Bitcoin Year 2025Market analysts and crypto experts anticipate that Bitcoin could soar to $600K this year, fueled by supportive policies and growing institutional adoption. Key drivers include deregulation efforts and pro-crypto measures under the current administration. President Trump has also reshaped the political landscape by appointing lawmakers who strongly advocate for cryptocurrency, setting the stage for a potential rally.

Marketneutral

EUR/USD Institutional Trading StrategyHello, guys! It's been a while since last I posted here on TradingView. I'm today releasing into the wild my trading strategy, key levels, order arrangement and overall method for trading specifically the EUR/USD, as I've specialised on trading this particular market 24/5 now. This is basically my level fading strategy and method to trade the Euro-Dollar, based off major daily round figures (even numbers), only using limit orders as entries, and stops above or below intermediary daily round figures (odd numbers). This is a time-tested strategy, it takes a great deal of discipline and patience, it carries a substantial amount of drawdown and with impending high-impact economic releases (Fed/ECB interest rate decisions, NFP and so on), which often result in impulsive trending phases, this is deadly and it is not recommended. This works well for swing/position traders just like myself, and for the EUR/USD overall.

Leave your comments on what you guys think about this strategy, its flaws and weaknesses, your experiences with similar range fading strategies, or any other kinds of feedback or questions that you might think of, I'll read every single one of them, that I guarantee.

See you all around and good trading :)

BTC/USD: Neutral Market without confirmation of bull or bearAt the moment, looking Bitcoin in Daily timeframe, I don't like how Bitcoin make their movement, I do not going to trade Bitcoin, but yes, I CHEC OUT what it's the Bitcoin behaviour, but the only information that I have in Daily and in H4 timeframe it's that Bitcoin form a bulish rising wedge, but the market it's completely neutral.

s3.tradingview.com

For that, in 3 Daily it's show us a lot consolidation in their price action and the movement will not be clear.

But looking in Daily timeframe one moment, Bitcoin could to be into this simetric triangle in formation, but I don't like to trade Bitcoin or cryptocurrency below of H4 timeframe and I prefer to trade from H4 timeframe and above. For that, I will going to check another cryptocurrencies like Ethereum and Cardano to get you update.

And also, I will going to make a class that I will going to show you how to create a cashflow into this financial market like Forex, indices, cryptos, commodities and shares. Because I believe when cryptocurrencies are worry to trade, we can to trade shares together with cryptocurrencies, and also S&P 500. But tomorrow I interesting to create a class to talk about here the cashflow.

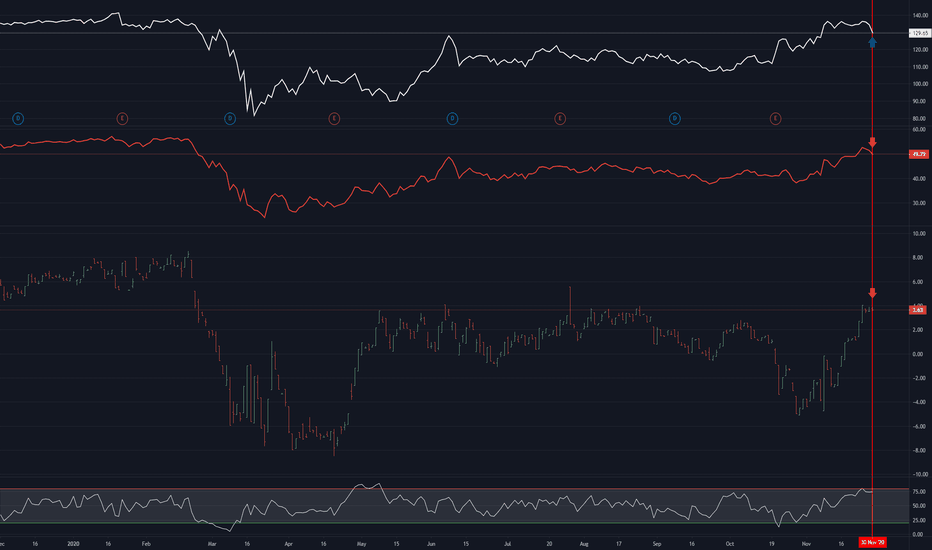

use BTAL as a form of protection and stability.BTAL combines a strategy of going long on low-beta stocks and shorting high-beta stocks. It is a market-neutral strategy that helps to balance a portfolio. A 5% position of your overall holdings in a market-neutral is a good rule of thumb.

It is a very simple and easy way to give your portfolio downside protection without having to worry about selling calls or buying puts. It is something that should always be a part of your portfolio, so don't shy away when you see red! Beef up the position or top it off when it's down. It will hit $27.85 again when the market has its next drop. It is actively managed and a 5 star Morningstar fund the last I checked.

Basically, when the market goes down, this goes up. It acts as a buffer for your portfolio.