Market Structure is Not Strategy — It’s Your Starting Point“The chart doesn’t hide anything. But your mind does.”

Before any indicator, setup, or signal… comes structure.

🔍 What is Market Structure?

At its core, market structure is the sequence of higher highs (HH) and higher lows (HL) in an uptrend, or lower lows (LL) and lower highs (LH) in a downtrend.

It is the skeleton of price .

Everything else — entries, zones, signals — is just clothing.

If you can’t see the skeleton, you’re reacting to noise.

🎯 Why It Matters:

It’s not a signal. It’s context .

It tells you whether you’re trading with the market or against it .

It defines where your patience begins — not where your entry is.

Market structure helps you let go of the urge to chase. It brings order to the chaos.

🧩 Key Components to Track:

Break of Structure (BoS): Confirms trend continuation

Change of Character (ChoCH): Signals a potential reversal

Swing Points: Define the intent behind price moves

Liquidity Sweeps: Often mask real structure beneath short-term traps

🛑 Common Mistake:

Most traders jump straight to the setup without asking the most important question:

“Where am I in the structure?”

They try to buy a pullback — in a downtrend.

They try to fade a move — right before continuation.

They chase candles — instead of waiting for alignment.

That’s not strategy. That’s stress.

🛠 Tip to Practice:

Use this simple framework to build clarity:

Start from the H4 chart — this gives you the broader directional bias

Drop to M15 — here’s where structure begins to form tradeable setups

Finally zoom into M1 — this is where confirmation happens before entry

Ask yourself:

Where did the last BoS or ChoCH happen on each timeframe?

Is M15 aligning with H4 intent — or contradicting it?

Did you enter after M1 confirmation , or based on impulse?

You don’t need to predict price. You need to align with it.

🪞 Final Thought:

Structure isn’t strategy.

It’s the mirror that shows what’s real before your bias speaks.

When you master structure, you stop forcing trades — and start flowing with them.

💬 Want more like this?

If this post resonated with you — drop a comment below.

Let me know what you'd like to dive deeper into — price action, gold setups, market structure, or the psychology behind your trades.

I’ll build future tutorials based on what matters to you.

📘 Shared by @ChartIsMirror

Marketstructure

Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

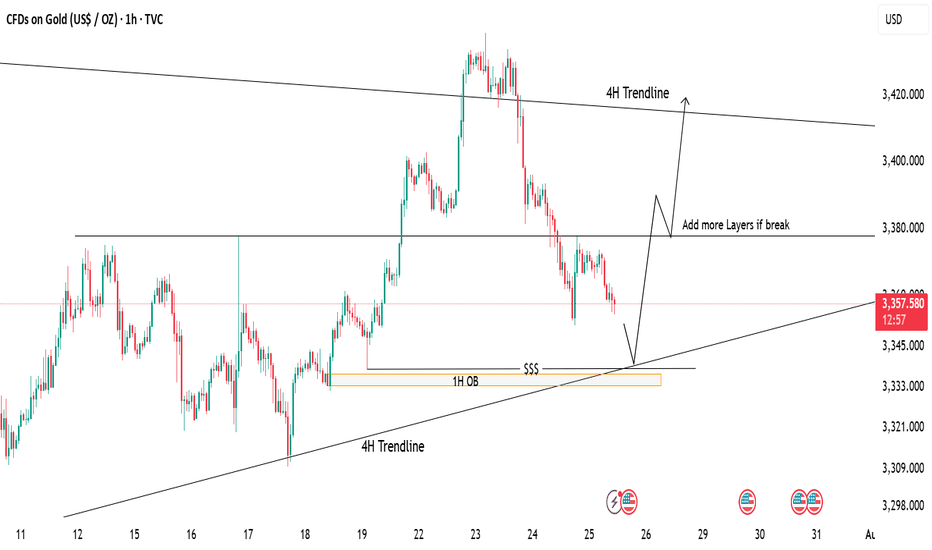

Gold Tapping Into Major Support – Eyes on Bullish ReversalPrice is currently retracing after a strong drop from recent highs. We're now approaching a key demand zone, aligning with:

📍 1H Order Block (OB)

📍 4H Trendline Support

📍 Liquidity Zone ($$$)

📉 If price taps into this area, it may offer a high-probability long setup.

📈 First target: 3380 (mid-range resistance)

🧱 If this breaks, we can look to scale in/add more positions, targeting the 4H trendline zone near 3420.

⚠️ Waiting for price reaction at support – patience is key!

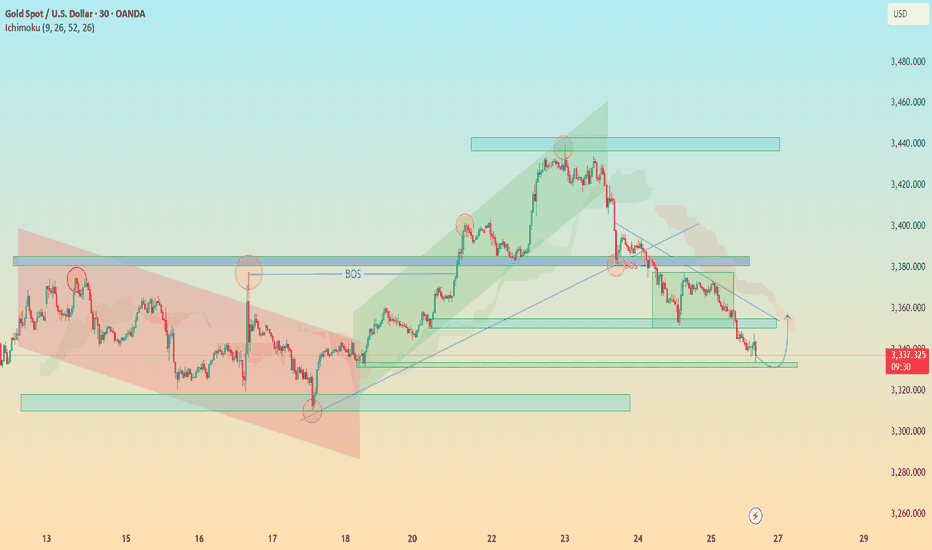

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

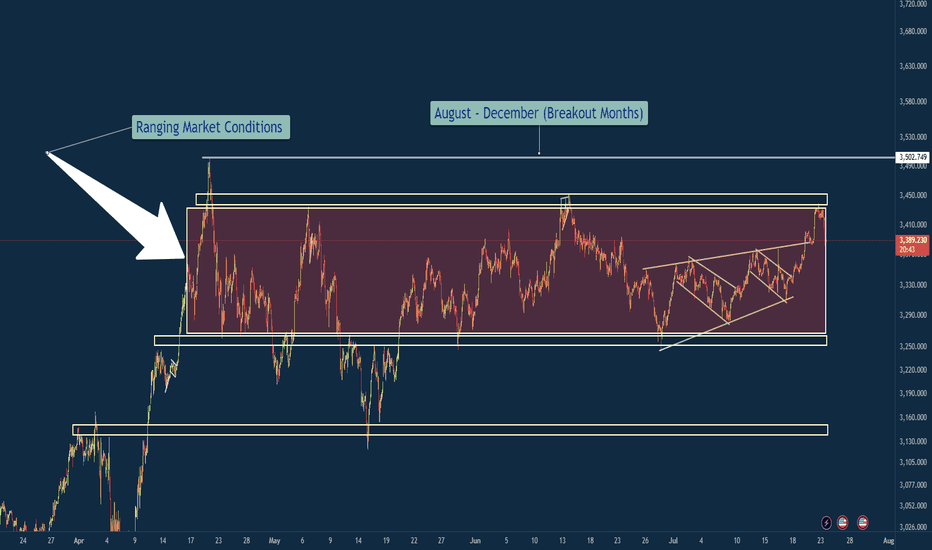

XAU/USD – Ranging Market Prepping for Breakout?Gold has been ranging for the next couple months and usually I am out of the market during the months of April Through July because historically these are not my best months trading XAU/USD. However you will see me posting a lot more in the coming months because my best months historically are August - December where the market really cranks up with some bigger moves.

So in a summarized version below you will find what it is that i am looking at with gold.

Gold (XAU/USD) has remained locked in a defined consolidation range between 3,250 (support) and 3,450–3,502 (resistance) since early April. Price has printed multiple internal falling wedge formations within this zone, indicating compression before potential expansion.

🔍 Technical Overview

Range Duration: ~3.5 months

Key Range:

Support: 3,250

Resistance: 3,450–3,502

Compression Patterns: Multiple falling wedges breaking upwards inside the range, hinting at bullish pressure.

Touch Confirmations: Both range boundaries have been tested multiple times, reinforcing validity (per Multi-Touch Confirmation).

Contextual Bias: Seasonally, August–December tends to be a high-volatility trending period for Gold.

🎯 Trade Plan

Inside Range:

Maintain neutral bias.

Execute range-to-range scalps/swing setups with clear invalidation zones.

Avoid trading mid-range.

Breakout Scenario (Bullish):

A clean close above 3,502 triggers breakout watch.

Ideal setup: Retest + 15-min flag → long continuation.

Potential upside target: ~3,700 (range height extension).

Breakdown Scenario (Bearish):

Loss of 3,250 opens door to bearish continuation.

Look for clean liquidity sweep or structure flip before committing.

Initial downside target: 3,100 zone.

🛡️ Risk Notes

Avoid third-touch entries in aggressive momentum unless followed by flag formation.

Remain disciplined with the 80/20 confluence rule — don't let perfectionism delay entries.

Always execute with pre-trade checklist and defined R:R profile.

✅ Summary

Gold is at a pivotal point. The confluence of a tight multi-month range, internal compression patterns, historical breakout timing, and validated levels builds a compelling case for an imminent expansion move. Remain patient, avoid anticipation, and react to confirmed structure and price behavior.

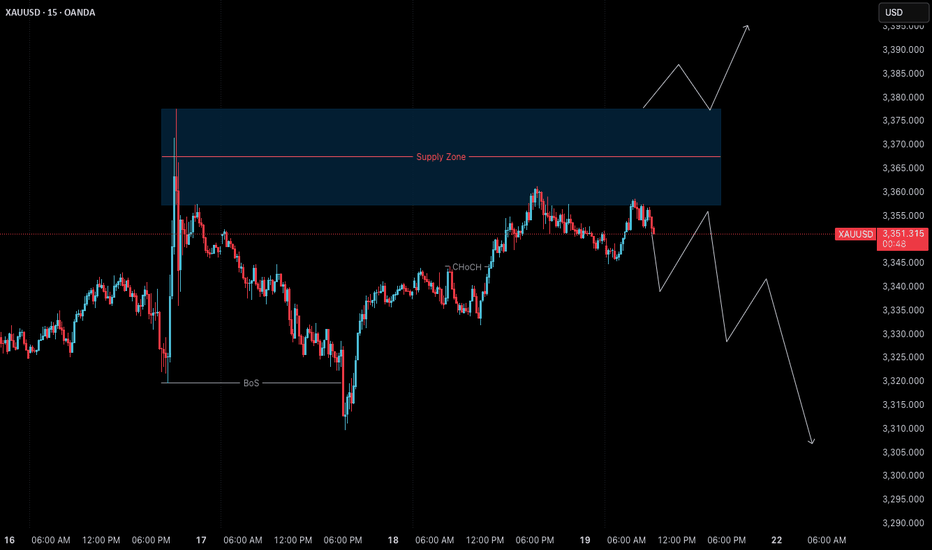

Gold (XAUUSD) – 21 July | M15 Pullback Within Bearish Structure🟠 Gold (XAUUSD) – 21 July Analysis | M15 Pullback in Bearish Trend

Gold is currently in a pullback phase within a bearish M15 trend .

The market structure is defined between the M15 lower high at 3377.650 and the previous low at 3310 .

On Friday, price retested the M15 supply zone near the lower boundary, and again today, it has reacted from the same area. This repeated rejection suggests that sellers are still defending this level.

🔍 Trend Context:

– M15: Bearish (Lower High → Lower Low structure intact)

– H4: Currently in a pullback phase

Unless the price breaks above the key 3377.650 level, the bearish structure remains valid. As such, our directional bias continues to favour shorts.

🟥 Key Supply Zone: 3358–3377.650

– Recent rejections seen from this zone

– Acts as the active short-term supply zone

– Watching for internal M15 bearish shift for possible entry

Preferred Scenario:

As price has already retested the M15 supply zone, if we now see a downside shift in internal M15 structure (e.g., ChoCH + BoS), we will look for a potential short entry aligned with the dominant M15 trend .

No confirmation, no entry. Always follow structure.

Alternate Scenario:

If the market breaks above the 3377.650 lower high, it would signal a potential bullish structure shift . In that case, we will step back from the short bias and re-evaluate long opportunities accordingly.

📌 Trade Plan:

– Wait for M15 internal structure to shift (ChoCh) bearish, followed by a Break of Structure (BoS)

– On the retest, mark the Point of Interest (POI) for potential short setup

– Only act on confirmation (e.g., M1 ChoCH + BoS)

– SL: 40 pips | TP: 120 pips | Risk-Reward: Always 1:3

Summary:

– Gold is in a pullback phase within a bearish M15 trend

– Key levels to watch: 3377.650 (lower high) and 3310 (previous low)

– Bias remains bearish unless structure flips

– Watch for internal structure shift for short opportunity

– Stay patient and aligned with the dominant trend

📘 Shared by @ChartIsMirror

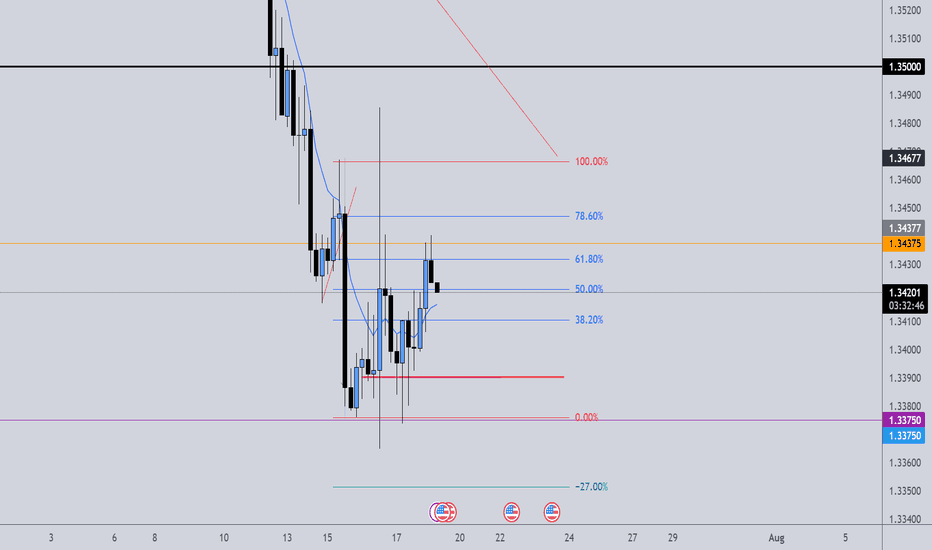

GBPUSD. 14.07.2025. The plan for the next few days.The nearest interesting resistance zone was already worked out in the morning and gave a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I think we'll see a correction that can be monetized. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

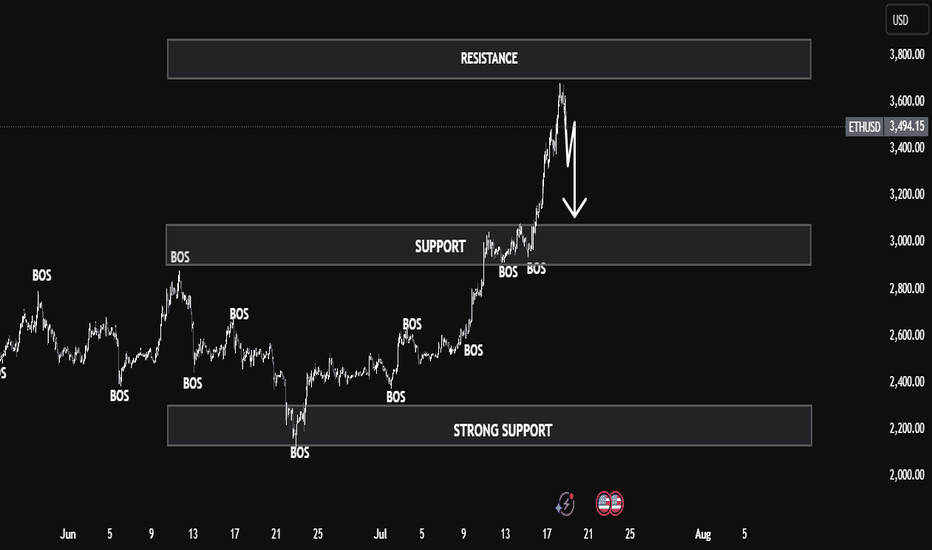

ETHUSD Smart Money Breakdown – Price Rejection from Premium ZoneEthereum has shown a strong impulsive rally after multiple Breaks of Structure (BOS) from early June, signaling a clear shift in market sentiment from bearish to bullish. Each BOS indicates that demand zones have been respected and liquidity has been efficiently used to fuel higher prices — a classic signature of institutional involvement.

🧠 Smart Money Insight

As price aggressively rallied into the resistance zone ($3,600–$3,800), the market entered a premium pricing area, where smart money typically offloads positions and hunts liquidity from late buyers. This area has historically been a high reaction zone — and as seen on the chart, ETH shows signs of buyer exhaustion, suggesting a possible short-term reversal.

🔁 Anticipated Market Behavior

A corrective move is likely from this resistance, and the first target for retracement lies in the support zone around $3,000–$3,200. This level aligns with:

Previous BOS retest area

Fair value imbalance fill

Mid-range equilibrium

If momentum continues downward, the next zone of interest will be the strong support region at $2,200–$2,400, which served as a major accumulation zone. That’s where large orders previously entered the market — and a strong reaction is expected again.

📊 Market Structure Summary:

BOS Confirmations: Validated bullish structure

Liquidity Grab: At resistance – potential sweep and reversal

Premium Zone Rejection: Smart money short opportunity

Discount Zone Targets: Support & strong support zones

✅ Conclusion

ETH is at a critical decision point. If price holds below resistance with continued bearish pressure, a retracement is not only healthy — it's expected. Traders should wait for confirmation of lower timeframe structure breaks before entering shorts, and target the $3,000 zone first, with eyes on $2,200 if momentum persists.

Gold 15-Min Chart Analysis Alert!Gold has successfully broken above the descending trendline, showing early signs of bullish momentum. Price has reclaimed structure and is now trading above the breakout level.

📌 Retest Zone:

We can expect a possible pullback towards the marked zone for a healthy retest before continuing the upward move.

🎯 Bullish Target:

As long as price holds above the support area, the bullish bias remains intact with targets around 3351+.

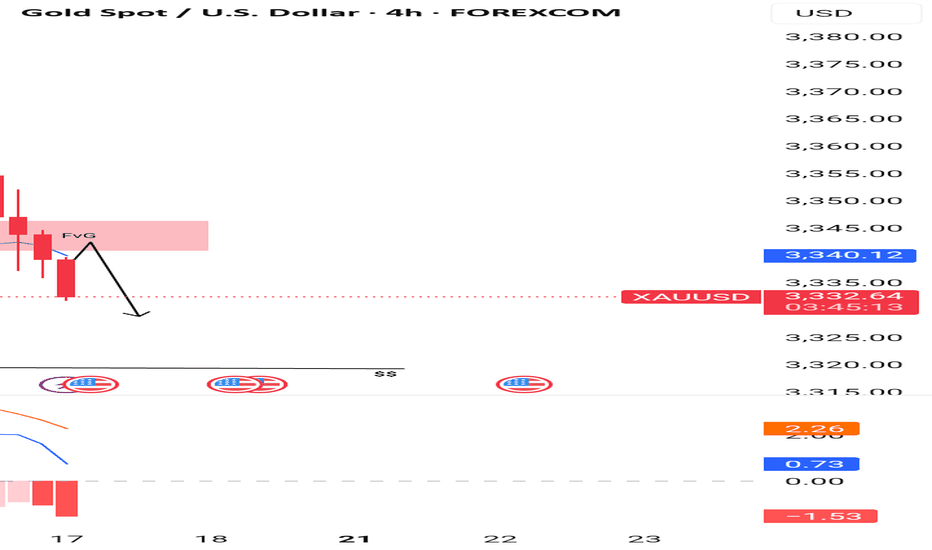

Gold Just Flipped Is the Drop Coming?🚨 Gold Market Update – Are You Ready? 🚨

Yesterday, the gold market swept the liquidity from the previous days taking out stop orders and clearing out weak positions. After the sweep, price closed lower, showing clear signs of weakness. 📉

But that’s not all...

In the process, it also broke through a key bullish Fair Value Gap (FVG) an area where buyers had previously shown strength. That FVG is now inverted, meaning it could act as a strong resistance level going forward.

With this shift in structure, there's a real possibility that gold could drop further, potentially hunting the liquidity resting near previous lows. The market might be gearing up for a deeper move.

🔥 So the question is:

Are YOU ready for the next leg down?

📌 As always Do Your Own Research (DYOR)

This is not financial advice just reading the tape.

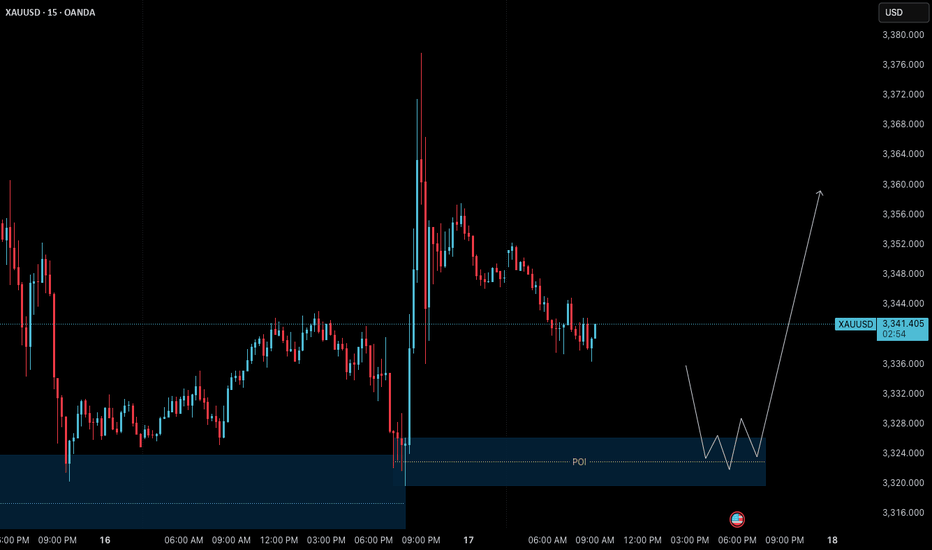

Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play🟢 Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play

Gold continues to follow the bullish structure we’ve been tracking in our recent posts. Yesterday's news-driven price action pushed the market to a new swing high near 3377.600 , confirming strength in higher timeframes. Now, price is currently in a retracement/pullback phase , pulling back toward a key intraday demand zone at 3326–3320 — offering potential opportunity for the next leg upward.

🔍 Where Are We Now?

The market is currently pulling back toward a key M15 demand zone: 3326–3320 . This level also aligns with a higher timeframe order block on the H4, making it a critical confluence area for structure-based traders.

This 3326–3320 zone is crucial because:

→ It’s a fresh M15 demand zone inside a higher timeframe bullish structure

→ It aligns with the H4 OB that previously acted as a launchpad

→ The overall trend remains bullish unless this zone is decisively broken

If the zone holds and we get LTF confirmation (such as M1 internal structure shift + micro-BoS), it may present a high-probability long setup.

⚙️ Structure Summary:

✅ H4: Bullish continuation structure with recent higher high

✅ M15: Pullback within bullish order flow

✅ M1 (for entry): Awaiting ChoCH + BoS as entry trigger inside POI

📌 Trade Setup Plan (upon confirmation):

→ Entry: From 3326–3320 demand zone

→ Stop Loss: 40 pips below entry

→ Take Profit: 120 pips (targeting new HH based on H4 projection)

→ Risk-to-Reward Ratio: 1:3

🧠 Key Trading Insight:

We never predict — we prepare .

We don’t chase price — we position with confirmation .

Discipline means waiting for price to invite us in , not entering just because a level looks attractive.

📈 Summary & Expectations:

➡️ Price is retracing into a structurally significant demand zone

➡️ Market bias remains bullish unless this zone fails

➡️ If the zone holds with valid M1 confirmation, we’ll consider a long setup targeting a new high

➡️ No confirmation = no trade. Patience > prediction.

📘 Shared by @ChartIsMirror

This analysis is part of our ongoing structure-based approach to trading Gold. All entries are derived from pure price action, multi-timeframe structure alignment, and trader discipline — as taught in our book:

“The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action”

1INCHUSDT - fear zone, return to the channel, growth potential1inch - is a decentralized exchange (DEX) aggregator that combines multiple DEXs into a single platform, aiming to provide users with the most efficient routes for swaps across all platforms.

📍 CoinMarketCap : #160

📍 Twitter(X) : 1.3M

The coin has already been listed on exchanges during the distribution phase of the cycle and was partially sold off in waves. Then, in line with the overall market, it declined to more reasonable accumulation prices, shaking out small investors and those who entered positions on positive news.

The price has been moving within a horizontal channel for a couple of years, and the channel’s percentage range reflects the coin’s liquidity. Currently, the coin is in a fear zone, at its lowest price levels. In moments like this, very few people have funds left to accumulate positions, as they’ve already been trapped by optimistic bloggers and a positive news background earlier.

Many were wiped out recently due to a breakdown and consolidation below the previous support of the inner channel, and now there's emptiness and fear below. What’s happening now is an attempt to return back into the inner channel. If this zone holds, the channel targets may be realized.

Resistance zones where the price may react are marked on the chart. Potential final downside wicks are also indicated. It’s important to allocate funds wisely for position building and use proper percentage distribution, according to your own experience!

______

📌 Not financial advice. Observing structure and recurring phases.

Operate within your strategy and with an awareness of risks.

GBPUSD Week 29 Swing Zone/LevelsAfter 7 straight weeks of profitable gold trading, we’re shifting gears to GBPUSD.

Why this pair? It’s offering a classic low-risk, high-reward setup that many traders appreciate:

🔒 Stop Loss: 10–15 pips

🎯 Take Profit: 50–100 pips

We’re analyzing price action using a simple but powerful concept:

Each zone is drawn based on how the high and low of one day compares with the next. For example:

Monday’s high/low vs Tuesday’s range

Tuesday’s vs Wednesday’s, and so on

This method helps spot potential continuation zones as market structure unfolds across the week.

👉 The key? Patience, and letting the levels tell the story.

As always price action determines trades

XAUUSD Daily Sniper Plan – July 14, 2025Hey team 👋 and welcome to a fresh new week on the charts!

We’re starting this Monday without any major news — just pure price action, clean zones, and structure doing all the talking. No distractions. No excuses. Let’s lock in our focus and let the market show us where the edge is.

🔸 Bias: Bearish while below 3390

Last week’s rejection from the H1 premium zone (around 3375) created clear signs of exhaustion. Price is now forming lower highs and lower lows, with clean CHoCHs on both H1 and M15. Until we reclaim 3390, we remain bearish — waiting for the next lower high to form.

🔽 Sniper Sell Zones (above current price)

3360–3370 → H1 premium FVG + CHoCH OB + EMA5 cap

3380–3390 → Inducement zone + internal imbalance + RSI divergence

🔼 Sniper Buy Zones (below current price)

3310–3320 → Discount FVG + BOS base + HL support

3280–3290 → Final HL structure zone + fib 61.8% + OB + RSI oversold

🟡 Decision Zone:

3330–3340 → Neutral zone

→ Wait for break and retest or rejection confirmation.

→ No setup = no trade.

🧠 Battle Plan – Execution Scenarios:

🔴 Scenario A – Bearish Setup Active:

If price returns to 3360–3370 or 3380–3390 and shows M15/M30 rejection → enter short.

Target: 3330 → 3310.

If 3390 is broken and held → cancel short bias.

🟢 Scenario B – Bullish Setup Activated:

If price sweeps 3320 or 3290 and reacts with strong bullish PA (engulfing or CHoCH) → enter long.

Target: 3340 → 3360.

No confirmation = stay flat, do not anticipate.

🟡 Scenario C – No Reaction / Choppy Flow:

If price consolidates between 3330–3340 without clean rejection or break → wait.

Let price show its hand. Today is Monday — we need clarity, not emotion.

Every level in this plan was drawn with purpose — no shortcuts, no borrowed zones.

If you value structure, discipline, and originality in your trading, you’re in the right place.

Your support means everything — I see every 🚀 and every comment, and I appreciate this community deeply.

Let’s keep growing, with real work and real structure.

Follow GoldFxMinds — we stay sharp, we stay true. 💛

📎 Trade Nation Disclaimer

Chart and structure based on Trade Nation broker feed on TradingView. For educational purposes only — not financial advice.

A High-Probability Play Unfolding!🌟 GOLD MARKET OUTLOOK – A High-Probability Play Unfolding! 🟡📉

Gold was riding a solid uptrend recently, showing strength across the board. But over the past few days, things have started to shift. We've seen a clear Market Structure Shift (MSS) followed by a Break of Structure (BOS) to the downside — signaling the start of a short-term bearish trend.

📍 What’s Happening Now?

Gold is currently trading lower after the BOS, but the market is now approaching a critical phase...

We’re expecting a retracement move to the upside — a temporary pullback that could trap early buyers (this is called inducement). This is where things get interesting!

🎯 What to Watch For:

Once the retracement plays out, we’ll be watching closely for:

🔻 Bearish Fair Value Gaps (FVGs)

🔻 Supply Zone Order Blocks

These areas could offer us high-probability sell entries aligned with the overall bearish momentum.

📉 The Target?

We’ll be aiming for the previous swing low, where liquidity is likely resting — a classic price magnet in such setups.

⚠️ Be Patient. Let the Market Come to You.

Wait for the retracement, let price fill the gaps, and only then look for confirmation to enter. Rushing in now means going against smart money flow.

🧠 DYOR – Do Your Own Research!

This is a market roadmap, not a signal.

Gold (XAUUSD) – July 9 | M15 Bearish Pullback After H4 OB Tap🟡 Gold (XAUUSD) – July 9 Analysis | H4 OB Tapped, M15 Still Bearish

The market has just tapped into the H4 order block near 3280 (3288–3275) — a level we’ve been tracking closely.

However, price action shows that the H4 pullback is still active and not yet complete.

Yesterday, Gold respected the H4 supply zone (3342–3345) exactly as anticipated.

Since then, price broke below the M15 low at 3296 , confirming that bearish momentum remains valid on the lower timeframe.

🔍 Structure Breakdown

• H4: Pullback ongoing

• H4 OB: 3288–3275 (just tapped)

• M15: Broke below 3296 → Bearish trend continuation confirmed

• Current M15 State: In pullback phase

⚠️ Key Consideration:

While we are looking at bearish opportunities, keep in mind that the H4 OB (3288–3275) is a significant demand zone.

If the market begins to reclaim structure and breaks the Lower High(H4 supply zone), this could signal resumption of the H4 uptrend .

Until that happens, we remain cautiously short — but prepared to adapt.

📌 What We’re Watching

Despite the H4 OB tap, M15 remains bearish until proven otherwise.

So the focus stays on short opportunities — no longs unless structure shifts.

📍 Key M15 POI for Rejection:

→ 3322–3326 (Order Block)

→ If price pulls into this zone and gives M1 confirmation (ChoCh + micro BoS)

→ We’ll plan short setups aligned with current trend

If this zone fails, or structure flips bullish, we’ll wait patiently for a potential revisit of the H4 supply zone (3342–3345) — which remains a valid short area for high-probability setups.

🧠 Summary:

✅ H4 OB (3288–3275) tapped

❌ No bullish reversal yet — M15 still bearish

🔍 Watching 3322–3326 for possible short

📉 Bias: Bearish until structure shifts

But be flexible — if LH breaks, the game changes.

📖 Respect the structure.

The chart doesn’t reverse because you want it to —

It reverses when the market is done moving the other way.

📘 Shared by @ChartIsMirror

Gold (XAUUSD) – July 8 Analysis | Decision Day at H4 Supply Zone

Gold is currently trading inside a key H4 supply zone (3342–3345) , and today’s session could act as a pivotal turning point for the ongoing structure.

We are now in a region where the H4 may either complete its pullback and resume the uptrend — or allow price to drop deeper toward 3280 before any bullish continuation.

Market Structure Overview

• H4 Trend: Still in a pullback

• M15 Trend: Gave a Change of Character (ChoCh) in the previous session

• Break of Structure (BoS): Not yet confirmed on M15

This puts us in a state of unconfirmed reversal . Without a clean BoS, this could still be a liquidity grab .

Key Levels & Current Setup

📍 H4 Supply Zone: 3342–3345

→ This is where price is currently reacting

→ Sellers may step in here if the broader pullback continues

📍 M15 Structure Status:

→ ChoCh already occurred

→ Price is in a retracement phase

→ BoS is needed to confirm a shift and signal the end of H4 pullback

What Today’s Session Will Decide

🔸 If M15 breaks structure upward (BoS):

→ H4 pullback may be complete

→ Bias turns bullish

→ We’ll plan long setups from M15 POIs with M1 confirmation

🔸 If M15 fails to break and reverses:

→ This could be a liquidity grab

→ Sellers may push price lower

→ Next downside target: 3280 H4 order block , still valid

⚠️ Reminder: Be Prepared for Both Scenarios

• No M15 BoS = No bias

• Wait for structure, not emotion

• Do not force long trades without confirmation

• 3280 remains a high-probability target if rejection confirms

Final Thoughts

This is a structure-led market — we don’t predict, we prepare.

Today’s price action may bring directional clarity.

Structure over speculation.

Let price show intent.

Then act with process, not impulse.

📘 Shared by @ChartIsMirror

CADJPY: Is the Trap Set?Price swept the liquidity below the previous day’s low and then broke structure to the upside. That’s often a strong sign that smart money just stepped in. I’m now watching for price to pull back and fill the imbalance it left after the break. If it respects that zone, there’s a good chance we’ll see it push higher toward the previous day’s high where more liquidity is waiting.

I’ve also added the 50 EMA on this chart as an extra layer of confluence. It helps me stay aligned with the overall market direction and avoid taking trades that fight the current trend.

It’s easy to get impatient here and jump in too soon, but discipline means waiting for the story to fully unfold. Trust your levels, trust the process, and remember that protecting your mental capital is just as important as protecting your trading account.

EURCAD: Liquidity taken, imbalance left behindPrice swept the liquidity above the previous day’s high and then broke structure to the downside. That’s often a sign that smart money was hunting stops before shifting direction. Now I’m watching for price to come back and fill the imbalance (FVG) it left after the break.

If that happens and price respects the FVG zone, we could see a continuation lower with the next target being the previous day’s low where more liquidity is likely sitting.

I’ve also added the 50 EMA here as confluence. It helps keep me trading in line with the broader market flow and stops me from fighting the trend.

This is one of those spots where patience is key . Let the market return to the zone on its own terms, wait for a reaction, and keep protecting your mindset just as carefully as your capital.

Gold (XAUUSD) – July 7 | Watching 3326 POI for Short Setup🟡 Gold (XAUUSD) – July 7 Bias | Short Setup Developing at 3326 POI

The Gold market remains in a pullback phase on the H4 timeframe , and price may still revisit the 3280 H4 order block before resuming its broader uptrend.

On the M15 timeframe, structure has now shifted clearly.

After an initial Change of Character (ChoCh) , we’ve seen a confirmed Break of Structure (BoS) , placing M15 officially in a downtrend .

✅ Why This Matters:

With both ChoCh and BoS complete, we no longer treat this move as a potential liquidity grab — it now reflects a valid structural reversal in the short term.

But instead of reacting impulsively, we study this shift as a live example of structure-based price action — and how entry zones form after confirmation.

🔍 M15 Order Block in Focus:

• 3323.500 – 3327.800 → Valid M15 POI for short setups

→ This is where we expect price might retrace before resuming its move

→ We’ll observe this zone for M1 confirmation (ChoCh + micro BoS) before taking any action

🎯 Target Zone:

• 3280 – H4 Demand

→ A clean structure-based target aligned with higher timeframe pullback

→ Our model requires minimum 1:3 RR , anchored to price structure

🔁 Key Takeaways:

• H4: Pullback phase remains intact

• M15: Downtrend confirmed (ChoCh + BoS complete)

• Execution plan: Observe 3326 POI; respond only if structure confirms again on M1

• No anticipation. No prediction. Just process.

📖 This is structure-based learning in real time.

We don’t chase setups — we observe shifts.

Let structure teach you. Let price confirm it.

The chart is the mirror.

📘 Shared by @ChartIsMirror