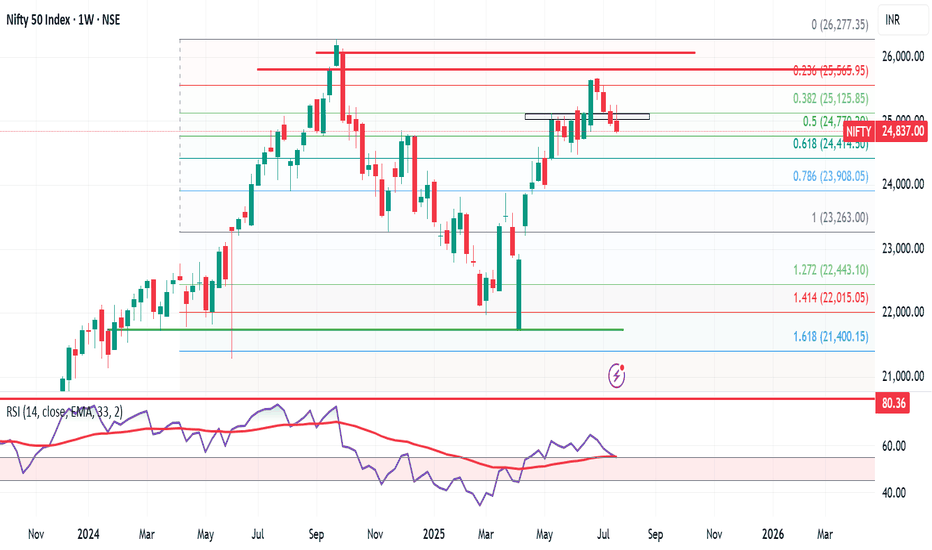

Weekly Market Wrap – Nifty Slides, Global Sentiment WeakensNifty ended the week on a bearish note, closing at 24,565, down 270 points or nearly 1.1% from last week's close. It touched a high of 24,956 and a low of 24,535, perfectly respecting the range I shared last week: 25,300–24,400.

As I highlighted earlier, the inverted hammer formation gave the bears an upper hand—and the index corrected 1.74% from the recent highs. My view continues to favor caution, with the expected trading range for the upcoming week at 25,000–24,100.

Key Levels to Watch:

Support Zone: 24,400 (key bounce area), followed by 24,100 / 23,900 in case of further breakdown.

Resistance Zone: Upside capped near 25,000.

If the market holds 24,400 around 6th–7th August, expect a short-term bounce. However, if this level is breached, expect dips to 24,100 or 23,900, which could offer short-covering opportunities.

Global Cues:

The S&P 500 also had a rough week, closing at 6,238, down 2.5% week-on-week. This decline sparked a wave of selling across global markets. The 6,200 level is crucial—if it holds, we might see a rebound globally, including in Indian equities. Below that, 6,100 remains the breakout retest zone, which I believe should provide some cushion.

💡 Strategy Going Forward:

Focus on stocks showing relative strength in this falling market—they’ll likely lead the rally once sentiment turns.

Avoid chasing rallies, and watch for signs of bottoming out near key support zones.

Keep an eye on global indices like the S&P 500 and Dow Jones, as their stability will dictate near-term direction for Indian markets.

Stay sharp, stay prepared. Let the bears have their moment, but be ready to pounce when the tide turns.

Marketoutlook

Nifty Weekly Market Update – Brace for Bearish Momentum? Nifty ended the week at 24,837, down 131 points from last week’s close. It made a high of 25,246 and a low of 24,806, staying perfectly within my projected range of 25,400–24,500.

As highlighted earlier, Nifty has now formed an inverted hammer on the weekly chart — a classic bearish reversal candlestick. 🔍

📅 Flashback: On 6th July, I mentioned giving bulls 10–15 days of playtime. That phase seems to be ending. The monthly time frame remains bearish, and now the weekly chart is aligning, indicating a stronger downside risk.

🔮 What’s Next?

👉 Expect Nifty to trade between 25,300–24,400 in the coming week.

👉 A break below 24,400 could open doors to 23,900.

👉 If 24,400 holds, bulls may still have a chance to regroup.

🧠 Pro Tip: Only Nifty Pharma is showing resilience. Those looking for long trades should focus on strong pharma stocks — the rest of the sectors are showing bearish signs.

Meanwhile in the US:

S&P 500 hits another all-time high, closing at 6,388, up 90 points from last week. My long-standing target of 6,568 now looks well within reach.

But here’s the catch — despite US strength, it’s not supporting Indian markets. If US markets correct, expect intensified selling pressure in India.

🎯 Strategy for Indian investors:

Let the bears rule till 7–8 August. Stay alert, and be ready to grab high-quality stocks at bargain prices. This is not the time to panic, but to prepare smartly.

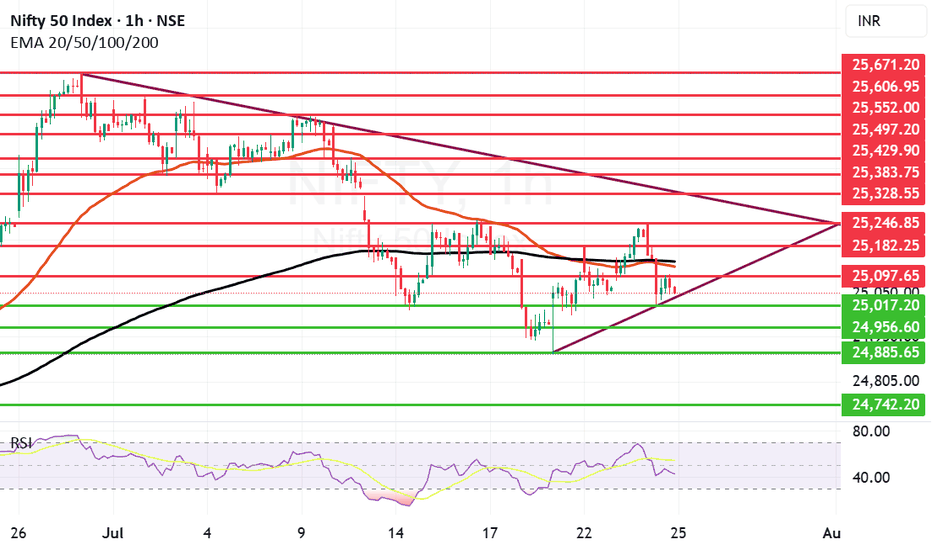

Nifty falls again as it can not sustain above 25240 level. Nifty again has shown some weakness as it was not able to sustain levels above 25240. The fall was lead by IT index which ended with deep cuts and fell 2.12% the other indices that saw fall were FMCG, Realty and Small Cap index. Trump's stance against Tech companies hiring from India and the deadlock in the trade deal also contributed to fall today. Index fell 157.8 points today and ended below both Mother and line on hourly chart. In the daily chart the candle we saw today was a bearish engulfing candle so further weakness can not be ruled out. The 2 major supports for nifty remain at 25017 and 24956 if these two supports are broken we may see Nifty falling towards 24885 or even 24742. Resistances for Nifty remain at 25097, 25138, 25182 and 25246. Only after we get a closing above 25246 we can see Nifty rally upwards.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

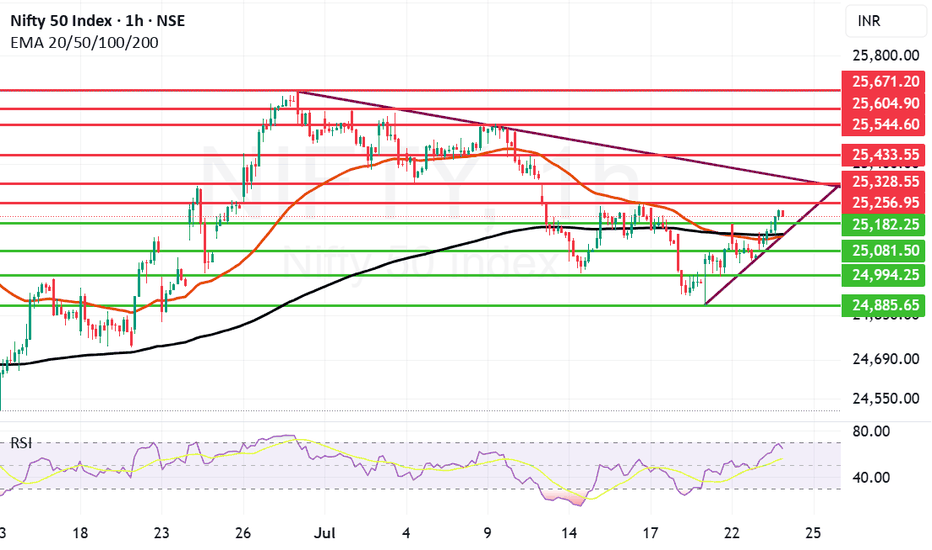

Strong Comeback by Nifty few Resistances ahead.Nifty made a remarkable comeback today ending 159 points up closing at 25219. Infosys has posted better than expected result and as of now the Infosys ADR is up by 1.26%. So if there is a turnaround in the IT sector we can see Nifty fly upwards.

The next resistance ahead of Nifty is at 25256 if we get a closing above this the next will be at 25328. These 2 will be critical resistances to cross. Once we get a closing above 25328 Nifty can target 25433 and 25544. Above 25544 Nifty becomes very strong. In case Nifty is not able to cross 25256 or 25328 levels the supports for Nifty are at 25182. After this zone there is a dual support of Mother and Father line of Hourly chart at 25136 and 25142.

These are very strong supports. (Thus the zone between 25182 to 25136 is full of supports). We hope that these supports are held. In case we get a closing below 25136 Nifty will again fall into bearish territory and can plunge towards 25081, 24994 or even 24885.

The shadow of the candles right now is positive but 2 very important resistances mentioned earlier are yet to crossed so game is in balance but only slightly in favour of Bulls.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

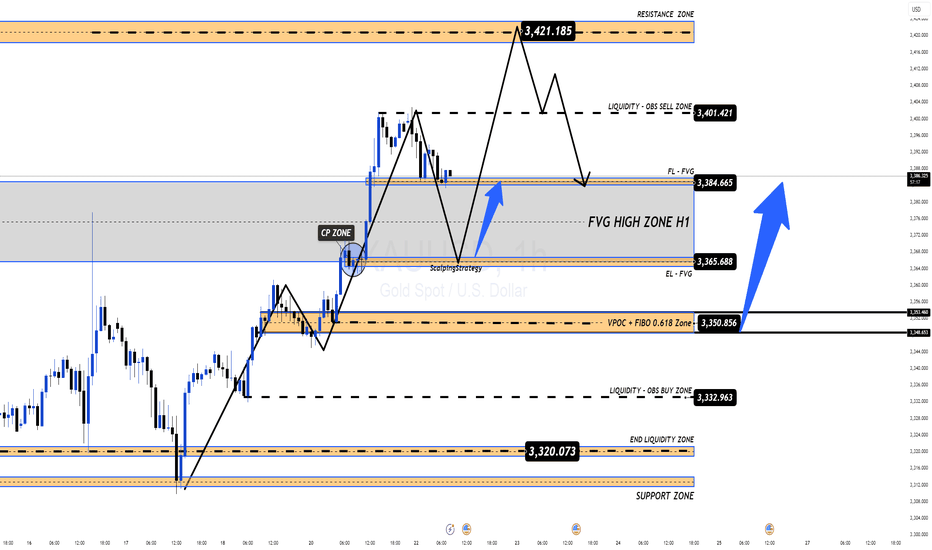

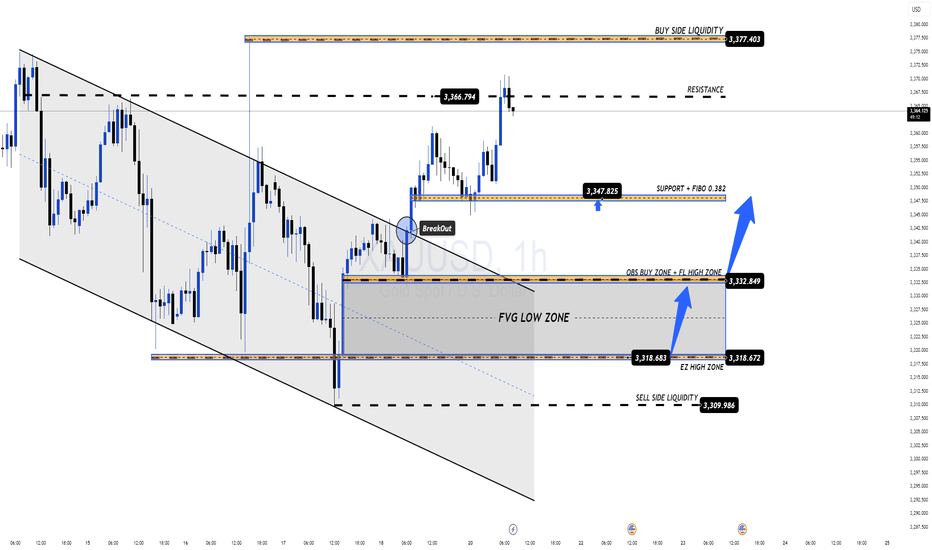

Gold 22/07 – Reversal in Sight After $3400? Watch These Key Zone XAUUSD – Intraday Market Outlook (22/07)

Gold posted a strong rally in the previous session, completing its short-term impulsive wave structure. However, as price approached the psychological resistance at $3400, it began to lose momentum, and a clear reversal candle appeared — a signal that today’s session may favour a pullback or correction.

🔍 Technical Overview

After printing a short-term top, gold is now retracing and has reached a critical support area: the FVG High Zone on the H1 chart. If bearish pressure continues and this level fails to hold, price is likely to drop further in search of deeper liquidity zones.

🔽 Key BUY Zones to Monitor Today

✅ Zone 1 – EL (End Liquidity within FVG): 3367 – 3350

→ A zone with strong potential for short-term rebounds due to previous liquidity sweeps.

✅ Zone 2 – Confluence of FIBO 0.5–0.618 + VPOC (3350 – 3335)

→ A technically significant area where multiple factors align — ideal for medium-to-long term entries.

📌 Trade Setup Ideas

🔸 BUY ZONE: 3351 – 3349

Stop Loss: 3344

Take Profit Targets:

3355 – 3360 – 3365 – 3370 – 3375 – 3380 – 3390 – 3400 – ???

🔸 BUY SCALP ZONE: 3366 – 3364

Stop Loss: 3360

Targets: 3370 – 3375 – 3380 – 3385 – 3390

🔻 SELL ZONE: 3420 – 3422

Stop Loss: 3427

Targets: 3415 – 3410 – 3405 – 3400 – 3390 – 3385

⚠️ Market Risk Reminder

While no major economic data is expected today, that doesn’t mean the market will stay calm. Unexpected volatility can still arise from geopolitical tensions or unscheduled central bank comments. Gold tends to compress and break out aggressively in low-news environments.

📌 Protect your capital with disciplined Stop Loss and Take Profit levels — no forecast is ever 100% certain.

📈 Strategic Outlook

Short-term bias: Market is likely to continue correcting

Medium to long-term plan: A deeper pullback could offer an excellent opportunity to build long positions from key demand zones, especially as markets begin to price in potential Fed rate cuts and gold continues its long-term bullish trend.

💬 Be patient, wait for confirmations, and trade with a clear plan — that’s what separates consistency from chaos.

QUIET START TO THE WEEK, WATCH OUT FOR KEY RESISTANCE!🔔 GOLD PLAN 21/07 – QUIET START TO THE WEEK, WATCH OUT FOR KEY RESISTANCE!

🌍 Market Overview

Gold has bounced back strongly following a brief pullback late last week. The move comes as geopolitical tensions and global conflicts continue to escalate.

While this week may not feature high-impact economic data, macroeconomic risks and global uncertainty remain the primary drivers of price action.

📊 Technical Outlook

Price is currently approaching a strong resistance zone between 3377–3380, which aligns with a Buy Side Liquidity region.

💡 Sellers may step in here to push the price lower, aiming to fill FVG zones (Fair Value Gaps) left behind during the previous bullish rally.

⚠️ Entering SELL positions at this level is risky — only act upon confirmed reversal signals (candlestick rejection or volume-based confirmation).

🎯 Trade Setup

🟢 BUY ZONE: 3331 – 3329

Stop Loss: 3325

Take Profits:

3335 → 3340 → 3344 → 3348 → 3352 → 3358 → 3364 → 3370

🔴 SELL ZONE (confirmation required): 3377 – 3379

Stop Loss: 3383

Take Profits:

3372 → 3368 → 3364 → 3360 → 3350

📌 Key Notes

The 3347 zone acts as short-term support for bulls. If this level breaks, a move toward lower FVG liquidity zones becomes more likely.

Keep an eye on EU session volume for clearer short-term direction and better trade timing.

✅ Final Thoughts

Discipline is key. Stick to your TP/SL strategy to manage risk effectively during early-week volatility.

🛡️ Wishing everyone a successful start to the week. Stay patient, stay focused.

GOD BLESS ALL!

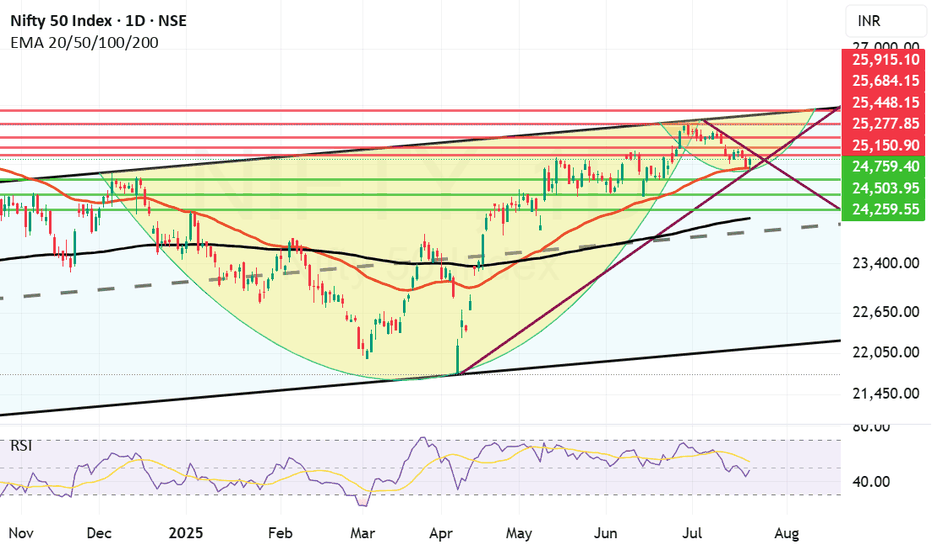

Nifty has taken support at Mother line as expected.Despite poor showing by Reliance post result and TCS continuing to fall Nifty staged a remarkable comeback on the back of Pvt Sector banking which did well. Bank Nifty came back strongly posting 1.19% gains today which enabled Nifty to rise 122 points or 0.49%. Capital Goods, Finance and Metals indices also gained more than 1% each.

Resistances for Nifty now remain at: 25150, 25277 (Trend line resistance), 25448, 25684 and finally channel top resistance at 25915.

Supports for Nifty remain at: 24938 (Mother Line Support of Daily Chart), 24759, 24503, 24259 and finally 24116 (Father Line support of Daily chart).

Shadow of the candle right now is neutral to positive and RSI is 47.63 with median RSI resistance at 54.09.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Closing above 25544 should be first step for Nifty to break freeNifty today closed in positive but still it might not be free enough to crate further bull run. the first step that Nifty needs to take to get out of this range bound trade zone or consolidation is to get a closing above 25544.

Further to this step it my find resistances at 25597, 25672. Once we close above 25672 the possibility that Bulls can regaining 26K levels and go even higher becomes stronger.

The Supports for Nifty currently remain at 25471, 25437 which is Mother line or 50 Hours EMA, 25344, 25219 and finally 25125. 25125 is the Father line support or 200 hours EMA. Closing below 25215 will empower Bears to drag Nifty further down wards.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Good Closing by Nifty: Trump Tariff decision awaits us next weekNifty closed the week at 25461 well after gaining 130 points from Friday low of 25331. Overall Nifty closed 55 point positive from Thursday closing. This was a very smart recovery of Nifty from the lows of the day but we are heading towards Trump Tariff deadline of 9th July. That has potential to shake the market and move it any direction so investors should keep an eye on the developments and keep their stop losses and trailing stop losses in place. Overall Nifty is on the path to V shaped recovery as indicated in the chart. If everything works out in favour of India in the negotiation the 816 point gap from previous all time high will be bridged sooner than later. Once we reach the Previous All-time high the recovery will be complete. But we have to be cautiously optimistic.

Nifty supports currently remain at: 25331, 25072, 24843, 24481. If 24481 is broken than Bears will try to drag Nifty towards 23840 (Which is the Mother line of Weekly Chart).

Nifty Resistances currently remain at: 25666 (Trend line Resistance), 25870, 26075, 26277 (Previous All time high).

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Critical Range 106,036–108,300, Sector Support Remains Bullish__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Bullish across all timeframes ≥1H (MTFTI UP); corrective compression seen on 15m/30m as short-term selling momentum decelerates.

Support/resistance: Major defensive cluster at 106,036–106,210; multiple resistances at 108,272/108,790 and 110,530–111,980. No excesses or validated breakdowns.

Volume: Historical average across all timeframes, no abnormal flows, no signs of euphoria.

Risk On / Risk Off Indicator: "Strong Buy" signal on all timeframes except 15m (neutral); sector momentum confirmed, software leadership maintained.

Investor behavior (ISPD DIV): Mostly neutral except for a micro-buy on 15m, no extremes of fear or euphoria.

__________________________________________________________________________________

Summary

__________________________________________________________________________________

Global bias: Remains bullish in the medium term, mature range, no imminent trigger catalysts.

Opportunities: Technical bounce/entry favored on 106,036–106,210 if support cluster holds and ISPD DIV validated. Conservative profit-taking below 108,000–108,300.

Risk areas: Confirmed breakdown (1H/4H close <106,036 with high volume and MTFTI reversal). Recommended stop <105,900.

Macro catalysts: Awaiting US data (PMI/ISM/JOLTS). Watch for macro surprises or FOMC. Low expected volatility until late July.

Action plan: Range-buy near support cluster, active stop/profit management, volume watch, confirm with intraday micro-signals.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Consolidating below major resistance >110k. Momentum and Risk On / Risk Off Indicator solid. No volume catalysts.

12H–4H: Bullish structure preserved, compression under resistance, supports holding (106k–106.5k), average volume.

2H–1H: Compression, repeated tests of 106,036 support, buying appears at each rebound; no clear selling continuation.

30min–15min: Technical correction, micro-bearish divergence on Risk On / Risk Off Indicator, but ISPD DIV buy marker on 106,036–106,210 cluster. Stable volume.

Summary: All ≥1H timeframes are bullish; 15m/30m show corrective compression in a mature, defended range.

Strategic Outlook:

- BTCUSDT continues to consolidate in a mature range with a multi-frequency support cluster at 106,036–106,210.

- Broadly UP trend, robust Risk On / Risk Off Indicator, no exogenous catalysts.

- Opportunity zone on cluster support test; confirm any bounce with returning flows or 15m behavioral signal.

- Key stop <105,900, progressive profit-taking below 108,000–108,300.

- Macro watch (PMI, ISM, FOMC) essential to anticipate volatility pickup or trend change.

On-chain / Macro: No short-term systemic risks. General wait-and-see, no stress or euphoria. Consolidative setup.

Risk / Reward: Adjust leverage and strict risk control; ratio ≥3:1 maintained as long as cluster support holds.

Recommended management: No chasing, favor range-buy approaches, dynamic stops, and gradual profit-taking on resistance.

__________________________________________________________________________________

Nifty goes into consolidation mode to end the month at 25500.Today Nifty went into consolidation mode searching for the supports nearby after a massive upward run in the last week. Even though we saw Nift climbing down 120 points today the closing above 25500 is a good sign. It was a volatile day where Nifty made a high of 25669 and a low of 25473 moving 200 points down. But recovered a bit to close at 25517.

The Supports for Nifty remain at: 25450, 25321 (Mother line Support), 25133 (Mid-channel support). If that is broken the Nifty may fall further towards 24976 or 24956 (Which is the Father line support). Channel bottom seems to be at 24657. If we get a closing below this zone we will comment about further supports on the down side.

The Resistance for Nifty remain at: 24539, 24596, 25665 and finally 25712. (25712 seems to be the channel and trend top. Once Nifty closes above this zone we will be able to comment about further levels on the upside.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Major Breakout in Nifty now holding the levels key. We saw a major Breakout in Nifty today. Finally Nifty closed above much coveted levels of 25251. Nifty made a high of 25565 and closed at 25549 which was a remarkable comeback. What we are seeing on chart is a cup formation happening in Nifty. For flying further Nifty needs to have a strong closing tomorrow and stronger monthly closing on Monday that is 30th June. These 2 closings will be very important. We need a Nifty closing above 25884. Even if that does not happen a monthly closing above 25251 will also be considered a strong closing. Nifty is strongly on the path of recovery for sure and supports and resistances for Nifty remain as under:

Nifty Supports Remain At: 25251, 24994, 24760 and 24588 (Mother line). If by chance under unlikely circumstances Mother line is broken then Bears will become more empowered and might try to pull Nifty towards 24209 or even 23892 (Father line support).

Nifty Resistances Remain At: 25565, 25740, 25884, 26066 and finally previous All time high resistance of 26277.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

EURUSD Sell/ShortFundamental Analysis

EURUSD rates is being influenced by the current Eurozone's economic performance, driven by key economies like Germany and France, continues to be shaped by industrial output, consumer confidence, and inflation trends. The European Central Bank (ECB) has likely maintained a cautious monetary policy, with interest rates possibly held steady or adjusted slightly to combat inflation while supporting growth. On the U.S. side, the Federal Reserve's stance on interest rates, potentially in a tightening phase to address persistent inflation plays a critical role. Recent U.S. economic data, including GDP growth, employment figures, and consumer spending, may indicate a robust dollar, putting downward pressure on EURUSD. Additionally, geopolitical tensions, energy prices (affecting Eurozone energy imports), and trade balances between the U.S. and EU are likely contributing to volatility. Given the current date, recent ECB and Fed statements or data releases for June 2025 inflation reports.

Technical Analysis:

Based on the provided EURUSD 1D chart (covering mid-2024 to mid-2025), the following technical observations can be made:

Trend and Moving Averages:

For EURUSD it shows a descending trend from a peak around 1.48 in mid-2024, with a potential reversal or consolidation forming in mid-2025. The 50-day and 200-day moving averages (depicted as orange lines) are sloping downward, with the price recently testing these levels around 1.12-1.13. A break above the shorter-term moving average could signal bullish momentum, while a failure to hold might confirm a continuation of the downtrend. Looking for key support levels here are identified at 1.09318 (TP 2) and 1.08000, with the current price hovering near 1.12003 (TP 1). Resistance is notable at 1.15625 (SL) and the previous high near 1.4800. The price action suggests a potential bounce from the recent low, with the next target being the resistance zone around 1.15625 if bullish momentum persists. Candlesticks and volume patterns are showing a recent green candlesticks indicate buying pressure, potentially forming a reversal pattern near the 1.12 level. Volume analysis would confirm the strength of this move, with higher volume on upticks supporting a breakout.

Overall Bias:

The technical setup suggests a short-term bullish correction within a broader bearish trend, contingent on breaking and holding above 1.15625. A drop below 1.09318 would invalidate the bullish case and resume the downtrend toward 1.08000 or lower.

Sentiment Analysis

Market sentiment as of June 2025 likely reflects heightened interest in EUR/USD due to recent economic data and central bank policies. Traders and analysts are closely watching for signs of ECB rate cuts or Fed rate hikes, which could sway the pair. On social platforms and financial forums, there may be a mix of caution and optimism looking out for caution due to the Eurozone's economic challenges (energy costs, political uncertainty), and optimism if U.S. data softens, weakening the dollar. The chart's visibility on trading platforms suggests retail and institutional traders are actively monitoring this pair, with a focus on the 1.12-1.16 range as a critical decision point. Sentiment could shift rapidly based on upcoming economic releases or geopolitical developments.

Conclusion

The EUR/USD pair is at a pivotal juncture, with fundamentals pointing to a stronger USD due to Fed policy, while from a technical standpoint suggest a short-term bounce toward 1.15625 if support at 1.12003 holds. Sentiment indicates active trader interest, with eyes on central bank moves. A break above resistance could target 1.4800 (long-term), while a failure might see a decline to 1.08000. Monitor upcoming data for confirmation.

Bitcoin Tests Key Support-Healthy Correction Within Bull MarketHealthy Pullback, Strong Structure:

Bitcoin’s recent dip is a constructive correction within a broader bull trend, as it tests the critical $100,000–$105,000 support zone—a former resistance area from early 2025.

Institutional Demand Holds the Line:

Maintaining levels above the psychologically important $100,000 mark highlights continued institutional accumulation and reinforces the underlying strength of the trend.

Momentum Reset, Base Building:

This pullback has helped reset overbought conditions from the prior rally, laying the foundation for the next potential leg higher.

Key Levels to Watch:

Support: $100,000–$105,000

Breakout Trigger: A close above $108,000 would confirm uptrend continuation

Outlook: Bullish bias remains valid as long as support holds

Investor Opportunity:

With structure intact and downside contained, this consolidation presents a favorable risk-reward setup for long-term investors looking to position ahead of a potential breakout.

#Bitcoin #BTC #CryptoMarket #TechnicalAnalysis #SupportAndResistance #BullMarket #RiskReward #InstitutionalBuying #MarketOutlook #PriceAction

Nifty 50 Trapped in a Tight Range – Breakout or Breakdown Ahead?📍 Market Overview:

For over a month now, the Nifty 50 Index has been moving sideways in a tight consolidation range, frustrating both bulls and bears. Since May 12, 2025, the index has fluctuated between 24,350 on the lower side and 25,250 on the upper side, forming a classic rectangular pattern often associated with accumulation or distribution phases.

This zone is now becoming a crucial battlefield that could define the index’s direction for the coming sessions.

🔲 The Consolidation Zone

Support Zone: 24,350 – 24,450

Resistance Zone: 25,150 – 25,250

Consolidation Duration: ~30+ days

Current Price: 24,793.25

This range has seen multiple rejections at the top and bottom, reflecting indecisiveness in broader market sentiment. Traders are waiting for a trigger — either fundamental or technical — that could push the index out of this range with strength.

📈 Bullish Scenario: Breakout Above 25,350

If Nifty 50 breaks and sustains above 25,350, especially with higher volume and a strong daily close, it could signal a bullish continuation pattern. This scenario would be supported by:

A potential breakout from the rectangle consolidation.

Positive sentiment from global markets or domestic catalysts (monsoon, earnings, policy announcements, etc.)

A shift in FII or DII buying behavior.

📌 Breakout Target:

👉 26,000 – 26,100 (Based on measured move projection)

📌 Next Resistance Zone:

👉 26,050 – 26,200

In this case, traders may look for long opportunities with trailing stop-losses under the breakout zone.

📉 Bearish Scenario: Breakdown Below 24,350

On the flip side, a decisive breakdown below the 24,350 mark, especially with increased selling pressure and bearish candles, may lead to a quick decline toward the next major support levels.

📌 Breakdown Target:

👉 23,550 – 23,400

📌 Next Support Zone:

👉 23,500 – 23,300

This could trigger panic selling or profit-booking in frontline stocks. Caution is advised in such scenarios, and shorting opportunities may arise for experienced traders.

🧠 Strategic Insights for Traders

Avoid trading within the range: Unless you're scalping, wait for breakout/breakdown.

Watch global cues and FII flows: They often align with large breakouts.

Stick to risk management: Whichever direction the index moves, always set a stop loss.

🚀 Final Thoughts

The market is clearly in a wait-and-watch phase, but such consolidation periods often precede large moves. Nifty’s current structure suggests a breakout or breakdown is imminent — and being positioned correctly can make a big difference in returns.

Stay alert. Don’t predict — prepare.

⚠️ Disclaimer

This article is for educational and informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Trading and investing in the stock market involve risk, including the risk of losing capital. Always conduct your own research or consult with a qualified financial advisor before making any trading decisions. We are not responsible for any losses incurred from decisions based on this analysis.

Resistance zones and Geo-political instability acting up.Geo-Political instability and resistance zone are acting up together to stop Nifty and not allowing it to close above 25K. As the world is looking at developments in Iran Vs Israel conflict with beated heart market today gave up some gains from yesterday. The only index looking strong is IT index right now. Avoid taking very long positions unless you are very sure of the company. Yesterday also Nifty failed to close above 25K opened briefly near 25K today and then moved downwards. Lot will be decided in the short term by the developments that happen tonight. Important G7 meet and US Federal reserve Rate Cut meet is also to happen later in the week. These 2 global factors will decide fate of the market in the short term. Local factors are all in line and nothing to worry for Indian markets on that front.

The supports for Nifty remain at: 24713 (Trend line support), 24425 (Mother line support of Daily chart), next support is near 23917, 23806 (Father line support of daily chart is in place). Closing below 23906 can lead to further down side and in such a scenario Nifty can fall further towards 23500 or 23047 levels. If we get a closing below that we will give updates regarding the same.

Resistances for Nifty remain at: 24982 (Today's high), 25112 and trend line resistance of 25251. When we get a closing above 25251 we will update you regarding the further upward resistnace levels.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Bitcoin Weekly Outlook – June 9, 2025Bitcoin ( BINANCE:BTCUSDT ) continues to maintain its bullish structure, now trading around $106.6K. While price action looks strong, the market is approaching a key resistance zone between $110K–$120K, with technical signals hinting at a possible short-term rejection before further upside.

🔍 Technical Overview

Current Price: $106,654

Resistance Zone: $110K – $120K

Support Zone for Pullback: $98K – $100K

200 EMA & 100 EMA: Still trending up and providing strong base support

The chart suggests a potential "rejection-retest-rally" structure forming, where BTC may temporarily pull back before making a fresh push toward new highs.

📊 Momentum & Indicators

Stochastic RSI on the daily timeframe recently bottomed and is starting to curl back up — a potential bullish shift in momentum

Volume remains stable — no signs of aggressive distribution or FOMO activity yet

💬 Sentiment & Structure

The current structure remains healthy, with HH-HL (higher high - higher low) formation intact. Market sentiment is optimistic but not yet euphoric, which is ideal for continued accumulation.

Short-term traders may look for a pullback opportunity near the $98K–$100K zone before re-entering.

🎯 Mid-Term Outlook

If BTC holds the $98K–$100K range during a pullback, it could act as a springboard toward the $120K target in the coming weeks.

✅ Summary

🔵 Bullish trend intact

📉 Possible short-term pullback before breakout

📈 Mid-term target remains: $120K

🚫 Avoid chasing breakouts — position wisely at key supports

Let the price come to you. Patience pays more than FOMO.

Market Outlook – Nifty Near Critical Levels! Caution Advised

Nifty Weekly Wrap-Up:

The Nifty 50 index closed the week at 25,003, posting a solid gain of +250 points from last week's close. It touched a high of 25,029 and a low of 24,502 during the week.

But here’s the twist—while the uptrend looks strong, we’re now at a crucial inflection point on the weekly chart.

Technical Outlook – Is a Bearish “M” Pattern Forming?

On the weekly timeframe, Nifty is at a level where a bearish M-pattern could potentially develop. To complete this pattern, the index could pull back towards support levels at:

24,414

24,200

24,000

If the selling deepens, the final support zone lies between 23,900–23,700, where a bounce-back is likely.

Bullish Scenario – Can Nifty Break Out?

If Nifty holds above 25,000 for at least 2 consecutive sessions, it could trigger a short-covering rally, paving the way for a move toward key resistance zones at:

25,400

25,565

26,100

Next Week’s Expected Range: 24,500 – 25,500

This range should see most of the action next week. If you're holding long positions, now is a great time to:

✔️ Lock in profits

✔️ Trail stop-losses

✔️ Prepare cash reserves for potential dip-buying opportunities

Global Watch – S&P 500 Hits Key Resistance

The S&P 500 closed near 6,000, up 100 points for the week. But heads up—it’s now testing a strong Fibonacci resistance at 6,013.

A rejection here could lead to a correction toward 5,900–5,850, a dip of 1.5–2.5%. If this unfolds alongside a Nifty pullback, it would align perfectly with our support targets around 24,400–24,500.

Final Takeaway:

Markets are looking stretched. While momentum remains positive, profit booking at higher levels is essential. Don’t get caught unprepared in case of a reversal. Stay tactical, stay liquid.

Smart money is already locking in gains. Are you?

Market breakdown: SPY & Current TradesIn today’s update, I go over the general outlook on the indexes, focusing on SPY, Nasdaq, and Dow Jones — all still moving in bullish confluence. Even after three distribution days, there’s been no major downside move, but we are seeing drying volume, so caution is key.

I also break down some of my current trades:

A few aren't performing as expected, and that’s part of trading. We won’t win every setup, and that’s okay.

Red-marked trades have been removed from the watchlist and will be monitored closely for irrational moves. I may cut losses if needed.

Green-marked trades are still active and aligned with my criteria, so I’ll likely continue to invest in them.

Lastly, I cover a trade that recently hit my take-profit (TP), specifically KEROS, which has now also been removed from the list. ✅

Thanks for watching another one of my videos, I hope you gained value from the breakdown!

Comment below if you have questions or your own thoughts on the market.

Let’s grow together.

GOLD Price Analysis: Key Insights for Next Week Trading DecisionIn this video, we dissect how gold traded last week (May 26–30), why the price hovered near the top of a descending channel, and what’s driving market indecision. From geopolitical tensions to Federal Reserve interest rate uncertainty, we connect the dots between fundamentals and technical structure, enabling you to make better-informed trading decisions.

📅 Key Events to Watch This Week:

✅ISM Manufacturing PMI

✅ADP Employment Change

✅ISM Services PMI

✅Average Hourly Earnings

✅Non-Farm Payroll (NFP)

🎯 In this analysis, I walk you through:

🔸My technical blueprint (key zones for buyers & sellers)

🔸My bullish and bearish scenarios based on the structure on the chart

🔔 Don’t forget to like the video in support of my work.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#GoldAnalysis #XAUUSD #GoldPriceForecast #GoldTrading #ForexAnalysis #MarketOutlook #NFP #FOMC #TechnicalAnalysis #FundamentalAnalysis #GoldBulls #GoldBears #TradingStrategy #Darcsherry #XAUUSDAnalysis #GoldOutlook #GoldPricePrediction

Bitcoin Weekly Outlook – June 2, 2025

Bitcoin ( BINANCE:BTCUSDT ) is holding strong above the psychological $100K mark, maintaining its bullish market structure on the weekly timeframe. However, technical indicators are flashing early signs of a possible short-term correction before another leg up.

🔍 Technical Analysis:

Current price: $105.1K

Key support zone: $89K (strong demand area + weekly structure retest)

Resistance to watch: $120K (major weekly supply zone + psychological level)

Stochastic RSI is currently overbought at 94+, which historically tends to trigger a healthy retracement before further upside continuation.

📊 Market Structure:

BTC remains well above the 200-week EMA, keeping bullish momentum intact

Higher Highs and Higher Lows are still in play

Volume is steady, showing no major distribution at the moment

📈 Sentiment Check:

Fear & Greed Index: 64 (Greed)

→ Suggests bullish sentiment is high

→ Greed often precedes short-term pullbacks or consolidation

🧭 Outlook:

A short-term correction toward the $89K–$92K zone is likely, as part of a healthy market cycle.

If support holds, BTC could rally back up with a mid-term target around $120K.

✅ Summary:

🔵 Bullish structure still intact

⚠️ Overbought signal = possible retracement

🎯 Mid-term target: $120K

🧘♂️ Don’t chase — wait for price to breathe, not break

Let the market come to you. Trade smart, not just hopeful.

Nifty feeling pressure, unable to sustain above 25K levels.Nifty not able to sustain levels above 25K is not a good news. Nifty has to sustain above 25094 level on daily and 25208 on weekly closing for further upward move. Market is not showing confidence due to daily tariff related news coming for global Power house US. So Volatility will remain for a while till everything falls in place.

Right now Nifty is resting near trend line support levels of 24731. If 24731 is broken Bears can drag Nifty towards 24469, 24067 (Mother line Support), 23899 or even 23637 (Father line support). If Nifty can sustain above 25094 then there is a possibility for up move towards 25208 or even 25446 levels. Things are delicately poised right now and proper Bear Vs Bull Tussle is going on.

Shadow of the candle is neutral to negative but any positive news on global front can change the tide in favour of Bulls.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Despite Geo-Political tensions, Nifty closes above Mother line. It was quite remarkable for Nifty to close above the Mother line (50 Hours EMA) despite the Geo-Political tensions and brewing storm of escalations at border. This shows the character of not only Indian market but the resilience of India as a nation. In yesterday's post itself we had mentioned that strong technical resistance has been reached. Add the tension and intent of India to fight against terrorism so it was a perfect recipe for a major fall. Which may happen if things escalate further next week but recovering from 23847 and to close above 24K at 24039 shows that when things will be back to normal the indices will bounce back. Resistance for Nifty now remain at 24096, 24335 and 24504. Supports for Nifty remain at 23914 (Major Mother line support) of 50 Hours EMA, 23800, 23530 and finally 23363.

While Long term players, FII, HNI and DII look at such opportunities to invest for Retail trader it becomes very difficult to control their emotions in such an environment of Geo-political pressure and then we saw a huge fall in the market. The opportunity was seized by both DII and FII with both hands as both turned net buyers for Rs.6492+ Crores. So traders / investors should always avoid knee jerk reactions. Who knows what happens during the weekend the support and resistance levels to watch out for are already mentioned in the message.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.