The Truth About APTOS! I've been following apt for about 6 months. I also airdroped. Aptos was designed to replace sol. Don't get me wrong, it's for manipulation, not technology. Apt team will never let you say anything critical in dc. They instantly silence you. The CEO of apt said ftx does not have apt, but ftx is one of apt's early investor. I saw it with my own eyes on apt website and dc channel. Ftx and alameda participated in the investment tour. This information was available on the Aptos website but has been removed. The CEO also confirmed this in the previous interview, and now they are denying it. I know that coins will be received by ftx are locked for now. From the name of Aptos to its early investors, everything is a copy of Solana. They were going to do the pump made by solana last year but the ftx scam has been exposed. Now think twice. Apt is Facebook's crypto version.

Manipulation

BTC/USDT BINANCEBTC/USDT BINANCE

4H hollows

A price rebound at the Golden Ratio of Fibonacci Retracement is expected, as it is the main Resistance Area.

Sideways movement between Support & Resistance Area is expected until Monday.

BTC = $16,855.78 +1.63%

13.32 ETH -2.47%

Market Cap: $846,597,962,034

24h Vol: $82,580,266,331

Dominance: BTC: 38.2%

ETH: 18.2%

Good Luck

#CryptoHellas Team

GBPJPY Monday Manipulation GBPJPY Outlook for Nov 7th- Nov 11th

LONG if Closes Bearish

Top-Down Analysis: Starting with a Top-Down analysis POV. In the Daily I will wait and watch for how Monday will Close. Remembering that Monday is huge day for manipulation we need to wait patiently. We do not always need to be in the market. A successful trader is a patient trader.

Trend Analysis: Last week GJ broke out of its channel. This could be a fake out to reel in orders. But, again, we will wait to see how tomorrow closes to adjust how we will attack this pair this week. I expect the pair to close bearish tomorrow.

Fib Retracement: Looking at the Latest Move and applying the Fib tool, we can see that GJ reacted to it’s .5 retracement. Also in this region you will see that GJ is reactionary to 165.000.

50/100/200EMA: Looking at the EMAs, you can see the GJ is currently reacting to the 100day (yellow) EMA. I expect GJ to stay above the 100day, and react to it, as I have placed the LONG entry zone. If everything plays out to this action, one could take advantage of another 300-500pip impulse.

If orders start to flood in, the price action will NOT move with a straight impulse as One would like, and it would invalidate this theory. An influx of orders will cause a volatile week, where we can see spreads reaching to sweep S/L’s, if that is the case.

SHORT if Closes Bullish

IF GJ closes bearish tomorrow, I expect to GJ to react to 168.000 before another move to the downside. If price moves to the downside this will, validate the Fake-Out, which I previously mentioned, and stay within the channel that it has been moving in the past week or so.

What are YOUR Thoughts? I’d Love to hear from you!

This is not financial advice! This is my Own Outlook on GJ’s price movement at this given time.

Thanks and I hope you enjoyed the read… Have a great Week!

Long BTCUSDTOn my previous posts, I already warned so many times that whales buying and retails selling and some refused admit that they are wrong.

I already warned retail traders so many times that it will make a double bottom and go up. Yet, some people act like they are very smart.

The whales are manipulating the price action to traps retails to short the bottom and reverse it up.

Investing and trading is a game of probability where the market moves up, down or sideways. Hence, the probability of a trader winning is around 33.33%.

In my previous idea, one guy thought he was smart when I talked about this accumulation and said RIP wychoff and here we are going up.

The crowd and retails are always wrong, people are too bearish at the bottom of a cycle and too bullish at the top of the cycle.

Sometimes, trading and investing is so simple with just copy and paste. But some people tried to be smart,

A lot of traders try to be right after I warned about the institution Wychoff's manipulation and some refused to listen and give into whales manipulation.

Some traders tried to aim for 16k price for BTCUSDT to buy the dip, but it never happened, the only way you can get rich is to buy at 20k and HODL.

Talked about it so many times and yet people still love to donate to the market trying to be smart.

The cryptocurrency , Bitcoin or BTCUSD is now trading at the golden support again with whales manipulating retails to short at support before doing a Wychoff's accumulation and reverse to the upside.

The manipulation was a huge success but I tried to warn the stubborn poor retails traders but yet they refused to listen. Only few listened, I hope they are in profits now.

Bitcoin prices had been ranging around at 20k as I said and now it had made a double bottom , soon it will continue to go up and everyone will get rich. A double bottom of a double bottom .

It had made an impulse correction and soon will go to 35k to fill the gap and beyond, to da moon.

On weekly, the chart had not broken the low and is making a higher high, soon it will go to the moon, buy now.

Amplify your gains by using leverage, long here and u can be filthy wealthy. Time to go all in and get rich.

Bitcoin or btcusd had made a double bottom technical structure. Bitcoin is doing the same Wychoff's accumulation and soon shall reverse the trend and bottoms here.

Do not be tempted by whales to short on bear traps!!

Warning, DO NOT short the market and get short squeezed. Buy the DIP.

I see a lot of retail traders lost money shorting bitcoin at 20k instead of buying it, this is your last buying opportunity before we move up to 35k to fill the CME gap.

The whales had been doing manipulation on bitcoin and ethereum .

It had already made a 5 waves up and will do a correction before pushing further up to 35k to fill the cme gap.

DO NOT MISS THIS last chance to buy the dip opportunity.

The whales are tempting you to short bitcoin so that they can push the prices up by doing this sideways movements.

Do not be deceived by the whales manipulation.

This manipulation by whales are food for them as retails traders getting liquidated easily.

The whales are accumulating. It is trapping breakout traders to short here, this will bottom here.

Long btc . Sick of this sideway obvious manipulation by whales.

On a higher time frame, it made a impulse and ABC correction, soon it will moon and everyone will get rich like WOW?!

This is not a signal and do not follow but a trade idea. Use your brain to trade and don't follow blindly!

Disclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach

Justin Sun's new scam. Technicals are bearish.First of all, there is a bearish divergence on the OBV

Second of all BTC HT shows incredible overbought status in stoch and RSI

Third, it reached resistance from October to November

Fourth, the volume is pale in comparison to the price 10~20m volume on a 1.4 billion token?

Fifth, Justin Sun has 1~3b in assets, he can't pump much further

Sixth, pattern shows Rising wedge which is bearish

Something is fishy here! The prices are fake or manipulated by Huobi. Something doesn't click. This pump is completely against the technicals. What's going on here. Sue Huobi.

WTI/USOIL (The Beast) - Can we break? Or is it a retracement?So it is Very fair to say that the last 2 weekly candles have been very naughty indeed.

For any EMA traders that took heed of the very important contacts with the 800 in the daily and the 100 on the weekly-provided they didn't fiddle too much-should have added substantial gains to trading account.

Most of our traders in this team did at least 150% with the top winner Tripling their account.

Its also fair to say that if you are not already in a long it may be better to stay on the side lines and wait for a decent short or await a dip to enter at a key support level. We do however need to bear in mind that historically October is "mark up" month.

The last idea spoke of a news that would send price down to the levels we were looking at in Jan 2022. That news was US rates going up more than expected and the result was high demand for the Dollar and a sharp rise in the DXY sending us down to one of the levels mentioned in the previous idea. We spoke of a move to begin from when a bottom is established at a place where there is a strong reaction as well as some other confluences.

The are that it happened from was 76.25. The confluences were as follows:

- Being at a level that had been tested multiple times in the past as both resistance and support

- Making contact (or overriding the 800 and 100 EMAs of the Daily and Weekly time frames respectively

- The formation of an inverse head and shoulders pattern

- The recovery of Blue Vector candles at the base by a big Red Vector candle (making the head) followed by a new Blue Vector candle at the base (making the second shoulder)

- Failure in 4HR time frame to embed to the downside on the Stochastic RSI and it's subsequent emergence out of oversold

5 very good reasons to go long blindly and hold 90% of the position for 1350 pips. The other 10% still running to see just how cheeky the Beast will be in it's charge to the upside (96.2 next stop if remains Bullish). Currently, it is at almost 1700 pips from where it took off from. But we are very close to the 800 EMA in the 4 Hour time frame.(tends to be a good place to have a strong price reaction)

We also have to bear in mind that most of the crazy moves we have seen his year have had a "distance traveled" of 1000-1700 pips before either retracing or reversing.

So What now?

Although we said in the previous idea, after a few Shandy's that we were going back to the high and would potentially break it and make a new all time high, there is a chance that that will not happen very soon. If it does, great but being realistic, we must think of the lower levels that it may visit before any pump to those levels.

BULLISH VIEW

There are Red Vector candles that were made all the way down from $123 Some of these will surely be recovered by March 2023.All of the ones that happened from $90 down have been recovered last week. The main ones that we are now looking at are the ones on the way to $103 where there is a price gap to the downside.

However before getting there, there is a Juicy Purple Vector Candle at $97 with it's wick top being at $97.67. We will look for a nice short there, even if price is to continue up.

The journey up there should be a nice ride from whichever the next solid support will be -if this trend has indeed reversed to the upside.

We are currently looking at the following levels as ranges to enter fresh positions for a continuation to the upside:

77.28 (4 Hour Blue Vector candle recovery)

78.11 (4 Hour Green Vector candle recovery)

79.90 (4 Hour price gap)

83.30-84 (Key support/resistance area)

86.00-44 (4 Hour Green Vector candle recovery)

89.20 (4 Hour Green Vector recovery and retest of 2.5 Pitchfork line)

Targets are in the paragraph above

This is essentially a 1200 pip range so we must be very careful. All the while bearing in mind that there are still levels like 75,74,72,66 and of course 62 that price could go to with the right conditions as they are all supports and places that Green Vector candles exist.

BEARISH VIEW

When price is moving so strongly in one direction they tend to say "buy the dips in an up trend and sell the rallies in a down trend."

If this is a case of sell the rally then there should be a short very soon.Especially if the DXY wants to go on more of a run to the upside and or Supply increases/Demand falls in Oil.

Now some would say that there has been a break in structure to the upside in the downtrend that we have been in since March, and that we are off to 98-100. But have we really? In our opinion not until we've cleared 96.6-97 comfortably has there been such a thing.

Now if we fail here (97) or somewhere close, there is a good chance that we are going to either come down to retest the levels in the Bullish view to go long again or we are going to continue a down trend and go and test 75,74,72,66 and of course 62.

We are looking for entries for a continuation of a down trend (if that's what is to come) at the following levels:

93.75 (4 Hour 800 EMA)

95.3 (4 Hour Green Vector candle recovery)

96.2-97.7 (4 Hour Green Vector candle recovery)

99 (4 Hour Green Vector candle recovery)

102 (4 Hour Green Vector candle recovery)

103.5-103.7 (Price gap)

108 (4 Hour Green Vector candle recovery)

110 (4 Hour Red Vector candle recovery)

113 (4 Hour Red Vector candle recovery)

This is a 1000 pip range so once again we must be very careful.

Good Luck Traders!

This is not financial or trading advice and should be taken with a pinch of salt.

Long BTCUSDTI already warned retail traders so many times that it will make a double bottom and go up. Yet, some people act like they are very smart.

The whales are manipulating the price action to traps retails to short the bottom and reverse it up.

Investing and trading is a game of probability where the market moves up, down or sideways. Hence, the probability of a trader winning is around 33.33%.

In my previous idea, one guy thought he was smart when I talked about this accumulation and said RIP wychoff and here we are going up.

The crowd and retails are always wrong, people are too bearish at the bottom of a cycle and too bullish at the top of the cycle.

Sometimes, trading and investing is so simple with just copy and paste. But some people tried to be smart,

A lot of traders try to be right after I warned about the institution Wychoff's manipulation and some refused to listen and give into whales manipulation.

Some traders tried to aim for 16k price for BTCUSDT to buy the dip, but it never happened, the only way you can get rich is to buy at 20k and HODL.

Talked about it so many times and yet people still love to donate to the market trying to be smart.

The cryptocurrency , Bitcoin or BTCUSD is now trading at the golden support again with whales manipulating retails to short at support before doing a Wychoff's accumulation and reverse to the upside.

The manipulation was a huge success but I tried to warn the stubborn poor retails traders but yet they refused to listen. Only few listened, I hope they are in profits now.

Bitcoin prices had been ranging around at 20k as I said and now it had made a double bottom , soon it will continue to go up and everyone will get rich. A double bottom of a double bottom .

It had made an impulse correction and soon will go to 35k to fill the gap and beyond, to da moon.

On weekly, the chart had not broken the low and is making a higher high, soon it will go to the moon, buy now.

Amplify your gains by using leverage, long here and u can be filthy wealthy. Time to go all in and get rich.

Bitcoin or btcusd had made a double bottom technical structure. Bitcoin is doing the same Wychoff's accumulation and soon shall reverse the trend and bottoms here.

Do not be tempted by whales to short on bear traps!!

Warning, DO NOT short the market and get short squeezed. Buy the DIP.

I see a lot of retail traders lost money shorting bitcoin at 20k instead of buying it, this is your last buying opportunity before we move up to 35k to fill the CME gap.

The whales had been doing manipulation on bitcoin and ethereum .

It had already made a 5 waves up and will do a correction before pushing further up to 35k to fill the cme gap.

DO NOT MISS THIS last chance to buy the dip opportunity.

The whales are tempting you to short bitcoin so that they can push the prices up by doing this sideways movements.

Do not be deceived by the whales manipulation.

This manipulation by whales are food for them as retails traders getting liquidated easily.

The whales are accumulating. It is trapping breakout traders to short here, this will bottom here.

Long btc . Sick of this sideway obvious manipulation by whales.

On a higher time frame, it made a impulse and ABC correction, soon it will moon and everyone will get rich like WOW?!

This is not a signal and do not follow but a trade idea. Use your brain to trade and don't follow blindly!

Disclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach

US30 Bearish continuationUS30 Levels 28th Sept

Were currently trading under the weekly levels that have kept us30 in a range,

We have fresh supply and a 5m FVG at the MP in confluence with the weekly - 2943

We also have the lower level of 9224 which was rejected during Asia and also created fresh supply.

I generally see that London seems to be creating supply through the morning session, which NY then mitigates and makes the real move of the day.

2920 has held strong, so with a break back I would trade short with caution.

Bitcoin Volume TransactionThis laterely the biggest #volume transacted in the the history of #bitcoin obviously they can't hide their activity with volume ( There is an #iceberg order ) Sitting on the #ASK absorbing all the buyers activities it is early to say we reached the #DIP , Laddies and gentelman we have a #Compositeman situation here

Apple Play timeline revision. Play for 30.9.22.Updated Apple timeline. We may see bounces, manipulation, delays to expire contracts, after hours moves. I closed my apple puts expiring today and bought Sept 30 exp on apple puts. 152.5 in the money puts to capture high delta.

Seems to me volume indicates MM are accumulating everyone's put positions and will ride it down after that. Could be after hours today. Often this is done tactically around exp date, weekends and timed with market movement to pay out as little as possible.

Long BTCUSDTInvesting and trading is a game of probability where the market moves up, down or sideways. Hence, the probability of a trader winning is around 33.33%.

A lot of traders try to be right after I warned about the institution Wychoff's manipulation and some refused to listen and give into whales manipulation.

Some traders tried to aim for 15k to buy the dip, but it never happened, the only way you can get rich is to buy at 20k and HODL.

Bitcoin or BTCUSD is now trading at the golden support again with whales manipulating retails to short at support before doing a Wychoff's accumulation and reverse to the upside.

Bitcoin prices had been ranging around at 20k as I said and now it had made a double bottom , soon it will continue to go up and everyone will get rich. A double bottom of a double bottom.

It had made an impulse correction and soon will go to 35k to fill the gap and beyond, to da moon.

On weekly, the chart had not broken the low and is making a higher high, soon it will go to the moon, buy now.

Amplify your gains by using leverage, long here and u can be filthy wealthy. Time to go all in and get rich.

Bitcoin or btcusd had made a double bottom technical structure. Bitcoin is doing the same Wychoff's accumulation and soon shall reverse the trend and bottoms here.

Do not be tempted by whales to short on bear traps!!

Warning, DO NOT short the market and get short squeezed. Buy the DIP.

I see a lot of retail traders lost money shorting bitcoin at 20k instead of buying it, this is your last buying opportunity before we move up to 35k to fill the CME gap.

The whales had been doing manipulation on bitcoin and ethereum .

It had already made a 5 waves up and will do a correction before pushing further up to 35k to fill the cme gap.

DO NOT MISS THIS last chance to buy the dip opportunity.

The whales are tempting you to short bitcoin so that they can push the prices up by doing this sideways movements.

Do not be deceived by the whales manipulation.

This manipulation by whales are food for them as retails traders getting liquidated easily.

The whales are accumulating. It is trapping breakout traders to short here, this will bottom here.

Long btc . Sick of this sideway obvious manipulation by whales.

On a higher time frame, it made a impulse and ABC correction, soon it will moon and everyone will get rich like WOW?!

This is not a signal and do not follow but a trade idea. Use your brain to trade and don't follow blindly!

Disclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach

Long BTCUSDTInvesting and trading is a game of probability where the market moves up, down or sideways. Hence, the probability of a trader winning is around 33.33%.

A lot of traders try to be right after I warned about the manipulation and some refused to listen and give into whales manipulation.

Some traders tried to aim for 15k to buy the dip, but it never happened, the only way you can get rich is to buy at 20k and HODL.

Bitcoin prices had been ranging around at 20k as I said and now it had made a double bottom , soon it will continue to go up and everyone will get rich.

It had made an impulse correction and soon will go to 35k.

On weekly, the chart had not broken the low and is making a higher high, soon it will go to the moon, buy now.

Amplify your gains by using leverage, long here and u can be filthy wealthy.

Bitcoin or btcusd had made a double bottom technical structure.

Do not be tempted by whales to short on bear traps!!

Warning, DO NOT short the market and get short squeezed. Buy the DIP.

I see a lot of retail traders lost money shorting bitcoin at 20k instead of buying it, this is your last buying opportunity before we move up to 35k to fill the CME gap.

The whales had been doing manipulation on bitcoin and ethereum .

It had already made a 5 waves up and will do a correction before pushing further up to 35k to fill the cme gap.

DO NOT MISS THIS last chance to buy the dip opportunity.

The whales are tempting you to short bitcoin so that they can push the prices up by doing this sideways movements.

Do not be deceived by the whales manipulation.

This manipulation by whales are food for them as retails traders getting liquidated easily.

The whales are accumulating. It is trapping breakout traders to short here, this will bottom here.

Long btc . Sick of this sideway obvious manipulation by whales.

On a higher time frame, it made a impulse and ABC correction, soon it will moon and everyone will get rich like WOW?!

This is not a signal and do not follow but a trade idea. Use your brain to trade and don't follow blindly!

Disclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach

Reminescence of a Scam Operator (ANTI SCAMMER GUIDE)Reminiscent of the roaring 1920s, the 2020 epidemic and the inability to work for many people brought an influx of new retail investors to the public market. Furthermore, the FED's decision to prop up the market by dropping interest rates combined with stimulus checks handed out by the U.S. government lured in even more investors who were hungry for profits. Although the market sensation also brought a rise of omnipresent scams across all trading platforms.

Lack of workforce, sophisticated methods, and automated bots often play into the hands of perpetrators who try to get ahead of the platform and its users. Therefore, we decided to write this concise article with the purpose of helping new investors to recognize good apples from bad ones.

The most common means of communication for criminals is to use private chat, public chat, comments, ideas, and headline references. Several examples of red flags are shown below.

RED FLAGS AND OTHER POINTS:

Asking for personal information and TradingView account information

One common tactic criminals use to exploit their victims is to ask for personal information or account information (login and password). This information should not be disclosed to anyone, including someone claiming to be a platform's employee/support (as these people tend to have access to this information).

Asking for trading account information

Another standard method bad actors use is asking for trading account information. On such occasions, a perpetrator asks for existing account information or requests a victim to create a new account; then, a perpetrator usually asks the victim to invest money into the account and let them use it in return for shared profits.

False promises

The third point probably accompanies every other point on our list. This point relates mainly to false promises about trading achievements, which often include statements about having a high win rate, high net worth, and an unbeatable trading system.

Financial gurus and lavish lifestyles

A high follower count and strong social media presence do not equal reliability. Perpetrators often portray lavish lifestyles across social media platforms to entice more people and trick them into buying a trading signal service or trading course (or any other service). The public image does not necessarily have to match a person's authentic lifestyle. Indeed, trading as a career is highly time-consuming and does not come with trading from a vicinity of a pool or ski resort; that is just public perception.

Trading signals and trading courses

Unfortunately, most of the time, trading signal services (for buy) lack performance and do not consider subscribers' risk tolerance and account sizes. In regard to trading courses, we hold a similarly low opinion of them as we think learning a skill to trade goes far beyond a few hours of any trading course.

Unrealistic win-rate claims

Most brokerages report that their retail clients lose about 50-90% of the initial capital, especially when trading CFDs. Therefore, we would like to put in perspective how realistic claims about a high win rate really are. Professional traders tend to peak at approximately a 50% win-rate over a consistent period. Thus, claims about a 90% or higher win rate are likely to be false.

Guaranteed moves and risk-free investments

Another tactic of scamming utilizes guaranteeing moves in the market. However, there is nothing like a guaranteed move since the market constantly changes and is influenced by complex factors.

These are just few points we included, however, we ask a public to share their own points in the comment section.

DISCLAIMER: This content serves solely educational purposes.

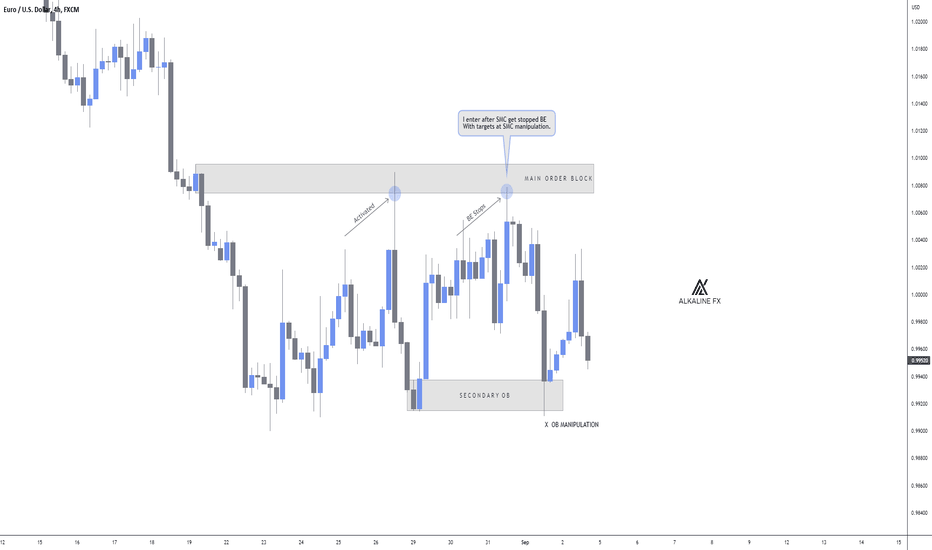

Smart Money Manipulation 🥊Alkaline is back baby! 💣

As smart money concepts gain popularity, liquidity increases.

I have taken a month away from trading to study the new forms of market manipulation and have been pleasantly surprised by what I have found.

Here is my discovery:

1) The market is currently focusing on taking liquidity from breakeven positions over fixed stop losses.

This is because emotional traders put their stops to BE quickly to avoid pain, especially during indecisive markets.

2) Order blocks are the perfect manipulation areas.

If you take time out to backtest significant order blocks, you will notice price will tap and lure or simply sweep above/below the zone before going in the intended direction.

3) That tight stop loss you are using is doing more damage than good.

Scale into your positions, trust me when I say this will reduce your emotions and give you a more relaxed trading style.

4) Use your brain, even if you are in denial.

If the majority of traders lose money, and the majority of traders now use smart money concepts, do the maths.

It feels good to be back after a long month of studying, I have lots of new things to teach and share.

I will be taking on new students shortly, have a great weekend everyone 👋

The Beast - Here again 6 months later. Hibernating is a good thing to do for some species. Some store food and save energy. Some avoid unfavorable climate conditions and some do it to metamorphosize into butterflies/moths or whatever.

We have definitely been storing food and eating good at team Squeeezy Trades.

So what has happened since our "Beast Loading up" idea?

- A drop to $83.4 on 090222 to establish what we would learn was the bottom for an astronomical move to the upside.Barring the revisit to $89 9 days later (180222) we haven't seen prices at these levels in 6 months.

- A war that took up well above $100 a barrel due to Russia being sanctioned by many and supply issues............Bla Bla Bla. (well..... pretty sure we made mention of the Red Vector candles from 2014 that were above $100 that needed recovering)- Oil actually went to $129.4ish and then did a mega dive.

- After 2 tests of $93 zone a 3 month rally commenced from there to $123.4ish before the 7 week down journey to where we are now.

Sooooo. What now?

We are looking at the same zones to the downside that we were looking at back in Feb. Why because that's where the Green Vector candles are. We are getting there!

For those who trade using EMAs we are coming up to a significant touching point in the daily time frame.

This is where price meets with the 800 EMA.

Why is this so massive?

(i) Because the 200 EMA in the daily was touched/tested twice in December of 2021 and - after the 100 EMA in the daily was broken at the 3rd time of asking in July - 6 times this summer before being broken. This makes the 800 EMA the next logical stop

(ii) this is where a reversal is more than likely to take place.

(iii) The Green Vector candles from 240122/250122 that began the sharp and powerful rises this year are in the vicinity of where the potential contact will take place.

What next?

Remember you heard it here first, there will be some big news that will cause a big drop, but after that there will be a run like never before that will take Oil back above $100 and to $132 where it will make contact with the next Red Weekly Vector candle from July 2008.

There after we believe $143 could be next and at a further stretch there will be a new All Time High made at $147. This could take until 2023 to happen but would be great to happen between Sept/Oct 2022 and March 2023.

We cannot forget that $62 (3 times - May 2021, Aug 2021 & Dec 2021) and $66 Dec 2021) area is actually the real support for the year of 2021. Bear it in mind.

$57 (March 2021) and $53 are levels it can go to break a Bull Heart but sure absolutely everyone is praying against that.

We stand by the theory that the 800 EMA in the daily will be the reversal point. As it is also the 100 EMA for the weekly TF.

Currently, depending on how the next 2 week candles go Price should line up to anywhere from $70 to $78 but could also do it from $80-$83.

We know this is not helping get the best entry prices but really and truly, behavior of price in the next 2 weeks will indicate the best time to get in.

We are waiting for a bottom to form at a place where a strong reaction happens in line with a bunch of confluences and levels aligning.

Good luck traders!

This is not financial advice and should be taken with a pinch of salt!