#MANTA/USDT – Bullish Setup Alert ?#MANTA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.186.

Entry price: 0.196

First target: 0.205

Second target: 0.214

Third target: 0.225

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

MANTAUSDT

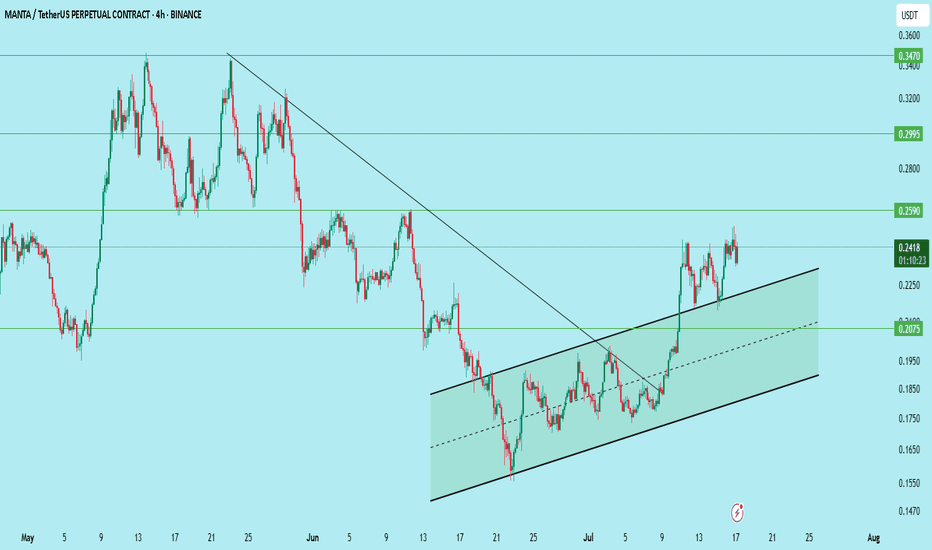

MANTA/USDT – Bullish Setup AlertMANTA has broken out of its long-term downtrend and is now trading within a clear rising parallel channel on the 4H chart.

Structure:

Downtrend broken

Higher highs and higher lows forming

Price respecting channel boundaries

Setup:

Entry: 0.225 (wait for retest)

Stop Loss: 0.2075

Target 1: 0.259

Target 2: 0.2995

Target 3: 0.347

Support: 0.225 / 0.2075

Resistance: 0.259 / 0.2995

Wait for the retest before entering. Risk-reward is attractive if the structure holds.

DYOR. Not financial advice.

MANTAUSDT Forming Descending ChannelMANTAUSDT is shaping up to be one of the more intriguing setups in the market right now, showing a well-defined descending channel pattern. This technical formation often signals a healthy consolidation phase within a broader trend, creating a launchpad for an eventual breakout. With trading volume remaining good and steady, there is a strong foundation for a significant move that could yield an 80% to 90% gain once the channel’s resistance is convincingly broken.

The MANTA project itself is increasingly attracting investor interest, thanks to its innovative approach to DeFi and cross-chain privacy solutions. As the crypto sector continues to look for new ways to scale and protect user data, MANTA stands out as a project that combines real-world use cases with strong tokenomics. This growing community interest can add momentum to the pair’s technical breakout, potentially driving the price rapidly towards its expected targets.

From a technical perspective, the descending channel acts like a coiled spring. When prices repeatedly test the lower support and upper resistance of the channel, traders watch for a breakout confirmation, which can lead to a sharp trend reversal. The combination of this reliable pattern with increasing investor confidence makes MANTAUSDT a pair worth watching closely for bullish signals in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MANTA Holding Rising Support — Eyes on BreakoutMANTA is once again respecting the rising support line and showing early signs of holding the structure.

Price action remains constructive — despite recent volatility, buyers are still defending the trendline well. As long as this rising support continues to hold, the setup remains bullish.

The next key area to watch is the resistance zone above. A breakout through that level could open the door for a much larger move, as visualised in the projected path.

For now, MANTA is in a healthy consolidation phase along the trendline. If momentum builds from here, it could trigger the next leg higher.

#MANTA/USDT#MANTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.290.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.305

First target: 0.329

Second target: 0.348

Third target: 0.373

Manta Classic Bullish Signals = Bull Market Confirmed—PP: 1900%This analysis can be used not only to spot the trading opportunity that is now MANTAUSDT, but also for learning purposes. Let's go back to basics.

Here MANTAUSDT is breaking daily above EMA55. This break is happening with a full green candle and yesterday's candle also closed full green. Today's full green candle has above-average trading volume and is coming after several short-term higher lows. So this is a constellation of signals. One signal, the break of resistance, supported by many additional signals (volume, candles and chart pattern).

The classic signal is the break above EMA55 on the daily timeframe. This confirms a bullish potential for the mid-term, minimum, which means 3 months.

The next signal comes from the RSI, it is super strong. A hyper bullish RSI while a project is trading at bottom prices is another classic bullish strong reversal signal. It is present here.

These together, with marketwide action, what the rest of the market is doing, is more than enough for me to say: Manta is going up.

Thank you for reading.

Namaste.

Manta Network Bottom Situation—Trading Tips & Tricks (575% Rise)We have a situation here where the market bottom has been confirmed.

Notice that MANTAUSDT is trading above its 11-March low but below its 3-Feb. low. The pairs that are trading above the 3-Feb. low are stronger from a TA perspective and from a trading perspective and likely a fundamental perspective as well, compared to those trading below.

They are stronger first because the recovery is strong and second because the crash was smaller. In both cases, the rise and the drop, the market showed more support and action on these. This is something to keep in mind when choosing your pairs.

Stronger pairs tend to produce better results.

When retraces and corrections happen, they tend to happen all across. So those stronger will continue to outperform and you better choose those when choosing you Altcoins, with some exceptions of course.

There are thousands of Altcoins and it is hard to choose.

For me, I chose on 7-April when the bottom hit, so all are green, but the world (and trading) doesn't end there. The truth is that bottom prices are great but available only for the short-term.

You can use moving averages as well to know which pairs are better than another and which ones are more likely to move next. The ones trading above the longer EMAs are the ones that are stronger.

Just a few tips and tricks to improve your chances of success.

Thank you for reading.

Namaste.

MANTA Breakout Trade Setup – Long OpportunityMANTA has broken out of a clean ascending triangle formation, confirming bullish strength. The breakout happened just above a key horizontal resistance and the 50 EMA, flipping both into support.

The chart shows a strong impulse candle on breakout, with a well-placed stop below the ascending trendline and a healthy 4.5R risk-reward to the upside. RSI sits near neutral (50.86), suggesting there's still room for price expansion.

DYOR, NFA

MANTA/USDT: Breakout Alert: 60-70% Upside Incoming!🚀 Hey Traders! MANTA Breakout Incoming! 👋

If this setup gets you hyped, smash that 👍 and hit Follow for high-quality trade setups that deliver real results! 💹🔥

MANTA is looking bullish and ready to explode! 📈 It’s breaking out of a falling wedge on the 4-hour timeframe, signaling a potential 60-70% upside move. Now’s the time to long and add on dips!

🔹 Entry Range: CMP – Add more up to $0.63

🎯 Targets:

✅ Target 1: $0.76

✅ Target 2: $0.85

✅ Target 3: $0.94

✅ Target 4: $1.10

🛡 Stop Loss (SL): $0.59

⚙️ Leverage: Use low leverage (Max 5x)

💬 Your Thoughts?

Are you bullish on MANTA’s breakout? Drop your analysis, predictions, or strategies in the comments! Let’s ride this wave and lock in those gains together! 💰🔥

Manta zones for accumulationManta IAP model with accumulation zones BINANCE:MANTAUSDT

Possible Targets and explanation idea

➡️IAP model zones for accumulation marked on a screen

➡️From signal confirmation to sell on TradeOn indicator -62% short profit

➡️Appeared signal take profit and close short position

➡️On daily we saw local signal to buy and small bounce.

➡️Step by step you can accumulate now or wait main zones for accumulation with DCA

➡️2 main money inflow periods with money power indicator. whales accumulate

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

MANTA/USDT CHART UPDATE !! MANTA/USDT daily chart highlights a promising long-term trade setup with a strong bullish potential.

The chart shows an upward-sloping trendline that has been respected since the token’s inception. It serves as a crucial support level around $0.75–$0.80.

The price is consolidating near the trendline support, creating a low-risk entry zone for long positions.

A rapid bounce off this zone could signal the start of a strong upward move.

The chart indicates a large, bullish arrow towards $4.00, suggesting a potential 4x move upon exiting this accumulation phase.

The main resistance zones are near $1.50 and $2.50 before reaching the $4.00 target.

Risk Management:

If the price breaks below the trendline, it will invalidate the bullish setup, indicating caution.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Can Manta Network Become the Best Layer 2 (investing chart... )hello dear trader...

Can Manta Network Become the Best Layer 2 Solution?

Given the unique features of Manta Network, including its integration with the Polkadot ecosystem, focus on privacy, strong Binance backing, and commitment to decentralization, the project has substantial potential to become one of the top Layer 2 solutions in the blockchain space.

If the development team can overcome technical challenges, address competition, and achieve widespread adoption, Manta Network could emerge as a leading privacy-focused Layer 2 protocol.

Ultimately, the future of Manta Network depends on market developments, user adoption, and the performance of the development team, but the project certainly holds a promising future in the evolving world of blockchain and decentralized finance (DeFi).

good luck

#MANTA/USDT Ready to go higher#MANTA

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.833

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.867

First target 0.935

Second target 0.978

Third target 1.03

MANTA 1D. Accumulation Ends. 12/02/24Previously, the price spent considerable time in an accumulation phase. After finding a bottom at $0.583, an upward trend began to form.

Currently, the price is testing a resistance level, attempting to break through and consolidate, which could indicate a continuation of the uptrend. Although unsuccessful so far, it seems to be only a matter of time. In the short term, a slight pullback is expected, followed by, in my opinion, continued growth.

Entry Plan (EP): $1.05 - $0.95

Take Profit (TP):

$1.535

$1.869

$2.222

Stop Loss (SL): $0.747

For spot positions: no stop-loss recommended.

DYOR.

Will MANTAUSDT Break Out or Break Down? Critical Moment ApproachYello, Paradisers! 🚨 Are you ready for the next potential breakout, or are you about to miss a crucial move? Let’s dive into MANTAUSDT and see what the charts are telling us!

💎MANTAUSDT has bounced off a key support zone and has shown a Change of Character (CHoCH) towards a bullish market structure. Additionally, a bullish divergence has formed, further increasing the chances of an upward move.

💎While the probability of a rise looks high, caution is essential as the price approaches the resistance trendline. If the price breaks through this resistance with strong candles, it will signal bullish strength.

💎Should the price break out and close a candle above the resistance zone, we could see the formation of a W-pattern structure, significantly boosting the likelihood of a bullish move.

💎However, if the price breaks down and closes below the support zone, our bullish outlook will be invalidated. In that scenario, it’s wiser to wait for better price action before making any moves.

Strive for consistency, not quick profits. Stay patient, disciplined, and keep those emotions in check, Paradisers!

MyCryptoParadise

iFeel the success🌴

MANTAUSDT Approaching Descending Channel ResistanceMANTAUSDT Technical analsysis update

MANTA has been trading within a descending channel for the past 150 days. The price now moves toward the channel's resistance, signaling a potential breakout. Currently, the daily chart shows that the price is trading above 100 EMA. Once a breakout occurs, a strong bullish move can be expected.

Buy zone : Below $0.88

Stop loss : $0.715

Regards

Hexa

#MANTA/USDT#MANTA

The price is moving within a bullish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 0.300

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum, upon which the price depends

Entry price is 0.3300

The first target is 0.3752

The second target is 0.4050

The third target is 0.4400

MANTAUSDT on the Verge: Will Key Support Hold or Break?Yello, Paradisers! Are you ready for a potential breakout that could shake up the market? Let’s dive into what’s unfolding with #MANTAUSDT and how it could impact your next trading move.

💎Currently, #MANTAUSDT is tracking a descending channel pattern, positioning itself near a potential breakout zone that could fuel a strong upward surge. Right now, #MANTA is testing a critical support level at $0.698. If the price holds this momentum, there’s a high probability we’ll see a bullish push, potentially breaking above the descending resistance.

💎But what if momentum falters? If #MANTA loses strength at the key support of **$0.698** and drops below, this would signal weakening bullish power, opening up room for sellers to step in. In this scenario, keep an eye on the lower demand zone at $0.614 a level that has historically held strong for buyers. A rebound from here could sustain the bullish outlook, but if #MANTA falls below $0.614, it could invalidate this setup and lead to a deeper decline, marking a potential shift toward bearish sentiment.

Stay sharp, stay strategic, and always keep the bigger picture in mind.

MyCryptoParadise

iFeel the success🌴