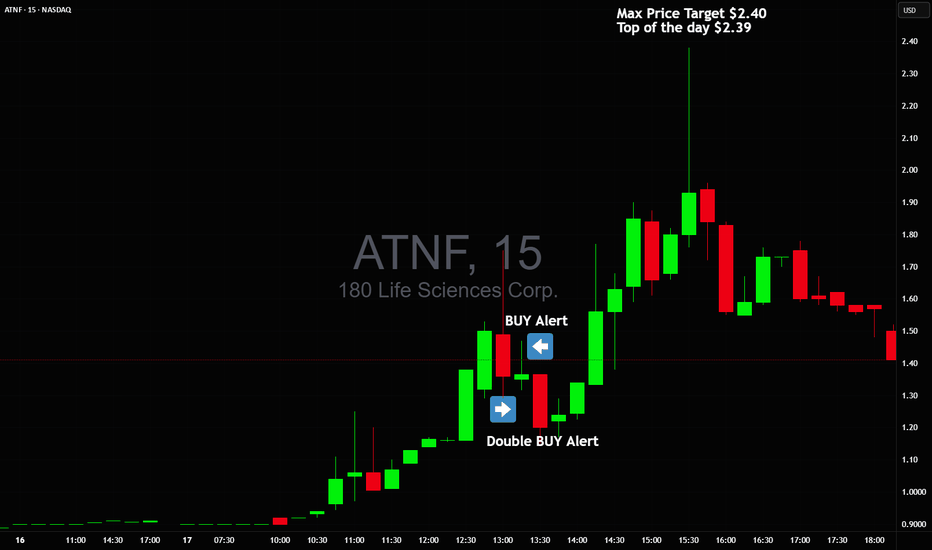

Double Buy Alert $1.35 avg with $2.40 max targetDouble Buy Alert $1.35 avg with $2.40 max target 🚀 High of the day was $2.39 🎯 NASDAQ:ATNF

Price action clearly signaled manipulation, I warned everyonw about it and sent out Double buy alert with new highs squeeze target!

Those who held all the way made +150% profit on this trade alone in 2 hours 💪🏻

NASDAQ:TELO NASDAQ:ABVE NASDAQ:NVDA NASDAQ:TSLA

Manipulation

BTC - Zoomed Out ScenarioAs predicted DXY has broken down a major monthly bearish trendline - currently finishing a bearish retest before further free fall.

If this plays out we have 2-3 years of a weakening / correcting dollar, and a strengthening investment in assets such as Bitcoin.

This means an extended bull market spanning 2-4 years on Bitcoin and equities.

However - there is a mass amount of liquidity to the uber lows towards 10,000 on BTC.

Market is showing manipulated intention to hit these lows by keeping the price below this bearish cross section - and that’s why bitcoin hasn’t been moving up yet.

This tells me this is more likely than we all think to play out.

I’m trading the following:

Short - 108,200 to 35,000

Long - 35,000 to 80,000

Short - 80,000 to 10,000

Will update accordingly if the plan changes.

Happy trading.

Why BTC hasn’t moved up recentlyBTC has been bobbing above and below this bearish triple crossover the past few months. What we see as consolidation is rather price getting stuck around these resistance levels.

The only reason why this would be occurring in my view, is due to the market makers having intention to allow this drop to play out.

The resistance is located at around 107,000 to 107,400 - watch this zone closely for a hold below / rejection and fast drop.

Scenario 1 marked with solid red line.

Scenario 2 marked with dotted red line.

Little update for y’all. Happy weekend trading.

The Bitcoin Manipulation Trick - How They Lure You Into the Trap📉 Bitcoin spends more time in deep drawdowns than at its peaks. Historically, BTC has spent over 80% of its existence trading 80-90% below its all-time highs, yet people keep falling for the illusion of wealth.

🧐 Here’s how the cycle works:

1️⃣ They drive up the price to make it enticing for new buyers.

2️⃣ You FOMO in at the highs, believing in the "next big wave."

3️⃣ Then they crash it, wiping out weak holders.

4️⃣ They keep it suppressed for years, forcing everyone out, via margin calls, financial strain, or sheer exhaustion.

5️⃣ When enough have capitulated, they restart the cycle.

📊 Historical Evidence:

- 2013 Crash: Over 400 days down 80%+ before recovery.

- 2017 Crash: Nearly 3 years below 80% of ATH.

- 2021 Drop: More than a year stuck 75% below peak.

🔎 If you’re buying now, be ready to:

⛔ Lose access to your money

⛔ Keep covering margins

⛔ Wait years for recovery, if it ever happens …

They play the same trick, every time. If you don’t recognize it, you’re just another part of the cycle. 🚀🔥

INDEX:BTCUSD NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:GOLD TVC:SILVER NASDAQ:MSTR TVC:DXY NASDAQ:HOOD NYSE:CRCL

BTC - On its way down from these trendlines How low can we go? We will find out.

Three bearish intersecting trendlines above.

Short began initiating from above as per my previous post.

I personally am not ruling out a flash crash to 10,000.

DXY is breaking down a major bearish trendline on the weekly / monthly - Market has a prime opportunity to manipulate Bitcoin into all of these long stop losses and trigger a massive liquidation event.

Stay alert and safe!

BTC - Be mindful of resistance around 109,800 to 110,000Per my second last post about this red trendline - be mindful that there is a resistance located 109,800 to 110,000 zone.

Although Bitcoin can break above, that doesn’t mean the resistance is invalid. Price will weave above and below until it sticks and plays out.

Personally I watch these levels for sudden fast movement and confirmation that it’s holding as resistance.

If you see a fast drop initiate from these levels, be mindful that this could be indicative of intention to hit the lows around 20,000.

For more information see my previous posts.

Happy trading

A Follow up to: “Adjustments for Better Readings & VSA vs BTC"When a trend approaches its end, we typically observe the formation of a buying or selling climax. That was certainly the case during Wyckoff’s era. Everything he described—market manipulation, signals, footprints—remains relevant today. But you know what that also means: if it's out there, it’s old news.

Yes, this is still happening, but we need to acknowledge that this information is no longer exclusive. And when a method becomes well-known—especially among retail traders—it can be used against them. Wyckoff himself hinted at this: the manipulators can and do use these same technical patterns to deceive. His real message?

“Keep an open mind.”

📉 In our current BTC chart, we’re seeing a textbook example of potential manipulation. A selling climax is visible—normally a sign of trend exhaustion and a bullish reversal. But is that really the case here? Did the downtrend truly end?

On the 1-Hour timeframe, both the RSI and volume indicators suggest otherwise: a bearish continuation seems more likely.

🧱 We're also witnessing a real-time formation of a Double Top pattern, taking shape since June 6. Measured by body candle spreads (excluding wicks), we observe four touches within a key price rectangle. These align with a known candlestick pattern: the Tweezer Top, commonly associated with bearish reversals.

What’s more, all of this is happening within a supply zone—actually three marked zones on the chart. The most recent zone shows signs of offloading pressure, amplified by both the Double Top and bearish candlestick formations.

And I haven’t even touched on the rejection wicks or how bearish volume spikes are gaining strength. That’s where the principle of Effort vs. Result comes in—remember, nothing in the market is free.

📊 In line with our past two posts, note how price action (PA) shows equal highs while RSI diverges, reinforcing earlier signals. The signs are stacking up.

So, the critical question now is:

Are we heading below the $100.718 level for a confirmed Head & Shoulders pattern?

Or is this just a retest before another move?

If this way of reading the market resonates with you and you want to go deeper—whether it’s building confidence or spotting signals before they play out—I work with a small circle of traders sharing TA privately on a daily basis. Feel free to reach out.

Till next time be well and trade wisely!

BTC Under Major Resistance HereBitcoin has shown strength towards playing out these ideas, as unrealistic as it may seem.

The interactions at specific levels have shown these trendlines to be valid.

I see two scenarios if BTC holds below its resistance at 104,550 to 105,000

104,600 to 35,000

35,000 retrace to 75,000

75,000 to 7,000

Alternatively:

104,600 to 20,000

Up from 20,000

While these seem like macro projections, per my previous posts and explanations - it’s possible to see this occur in a very small period of time. IE flash crash, stop hunt, etc.

Happy trading.

Bitcoin – Entering a distribution phase after a bull trap?Since the second week of May, Bitcoin (BTC) has exhibited a textbook accumulation phase, with a well-defined trading range forming just below the previous all-time high. Beginning around May 12, price action became increasingly compressed, marked by a series of higher lows and relatively flat resistance, indicating growing demand and waning selling pressure. This consolidation structure persisted for more than a week, suggesting that larger players were accumulating positions in anticipation of a breakout. Now it could be making the Power of 3. Accumulation, manipulation and distribution.

Accumulation, manipulation and distribution

Eventually, this coiled energy resolved to the upside. BTC broke through the upper boundary of the accumulation zone with increasing volume and momentum, triggering a sharp rally and leading to the formation of a new all-time high. At that point, market sentiment turned decidedly bullish, with breakout traders entering the market, expecting continuation. However, the price failed to sustain above the previous ATH for long. Despite the breakout’s initial strength, Bitcoin was unable to establish a solid foothold above the critical psychological and technical level, which has now proven to be a key inflection point.

Soon after setting a new high, BTC began to reverse, shedding gains and retracing back below the former resistance level, which had temporarily acted as support. The breakdown below the $106,000 mark, previously the ceiling of the accumulation range, signaled a notable shift in market structure. What was initially viewed as a healthy continuation pattern evolved into what now appears to be a classic bull trap. This type of failed breakout often leaves market participants vulnerable, as late buyers are caught in drawdowns and early longs may be incentivized to exit positions.

Given this context, the recent price action carries the hallmarks of a Power of 3, where market makers and institutions may be offloading positions to less informed participants. This phase is often mistaken for continued accumulation by retail traders due to its structural similarity; however, the key difference lies in the failure to maintain new highs and the emergence of lower highs on any attempted bounce. The rejection above the ATH and the subsequent breakdown below $106K has introduced significant overhead supply, which may act as resistance in the near term.

Target levels

As BTC continues to trade below this critical level, the likelihood of a further retracement grows. The market appears to be transitioning into a phase of redistribution or distribution proper, where price is likely to be capped on rallies and pressured lower over time. It is reasonable to expect that Bitcoin could revisit $100.000 to mid-$90,000s, an area that may serve as a magnet for liquidity and a potential staging ground for the next major move. This region could represent a "Last Point of Supply" (LPSY) within the Wyckoff framework, typically the final area where smart money distributes before initiating a more decisive markdown phase.

Nevertheless, this potential pullback should not be viewed solely as a sign of weakness. In many bull cycles, such corrections and shakeouts serve to flush out over-leveraged positions and reset sentiment, ultimately laying the groundwork for renewed upward momentum. Should BTC find stability and demand re-emerge in the $95K–$100K range, it could mark the beginning of a new re-accumulation phase, leading to a healthier and more sustainable advance.

Conclusion

In summary, the recent breakout above ATH followed by a sharp reversal and loss of key support paints a cautionary picture in the short term. Bitcoin may currently be navigating a distribution zone, with downside pressure likely to persist as the market digests recent gains. However, such corrections are typical in broader uptrends and often present opportunities for strategic entries once the next accumulation structure becomes clear. Patience and disciplined observation will be essential as the market defines its next directional bias.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Mastering the ICT Power of 3 concept - How to use it in trading!The financial markets often appear chaotic and unpredictable, but behind the scenes, institutional players operate with clear strategies that shape price action. One such strategy is the ICT (Inner Circle Trader) "Power of 3" model, a framework used to understand and anticipate market cycles through three key phases: accumulation, manipulation, and distribution. This guide will break down each of these phases in detail, explaining how smart money operates and how retail traders can align themselves with the true direction of the market.

What will be discussed?

- The 3 phases

- Examples of the PO3

- How to trade the PO3

- Tips for trading the PO3

The 3 phases

Accumulation

The Accumulation Phase in the ICT "Power of 3" model refers to the initial stage of a market cycle where institutional or "smart money" participants quietly build their positions. During this time, price typically moves sideways within a tight range, often showing little to no clear direction. This is intentional. The market appears quiet or indecisive, which is designed to confuse retail traders and keep them out of alignment with the real intentions of the market's larger players.

In this phase, smart money is not looking to move the market dramatically. Instead, they are focused on accumulating long or short positions without drawing attention. They do this by keeping price contained within a consolidation zone. The idea is to gather enough liquidity, often from unsuspecting retail traders entering early breakout trades or trying to trade the range, before making a more aggressive move.

Manipulation

The Manipulation Phase in the ICT "Power of 3" model is the second stage that follows accumulation. This phase is where smart money deliberately moves the market in the opposite direction of their intended move to trigger retail stop losses, induce emotional decisions, and create liquidity.

After price has consolidated during accumulation, many retail traders are either already positioned or have orders waiting just outside the range, either stop losses from those trading the range or breakout orders from those anticipating a directional move. The manipulation phase exploits this positioning. Price will often break out of the accumulation range in one direction, appearing to confirm a new trend. This move is designed to look convincing, it might even come with a spike in volume or momentum to draw traders in.

However, this breakout is a false move. It doesn’t represent the true intention of smart money. Instead, it's meant to sweep liquidity, triggering stop losses above or below the range, and then reverse sharply. This stop run provides the liquidity needed for large players to finalize their positions at optimal prices. Once enough liquidity is collected, and retail traders are caught offside, the real move begins.

Distribution

The Distribution Phase in the ICT "Power of 3" model is the final stage of the cycle, following accumulation and manipulation. This is where the true intention of smart money is revealed, and the market makes a sustained, directional move, either bullish or bearish. Unlike the earlier phases, distribution is marked by clear price expansion, increased volatility, and decisive momentum.

After smart money has accumulated positions and shaken out retail traders through manipulation, they have the liquidity and positioning needed to drive the market in their desired direction. The distribution phase is where these positions are "distributed" into the broader market, meaning, institutions begin to offload their positions into the retail flow that is now chasing the move. Retail traders, seeing the strong trend, often jump in late, providing the liquidity for smart money to exit profitably.

This phase is typically what retail traders perceive as the real trend, and in a sense, it is. However, by the time the trend is obvious, smart money has already entered during accumulation and profited from the manipulation. What appears to be a breakout or trend continuation to most retail participants is actually the final leg of the smart money’s strategy. They are now unloading their positions while price continues to expand.

Examples of the Power of 3

How to trade the PO3?

Start by identifying a clear accumulation range. This typically happens during the Asian session or the early part of the London session. Price moves sideways, forming a consolidation zone. Your job here isn’t to trade, but to observe. Draw horizontal lines marking the high and low of the range. These become your key liquidity zones.

Next, anticipate the manipulation phase, which usually occurs during the London session or at the NY open. Price will often break out of the range, triggering stop losses above the high or below the low of the accumulation zone. This move is deceptive, it is not the real trend. Do not chase it. Instead, wait for signs of rejection, such as a sharp reversal after the liquidity grab, imbalance filling, or a shift in market structure on a lower timeframe (like a 1- or 5-minute chart).

Once manipulation has swept liquidity and price starts showing signs of reversing back inside the range or beyond, you now look for a confirmation of the true move, this begins the distribution phase. You enter in the direction opposite of the manipulation move, ideally once price breaks a structure level confirming that smart money has taken control.

For example, if price consolidates overnight, fakes a move to the downside (running sell stops), and then quickly reverses and breaks above a key swing high, that's your signal that the true move is likely up. Enter after the break and retest of structure, using a tight stop loss below the recent low. Your target should be based on liquidity pools, fair value gaps, or higher-timeframe imbalances.

The key to trading the Power of 3 is patience and precision. You're not trying to catch every move, but to wait for the market to complete its cycle of deception and then ride the clean expansion. Ideally, your entry comes just after manipulation, and you hold through the distribution/expansion phase, taking partials at key liquidity levels along the way.

Tips for trading the PO3

1. Learn price movements

Before you can effectively apply the ICT Power of 3 strategy, it’s crucial to have a deep understanding of how price behaves. This means being comfortable identifying market structure, recognizing trend direction, and interpreting candlestick dynamics. Since the Power of 3 is deeply rooted in how price moves in real time, a strong grasp of these basics will give you the confidence to read the market correctly as each phase develops.

2. Analyse multiple timeframes

Although the Power of 3 pattern shows up on lower timeframes, relying on just one can lead to misreads. You’ll gain a clearer picture when you align the short-term view with higher timeframe structure. For example, what appears to be accumulation on the 15-minute chart may simply be a retracement in a larger trend on the 1-hour or daily. By examining multiple timeframes together, you can better identify the true setup and avoid being tricked by noise.

3. Exercise patience

A key part of trading the Power of 3 is knowing when to act, and more importantly, when not to. It’s easy to get impatient during the accumulation or manipulation phases, but entering too early often leads to frustration or losses. True discipline comes from waiting for the expansion or distribution phase, when the market reveals its real direction. This is where the most favorable risk-to-reward setups occur.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

BTC - Another Potential Bearish PatternHere I present my second alternative for a Bearish case for Bitcoin.

Per my previous posts I explain in detail the interest in recollecting liquidity in these lower zones. Previously I presented pathways to the uber lows at 7,000-10,000 - however this is another possible case.

I believe Bitcoin can see a drop from 109,200 straight down to 19,000-20,000

Why?

1. Major Volume support at this level

2. Major liquidity pools in confluence with this level

3. Price would form a W bottom with a higher low - which aligns with DXY breaking down on the monthly time frame. We can use DXY to project a bull market spanning 2-5 years (weakening dollar = more interest in deflationary assets such as Bitcoin)

4. Per the note above, it’s unlikely that BTC continues straight up without a sharp drop. The way this market works is to a large degree with leverage trading. The market and exchanges desperately want to shake out these longs, especially if we consider a 2-5 year bullish forecast through a macro view.

5. Confluence with this diagonal trendline which shows a clear support / resistance structure (note the Bitcoin chart is formed via diagonal ascending support and resistance lines - we can demonstrate this clearly and repeatable by duplicating the correct trendline and seeing how it forms the chart at any location)

Personally, I am shorting Bitcoin from 109,000 - and am expecting to see a fast drop through the rest of the weekend.

I will watch what the price does, where it reacts and interacts, and attempt to get a head start on understanding the true bottom before this “true” bull cycle begins.

Happy trading

BTC - Bullish Madness or Bearish Retest?Zooming out on BTC chart we can note this major bearish trendline on the HTF. This diagonal support / resistance line can take BTC to 7,000.

Likely? Maybe not. Possible? Absolutely.

A straight move up on BTC like we have seen the last two years is very dangerous. There is a large chain reaction of leveraged sell orders via long position stop losses cascading down the price levels.

Can this trigger a massive and fast flash crash?

In my view - absolutely.

Here are two potential moves that take price to those low liquidations levels.

Possibility 1

110,000 to 35,000

35,000 retrace to 81,000

81,000 to 7,000

Possibility 2

110,000 to 43,000

43,000 retrace to 72,000

72,000 to 7,000

Note that both of these possibilities end with 7,000. I’m mapping out two routes that take us there, using confluences with trendlines, volume profiles, liquidity mapping, and common sense.

Always remember that crypto is a very new market, with some unique mechanics that differentiate it from other more established markets. Predominantly the futures and high leverage usage and the ways these platforms make their money…

Beware and be prepared.

BTC - Liquidity Mapping to Predict MovementAs a part II to my previous post on “Bull Market OR Bearish Retest?” - Here is a 2 day liquidity map on BTC’s chart.

I’m anticipating a sharp drop to 7,000 - why is this number significant?

There is a mass amount of liquidity in the chart down towards 7,000-10,000.

This liquidity is in the form of long stop loss orders.

In layman’s terms - the sell orders required to take price to this extreme low are already within the chart. It is a pre-set consequence to traders decisions in a market dominated by leveraged buys and sells.

If we consider what the “floor” price of BTC is (IE all long term secured holders) - we first have to seperate out the leveraging liquidity used in the futures market.

How much of the BTC market cap is injected liquidity from futures / derivatives? In my view, anything above 7,000.

This liquidity can flow in and out, and the business and function behind it isn’t affected. This liquidity is extremely fluid. It can drop 90,000 and rise 90,000 shortly after without any affect on the fundamental value of Bitcoin.

Sure there is a psychological consequence with perceived value and market stability - but the fact is, leveraged liquidity can enter the market and leave the market with no impact at all on the wallets of market makers.

Food for thought - happy trading.

Trump vs. Powell: 4d Gold Price Roller Coaster📊 Summary of Recent 4 Trading Days

During the ongoing US-China trade war, President Trump has ramped up his public criticism of Federal Reserve Chair Jerome Powell. Though he lacks the authority to remove Powell directly it seems, Trump's frustration with the Fed’s independent policy direction has led to an apparent institutional power struggle.

This conflict hasn’t gone unnoticed by the markets. Just the mention of removing Powell caused the gold price to spike, as stock market money got squeezed out, amplified by tensions in the trade war. The Federal Reserve’s credibility is high, so such remarks naturally trigger significant volatility.

After Trump's initial outburst, gold surged $216. But when he softened his tone, the price reversed just as dramatically—falling about $240 (with the trading day still ongoing at the time). Hopes for progress in trade negotiations also played a role in this sharp reversal.

⚠️ Warning Signs of Market Distortion

Statements from the US President now function almost like market-moving events in addition to normal news. For gold traders, this creates an unstable environment where typical technical setups may fail.

The past days showed signs of manipulated or artificial movements—with potential insider activity. One notable example: Gold looked set to break higher after a 1-hour candle closed above the EMA 20 line. But a sudden $12 bearish candle in the last 30 seconds erased the setup. It felt orchestrated—possibly by institutional players defending key levels.

💡 Trader’s Takeaway

Don’t blindly trust technical signals in this environment.

Watch for political noise—it’s louder than usual.

Prefer quieter markets if you’re risk-averse.

Expect $100+ daily ranges and frequent price whipsaws.

🗣 What’s your take?

Is Trump really influencing the gold market on purpose—or just creating chaos? Let’s discuss below. 👇

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

NZDCAD Discretionary Analysis: Bank Manipulation?The price just crashed into the distribution block, straight into that sellside liquidity order block like it knew exactly where it was going. Bank manipulation? It's all over this one. The institutional orderflow is running the show, and with a sharp liquidity spike followed by orders stacking up like a ticking time bomb, it's getting real... they are manipulating the price. The fair value gap is wide, and that uptrust into the distribution channel? That's the red flag that’s flashing "this is it." Everything is lined up for a big move, and I'm here for going on the lower timeframe and entering on that liquidity sweep from a NY Open manipulated candlestick.

Just kidding, I just think it's gonna go up.

313% vertical this morning $0.30 to $1.24300% vertical BOOM 💥 squeezing out shortsellers who were just moments before trying to manipulate downside 👉🏻 Priceless! 🤑

+33% gain realized with 3 Buy Alerts into vertical NASDAQ:ICCT

What red market is everyone talking about? We don't know anything about that 🤷🏻♂️

What happens if you give a TikTok trader a billion dollars?In this video, I covered the topic of accumulation and distribution of large positions.

I explained why big market players prefer using limit orders when building and offloading their positions.

I also talked about how retail traders — who I often call TikTok traders — tend to rely on market orders, and why the price is more likely to move against the masses of TikTok traders.

Understanding this is crucial when analyzing what’s really going on "under the hood" of the market. I’ll dive deeper into this in my upcoming posts.

So don’t miss out! Subscribe!

Bearish Dump Continuation: TRUMPUSDTContext: We're more than half way through a dump on TRUMPUSDT

-Pullback into the zone after heavy bearish shift on Friday.

-Imbalance on the market profile

-61.8 Retest to the imbalance zone

-A miro-structure 61.8 retracement to the POC and VWAP (Intraday)

-Larger imbalance gaps awaiting below $10

Coinbase Gap TradeI find Coinbase very interesting right now, especially since we’ve likely completed Wave 4 around the $240 level. Since then, price has been stuck in a sideways consolidation, following an unfilled breakout gap after Wave 4 ended. This gap is still open, and I believe there’s a strong chance we’ll at least partially close it.

From a market cycle perspective, we’re currently in the accumulation phase, followed by the manipulation phase (red), and then the distribution phase (green). My plan is to target that distribution phase, aiming for the gap closure.

I’m placing a limit order roughly in the middle of the gap, just above the Yearly Open, which I expect to act as support. The RSI is still low—not oversold yet—but there’s some room for more downside before the entry triggers.

The limit order is set at around $259, with a target of at least $326, offering solid reward potential—exactly the kind of setup I’m looking for.

🔹 Asset: Coinbase

🔹 Timeframe: 1H

🔹 Entry: 259.36

🔹 Stop: 244.25

🔹 Target(s): TBA