring Tail Risks

The model underestimates the impact of extreme, rare events, known as tail risks. These events, including economic collapses or geopolitical crises, can significantly disrupt even well-diversified portfolios.

Dependence on Historical Data

The theory relies on historical data to estimate risk, returns, and correlations. However, past performance doesn’t always reflect future outcomes. During major market disruptions, correlations between assets—normally stable—can spike, reducing the effectiveness of diversification. For instance, in the 2008 financial crisis, many traditionally uncorrelated assets fell simultaneously.

Simplified Risk Measures

MPT equates risk with volatility, which doesn’t always capture the full picture. Sharp price swings don’t necessarily mean an asset is risky, and relatively stable prices don’t guarantee reliability. This narrow definition can lead to overlooking other important factors, like liquidity or credit risk.

How Investors and Traders Use MPT Today

Modern Portfolio Theory remains a cornerstone of investment strategy, and its principles are widely applied in portfolio construction, asset allocation, and diversification.

Portfolio Construction and Asset Allocation

Central to Modern Portfolio Theory is asset allocation: determining the optimal mix of assets based on an investor’s risk tolerance and goals. A classic example is the 60/40 portfolio, which allocates 60% to equities for growth and 40% to bonds for so-called stability. This balance aims to provide steady possible returns with reduced volatility over time.

Another well-known approach is Ray Dalio’s All-Weather Portfolio, designed to perform across various economic conditions. It includes:

- 30% stocks

- 40% long-term bonds

- 15% intermediate bonds

- 7.5% gold

- 7.5% commodities

This portfolio reflects MPT's emphasis on diversification and risk management, spreading investments across asset classes that respond differently to market shifts.

Alternative Investments and Diversification

MPT has evolved to include alternative investments like real estate, private equity, crypto*, hedge funds, and even carbon credits. These assets often have lower correlations with traditional markets, enhancing diversification. For example, real estate might perform well during inflationary periods, offsetting potential declines in equities.

Investors also consider geographic diversification, combining domestic and international assets to balance regional risks.

Implications for Traders

While MPT is often associated with long-term investing, its principles can inform trading strategies. For instance, traders might diversify their positions across uncorrelated markets, such as equities and commodities, to reduce overall portfolio volatility. Dynamic position sizing—adjusting exposure based on market conditions—also aligns with MPT’s risk-return framework.

The Bottom Line

The Modern Portfolio Theory offers valuable insights into balancing possible risk and returns, helping traders and investors create diversified, resilient portfolios. While it has its limitations, MPT’s principles remain widely used in portfolio construction and trading strategies.

FAQ

What Is the Modern Portfolio Theory?

The Modern Portfolio Theory (MPT) is a framework that helps investors construct portfolios to balance possible risk and returns. It emphasises diversification, using statistical analysis to combine assets with varying risk and return profiles to reduce volatility and optimise potential income.

What Are the Two Key Ideas of Modern Portfolio Theory?

MPT focuses on two main concepts: diversification and the risk-return trade-off. Diversification spreads investments across assets to potentially reduce risk, while the risk-return trade-off seeks to maximise possible returns for a given level of risk.

What Are the Most Important Factors in Modern Portfolio Theory?

Key factors include expected returns, risk (measured by volatility), and correlation between assets. These elements determine how assets interact within a portfolio, enabling investors to build an efficient mix that aligns with their risk tolerance and goals.

What Are the Disadvantages of Modern Portfolio Theory?

MPT assumes rational behaviour and relies on historical data, which does not predict future market behaviour. It also underestimates extreme events and simplifies risk by equating it solely with volatility.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DOGS Main Trend. Tactics of Working on Risky Crypto 03 2025Logarithm. Time frame 3 days. Tactics of working on super-risky cryptocurrencies of low liquidity, which are always sold (without loading the glass), by the creators of “nothing”. In order to increase sales, of course, when they rationally reverse the trend and make pumps at a large % and marketing positive news "have time to buy". On such assets with such liquidity, “killed faith” (at the moment), and control of the emission in “one hand” it is not difficult. Something like in BabyDOGE.

On such assets you should always remember:

1️⃣ allocate a certain amount for work in general on such assets from the deposit as a whole.

2️⃣ distribute money (potential reversal and decline zones) from this allocated amount to each similar asset in advance.

3️⃣ diversify similar assets themselves (5-10 cryptocurrencies), understanding that sooner or later they will scam. The scam of one of them should not be reflected significantly on the balance of the pump/dump group of low liquidity. It is impossible to guess everything that does not depend on you, and it is not necessary. Your miscalculations (what does not depend on you) are smoothed out by your initial trading plan and risk control, that is, money management (money management).

4️⃣ Set adequate goals. Part of the position locally trade 40-80% (not necessary, but this sometimes reduces the risk).

5️⃣ Work with trigger orders and lower them if they did not work and the price falls.

6️⃣ Remember that in consolidation and cut zones in assets of such liquidity, stops are always knocked out, so the size of the stop does not really matter. It will be knocked out, especially before the reversal.

7️⃣ Before the reversal of the secondary trend, as a rule, they first do a “hamster pump” by a conditionally significant %, when everyone is "tired of waiting". They absorb all sales. Then the main pumping without passengers by a very large % takes place to form a distribution zone. As a rule, it will be lower than the pump highs, that is, in the zone when they are not afraid to buy, but believe that after a large pump, the highs will be overcome significantly.

8️⃣ Remember that assets of such liquidity decrease after listings or highs by:

a) active hype, bull market -50-70%

b) secondary trend without extraordinary events -90-93%

c) cycle change -96-98% or scam, if it is a 1-2 cycle project (there is no point in supporting the legend, how it is easier to make a candy wrapper from scratch without believing holders with coins).

9️⃣In the capitulation zone, there can be several of them depending on the trend of the market as a whole and rationality, the asset is of no interest to anyone. Everyone gets the impression that everything is a scam. That is, on the contrary, you need to collect the asset, observing money management, that is, your initial distribution of money and the risk that you agreed with in advance. As a rule, in such zones people "give up" and abandon their earlier vision.

🔟 After the entire position is set (pre-planned, according to your money management), stop and do not get stuck in the market and news noise. Wait for your first goals.

Remember, people always buy expensive, and refuse to buy cheap ("it's a scam", they try to "catch the bottom"), when "the Internet is not buzzing". This all happens because there is no vision, and as a consequence, no tactics of work and risk control . Many want to guess the “bottom”, or “maximums”, and refuse to sell when they are reached. The first and second are not conditionally available, on assets of such liquidity and emission control. But, there are probabilities that you can operate and earn on this, without getting stuck in the market noise. And also in the opinions of the majority (inclination to the dominant opinion and rejection of your plan and risk control), from which you must fence yourself off.

Most people, immersed in market noise and the opinions of others , choose for themselves the price movement, which is beneficial to them at the moment , and to which they are inclined, but do not provide themselves with the tactics of work. This is a key mistake, and the main manipulation that the conditional manipulator achieves, who, by the way, is sometimes not on the asset, to form an opinion and, as a consequence, the actions of the majority.

Because, in essence, most people do not have the tactics of work. Where the news FUD (inclination to the dominant opinion), “market noise” (cutting zones and collecting liquidity), the opinion of the majority, is directed, that is what they are inclined to.

When the price goes in the other direction, it is disappointment.

If these are futures — liquidation of the position. Zeroing out due to greed.

If this is spot — "proud random holders" , without the ability to average the position (no money), to reduce the average price of the position set as a whole, and as a result increase the % of profit in the future.

A trading plan and risk control are the basis, not guessing the price movement. If you do not have the first “two whales” of trading in your arsenal, then you have nothing. It doesn't matter how much you guess the potential movement, as the outcome of such practice is always the same, and it is not comforting.

#MANA/USDT Ready to go higher#MANA

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.5516

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 0.5593

First target 0.5732

Second target 0.5862

Third target 0.6016

#MANA/USDT#MANA

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.5240

Entry price 0.5317

First target 0.5434

Second target 0.5570

Third target 0.5732

Celer Network (CELR)CELR Analysis

🔹 Overview:

CELR is a Layer 2 solution designed to enhance blockchain transaction speed and reduce fees. The token has been trading in a long-term range between 0.009 and 0.033. After reaching the top of this range, the price has started a corrective move to the downside.

🔹 Key Levels:

1️⃣ Support Levels:

🔸 Fibonacci 0.382: 0.020 - 0.019

🔸 Fibonacci 0.5: 0.018 - 0.017

🔸 Fibonacci 0.618: 0.016 - 0.015

🔸 Range Bottom: 0.0105 - 0.009

2️⃣ Resistance Levels:

🔸 Range Top and Weekly Resistance: 0.03038 - 0.03590

🔸 Target 1: 0.068 - 0.081 (Fibonacci 1.618 level)

🔸 Target 2: 0.14 - 0.19 (Fibonacci 2.618 level)

🔹 Volume and Entry Signals:

🔸 Volume Trend: Increased volume at the weekly resistance level is a strong indicator for a breakout move toward higher targets.

🔸 RSI (Relative Strength Index):

A breakout above the RSI overbought zone could confirm a strong upward trend.

Holding key RSI support levels can act as an early signal for price recovery.

🔹 Scenarios:

✅ Bullish Scenario:

If the price breaks above the red resistance zone at 0.033 - 0.035 and holds with strong volume, it is likely to move toward Fibonacci targets at 0.068 - 0.081 and 0.14 - 0.19.

⚠️ Bearish Scenario:

If the price fails to hold Fibonacci support levels, we may see further downward movement toward the range bottom at 0.0105 - 0.009. A breakdown below this level could trigger deeper price declines.

🔹 Conclusion:

📊 Entry Zones:

Gradual Entries: At support levels 0.020, 0.018, 0.015

Safe Entry: Upon a confirmed breakout above the red resistance with high volume.

📉 Stop-Loss: A break below the 0.015 - 0.013 range signals a potential invalidation of bullish setups.

🔑 Recommendation:

Given CELR’s low market cap, this project carries a high investment risk. Proper risk management and position sizing are crucial.

🔍 Confirmation Signals:

✅ Volume increase during breakout above resistance

✅ Positive reaction to Fibonacci support levels

✅ RSI holding support or breaking into overbought zones

Final Note: Always manage risk and approach trades with a clear plan. The crypto market’s volatility can be both an opportunity and a challenge. Stay disciplined and aim for consistent, reasonable gains. 🚀

The 20 Trading Lessons from Top Traders I have read a lot of trading books since the time I started trading my own account and the one book that really helps me out and “I wish I’ve read this one first” – is Market Wizards Interview with Top Traders by Jack D. Schwager.

Here’s the list that struck me most that I’d like to share:

“Early trading failure is a sign that you are doing something wrong; it is not necessarily a good predictor of ultimate potential failure or success.” – Michael Marcus

“If you don’t stay with your winners, you are not going to be able to pay for the losers.” – Michael Marcus

“Liquidating positions is the way to achieve mental clarity when one is losing money and confused regarding market decisions.” – Michael Marcus

“Being a successful trader also takes courage: the courage to try, the courage to fail, the courage to succeed, and the courage to keep going when the going keeps tough.” – Michael Marcus

“Place your stops at a point that, if reached, will reasonably indicate that the trade is wrong, not at a point determined primarily by the maximum dollar amount you are willing to lose per contract. If the meaningful stop point implies an uncomfortably large loss per contract, trade a smaller number of contracts.” – Bruce Kovner

“The times when you least want to think about trading – the losing periods – are precisely the times when you need to focus most on trading.” – Richard Dennis

“Everybody gets what they want out of the market.” – Ed Seykota

“It is a happy circumstance that when nature gives us true burning desires, it also gives us the means to satisfy them.” – Ed Seykota

“Frankly, I don’t see markets; I see risks, rewards and money.” – Larry HIte

“ I have two basic rules about winning in trading as well as in life: 1. If you don’t bet, you can’t win. 2. If you lose all your chips, you can’t bet” – Larry Hite

“In my judgment, all traders are seekers of truth.” – Michael Steinhardt

“The more disciplined you can get, the better you are going to do in the market. The more you listen to tips and rumors, the more money you’re likely to lose.” – David Ryan

“When the market gets good news and goes down, it means the market is very weak; when it gets bad news and goes up, it means the market is healthy.” – Marty Schwartz

“Learn to take losses. The most important thing in making money is not letting your losses get out of hand. Also, don’t increase your position size until you have doubled or tripled your capital. Most people make the mistake of increasing their bets as soon as they start making money. That is a quick way to get wiped out.” – Marty Schwartz

“The best traders are the most humble.” – Mark Weinstein

“You have to learn how to lose; it is more important than learning how to win.” – Mark Weinstein

“Most traders who fail have large egos and can’t admit that they are wrong. Even those who are willing to admit that they are wrong early in their career can’t admit it later on. Also, some traders fail because they are too worried about losing.” – Brian Gelber

“You are never really confident in this business, because you can always be wiped out pretty quickly. The way I trade is: Live by the sword, die by the sword. There is always the potential that I could get caught with the big position in a fluke move with the market going the limit against me. On the other hand, there is no doubt in my mind that I could walk into any market in the world and make money.” – Tom Baldwin

“Clear thinking, ability to stay focused, and extreme discipline. Discipline is number one: Take a theory and stick with it. But you have to be open-minded enough to switch tracks if you feel that your theory has been proven wrong. You have to be able to say, my method worked for this type of market, but we are not in that type of market anymore.” – Tony Saliba

“ How do you judge success? I don’t know. All I know is that all the money in the world isn’t the answer.” Tony Saliba

There’s still a lot of golden information that I want to write in here – for ourselves and for everyday reading so as to keep us aligned with our trading goal, but I prefer to encourage you to read the book.

Trading Psychology: How to trade economic data.As traders, one of the biggest challenges we face is deciding what factors to consider when opening a trade: should we base ourselves on charts, news, macroeconomic data?

Many opt for a combination of all these elements, and although all traders go through the same stages, there are different routes to success. The problem with following the crowd is that you end up doing exactly what everyone else is doing.

The solution: forge your own path, with all the challenges this entails.

Most traders follow the news, analyze the data and then compare them with the charts to try to determine the best entry point. And as if that were not enough, they often seek the opinion of other online traders to confirm their decision. However, consulting the opinions of others can be counterproductive, as they can alter, for better or worse, any personal opinion about the analysis we are conducting.

We always tend to think that others know more than us and that if they think differently, it must be for some reason and that we will not be the ones who are right.

This is just another example of market psychology and the human tendency to always follow the crowd, regardless of whether it is right or not.

I believe that in order to make a living from trading, research must start with yourself, it is essential. And this is necessary to confirm or refute the information with which the market bombards us every minute.

You need very intense training and experience to make a living from trading.

How many traders trade intraday based on economic calendar data? How many really make money? It’s not worth it.

Aware of the multitude of traders who congregate around the platform at key times, market makers have all kinds of tricks. Their favorite; the sweep. Up, down and both sides at the same time.

Is a mental stop better? In my case, no. I don’t know how mentally strong you are, but the word says it all: mental-stop. When you expose yourself to letting the mind think, you are entering dangerous psychological terrain and it is very difficult, if you are losing, to close with discipline in each and every operation.

Notice that I say in each and every one, because with not respecting a single one and that the price does not return in that operation to the entry point, it will be your elimination as a trader.

Therefore, anything that can cause a loss is worth discarding.

Greed doesn’t let you, we know that with a data in favor of our position you can make a lot of money but if the data is contrary and also forms a gap, no one will save us. And let’s not talk about if you are leveraged. Being leveraged and having the position run against you is one of the hardest experiences a trader can have.

Seeing how your capital is destroyed at forced marches, how losses increase, how you are not able to close because you expect a recovery to do so is dramatic.

Realizing that first loss, which at first seemed big to you and now doesn’t seem so much. You would “kill” to lose only that.

Then, once you are losing a lot you will no longer be able to close. There comes a time when you assume it and let the losses run as far as they go. You have accepted it. You risk the account in the hope of recovering.

This means hours of waiting for the desired recovery. In addition, the market is very rogue. After the fall comes the rebound, usually up to half. You get the idea that it is going to recover completely and instead of closing you hold on to see if the moment comes when you no longer lose anything.

The market will make you believe that this is going to happen. You may even average (add more positions) so that the recovery is faster and by the way, if the price goes beyond where you have opened the first operation, you even come out with profits.

But, as I say, the market is very cruel and when you start to dream and have hope again, it turns around and falls with even more force if possible, crushing your account and destroying your morale.

The result we all know. If the account does not have enough capital to withstand the bleeding, margin call will “come to see us”. And if it does, it will take you days, weeks, months or even years to recover your capital, if you do. Days, weeks, months and even years without liquidity to do what you like the most, trading.

In view of this, stoploss, as well as avoiding any situation that makes you lose is more than justified.

COMPOUND INTEREST: The Secret SauceIn this video I cover the topic of "Compound Interest". I go over the WHAT, WHY, WHO and HOW of it.

The Importance of Compound Interest in Trading

Compound interest is a fundamental concept in the world of finance and trading, offering a powerful mechanism for growing wealth over time. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on the principal and also on the accumulated interest of previous periods. This seemingly small difference can significantly impact long-term investment returns.

Amplifying Returns

In trading, compound interest can exponentially increase the growth of your account. When profits from trading are reinvested, they start to generate additional earnings. For example, if a trader earns a 10% return on a $1,000 investment, they would have $1,100 after the first period. In the next period, the 10% return is calculated on the new total of $1,100, resulting in $1,210, and so on. Over multiple periods, this effect leads to exponential growth, far outstripping the returns from simple interest.

Long-Term Benefits

The magic of compound interest becomes particularly evident over longer time horizons. The longer an investment is allowed to compound, the greater the potential growth. For traders, this underscores the importance of patience and a long-term perspective. By consistently reinvesting earnings and allowing them to compound, traders can achieve significant wealth accumulation even if individual trade returns are modest.

Mitigating Risk

Compound interest also highlights the importance of managing risks and minimizing losses. In trading, avoiding substantial losses is crucial because significant drawdowns can severely disrupt the compounding process. A trader who loses a large portion of their capital will need significantly higher returns to recover, which can be challenging. Therefore, prudent risk management and maintaining steady, positive returns are key to leveraging the power of compound interest. Psychology plays a role as well as losing large amounts of your account can negatively affect your decision making.

Conclusion

Understanding and leveraging compound interest is essential for traders aiming to maximize their long-term returns. By reinvesting profits and allowing them to compound over time, traders can achieve exponential growth in their investments. Coupled with effective risk management, the power of compound interest can transform modest returns into substantial wealth, making it a cornerstone of successful trading strategies.

Risk Management Guide for Beginner TradersHello traders.

In this video, I delve into the fundamental principles of risk management tailored specifically for beginner traders entering the world of financial markets. I start by emphasizing the importance of understanding risk and its implications on trading outcomes. By setting clear goals and objectives, traders can align their risk management strategies with their investment aspirations.

We explore practical risk management tools such as stop loss orders, which act as a safety net to limit potential losses on trades. Calculating position sizes based on risk tolerance and stop loss levels ensures traders are not overexposed to any single trade. Continuous monitoring and review of trading performance enable adjustments to risk parameters in response to changing market conditions.

I also shared some tools that can be used to help make the process of calculating risk efficient and accurate. By mastering these risk management techniques, beginner traders can safeguard their capital and embark on their trading journey with confidence and resilience.

🔔COMP Analysis: Consolidation Phase on 4H Chart⚡️🔍COMP is currently in a consolidation phase on the 4-hour timeframe, forming a sideways trading range. Considering the upward trend behind it, if the long trigger is activated, it would be favorable to open long positions with increased confidence.

📉For short positions, our risk trigger is at 85.37. Given the bullish nature of the market, I do not recommend entering short positions right now. Instead, wait for a breakdown below this level and consider entering short positions with a trigger at 76.92.

📈Regarding volume, COMP has encountered significant volume at the resistance of 95.21, followed by a decrease in volume. This indicates strong resistance that may not easily be breached. If you anticipate a bullish move, consider entering positions earlier than the resistance level, as it may break, and the confirmation candle may not provide timely validation.📊

💥As for indicators and oscillators, there is not much to add as the market is range-bound, and additional information may not be beneficial.

🧠💼It's important to acknowledge the inherent risks in futures trading, with the potential for margin calls if risk management is neglected. Always adhere to strict capital management principles and utilize stop-loss orders, ensuring that the initial target offers a risk-to-reward ratio of 2.

📈GMX Futures: Potential Long Opportunities🚀🔍In the 4-hour timeframe, GMX exhibits a clear ascending trendline providing consistent support, yet to be breached. It once faked out the trendline, followed by higher lows, demonstrating resilience and breaking the resistance at 59.2 with conviction.

📈Following the break, two significant red candles with substantial volume are observed, serving as potential pullbacks. Should the current candle engulf the previous one, it presents a favorable opportunity to enter a long position in futures. Aim for a risk-to-reward ratio of at least 2, ensuring the use of stop-loss orders to mitigate potential losses.

💎For those waiting on the sidelines, patience until the trigger at 64.35 is advisable before considering entry.

✅The target for long positions, apart from the risk-to-reward ratio of 2, could be set at 71.66, although current price levels may pose a challenge for immediate attainment.

📉In the event of a reversal at 59.2, a more aggressive entry could be considered at 57.52 in lower timeframes. However, exercise caution and promptly secure profits to avoid substantial losses.

🐢For a more conservative approach, waiting for confirmation at 54.01 before considering short positions is prudent.

🧠💼It's important to acknowledge the inherent risks in futures trading, with the potential for margin calls if risk management is neglected. Always adhere to strict capital management principles and utilize stop-loss orders, ensuring that the initial target offers a risk-to-reward ratio of 2.

DOGE: Breakout Potential/ Long-Term Investment Considerations

Accumulation Range Breakout:

BINANCE:DOGEUSDT has successfully broken out of its previous accumulation range over the past few weeks.

🐃This breakout confirms a bullish trend reversal and indicates potential for further price appreciation.🐃

🍣Key Resistance Level and Consolidation:

The price has reached a significant resistance level, leading to price consolidation and RSI reset.

A successful breakout above this resistance level could propel the price towards the next weekly resistance at 0.3.

📊Volume and RSI Considerations:

Adequate market volume is crucial to facilitate a breakout above the current resistance level.

RSI approaching the overbought zone would indicate strong momentum and support the bullish case.

📈MID-Term Investment Potential:

Based on higher targets, DOG could be a viable investment option if the overall market trend remains favorable.

However, investors should exercise caution due to the inherent risks associated with cryptocurrency investments.

🔍📉Reversal and Ranging Scenarios:

Rejection at the current resistance level and a breakdown of the RSI trendline could result in a price correction or extended consolidation.

🚫Investors should monitor these factors and adjust their strategies accordingly.

🚫This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research and employ sound risk management practices before investing.🚫

MINA Analysis: Potential Correction, SELL or BUY Setup?!🍣📈Weekly Channel Breakout and Retest:

MINA previously broke out of its weekly channel and reached its target successfully.

The recent breakdown below the channel indicates a loss of bullish momentum and potential for a retracement.

🔍📉Corrective Phase and Resistance Levels:

If MINA undergoes a correction, it is likely to retrace upwards until reaching its weekly resistance level.

A rejection at this resistance level, coinciding with the RSI reaching the daily blue resistance line, could present a selling opportunity.

🚫Early Sell Setup and Risk Management:

A sell position could be initiated early at the current price level (below the lower channel line) using the red trigger line as confirmation.

Trailing the stop-loss to the lower support zone can help mitigate risk and maximize profit potential.

✅Important Considerations✅

The overall market trend should be taken into account before executing any trades.

Confirming the reversal with additional technical indicators and market sentiment analysis is essential.

🚫This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research and employ sound risk management practices before trading.

🚫

🚨#MANA/USDT Long#MANA

The price is moving in a perfectly formed head and shoulders pattern

We have a higher moving average of 100

The rise is expected to continue to complete the model based on 4 goals

Entry price is 0.4611

The first target is 0.4779

The second target is 0.4935

The third goal is 0.5172

The fourth target is 0.5378

Simple management is easier on your mindhi, just wanted to share a couple of thought on management, mainly for new members.

in my eyes, there are two categories of management: simple (fixed RR) and more complex (variations of trailing).

Both have positive and negative sides.

In my eyes, as a very very subjective opinion, simple fixed RR system will be better for most people. Or ok, I'll not speak for most, but for me definitely.

Why so:

incredible simplicity, cause you just need to test to see how much your trades usually run + create b.e. rule, and you're good to go

3-5RR are usually best for fixed RR systems

do not underrestimate the energy that goes into making decisions while managing and waiting, watching for the trade to develop into higher RR's. With fixed you don't have this - you just go b.e. and then you can close the terminal, and go away if needed. However yes, advanced experienced consistent traders would trail almost with no extra emotions, cause it's usually more mechanical. With that said, for many relatevely new traders, trailing could be extra emotional.

with fixed, you'll have less chances to become emotional, because of many reasons, for me personally fixed RR system gives a sense of accomplishment on every trade, while with managing I'm constantly thinking how can I manage longer better etc. So I'm rarely satisfied when I'm getting stopped out on trail, cause I'm still "stopped out", while on fixed I have a sense of good work done. I know it's weird, but it's personal experience

I could continue, but I guess the general guideline is there.

My main message is that TP can be a very simple fixed 3 or 4RR and that would be more than enough and easier for most people's mind

have a good weekend.

24-01-30 update AUDUSD Long Entry: Trade Management 24-01-30 update

AUDUSD Long Entry

Entry Price: 0.65700

Stop Loss Price : 0.65300 / 40 Pips

Take Profit: 0.66300 / 60 Pips

Risk To Reward : 1 for 1.5

Trade Grade: b +

-Tagged into trade at same price levels above

* Trade Management*

A. Risk entry (pending order)

B. Take Profit at levels above

B2: I might scale the risk off if the market trends in the direction of the trade. Cut losses quickly and let the winners ride is a big part of my trading style

If anyone wants to know when I reduce risk please message me