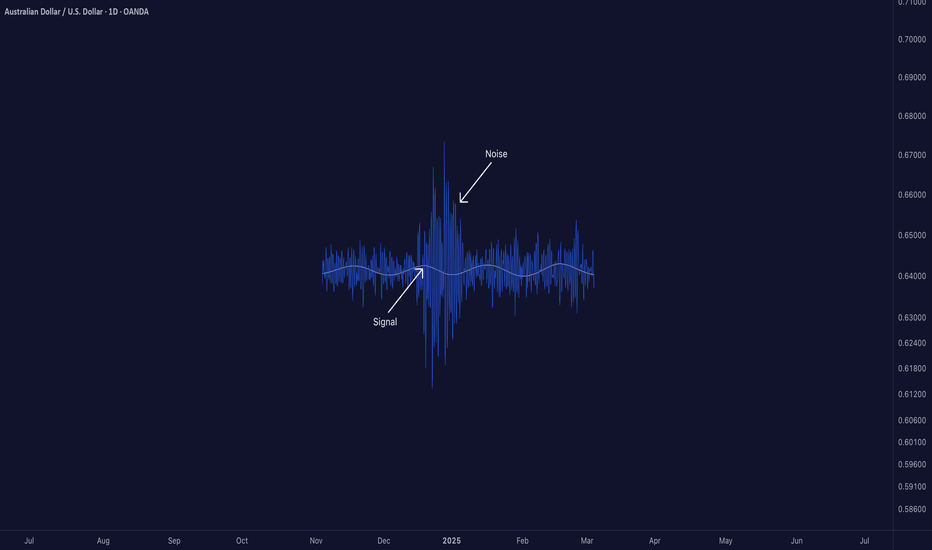

Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Marketdynamics

LTO Network: Your Altcoin ChoiceA bullish wave follows a correction.

The end of a correction signals the start of a bullish wave.

What we have here is the long-term LTO Network chart. The last part is clearly a strong correction. After this correction a bullish impulse will develop. 5-up waves. 1,2,3,4,5.

Last week LTOUSDT produced an All-Time Low. This session also have some of the weakest volume ever for a major move. Lower low on low volume means that the bearish move reached its end. If the bearish move is over, what happens next?

This is the stop-loss hunt event. All LONG positions liquidated. All spot stop-loss orders activated. Full market flush and reset complete. With this move, literally millions of participants left the market, they will trade Crypto no-more. They will have nightmares when you mention Cryptocurrencies for years to come. But not all is lost.

At the same time that the bearish cycle ends, this heralds the start of a new cycle and bullish phase. It will be great.

Just as the market can hit new All-Time Lows when the bears are in control, the market can hit new All-Time Highs when the bulls control the game.

The time to buy is now.

Once you hit bottom, there is no other place left to go but up.

LTO Network already hit bottom, so we can be sure that soon enough we will experience a new phase of growth.

The action won't go full green right away. The bull market will not happen as the C wave of the current corrective phase, no. It tends to build up slowly for months. Months sideways, growing, slowly; higher highs and higher lows.

Some shakeouts happen but still the base, the ATL, stays the same. The shakeouts remove a big portion of the slow and steady growth, but just as fast as the market drops it starts to recover again. The recovery is always slow... It builds up for months and then bullish momentum shows up.

Bullish momentum leads to the first strong bullish wave. After this wave a major correction, just one, strong higher low, strong recovery and then come the bull-run phase.

This is the bull market dynamics in a glance. It will take time but it will be great.

Many people will lose patience and fold.

Some will become bored.

Others will look at the screen, track the market but will never buy when prices are low.

Then, suddenly, everything starts going up. Some of these people that are looking at the screens and the prices daily, they will be wondering, "Why didn't I buy when prices were low?" "What was holding me back?" "Why didn't I take action?"

You don't have to be in that group.

You can be in the group that will end up saying, "Wow, this time I managed to secure profits on most of my coins. 10-20X nice. Thank you Master, thanks a lot for your continued support!"

But you have to start today.

If not buying, start planning and then take action.

Thank you for reading.

Namaste.

Decoding Money Flow within Markets to Anticipate Price DirectionI. Introduction

In the intricate world of financial markets, understanding the flow of capital between different assets is paramount for traders and investors aiming to anticipate price movements. Money doesn't move haphazardly; it often follows patterns and trends influenced by a myriad of factors, including economic indicators, geopolitical events, and inter-market relationships.

This article delves into the concept of money flow between markets, specifically analyzing how volume movements in one market can influence price directions in another. Our focus centers on two pivotal markets: the 10-Year T-Note Futures (ZN1!) and the Light Crude Oil Futures (CL1!). Additionally, we'll touch upon other significant markets such as ES1! (E-mini S&P 500 Futures), GC1! (Gold Futures), 6E1! (Euro FX Futures), BTC1! (Bitcoin Futures), and ZC1! (Corn Futures) to provide a comprehensive view.

By employing the Granger Causality test—a statistical method used to determine if one time series can predict another—we aim to unravel the nuanced relationships between these markets. Through this exploration, we aspire to equip readers with insights and methodologies that can enhance their trading strategies, particularly in anticipating price directions based on volume dynamics.

II. Understanding Granger Causality

Granger Causality is a powerful statistical tool used to determine whether one time series can predict another. While it doesn't establish a direct cause-and-effect relationship in the strictest sense, it helps identify if past values of one variable contain information that can predict future values of another. In the context of financial markets, this can be invaluable for traders seeking to understand how movements in one market might influence another.

Pros and Cons:

Predictive Power: It provides a systematic way to determine if one market’s past behavior can forecast another’s, helping traders anticipate potential market movements.

Quantitative Analysis: Offers a statistical basis for analyzing market relationships, reducing reliance on subjective judgment.

Lag Dependency: The test is dependent on the chosen lag length, which may not capture all relevant dynamics between the series.

Not True Causality: Granger Causality only suggests a predictive relationship, not a true cause-and-effect mechanism.

III. Understanding Money Flow via Granger Causality

The data used for this analysis consists of daily volume figures for each of the seven markets described above, spanning from January 1, 2018, to the present. While the below heatmap presents results for different lags, we will focus on a lag of 2 days as we aim to capture the short-term predictive relationships that exist between these markets.

Key Findings

The results of the Granger Causality test are presented in the form of a heatmap. This visual representation provides a clear, at-a-glance understanding of which markets have predictive power over others.

Each cell in the matrix represents the p-value of the Granger Causality test between a "Cause" market (row) and an "Effect" market (column). Lower p-values (darker cell) indicate a stronger statistical relationship, suggesting that the volume in the "Cause" market can predict movements in the "Effect" market.

Key Observations related to ZN1! (10-Year T-Note Futures):

The heatmap shows significant Granger-causal relationships between ZN1! volume and the volumes of several other markets, particularly CL1! (Light Crude Oil Futures), where the p-value is 0, indicating a very strong predictive relationship.

This suggests that an increase in volume in ZN1! can reliably predict subsequent volume changes in CL1!, which aligns with our goal of identifying capital flow from ZN1! to CL1! In this case.

IV. Trading Methodology

With the insights gained from the Granger Causality test, we can develop a trading methodology to anticipate price movements in CL1! based on volume patterns observed in ZN1!.

Further Volume Analysis with CCI and VWAP

1. Commodity Channel Index (CCI): CCI is a versatile technical indicator that when applied to volume, measures the volume deviation from its average over a specific period. In this methodology, we use the CCI to identify when ZN1! is experiencing excess volume.

Identifying Excess Volume:

The CCI value for ZN1! above +100 suggests there is an excess of buying volume.

Conversely, when CL1!’s CCI is below +100 while ZN1! is above +100, it implies that the volume from ZN1! has not yet transferred to CL1!, potentially signaling an upcoming volume influx into CL1!.

2. Volume Weighted Average Price (VWAP): The VWAP represents the average price a security has traded at throughout the day, based on both volume and price.

Predicting Price Direction:

If Today’s VWAP is Above Yesterday’s VWAP: This scenario indicates that the market's average trading price is increasing, suggesting bullish sentiment. In this case, if ZN1! shows excess volume (CCI above +100), we would expect CL1! to make a higher high tomorrow.

If Today’s VWAP is Below Yesterday’s VWAP: This scenario suggests bearish sentiment, with the average trading price declining.

Here, if ZN1! shows excess volume, we would expect CL1! to make a lower low tomorrow.

Application of the Methodology:

Step 1: Identify Excess Volume in ZN1!: Using the CCI, determine if ZN1! is above +100.

Step 2: Assess CL1! Volume: Check if CL1! is below +100 on the CCI.

Step 3: Use VWAP to Confirm Direction: Compare today’s VWAP to yesterday’s. If it’s higher, prepare for a higher high in CL1!; if it’s lower, prepare for a lower low.

This methodology combines statistical insights from the Granger Causality test with technical indicators to create a structured approach to trading.

V. Case Studies: Identifying Excess Volume and Anticipating Price Direction

Case Study 1: May 23, 2024

Scenario:

ZN1! exhibited a CCI value of +265.11

CL1!: CCI was at +12.84.

VWAP: Below the prior day’s VWAP.

Outcome:

A lower low was made.

Case Study 2: June 28, 2024

Charts for this case study are at the top of the article.

Scenario:

ZN1! exhibited a CCI value of +175.12

CL1!: CCI was at -90.23.

VWAP: Above the prior day’s VWAP.

Outcome:

A higher high was made.

Case Study 3: July 11, 2024

Scenario:

ZN1! exhibited a CCI value of +133.39

CL1!: CCI was at +0.23.

VWAP: Above the prior day’s VWAP.

Outcome:

A higher high was made.

These case studies underscore the practical application of the trading methodology in real market scenarios.

VI. Conclusion

The exploration of money flow between markets provides valuable insights into how capital shifts can influence price movements across different asset classes.

The trading methodology developed around this relationship, utilizing the Commodity Channel Index (CCI) to measure excess volume and the Volume Weighted Average Price (VWAP) to confirm price direction, offers a systematic approach to capitalizing on these inter-market dynamics. Through the case studies, we demonstrated the practical application of this methodology, showing how traders can anticipate higher highs or lower lows in CL1! based on volume conditions observed in ZN1!.

Key Takeaways:

Granger Causality: This test is an effective tool for uncovering predictive relationships between markets, allowing traders to identify where capital might flow next.

CCI and VWAP: These indicators, when used together, provide a robust framework for interpreting volume data and predicting subsequent price movements.

Limitations and Considerations:

While Granger Causality can reveal important inter-market relationships, it is not without its limitations. The test's accuracy depends on the chosen lag lengths and the stationarity of the data. Additionally, the CCI and VWAP indicators, while powerful, are not infallible and should be used in conjunction with other analysis tools.

Traders should remain mindful of the broader market context, including economic events and geopolitical factors, which can influence market behavior in ways that statistical models may not fully capture. Additionally, effective risk management practices are crucial, as they help mitigate potential losses that may arise from unexpected market movements or the limitations of any predictive models.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Watch me read and trade the market like youve never seen before.Long video but WELL worth the watch if you're trying to learn how I do what I do. In this video I walk through every candle on a 1 minute chart prior to the impending drop - and I explain how and why I am expecting the drop.

There is simply no other way to read the market with this much certainty and confidence! And whatever I do here on the 1 minute chart can be identically correlated to the 5 min, 15 min, 1HR, 1D, 1M, etc. All time frames work together and it's important to use them all to tell the story and pick the best entries.

Feel free to ask questions in the comments or let me know if you found this helpful, cool, or anything!

Happy Trading :)

Watch this and you will see the market differently! Guaranteed!*If you watch this whole video, tell me it doesn't change your perspective a little bit. It's clear as day what price needs to do to continue its healthy bullish movements - and we've identified the patterns/algorithms!

Let me know your thoughts and if this was as exciting for you as it was for me - or if you want your time back, see below

*No money (or time) back but happy to hear your feedback in the comments!

SQ Multi-Time Frame Detailed Analysis of dynamics & Trade EntryThis is what I love to do - Figure out the puzzle that is a stock chart. And when we make sense of it, we feel like we have the keys to the jungle. So now that we have the "foresight" we want to craft as detailed and mechanical of a system that we can to ensure to the most consistent extent that we get a good entry into a good position.

Obviously my brain is in charge of making decisions and actually telling the story that's ensuing - but the market is doing it without my brain which is why I know there is a way to "automate" this to flow with the market.

Every time I post a video for you all, it advances my knowledge and my ability to teach this to others and ultimately potentially an automated source.

Hope you all enjoy these videos - videos like these are not for everyone rather for people who are actually studying this form of analysis and trading - but there's still something to gain if you're new as I try to talk generally about a lot of these occurences.

Happy Trading :)

🔄 Time Changes Everything! 🕒shibunacci - "The more you examine it, the more it begins to make sense and truly astonishes you. 🧐 This observation underscores that the concepts of support and resistance are not static; they evolve dynamically, influenced by various factors, time being a primary one. ⏳ Understanding this can significantly enhance our strategic approach, as it reminds us of the fluid nature of these critical analytical markers. 💡"

Gold Watch: CPI Impact and Interest Rate DynamicsGreetings Traders,

Our spotlight is on XAUUSD, where we are actively eyeing a potential buying opportunity around the 2015 zone. As gold trades in an uptrend, it currently finds itself in a correction phase, steadily approaching the trend at the critical 2015 support area. This numerical level carries historical significance, serving as a vital juncture where the correction may align with substantial market forces, creating an opportune entry point for traders.

To comprehend the potential market dynamics, we must delve into the macroeconomic fundamentals. The Consumer Price Index (CPI) data, released on October 25, 2023, revealed an actual inflation rate of 1.2%, surpassing the forecast of 1.1% and the previous 0.8%. This ongoing trend of rising inflation is crucial, as it has the potential to influence the Federal Reserve's monetary policy decisions. The latest FOMC data, dated December 13, 2023, reflects a steady interest rate of 5.50%. Such a stance indicates a commitment to combat inflation, but the continuous dovish rhetoric and the decision to maintain the interest rate may suggest that the Fed is cautious about tightening too quickly. This dovish sentiment in the monetary policy can lead to further weakness in the USD.

Considering the interest rate evolution, the Fed has been on a trajectory of cautious adjustments. For instance, in the FOMC meeting on September 20, 2023, the interest rate was held at 5.50%, maintaining the status quo. This steady approach is indicative of the Fed's commitment to managing inflation without overly hindering economic growth. The correlation between interest rates and the strength of the USD is pivotal in understanding gold's potential upsides. The negative correlation between gold and the USD implies that a weakening dollar could propel gold prices higher.

As traders navigate the XAUUSD chart, the careful consideration of both CPI and interest rate data is imperative. The dovish monetary policy's potential impact on the USD's strength and the subsequent influence on gold prices should be a focal point in crafting effective trading strategies.

GOLD/XAUUSD Trade IdeaMy trading plan is to buy XAU/USD at the H4 timeframe based on the bullish sequence, with a risk-reward ratio of 1:3.

I'll use a stop-loss order at FE 1.618 + 10 Pips (Spread) and set a take-profit order three times further away from my entry point.

I'll monitor the market for any changes in the bullish sequence or external factors that may affect the price of gold.

I'll also manage risk by trading with a portion of my capital, avoiding over-leveraging, and keeping a trading journal.

I'll review and update my plan regularly to ensure its relevance and effectiveness.

ES1!11. 19. 22 This is part 2 of the ES. I think it's very easy to start a trade I'll be on the wrong side of the market if you're not very careful. On Friday, the market had already had its low for the day and the high for the day with many hours left when I found an opportunity to go long when the market was just above its opening price after it has already move to its high for the day and was about to move lower to the starting price for the day. I don't think this is an easy trade Unless you consider the context behind the trade: Just how strong the support really was.

Things to Remember As the Market Dynamics ChangeA successful trader must be like a chameleon, willing to change with market conditions. Markets reflect the economic and geopolitical landscapes. The global pandemic changed many assumptions, forcing market participants to develop new skills to deal with the price carnage in early 2020. The impact of unprecedented central bank liquidity and government stimulus caused the need to pivot and adapt to new conditions.

Plan first- Trade or invest later

Risk-reward is critical

Leverage is a function of price variance

Stick to the game plan

There are always other opportunities in volatile markets

In early 2022, Russia’s invasion of Ukraine has turned the world upside down. The US, Europe, and allies worldwide support Ukraine by providing aid and slapping Russia with sanctions. However, the meeting between the Russian leader and Chinese President Xi at the Beijing Winter Olympics was a watershed event and may have set the stage for the incursion. China and Russia entered into a long-term $117 billion agreement for Russia to supply energy and other commodities to the world’s most populous country with the second-leading economy. The deal could make US and European sanctions toothless or lessen the bite on Russia’s economy as President Putin moves to take the former Soviet satellite back under his umbrella.

With the US, NATO, and other allies on one side and China, Russia, North Korea, and Iran on the other, the risk of a confrontation with nuclear ramifications dramatically increased. The pandemic has given way to a geopolitical crisis, requiring another pivot by investors and traders to deal with the current environment.

Volatility is likely to be the norm instead of the exception for the foreseeable future. The increasing price variance is a nightmare for passive investors but creates many opportunities for nimble traders with their fingers on the pulse of markets.

Success in markets always requires discipline, and increased volatility only makes discipline more critical. In early March 2022, we must remember the key factors that increase the odds of success in markets.

Plan first- Trade or invest later

Organization and planning are critical in life, and trading and investing are no exception. In a highly volatile market, planning becomes even more essential.

We follow three rules for considering any risk position:

Respect the market sentiment- The path of least resistance reflects market sentiment, making the trend your only friend in markets across all asset classes.

Write down your ideas, planning, organizing, and memorializing your thoughts. Referring back to the original justification for a trade or investment will remind you of the thought process.

Do not trade or invest for the sake of participating in any market. The risks in over-trading or investing without a plan increase with price volatility.

When considering entering any risk position, eliminate any emotional impulses by ignoring the news cycle and so-called “expert” advice. The price action is the most objective view of the market’s interpretation of the geopolitical and economic landscapes.

Risk-reward is critical

Any plan needs to outline the risk tolerance, which must be a function of profit targets. We follow three rules regarding risk versus reward:

The risk-reward equation should be at least 1:1, meaning do not risk more than your expected profit level.

Higher price variance should increase the expected reward level compared to the risk. Even the most successful traders call the market’s direction wrong more than right. A higher reward target versus risk increases the potential for success over time, allowing for small losses and higher profits.

Never increase the risk level because an asset price moves contrary to expectations. Admitting you are wrong can be humbling, but it is a critical element for financial survival.

Risk-reward is the essential part of a plan that establishes the discipline necessary for success. Risk-reward levels should always reflect price variance, and higher price volatility requires more expansive risk-reward levels.

Leverage is a function of price variance

Leverage can be a blessing or a curse. Greed and fear are impulses that drive human behavior.

Leverage levels should always reflect market volatility.

In volatile markets, reduce leverage to protect capital.

In static markets where volatility declines, increasing leverage is more appropriate.

When risk positions are in the money, greed drives us to feel we are not long or short enough. Fear makes us believe we are too long or short when they are out of the money. A plan and the appropriate leverage will help avoid listening to the little voice in our heads that incites the fear and greed impulses.

Stick to the game plan

Mike Tyson once said, “Everyone has a plan until they get punched in the mouth.” Markets are not forgiving when they move against our expectations. Sticking to a game plan prepares you for the sock in the kisser.

The risk level should be set in stone at the beginning of any trade or investment.

It is acceptable to increase reward horizons when prices move in our favor.

A risk position is always long or short at the current price, not the execution price.

Assess risk at each price level and adjust levels accordingly.

Adjust risk levels using trailing stops when an asset’s price moves in the desired direction.

Never allow a profitable position to become a loser by expanding the original risk level. Protect capital by protecting profits and have the fortitude to take small losses by sticking to the original game plan. When prices move contrary to expectations, admit to yourself you were wrong. When prices move in your favor, do not allow greed to creep into the plan.

There are always other opportunities in volatile markets

Most traders or investors will miss many trades and investment opportunities. Do not despair! In volatile markets, there is always another opportunity right around the corner.

Markets reflect the geopolitical and economic landscapes. The dynamics have dramatically changed with Russia’s invasion of Ukraine. Elevated volatility in markets across all asset classes will be the norm, not the exception.

When approaching markets, do the work and write down a plan. Make sure it has a logical risk-reward balance that reflects price variance before executing a buy or sell order. Follow the rules by sticking to your plan. Eliminate fear and greed emotions by establishing comfortable risk-reward levels.

A successful approach to trading and investing requires a portfolio approach. No one trade or investment should determine overall results. There are no guarantees in any markets, but following rules, sticking to a plan, and eliminating emotions will improve your chances of long-term success.

Be careful in markets as the dynamics have changed.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

looking at gold silver miners3.19.20 I am talking about the mining stocks. Pierre Lassonde is the name I could not remember...interviewed on King World News. Useful...just as Kitco is useful, but treat like you would treat your dog who bites...even you. I wish I could recommend a gold/silver advisory service that has a good reputation...but I don't have one that I have followed. I DO think the good services are effective in exposing information that includes Geo-political issues for various mining companies. Two stocks I got from the Lassonde inverview. Two other stocks are from something I read or listened to...and I probably added to my watch list...I kept on the watch list. BUT YOU NEED TO DO YOUR HOMEWORK. If gold and silver break higher, the mining sector will move much higher....many times higher that the physical gold and silver.....BUT THEY ARE VERY RISKY and you don't load the boat with any one stock...you want 4 or 5 stocks or more do diversify the risk.

I am very comfortable with the markets I talk about most. I am not comfortable with mining stocks. IF ANYONE IS COMFORTABLE WITH METALS ADVISORY SERVICES THAT ARE HIGHLY RATED, PLEASE SEND ME ME A PRIVATE NOTE OR POST HERE...I WOULD APPRECIATE THIS AND WILL TAKE A LOOK. IF I LIKE A SERVICE i WILL SUBSCRIBE. I have had many advisory services over the years...never like them...and haven't had any for over 10 years>>>>but the unique Geo-political issues are important for the mining companies....and good advisory services will include this information.

market dynamicsI'd like to talk about market dynamics with the gold market today. This was a very difficult video to produce because I just didn't have enough time to talk sufficiently and without making some mistakes. One point that I did not articulate well is that if you become a seller and the market works against you, then you become a buyer so you are not only feeding the market price action as a seller, but you will feed the market again when you buy the closure short position and this is important because when markets expand the way that I described here buyers and sellers are feeding the market in both directions, and when they trade to their exit when they are losing is feeding the market in the opposite direction that they intended. So when you see big swings in the market going higher it's not just because buyers are stepping in to open, but there are sellers who are buying to close.

One other point: FX entered his trade on a 135 pattern to go long, but when the market broke to a new high and then corrected to the 618 level, it created another 135 pattern to go long. what I said about taking a long trade at that point was based on the volatility of the swings and that if you could locate the entry at the 618 level, there could be an argument to take a long trade there up to the breakout when it went lower and this would represent seven or $800 without too much difficulty. What that means is that your initial draw down of $1800 on your first position comes to the 618, if you can add a contract by scaling into the market, and if you thought the market could trade seven or $800 higher you could actually exit 1 contract, or maybe both contracts to reduce that draw down from the high to couple hundred dollars of today's high.

I am not recommending to anyone to scale in and out of the market or to scale into the market to add to a losing position, but very good traders can do this because they understand market dynamics, and the markets will show you these patterns happening if you're aware of them and this is another way of being aware of how the market trades alternatively in the favor of buyers and sellers if you were always considering both sides of the market. ( sorry for any typos )

ENPH long trade before the reversal This is a different kind of entry than most people will not see or understand. I like to think it involves something I would call market dynamics...but it boils down to buyers vs sellers and fast money vs smart money.

I ran out of time on the video...probably a good thing because I was probably getting a little hypertensive base on the tone and volume of my voice...so that is probably a good thing. Let's see how it plays out.

How to Follow the Market's RhythmMost traders overtrade, for one reason or another. Overtrading is perhaps one of the quickest ways to decimate your account and especially as a retail trader with limited risk capital, the best thing is to only trade when the market is active and offering A+ trades. Efficiency is possible by working smarter, not harder.

The question becomes: how can you identify those instances when it's worth pulling up a chair? When will the market be ripe for participation and when is it better to sit on your hands?

The Market's Rhythm

Some weeks the market is very active, and some weeks (like this week in particular) the market is simply chopping around. There is a rhythm to the market, which is important to understand. All traders probably know by now the usual behavioural traits of the three main money centers in Foreign Exchange:

London is usually the trend-setter;

New York is the deepest liquidity pool and frequently challenges the London move;

Asia is usually the consolidation session.

But sometimes the market is awake and sometimes it seems like it's sleeping. How can you logically forecast when to sit in front of your screens and when to something else with your time?

Let's take this week as an example. This week we've had 3 relatively big pieces of data thus far:

UK employment data

UK CPI

US CPI

You would think that the markets would be pushed around by such items (which usually generate viable NewsFlow Trades) but instead all has gone silent this week. The markets are evidently waiting for something. Bill Lipschutz, founder of Hathersage Capital and Market Wizard, put it this way:

"What is important is to assess what the market is focusing on at the given moment".

By paying attention to any bank sheet or market wrap, it becomes immediately evident what the drivers are for the day or week ahead. This goes one step further than just watching an economic calendar because amongst all the pieces of data, you know which ones will be the main focal points.

In particular, this week the FOMC rates decision and the ECB rates decision take center stage. The markets frequently remain rangebound ahead of such influential decisions and for good reason: if something unexpected comes out of either meeting, it could potentially force a decisive shuffling of positions - meaning large moves. This would make any pre-event risk taking fruitless.

Mindful Inactivity

The key to remaining in touch with the market's rhythm resides in a few important practices:

check your macro calendar at the beginning of each day (as a reminder);

read up on a few bank sheets over the weekend in order to get a feeling for what will be in focus during the week ahead;

read session wraps in order to stay in touch with the day-to-day happenings (ForexLive produces free market wraps for example);

take into consideration bank holidays, regular holiday times (August/December).

Mindful inactivity means that you’re acting like an eagle and not like a pigeon. Eagles do not waste energy. They wait for thermal columns and glide seamlessly upwards, carried by the hot rising wind. Thermals appear during morning or early afternoon hours after the sun rises and warms the earth. When a surface grows hot enough, a thermal column rises into the atmosphere. So that's when it's more likely to see eagles flying. They don't appear out of thin air...you know that they are creatures of habit and are attracted by a certain dynamic.

Mindful traders are tuned into the rhythm of the market and listen, read and prepare. If a trend is starting on the back of a meaningful story/development/news item, a significant price change may follow. Hence, waiting for the market to be inspired by something enhances the risk-reward ratio of your trades, and can also positively impact your win rate.

Good Luck!