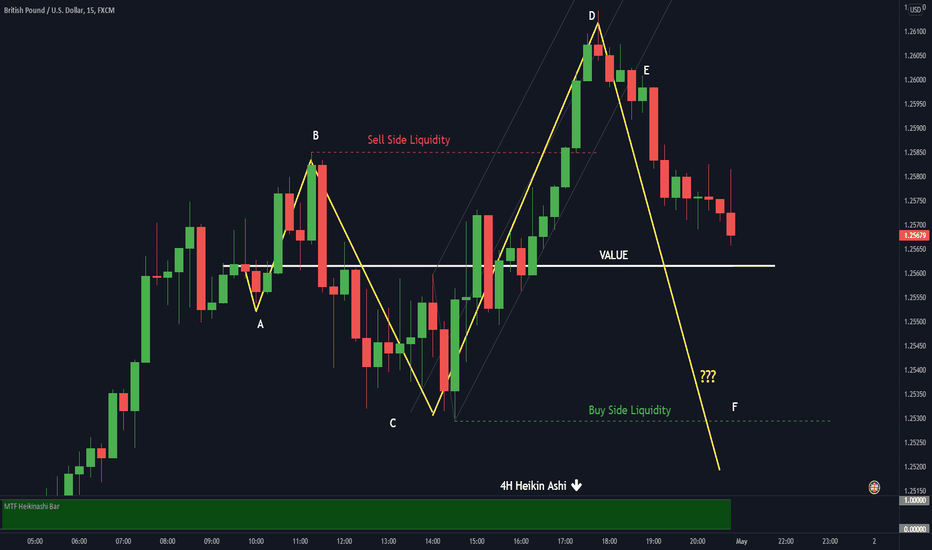

Trading The Forex Master Pattern (Part 2)A, B, C, D - Classic funneling out master pattern price action, detailed in previous post.

D , E - Would have been textbook sell entries if the 4H Heikin Ashi had rotated to red (or at least the 1H for more aggressive traders)

F - Expected expand low target (buy side liquidity). If price reaches here we MIGHT resume the downtrend. Price usually reverses when liquidity lines are hit. If price is to continue lower after hitting the buy side liquidity line, we want to see it finding resistance at the value line in the case it reverses for a bit.

Master

bitcoin 4 hour possible reversal descent into the retestYesterdays AB=CD set up was impeccable and took approximately a week and some change to finally take off appropriately. I hope you guys saw the entry as well on the 45 time frame post I had posted. Although it was a small 5% growth from the initial floor setup and 2.3% or so from the continuation confirmation, something is better than nothing because patience rewards and those percentages add up in the long run. For you option traders, I'm sure you had a ball park of a time with that take off. Okay so back to pressing matters, there seems to be a potential reversal back into a retest zone due to the indecision at the top of the trend there which is followed by a small volume seller candle. Granted, sellers need to push it rather far and compete with the buyer tsunami on the side but as we all know, Bitcoin does the impossible all the time so don't enter without first seeing where price settles at such as looking for the long wicks, the average price number it continuously rests at without moving to far and pay attention to the seller/buyer engulfing candles. There is a huge possibility that there will be a wave of seller candles too so do not buy expecting to turn the tides if there is no proof of the tides turning. Happy trading and have fun. For today, I have no re adjusted my chart all to much expect move my Orange Trend Line to coincide with what is going on currently. Floors and roofs are seemingly still consistent with what is currently going on. As usual, I did not proof read this and I am not here to tell you what to do. I am here as a humble guide to clear up the confusion.

Bitcoin on the 4 hour time frame breaking last weeks RSI trendThere isn't much to say for this post if you had been following the previous ones. On the positive side, the trend on the RSI graph has broken free from the downtrend and is currently hitting a roof on the Heikin Ashi graph and Candle Stick graph which is a good thing I may add due to the Day time frame being on the uptrend as well. On the negative side, there may be a chance things may become erratic (volatile) on due to price needing to form a new trend line. Let us hope that things continue to look well for today and price does form a strong uptrend.

btc takeoff Heikin EditionTo further confirm thswite slowdown on the sellers end, switching over to Heikin Ashi shows a massive lack of volume on the sellers side. In my experience, whenever there is a slow down from something of this scale and a buyer candle begins to form, the possibility of it retracing back upwards in high. Of course, we have the candles as reference to that but further proving a point is good for the mental state.

this company investing in Defi Company might growthis company investing in Defi Company might grow

that simple

i like Defi therefore I like this stock

- These are my Notes and not financial advice.

#DOMINANCE Should Fall! But for how long? On demand Chart!Dominance bounced around the 57 level in September second week. That was the time when I posted a chart and warned everyone to hold more BTC and minimise your exposure in altcoins.

Since then we have seen correction in altcoins for almost 76 days.

Now it got rejected from the upper trendline resistance of the channel.

What can we expect now?

I am expecting Dominance to fall from here. 64 Level was crucial and it already broke below it and currently retesting this level. Alts. must perform well for at least next 3 to 4 weeks.

Alts are taking a hit right now while BTC is under a short term correction.

The next crucial levels to watch are 61.20 and 58.

If Dominance breaks below the 61 level the alt season may get extended to almost 56 days.

History says Nov to Jan are good for altcoins.

I am holding the few altcoins that I posted like BLZ CTSI DUSK PPT and will add more on confirmations.

I will be posting altcoin setups soon, stay tuned.

Do hit the like button if you like my simple updates and share your views in the comment section.

#PEACE

Dow Jones Resistance at 88% with Retracement and 50% ExpansionZooming out to the bigger time frame from monthly to weekly to daily. We are seeing level confluence at the range. In this drawing, it is just the retracement. If you look at it, there is also an Expansion of 50%. If you take the low of 23rd March with the High of 27 April on the Weekly chart, You'll get 28039. If the week shows negative, we might see some moves happening next week. Bigger time frame its easier to see. 4hr Chart showing harmonic patterns too if you're looking for early entry.

It broke the high of a few target, so what now?This is the weekly chart. It’s much cleaner compared to the daily chart. Nevertheless, always use MTF to see the magic.

From my previous ideas, I’ve mentioned that some of the target are met. We are now waiting for a reversal. So if there is no reversal bar in the next couple of days...

Then...

We’re looking for the market to continue higher. As of now, there is no sell signal yet.

Now on the upside it’s showing us that it’s heading somewhere... where? Look at the numbers you’d be able to see a few target.

Patience and precision would get you the much need bonus in the Covid 19 period.

What will trigger the next possible drop?

No one knows but what we know is that the calculation works, we’re ahead of any news.

For now be safe from anywhere you are in the world.

Go with god.

MasterCard (MA) Establishes a New All-Time HighHello traders!

Welcome to PrimeXBT’s technical analysis of MasterCard’s stock, the multinational financial services corporation that has been demanding investor’s attention.

Fundamental Analysis / News:

Recently, MasterCard (NYSE:MA) climbed +0.87% after-hours after increasing its quarterly dividend to $0.40/share from $0.33/share and authorizing the repurchase of as much as $8B of Class A common stock.

MA says the new buyback plan will take effect at the conclusion of the current $6.5B repurchase program, which has ~$300M remaining under its authorization.

Technical Analysis:

At the end of last week, MA's stock price broke through the previous historical all-time high level.

If the price breaks this psychological resistance level, a continuation of the uptrend will be confirmed and we’ll have to search for new buying opportunities based on the same level.

Overall, it is expected that in the short-term the market price will gradually drop to its current support zones before building enough momentum to set another record high.

Support zone #1: $292.30-293.60

Support zone #2: $280.30-282.20.

Psychological resistance level: $300

Market Cap: $299.469B

We only offer you the most valuable analysis each day. Stay tuned for more infographics, analytics, reviews, summaries, and more!

Update: The CLEAREST chart in historyAn update for our signal which earned us +20%. What comes next, after we had successfully predicted the reversal?

DUSK/BTC has fallen back to a state of relative compression. Periods of 200, 100 and 55 are regressing below the necessary level of 0.7 on the WAVE-PM indicator, but still need time to do so.

14-day volatility characterized by the orange oscillator is below critical levels, and therefore has enough potential to produce a short-term movement in the following days.

Its target could be the 200 MA on the 1H chart, or similarly the 50 MA on the 4H chart (turquoise color). As this is a more risky signal, we DON'T recommend taking it without setting tight stop-losses and doing your own research first.

For the rest of the compression, the price should remain inside the 50 MA Bollinger Band on the daily chart, which is currently at the levels of 537 (lower band) and 667 (upper band). These are the relative highs-and-lows, and a movement on either side should be stopped by them until enough volatility ceases to be and a new trend begins. Please, use the displayed purple band for an approximate reference.

Commodity Channel Index, custom volatility indicators and Bollinger Bands and their derivatives were used in the technical analysis. This is not a financial advice and you agree to take 100% responsibility.

Follow @MeowSignals for more insights! Also make sure to visit our...

Facebook: www.facebook.com

Website: (coming soon)