Marijuana

LONG CGCExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

TNY Update. RSI is low on a 1 year chart.This is the same chart as my previous, just zoomed out on a 1 year time frame to give a better Macro picture.

What appeared to be a descending triangle on a smaller time frame in the chart linked to this post, still visible on the 1 year chart as well, was exactly that.

Now it appears TNY is getting ready to break through this "potential" Ascending Triangle & create a new higher low! Some news would help, and these are "some" of the "potential" news releases to be expected in the upcoming days, weeks or months ahead.

-LB Licensing

-Nevada Partnership

-Phase 2 equipment moving to Nevada

-Co-packing Clients (2 done, 6 in negotiation, and likely more coming)

-Expansion of LB with new bottling lines because of too many co-packing clients

-Canadian LP partners

Time will tell per usual.

Time for an Aleafia bounce?Aleafia looks like it is ready for a bounce at the very least.

The RSI is also forming an ascending triangle.

Easy risk to reward on this one. Either it breaks out from a $1 entry with a target around $1.50 or it breaks down from the $1 level, invalidating this trade idea.

Should you buy this marijuana stock - MDCL?There has been a lot of news about Medicine Man Technologies acquiring more market share of the cannabis or marijuana sector in Colorado that has pushed this stock from $1 to $4 in 2019, but is it just hype?

Richard Chiang's name added to $XHUA Officer's section on OTCM8K Filed in May 2019 after the Custodianship was granted to Chiang shows the company will be an Emerging Growth company suggesting another possible Chiang R/M coming in:

www.otcmarkets.com

For more DD please read the following iHub post:

investorshub.advfn.com

Aurora Cannabis. (ACB) Time to Start Buying?! Hey guys. So I have always been a fan of marijuana stocks and who can love trading the devils lettuce, but not trade ACB!?

Over the summer we had a big sell off in the sector, but that was expected after the run we had that winter. The market is starting to catch some support and we are seeing more consistent green days for the green good. At this point in time you could do one of two things... you could wait it out, or what I personally do for longer term investments.. Start accumulating. We could bleed a little more, but to be honest... I dont see it falling much more. Another option for people who prefer less risk exposure could be to wait for earnings. Earnings is only a few weeks away and should provide a significant outlook for Auroras future.

TNY updare.So, since the last time I posted a chart on TNY we were trading in descending triangle that broke to the downside on a "short term time frame." I had mentioned that the pattern could also be a bull flag , but that was not the case.

It is interesting however to see Tinley get back up to the 56c level where there seems to be historic support dating back to Aug 2018.

I can speculate all I want about where the share price may be in the future, but only time will tell per usual.

$CLSI R/M Candidate Shell Has Been Sold and Is Off the MarketBased on research it has been discovered that the old CEO of Clancy sold all his remaining shares and took the company private handing the $CLSI shell over to a broker who had 100% control, the broker has confirmed the shell has been sold and is currently off the market. Which means a check has been cut and one of the two $50 Mil rev companies mentioned in previous DD or possibly another large company will be reverse merging into it. The first filing that will reveal this will be an 8-K which is anticipated to drop within the next 2 weeks.

I believe the price will gradually go up into the 8-K drop and the day of will substantially go up, my own personal estimate is about 500% from now until the day after the 8-K drop, 300% of that will most likely be the day of the 8-K drop.

After that there will be other filings and PR's to look forward to as the company merges in and it is revealed the true value $CLSI will hold in the long run.

$DCGD was the last company to undergo this process and advanced about 50,000% from start to the all time high recently.

AGRA AGFAF AgraFlora OrganicsThe chart speaks for itself

Reversal soon

-bullish divergence

-trading in fractals identical to previous price

Is a bottom near for Canopy Growth Corp?Did Canopy create a double top, or is the stock going to create a Macro higher low & stick in a bottom tmrw or sometime right away next week?? If Canopy doesn't take control of the market tmrw with some big news to offset the market sentiment than don't look down, in my humble opinion which is only worth a grain of sea salt from...….

Time will tell per usual.

$CLSI 2 Psbly 3 Candidates for R/M Filings to Hit Anyday PT $1$CLSI DD Compilation So Far

Company handling the selling of the shell was found out to be Green Rush which is owned by High times Magazine, the person indicated there were two possible bidders for the company both of which do $50,000,000 in revenues, but wouldn't say who they were. Very astute shareholders DD'ed and came up with two Colorado CBD companies Mile High Labs and Ecogen. So far this is as far as we've DD'ed, will continue to DD and update as the process continues.

i.redd.it

i.redd.it

i.redd.it

i.redd.it

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

pbs.twimg.com

VIDA heading back past 50 cents and then ?Watch for a break out here next week. I think we could see a break up past 40 cents soon and into that 50 cent range. After that we could really start to move back up. VIDA has recently done some good partnerships that will help on the fundamental side.

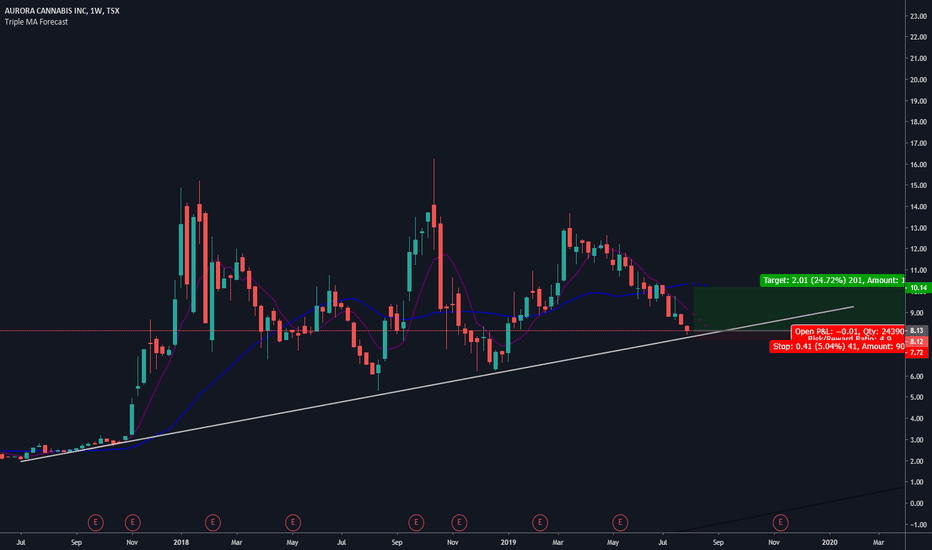

ACB Trendline Bounce TradeACB appears to be in a good buy spot here- This stock along with many of the marijuana names have been beaten up in the last few weeks/months.

The price is on/near the diagonal bullish trendline it has respected for a long period. Although it is not the strongest of trendlines with only 3 real bounces. I do think the risk meets tbe reward here.

Im looking at a trade just under 5:1.

Close any weekly candle close below the trendline. Take profit at the moving average. If it breaks the moving average in a strong way I will update my price targets.

Happy Trading :)

Can Tilray Get Back to over $100?Looking at Tilray with the MACD and Megalodon indicators, we can see a buy signal on the daily for Tilray. Something that we've seen only twice before, both times being the start of significant rise. The Daily MACD doesn't have as much room to turn as did previous signals, however it does look a lot sturdier and supportive. As of right now though, we cannot chase this stock. Looking at the shorter time frame we can see a strong sell signal from the Megalodon. So while I am feeling confident about Tilray in the long term, we must wait for a short term correction to find our buying opportunity.

The Megalodon indicator uses a machine learning algorithm, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes! You will also receive real time buy and sell signals for the stock market, cryptocurrency, as well as forex markets! We also busy completed our cryptocurrency automated trade bot. It trades for you, using our backtested indicator with phenomenal results! So try it today!!!

ACB July 30th 2019

Just my prediction on ACB.

Looks like it's going up. Could keep climbing until around the time of the earnings report.

Earnings report on September 9/23.

Will Vida Launch? A slightly premature judgment.I may be jumping the gun here on the daily chart but Vida did have a bottoming out and I believe we could be running back up again.