CGC Stock Price Analysis: Chart Annotation for Traders.Conclusion of today’s CGC (Canopy Growth Corporation) analysis: Price closing below ~35.45 or 24.78 implies lower prices in Canopy stock price.

The purpose of today’s CGC stock analysis is to inspect the different chart patterns that can be identified in CGC (Canopy Growth Corporation) and their implication(s). Use of a logarithmic scale of the Daily timeframe reveals two (2) chart patterns which will be further discussed below.

A rising wedge (diagonal) in CGC is established by drawing a line across price peaks and also price lows with the most recent pivot used occurring between December 21, 2018 and January 2, 2019.

The ideal implication of the pattern is bearish, therefore indicating lower prices ahead. The second pattern up for consideration is the descending triangle chart pattern, which is also ideally bearish. The top boundary is established using price highs in October of 2018, February of 2019, and March 2019.

The lower boundary of the pattern is the horizontal line price level at 24.78.

It is important to note that the aforementioned price level also is the upper boundary of immediate support region anticipated in Canopy stock price upon a breakout below its wedge and 19.53 represents the lower support boundary.

A close below ~35.45 will confirm the wedge, whereas a close below 24.78 confirms the descending triangle.

The ideal scenario for both patterns as mentioned above is bearish, but that does not happen all the time. A great tip for using chart patterns is to carry out momentum studies, which can be highly invaluable in helping to guide trading decisions using chart patterns

Marijuanastocks

Resistance & Support. Ascending Triangle Breakout?The news release from Tinley today was enough to test the resistance level at roughly 85c to 86c, which is the top of an Ascending Triangle!

It would be nice to see Tinley break through this resistance flush tmrw, Friday, or possibly next week & consolidate above the Ascending Triangle.

There's not much resistance until 1.13$ CAD if Tinley can breakout of this Ascending Triangle with volume.

We could be in for a Moon Shot everyone. Tinley appears ready to knock some public MJ Companies looking to enter the "infused beverage space" off of their High Horse!

Tilray Falling Wedge breakout soonAlthough having been bearish on TLRY most of the time, i today, stumpled upon this chart again and saw the falling wedge without even drawing anything.

Eventually we'll get a move down that closes within the lower blue line or something but generally this is very positive for the shorter term.

looking at 95-105$ range.

ps: yes, im charting this like a shitcoin

NBEV: Classic Abcd Bull pattern Weekly ABCD bull pattern

NBEV deal with Walmart news could help drive this bull pattern

ACBACB bull play

-inverted head and shoulders pattern

-need to see resistance at the neckline break up through 9.43 & 9.50

BAMM - Great Momentum, Flagging before next Push CSE:BAMM OTC:BMMJ Body and Mind closed friday with a doji candle, possibly signalling a short pause before advancing. We have kept daily higher lows intact since March 19th, consolidating on the hourly as we advance. The weekly chart looks very strong with increasing price, increasing volume, big green bars closing at or close to the high. However I would expect to see a bit of a weekly flag before pushing into the $1.00 range. Meaning we could see this first week of April, trade sideways in the 90c to 98c range before we push higher. This would be completely healthy and will be a good chance to accumulate below a dollar before we push higher.

On Thursday we had a bullish cross of the 50day SMA over the 100day SMA and have two very strong up-trend lines that we can play off of in the coming days. The RSI is a little heated right now being that we have been over 70 for the last 6 trading days, thought for reference VFF (Village Farms) spent almost 2 complete months over 70 and only half of that period was in "blue sky breakout" so this indicator is not to be solely relied on.

We have been hugging the top of the bollinger band for two weeks (11 trading days) now, so a bit of sideways action will help cool this indicator off as well. Volume has peaked a couple times but is sustaining above 350k which is double the 50 day average volume.

Resistance

98c and $1.00 will be our next two resistances, based off the Level 2 (market depth) data there have been some sell blocks posted there for a couple weeks now, should not be a big concern given the momentum but id expect a pause around there to chew through them. after that there is not to much up to $1.11 and $1.20 which is our 52 week high

Support

91c and 92c are our last two daily higher lows, holding those as we go sideways will be strong. 85c is our critical support to hold now on any daily consolidation that could potentially take place

This stock has plenty of strength and can see it moving higher before any medium term consolidation takes place. Volume has peaked a couple times but is sustaining above 350k which is double the 50 day average volume.

APHAHigh of yesterdays bounce need to break for bears to gain control

-look for daily lower high compared to 9.83 if hourly breaks bullish over 9.35

-further downside if hourly breaks bearish under 9.15 during regular hours, next support on the daily at 8.08

CGCMonthly equilibrium setup

-41.68 next level of support on the daily

-if 41.68 breaks no weekly support established, look for monthly higher low

CGCTightening hourly range

-hourly support: 43.66, 43.35

-hourly resistance: 44.85, 45.35

-if hourly breaks bullish, look for a daily lower high compared to 48.60

-if hourly breaks bearish, next support at 42.91 then 41.68

Cheech n Chong says Sym TriangleDrawn out a few outcomes on this chart sym triangles can break either way its at the top of a run so it looks bullish to me but it also is coming up on the resistance marker of the previous run in October and has yet to make a higher high from that run.... so TECHNICALLY is bearish. either way heres a few trend lines and support/resistance markers for you all.

Green is Bearish target with an extended target to the bottom the trend line...

Red is Bullish target of the triangle which breaks the trend of the LOCAL high and could retest the large upper trend line at a later date.

Best of luck traders hope this helps some of you :) Comment, Like, and discuss can only get better if you all challenge my thoughts/ideas.

CGC with a massive indecision on the weekly.When this thing breaks, I would expect a massive move either way. What's it going to be heading towards summer ? Is Canopy primed for another leg up after this gigantic bull flag ? Or is it going back down ......what do you think ?

CGC closed above 1o emaCGC has

CGC has been dormant. it finally closed above 10 ema on the 4H.

Let's see if it finds support there

Is WAYL ever gonna break out of this falling wedge ?It seems that from the time it reached ATH, it's been in a giant falling wedge. Even clearer on the monthly:

Is this stock going to continue falling ? Or is this a good buy opportunity ?

From what I know of this company, it's had it's fair share (pun intended) of drama. Insider selling, lawsuits threats, twitter arguments between the CEO Ben Ward and Equity Guru.

(highenergytrading.com)

Honestly I have not followed the stock much since it switched from Maricann to Wayland Group. I still hold a small position though, and I sold and bought from time to time without paying much attention to the longer timeframe charts.

What I do know, is that the weekly chart just bounced on 0,87$, creating a double bottom and a good place to put a stop loss. The 1$ price level will probably offer resistance and right now the stock seems to be hesitating as to which way it'll go. This seems to be in line with the Cannabis Sector, which has been in an EQ for the past few weeks. For those who hold the bag (like me), there might be a good opportunity to average down if 0,87$ continue acting as support. But what I really what to see, is a weekly close above the falling wedge, and increasing volume that might signal a trend change and give back confidence to investors.

Will Aurora Cannabis Reach ATH soon ?The volume was quite impressive last week, smashing through the 8$ resistance and closing very strong above the pink trend line. What's interesting about this trend line is that you can extend it back 2 years when the price was under 1$ and it's been tested again and again, acting both as support and resistance. Next weeks we might see some follow through with resistance around the 10$, 11$ and 12$ levels, but more importantly the all time high is in sight. I don't know what's driving this surge for the past 2 weeks and I must admit I'm a bit skeptical. If for some reason there's a pullback that bounces on the pink trend line, it could be a good opportunity to make an entry. Other than that, I'll be careful as this stock and this sector can drop quickly, so this chart is more to help look for an area where buying could happen IF there's a sudden drop.

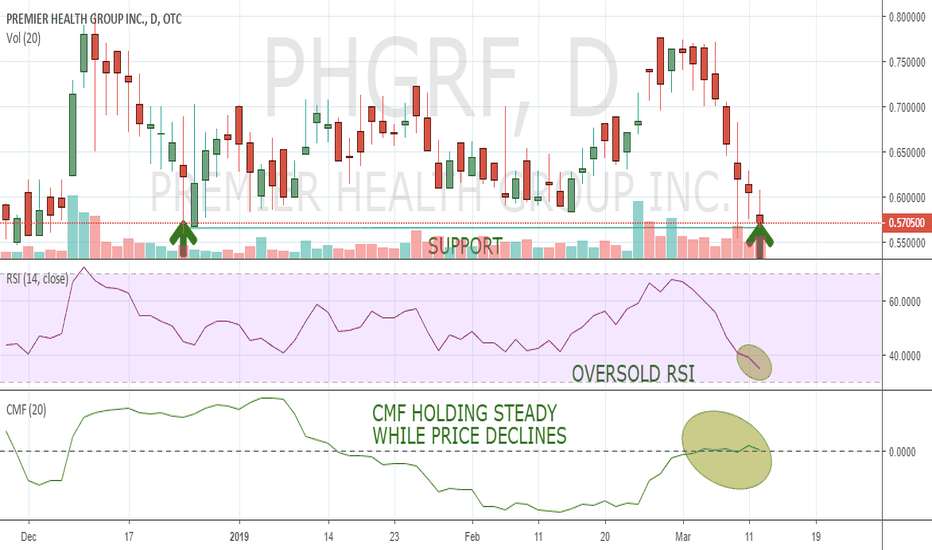

Possible Penny Stock Bounce Set Up(OTC:PHGRF) recently experienced a large sell off with the RSI moving into oversold territory. CMF has held steady during this price decline indicating that investors are not rushing for the exit during this pullback. As (OTC:PHGRF) reaches a support level in the mid .50s the RSI and CMF appear to be signaling a possible bounce from these oversold conditions.

CGC at a resistance and weekly looks like a bull flagGoing to setup a trade using April $47.5 calls stop-limit $4.25 (tweezer top at $4.20 on the options) with a $1 stop. Risking $100 per contract.

Upper targets low to mid $50 range. Only concern is that the gap from the last two days has no been filled, but let's see if the sellers jumping on at this resistance get squeezed up.

Cheers!