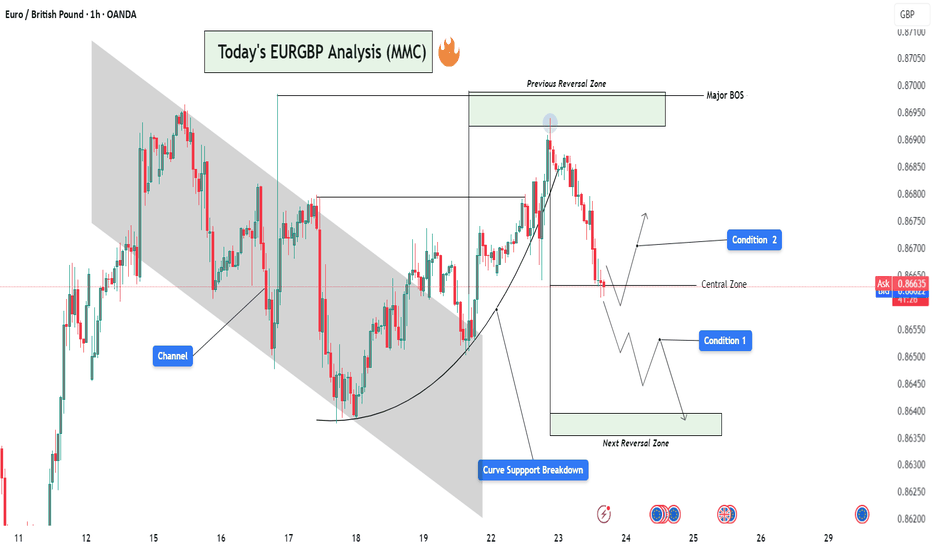

EURGBP Analysis : Curve Breakdown + Directional Setup + Target🧠 Institutional Context & Smart Money Bias

This EURGBP chart offers a masterclass in engineered liquidity and market traps. Institutions have created an illusion of bullish strength through:

A manipulated rounded accumulation curve

A controlled channel phase

A false breakout above the reversal zone

These are textbook signals that the retail crowd is being misled, while smart money is preparing for a deeper move. Let’s dissect it step by step.

📊 Phase-by-Phase Technical Breakdown

🔻 1. Bearish Channel – Sentiment Shaping Phase

From July 11 to July 21, the pair traded within a descending parallel channel, forming a bearish market structure.

This phase was not a genuine trend, but a sentiment builder—to:

Create a belief in continued bearishness

Gather liquidity around the channel boundaries

The upper and lower bounds of the channel were respected precisely, revealing market maker intent.

📈 2. Parabolic Curve Support – Trap Engineered

Price transitioned out of the channel into a rounded bullish curve—a visual cue suggesting accumulation and strength.

This curved trendline often misleads retail traders into thinking a breakout rally is coming.

Price surged aggressively toward the Previous Reversal Zone, further fueling FOMO buys.

But this move was not sustainable. Why?

➡️ Because it lacked a clean base and was built off a manipulated liquidity sweep. The curve was a setup.

🟥 3. Previous Reversal Zone & Major BOS – Institutional Exit Point

Price entered the Previous Reversal Zone, a marked area of prior supply.

This is where institutional orders were likely resting.

After briefly exceeding the previous high, the market instantly reversed with force—evidence of:

Stop hunts

Distribution

Smart money selling into retail breakout buyers

The Major BOS (Break of Structure) confirms the shift: The trend is no longer bullish.

⚠️ 4. Curve Support Breakdown – Structure Shift Triggered

After peaking, the price violated the curve support, confirming the bullish trap.

This breakdown signals a phase transition:

From accumulation illusion → distribution reality

From retail optimism → smart money unloading

🟨 5. Central Zone – Decision Point

Price is now hovering at the Central Zone, a region of equilibrium between buyers and sellers.

This is where market makers may:

Redistribute for another leg down

Fake a pullback before continuing lower

Temporarily rally to trap more longs

This area will determine short-term directional bias. That’s why your setup smartly outlines two conditions from this point.

🔀 Trade Scenarios – MMC Conditions

🔻 Condition 1: Bearish Continuation Toward Next Reversal Zone

If the price rejects the Central Zone and begins forming lower highs and bearish structures:

Expect further downside

This confirms the market is in redistribution mode

Target: Next Reversal Zone at 0.8630–0.8640

💡 Rationale: Institutions are driving price back into demand zones to grab new liquidity or fill leftover buy orders.

🔁 Condition 2: Temporary Recovery & Trap Continuation

If price holds above the Central Zone and breaks short-term highs:

A short-term bullish rally may occur

Likely targets: 0.8675–0.8685

This may act as a fake-out rally, creating more buying interest before a deeper dump

💡 Rationale: Smart money may induce more buyers to create fresh liquidity pockets before dropping toward the next reversal zone.

🔐 Key MMC Zones & Structure Levels

Zone/Level Purpose

0.8695–0.8700 Previous Reversal Zone / Major BOS – Institutional distribution area

0.8660–0.8665 Central Zone – Mid-point equilibrium & battle zone

0.8630–0.8640 Next Reversal Zone – Potential bullish interest area for demand

🧠 Smart Money Summary

This chart showcases a multi-stage smart money plan:

Create channel to shape bias

Form curve to generate false hope

Push into supply and trap late buyers

Break curve support to shift structure

Retest Central Zone to decide next manipulation leg

Deliver price toward true unfilled demand zones

This is how institutions engineer movement while retail gets trapped chasing direction.

Marketmanipulation

BTC - Liquidity Mapping to Predict MovementAs a part II to my previous post on “Bull Market OR Bearish Retest?” - Here is a 2 day liquidity map on BTC’s chart.

I’m anticipating a sharp drop to 7,000 - why is this number significant?

There is a mass amount of liquidity in the chart down towards 7,000-10,000.

This liquidity is in the form of long stop loss orders.

In layman’s terms - the sell orders required to take price to this extreme low are already within the chart. It is a pre-set consequence to traders decisions in a market dominated by leveraged buys and sells.

If we consider what the “floor” price of BTC is (IE all long term secured holders) - we first have to seperate out the leveraging liquidity used in the futures market.

How much of the BTC market cap is injected liquidity from futures / derivatives? In my view, anything above 7,000.

This liquidity can flow in and out, and the business and function behind it isn’t affected. This liquidity is extremely fluid. It can drop 90,000 and rise 90,000 shortly after without any affect on the fundamental value of Bitcoin.

Sure there is a psychological consequence with perceived value and market stability - but the fact is, leveraged liquidity can enter the market and leave the market with no impact at all on the wallets of market makers.

Food for thought - happy trading.

Trump vs. Powell: 4d Gold Price Roller Coaster📊 Summary of Recent 4 Trading Days

During the ongoing US-China trade war, President Trump has ramped up his public criticism of Federal Reserve Chair Jerome Powell. Though he lacks the authority to remove Powell directly it seems, Trump's frustration with the Fed’s independent policy direction has led to an apparent institutional power struggle.

This conflict hasn’t gone unnoticed by the markets. Just the mention of removing Powell caused the gold price to spike, as stock market money got squeezed out, amplified by tensions in the trade war. The Federal Reserve’s credibility is high, so such remarks naturally trigger significant volatility.

After Trump's initial outburst, gold surged $216. But when he softened his tone, the price reversed just as dramatically—falling about $240 (with the trading day still ongoing at the time). Hopes for progress in trade negotiations also played a role in this sharp reversal.

⚠️ Warning Signs of Market Distortion

Statements from the US President now function almost like market-moving events in addition to normal news. For gold traders, this creates an unstable environment where typical technical setups may fail.

The past days showed signs of manipulated or artificial movements—with potential insider activity. One notable example: Gold looked set to break higher after a 1-hour candle closed above the EMA 20 line. But a sudden $12 bearish candle in the last 30 seconds erased the setup. It felt orchestrated—possibly by institutional players defending key levels.

💡 Trader’s Takeaway

Don’t blindly trust technical signals in this environment.

Watch for political noise—it’s louder than usual.

Prefer quieter markets if you’re risk-averse.

Expect $100+ daily ranges and frequent price whipsaws.

🗣 What’s your take?

Is Trump really influencing the gold market on purpose—or just creating chaos? Let’s discuss below. 👇

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Hidden Forces: Decoding Buyer & Seller Activity on ChartsTotal Volume vs. Volume Delta: The total volume on the chart includes both buys and sells, making it less useful for analysis. Volume Delta, however, shows whether buyers or sellers dominated within a candle.

A green Delta candle means more aggressive retail buying; a red one means more retail selling. This helps analyze market sentiment beyond price movement.

Price & Delta Relationships:

1. Price and Delta move together → Organic movement, likely driven by retail.

2. Delta moves, but price doesn’t → Retail is heavily biased in one direction, absorbing limit orders. Possible smart money trap.

3. Price moves, but Delta doesn’t → Retail didn’t participate in the move. Lack of belief or failed market-making attempt.

4. Price moves against Delta → Strong indication of market manipulation. Large players using aggressive strategies against retail.

Market Manipulation & Smart Money:

* Whales leverage retail psychology and order flow to position themselves.

* Retail often gets caught in fake moves, unknowingly providing liquidity to big players.

Final Thought: By analyzing Delta and price movement together, we can spot hidden large buyers and sellers and understand market dynamics beyond surface-level price action.

Can a Corporate Titan Withstand the Tremors of Allegations?In the high-stakes arena of global business, few narratives captivate the imagination quite like the meteoric rise and sudden turbulence of an economic powerhouse. The Adani Group once celebrated as a paragon of Indian entrepreneurial success, now finds itself navigating treacherous waters of legal scrutiny and market skepticism. What began as a remarkable journey of a diamond trader turned infrastructure magnate has transformed into a complex tale of ambition, power, and potential corporate misconduct that challenges our understanding of success in the modern economic landscape.

The allegations against Gautam Adani—ranging from securities fraud to a purported massive bribery scheme—represent more than just a corporate challenge; they symbolize a pivotal moment of reckoning for corporate governance in emerging markets. With U.S. prosecutors indicting Adani and a damaging report by Hindenburg Research accusing the group of "the largest con in corporate history," the conglomerate has witnessed a staggering $68 billion evaporation of market value. This precipitous fall from grace serves as a stark reminder that even the most seemingly invincible corporate empires can be vulnerable to the harsh light of forensic scrutiny and legal investigation.

The unfolding saga transcends the individual narrative of Gautam Adani, touching upon broader themes of economic development, political connections, and the delicate balance between entrepreneurial ambition and ethical conduct. As the Adani Group confronts these unprecedented challenges, the world watches with bated breath, understanding that the outcome will not merely determine the fate of one business empire, but potentially reshape perceptions of India's economic credibility on the global stage. The resilience, transparency, and response of the Adani Group in the face of these allegations will serve as a critical case study in corporate accountability and the complex interplay between business, politics, and regulatory oversight.

Ultimately, this narrative invites us to reflect on the fundamental principles of corporate integrity and the thin line between visionary entrepreneurship and potential systemic manipulation. As investors, policymakers, and global observers, we are compelled to ask: Can reputation, built over decades, withstand the seismic tremors of serious allegations? The Adani Group's journey offers a compelling, real-time exploration of this profound question, challenging our assumptions about success, power, and the intricate mechanisms that govern global business ecosystems.

Avoiding the Pump and Dump: A Beginner's GuideAvoiding the Pump and Dump: A Beginner's Guide to Protecting Your Investments

In the dynamic world of stock trading, new traders are constantly seeking ways to maximize profits and minimize risks. Unfortunately, one of the most deceptive and harmful schemes that can easily trap beginners is the infamous pump and dump scheme. This fraudulent practice has been around for decades, targeting unsuspecting traders by artificially inflating a stock's price and then swiftly cashing out, leaving the victims with significant losses. For traders on platforms like TradingView, especially those just starting, it’s crucial to understand how to spot these schemes and avoid falling prey to them.

This guide will provide you with the knowledge you need to recognize pump and dump schemes by analyzing monthly, weekly, and daily charts, identifying repetitive patterns, and understanding market sentiment. By the end, you'll know exactly what to look for to safeguard your investments.

What is a Pump and Dump?

A pump and dump scheme occurs when a group of individuals, often coordinated through social media or private channels, artificially inflates the price of a stock. They "pump" up the stock by spreading misleading information or creating hype around the asset, leading to increased buying interest. Once the stock price has risen significantly, the perpetrators "dump" their shares at the elevated price, leaving uninformed buyers holding a stock that will soon plummet in value.

The key elements to watch out for are:

Unusual price spikes without any corresponding fundamental news.

High trading volume during these spikes, suggesting that a group of individuals is actively manipulating the price.

Aggressive promotion through emails, forums, or social media channels, often making exaggerated claims about a stock's potential.

Understanding Timeframes: Monthly, Weekly, and Daily Charts

One of the most effective ways to spot pump and dump schemes is by analyzing various timeframes—monthly, weekly, and daily charts. Each timeframe provides different insights into the stock's behavior, helping you detect irregular patterns and red flags.

Monthly Charts: The Big Picture

Monthly charts give you a broad overview of a stock's long-term trends. If you notice a stock that has been relatively inactive or stagnant for months, only to suddenly surge without any substantial news or developments, this could be a sign of manipulation .

What to look for in monthly charts:

Sudden spikes in price after a prolonged period of flat or declining movement.

Sharp volume increases during the price rise, especially when the stock has previously shown little to no trading activity.

Quick reversals following the price surge, indicating that the pump has occurred, and the dump is on its way.

For example, if a stock shows consistent low trading volume and then experiences a sudden burst in both volume and price, this is a classic sign of a pump. Compare these periods with any news releases or market updates. If there’s no justifiable reason for the spike, be cautious .

Weekly Charts: Spotting the Mid-Term Trend

Weekly charts help you see the mid-term trends and can reveal the progression of a pump and dump scheme. Often, the "pump" phase will be drawn out over several days or weeks as the schemers build momentum and attract more buyers.

What to look for in weekly charts:

Gradual upward trends followed by a sharp, unsustainable rise in price.

Repeated surges in volume that don’t correlate with any fundamental analysis or positive news.

Recurrent patterns where a stock has previously been pumped, experienced a sharp decline, and is now showing the same pattern again.

Stocks used in pump and dump schemes are often cycled through multiple rounds of pumping, so if you notice that a stock has undergone several similar spikes and drops over the weeks, it’s a strong indicator that the stock is being manipulated.

Daily Charts: Catching the Pump Before the Dump

Daily charts provide a more granular view of a stock's price movement, and they can help you detect the exact moments when a pump is taking place. Because pump and dump schemes can happen over just a few days, monitoring daily activity is critical.

What to look for in daily charts:

Intraday price spikes that happen suddenly and without any preceding buildup in momentum.

A huge increase in volume followed by rapid price drops within the same or subsequent days.

Exaggerated price gaps at market open or close, indicating manipulation during off-hours or lower-volume periods.

On a daily chart, if a stock opens significantly higher than the previous day's close without any news or earnings report to back it up, this could be the start of the dump phase. The manipulators are looking to sell their shares to anyone who has bought into the hype, leaving retail traders holding the bag.

Repeated Use of the Same Quote: A Telltale Sign of a Pump and Dump Scheme

Another red flag is when the same stock or "hot tip" keeps resurfacing in social media, forums, or emails. If you notice that the same quote or recommendation is being promoted repeatedly over time, often using the same language, this is a strong sign of manipulation. The scammers are likely trying to pump the stock multiple times by reusing the same tactics on new, unsuspecting traders.

Be cautious of stocks that:

Have been heavily promoted in the past.

Show a history of sudden spikes followed by rapid declines.

Are promoted with vague, overhyped language like "the next big thing" or "guaranteed gains."

If the same stock is mentioned multiple times in trading communities, check its historical chart. If the stock has undergone previous pumps, you will likely see sharp rises and falls that align with the promotional periods.

How to Avoid Pump and Dump Schemes

Now that you know how to spot the signs, here are actionable steps you can take to protect yourself from becoming a victim of a pump and dump scheme:

Do Your Research: Always verify the information you receive about a stock. Check if there’s legitimate news, earnings reports, or significant company developments that justify the price movement. Avoid relying solely on social media or forums for your stock tips.

Look at Fundamentals: Focus on stocks with solid fundamentals, such as earnings growth, revenue increases, and strong management. Stocks targeted for pump and dump schemes often have weak or non-existent fundamentals.

Use Multiple Timeframes: As we've discussed, examining stocks across different timeframes—monthly, weekly, and daily—can help you spot abnormal price behavior early on.

Monitor Volume and Price Movements: If you see large, unexplained surges in volume and price, be skeptical. Legitimate price increases are usually accompanied by news or fundamental changes in the company.

Avoid Low-Volume Stocks: Pump and dump schemes often target low-volume, illiquid stocks that are easier to manipulate. Stick to stocks with healthy trading volumes and liquidity.

Set Stop Losses: Always use stop losses to protect yourself from sudden price drops. Setting a stop loss at a reasonable level can help limit your losses if you accidentally invest in a stock being manipulated.

Be Wary of Promotions: If a stock is being aggressively promoted, ask yourself why. More often than not, aggressive promotions are a sign that the stock is part of a pump and dump scheme.

Conclusion

Pump and dump schemes prey on traders’ fear of missing out ( FOMO ) and the allure of quick profits . However, by using a disciplined approach to trading, analyzing charts across multiple timeframes, and paying close attention to volume and price movements, you can avoid falling victim to these schemes.

Remember: If something seems too good to be true, it probably is. Protect your investments by staying informed, doing thorough research, and trusting your analysis. By following these guidelines, you can navigate the markets with confidence and avoid the pitfalls of pump and dump schemes.

Happy trading, and stay safe!

Quadruple Witching: What Retail Traders Should Know█ Quadruple Witching is Happening Today: What Retail Traders Should Know!

Today marks Quadruple Witching, a pivotal event in the financial markets that occurs four times a year—on the third Friday of March, June, September, and December. During Quadruple Witching, four types of derivative contracts expire simultaneously:

Stock Index Futures

Stock Index Options

Single Stock Futures

Single Stock Options

When all four of these contracts expire simultaneously, it can lead to increased trading volume and heightened volatility in the markets. The term "witching" is derived from the "Triple Witching" event, which involves the simultaneous expiration of three types of contracts (stock index futures, stock index options, and single stock options). Quadruple Witching adds the expiration of single stock futures to this mix.

This convergence leads to a surge in trading activity and heightened market volatility as traders and investors adjust or close their positions.

█ When Does Quadruple Witching Occur?

Quadruple Witching takes place on the third Friday of March, June, September, and December each year. These dates align with the end of each fiscal quarter, making them significant for various market participants.

█ What Retail Traders Should Be Aware Of

⚪ Increased Volatility

Price Swings: Expect more significant and rapid price movements in both individual stocks and broader market indices.

Unpredictable Trends: Sudden shifts can occur, making it challenging to anticipate market direction.

⚪ Higher Trading Volume

Liquidity Peaks : Trading volumes can spike by 30-40%, enhancing liquidity but also increasing competition for trade execution.

Potential for Slippage: High volumes may lead to slower order executions and potential slippage, where trades are executed at different prices than intended.

⚪ Potential for Market Manipulation

Large Institutional Trades: Institutions managing vast derivative positions can influence stock prices, creating opportunities and risks.

Short-Term Opportunities: Retail traders might find short-term trading opportunities but should exercise caution.

⚪ Emotional Discipline

Stress Management: The fast-paced and volatile environment can be emotionally taxing. Maintain a clear trading plan to avoid impulsive decisions.

Risk Management: Use stop-loss orders and position sizing to protect against unexpected market moves.

█ Historical Perspective and Market Behavior

Historically, Quadruple Witching days have been associated with noticeable market movements.

⚪ Price Trends

Some studies suggest that markets may trend in the direction of the prevailing market sentiment leading into the expiration day.

⚪ Volatility Patterns

Volatility tends to spike during Quadruple Witching, especially in the final hour of trading, as traders finalize their positions.

⚪ Volume Spikes

Trading volumes can increase by 30-40% compared to regular trading days, reflecting the high level of activity as contracts expire.

█ Tips for Navigating Quadruple Witching

⚪ Avoid Trading

Some traders prefer to stay out of the market to avoid unpredictable price movements and potential losses.

⚪ Stay Informed

Market News: Keep abreast of financial news and updates that may influence market sentiment.

Contract Expirations: Be aware of which contracts are expiring and their potential impact on specific stocks or indices.

⚪ Focus on Liquidity

Trade Liquid Stocks: Opt for highly liquid stocks and ETFs to ensure smoother trade executions and tighter bid-ask spreads.

Avoid Thinly Traded Assets: Steer clear of stocks with low trading volumes to minimize execution risks.

⚪ Use Limit Orders

Control Entry and Exit Points: Limit orders allow you to set specific prices for buying or selling, helping manage execution prices amidst volatility.

⚪ Monitor Key Levels

Support and Resistance: Keep an eye on critical technical levels that may act as barriers or catalysts for price movements.

Volume Indicators: Use volume-based indicators to gauge the strength of price movements.

⚪ Maintain Discipline

Stick to Your Plan: Adhere to your trading strategy and avoid making decisions based on fear or greed.

Manage Risk: Implement strict risk management practices, such as setting stop-loss levels and not overexposing your portfolio.

█ Key Takeaways

⚪ Frequency: Occurs four times a year on the third Friday of March, June, September, and December.

⚪ Impact: This leads to increased trading volume and volatility due to the expiration of four types of derivative contracts.

⚪ Strategies: Traders may choose to avoid trading, focus on liquid assets, implement strict risk management, or exploit short-term volatility.

⚪ Risks: These include unpredictable price movements, liquidity issues, execution challenges, and emotional stress.

█ Conclusion

Quadruple Witching can significantly impact market dynamics, presenting both opportunities and challenges for retail traders. By understanding the mechanics of this event and implementing strategic measures, traders can better navigate the heightened volatility and make informed decisions. Remember to stay disciplined, manage your risks effectively, and focus on liquid assets to optimize your trading performance during Quadruple Witching days.

-----------------

Disclaimer

This is an educational study for entertainment purposes only.

The information in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell securities. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

Understanding Dark Pools█ Diving Into Dark Pools

In recent years, dark pools have become a significant part of the financial markets, offering an alternative trading venue for institutional traders. But what exactly are dark pools, and how do they impact market quality and price efficiency? This article delves into the comprehensive study titled "Diving Into Dark Pools" by Sabrina Buti, Barbara Rindi, and Ingrid Werner, which sheds light on the complexities of dark pool trading in the US stock market.

█ What Are Dark Pools?

Dark pools are private financial forums or exchanges for trading securities. Unlike public stock exchanges, dark pools do not display the order book to the public until after the trade is executed, providing anonymity to those placing trades. This lack of pre-trade transparency can help prevent large orders from impacting the market price, which is particularly beneficial for institutional investors looking to trade large volumes without revealing their intentions.

█ How Do Dark Pools Work?

In dark pools, the details of trades are not revealed to other market participants until the trade is completed. This lack of transparency helps prevent significant price movements that could occur if the order were known beforehand. Dark pools typically execute trades at the midpoint of the best bid and ask price in the public markets, ensuring fair pricing for both parties involved.

█ Why Are Dark Pools Used?

Dark pools are primarily used by institutional investors who need to execute large trades without revealing their trading intentions. Displaying such large orders on public exchanges could lead to unfavorable price movements due to market speculation and front-running by other traders.

█ Benefits of Dark Pools

Reduced Market Impact: Large orders can be executed without affecting the stock's market price.

Anonymity: Traders can buy or sell significant amounts without revealing their identity or strategy.

Lower Transaction Costs: By avoiding the public markets, traders can often reduce the costs associated with large trades.

Improved Execution: Dark pools can offer better execution prices due to the lack of market impact and reduced volatility.

█ Why Do Large Actors Hide Their Orders Using Dark Pools?

Large institutional investors use dark pools to hide their orders to:

Avoid Market Manipulation: Prevent others from driving the price up or down based on the knowledge of a large pending trade.

Maintain Strategic Advantage: Keep trading strategies and intentions confidential to avoid imitation or counter-strategies by competitors.

Achieve Better Prices: Execute trades at more favorable prices by not alerting the market to their actions.

█ Actionable Insights for Traders

Understand Market Dynamics: Knowing how and why dark pools are used can provide insights into market liquidity and price movements.

Monitor Market Quality: Be aware that increased dark pool activity can improve overall market quality by reducing volatility and spreads.

Assess Price Efficiency: Recognize that while dark pools can enhance market quality, they might also lead to short-term inefficiencies like price overreaction.

█ Key Findings from the Study

The study analyzed unique data on dark pool activity across a large cross-section of US stocks in 2009. Here are some of the critical insights:

Concentration in Liquid Stocks: Dark pool activity is predominantly concentrated in liquid stocks. Specifically, Nasdaq stocks show higher dark pool activity compared to NYSE stocks when controlling for liquidity factors.

Market Quality Improvement: Increased dark pool activity correlates with improvements in various market quality measures, including narrower spreads, greater depth, and reduced short-term volatility. This suggests that dark pools can enhance market stability and efficiency for certain stocks.

Complex Relationship with Price Efficiency: The relationship between dark pool activity and price efficiency is multifaceted. While increased activity generally leads to lower short-term volatility, it can also be associated with more short-term overreactions in price for specific stock groups, particularly small and medium-cap stocks.

Impact on Market Dynamics: On days with high share volume, high depth, low intraday volatility, and low order imbalances, dark pool activity tends to be higher. This indicates that traders are more likely to use dark pools when market conditions are favorable for large trades.

█ Conclusion

Dark pools play a crucial role in modern financial markets by allowing large trades to be executed without revealing the trader’s intentions, thus minimizing market impact and reducing costs. For retail traders, understanding the mechanics and implications of dark pools can lead to better-informed trading decisions and a deeper comprehension of market behavior. The study concludes that while dark pools generally contribute to improved market quality by reducing volatility and enhancing liquidity, their effect on price efficiency is nuanced. For small and medium stocks, dark pools can lead to short-term price overreactions, while large stocks remain largely unaffected. The findings underscore the importance of understanding the different impacts on various stock categories to make informed trading decisions.

For institutional traders and market participants, understanding the role and impact of dark pools is crucial for navigating the modern financial landscape. By offering an alternative venue for executing large trades discreetly, dark pools play a pivotal role in today's trading ecosystem.

█ Reference

Buti, S., Rindi, B., & Werner, I. (2011). Diving into Dark Pools. Charles A. Dice Center for Research in Financial Economics, Fisher College of Business Working Paper Series, 2010-10.

-----------------

Disclaimer

This is an educational study for entertainment purposes only.

The information in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell securities. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

The dreaded 4 o'clock candle of death! Market manipulation!As we all know, there's a group of people that will never be held accountable, that regulators will never bother, for whom 'ethical standards' do not exist, that constantly, and consistently manipulate the price of XRP to the downside while the vast majority of traders are tucked in bed asleep, clueless and oblivious, why their stop-losses are taken out, and in most cases long positions are being completely liquidated, and the majority of their hare-earned profits are stolen from them by large accounts.

It's called 'the dreaded 4 o'clock candle of death' for those of you aren't aware.

Even though every transaction is clearly registered on the blockchain for the world to see. Even though we can all see the accounts responsible. Even though it's clear manipulation, and clearly illegal.. NOTHING WILL EVER BE DONE ABOUT IT!

Pack your bags, accept your losses and move on because money isn't the name of the game - 'control' is!

P.S. Never leave your position open overnight if you're trading with leverage, because 'THEY' will come for your profits, and nothing will ever stop it, it will never change, it's just how the game is played - more for 'THEM' and less for everybody else.

Welcome to the unregulated wild-wild-west of trading.

Psychology & Market Manipulation - Case StudyGood Day - hope everyone is doing well, and welcome to a brief case study of an Trade Idea we shared with VIP Members earlier this year, and executed for our Fund.

Without repeating what's above - it's clear that the market will give Retail Traders a 'Judas Goat', to induce false positions, early sells and generally spread a feeling of fear & anxiety, clouding judgement, firing up the amygdala, and feasting at an empty table, the liquidity that was so easily given up to the most powerful actors in the market: Banks & Financial Institutions.

By truly understanding liquidity, price action and psychology - you can consistently execute flawlessly, on high-risk-reward opportunities.

And that's all it comes down to, and the end of the day, when we talk about trading.

Do you agree?

Let me know in the comments below. Cheers.

Manipulation after ManipulationI was able to spot the first noted market manipulation in BTC. Sorry if I did not include the details as it would clog the chart. However, similar case happened on the second manipulation just hours after the first one. The details are posted in the chart.

Never expected that whales would perform the manipulating illusion twice at the same day haha. Indeed, BTC is really a highly manipulated coin

If you have questions, feel free to dm me in my twitter: @flerovium_

$SLP Market Manipulation Successful!I want to start this article with the quote I published in twitter

"The more you anticipate, the more you'll be manipulatable"

A lot anticipated the Origin pump of $SLP since the start of April. Market manipulators knew that. As you can observe from vector 0, MM's started to push the price to create an illusion that SLP is very bullish. They were able to perform the Tri-dimensional Axes of Manipulation, namely, Von Restorff Effect, Reverse Psychology, and Bandwagon effect. The details are in the chart.

If you have questions, you can dm me in my twitter account:

@flerovium_

XAU/USD - Potential 700+ Pip Drop Analysis Broken DownPrice broke the HH & HL structure on the 1 & 4hr timeframe, and has now been retracing upwards towards the Daily/1hr OB.

We also have a strong liquidity level below and an IC candle right below it, making it a decent level to target.

Our first potential entry area is marked from the 1 hour OB, and our tighter, lower risk entry is marked from the 15 min OB. The 15 min entry also perfectly lines up the the 0.88 fibonacci level, making it look like a stronger entry point.

Looking at both sides of the coin, there still is great possibility that the HH’s & HL’s could continue and price could resume heading to the upside, breaking past our entry point and testing off the OB at the 1860 level instead.

EURUSDEURUSD had a lot of inducement in liquidity and therefore a lot of retail traders being caught in the trap of the market maker, but it then produced two sniper entries targeting last week's low, the market are not random. the trick is to be able to know what the market maker is planning and what the algorithm is is about to do, the algorithm will never favour retail traders unless you know what is happening behind the scenes, that's the best way you can have an edge over the market.

XAUUSD SMC analysisGold had a nice move this week, the move was nice and simple. from last week's consolidation and liquidity inducement, this week was just a sweep of liquidity from that consolidation especially the buy side liquidity, it then gave us a nice entry when it mitigated on a 30 min Orderblock with a nice sniper entry at 1870 targeting areas of imbalances.

EURUSDAlthough i did not have a worthy trade setup on wednesday, EURUSD provided an amazing trading week for many, this is the perfect example of what true institutional trading and market manipulation is all about. If you know what you are looking for, the market becomes your play ground. learn the truth of the market and stop following these IG "gurus" that mostly mislead you and fill you with retail useless information.

Market manipulation. Man does it tick me off. How do I cope?This is a TUTORIAL about ATTITUDE and is NOT technical analysis. Maybe my thoughts (rant?) will help you remain calm the next time they manipulate prices.

I'm gonna "get real" here and be a little rude and a whole lot long-winded. If you don't like me, that's fine. Block me. But my objective is honorable in that I hope to help you develop "stalls of beel" if you get my drift. Fingers crossed that will make it through the moderators.

Greetings from central Pennsylvania, USA. You can call me Pops. I'm 59. My thoughts on September 7th...

Here we go again. Another EIGHT THOUSAND DOLLAR DUMP in BTC price in TWO HOURS. Who among us is NOT frustrated? It's obviously market manipulation and it's universally DISGUSTING. BUT, it is not the end of the world. My ATTITUDE has saved me from financial loss during EVERY dump like this without fail.

So how do I avoid losing money? That's EASY. And how do I TRY to remain calm? That's not so easy. In fact, it's VERY, VERY difficult to remain calm because I hate it when "the strong" take advantage of "the weak." But remaining calm is possible - for ME - because I have DECIDED BEFOREHAND how important it is and how I am going accomplish it.

My "attitude/investment/trading" rules are, in general:

1. ABSOLUTE NUMBER ONE RULE is that I do my financial business on a large computer screen. NO MOBILE PHONE CRYPTO!! That's like trying to look at the universe through a pin hole. The first thing I tell friends is if they want to talk crypto investing, use a real computer or you're just not serious.

2. I refuse to "have" FOMO or FUD. They are EMOTIONAL reactions and I refuse to risk my money with emotional decisions.

3. It's all MY money. No leverage trades. NEVER, NEVER, EVER! Leverage, in MY opinion, would cause ME to "go broke quickly." No thank you. I'm patient enough to "get rich slowly."

4. I NEVER sell during these dumps. NEVER. Period. I know market manipulators have dumped the price because they are preparing to allow it to go up again. And - I have seen it over and over again - it will probably recover within a couple of days. Look, man, I didn't make no money and I didn't lose no money until I either take profits or sell at a loss. Until that happens, it's just numbers on a screen.

5. Every supposed "nightmare" like this dump presents an opportunity - for a person with a resilient ATTITUDE and a creative mind.

Those are just some of my general rules.

Now here is what my resilient attitude is doing with today's nightmare. To make the math easy and to keep this EXAMPLE easy, let's just say the 10 o-clock candle high was $51,000 and the 11 o-clock candle low was $43,000. Those are not the PRECISE numbers, but this is all "food for thought" and is "approximately" what I have done today...

I have now set aside a portion of my portfolio EXCLUSIVELY to take advantage of these dumps. In this EXAMPLE ( that's EXAMPLE) I bought .1 BTC at $4,682 when the 11 o-clock candle closed. I'm not gonna bullcrap you and say I "caught the bottom" at $43k. But that gigantic tail on the 11 o-clock candle says the close at $46.8k is about as low as I could buy without using a crystal ball. And I immediately set a sell order for when the price returns to $51,000 and I'll be selling my .1 BTC for $5,100 and now I've got a little bit more to "buy the dip" and repeat this process the next time this happens again.

So I've got chunks of money for different investment and/or trading purposes. And another chunk today. Not financial advice. Blah, blah, blah. I'm making a decent living, especially for an old dude in crypto. If you think I'm an idiot, you are absolutely correct. So block me and move on. Of course I'll be an emotional wreck for days, but, in time, somehow, my life will have meaning again.

However... if you are a person who understands the value of thinking outside the box, of brain-storming, of "kicking around ideas," then stick around because every post I make is going to be just like this.

NOW CHEER UP, MAN!

Wyckoff Accumulation (Update)For the past month Bitcoin has been in a very boring sideways moving range. However this pattern shown in the chart is a Wyckoff accumulation pattern which is used by the big whales to manipulate the market and acquire as much Bitcoin as possible while making the weak hands sell their Bitcoins by bulltrapping and bear trapping as seen in phase B and C. If BTC can hold the 33k level until the next daily candle this might be the last time we see 33k. We are at the very end of Phase C according to the Wyckoff accumulation pattern and are starting Phase D which signals a huge move towards the upside before consolidating a bit and launching even higher in Phase E. This would be a really good long position to keep an eye for. RSI on the Daily is also looking very bullish. It has been trending in a downwards sloping resistance for a couple of days now and a break up is inevitable and could result in a big move for Bitcoin! have linked a picture of the Wyckoff accumulation pattern. Good luck traders!

BTC/USDT SHORT...BITBAY:BTCUSDT

Like I already told you. DONT LAUGH AT ME...

I mentioned that I WILL NOT DO ANYTHING :) and you laughed at me. But it is okay.

Hope we will do better now and help each other and send me a more informative criticism not just bullsh^t comments.

I am here to share these trades

I have been telling you not to do anything unless we are close to that 30K wall. We need to hold that wall and or we will fall if we don't.

The only mistake i did with you guys is I DID NOT let you make aware that we will face a huge fight of FUDs and Official news even tho it is old.

This is not Bear Market (prolonged) this is just place we need to retrace from a raging heights from 10K to 30K to 40K back to 30K to 50K to 64K and we are here.

Still fvvck the government. Let's not say things about race. Government are one and their goal is to control us. Real Democracy is Decentralized. This is the time we can own something finally don't sell your BTC to the whales and bad whales. They will really buy it.

my techanalysis is still the same for the last week. I am the only consistent. I wont change. we are still shorting this then take profit to safe coins then move those short profits at buying more good project coins...

HODL wallet I have is...

$LTC $BTC $ETH $ADA $LINK $DOT $BNB

Cathie Wood vs. HindenburgIn the Blue Corner: Cathie Wood

Who is Cathie Wood?

Cathie Wood is the founder and CEO of Ark Invest. One of the most popular investment management firms that focus on growth sectors and long-term, high-reward investments.

Wood is the former Chief Investment Officer at AllianceBernstein, but left the company in 2014 to start Ark Invest after her popular disruptive innovation funds were deemed to be too risky.

Why has she become so famous?

In 2021, Forbes named her in the “50 over 50” list of influential figures over the age of 50. She was named the Best Stock Picker of the Year by Bloomberg News in 2020.

Wood has gained a massive following in social media communities such as FinTwit and Reddit. Her focus on popular growth names is held by many as the industry standard of how growth sectors are performing.

Wood has made several forward-looking forecasts that have gained both the ire and praise of Wall Street.

In 2018, she famously predicted Tesla TSLA would hit $4,000.00 per share. She was ridiculed at the time, but in January of 2021, Tesla shares hit that mark on a split-adjusted basis.

Wood has also predicted that the digital currency Bitcoin BTC will one day hit a price of $500,000.00.

She definitely puts her money where her mouth is by adding both Grayscale Bitcoin Trust GBTC and Coinbase COIN shares to her various ETFs.

In the Red Corner: Hindenburg Research

Who is Hindenburg Research?

Hindenburg Research is a well-known investment research firm that focuses on short-selling stocks by releasing reports alleging things like fraud or providing information that misleads investors.

Hindenburg was founded by Nathan Anderson. An activist short-seller that has made a living off of taking down publicly traded companies.

Why are they so famous?

Hindenburg Research has been one of the more accurate short-selling investment research firms over the past few years and have revealed fraudulent activities by several different companies.

First, it exposed electric truck maker Nikola Motors NKLA in a damning report that revealed CEO Trevor Milton was behind operating Nikola as an ‘intricate fraud’ .

The timing of the report couldn’t have been better: It was on September 10, 2020.

Just days after Nikola announced it was entering into an agreement with auto industry heavyweight General Motors GM .

Milton was ousted as CEO and never did deliver his long awaited rebuttal to Hindenburg.

Shares of Nikola have plummeted from unimaginable highs of $93.99 in June of 2020, to its current price of just over $15.00 per share.

Nikola is now the poster child of skepticism surrounding companies that come public via SPAC IPOs.

Hindenburg took on another EV SPAC company in Lordstown Motors RIDE , releasing a scathing report on March 12 of this year.

Just last week, Lordstown saw both its CEO and CFO resign. As well as the company reporting that there is significant doubt it will be able to meet previous production estimates.

Hindenburg has taken on other heavyweights and is well known for taking a short position and driving stock prices lower.

The Heavyweight Fight: Cathie Wood vs. Hindenburg Research

Round 1: Hindenburg Throws The First Punch

On June 15th, Hindenburg struck again, this time targeting popular sports gambling and fantasy sports company DraftKings DKNG .

Some well-known investors in DraftKings include Walt Disney DIS , WWE owner Vince McMahon, and owner of the New England Patriots, Robert Kraft.

DraftKings also has lucrative partnerships with the NFL, MLB, NHL, NASCAR, UFC, and the Dish Network.

A lot of potential brands could be hurt by these allegations if proven true.

n the report, Hindenburg alleges that DraftKings’ SPAC merger partner, a Bulgarian company called SBTech, is heavily involved in the black market and illicit gambling that has ties to money laundering and organized crime.

SBTech was absorbed into DraftKings as a part of the SPAC merger.

It now operates as an in-house part of the DraftKings brand. Therefore, allegations against SBTech are allegations against DraftKings as well.

According to Hindenburg, SBTech attempted to distance itself from the black market and organized crime prior to the merger with DraftKings.

It even created a new entity called BTi, that acted as a front for SBTech so it could continue to make revenues from markets where gambling was illegal.

Hindenburg gives an estimate that 50% of SBTech’s revenues are made in markets where gambling is considered illegal.

n fact, Hindenburg actually gives several gambling websites that have ties to known organized crime rings, that led back to SBTech and its subsidiaries.

These allegations are some of the most serious that Hindenburg has reported, with legitimate legal consequences that could have a long-term effect on the DraftKings brand.

Shares of DraftKings fell by 4.2% following the news.

Does Hindenburg Research have a short position on DKNG? At what price?

Oh you better believe Hindenburg has a short position in DKNG. So as with most short-seller reports, take them with a grain of salt.

While Hindenburg does not reveal how large of a short position they own, fundamentally it is in their best interest for the DKNG stock to continue to fall.

Round 2: Cathie Wood Attacks

Enter Cathie Wood, who may just be the personification of buying the dip!

Wood is well known to target companies she likes long-term that are beaten down.

Some examples of this include her continued support of Coinbase COIN and Teladoc TDOC during their prolonged dips.

So how much DraftKings did Wood buy? She added $42 million worth or 870,299 shares following Hindenburg’s report.

Wood added these shares to both her Ark Next Generation Internet ETF ARKW and her Ark Innovation ETF (ARKK).

The stock now represents the 19th and 17th largest holdings in each ETF respectively.

It seems like the markets were supportive of Wood’s investment as shares of DraftKings closed the next day higher by 0.6%, outpacing the broader markets.

There Can Be Only One!

… Who will win?

Judging from DraftKings’ rise the next day, it looks as though Wood and Ark Invest have taken round one from Hindenburg.

The report from Hindenburg was thorough and detailed, but unfortunately for them, there is a general disdain right now for short sellers in this market.

Retail investors have made it their mission to blow up short positions across the market, so we just don’t think Hindenburg’s latest report will hold up against the Queen of Growth, the Duchess of Buying that Dip, Cathie Wood.

What do YOU think? Who will win this fight?

USDCHF Continuation, LongGood morning ladies & gents,

Following on from my USDCHF idea last week that has destroyed TP 1, I'm now anticipating continuations long for another day. I'd anticipate a repricing on Tuesday/Wednesday downwards, but for now, DXY should be strong.

In light of this, I've taken an entry here off the M30 +OB anticipating price to hit the high of the day then take the next high lying above.

Let's see how it plays out.

RR 1:5 on the table.

Partials will be taken @ the following points I've highlighted.

As it's Monday, I'll be employing significantly lower risk as statistically this is my LEAST profitable day where I tend to avoid trading - unless a pristine setup forms like so.

Good luck.

- AmplaFX