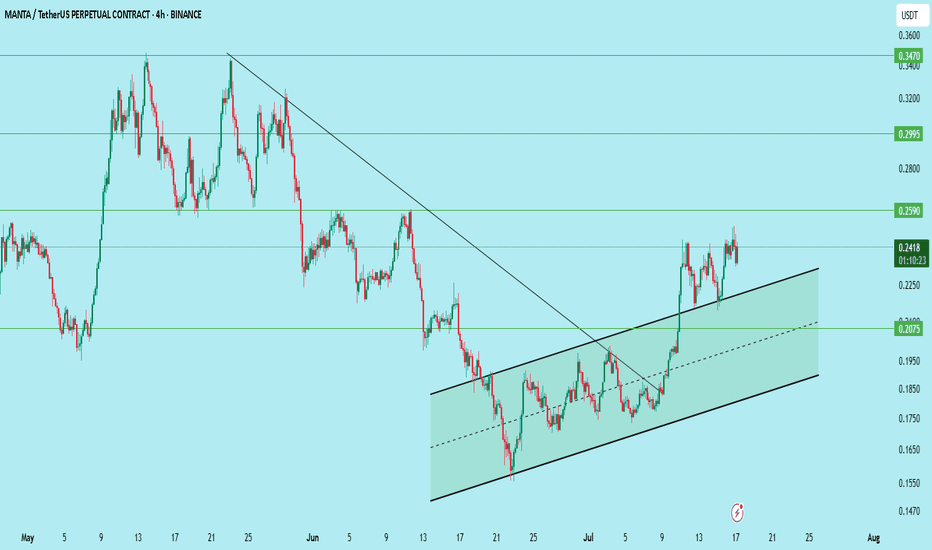

MANTA/USDT – Bullish Setup AlertMANTA has broken out of its long-term downtrend and is now trading within a clear rising parallel channel on the 4H chart.

Structure:

Downtrend broken

Higher highs and higher lows forming

Price respecting channel boundaries

Setup:

Entry: 0.225 (wait for retest)

Stop Loss: 0.2075

Target 1: 0.259

Target 2: 0.2995

Target 3: 0.347

Support: 0.225 / 0.2075

Resistance: 0.259 / 0.2995

Wait for the retest before entering. Risk-reward is attractive if the structure holds.

DYOR. Not financial advice.

Mantanetwork

#MANTA/USDT#MANTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.290.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.305

First target: 0.329

Second target: 0.348

Third target: 0.373

Manta Classic Bullish Signals = Bull Market Confirmed—PP: 1900%This analysis can be used not only to spot the trading opportunity that is now MANTAUSDT, but also for learning purposes. Let's go back to basics.

Here MANTAUSDT is breaking daily above EMA55. This break is happening with a full green candle and yesterday's candle also closed full green. Today's full green candle has above-average trading volume and is coming after several short-term higher lows. So this is a constellation of signals. One signal, the break of resistance, supported by many additional signals (volume, candles and chart pattern).

The classic signal is the break above EMA55 on the daily timeframe. This confirms a bullish potential for the mid-term, minimum, which means 3 months.

The next signal comes from the RSI, it is super strong. A hyper bullish RSI while a project is trading at bottom prices is another classic bullish strong reversal signal. It is present here.

These together, with marketwide action, what the rest of the market is doing, is more than enough for me to say: Manta is going up.

Thank you for reading.

Namaste.

Manta Network Bottom Situation—Trading Tips & Tricks (575% Rise)We have a situation here where the market bottom has been confirmed.

Notice that MANTAUSDT is trading above its 11-March low but below its 3-Feb. low. The pairs that are trading above the 3-Feb. low are stronger from a TA perspective and from a trading perspective and likely a fundamental perspective as well, compared to those trading below.

They are stronger first because the recovery is strong and second because the crash was smaller. In both cases, the rise and the drop, the market showed more support and action on these. This is something to keep in mind when choosing your pairs.

Stronger pairs tend to produce better results.

When retraces and corrections happen, they tend to happen all across. So those stronger will continue to outperform and you better choose those when choosing you Altcoins, with some exceptions of course.

There are thousands of Altcoins and it is hard to choose.

For me, I chose on 7-April when the bottom hit, so all are green, but the world (and trading) doesn't end there. The truth is that bottom prices are great but available only for the short-term.

You can use moving averages as well to know which pairs are better than another and which ones are more likely to move next. The ones trading above the longer EMAs are the ones that are stronger.

Just a few tips and tricks to improve your chances of success.

Thank you for reading.

Namaste.

MANTA/USDT – Bullish Structure Forming MANTA/USDT – Bullish Structure Forming

MANTA is showing early signs of a trend reversal, with multiple confluences indicating strength from the bulls. After a prolonged downtrend, the asset has not only broken key resistance levels but also flipped the 50 EMA, a major dynamic resistance, into support.

✅ Key Technical Highlights:

Double Bottom Formation:

The chart has clearly printed a double bottom, one of the most reliable reversal patterns.

This formation suggests that bears are losing control and buyers are starting to step in with conviction.

Breakout Above the 50 EMA:

Price has decisively broken above the 50 EMA (~0.2127), which had previously acted as dynamic resistance during the downtrend.

Notably, the price retested the 50 EMA and successfully bounced, confirming it now as support.

Resistance Flip to Support:

The previous horizontal resistance zone has been breached and retested, reinforcing its role as a demand zone.

Market Structure Shift:

Lower highs and lower lows have now transitioned into higher lows and higher highs, signaling a structural shift from bearish to bullish.

Momentum and Candle Structure:

The bullish candles post-retest show strong momentum with minimal upper wicks — a sign of buyer strength.

Manta zones for accumulationManta IAP model with accumulation zones BINANCE:MANTAUSDT

Possible Targets and explanation idea

➡️IAP model zones for accumulation marked on a screen

➡️From signal confirmation to sell on TradeOn indicator -62% short profit

➡️Appeared signal take profit and close short position

➡️On daily we saw local signal to buy and small bounce.

➡️Step by step you can accumulate now or wait main zones for accumulation with DCA

➡️2 main money inflow periods with money power indicator. whales accumulate

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Can Manta Network Become the Best Layer 2 (investing chart... )hello dear trader...

Can Manta Network Become the Best Layer 2 Solution?

Given the unique features of Manta Network, including its integration with the Polkadot ecosystem, focus on privacy, strong Binance backing, and commitment to decentralization, the project has substantial potential to become one of the top Layer 2 solutions in the blockchain space.

If the development team can overcome technical challenges, address competition, and achieve widespread adoption, Manta Network could emerge as a leading privacy-focused Layer 2 protocol.

Ultimately, the future of Manta Network depends on market developments, user adoption, and the performance of the development team, but the project certainly holds a promising future in the evolving world of blockchain and decentralized finance (DeFi).

good luck

#MANTA/USDT Ready to go higher#MANTA

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.833

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.867

First target 0.935

Second target 0.978

Third target 1.03

MANTAUSDT Approaching Descending Channel ResistanceMANTAUSDT Technical analsysis update

MANTA has been trading within a descending channel for the past 150 days. The price now moves toward the channel's resistance, signaling a potential breakout. Currently, the daily chart shows that the price is trading above 100 EMA. Once a breakout occurs, a strong bullish move can be expected.

Buy zone : Below $0.88

Stop loss : $0.715

Regards

Hexa

MANTA 400% Gain IncomingOMXHEX:MANTA - Technical Analysis Request

Three distributions shown. The current range is likely an accumulation before a breakout.

The value are lows shown of the previous ranges will be the most important resistance zones.

From current price 400% possibility to ATH #MantaNetwork

Lows of the range has been swept. Next challenge is to break the trendline and continue upwards.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

#MANTA/USDT#MANTA

The price is moving within a bullish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 0.300

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum, upon which the price depends

Entry price is 0.3300

The first target is 0.3752

The second target is 0.4050

The third target is 0.4400

MANTA target $1.44h time frame

-

Entry: $1.4

TP: $0.7

SL: $0.545

RR: 4.52

-

(1) Double bottom is creating, and just go break the descending wedge

(2) Best time to complete this bottom structure is in the end of November

(3) Fib extension provides different targets for you to take partial profit

(4) Stop loss once going below $0.545

#MANTA/USDT Trade Setup, 600% Spot Long potential!Manta Breakout Alert!

Manta is trading at a long-term resistance of $0.72, and I’m anticipating a breakout.

While there’s a slim chance of a retest around $0.60 in the coming days, once we see a confirmed breakout and a successful retest, the potential upside could take us to $4.

Trade Setup:

• Entry Range: $0.576 - $0.725

• Targets: $1.04, $1.518, $2.267, and $4.05

• Stop Loss: $0.48

• Risk-Reward Ratio: A highly attractive 1:36

I plan to make $100k with a margin of $10k at 5x leverage on this trade!

I am already positioned and will keep you updated on this.

Let me know your thoughts in the comments! If you find this analysis valuable, hit that like button.

For more setups like this, follow me and share this setup with your friends.

Thank you, and peace!

#MANTA , $MANTA , MANTAUSDT, MANTAUSD#MANTA ...... is in a very nice entry point and near stop loss to get high profit

#MANTA

OMXHEX:MANTA

#MANTAUSDT

#MANTAUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

#bitcoin

#BTC

#BTCUSDT

BINANCE:MANTAUSDT

Manta the best zones to buy againBINANCE:MANTAUSDT

This is not an necessarily the Manta will hit this targets, but based on IAP model what I've shared before this is the levels for accumulation again

You can accumulate on any level based on your strategy, I just shared my plan

Possible Targets and explanation idea

➡️IAP model, after initiation we got move over -0.618 lvl on D tf

➡️5 Feb we come back to 27 block and 22 feb perfectly reject at -0.618lvl again

➡️Zones to buy is blue zone Ok to buy zone

➡️Green zone the best zone but I dont think so Manta will drop so low

➡️My Money Power custom indicator showed money outflow on D timeframe

➡️ Build your own plan for any single coin and follow your plan

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Trade Idea for Manta Network (MANTA) - Accumulation StrategyManta Network (MANTA) is currently trading around $2.00, making it a notable player in the privacy-focused blockchain space. Manta Network aims to provide privacy-preserving transactions using zk-SNARKs technology, ensuring users' data security and confidentiality on the blockchain.

Start building a position at the current market price of around $1.70. This level offers a strategic entry point considering the project's potential and current market valuation.

Plan to accumulate more MANTA tokens if the price drops to $1.60 and further to $1.40. This approach allows for averaging down the entry price and maximizing exposure during market dips.

Set take-profit targets at $2.70, $3.45, and $3.90. These targets are chosen based on anticipated resistance levels and historical price movements, aiming to capture significant upside potential.

Manta Network is focused on enhancing privacy for DeFi users by integrating advanced cryptographic techniques. Its unique approach to privacy in the decentralized finance sector positions it as a critical player as privacy concerns continue to rise in the blockchain space.

The broader cryptocurrency market trends and increasing interest in privacy solutions can drive demand for MANTA tokens. Monitoring developments and partnerships within the Manta Network ecosystem will be essential to adjust the investment strategy accordingly.

Accumulating MANTA at strategic price points leverages market volatility and the project’s promising fundamentals in the privacy space. The phased profit-taking strategy aims to optimize returns while balancing risk.

This trade idea is based on the current market data and Manta Network’s strategic positioning as of May 2024. Cryptocurrency investments carry inherent risks, including the loss of principal. Investors should conduct their own research and consider their financial circumstances and risk appetite before engaging in cryptocurrency trading. This analysis is not financial advice.

When to buy MANTA safely ?The Manta price is now being openly "pumped up" by MM, so only MM knows where the maximum price will be.

The maximum MANTAUSDT price could have already been, or perhaps it will be, for example, at $4.70

Personally, we don't trade on manipulative growth - we'd rather wait patiently for a deep correction, which will come sooner or later.

For example, $1.50-1.70 for MANTA is a fair and reasonable price to buy, or not?)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

MANTA target $30+12h time frame

-

MANTA had made a big box, ranging from $4 to $2, and took around 84 days. The quick dip from $2.5 to $1.5 help us confirm the time span it needs at least to build an accumulation zone, that will be similar to the left structure, which is 84 days. It means we will only see MANTA performs prior others since July if it makes a standard accumulation structure.

Next, the target is very easy to estimate when you know how to refer to mc in bull market. Current mc of MANTA is around $445 million, and the total supply is $1 billion, the reasonable mc that MANTA, as a key of layer 2 sector, could reach is definitely over $30 billion, which would bring MANTA up to $30 or even higher if layer 2 got attention in future.

-

Bull target: $30+