Tesla’s 32% Plunge: A Critical Analysis and What’s Ahead (READ)By reviewing the #Tesla stock chart on the weekly (logarithmic) timeframe, we can see that the price started a significant decline from the $270 level, just as we anticipated, dropping by over 32% down to $180. At the time of this analysis, no one expected such a steep decline in Tesla's stock, as most were predicting a rise above $300 or even $400. However, the price disregarded the majority’s opinion and followed its own course, resulting in this sharp drop. Currently, the price is around $216, and I expect an initial rise to $233. After that, we'll need to watch how the price reacts to this critical supply zone. This analysis will be updated accordingly.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

The Main Analysis :

((2+4+7+13+15+18+26+36+38+69+87+101+183+209+1000+1002+1000000000+1000000001+ 1000000853)^♾️*69) + 1 !

Marketcrash

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

What a day on the markets!

Yesterday we said we would want to see price push up into the higher resistance levels for the long trades and if we got a RIP there an opportunity to short would be available to traders. What an opportunity that was! We update trades during the London sessions stating that there was no clear sign of the move stopping or a reversal in play, and for that reason to hold runners until we find support to long. We had the 2360 level in mind, and once attacked said if it didn't break the bounce should take us back up into the 2390-95 region initially.

Now we have that flip again making the 2420 price point the resistance to be attempted and broken in order to complete and correct the move back upside to create a new ATH. Our issue here as mentioned earlier is that price is looking like it will want to retest that low, so if you're in long it might be an idea to protect and take partials. Levels are to be tested with a risk model in place, if you're uncomfortable and less experienced, let the chop end before entering these markets.

If we do struggle above, they will want to clear the BE traders before then attempting to move it again, which will now likely be tomorrow. So, resistance 2320 key level, needs to hold to then retest. If we can break above, bar the extreme stretch, we should get the move we wanted.

As always, trade safe.

KOG

FTSE 100 just broke below May's lows - Big crash on the way?M Formation has been fomring on the FTSE 100 since May 2024.

We then had a major breakout just yesterday with the price going below 20MA.

The downtrend line (red) is in check and we can expect further downside to come.

Target will be around 7,591

UVXY crosses over mean anchored VWAP LONGUVXY which leverages the VIX as a measure of volatility / greed/ fear has finally crossed

over the mean anchored VWAP. This is a sign of bullish momentum and perhaps a signal that

traders should hedge or consider their positions in terms of hard risk management. Those

who traded this move up today made 10% or better in the trade. Those who bought call options

expiring tomorrow made 10X and those with call options for next Friday made 5X overnight.

Tomorrow is another day. Likely the market will rise from the correction and UXVY will fade

a bit. No matter, its value for insurance and hedging is reinforced on days like the past day.

I am maintaining a full position aside the call options closed at the afternoon bell which

expire on Friday and had time decay to contend with. My first target is 7.75 then comes

8.05 and 8.45. I will take off 20% at each target and keep the others for insurance for

a true market crash or black swan event to buffer losses while stops get hit.

Coinbase's Market Outlook: A Simple OverviewSince Coinbase went public in April 2021, its stock price has taken quite a tumble. Looking at the weekly chart, we're in the middle of a downward trend, marked by a 5-wave cycle that's not looking too cheerful.

To shake off this gloomy forecast, the stock needs to climb above the peak of Wave (1), which is at $208. If it can't make that climb, there's a good chance it might revisit its lowest point ever at $31.55. There's a bit of a funny situation with the 50% extension target shown on the chart—it points to $-10, which obviously can't happen. 😅

Realistically, we're expecting the price might settle somewhere between $35 and $30, with a double bottom pattern seeming like the most likely scenario.

We'll keep an eye on things and see how it unfolds.

S&P 500 2024-2025 OutlookSP:SPX is not going to crash in the Q1 or Q2 2024. I have measured that we will continue the rally atleast until the resistance zone around 5200-5800.

I used fibonacci retracement to determine the rally target and the pullback target. If we topped at 5200-5800, we will most likely drop to the support area around 3500-3200. I highlighted some area in the RSI graph, if we reached that area we most likely will have a pullback. Another case is if we still continue the rally up until 7000-8000, an economic bubble perhaps, the crash would be more deadly.

Overall i think 2024 will be good for people to make money and prepare for a major crash. Stocks & crypto will be making new all time highs, the first two quartals should be fine for us. Fourth quartal will be the most decisive because of US election, could turn very good or very bad. My advice is to also follow all the latest news about geopolitical tension, we might have a world war 3 or at least a major war that will play a very big factor on the economy in general.

Prepare.

What happens when Crypto Chessboard flips?In-depth analysis considers various factors:

Despite the approaching Bitcoin halving.

We consider the following:

Acknowledging the historical price surge before the Bitcoin ETF launch, making it resistant to substantial capital investments.

Recognising the lack of momentum post-ETF launch and the struggle to breach the upper resistance around 51-52k.

Taking into account the challenging global economic situation, particularly in the United States.

Highlighting the potential impact of a Black Swan Event, investigating the consequences of a fictitious ETF post.

Addressing uncertainties following CZ's departure from Binance as CEO, posing another potential Black Swan event that could push prices below the Wyckoff distribution phase boundary at 24-22k.

Speculating a third logical move by corporate traders to increase market liquidity, creating a massive bull trap to attract influencers and optimists anticipating a significant Bitcoin ETF-driven price surge, leading to widespread doubt in Bitcoin and a gradual decline to the Wyckoff lower support.

Related Financial News:

- Bitcoin's halving event draws attention from traders, with speculation on its potential impact.

- Historical price patterns show resistance before major events like ETF launches, impacting capital flow.

- Global economic uncertainties, especially in the U.S., contribute to the overall market sentiment.

- Increased scrutiny on potential Black Swan events, emphasizing the need for risk assessment.

- Binance's CEO change introduces an element of uncertainty, potentially affecting market dynamics.

- Corporate traders strategizing for liquidity boosts, creating opportunities for market manipulation.

- Influencers and optimists fuel expectations of a Bitcoin ETF-driven surge, but skepticism prevails due to historical patterns and external uncertainties.

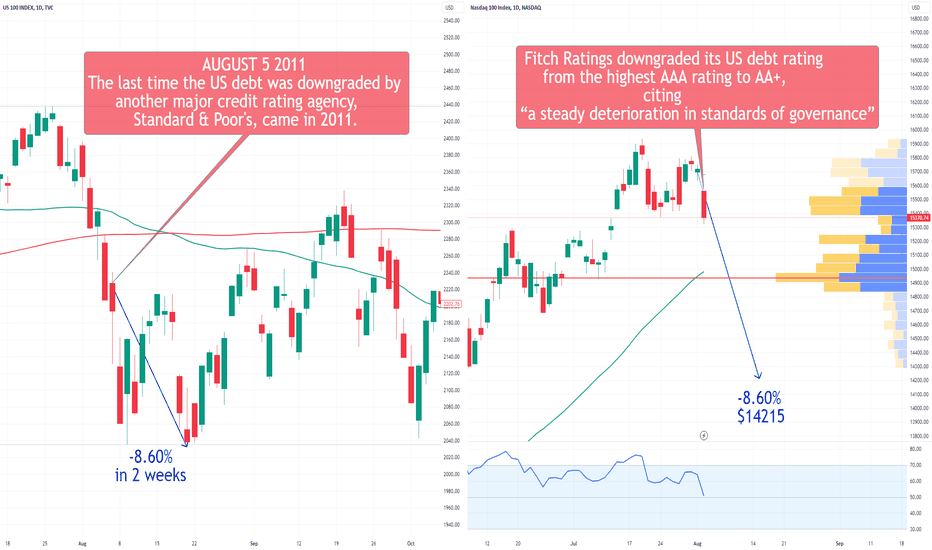

NDX Nasdaq100 Fell 8.60% After the Last U.S. Credit Downgradeitch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance."

This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default.

In the past, a similar credit downgrade had a significant impact on the NDX, which fell 8.60% in just two weeks. Back in August 5, 2011, Standard & Poor's, one of the major credit rating firms, downgraded U.S. debt after another major debt ceiling battle.

Jim Reid, a strategist at Deutsche Bank, pointed out that while the news of Standard & Poor's being the first to downgrade 12 years ago was substantial, investors had already adjusted their perceptions of the world's most important bond market, recognizing that it was no longer a pure AAA. Nonetheless, Fitch's recent decision to downgrade is still significant.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, reaching its highest level since November 2022.

As for the price target for this year, it remains at $16650, as shown in the chart below:

Looking forward to read your opinion about it!

VIX Spike - BIG Crash PendingThe VIX will spike again, nothing to do about it.

Fundamentally, a perfect storm is brewing.

We had/have many events in the markets:

- Covid Pandemic

- Supply Chain Disrupted

- Ukraine Invasion

- Russia Sanctions

- Inflation Spike

- Energy Crisis

- Global Drought

- Interest Rates Hikes

What's next, a full-blown WAR?

SNP500 & My BIG SHORT - Recession TradeSPX is destined to drop hard, back to 2009 lows.

I decided to go short, to catch the next Market Crash.

It's the previous Wave 4 of a lesser degree.

If you know Elliott Wave as I do, then you are getting ready too.

In my opinion SPX500USD has topped a Wave 5 of a large degree.

More info on that in my Full Wave Count for that 150y old chart.

Here's a picture on that SPX500 / US500 Monthly Chart:

Now, what are the main reasons behind my BIG SHORT on US500.F ?

1. The Volatility Index (VIX) is showing a Fractal, the 2007-2009 same/exact sequence.

2. The United States Consumer Confidence Index (USCCI) is telling me that Consumers are entering the Fear Period.

3. The Federal Reserve Funds Rate (FEDFUNDS / FRED) has broken out of an important Downtrend.

4. The US Inflation Rate (USIRYY) is saying that a full-blown war has started.

5. The 10y Treasury Note Yield (TNX) just broke out of a 40y Downtrend.

6. The US 10y Government Bonds (US10 / US10Y / USB10YUSD) finalized a big bearish leg.

7. The Crypto Market Cap (TOTAL) & Bitcoin (BTCUSD) : The Golden King is taking over.

I know what you might be thinking: SPXUSD could actually do one last Bullish move, an overshoot in the last of the last 5th, right?

In this case, the Wave Count on ES1! could be one step behind, and the Impulse Extension in the 5th of 5th was left out.

Yes, that could be a scenario as well, and I will get burnt.

However, I do not think that's the case, so I am loading my Shorts on SPX500USD !

I could not help but noticing that SPX500 is doing the same Fractal Sequence it did on the previous 2007-2009 Recession.

My Sell Orders & Trading Signals on the SPX Market Crash:

* Aggressive Entry: @ Market Price ($3960)

* Moderate Entry: @ $4500 with SL @ 4900

* Conservative Entry: @ 4700.0 with SL @ 5400

* Position Trading: Sell Stop @ 3700.0 with SL @ 4800.0

* Targets @ : $3200 / $2750 / $2500 / $2200 / $1800 / $1400 / $1100

* Safety measures: when in the green, moving SL @ BE.

Good luck and many pips ahead!

Richard, the Wave Jedi.

Prediction of the dollar index in the long term (weekly)The dollar index has moved on the path of July 11 so far and the scenario has not changed for now

According to the left of the chart and the completion of the technical model of liquidity provision, the long-term correction of the dollar index has been completed and it has started its main movement. This break of the dollar in 2023, in my opinion, was like the rest of a sheep before going to the slaughterhouse.

2023 was a break before the slaughter of all markets and 2024 is the beginning of the fall of markets.

This is confirmed by the dollar index with targets of 114 and 121.

Of course, markets like crypto are still alive and we can see price growth in them, but soon they will also approach the crash market.

The whales are currently resting.

World Wars & US Inflation From 1914This is the US Inflation Rate (YoY) from 1914 until 2022.

Symbol is called USIRYY and it measures the Inflation Volatility in the United States.

With the War going on in Ukraine, and Russia trying to force its way through, I took the liberty of looking into the following:

- How Global Wars Affect Inflation

- How US Inflation Reacts to External Wars

- How Wars Affect the Financial Markets

You can see the time-lines, it's all laid-out in the chart (graph).

I took all the Major World Wars and events that significantly affected, not only the US Inflation, but Inflation itself.

First of all, the US Inflation Rate (USIRYY) tells me the following:

* When the US was involved in a War, we can notice that the US Inflation spiked.

* Most of the times when US was not involved in an External War, then Inflation dropped.

That's because of War & Uncertainty Sentiment around this "terrific" word.

War does not bring anything good, in fact, in only brings bad times.

People die and global sentiment gets super-negative.

This of course, leads to... you guessed it: Market Crash.

Why? Because after or during times of War, there are Recessions and Depressions.

Supply Chains are disrupted and the Global Economy falls on its face.

What about looking at things from a Technical Analysis perspective?

* Symmetrical Triangle: and the only way is UP!

I will give you points which I believe are worth keeping in mind for the next Market Crash.

First of all, let's be logical about this.

Winter is coming and it's only gonna get worse before it gets better.

As Inflation spiked to a 40y high, the higher powers intervened, in an attempt to cool the Inflation spike off.

I'm talking here about the Federal Reserve (FED) ramping up the Interest Rates.

This is the Effective Federal Funds Rate (FEDFUNDS).

Can you see the break-out?

They want to calm down Inflation, but they can't.

Why? Because this is no ordinary Inflationary period, it's a long-lasting thing.

One of those hyperinflation, deflation, stagflation, or whatever the heck these experts call it... :)

The Volatility Index (VIX) tells me that another spike in Fear Sentiment is inevitable.

I'm in love with Elliott Wave Analysis, so I labeled this next chart.

This is the United States Consumer Confidence Index (USCCI) and it measures exactly what its name says, LOL.

When it drops, people are freaking out. When it rises, people are optimistic and the Markets are going up. Daaaa!

With all that said, what's the bottom line here?

I believe that periods of terror are gonna hit us all.

Are we having World War 3? Who the heck knows?

All I know is that there are more pieces to this puzzle:

United States 10Y Bonds (USB10YUSD) have reached the Support, and a spike bigger than the Covid Pandemic has started:

The 10Y Treasury Note Yield (TNX) have broken out of a 40y down-trend:

Isn't it ironic how it synced with the Inflation 40y high?

Damn!

Germany 40 (DAX, GER30, GRXEUR) is doomed.

Fractal sequence, Descending Channel, and a "beautiful" ABC Elliott Wave Pattern.

So, how can you prosper from all this?

Metals could be a good hedge.

Gold (XAUUSD) just broke out of an important Bearish Structure.

Maybe it will go up.

Natural Gas (NG1!) & Crude Oil (USOIL) however, are showing Bearish Reversals.

Bitcoin (BTCUSD) is Bearish until further notice as well.

But this may become the new currency moving forward.

In times of terror, the banking systems might need to change.

Cash and Card is so '00.

WHAT'S YOUR TAKE? WAR OR PEACE?

Leave your commend down below.

Cheers!

Richard

SPX Market Crash: The 150y Elliott WaveThis is an SPX chart from 1872. A 150 year old chart.

As you know, I am the Elliott Wave Jedi.

So, I took the liberty of labeling this SPX500 chart.

There's only one thing I can say:

"SNP500 is preparing for a BIG Drop, a Market Crash".

My Wave Count suggests that a major Bearish Swing is starting, or will start soon.

The 2009 lows are inevitable. Price Action will be drawn there like a magnet.

Calling all Autobots!

( SPX , SPX500 , SPX500USD , SPXUSD , US500 , SP500 )

A Recession is due and bigger events will crash the markets globally.

* Some more details in the related ideas.

Fundamental Analysis & Facts:

* Fear vs Greed: VIX (Volatility Index)

It will spike!

* US Consumer Confidence Index: USCCI

People are worried about the future.

* US Inflation Rate: USIRYY

War is coming.

* US 10y Yields: TNX

The 40y Downtrend Break-Out

* US 10y Bonds: USB10YUSD

Bonds Rush, Investors & Fear

Technical Analysis: Elliott Wave Cycles

The Wave Count tells me that a Major Degree is ending, in this case it's the SubMillenium Wave 3.

If you are good at counting waves, then you can see that as well.

The Elliott Wave Time Degrees are on the chart.

Levels I am watching: $4500 & $6500.

IMO, SPX has already started the Recession Bearish Swing, so I am already treating the ATH as the actual top.

In case of another ATH, then this will mean that the current position was a SuperCycle (IV).

After the last 5th, SPX will surely drop, from around $6500 back to $1100.

However, as I said: "I believe the Markets have topped, and that the Recession has started".

Check out a close-up: 2009-2022 Elliott Wave Count.

I am shorting the Markets.

Good luck guys and many pips ahead!

Richard, the Wave jedi.

P.S. Props to @TradingView for providing this 150y old chart.

Nasdaq -> Sell Everything Now!Hello Traders and Investors ,

my name is Philip and today I will provide a free and educational multi-timeframe technical analysis of the Nasdaq 💪

Looking at the macro view on the monthly timframe you can see that at the moment the Nasdaq is retesting massive resistance of the 10+ years rising channel formation so I do expect a monthly push lower.

With the recent weekly rejection of the major previous structure zone, everything is looking like Nas100 will also break the current support level and simply drop further towards the downside.

And you can also see that there is the possibility that Nas100 will create a regular head and shoulders in combination with a double top on the daily timeframe which is a massively bearish reversal pattern suggesting that we might see a harsh move lower on Nas100.

Keep in mind: Don't get caught up in short term moves and always look at the long term picture; building wealth is a marathon and not a quick sprint📈

Thank you for watching and I will see you tomorrow!

My previous analysis of this asset:

Are we approaching the last cycle expansion phase?The last cycle expansion phase or the euphoric stage, has already occurred between 2020 and 2021.

Sir John Templeton said: “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

Reference of Nasdaq:

E-mini Nasdaq-100 & Opt

Minimum fluctuation

0.25 index points = $5.00

Micro E-mini Nasdaq-100 Index & Opt

Minimum fluctuation

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Why Russell Index the most Reflective for Bank Run Crisis?Russell represents the true economy of United States.

There are 2,000 medium size companies with each value between $300m to $2b. The index includes a diverse range of companies from various sectors, including financials, healthcare, consumer goods, industrials, and technology. In my opinion Russell represents the true economy of united states.

If the bank run crisis deepens, it is possible that 2,000 companies will not hold up well. The reasons for this are stated in the video. This could affect the other major indices, with the Russell 2000 potentially leading the pack. The Russell 2000 is considered more reflective of the US economy compared to the other major indices with big names like Apple, Amazon, and Microsoft.

E-mini Russell 2000 Index Futures & Option

Outright:

0.10 index points = $5.00

Micro E-mini Russell 2000 Index Futures

Outright:

0.10 index points = $0.50

Micro E-mini S&P 500 Index Futures & Option

Outright:

0.25 index points = $1.25

Micro E-mini Nasdaq Index Futures & Option

Outright:

0.25 index points = $0.50

Micro E-mini Dow Jones Industrial Average Index Futures

Outright:

1.0 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

The Deflationary SpiralAll credit booms brought about by Central Bank-induced artificially low interest rates and loose lending standards end in busts. In the recessionary phase that follows the boom, credit becomes much harder to attain and many over-leveraged businesses end up going bankrupt. The recessionary phase reveals the malinvestments and unsound business decisions that were made during the economic boom. Businesses & Consumers deleverage their balance sheets either through paying down debt or through bankruptcy. As loan demand falls & credit conditions tighten, debt issuance falls, which reduces the supply of money into the economy because the vast majority of currency that enters the economy is loaned into existence. When credit growths slows and begins contracting alongside a falling money supply, inventory piles up and profits & margins fall while consumer spending falls. Businesses are then forced to sell at discounted rates to liquidate inventory in anticipation of weak future demand, which further reduces profits & margins and leads to increased unemployment and weaker levels of consumption. The “Deflationary Spiral” subsides and an economic recovery can take place once balance sheets are back to healthy levels which can support debt accumulation, capital investment recovers, and once large amounts of the “bad” debts taken on during the economic boom have been deleveraged.

US M2 Money Supply is currently down -4.2% YoY using March 2023 data, the largest monetary contraction in the USA since the Great Depression. Using data going back to 1870, every time the money supply contracted by over 1% YoY the stock market had a large correction and the economy fell into a severe & lengthy contraction with unemployment reaching at least 7%. A banking panic always accompanied those contractions as well. Commercial bank deposits are currently down around -5% YoY, the most since the Great Depression. Total commercial bank deposits didn’t even contract during the early 1990s Savings & Loan Crisis. With money supply shrinking and the majority of banks unable to pay competitive rates on deposits, deposits will continue falling and more bank failures will occur. The large amounts of unrealized losses on bank balance sheets represent another impediment to loan growth and banks have continued to raise reserves for multiple quarters in response to rising default rates.

Fed research from the Fed Bank of Saint Louis show bank lending conditions (measured by percentage of banks tightening lending conditions) are comparable to early 2008 & late 2000. Bank lending conditions are a leading indicator for unemployment. The unemployment rate currently is still below 4%, but with the Conference Board’s Leading Economic Indicators index currently at -7.2% and the bond yield curve still inverted, many reliable economic datapoints show that the economy is closer to the beginning of this business cycle downturn and debt deleveraging than the end. Yield curve inversions & Conference Board LEI’s have been some of the best leading indicators for a recession since the 1970s. Since 1968, any Conference Board LEI contraction of more than -2% YoY has never yielded a false positive in regards to a coming recession. The Credit Managers’ Index newly released data for April showed that the index for rejection of new credit applications (within the service sector) was 45.9, its lowest level since March 2009.

The US Consumer is beginning to run dry on savings. The majority of Americans are living paycheck to paycheck and consumer credit growth (which had been expanding rapidly in 2022) has slowed markedly. Total consumer credit growth has fallen about 50% YoY (using the 3 month average of data from December - February). After falling below 3.2% in the summer of 2022, the US savings rate is still low by historic standards, currently 5.1%. Announced job cuts for the month of March were 89.7K, higher than the first 3 months of the 2008 recession. US large corporate bankruptcy filings (Bankruptcies of companies with over $50M in liabilities) from Jan-April totaled 70, seven more than during the same length of time in 2008. Student loan debt payments are set to resume again this summer, which will further reduce consumer spending. US Consumer sentiment levels measured by University of Michigan hit the lowest levels ever (going back to 1952) in the summer of 2022, and they have been fluctuating around 2H 2008 & 1H 2009 levels ever since. Delinquency rates on things like automobiles, credit cards, and commercial real estate loans are soaring. Cox Automotive found 1.89% of auto loans in January were "severely delinquent" and at least 60 days behind payment, the highest rate since the data series began in 2006. In March, the percentage of subprime auto borrowers who were at least 60 days late on their bills was 5.3%, up from a seven-year low of 2.58% in May 2021 and higher than in 2009, the peak of the financial crisis, according to data from Fitch Ratings.

Retail sales are an economic metric that track consumer demand for finished goods. US real retail sales down -2.1% and EU real retail sales are -9.9%. German real retail sales for the month of march just came in at -15.8% YoY! According to Bloomberg, Global PC shipments are down close to 30% YoY & Apple computer shipments are down about 40% YoY. In the past 50 years, US Gross fixed capital formation has only gone negative in the US before and during recessions. It is now negative and there has never been a false positive. Data from the Mortgage bankers association showed a -39% YoY decline in Mortgage purchase applications, a decline to its lowest levels in over 26 years. US Building Permits are down -24% YoY. Housing Starts YoY are down -17% YoY. Existing Home Sales are down -22%. Every national housing downturn in the past 45 years has taken at least 4 years from peak to trough prices, indicating that the current housing downturn is likely to continue for at least 2-3 years.

Every FED Regional bank report on manufacturing (using a 3 month average of the data) is in a contraction. The April Philadelphia FED Manufacturing index came in at -31.3. Since 1969, Every reading under -30 was either in a recession or a few months away from one. April Richmond FED Service Sector Index registered a -23, the same number as in Nov 2008 & Feb 2009 & worse than Jan 2009 which was -20 (August and September 2008 were -10 for reference). US manufacturing production is down -.5% YoY. March 2023 ISM PMI data was also very insightful. USA ISM Manufacturing PMI (March) was 46.3, its lowest level since June 2009 (excl. H1 2020). For reference, in the 08 recession, it wasn’t until October 2008 that the ISM manufacturing PMI fell under 46.3, over 9 months into that recession. USA ISM Manufacturing New Orders (March) was 44.3, its lowest level since March 2009 (excl. January 2023 & H1 2020), USA ISM Non-Manufacturing PMI (March) came in at 51.2, its lowest level since Jan. 2010 (excl. H1 2020).

The US Stock market is trading at one of the highest Shiller PE ratios & stock market capitalization to GDP ratios in history. Present day stock market valuations are rivaled only by the Roaring 20s Bubble (1929), The Nifty-Fifty Bubble (late 1960s/early 1970s) & the 1999/2000 Dot-com Bubble. All 3 of those examples were followed by the most negative 10 year real returns in USA stock market history going back to 1913. Over 40% of businesses in the Russell2000 are unprofitable and over 1/5 of the S&P500 are zombie companies. Clearly, the stock markets as of April 2023 are still in bubble levels of overvaluation.

Looking at the data in aggregate, I believe that a recession is currently occurring. Assuming earnings fall by about 30% peak to trough, using a conservative average from the past 4 US recessions, I assume S&P annualized earnings will fall to around 155. Using a conservative valuation multiple of 14, that gives a target price of about 2,200 for the S&P500 that is likely to be hit in Q4 2023 or 2024.

Thank you for reading,

Alexander Charles Lambert

COIN Coinbase potential Sell-Off !!!If you haven`t bought COIN puts here:

Or sold it here:

Then you should know that COIN Coinbase was more than a client of Silicon Valley Bank, and the relationship between the two companies was more than just a client-provider one.

Back in 2014, when cryptocurrency projects and businesses affiliated with crypto struggled to secure financing from traditional sources, Coinbase gave a stock warrant to Silicon Valley Bank.

This was part of an agreement between the two companies, which allowed Coinbase to use the bank's services.

The warrant gave the bank the option to buy more than 400,000 shares of Coinbase's class B common stock for slightly over $1 each. The warrant was valid until June 2024, but it is unclear what its status is currently.

However, Silicon Valley Bank's latest annual report to the Securities and Exchange Commission revealed that the bank earned $116 million in gains "related to Coinbase's direct listing" in 2021.

Coinbase has also paused conversions between USDC (a stablecoin pegged to the US dollar) and US dollars, due to the ongoing banking crisis that has affected the crypto industry.

Circle, which backs USDC, confirmed that $3.3 billion of the $40 billion supporting its stablecoin was deposited at Silicon Valley Bank.

Following the bank's seizure by the FDIC, the fate of that cash is uncertain, and USDC's dollar peg has been lost temporarily.

It remains unclear what Coinbase's exposure to USDC is at this time.

Considering the chart, my Price Target for COIN Coinbase is $34, for a potential Double Bottom.

Looking forward to read your opinion about it!

Crash scenario for ETHThis could be a crash scenario for market .

400~200 $ is a power full target for ETH .

time is always matters . but around 13 sep we have a time pivot . dont look for near targets for low price yet.

short position stop loss . we are still in weekly down trend . 1300 $ is first target and possible support .if it breaks it will become a strong resistance then be careful about your positions

Key Levels and Market overview for the Asian session open 22/02A review of the price action from the European session and recap of US price action as US indexes followed on from weakness in Asian and European trade. I remain of the view that data is still showing 'sticky inflation' which eventually leads to higher interest rates and lower spending which will cap the indexes as we can see from the selloff. I look at some key levels to watch and the price action setups I expect to see play out.

Markets covered :-

DOW

Nasdaq

DAX

FTSE

ASX200

Hang Seng

USD Index

Gold

Oil

Copper

BANKNIFTY ANALYSIS - Are we entering recession ? As we can how the markets have been respecting these Major support and resistances since years covering every major crash .

We can see that currently we are testing the resistance and showing possible signs of rejection which makes me think that the markets have topped out and might become bearish from now on .

On the other hand , It will be very bullish if we break above this resistance level , which I know we will break in upcoming years .

News comes later . charts always speaks first .

Things to keep in Mind :-

Wars going on

Inflation Rates

Increasing Taxes

Fed is extremely hawkish .

All of these might led to the capitulation event soon .

Remarkable similarities to February2020 & August-September 2008 The current rollover in the market, featuring a clear double top with negative RSI divergence, is remarkably similar to the February 2020 & August-September 2008 rollovers. My opinion is that the current rollover will resolve with a large move to the downside in similar fashion to the aforementioned time periods.