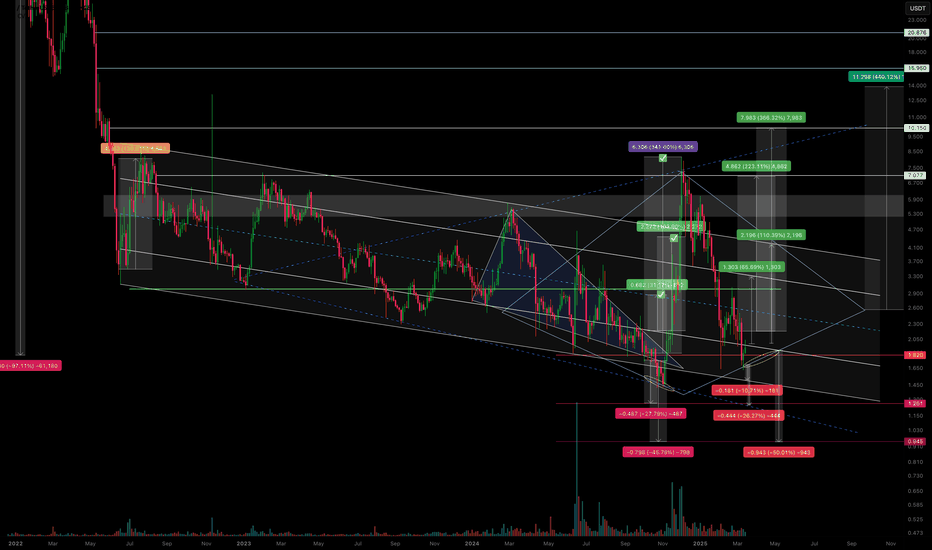

CVX/USDT – Is the scenario repeating? Continuing to work.The previous trading idea has played out with 3 out of 4 marked zones reached.

We saw a false breakout from the descending channel, followed by a pullback in line with the overall market—returning to the channel’s support zone.

I’ve noticed a potential formation of either a diamond pattern or an expanding triangle, but we’ll see how it plays out further.

Regarding declines and support zones:

-10.71% drop to the support of the descending channel.

-26.27% drop to the anticipated support of the expanding triangle.

-50% drop, likely as a squeeze under extremely negative news.

Regarding growth and resistance zones:

+65% rise to the resistance of the internal channel.

+110% rise to the resistance of the external channel (and if a diamond pattern forms, then its boundary).

+246% rise as a second attempt to break out of the descending channel.

+440% rise as a potential realization of diamond pattern pricing (if it forms).

All of this should be factored into your trading strategy, even the less likely scenarios.

I'll share the execution of the previous trading idea in my TG. I've also marked it on the chart.

Marketanalysis

Weekly Macro Brief: Chinese Economic Data, US Inflation, Tariff CME_MINI:ES1! CME_MINI:NQ1! COMEX:GC1! CME:BTC1! CME_MINI:RTY1! COMEX:SI1! CME_MINI:MNQ1! NYMEX:CL1! CME_MINI:M6E1! CBOT:ZN1! CME_MINI:MES1!

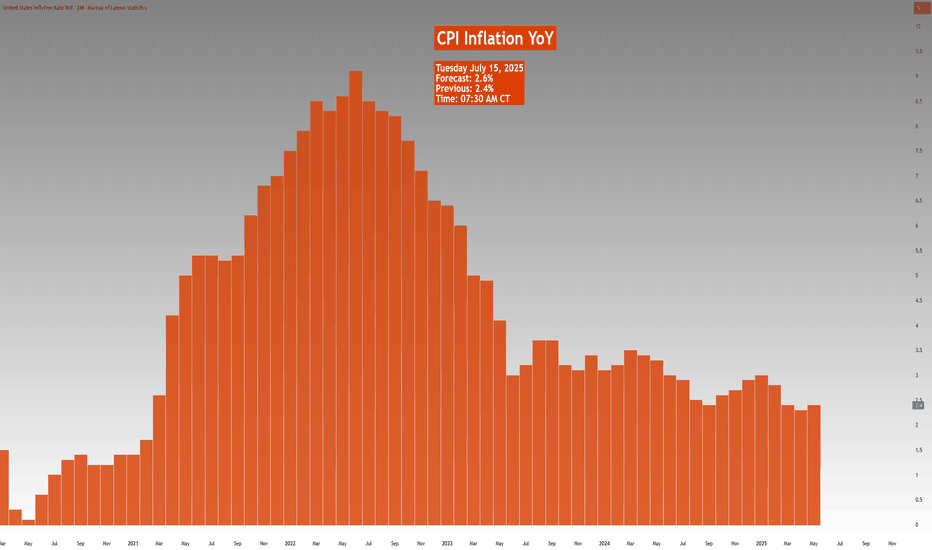

Highlights this week include Chinese economic data points, UK CPI, US CPI, PPI, and Retail Sales. Inflation data is key, as it comes ahead of the Fed's meeting on July 30th, 2025.

Market participants, including institutional investors and futures brokers like EdgeClear, will be scrutinizing these data points closely to monitor global growth and underlying inflation pressures.

Fed speakers are scheduled throughout the week. With increasing calls for Fed Chair Powell voluntary resignation and impeachment, the US administration desiring lower rates, the Fed’s independence and credibility to carry out its dual mandate is at risk. It will be interesting to monitor who folds first. Last week’s FOMC minutes revealed a divided Fed on the interest rate outlook, affirming its June dot plot.

On the fiscal policy front, we are already witnessing a shift in global trade policies, with many nations making concessions to negotiate trade deals with the world’s largest economy. In our analysis, the inflation impact of tariffs may not show up until Q4 2025 or early 2026, as tariff threats are mostly used as a lever to negotiate deals. While effective tariff rates have increased, as Trump reshapes how tariffs are viewed, cost pass-through to consumers will be limited in Q3 2025, as companies’ front-loaded inventory helps mitigate the risks of increased tariff exposure.

So, what we have is an interesting development shaping up where, while inflation may rise and remain sticky, it is yet to be seen whether slowing consumer spending will weaken enough to the point where companies have to start offering discounts, which would nullify the tariff risk to the end consumer and result in companies absorbing all tariffs. This scenario will see reduced earnings margins leading into the last quarter and early 2026. However, it will materially reduce risks of higher inflation.

In summary, the complex interplay between tariffs, inflation, and consumer behavior presents critical considerations for traders. EdgeClear, as a dedicated futures broker, remains focused on equipping clients with the insights needed to help navigate this evolving macroeconomic environment.

Overnight Data Recap:

• Chinese Trade Balance (CNY)(Jun) 826.0B (Prev. 743.6B)

• Chinese Trade Balance USD* (Jun) 114.77B vs. Exp. 109.0B (Prev. 103.22B)

• Chinese Imports YY* (Jun) 1.1% vs. Exp. 1.3% (Prev. -3.4%)

• Chinese Exports YY* (Jun) 5.8% vs. Exp. 5.0% (Prev. 4.8%)

Key Economic Releases:

• MON: EU 90-Day Retaliatory Pause Ends

• TUE: OPEC MOMR, Chinese House Prices (Jun), Retail Sales (Jun), GDP (Q2), EZ Industrial Production (May), German ZEW (Jun), US CPI (Jun), NY Fed Manufacturing (Jul), Canadian CPI (Jun)

• WED: UK CPI (Jun), EZ Trade (May), US PPI (Jun), Industrial Production (Jun)

• THU: Japanese Trade Balance (Jun), EZ Final HICP (Jun), US Export/Import Prices (Jun), Weekly Claims, Philadelphia Fed (Jul), Retail Sales (Jun)

• FRI: Japanese CPI (Jun), German Producer Prices (Jun), US Building Permits/Housing Starts (Jun), Uni. of Michigan Prelim. (Jul)

China GDP / Retail Sales/ Housing (TUE):

• Q2 GDP is expected to slow to 5.1% Y/Y (vs 5.4% in Q1) and 0.9% Q/Q.

• Retail sales have been resilient, but industrial production and investment show signs of weakness; deflation and labor market concerns persist.

• Property prices continue to decline, fueling stimulus speculation; policymakers remain cautious, with only modest easing expected (LPR and RRR cuts in Q4).

US CPI (TUE)

• June CPI expected at +0.3% M/M headline and core, suggesting a modest rebound from May’s subdued figures.

• Inflation impact from tariffs seen as temporary; Fed officials maintain a cautious stance with possible rate cuts only if price pressures stay benign.

• Markets are pricing near-zero odds for a July rate cut, but still expect two 25bps cuts by year-end in line with Fed guidance.

US Retail Sales (THU):

• Headline June retail sales expected flat M/M; ex-autos expected to rise +0.3%, showing signs of consumer stabilization.

• BofA data shows mild spending rebound, though discretionary service spending continues to weaken, especially among lower-income households.

• Spending strength remains concentrated in higher-income cohorts; weakness in wage growth limits broader consumption momentum.

US Trade Tensions – Tariffs & Negotiations:

• Trump announced 30% tariffs on EU and Mexican goods effective August 1st, separate from sector-specific tariffs.

• Trump stated the EU is engaging in talks and South Korea is also pursuing a trade deal.

Mexico Response:

• President Sheinbaum expects a deal before August 1st but reaffirmed Mexican sovereignty is non-negotiable.

• Mexico’s Economy Ministry is negotiating to protect domestic firms and workers, aiming for an alternative resolution.

EU Response:

• European Commission President von der Leyen warned that 30% tariffs would disrupt key transatlantic supply chains.

• The EU will extend suspension of countermeasures until early August but is prepared to respond proportionally if needed.

• The EU prefers a negotiated solution and dropped plans for a digital tax, seen as a concession to US tech interests.

• Separately, the EU is drafting a broad corporate tax on firms with turnover above EUR 50 million to support its budget.

Range Bound consolidation going on in the market. Range bound consolidation is going on in the market. As you can see in the chart there is consolidation going on before a substantial up or down move happens. Mostly it looks like Tariff negation deadline will be extended or India might end up getting the tariff deal sealed. all eyes on Trump and TCS results tomorrow. TCS has been reeling close to an year now after making a high of 4592 everything depends on the result tomorrow. The result can give direction to the market as TCS has good weightage (Around 6.09% in Nifty and 7.43% in BSE Sensex). TCS has 21.93% Weightage in Nifty IT index so the result tomorrow is a must watch. It can give direction to the It index as well.

Supports for Nifty remain at 25413 and 25243. If by chance this level is broken Nifty can fall further towards Mother line which is at 24862 or in worst case scenario towards Father line of daily chart at 24030.

Resistances for Nifty remain at: 25531 and 25710 Closing above which Nifty becomes very strong. After we get a closing above 25710 Nifty can swiftly move towards 25888 or even 26K+ levels.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Gold To The Basement? Week Ahead with Bearish Bias by PhoenixFX🌟 Welcome to Phoenix FX’s Intraday Pulse! 🌟

Hello, Phoenix FX family! 👋 I’m thrilled you’ve joined us for today’s TradingView chart breakdown. Our focus? Intraday opportunities—spotting those high-probability setups you can enter, manage, and leave to run whilst you concentrate on the things you love doing.

Here’s what you’ll find in this analysis:

Key Levels & Zones: Support, resistance, and Fair Value Gaps that matter on the smaller timeframes.

Price-Action Clues: Exact candlestick patterns and momentum signals to watch for your next entry.

Trade Triggers & Targets: Clear criteria for when to get in, where to take profits, and how to manage your risk.

Whether you’re hunting quick scalps or tactical swing moves, our goal is simple: help you trade with confidence, clarity, and community support. Got a different view or a fresh idea? Drop it in the comments—after all, “each one, teach one.” 😉

Let’s dive into the charts and make today’s market moves count! 🚀📈

Donald Trump’s presidency continues to exert outsized influence on gold through three main channels: trade policy uncertainty, fiscal stimulus (and resulting deficits), and shifts in safe-haven demand. Here’s how each factor has played out—and what it could mean for gold going forward:

1. Trade-War Uncertainty

What’s Happening: The Trump administration’s aggressive use of tariffs—including recent 25% duties on goods from Japan and South Korea—has periodically roiled markets and driven investors into gold as a safe haven. On July 7, gold pared losses after tariff news, as traders sought refuge despite a firm dollar.

Looking Ahead: If further tariff escalations or retaliations emerge, expect renewed spikes in gold. Conversely, any de-escalation or trade-deal breakthroughs could sap that safe-haven bid.

2. Fiscal Stimulus & Deficits

What’s Happening: Senate Republicans recently passed a Trump-backed tax‐and‐spending package projected to add $3.3 trillion to the U.S. deficit. Larger deficits—especially when financed by the Fed—tend to stoke inflation expectations, which bolsters gold’s appeal as an inflation hedge.

Looking Ahead: Continued large-scale stimulus or fresh tax cuts without offsetting revenue measures could keep real yields low (or negative), a classic tailwind for gold.

3. Safe-Haven Flows & Investor Positioning

What’s Happening: Despite peaking at record highs earlier this year, gold remains up roughly 30% since November, driven largely by investor fears around Trump’s policy unpredictability and geopolitical tensions.

Looking Ahead: Should Trump-era uncertainty persist—whether around trade, foreign policy, or domestic turmoil—gold is likely to retain its status as a portfolio diversifier and crisis hedge. A sustained drop in U.S. real rates or fresh bouts of market volatility would reinforce that trend.

🎯 Outlook Summary

Bullish Drivers: Ongoing trade-war rhetoric, larger deficits, and any new geopolitical flashpoints.

Bearish Risks: Clear resolution of major trade disputes, a pivot by the Fed toward earlier rate cuts (reducing real‐rate support for gold), or diminished investor fear.

------------------------------------------------------------------------------------------

PhoenixFX price action analysis based on the Daily time frame

🔴 Primary Resistance (Daily)

Zone: $3,348 – $3,400

Why It Matters:

Multiple daily closes have stalled here, leaving a clear Fair-Value Gap (dashed purple). Sellers are likely to defend this range until we see a decisive daily close above $3,400.

📉 Bearish Bias – Short Setups

Short at Resistance

Entry: Bearish daily reversal candle (engulfing, pin-bar) in $3,348–$3,400

Targets:

TP1: $3,290 (50% of Primary Buy Zone)

TP2: $3,250 (Primary Buy Zone low)

TP3: $3,172 (Secondary Buy Zone high)

Stop-Loss: Above $3,420

Breakdown Short

Trigger: Daily close below $3,250 (Primary Buy Zone low)

Entry: On the open of the next daily candle after close below $3,250

Targets:

TP1: $3,172 (Secondary Buy Zone)

TP2: $3,026 (Final Buy Zone 50% level)

Stop-Loss: Above $3,290

🔵 Potential Long Opportunities

Defensive Long (Aggressive)

Entry: Bullish daily rejection candle in $3,250–$3,290

Targets:

TP1: $3,348 (short-term resistance)

TP2: $3,400 (key resistance)

Stop-Loss: Below $3,230

Trend-Reversal Long (Ultra-Conservative)

Trigger: Daily close above $3,400

Entry: Open of the next daily candle after the close above $3,400

Targets:

TP1: $3,450

TP2: $3,500+

Stop-Loss: Below $3,360

📊 Week-Ahead Scenarios

Bearish Scenario (High Probability):

Price remains capped under $3,400.

Look for a bearish signal in $3,348–$3,400 to initiate shorts.

A break below $3,250 extends the move into deeper demand zones ($3,172 → $3,026).

Bullish Counter-Trend (Lower Probability):

Strong daily rejection candle in $3,250–$3,290 could spark a relief rally.

Short-term longs can target $3,348 and $3,400—ideal for quick swing trades.

Only a sustained daily close above $3,400 shifts the bias back to the upside.

Just a Heads-Up:

This is my take on the charts—not gospel, not financial advice, and definitely not a crystal ball 🔮.

Trading is part skill, part patience, and part “what just happened?” 😅

We all see things a little differently, and that’s the beauty of it. So if you’ve got a hot take, wild theory, or just want to drop some chart wisdom—hit the comments!

Let’s grow, learn, and laugh through the madness together. 🚀📈

Each one, teach one.

— Phoenix FX Team 🔥🦅

Bitccoin bullish momentum under resistance, key zone at $110k__________________________________________________________________________________

Technical Overview – Summary Points

➤ Momentum: Predominantly bullish on all higher timeframes, momentum slowdown observed on short-term (15min).

➤ Supports/Resistances:

Major resistance: 110,630 – 111,949 (repeated tests on Weekly/Daily pivot high)

Key supports: 107,761 – 106,000 (H4/H12 pivot), weaker pivot zones below 105,054 and 98,133

➤ Volume: Within normal ranges on daily/12H/6H, elevated but not extreme on 15min – potential short-term distribution signal.

➤ Behavioral: No buy/sell climax (ISPD DIV neutral), no panic, Risk On / Risk Off Indicator with strong buy signal up to 1H.

__________________________________________________________________________________

Strategic Summary

➤ Global bias: Mature bullish. Confirmed momentum across timeframes, but caution with short-term timing (frequent traps under resistance).

➤ Opportunities:

Tactical buying on pullback into 107,761–106,000 support zone with confirmed reversal signals (wicks, absorption, incoming volume)

Momentum buying on confirmed break above 110.6–112k, with active stop management below latest pivot

➤ Risk zones:

Invalidation below 105,054, then strong reversal under 98,133

Avoid trading low timeframes if abnormal volume ("liquidity grabs")

➤ Macro catalyst: Few high-impact events expected before FOMC end of July; overall global environment is risk-off but no immediate escalation.

➤ Action plan: “Trend Following” until invalidation, active stop management below key pivots, entries on pullback or clear breakout, flexibility for upside/faulty support.

__________________________________________________________________________________

Multi-Timeframe Analysis

: Strong bullish alignment (“Strong Up”/“Up”), technical support on major pivots 107,761–106,000.

30min : Micro-range compression, recent volume up but no excess – weak immediate opportunity (await breakout or retest of support/pivot zone).

15min : Very high volumes on micro-range, increasing micro-volatility – likely distribution/trap, observation only, no action unless 107.7k support breaks hard.

Risk On / Risk Off Indicator : Strong buy signal daily–1H, neutral on 15min; institutional confidence preserved as long as major range remains intact.

Synthetic summary : BTC market structurally healthy, tactical upside still valid – increased monitoring required for short-term volume flush or first distribution move on key support break.

__________________________________________________________________________________

Strategic bias summary

Mature bullish, low euphoria, institution-driven environment

Prioritize entries on validated support zones, or breakout with agile stop management

Short-term volatility to be handled with care (frequent traps on 5–15min)

__________________________________________________________________________________

Brent Crude Oil Long Swing Setup – Support Break at Key LevelBrent Crude Oil OANDA:BCOUSD has broken to the next key support level after a cease-fire announcement in the Middle East. A long position is considered only if support holds at $69.00.

📌 Trade Setup:

• Entry Zone: $69.00

• Take Profit Targets:

🥇 $73.50 – $76.00

🥈 $79.00 – $83.00

• Stop Loss: Daily close below $67.00

#BrentCrude #OilTrading #ForexTrading #LongPosition #SupportLevel #TradeSetup #CrudeOil #MarketAnalysis #TradingOpportunities #Commodities #OilMarket #Investing #PriceAction #OilPrices #TradingStrategy #ForexCommunity #InvestmentOpportunities #MarketUpdate

AERO Long Swing Setup – Strong Pullback into Fibonacci SupportAERO has shown notable strength in recent months and is now retracing into a key support zone, aligning with the 38.2% Fibonacci level. The $0.75–$0.80 area offers a solid long swing opportunity.

📌 Trade Setup:

• Entry Zone: $0.75 – $0.80

• Take Profit Targets:

o 🥇 $1.04 – $1.32

o 🥈 $1.60 – $2.05

• Stop Loss: Daily close below $0.70

GBPUSD Price Action Analysis | Sell Setup Below 1.36106In this GBPUSD market overview, we break down recent price action following yesterday’s strong bullish rally from the momentum low. The session was highly emotional across major forex pairs, which is typical when a major wave structure reaches its end. This often results from incomplete auctions on one side of the market, causing order flow imbalances that drive sharp price movements.

The key price level we're watching on GBPUSD is 1.36326. Price approached this zone with momentum, and the rejection at 1.36267 triggered a classic TCP (Trend Changing Pattern), followed by a single upside break, confirming exhaustion at the highs.

📉 Sell Setup:

According to the Waves of Success execution model, the best short entry is below 1.36106, in alignment with the prevailing bearish structure.

⚠️ Alternative Scenario:

We are not looking for long setups on GBPUSD at this time — our bias remains bearish unless significant structure changes occur.

This analysis combines wave structure, trend confirmation patterns, and institutional price levels for a professional, risk-managed approach.

🔑 Key Levels:

Resistance: 1.36326

Rejection High: 1.36267

Sell Trigger: 1.36106

ETH BUY BIASEthereum (ETH/USD) – Weekly Chart Summary

• Current Price: ~$2,250

• Trend: Bearish structure with lower highs and lower lows

• Key Zones:

• Support (Demand): $1,800–$2,000 and $1,400–$1,700

• Resistance: $2,800–$3,600 (liquidity zone)

• 200-Week MA: Acting as dynamic support near current levels

• Outlook: Potential drop into demand zones, followed by a strong bullish reversal targeting the $3,200–$3,600 region

• Risk: Failure to hold $1,800 could trigger deeper losses

📈 Bias: Wait for price to reach key demand zones before entering long positions.

EURUSD – Follow-Up UpdateEURUSD traded above the 1.1573 level on Thursday, marking a second break to the upside following the earlier trend-changing pattern — a potential sign of bullish continuation.

However, on the 1H/M15 chart, we've observed a minor ABC corrective decline (pullback). We’re now watching for a break below 1.1511, which could signal the start of a short-term bearish move.

🎯 Short-Term Target:

The next key level is 1.1214, a weekly structural support zone and the low of the previous trend-changing pattern.

📌 Key Zones to Watch:

Bearish confirmation: Break below 1.1511

Medium-term target: 1.1214

Stay alert to price action around these levels.

Trade safe, and have a blessed weekend.

Why? Because liquidity is building at this support zone.🚨 GBP/JPY Traders — Don’t Get Trapped! 🚨

GBP/JPY has just touched a major support level, and on the surface, it looks like a golden buying opportunity. But here’s the catch: this is exactly where most retail traders get trapped.

Why? Because liquidity is building at this support zone. Smart money knows retail traders have stop losses and pending orders sitting right below — and they’re coming for it. 🧠💰

Here’s what the market is likely to do next:

📈 Step 1: A small bullish bounce to lure retail traders in. Everyone starts thinking, “This is the reversal!”

🔄 Step 2: Boom — a sharp move down. Stop hunts. Fakeouts. Panic sells. The market dips below support, grabbing liquidity.

🚀 Step 3: Once liquidity is swept and BPR (Break Point Range) is hit, then the real move begins.

This is a classic setup — trap retail, feed institutional orders, and then drive the market in the true direction.

⚠️ Don’t fall for the bait. Stay patient. Let the trap spring before you strike.

📊 Watch structure. Watch liquidity. Watch price behavior. That’s where the edge is.

DYOR — Do Your Own Research. This isn’t financial advice — it’s a trader’s insight.

Trade smart. Trade sharp. 💼🔥

US & Global Market Breakdown | Profits, Losses & Bearish TradesIn this video, I break down the current state of the US and global economy, and why I believe we’re heading into a bearish phase.

📉 Fundamentals:

I cover the key macroeconomic factors influencing the markets — including Trump’s proposed new tariffs, slowing GDP growth, and ongoing supply chain constraints. These all point toward increasing pressure on the global economy.

📊 Technical Analysis:

I go over the major indexes and highlight their recent behavior. We’ve seen reactions from resistance levels, contraction patterns forming, and a significant volume dry-up — followed by today’s spike in volume, which occurred right at resistance. These are potential signs that the market may be shifting toward a bearish trend.

That said, we could still just be witnessing a deeper pullback within a longer-term uptrend. Markets are unpredictable, and no one knows for sure — which is why it’s important to always do your due diligence.

💰 I also review the profits and losses I’ve taken on recent bullish trades, and why I’ve now positioned myself in select short opportunities based on what I’m seeing.

If I’m sharing this, it’s because I’m personally investing my capital based on my conviction — so always use your own judgment and risk management when making decisions.

If you found value in the breakdown, leave a like, comment, and subscribe for more timely updates.

LINK Long Setup – Retrace to Key Support After Strong RallyLINK saw a strong rally from April to mid-May, and is now undergoing a healthy retracement. Price is approaching the $13.00–$13.50 support zone, offering a potential long spot entry as the market cools.

📌 Trade Setup:

• Entry Zone: $13.00 – $13.50

• Take Profit Targets:

o 🥇 $15.00 – $16.00

o 🥈 $17.00 – $18.00

• Stop Loss: Daily close below $12.00

AVAX Long Swing Setup – Retrace to Major Support in PlayAVAX is undergoing a healthy correction, setting up a potential swing opportunity as it approaches the $19.00–$20.00 support zone. This level has held as a key pivot in the past, and we’re now watching for bullish confirmation to enter long.

📌 Trade Setup:

• Entry Zone: $19.00 – $20.00

• Take Profit Targets:

o 🥇 $22.50 – $24.00

o 🥈 $27.00 – $29.00

• Stop Loss: Daily close below $17.80

RNDR (Render) – Higher Low Setup for Potential Upside ExpansionRENDER is holding strong above the $3.50–$4.00 support zone, forming what appears to be a higher low — a classic sign of potential trend continuation. This setup provides a favorable risk-to-reward ratio with clearly defined invalidation and upside targets.

📥 Entry Zone:

$3.50 – $4.00

🔸 Holding above demand

🔸 Prior resistance now acting as support

🔸 Potential higher low setup

🎯 Take Profit Targets:

🥇 $6.00 – Previous local top / liquidity pocket

🥈 $8.00 – Major resistance zone from prior cycle

🥉 $10.00 – Psychological round number + HTF extension target

🛑 Stop Loss:

Daily close below $2.50

Clears invalidation of the structure

Below HTF support base

"SOL Market Cap Breakdown Setup| Bearish Retest Targeting 83.3B"SOL Market Cap is showing signs of a potential breakdown after a series of lower highs and a bearish retest of previous support. Price is currently retesting the breakdown level. If confirmed, the next support zone is near 83.3B.

This is a technical analysis-based observation, not financial advice. Always manage risk and confirm with your own strategy before making any decisions.

XAU/USD 19-23 May 2025 Weekly AnalysisWeekly Analysis:

Swing Structure -> Bullish.

Internal Structure -> Bullish.

Analysis and bias remains the same as analysis dated 16 March 2025.

In my analysis dated 27 October 2024 I mentioned (below) that price could potentially print higher-highs in order to reposition CHoCH. This is exactly how price printed. CHoCH positioning has been brought significantly closer to current price action. CHoCH positioning is denoted with a shortened blue dotted horizontal line.

The remainder of my analysis and bias remains the same as analysis dated 09 February 2025.

Price has printed a further bullish iBOS.

Price is currently trading within an internal low and fractal high. CHoCH positioning is denoted with a blue dashed line.

Price Action Analysis:

In my analysis dated 27 October 2024, it was noted that the first sign of a pullback would be a bearish Change of Character (CHoCH), indicated by a blue dotted line. Price's consistent upward momentum had repositioned previous CHoCH much closer to recent price levels as expected for weeks. Current CHoCH positioning is quite a distance away from price, therefore, it would be viable if price continued bullish to reposition ChOCH.

Note:

It is highly unlikely price will "crash" as many analysts are predicting. My view is this is merely a corrective wave of the primary trend.

Given the Federal Reserve's dovish policy stance alongside heightened geopolitical risks, market volatility is likely to remain elevated, influencing intraday price swings.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty and potential repricing of Gold.

Weekly Chart:

Daily Analysis:

Swing -> Bullish.

Internal -> Bullish.

Analysis and Bias remains the same as Analysis dated 11 May 2025.

Since my last weekly analysis price has finally printed a bearish CHoCH.

This is the first indication, but not confirmation of bearish pullback phase initiation.

Price is now trading within an established internal range.

Price should now technically trade down to either discount of 50% internal EQ, or Daily demand zone before targeting weak internal high, priced at 3,500.200.

Note:

The Federal Reserve’s continued dovish stance, coupled with escalating geopolitical uncertainties, is expected to sustain elevated market volatility, influencing both intraday and broader trend developments.

Additionally, price action may be further shaped by U.S. policy decisions, including measures enacted under President Trump. Shifts in geopolitical strategy and economic policymaking could introduce further uncertainty, contributing to the ongoing repricing dynamics within the gold market.

Daily Chart:

H4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 23 April 2025

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

USDJPY: FVG Then Bullish Overflow?It has been a significant week for USD/JPY. Following a break of structure (BOS) on the 4-hour timeframe, price moved away from equilibrium, leaving behind a Fair Value Gap (FVG). As the new week begins, we may observe a false move designed to induce traders into premature short positions before a potential bullish reversal—or vice versa. Additionally, given the recent BOS, price may temporarily stall to facilitate order accumulation. Next week will be pivotal in determining the pair’s next direction.

Watch out for the key levels

XRPUSDT: Turning Bullish, Chart Signals +20% Upside PotentialHey Realistic Traders!

Is XRPUSDT Gearing Up for a Major Bull Run or Just Faking Us Out Again? Let’s Break It Down...

XRPUSDT has finally broken out of its bearish channel, and price action is holding strong above that zone. This is a solid indication that bulls are gaining control. Shortly after the breakout, a smaller falling wedge formed, which is typically a bullish continuation pattern.

What adds further interest to this setup is that the falling wedge appears to be developing during what may be Wave 4 of the Elliott Wave cycle. While Wave 4 is usually corrective, it can occasionally take the form of a wedge or triangle-like pattern. If this interpretation holds, it would suggest that a bullish Wave 5 may follow, often the final impulse leg in the trend.

Zooming into the 4-hour chart, a fresh breakout has just occurred, further strengthening the bullish case. Adding to this, the MACD has printed a golden cross, a classic momentum signal that supports the outlook for continued gains.

With all these factors aligning, the first target is set at 2.5454. A minor pullback could occur at that level before price continues its move toward the second target at 2.8535. Both targets have been calculated using Fibonacci extension levels from the current bullish wave.

This outlook remains valid as long as the price stays above the stop-loss level at 2.0355.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Ripple.