MARKETS week ahead: August 4 – 10Last week in the news

US macroeconomic data took center stage during the previous week, with major correction occurring on Friday, after the NFP July data were released. Investors fear of economic consequences of implementing trade tariffs pushed US equity markets to downside. The S&P 500 lost 1,5% on Friday, closing the week at the level of 6.238. On the same grounds the price of gold strongly gained 2,2% on Friday, reaching the last price at $3.362. Strong reaction also came from US Treasury yields, where the 10Y US benchmark dropped to the level of 4,22%. This time the crypto market was also affected, where BTCs price dropped sharply, closing the week around the $113K level.

The FOMC meeting was held during the previous week, without changes in the level of interest rates. As per Fed's view, the economy is growing at a solid pace, while they acknowledged increasing risks originating from implemented trade tariffs on inflation and potential slowdown in the future economic growth. There were no comments regarding potential rate cuts in September, except that the Fed will continue further to balance interest rates based on “the incoming data, the evolving outlook and the balance of risks”, as noted by Fed Chair Powell.

A macro data heavy week in the US included data on JOLTs in June of 7,437M, modestly below market forecast of 7,55M. The PCE Price Index in June was relatively steady with 0,3% for the month and 2,6% for the year, which was in line with market expectation. However, what shocked the market on Friday were posted non-farm payrolls data for July of only 73K, although the market estimate was standing at 110K. During Saturday, news was published that the US president Trump requested immediate release of a duty of a Commissioner of labor statistics, due to posts of inaccurate labor data and its frequent revisions. The US President also questioned the accuracy of the July NFP figure of 73K.

During the previous weekend the U.S. finalized the trade-tariffs deal with the European Union. Details of the deal are officially published at the website of the European Commission, and include, among other, tariffs of 15% on imports from the EU, establishment of tariff-rate quotas for imports of steel, aluminium and copper from the EU, cutting the current 50% current tariffs. EU companies will also invest at least $600B in different sectors in the US by 2029.

Interesting news for crypto enthusiasts was posted by Cointelegraph, noting that on July 4, 2025, eight dormant Bitcoin wallets from the Satoshi era collectively moved 80.000 BTC, with each wallet transferring 10.000 BTC. The Satoshi era, generally defined as the period from 2009 to 2011, was when Bitcoin could still be mined or transacted using standard computer processors. The sudden activation of these long-inactive wallets has sparked intense speculation, with some suggesting that emerging quantum computing threats may have prompted the transfers. Still, analysts with a knowledge of blockchain technology commented that coins were not transferred directly to cryptocurrency exchanges but instead moved to newly created SegWit addresses — a move that likely indicates a security upgrade.

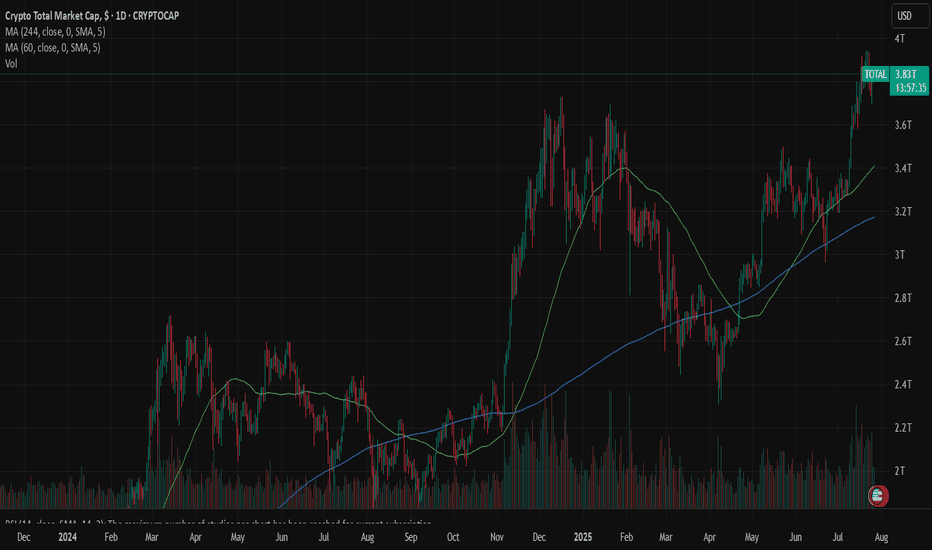

CRYPTO MARKET

As the crypto market became part of mainstream markets, it needed to manage both ups and downs of the investors' sentiment, which was usually related to traditional markets. This occurred during the Friday trading session, when investors' fear of future consequences of implemented trade tariffs turned to the negative side. Total crypto market capitalization decreased by 6% on a weekly basis, losing a total $216B. Daily trading volumes were relatively flat on a weekly basis, moving around $304B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands at +12%, with a total funds inflow of $384B.

This week BTC was leading the market cap drop, with an decrease in value of 4% w/w and outflow of almost $96B in funds. ETH also had a drop in value of 7,2%, with total funds outflow of $32B. The third coin by total market cap, XRP, was traded around 10% lower, closing the week with total fund outflow of $18,6B. Another coin with a significant drop in the market cap was Solana, of almost 13% w/w, and funds outflow of $13B. Both DOGE and ADA were on a losing side, where DOGE was traded 17,1% lower, losing $6,13B in the market cap, while ADA dropped by 14,6% with an outflow of $4,3B. The majority of other altcoins finished the week with a loss in value between 14% and 18%.

This week there has not been too much activity when circulating coins are in question. Algorand had an increase of coins on the market by 0,2% w/w, while Stellar's number of coins surged by 0,3%. This week Filecoin had a modest increase of 0,1% on a weekly basis, same as ZCash and DOGE.

Crypto futures market

The general drop in the value of crypto coins on the spot market was also reflected to some extent also in the futures market. BTC futures were traded lower by more than 3% for all maturities, while ETH futures had a weekly drop in value of more than 4%. However, it is important that the general levels of the value of futures remain at higher grounds.

BTC futures maturing in December this year closed the week at $116.390, and those maturing in December next year were last traded at $123.490. A similar situation is with ETH futures, which managed to hold grounds above the $3K. Futures maturing in December 2025 closed the week at $3.631, and those maturing a year later were last traded at $3.894.

Marketoverview

MARKETS week ahead: July 27 – August 2Last week in the news

Trade tariff (un)certainties shaped market sentiment during the previous week. The US-Japan trade deal was settled which brought some relaxation among investors. The US equities continued with a positive trend, with the S & P 500 reaching fresh all time highest level, ending the week at 6.388. On the same ground the price of gold turned a bit toward the downside, closing the week at $3.336. The relaxation was evident also in 10Y US Treasury yields, which closed Friday trading session at 4,38%. BTC had a short liquidation session on Friday, shortly reaching the $115K level, however, swiftly returned back toward the $118K.

The European Central Bank (ECB) held its July meeting during the previous week, where it held interest rates steady after seven consecutive cuts, signalling a more cautious approach going forward. While its macroeconomic outlook remains unchanged, the ECB sees downside risks to growth, including global trade tensions and weak market sentiment. President Lagarde downplayed concerns about the stronger euro and minor inflation undershooting, emphasizing a data-dependent, meeting-by-meeting policy stance. Although the ECB appears comfortable with its current position, a final rate cut in September is still possible if inflation or macro data disappoint.

President Trump announced a major trade deal with Japan this week, featuring a 15% reciprocal tariff, marking a shift in bilateral trade relations. The U.S. also reached a framework agreement with Indonesia, reinforcing efforts to strengthen trade ties across Asia. Trump signalled that more deals may be finalized before the August 1 tariff deadline, including potential progress with the EU, as a meeting with Commission President von der Leyen is set for Sunday in Scotland. These developments have been well received by investors, easing concerns over trade uncertainty and potential supply chain disruptions.

China unveiled a global AI action plan at the World Artificial Intelligence conference in Shanghai, calling for international cooperation on technology development and governance. Premier Li Qiang proposed establishing a global AI cooperation organization to coordinate regulation and infrastructure, emphasizing equitable access. The plan positions China in contrast to the U.S., favoring multilateralism over America's more block-oriented approach to AI strategy. Featuring participation from over 800 companies including domestic giants Huawei and Alibaba, the conference showcased thousands of AI innovations and signals China's ambition to challenge U.S. dominance in the field.

Palantir's stock achieved a new record high last Friday, rising over 2% and lifting its market cap to around $375B. With the latest move, the company is now holding 20th place as the most valuable U.S. company. The company's shares have more than doubled this year as investors' enthusiasm grows around its AI capabilities and government contract momentum. Analysts attribute the rally to Palantir's strengthened role in AI analytics and expansion in defence-related software and data contracts.

CRYPTO MARKET

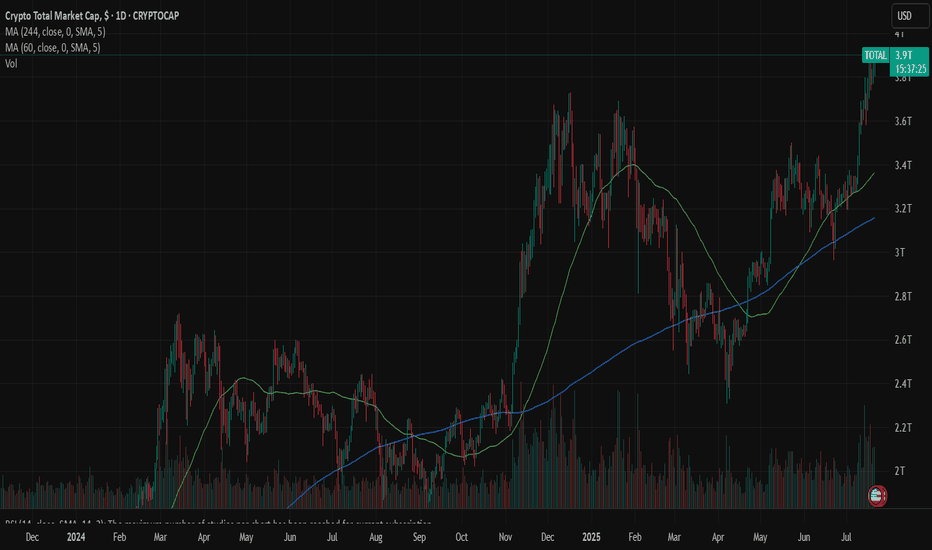

The crypto market was traded in a mixed mode during the previous week. Some liquidations were made in BTC, followed by altcoins, however, there were also coins with relatively solid weekly performance. Total crypto market capitalization was increased by 1% on a weekly basis, adding total $39B to its market cap. Daily trading volumes were modestly decreased to the level of $275B on a daily basis, from $333B traded a week before. Total crypto market capitalization increase from the beginning of this year currently stands at +19%, with a total funds inflow of $600B.

BTC had a relatively flat week, with only $3B of funds inflow. On the other hand ETH continues to perform strongly, with another week in a positive territory of 5,3%, increasing its cap by $23B. XRP did not perform well on a weekly basis, as the coin had a drop in value of 7,4% and outflow of $15B. Some of the significant weekly gainers include Litecoin, with a surge of 13% on a weekly basis, Maker was traded higher by 14%, BNB gained 7%, while Solana was higher by 5% same as Uniswap. Other altcoins were traded either with a modest drop in value or with a modest increase in value.

There has been increased activity with circulating coins. Another week in a row, IOTA is increasing the number of coins on the market by 0,8% w/w. EOS had an increase of 0,6%, same as Polkadot. The majority of other altcoins had a modest increase of circulating coins of 0,1%, including XRP.

Crypto futures market

This week the crypto futures market reflected perfectly developments on the spot market, with ETH long term futures managed to pass the $4K level.

BTC futures were traded mostly flat compared to the previous week. Futures maturing in December this year closed the week at $120.810, and those maturing in December 2026 were last traded at $127.500. At the same time, ETH futures were traded around 2,5% higher for all maturities. Futures ending in December 2025 reached the last price at $3.779, while those maturing in December 2026 for the first time ended the trading week at $4.058.

MARKETS week ahead: July 20 – 26Last week in the news

Resilient inflation and the jobs market in the US supported further investors sentiment, bringing equities to higher grounds. The new all time highest level was reached by the S&P 500, which is closing the week at 6.296. The US Dollar gained in value during the week, however, the price of gold remained relatively flat, closing it at $3.349. Strong macro data decreased expectations among market participants over the Fed's rate cut, bringing 10Y US yields down to 4,42%. The new Genius Act was passed in the U.S. House, supporting the price of BTC to hold at higher grounds, above the $118K.

The U.S. economic data in focus last week was led by June inflation figures. Headline inflation remained relatively stable, rising 0.3% for the month and 2.7% on a yearly basis, both matching market expectations. Core inflation came in at 0.2% for the month and 2.9% annually, slightly below forecasts by 0.1 percentage points, though still elevated. The Producer Price Index (PPI) was flat in June (0.0%), with core PPI also unchanged. On an annual basis, PPI rose by 2.3%, and core PPI by 2.6%. Meanwhile, retail sales in June outperformed, climbing 0.6%, well above the expected 0.1%. Another positive news came from the University of Michigan preliminary Consumer Sentiment Index for June, where five-year inflation expectations eased to 3,6% (down from 4% posted previously), while one-year expectations declined to 4,4% from the previous 5%. Resilient macro data decreased market expectations over the potential Feds rate cut in September to 50% from previous 70%, as per data shown in CME FedWatch Tool.

The Genius Act was passed by the U.S. House on July 17th, after its approval from the Senate in June. The bill represents an important milestone for the crypto market, as it sets a comprehensive federal standard for stablecoins, clearing the way for banks and fintechs to issue them under clear reserve and audit rules. Among others, it allows permitted institutions to issue U.S. Dollar-pegged stablecoins, backed 1:1 by liquid reserves such as cash or Treasuries. It also mandates strict rules for reserves, custody and consumer protection in terms of full reserves, monthly disclosures, segregation of assets and priority in bankruptcy, aimed to boost consumer confidence and financial stability.

Weekly news on trade tariffs include a report by the Financial Times indicating that the US President had intensified his trade demands on the European Union after weeks of negotiations. According to the report, Trump is now pushing for a minimum tariff of 15% to 20% on imports from the EU, escalating further trade tensions.

Effective July 23, the composition of the S&P 500 index will be adjusted. A tech company Block will be added to the index, replacing energy company Hess, which will be removed. Following the announcement, Block’s shares jumped 10% on Friday.

Denmark is the first country in the world which passed the legislation by which citizens of their country own the copyright to their own face, voice and body. With this move Denmark Government is trying to protect its citizens from AI deepfakes, and similar misuse of data, pictures and voices of its citizens, without an explicit consent.

CRYPTO MARKET

While the previous week was the one dedicated to BTC, this week belongs to altcoins, who drove total market capitalization to higher grounds. The adoption of the Genius Act by the U.S. House was the main trigger behind the strong demand for altcoins. The crypto market gained a total $181B in market cap, increasing it by 5% on a weekly basis. Out of $181B, BTC participated with “only” $11B. Daily trading volumes were also increased to the level of $333B, from around $300B traded a week before. Total crypto market capitalization from the beginning of this year currently stands at 17%, with a total funds inflow of $561B.

This week belongs to ETH and other altcoins, which were major weekly gainers. ETH managed to add $74B to its market cap, increasing it by an incredible 20,8%, reaching levels of $3,5K. XRP was also one of coins with a gain above 25%, adding total $41B to its market cap. This week, market favourite Solana added $9,4B to its capitalization, increasing its total value by 11%. BNB managed to collect new $6,3B, surging by 6,6%, while DOGE added $6,7B to its market cap, which was increased by 23%. Among significant gainers ADA should also be mentioned, with an weekly increase in its cap by $4,2B or 17%.

A relatively calmer week when coins in circulation are in question. The main weekly difference relates to ZCash which withdraws 3,8% of its coins from the market free float. At the same time, Solana was the one to increase its number of circulating coins by 0,4% this week. Algorand also had an increase of coins on the market by 0,3%.

Crypto futures market

BTC and ETH futures were moving in opposite directions during the previous week. While BTC futures had a modest drop in value for all maturities, ETH futures gained significantly. BTC futures were traded by around 0,8% lower from the week before. Futures maturing in December this year closed the week at $121.215, and those maturing a year later were last traded at $128.345.

At the same time, ETH futures marked a surge in value of around 18% for all maturities. The coin passed the $3,5K levels. December 2025 futures were closed at $3.678, while those maturing in December 2026 were last traded at $3.958.

MARKETS week ahead: July 13 – 19 | XBTFXLast week in the news

Previous week was short in US macro news, however, news regarding trade tariffs were the ones that shaped market sentiment at Friday's trading session. The optimism on the US equity markets still holds, regardless of a short correction on Friday. The S&P 500 reached another all time highest level, ending the week at 6.259. Gold was once again a refuge from tariffs for investors, gaining during the week, ending it at $3.354. Tariffs tensions rattled US Treasury yields, with the 10Y benchmark closing at 4,41%. Certainly, the winning asset of the week was BTC, which broke the $108K resistance and moved all the way up to $118K, bringing another all-time highest level.

This week was relatively quiet in terms of key U.S. macroeconomic data. The main highlight was the release of the FOMC meeting minutes from June. The minutes didn’t reveal any new information beyond what has already been communicated publicly. The Federal Reserve continues to emphasize the need for flexibility regarding future rate cuts and is likely to remain on hold until economic indicators more clearly signal a slowdown. Most analysts still expect the next rate cut to come in late 2025 and early 2026. This outlook is shaped by persistent risks of both rising inflation and increasing unemployment, driven by recently imposed trade tariffs, which present ongoing challenges for Fed policymakers.

When it comes to trade tariffs, the previous week brought news regarding imposition of a 35% tariff on imports from Canada and a 50% tariff on goods coming from Brazil into the U.S. There have also been discussions about the possible introduction of a broader 10% universal tariff on most other countries, with some mentions of rates as high as 15% or 20%, as well as 50% on all copper imports. News posted on Saturday noted the introduction of a 30% tariff on all imports from the European Union and Mexico. The European stocks closed the Friday's trading session lower, waiting for a tariffs-letter from the US Administration, which was released on Saturday.

News is reporting that the US Government managed to end June with a budget surplus of $27B, for the first time since 2017. The reason behind the increased funds analysts are noting a surge in income from tariffs, which reached $113B this year. Still, the broader fiscal picture remains challenging, as analysts are concluding.

Speaking at an event, Fed Governor Christopher Waller stated that the growing use of stablecoins could lead to faster and more affordable payments. "As a free-market capitalist economist, my goal is to see competition in the payments space lower costs for households, consumers, and businesses—plain and simple," he said. Waller also noted that while stablecoins might reduce the demand for physical U.S. currency, they could simultaneously strengthen overall demand for the U.S. dollar.

CRYPTO MARKET

This was a week for celebration for crypto enthusiasts. BTC not only reached the all time highest level, but this coin is on the road to $120K as it managed to reach level above the $118K. This was indeed another significant milestone for BTC to reach, while crypto enthusiasts are noting that the price could easily reach even higher values till the end of this year. What will be the case, is to be seen in the future. Total crypto market capitalization significantly gained during the week, ending the week total 10% higher from the week before, adding $330B of new funds. Daily trading volumes were more than doubled, with an average daily trading volume of around $300B. Total crypto market capitalization from the beginning of this year currently stands at 12%, with a total funds inflow of $380B.

The vast majority of crypto coins gained during the previous week, and managed to significantly increase their market capitalization. The most important coin which drove the market to the upside was BTC, with a surge in value of 8,6% on a weekly basis, adding a total amount of $185B to total crypto market capitalization. ETH also had an incredible week, surging, after a longer period of time, to levels above the $3K, adding 17,5% to its market cap with an inflow of $53B of funds. All major coins had a positive week. Solana was traded higher by 9,3%, adding $7B to its market cap. ADA ended the week higher by 22,6%, with an inflow of $4,6B. One of the unexpected significant gainers of the week was Stellar, with an incredible surge in value of 63,7%. DOGE gained 21%, Uniswap surged by 21%, Algorand was traded higher by 26%. Indeed one incredible week for all crypto coins with strong gains.

As on the spot market, there has also been higher activity when it comes to coins in circulation. It is not frequently seen that BTC has a weekly increase of circulating coins, as it was during the previous week, when the number of coins was increased by 0,1%. Stellar increased its value by an incredible 63,7%, but at the same time, it increased the number of coins on the market by 0,4% w/w. IOTA had a surge in coins on the market by 0,8%, while Filecoin added 0,4% of new coins on the market. Interestingly, this week, BNB decreased the number of circulating coins by 1,1%.

Crypto futures market

In line with the surge of the value of coins on the spot market, crypto futures also skyrocketed in value, reaching some of the all time highest values for long term maturities. BTC short term futures ended the week by more than 9% higher, while the longer term futures were up by more than 7%. Futures maturing in December this year reached the last price at $122.135. At the same time futures maturing in December 2026 reached the new all time highest level at $129.355. As per values of futures, the price of BTC has more space to reach higher grounds.

ETH futures also had an excellent week, surging by more than 20% for shorter maturities and above 16% for longer maturities. What is most important is that futures finally ended the week above the $3K levels. Futures maturing in December 2025 closed the week at $3.121 and those maturing a year later were last traded at $3.359.

MARKETS week ahead: July 6 – 12Last week in the news

The US jobs data posted during the previous week shaped investors sentiment. The jobs market seems resilient, making market participants diminish any expectations that the Fed might cut interest rates at July's FOMC meeting. In this sense, the 10Y Treasury yields adjusted from level of 4,2% to close the week at 4,33%. On the opposite side, strong jobs figures pushed the S&P 500 to reach all time highest levels for the last five days, closing the week at the level of 6.279. Weakening of the US Dollar supported the price of gold to end the week higher, at the level of $3.333. The crypto market had a volatile week, with BTC reaching the level of $110K, still, ending it at levels above the $108K.

This week was marked with US jobs data, exposing its further resilience. The JOLTs job openings ended May at 7.769M, which was higher from market anticipation of 7,3M. The posted unemployment rate for June was standing at 4,1%, slightly lower from 4,2% posted for the previous month. The data which mostly impacted market sentiment were related to the Non-farm Payrolls for June, with 147K new jobs. It was higher from the market estimate of 110K for the same period. A strong jobs market made an impact on investors to rethink the potential Fed's rate cut at July's FOMC meeting. Current expectations for September's rate cut were increased.

Trump's “big, beautiful bill”, proposing significant tax cuts, passed the U.S. Senate during the previous week, and is now back in the House for final approval. Analysts are still concerned regarding its effects on the US level of debt in the next 10 years period, currently estimating further broadening of the US debt by $3,7 trillion.

Although the last two weeks passed with increased optimism on US equity markets, still both analysts and investors are closely watching developments with trade tariffs deals by the US Administration. Last week, the US made a deal with Vietnam of 20% tariffs for imports from Vietnam, while the US goods will be tariff-free. However, the next week will be important from the perspective of the end of a 90-days delayed tariffs period, which the US Administration left for the majority of countries around the world, leaving them the space for negotiations. Talks with major US trade partners are still ongoing, including China, European Union, Japan and India.

News is reporting that the ECB will most likely wait for the September meeting to further cut interest rates on Euro. The reason for such expectations are mentioned uncertainties regarding the trade agreement with the US Administration. Economists are also noting this year`s surge of Euro against US Dollar of 14%, which might add an additional burden on the EU economy in addition to trade tariffs.

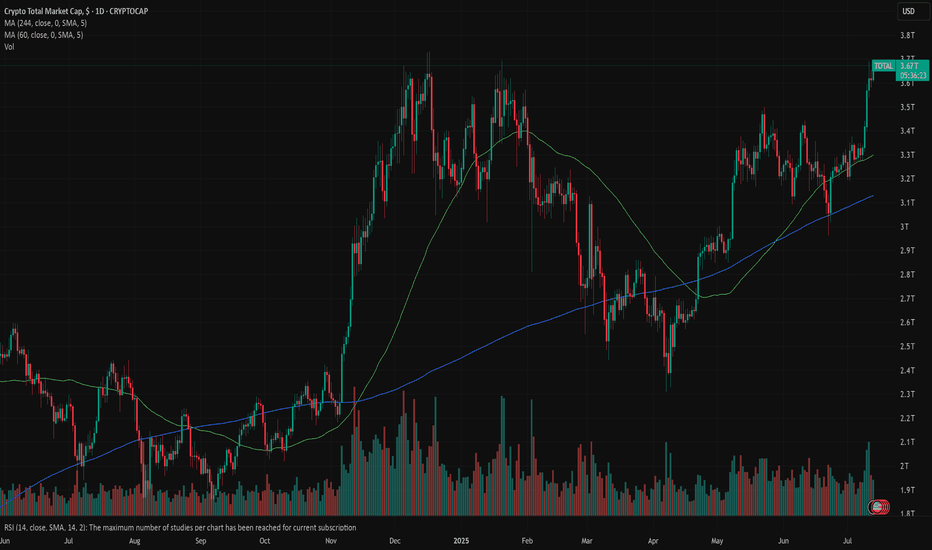

CRYPTO MARKET

Another volatile week on the crypto market passed. The positive market sentiment was under influence of better than expected US jobs data posted for June. The BTC reached the level of $110K on Wednesday, but still, ending the week lower. Majority of other cons peaked during the week, but are still ending the week lower. On a weekly basis, there has been almost an equal number of gainers and losers among crypto coins. Total market capitalization gained 1% for the week, adding $24B to its total cap. Daily trading volumes remained relatively flat during the week, moving around $153B on a daily basis. Total crypto market capitalization from the beginning of this year currently stands at 2%, with a total funds inflow of $50B.

The largest coin was moving the market during the previous week. BTC closed the week by 0,7% higher on a weekly basis, adding $15B to its total cap. This week ETH also managed to close it 2,7% higher, increasing its market cap by $7,9B. Market favourite Solana had a significant surge during the week, till the level of $159, however, it is ending the week above the $146, marking the weekly loss of 2,9%, or $2,3B outflow of funds. DOGE had a similar movement, but ending the week with a modest loss of 0,5%. ADA managed to sustain its weekly gains, ending it at 1,8% higher. Uniswap had a drop in value of 2,7% while Maker lost almost 5% in value.

Although market prices of crypto coins had a relatively volatile week, still when it comes to circulating coins, the situation was much calmer. Stellar had the highest weekly decrease of the number of coins on the market , of 1%. Such withdrawals are not frequent with this coin. Filecoin traditionally is increasing the number of coins on the market, with this week's increase of 0,3%.

Crypto futures market

Crypto futures also reacted to a positive investor sentiment, where both BTC and ETH futures ended the week higher. BTC short term futures had a modest increase of some 0,7%, while the longer term ones closed the week higher by 2,6%. Futures maturing in December this year ended the week at the level of $113.750, and those maturing a year later were last traded at $120.395.

Similar development was also with ETH futures, where short term ones closed the week by 2,9% higher, and longer term ones surged by more than 7% on a weekly basis. ETH futures maturing in December 2025 were last traded at $2.689. Futures maturing in December 2026 closed the week at $2.894.

MARKETS week ahead: June 30 – July 7 Last week in the news

The news regarding a deal settlement on trade tariffs between the U.S. and China, brought some relief on financial markets during the previous week. The most significant weekly gainer was the US equity market, where the S&P 500 reached a fresh, new all time highest level at 6.185. On the same grounds, the price of gold turned into a correction, with a weekly drop of 2%, reaching the level of $3.273. A further easing of inflation in the U.S. impacted 10Y Treasury yields to ease down to the level of 4,27%. The crypto market managed to sustain upper grounds during the week, with BTC holding above the $107K.

The information which occupied the market's attention during the previous week, was that the US Administration and China managed to settle a trade tariffs deal. Although the details of a deal have not been publicly disclosed, still, the market reacted in a positive manner, bringing the US equity market to higher grounds. The posted macro data showed further ease in the US inflation. Fed's favourite inflation gauge, the PCE index reached 0,1% in May, bringing it to the level of 2,3% on a yearly basis. The core PCE remains elevated, with 0,2% in May and 2,7% for the year. Still, all figures were in the line with market expectations, increasing odds that the Fed might cut interest rates in September.

Weekly tariffs news include the discontinuation of trade negotiations with Canada. As the U.S. President posted on social media, the termination of negotiation is immediate, and the US will decide on the level of tariffs within the next five days. Such a decision came after Canada decided to impose a digital services tax on US tech companies.

CNBC is reporting that Coinbase is the best performing stock in June, with a surge of 43% only during this month. As the reason for such a strong price movement analysts are noting several combined reasons, like its inclusion into S&P 500 index, the GENIUS Act which was passed in the Senate and a strong performance of Circle.

Fed Chair Powell was for one more time a topic of the US President answering the journalists questions. The US President commented that he will put as the head of the Fed anyone who will support the rate cuts. He also noted that there are several candidates for this place, not explicitly mentioning names.

There has been a discussion among analysts whether stablecoins represent a threat to payment card business, concretely to Visa and Mastercard. The one alternative for these companies to sustain the market game is to issue their own stable coins which could function on a prepaid basis. However, a few services which are currently not provided by stablecoins, like buy now - pay later are still advantageous to card issuers.

CRYPTO MARKET

It was a week of ups and downs on the crypto market, however, the week ended in a positive territory. The US-China deal on trade tariffs brought some relaxation among investors, which was also reflected in a crypto market. Total crypto market capitalization gained 4% during the week, where major crypto coins are participating with 70% in total funds inflow of $130B. Daily trading volumes were slightly decreased to the level of $146B on a daily basis from $187B traded a week before. Total crypto market capitalization from the beginning of this year currently stands at 1%, with a total funds inflow of $26B.

The major coins on the market were the ones which mostly supported an increase in a weekly capitalization of the crypto market. BTC managed to add $87B to its market cap, increasing it by more than 4% on a weekly basis. Second place took Solana this week, with an inflow of $7,2B, where its market cap surged by almost 10%. XRP had a strong funds inflow of $5,8B, or 4,7%, while ETH collected $5B which was an increase of 1,8% for this coin. BNB was moving within a modest territory, with a weekly surge of 2% adding almost $2B to its market cap.

It was an active week also when it comes to coins in circulation. This week both Solana and Polkadot had an increase of the number of coins on the market of 0,6%. At the same time IOTA increased its number of coins by 0,8%. Although it is a stablecoin, it is worth mentioning that Tether is continuously increasing the number of its coins, which surged by 1% last week. This could be treated as an indicator of increasing popularity of stablecoins during the recent period.

Crypto futures market

The crypto futures market ended the week in alignment with the spot market developments. BTC futures were closed above 3% higher from the end of the previous week. Futures maturing in December this year were closed at $110.680, and those maturing a year later were last traded at $117.270. On a positive side is that the long term futures are slowly nearing the historically highest level of $124K reached in January this year.

ETH futures were traded relatively flat compared to the week before. Futures maturing in December 2025 closed the week at $2.514, and those maturing in December 2026 achieved the last price at $2.703.

MARKETS week ahead: June 23 – 29Last week in the news

Geopolitical tensions, the FOMC meeting and inflation fears could be the summary of topics for the previous week. Markets are currently in a sort of limbo phase, not sure what direction to trade, considering high uncertainties which are surrounding financial markets. The S&P 500 tried to be positive at the beginning of the week, but ended it lower, at the level of 5.967. The US Dollar was traded in a mixed manner, but the price of gold took a bit of a relaxing trend, closing the week at the level of $3.371. The 10Y yields reacted to the Fed's narrative around interest rates and closed the week lower, at the level of 4,37%. The crypto market was also traded in a mixed manner, but more toward the downside, where BTC closed the week lower, at the level modestly above the $103K.

The main event of the previous week was the FOMC meeting. The Fed kept interest rates unchanged, as widely expected. The Fed stays on the course of two rate cuts during the course of this year. Once again it has been noted that “uncertainty about the economic outlook has diminished but remains elevated”. The uncertainty mostly relates to the effects of the implemented trade tariffs on the U.S. economy in the future period. Possibility of higher inflation is also noted. With that respect, the Fed will stay data-dependent when deciding over the future course of interest rates.

Based on official comments, it seems that the FOMC members are not united when it comes to the final decision regarding the cut of interest rates. During the previous week, Fed Governor Waller noted in an interview that the Fed might make the first rate cut in July, considering the current inflation level and jobs market. On the opposite side was San Francisco President Mary Daly, who stated that some more confidence is needed that the trade tariffs would not make a significant impact on inflation, before the next rate cut.

As news is reporting, Tesla has signed an agreement with China to build a grid-scale battery power plant in China. As noted, it is going to be the largest project in China that Tesla is going to conduct, with an estimated worth of $556M.

Coinbase announced that the company had secured a Markets in Crypto Assets or MiCA license from Luxembourg authorities, based on which it will be able to offer crypto services to clients in the EU. With this license, the company also noted that their central hub in the European Union will be in Luxembourg, instead of Ireland, as previously planned.

The Swiss National Bank cut rates by 25 bps to 0% during the previous week. The decision was made after the country was struggling to sustain the inflation growth, entering into deflation in May. The inflation in Switzerland peaked at 3,5% in August 2022, and since then is on a deflationary road.

CRYPTO MARKET

There have been a lot of topics for investors during the previous week, including geopolitics and macroeconomics, which left the crypto market a bit behind the traditional markets. Although during the first half of the week, crypto coins were traded in a mixed manner, still, the weekend brought some major pulls toward the weekly negative zone. Total crypto market capitalization dropped by 3% on a weekly level, dragging down $84B in the value of the market. At the same time, daily trading volumes remained relatively flat on a weekly basis, moving around $187B. Total crypto market capitalization currently stands at the negative territory of -3%, compared to the end of the previous year, with a total outflow of $104B.

For one more time BTC was pushing the total market cap to the downside, with an outflow of $38B, decreasing its value by 1,8% for the week. ETH was also traded in a negative territory, down by 4,8% on a weekly basis, with an outflow of $14,6B. The majority of other coins traded in red for the week, where DOGE was down by 10,1%, Cardano dropped by 9,1%, ZCash lost 9,8% in value. Market favorite coins had a relatively modest weekly drop as BNB ended the week by 1,3% lower and Solana was down by 3,2%. Only a few altcoins ended the week in shiny green, like Tron, which was higher my modest 1% or EOS with a plus of 1,7% for the week.

This week Solana managed to add new coins on the market, increasing its total number by 0,7%. Such a strong increase is not very frequent with Solana. On the other hand, a total surprise came from LINK, who added 3,2% of new coins to the market. Filecoin traditionally increases its circulating coins on a weekly basis, adding 0,2% new coins for this week.

Crypto futures market

The crypto futures market reflected developments from the spot market. Both BTC and ETH futures ended the week lower from the week before. BTC futures ended the week by 1,8% lower, while ETH futures were last traded around 4,5%.

BTC futures maturing in December this year reached the last price at $107.345, and those maturing a year later at $113.520. The good news is that BTC long term futures are still holding above the $100K level, exposing the investors anticipation regarding future potential of BTC.

ETH futures maturing in December this year closed the week at $2.525, and those maturing in December 2026 at $2.710.

MARKETS week ahead: June 15 – 21Last week in the news

Newly emerged tensions in the Middle East impact market sentiment as of the end of the previous week. The US equity markets reacted in a negative manner, bringing the S&P 500 down by more than 1%. The US Treasury yields started their relaxation during the week, however, reversed on Friday back to the level of 4,4%. The US Dollar lost in value, however, the demand for safe-haven assets pushed the price of gold more than 1,4% higher, ending the week at the level of $3.443. The BTC had a rollercoaster week, with highs at $110K, but is ending the week above the $104K level.

The previous week started in a promising sentiment. The US May inflation data was posted, indicating a clear down trend. The inflation in May reached the level of 0,1%, bringing it to the level of 2,3% compared to the previous year. Core inflation was also standing at 0,1%, while both figures were slightly better from market estimates. The week-end brought the University of Michigan Consumer Sentiment preliminary for June, where inflation expectations were also decreased. Yearly inflation expectations significantly dropped to the level of 5,1% from 6,6% posted for the end of May. The five year inflation expectations were also decreased from 4,2% to 4,1%.

The inflation data supported market expectations that the Fed will hold interest rates unchanged at their meeting in June, but increased odds for the next cut in September. The FOMC meeting is scheduled for June 18th, together with macro projections. Analysts are pointing that the macro projections will be in the spotlight of investors, as they are still trying to wage the total impact of the imposed trade tariffs. At their May meeting, it has been shortly noted by Fed Chair Powell that the risks of both higher inflation and unemployment had risen. As data are showing that the inflation is slowing down, the increasing unemployment might impact the Fed to cut interest rates in order to fulfil their dual mandate.

The new unrest in the Middle East is another topic that puts concerns among investors. Seeking safe-haven assets, the price of gold gained 1,4%, only on Friday trading. The investors are also concerned that the surging prices of oil, due to the crisis, might spillover to the US inflation figures in the coming period. Although the US at present moment, is not highly exposed to the volatility of oil prices on world markets, still, analysts are pointing to the effect which might come from increased commodity prices, as a consequence of surged oil prices. This will be another topic closely watched at the FOMC press conference on Wednesday.

Interesting news came from Sweden. As Reuters was reporting, the Swedish pension fund AP7 blacklisted shares of Tesla and sold the whole stake. As announced by the fund “ AP7 has decided to blacklist Tesla due to verified violations of labor rights in the United States”. Nevertheless, shares of TSLA gained 1,94% in Friday's trading session.

CRYPTO MARKET

The rollercoaster on the crypto market was evident during the previous week. The newly emerged Mid-East crisis left its market also on a crypto market. The coins were traded in a mixed manner, but ended the week in a negative territory. On the other side were a few coins which managed to end the week in green. Total crypto market capitalization decreased by 1% on a weekly basis, losing around $22B from the market cap. Daily trading volumes were relatively flat compared to the week before, moving around the $185B on a daily basis. Total crypto market capitalization once again entered into the negative territory from the beginning of this year, currently standing at minus 1%, with a total outflow of $20B.

BTC ended the week flat from the end of the previous week, although the price of coin at one moment reached the level of $110K at the beginning of the week. ETH managed to gain 1% in value, adding $3B to its total capitalisation. Other gainers among altcoins were Uniswap with a surge in value of 17,3% and Maker, with an increase in value of 23% on a weekly basis. The major coins on the market were traded with a negative sentiment. Market favorite Solana ended the week by 4,7% lower from the week before, losing $3,75B in its cap. BNB was modestly down by 1%, while DOGE decreased its value by 4%.

Although Solana was traded with a negative sentiment, still, the coin managed to increase its total coins in circulation by 0,5%. This week IOTA had a stronger increase of total number of coins on the market by 0,8%. The majority of other altcoins had an increase of coins in circulation by 0,1% w/w.

Crypto futures market

The latest drop in the value of BTC and ETH was not reflected in the prices of crypto futures as of the end of the week. BTC futures ended the week higher by around 0,6% for all maturities, while ETH futures had an increase of around 1,5% on a weekly basis.

BTC futures maturing in December this year closed the week at $109.390 and those maturing a year later were last traded at $115.590. At the same time ETH futures with maturity in December this year closed the week at $2.637, and those maturing in December 2026 were last traded at $2.838.

MARKETS week ahead: June 8 – 14Last week in the news

The first trading week in June started with surprisingly better than expected US jobs data, which influenced some positivity in investors sentiment. The US equity markets gained during the week, with S&P 500 heading again toward levels above the 6K. The US Dollar also modestly gained on Friday, pushing the price of gold to the lower ground, ending the week at the level of $3.309. The US 10Y Treasury benchmark also had a strong reaction on the US jobs data, surging to the level of 4,5% on Friday. The crypto market was traded in a mixed manner, however, BTC managed to hold the $105K level as of the end of the week.

Previous week was marked with the US jobs data, which the market closely watched. At the start of the week JOLTs job openings in April were posted, with a modestly higher figure than anticipated. Jobs openings reached 7,391M, while the market was expecting to see the figure of 7,1M. However, the major data were posted on Friday, impacting the positive market sentiment. The Non-farm payrolls in May added 139K new jobs, while the market estimate was at the lower grounds, around 130K. The market reaction was positive for the equity market, however, it pushed US Treasury yields to higher grounds. Investors are not anticipating that the Fed might hold interest rates at current levels for a longer period of time, than previously anticipated. The CME FedWatch tool is currently estimating odds of 100% that the Fed will hold interest rates steady at their June meeting.

On the opposite side from US investors' sentiment was the European Central Bank, which cut interest rates for the eighth time this year by 25 basis points. The ECB reference rate currently stands at 2%, at the same level where yearly inflation in the Euro Zone stood in May. The ECB currently sees reference interest rate at neutral level. At the same time, ECB commented that the next move will be data-driven, in which sense, neither the ECB nor markets could perceive when and what will be the next ECB move. ECB President Lagarde commented that the US tariffs would hurt EuroZone growth, but extra government spending on defence would bring some positive effects to the economy. The ECB also lowered the inflation forecast for this year and next, while its growth projections remained unchanged. The inflation forecast for this year stands at 2% from 2,3% previously, and at 1,6% in 2026.

Since tariffs are the major headline news, some new information from the previous week includes continuation of negotiations between US and China in London in a week ahead. The US President announced that China agreed to let some rare minerals flow from China to the US. At the same time, Reuters posted that the China central bank bought gold on the market for the seventh consecutive month in May, increasing further its gold reserves.

Another event that spotted market attention was a dispute between the US President and his ally Elon Musk over the “big, beautiful” tax bill which is to be adopted in the US, including significant tax cuts. Musk commented on social networks that this bill will add $36,2 billion new debt to the US balances, which could further hurt the sustainability of the US debt. The shares of Musk's company Tesla dropped by 14% on the news, however, modestly recovered as of the end of the week.

CRYPTO MARKET

During the previous week the crypto market continued with consolidation, after reaching the new highs two weeks ago, especially concerning the BTC price moves. Although the market traded in a modestly negative sentiment during the week, Friday's US jobs data, which was better than expected, also pushed the crypto market to cover some of the weekly losses. Total crypto market capitalization remained flat on a weekly level, with a modest weekly funds outflow of $8B. Daily trading volumes also eased to the level of $194B on a daily basis, from previous weeks $234B. Total crypto market capitalization increase from the beginning of this year, currently stands at 0%, with an inflow of funds of around $2B.

The crypto market was traded in a mixed manner during the previous week. The leader of the market, BTC, was initially traded toward the downside, but managed to end a week flat, with a small funds inflow of $6B. On the opposite side was ETH, which lost less than 2% in the market value, decreasing its cap by $5,9B. Major crypto coins were also traded with a negative sentiment, but with relatively small weekly loss. In this group is BNB, with a weekly drop in value of 1,6%, Solana was down by 2,8%, ZCash was down by 3,7%. DOGE was down by 5% on a weekly basis, due to a dispute between the US President and his ally Elon Musk, a promoter of DOGE. Few coins which ended the week in green were Maker, which surged by 7,5%, Tron was traded higher by 4,4% and OMG Network ended the week higher by 3,4%.

There have been some interesting developments when circulating coins are in question. Namely, during the previous week BTC increased the number of coins on the market by 0,1%. Such a situation is extremely rare on the market, which is why it deserves attention. At the same time, Solana also had an increase in circulating coins by 0,6% while the number of coins of EOS were higher by 0,5% w/w.

Crypto futures market

In line with the consolidation on the spot market, the crypto futures eased during the previous week. BTC futures were traded modestly down by 0,3%, which could be treated as a flat weekly trading. Futures maturing in December this year closed the week at $108.695, and those maturing a year later, were last traded at $114.860.

ETH futures had a higher drop of around 3,5% for all maturities. ETH futures ending in December 2025 closed the week at $2.597, and those maturing in December 2026 were last traded at $2.795.

MARKETS week ahead: June 1 – 7Last week in the news

May ended with an eased tensions on financial markets. The daily dose of tariff-tweets is not something that has such a strong impact on market moves as it was in the beginning of the period. Investors are again turning their view on actual macro data and company earnings. The S&P 500 managed to end the month in a positive tone, and a gain of 6%. Eased inflation expectations turned the 10Y US Treasury benchmark to the downside, ending the week at the level of 4,39%. Eased tensions also impact the price of gold to get back in alignment with movements of the US Dollar, ending the week at the level of $3.288. After reaching the Pizza Day new ATH, the price of BTC eased due to profit taking, still ending the week above the $104K.

The inflation expectations in the US eased during the previous week, as per official posted data. The posted PCE data at 0,1% in April and 2,1% for the year, were fully in line with market expectations. Core PCE was also standing at the same level. Both indicators are showing that the inflation in the US is at the down path, also in line with Fed expectations. Friday brought May final University of Michigan Consumer Sentiment data, which was at the level of 52,2, modestly higher from anticipated 51. However, the most important information for markets was easing in inflation expectation, where five year expectations dropped to the level of 4.2%. At the same time, the market was expecting to see the figure of 4,6%. Eased inflation is boosting market confidence that the Fed might cut interest rates till the end of this year.

The narrative regarding trade tariffs continues to be one of the main topics in the news. During the previous week the US President announced on social networks that China has “violated” trade agreements with the US. On the other hand, there are announcements for increased tariffs on all steel imports to the US, to 50% from the current 25%. As a response to such a narrative the European Union commented its readiness to impose countermeasures on the US.

The European Central Bank will hold a regular meeting on June 5th. The majority of market participants are expecting to see the further 25 basis points cut during this meeting, with a pause in July. This cut will bring the reference rate to the level of 2%, which the majority of economists are perceiving as a neutral level.

News is reporting an increasing interest from companies in the US to hold BTC. As per a CNBC article, the Trump Media is planning to raise $2,5 billion in order to buy BTC, while GameStop plans to invest $500 million to this coin. At the same time, Tether, SoftBank and Strike will launch Twenty One company which will hold 42.000 BTCs and will be the third largest holder of BTC globally.

CRYPTO MARKET

After reaching the fresh, new ATH, the BTC entered into correction during the previous week, pulling back the total crypto market capitalization, and the rest of altcoins. This move could be anticipated for this week, considering the profit-taking period, which usually comes with a strong push of value to the higher grounds. Total crypto market capitalization returned to the levels from the start of this year, erasing modest increase in capitalization. Daily trading volumes were modestly decreased to the level of around $234B on a daily basis, from $306B traded the week before. Total crypto market capitalization increase from the beginning of this year, currently stands at 0%, with an inflow of funds of around $10B.

Two weeks ago BTC gained significant 4,8% in value, however, during the previous week, the coin lost 3,9%. Net market capitalization for the last two weeks is still positive, of some $15B increase in total BTC market capitalization. ETH had a relatively calmer week, with a modest funds outflow of $1,3B, which is less than 0,5% of ETHs value. Major coins on the market were also traded in a negative manner. BNB was traded down by 1,8%, while Solana lost 11% in value, with an outflow of $10B. DOGE also ended the week in red, with total outflow of $4,9B or 14,5%. This week Algorand and Polkadot were also traded at higher negative sentiment, where each coin lost in value more than 10%. Only rare coins managed to end the week in green. One of such coins was ZCash with an increase in value of modest 2,2%. OMG Network also ended the week with 3,5% weekly gain.

When coins in circulation are in question, IOTA had a significant weekly increase of 0,8%. Solana added 0,4% new coins on the market. Filecoin, traditionally, is increasing the number of its coins on the market, adding this week 0,8% more coins.

Crypto futures market

This week there has been some relaxation in the price of crypto futures, in line with the relaxation on the spot market. BTC futures ended the week by around 4% lower from the week before, for all maturities. At the same time ETH futures were traded relatively flat on a weekly basis.

BTC futures ending in December 2025 closed the week at $108.995, and those maturing a year later, reached the last price at $115.280. ETH futures with maturity in December 2025 were last traded at $2.692, and with maturity in December 2026 closed the week at $2.897.

MARKETS week ahead: May 26 – 31Last week in the news

The market sentiment was once again shaped by fundamentals during the previous week. On one hand, the new narrative regarding tariffs raised concerns over potential stagflation, while the new tax and spending bill adopted by the US House of Representatives is raising concerns over the broadening of the US debt. The US equities were traded with a negative sentiment, where S&P 500 ended the week at the level of 5.802. This news also supported the weakening of the US Dollar and rise in the price of gold, which ended the week at $3.357. Gold gained almost 2% only on Friday. The US Treasury yield also strongly reacted, where 10Y reached 4,62 at one moment, however, ending the week at 4,5%. This week BTC celebrated Pizza Day anniversary, with a fresh, new all time highest level at $111,7K.

The markets tried to start the previous week with a positive sentiment, however, news regarding new tariffs imposed by the US Administration turned the sentiment to negative territory. As per the announcement of the US President, the new 50% tariffs on imports from the European Union, will become effective as of 1st July. Although the US Administration is open to discussion, the latest news from the US President states “not looking for a deal”.

As announced on social network “Truth” the US President will impose a 25% tariffs on all IPhones which are produced outside of the US. This news hit shares of Apple, which lost about 3% only during Friday's trading session. At the same time, some analysts are noting that the production of IPhones in America will significantly impact the price of smartphones, which might reach $3.000 from current $1.000.

The US House of Representatives adopted a tax and spending bill, during the previous week. Although the bill includes cuts to Medicare, it also includes several other tax cuts, which significantly raised concerns over broadening of the US debt in the next 10 years period. It comes after a US credit rating cut by rating agency Moodys during the previous week, on the same concerns.

News is reporting that the companies are turning to AI in order to estimate the potential global impact of their supply chains, after introduction of trade tariffs by the US Administration. It is called “AI tariff agent” which can immediately calculate changes for 20.000 products.

The US Steel Corporation made a business agreement with Japanese Nippon Steel. The takeover was initially stopped by the US President Joe Biden, however, the Trump administration supported this deal but in terms of partnership between two companies. As it has been noted, the deal is supposed to create 70K new jobs in the US steel industry and $14B to the US economy.

CRYPTO MARKET

Bitcoin celebrated the anniversary of Pizza Day by reaching another significant milestone - a fresh, new all time highest level. At the same time, the rest of coins were traded in a relatively mixed manner. However, regardless of mixed trading, there has been an increase of total crypto market capitalization of around 4% on a weekly level, where around $114B had been added to the crypto market, mostly of which came from BTC. Daily trading volumes were also almost doubled on a weekly basis, from $148B traded week before to $306B. Total crypto market capitalization increase from the beginning of this year, currently stands at 4%, with an inflow of funds of around $139B.

BTC celebrated its anniversary with an increase in cap of 4,8% on a weekly level, adding total $99B to its capitalization. The rest of the crypto market did not follow a surge in value, as they were mostly traded in a mixed manner. On a positive side were Monero, with a surge in value of 16,7% w/w adding $1B to its cap. ETH modestly increased its value by 1,7%, with an inflow of $5,2B. Another coin with a significant weekly surplus was ZCash, which added 26% to its value. BNB was traded higher by 4%, while Solana added 3,6% in value. Uniswap was also traded higher by 4%. On a completely opposite side were coins like Maker, which dropped in value by almost 29% w/w. XRP and Litecoin lost around 2% in value, while Polkadot was traded lower by more than 3%.

When coins in circulation are in question, there has been higher activity during the previous week. This week ZCash added 5,2% more coins to the market. XRP, DOGE and DASH had an increase in circulating coins by 0,1%, the same as Solana and Filecoin. This week Polkadot had a higher increase of coins in circulation by 0,6%.

Crypto futures market

BTC futures were following the spot market, in which sense, futures on this coin ended the week by more than 5% for all maturities. Different situation was with ETH futures. Although ETH gained a modest 1,7% w/w, its futures perceived the market at different levels, where all maturities gained more than 9,5% on a weekly basis.

BTC futures maturing as of the end of this year closed the week at the level of $113.520 and those maturing a year later at the level of $119.980. ETH futures with maturity in December 2025 were last traded at $2.682 while December 2026 was closed at $2.835. It is interesting that ETH long term futures are still struggling to pass the $3K level.

MARKETS week ahead: May 18 – 24Last week in the news

The US inflation and inflation expectations were in the spotlight of market interest during the previous week. The weekly surprise came from the US-based credit rating agency Moody’s, which downgraded the US sovereign by one notch. As the news came late Friday, the market reaction was reflected in an after-hours trading, where the 10Y Treasury benchmark reached again the level of 4,48%. As tariffs tensions are settling down, the positive market sentiment continues to hold on US equity markets. The S&P 500 had five positive trading days, adding more than 5% to its value during the week, and closing it at 5.958. Due to the same reason, the price of gold eased, ending the week at the level of $3.201. The crypto market was side traded during the week, where BTC was moving between levels of $103K and $105K.

The US inflation figures were posted during the previous week, which was in line with market expectations. The US inflation in April was standing at 0,2% for the month, and 2,3% on a yearly basis. At the same time core inflation continues to be modestly elevated on a yearly basis, with the level of 2,8% in April, however, it reached 0,2% on a monthly basis. The surprise came from the University of Michigan inflation expectation survey, which was elevated compared to the previous posted figures. The preliminary data showed an increased 5 years inflation expectations of 7,3%, from 6,5% posted previously. Expectations for a yearly inflation were also higher, at the level of 4,6% from 4.4% posted previously. Analysts are noting that such sentiment of US consumers is coming from tensions over trade tariffs between the US and China.

The significant news from rating agencies came during the weekend, noting that the US based rating agency Moody’s downgraded the US sovereign rating by one notch, from Aaa to Aa1. The rating cut came as a result of concerns over sustainability of the US budget deficit and higher rising costs of debt in the environment of higher interest rates. The market reaction was negative, but was reflected in an after-hours trading. The 10Y US Treasury benchmark surged to the level of 4,48%, while 30Y Treasury yields climbed to the level of 4,96%.

The US President's visit to Gulf countries was under close watch of news and markets during the previous week. The most important outcome of these visits are significant trade and investment agreements which the US and Gulf countries signed during the visit. Some deals include a $1,2 trillion commitment by Saudi Arabia of the “economic exchange”, a $1,4 trillion investment over the next 10 years of UAE in the US. Projects were mostly related to investment in the AI and tech companies but also purchases of Boeing planes and military equipment, as per news reports.

Another news covered the US President's visit to the United Arab Emirates, where it is noted that Nvidia, Cisco and Oracle will support the project called “UAE Stargate”, which is an artificial intelligence data centre based in Abu Dhabi.

CRYPTO MARKET

After a significant rally two weeks ago, the crypto market slowed down a bit during the previous week. It was traded in a mixed mode, however, the majority of coins had a weekly correction in the price. BTC managed to sustain the weekly levels above the $103K, holding the total crypto market capitalization relatively flat. The total crypto market cap remained relatively flat on a weekly basis, losing less than $ 1B in value. Daily trading volumes eased during the week, trading around $148B on a daily basis, which was a significant drop from $309B traded the week before. Total crypto market increase from the beginning of this year, currently stands at 1%, with $25B inflow of funds.

BTC had a relative volatility during the previous week, but it managed to end it relatively flat, adding $12B to its total market cap, or 0,6% w/w. ETH also managed to sustain previously gained levels, also ending the week flat, adding a modest 0,6% to its cap. Another coin which was traded with a positive sentiment for the second week in a row was Monero, which managed to add additional 6,7% to its total capitalization. Tron is also in this group with a weekly gain of 4,2%. On the opposite side were coins whose price went through a weekly correction. XRP had a drop in value of 1%, losing $1,45B in market value. BNB dropped by 1,2% while ADA had a major correction of 7%. Uniswap was last traded won by 14,6%, Filecoin and Algorand also experienced a drop in value of more than 7% each.

When it comes to circulating coins, the highest weekly increase had IOTA of 0,5%. IOTA was followed by Filecoin, with an weekly increase in circulating coins of 0,4%. This week Maker had a withdrawal of the circulating coins by -0,2%. It is interesting to note that stablecoin Tether issued the new 0,9% new coins on the market.

Crypto futures market

During the previous week there has been a significant increase in the value of ETH futures. Although this coin managed to add 0,6% to its market cap, still futures showed that this coin should be more than 11% higher from its current market value. This includes both short term and long term futures. Futures maturing as of the end of May were last traded at levels above $2,6K. At the same time, futures maturing in December this year were last traded at $2.720, and those maturing a year later closed the week at $2.926. This means a positive market sentiment, increasing the possibility for ETH long term futures to reach levels above the $3K in the near future.

BTC futures remained relatively flat as of the end of the week, moving in line with the market sentiment from the spot market. In this sense, futures maturing in December this year reached the last trading price at $108.455, and those maturing in December 2026 closed the week at $114.930.

USDJPY: FVG Then Bullish Overflow?It has been a significant week for USD/JPY. Following a break of structure (BOS) on the 4-hour timeframe, price moved away from equilibrium, leaving behind a Fair Value Gap (FVG). As the new week begins, we may observe a false move designed to induce traders into premature short positions before a potential bullish reversal—or vice versa. Additionally, given the recent BOS, price may temporarily stall to facilitate order accumulation. Next week will be pivotal in determining the pair’s next direction.

Watch out for the key levels

MARKETS week ahead: May 11 – 17Last week in the news

The major event during the previous week was the FOMC meeting. Fed held interest rates unchanged, but the main input from Chair Powell was that the Fed is ready to take immediate action in case of a negative consequences of imposed trade tariffs. This brought back investors confidence in financial markets, where the US Dollar gained in value, as well as the US equity market. The S&P 500 closed the week at the level of 5.659. The price of gold dropped on a stronger US Dollar, to the level of $3.326. There has been a reaction also in US Treasury yields, where the 10Y benchmark was last traded at 4,39%. This time the crypto market was not left behind the major developments. BTC made a significant weekly gain by managing to cross the $100K psychological level, reaching the highest levels as of the end of the week above the $103K.

The most expected and watched event during the previous week was the FOMC meeting and Fed Chair Powell's address to the public in an after-the-meeting press conference. The Fed left interest rates unchanged, as was expected, but noted something which brought back the confidence among market participants. Namely, it has been acknowledged that the uncertainty over economic outlook has increased, mostly due to imposed trade tariffs. Still, on a positive side is that the Fed is ready to take immediate actions in case that trade tariffs make a significant impact on the US economy and Fed's dual mandate targets.

In an interview, St. Louis Fed President Musalem noted that he will not vote for rate cuts until he is certain over the effect of imposed tariffs on the US economy. In this sense, there is the question whether tariffs would lead to persistent inflation, or it is going to be only a one-off effect. The same opinion with Musalem shares Fed Governor Lisa Cook, and is also concerned about future productivity of the US economy and discouragement of investments.

The week ahead might bring back some investors' concerns as it is expected to be the start of negotiations between the US and China over the imposed trade tariffs. The US signed an agreement with the U.K. over tariffs of 10%, while many analysts are noting that this might be the target for the rest of the countries in the world. As per US President, his expectations are that tariffs with China might be agreed at 80%. Although this is a drop from the current 145%, analysts are still noting that this is again too high a level of tariffs which might hurt the US economy.

The ECB Board member Schabel noted in an interview during the previous week, that ECB should stop further cuts of interest rates. The mentioned reason is that the increased global instability is slowly adding to inflation in the EuroZone.

CRYPTO MARKET

A positive sentiment from traditional financial markets this time was reflected also on the crypto market. This was one of weeks with significant gains, where the vast majority of crypto coins finished the week in green. What is most important, the total crypto market capitalization returned to the positive territory from the start of this year, by gaining 10% only during this week. Total value was increased by $309B. Daily trading volumes surged to the level of $235B on a daily basis, from $106 traded the week before. Total crypto market increase from the beginning of this year, currently stands at 1%, with $ 26B inflow of funds.

Bitcoin was the major coin who led total crypto market capitalization to the higher grounds. BTC added $140B to its market cap, increasing it by 7,3% on a weekly basis. Excellent performance had ETH, which surged by even 36%, adding $80B to its market cap. Market favourite Solana was up by more than 17%, increasing its cap by $13B. The same amount of funds was added to XRP, whose surge was 10,6% w/w. The meme coin DOGE was another significant gainer with an increase in value of 33,2%, collecting new $8,7B. Uniswap and Theta were also significant gainers with a surge in market cap of more than 30%. There are a significant number of other altcoins who managed to gain between 10% and 20% w/w.

There has been increased activity with circulating coins. Stellar added 0,4% of new coins to the market. IOTA increased the number of circulating coins by 0,3%, while Filecoin and Solada added 0,2% new coins to the market.

Crypto futures market

In line with spot market developments and increased positive sentiment, the crypto futures market gained during the week. BTC futures were last traded higher by more than 6%, while ETH futures surged by more than 26%. What is important to note is that BTC long term futures passed the level of $110K. In this sense, futures maturing in December 2026 closed the week at the level of $114.130, and those maturing as of the end of this year were last traded at $107.460.

ETH long term futures are now trading above the $2,5K level. Futures maturing in December 2026 closed the week at $2.636, and those with maturity in December 2025 reached the last price at $2.450.

MARKETS week ahead: May 5 – 11Last week in the news

Two major events during the previous week shaped the market sentiment. One is related to the Chinese government which noted a consideration to start the negotiations in order to relax currently imposed trade tariffs, while the other is related to stronger than expected US jobs market. The US equities finished the week higher, where S&P 500 closed the week at the level of 5.686. The US Dollar also gained strength on positive news. Inversely, the price of gold was traded at the lower grounds, ending the week at the level of $3.240. The US 10Y yields reacted on a strong jobs data, diminishing the potential recession in the US, where yields closed the week at the level of 4,30%. BTC was also among weekly gainers, where the level of $ 98K has been tested.

The previous week was full of currently important US macro data, which brought back higher volatility on financial markets. The week started with jobs opening data. Posted JOLTs showed 7.192M jobs open in March, which was modestly below market expectation of 7,48M. Fed's favourite inflation gauge, the PCE Price Index, was standing at the level of 0% in March, same as core PCE. On a yearly basis, the PCE was 2,3%. However, the star of the week were the Non-farm payrolls, which increased by 177K in April, which was much better than anticipated 130K. This figure brought a relief to market participants, as it seems that the US economy is not entering into a recession. On the opposite side are some analysts who are noting that it is too early in time for trade tariffs to be reflected on the US economy and jobs data. Still, the GDP Growth rate preliminary for Q1 came as a surprise at the level of -0,3% for the quarter. The market was expecting to see the figure of +0,3%. Analysts are in consensus that such a surprising drop in the output of the US economy is a reflection of trade tariffs imposed by the US Administration in the previous period.

A lot of investors' attention took the Assembly meeting of Berkshire Hataway, held on Saturday in Omaha, US. As announced, its founder and CEO Warren Buffet will step down from his CEO position as of the end of this year. His place will take Greg Abel, vice chairman of Berkshire Hataway for non-insurance operations. Reflecting on trade tariffs, Warren Buffet strongly criticized, noting “Trade tariffs are an act of war … trade should not be a weapon”.

The FOMC meeting is scheduled to take place on May 6-7th. This meeting will be closely watched by markets, as it is expected that the Fed will provide their current view on the current state of the economy as well as potential negative implications of imposed trade tariffs. As per current market expectations, based on the CME FedWatch Tool, the first rate cut during this year is postponed for July this year, amid currently strong jobs data.

CRYPTO MARKET

The crypto market had another relatively positive week. News related to the potential relaxation of the US-China trade tariffs as well as better than expected US jobs data, left their positive market also on the crypto market. BTC was for one more time in the focus of market participants, however, the majority of other coins was not left behind. Total crypto market capitalization gained 1% compared to the week before, adding $35B to its total market cap. Daily trading volumes were modestly decreased to the level of $106B on a daily basis, from $166B traded the week before. Total crypto market increase from the beginning of this year, currently stands at -9%, with $283B outflow of funds.

The leader of the market during the previous week was BTC. This coin managed to gain more than 2% on a weekly basis, adding total $ 39B to its market cap, but also to the total capitalization of the crypto market. ETH also had a relatively good week, considering gain of 1,15% in value adding $2,5B to its market cap. One of the significant weekly gainers was Monero, with a surge in market cap of 24%, adding $ 1B to the total value. On the opposite side were coins which did not manage to finish the week in green. Market favourite Solana lost 1% in value on a weekly basis, while BNB was last traded down by 1,4%. This week Uniswap ended with a loss of 11,8% on a weekly basis, while Algorand and Filecoin were traded down by around 8%.

There has been sort of increased activity when coins in circulation are in question. Filecoin managed to increase its coins in circulation by 0,4%. IOTAs total coins on the market surged by 0,5%, while Stellar and DASH marked an increase of 0,2%, same as XRP. This week Maker decreased its number of circulating coins by 1,4%.

Crypto futures market

The positive market sentiment continues to be reflected in the crypto futures. Both BTC and ETH futures were traded higher during the previous week.

BTC futures gained in value around 1,5% for all maturities. Futures maturing in December this year managed to pass the $100K level, ending the week at $101.305. At the same time, futures maturing in December next year closed the week at $107.390.

ETH futures were traded higher by around 2% for all maturities. December 2026 ended the week at $1.938. Futures maturing a year later managed to pass the $2K level, closing the week at $2.084.

MARKETS week ahead: April 28– May 4Last week in the news

The market is currently perceiving that there is sort of relaxation in the US-China trade war. This was the major premise which boosted US equity markets. The S&P 500 gained around 4,6% on a weekly level. A positive market sentiment and short relaxation on uncertainty brought the price of gold lower by 2% on Friday, ending the week at the level of $3.318. On the same premise reacted the US Treasury bond market. The 10Y US benchmark closed the week lower, at the level of 4,25%. The crypto market was also part of the positive sentiment, as BTC managed to make a break-through from previous levels and reach levels above the $95K.

The US-China trade war continues, however, with a softener rhetoric, which brought market sentiment to the positive side. Still, it remains quite confusing, where the majority of analysts are not sure what the final deal would look like. Actually, it seems that nobody knows, even the US Administration. The latest comment from the US President on the topic is that eventually tariff rates will “come down substantially, but it won't be zero”. Also, the US President commented that he has no intention of “firing Powell”.

The Financial Times posted an article in which the journal noted that Apple was planning to shift all Iphones assembly to India. Analysts, involved in the matter, reacted to this news with arguments that such a move is highly questionable, both from the logistic side and from a tariffs side.

The federal Reserve withdraws crypto guidance for banks. The Federal Reserve revoked its 2022 and 2023 guidance that required banks to notify or get approval before engaging in crypto or stablecoin activities.

As Reuters reported during the previous week, based on six sources, the ECB is considering further cutting of its policy rates at the June meeting. The relaxing inflation and drop in the economic outlook ECB members see as a good reason to further decrease their reference interest rates.

China is targeting the supremacy in the AI industry and development in comparison to its US counterparts. As news reported, the China President Xi Jinping called during the previous week for a “self-reliance and self-strengthening” in China within artificial intelligence. This now represents a key strategic area for China when it comes to their US counterparts.