MA Mastercard Incorporated Options Ahead of EarningsIf you haven`t bought MA before the rally:

Now analyzing the options chain and the chart patterns of MA Mastercard Incorporated prior to the earnings report this week,

I would consider purchasing the 545usd strike price Puts with

an expiration date of 2025-8-8,

for a premium of approximately $4.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Mastercard

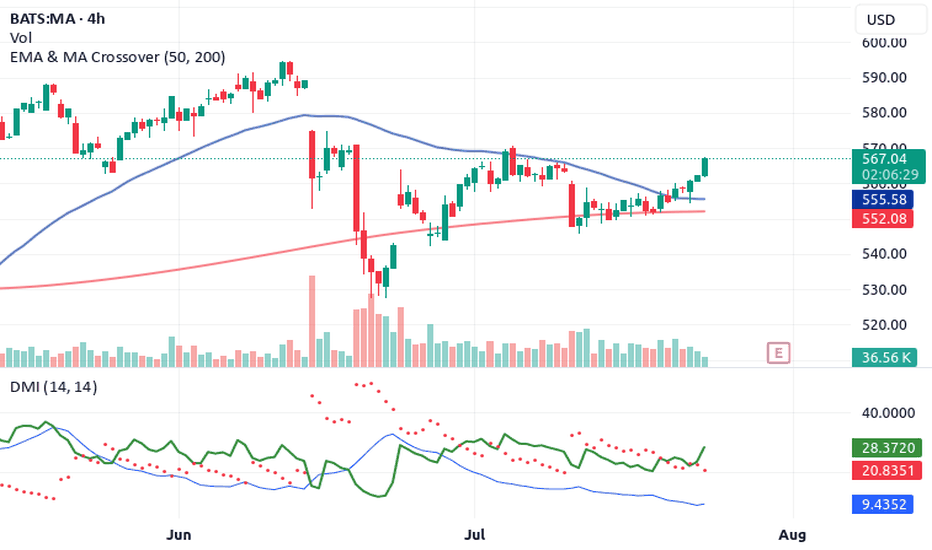

Top 4 Buy Signals Lighting Up Mastercard (MA) 🚀 Top 4 Buy Signals Lighting Up Mastercard (MA) | Rocket Booster Strategy

Mastercard Inc. (MA) is showing explosive potential, and it’s not just one signal—it’s a whole confluence of confirmations. When

you align this much market momentum, you don’t ignore it. Let’s break down how Rocket Booster Strategy gives us a powerful buy indication on the daily chart.

🔍 The Confluence Setup

✅ 1. DMI Buy Signal

The Directional Movement Index (DMI) is in bull mode. ADX is

rising and the +DI is firmly above -DI. This shows the trend is not just alive—it’s gaining strength.

🔻 2. Volume Oscillator Pullback

While Volume Oscillator is down, this is seen as constructive and not bearish. It suggests a quiet zone before the thrust—just like fuel loading before a rocket launch.

Smart traders know: momentum can build silently.

💥 3. Awesome Oscillator = Strong Buy

The Awesome Oscillator is green and firing hard. We’ve seen a clear twin-peak bullish formation followed by a break above zero

—classic acceleration sign.

🕯️ 4. Rising Window (Japanese Candlestick Pattern)

A Rising Window—a bullish continuation gap—has formed. This is one of Steve Nison’s top continuation patterns. It signals strong

institutional conviction in this trend.

📈 What Does This Mean?

When DMI, AO, candlestick patterns, and our own Rocket Booster Strategy all point up, it’s time to pay attention. This setup is rare—and high-probability.

🧠 Rocket Booster Strategy Recap

This strategy uses 3 momentum alignment points:

High Momentum Indicator (like AO) in Buy Mode

Pattern Confirmation (Rising Window or Engulfing)

Volume Correction Before Breakout (Fuel Before Fire)

When all 3 click into place, we have ignition.

🎯 Final Thoughts

Mastercard is looking primed for takeoff on the daily timeframe. Whether you’re an investor or a swing trader, this chart is

speaking loud and clear. But as always, risk management is your co-pilot.

✅ Add it to your watchlist.

🚀 Simulate entries.

🧠 Trust the confluence.

Rocket Boost This Content To Learn More

Disclaimer: This is not financial advice. Always use a simulation/demo account before committing real capital. Trade responsibly.

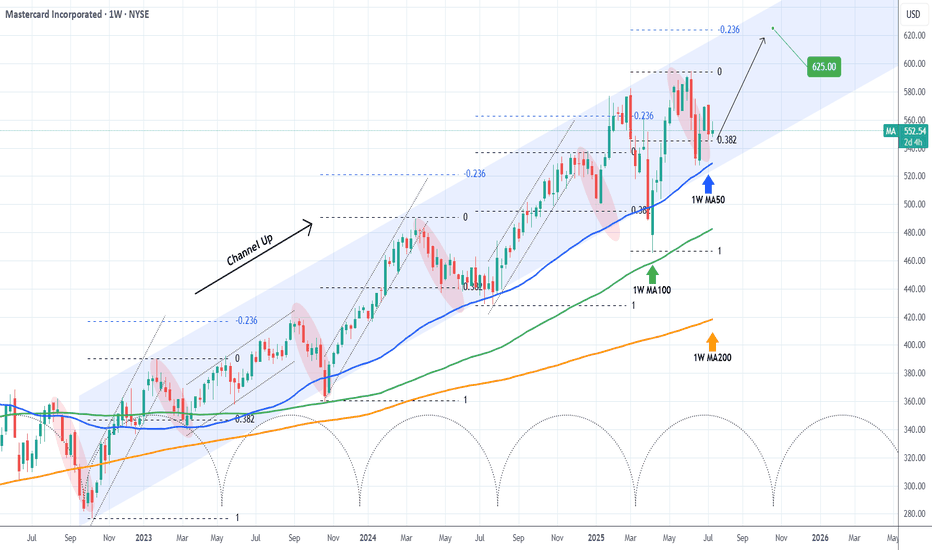

MASTERCARD Best buy entry now. Target $625.Mastercard (MA) has been trading within almost a 3-year Channel Up that only broke (but recovered naturally) during Trump's trade war. Still, the 1W MA100 (green trend-line) contained the downfall, as it always had.

Normally the Bearish Legs of this pattern tend to find Support on the 1W MA50 (blue trend-line), as the latest one did 3 weeks ago. Now that the price is trading still on the 0.382 Fibonacci retracement level, it historically is the best buy opportunity, as per all previous Bullish Legs.

The Channel Up has always priced its Higher High (top) on at least the -0.236 Fibonacci extension. As a result, we are targeting $625.00 before the year ends.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Mastercard and Visa Shares Decline Due to Stablecoin BillMastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill

Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency exchange Coinbase (COIN), while simultaneously putting pressure on Mastercard (MA) and Visa (V) shares.

According to media reports, market participants are concerned that stablecoins could pose serious competition to these companies, which earn revenue primarily from transaction fees. This serves as an example of how blockchain technology, with its low-cost features and high speed, could disrupt leaders in the traditional finance sector.

Technical Analysis of Mastercard (MA) Stock Chart

In May, MA shares formed an upward trend (shown in blue), but this was already broken by a strong downward move, accompanied by a wide bearish gap in the $575–$585 range.

Near the lower boundary of the channel, a contracting triangle pattern (shown in black) can be observed – this can be interpreted as a temporary balance between buyers and sellers. However, it didn’t last long: the widening spread of bearish candles (1 and 2) indicates growing selling pressure.

It’s possible that following a drop of over 9% from the June high, Mastercard (MA) shares might attract buyers betting on a short-term rebound. Nevertheless, in the longer term, developments related to the GENIUS bill could contribute to a continued downward trend.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Mastercard: Approaching the Top of Wave BMastercard has rebounded after a brief cooling period, and we now expect turquoise wave B to complete just below resistance at $620. Once that top is in, wave C should drive a meaningful retracement, ending with the low of magenta wave (4). Alternatively, if turquoise wave alt.(4) has already bottomed — which we estimate as a 40% probability — then a direct breakout above $620 would suggest a shift toward a much more aggressive advance. That path would take the stock straight into magenta wave (5), completing blue wave (I) with a strong rally.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

MASTERCARD: One more dip possible but long term target is $620.Mastercard is neutral on its 1D technical outlook (RSI = 52.317, MACD = -0.060, ADX = 29.709) having just recovered its 1D MA50 following the March 13th rebound. The pattern here is a Channel Up and March's bearish wave already hit the 0.382 Fibonacci retracement level much like the previous one did on May 1st 2024. That however went on to extend the decline to close to the 0.5 Fibonacci level and hit the 1D MA200. Consequently there is a chance of one more month of slow decline to the 1D MA200 but overall, this is a good enough level to buy again for the long term and aim for the -0.382 Fib extension (TP = 620.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

MASTERCARD: Despite the CRASH!, good graph!! Attention!!

On January 30, the American payment services provider Mastercard presented results that far exceeded forecasts.

It earned 12,874 million dollars (12,351 million euros) in 2024, 15% more than the previous year. Net income reached 28,167 million dollars (27,023 million euros), 12.2% more.

Meanwhile, operating costs reached 12,585 million dollars (12,074 million euros), 13.5% more.

Mastercard CEO Michael Miebach commented on the results: “This quarter we have achieved good results, with net income growth of 14%, or 16% without taking into account currencies.”

He continued: “Our diverse capabilities in payments and services and solutions, including the acquisition of Recorded Future this quarter, set us apart and position us well for long-term growth, as we outlined at our investor day.”

-----------------------------------------------------------------------

---> What does it look like technically?

DESPITE THE STOCK MARKET CRASH we are immersed in due to the TRADE WAR, if we look at the chart, the trend is still clearly bullish and has not yet broken ANY important support that would put it in danger, therefore, EVERYTHING INDICATES THAT WE ARE FOUND WITH A GREAT OPPORTUNITY TO GO LONG, since the market has fallen a lot and it is logical to expect an upward correction in the next few days of the SP500 index, which will logically support the rise in the price of Mastercard.

Furthermore, the price today touched the 61.8% Fibonacci and respected it (DESPITE THE CRASH), which gives us another clue that the area is respected and is possibly the floor of the next bullish impulse.

--------------------------------------

Strategy to follow:

ENTRY: We will open 2 long positions if the H4 candle closes above 553

POSITION 1 (TP1): We close the first position in the 575 area (+4%)

--> Stop Loss at 530 (-4%).

--> Ratio 1:1

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-4%) (coinciding with the 530 of position 1).

--> We modify the dynamic Stop Loss to (-1%) when the price reaches TP1 (575).

-------------------------------------------

SET UP EXPLANATIONS

*** How do you know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, what we do is divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a certain distance. That certain distance is the dynamic Stop Loss.

-->Example: IF the dynamic Stop Loss is at -1%, it means that if the price drops by -1%, the position will be closed. If the price rises, the Stop Loss also rises to maintain that -1% in the rises, therefore, the risk is increasingly lower until the position becomes profitable. In this way, very strong and stable price trends can be exploited, maximizing profits.

The global market is rebootingOn February 18, negotiations between the United States and Russia are scheduled to take place in Saudi Arabia. These talks could pave the way for restoring economic relations and addressing global challenges.

“American companies lost over $300 billion by exiting the Russian market,” said Kirill Dmitriev, head of RFPI, on the eve of talks with the U.S. delegation in Saudi Arabia. He emphasized the importance of economic dialogue, noting that the Russian market remains attractive to investors.

It is now known that several major American companies intend to return to Russia. Amid a potential thaw in U.S.-Russia relations, Visa (#Visa), Mastercard (#MasterCard), Apple (#Apple), PepsiCo (#PepsiCo) and McDonald's (#McDonald) have all announced their intentions in recent days.

The U.S. stock market remains resilient thanks to domestic growth drivers. Additionally, several key factors are expected to drive growth in the near future:

Federal reserve monetary policy: A possible rate cut or maintaining low interest rates is spurring investments. This, in turn, boosts company valuations and pushes up indices such as the Dow Jones (#DJI30) and S&P 500 (#SP500).

Technology sector: Ongoing advancements in AI, cloud services, and biotechnology are attracting capital. Moreover, integrating artificial intelligence into large businesses helps reduce costs by automating routine processes, while AI algorithms enhance strategic planning and risk management.

Corporate earnings growth: Increasing corporate profits are one of the key factors supporting the positive momentum in the stock market, including the S&P 500 (#SP500), which reflects the performance of the 500 largest U.S. companies. Strong quarterly reports from these companies play a crucial role in reinforcing investor confidence and ensuring market stability.

Geopolitical expectations: Tensions among major global players like the U.S., EU, and Russia could lead to sanctions, trade wars, and economic restrictions, which negatively impact the global economy and stock markets. A thaw in relations could reduce the likelihood of such conflicts and, consequently, lower the risks associated with sanctions and instability.

FreshForex analysts are confident that as geopolitical tensions ease, companies will start to return, which will undoubtedly drive up their stock prices. Don’t miss this chance – invest in stocks with us!

Our terminal offers 270 trading instruments, including CFDs on corporate stocks and indices. Trade with a favorable leverage of 1:1000 and enjoy attractive bonuses!

Mastercard outperforming the US markets with more upsideMastercard is definitely one of the outperformers in 2025,

Strong Financial Performance: Mastercard exceeded earnings and revenue expectations due to robust holiday consumer spending.

Growth in Payment Volumes: Increased transaction volumes, especially cross-border, boosted revenue growth.

Strategic Acquisitions: The acquisition of cybersecurity firm Recorded Future enhances its digital security offerings and services.

Positive Market Sentiment: Analysts raised price targets, reflecting confidence in the company's growth prospects.

Technicals are also looking super.

Price>20 and 200

Rev Cup and Handle

Target $610.86

MASTERCARD Huge sell signal emerged, hit 1D MA50 after 4 months.Mastercard (MA) has been trading within a 2-year Channel Up that has given us very accurate trades. Our previous signal (April 02, see chart below), was a sell right on the pattern's top that easily hit our $440 Target:

Once more we see a long-term Top on this stock as the price almost priced a Higher High and on yesterday's Fed fueled pull-back, it hit its 1D MA50 (blue trend-line) for the first time in 4 months (since August 06).

Apart from that, the 1D RSI has been on a Bearish Divergence of Lower Highs (against the Higher Highs of the Bullish Leg/ dotted Channel Up) since October 18. All such previous Bearish Divergences within this 2-year Channel Up, have started the Bearish Legs (red ellipses) of the pattern, which hit at least their 0.382 Fibonacci retracement levels.

As a result, we have a high probability short signal at our hands, targeting $495.00 (Fib 0.382).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Mastercard’s Support Zone: Waiting for Buyers to Step Back InIf Mastercard’s price retraces to the green support zone, it could signal a renewed interest from buyers eager to push the price back up. This zone has previously served as a level where buyers stepped in, and if the price approaches it again, we may see a similar reaction. My strategy is to wait for signs of a bounce in this area, as it could provide a strong entry point for a long position. By observing price action and looking for bullish confirmation in the green zone, this setup could offer a promising opportunity for a move to the upside. Patience is key here, as I’ll only consider entry once there’s clear evidence of buyers returning.

The Payment Card Titan: Comparing Visa, Mastercard, and Amex◉ Abstract

The global credit card market is projected to grow from USD 559.18 billion in 2023 to USD 1,146.62 billion by 2033, driven by advancements in digital payment technologies, e-commerce growth, increased financial literacy, and urbanization, especially in Asia-Pacific.

Visa leads the market with a 38.73% share, followed by Mastercard and American Express. Visa and Mastercard operate primarily as payment networks, while American Express both issues cards and offers unique rewards. Financially, all three companies show strong revenue growth, with American Express yielding the highest ROI but also carrying significant debt.

Despite this debt, American Express appears undervalued based on financial ratios. Overall, while American Express presents an attractive investment opportunity, Visa and Mastercard also demonstrate solid fundamentals and growth potential for investors in the expanding credit card market.

Read the full analysis here . . .

◉ Introduction

The Global Credit Card Market Size was Valued at USD 559.18 Billion in 2023 and the Worldwide Credit Card Market Size is Expected to Reach USD 1146.62 Billion by 2033,

◉ Key Growth Drivers

● Digitalization and Technology: Advancements in payment technologies, including mobile wallets and contactless payments, enhance convenience and security.

● E-Commerce Growth: The rise of online shopping increases demand for credit card payments, as consumers prefer their ease and safety.

● Financial Literacy: Improved understanding of financial products encourages more consumers, especially in developing regions, to adopt credit cards.

● Urbanization: Growing urban populations, particularly in Asia-Pacific, lead to greater access to banking services and credit facilities.

● Emerging Markets: Rising disposable incomes in developing countries drive new credit card accounts as financial institutions expand their offerings.

● Consumer Convenience: The preference for quick and easy payment methods boosts credit card usage over cash transactions.

● Rewards Programs: Attractive loyalty programs incentivize consumers to use credit cards for everyday purchases.

● Regulatory Support: Government initiatives promoting cashless transactions foster a favourable environment for credit card adoption.

◉ Market Overview

As of 2022, the global credit card market was primarily led by Visa, which held a 38.73% share of the worldwide payment volume. Mastercard followed with a 24% market share, while American Express (Amex) accounted for 4.61%. Notably, China UnionPay is also a major player in this space, surpassing Amex in terms of purchase volume

◉ Key Players in the Payment Card Industry

1. Visa NYSE:V

● Market Cap: $552 B

● Market Share: 38.73%

● Business Model: Payment network facilitating transactions between consumers, businesses, banks, and governments globally.

● Card Issuance: Does not issue cards itself.

● Global Reach: Extensive acceptance network across more than 200 countries.

2. Mastercard NYSE:MA

● Market Cap: $474 B

● Market Share: 24%

● Business Model: Payment processor and network partnering with banks to offer various card products.

● Card Issuance: Does not issue cards itself.

● Global Reach: Broad acceptance worldwide with diverse products catering to different consumer needs.

3. American Express NYSE:AXP

● Market Cap: $203 B

● Market Share: 4.61%

● Business Model: Card issuer and payment network offering unique benefits and rewards directly to cardholders.

● Card Issuance: Issues its own cards.

● Global Reach: High acceptance rate in the US (99% of merchants), lower in Europe and Asia due to higher transaction fees.

◉ Technical Aspects

● From a technical perspective, there's a notable similarity among the three stocks: each is exhibiting strong bullish momentum, consistently achieving higher highs and higher lows.

● All three stocks have formed a Rounding Bottom pattern, and after breaking out, their prices have climbed to new heights.

● While Mastercard and American Express are currently trading at their all-time highs, Visa is positioned just below its peak.

◉ Relative Strength

The chart vividly demonstrates that American Express has excelled remarkably, achieving a return of nearly 85%, whereas Mastercard and Visa have delivered returns of 28% and 20%, respectively.

◉ Revenue & Profit Analysis

1. Visa

● Year-over-Year

➖ In FY23, Visa achieved a remarkable revenue increase of 11.4%, reaching $32.7 billion, up from $29.3 billion in FY22.

➖ The EBITDA for FY23 also saw a significant rise, totalling $22.9 billion compared to $20.6 billion in FY22.

● Quarter-over-Quarter

➖ In the latest June quarter, Visa's revenue rose to $8.9 billion, slightly surpassing the $8.8 billion reported in March 2024. This reflects a year-over-year growth of nearly 9.5% from $8.1 billion in the same quarter last year.

➖ The EBITDA for the most recent June quarter reached $6.2 billion, indicating an almost 9% increase from $5.7 billion in the same quarter last year.

➖ In June, the diluted EPS saw a modest rise, climbing to $9.35 (LTM) from $8.94 (LTM) in March 2024, which represents a notable year-over-year increase of 18.6% from $30.3 (LTM).

2. Mastercard

● Year-over-Year

➖ Mastercard's revenue for FY23 experienced a robust growth of 12.9%, reaching $25.1 billion, up from $22.2 billion in FY22.

➖ The EBITDA for FY23 also increased, reporting $22.9 billion, up from $20.6 billion in FY22.

● Quarter-over-Quarter

➖ In the recent June quarter, Mastercard's revenue climbed to $7.0 billion, compared to $6.3 billion in March 2024. Year-over-year, this marks an increase of nearly 11% from $6.3 billion in the same quarter last year.

➖ The EBITDA for the latest June quarter was $4.4 billion, reflecting an almost 9% rise from $3.9 billion in March 2024.

➖ In June, the diluted EPS saw a slight increase, rising to $13.08 (LTM) from $12.59 (LTM) in March 2024, which is a significant year-over-year increase of 23% from $10.67 (LTM).

3. American Express

● Year-over-Year

➖ For the fiscal year 2023, the company experienced a remarkable revenue growth of 9.7%, reaching an impressive $55.6 billion, compared to $50.7 billion in fiscal year 2022.

➖ Additionally, operating income showed a positive trajectory, with fiscal year 2023 reporting $10.8 billion, an increase from $10 billion in the previous fiscal year.

● Quarter-over-Quarter

➖ In the latest June quarter, revenue continued its upward trend, totalling $15.1 billion, up from $14.5 billion in March 2024. This represents a significant year-over-year growth of nearly 8.7% from $13.9 billion in the June quarter of the previous year.

➖ Furthermore, operating income for the June quarter reached $3.2 billion, marking a substantial increase of almost 19% from $2.7 billion in the same quarter last year.

➖ The diluted earnings per share (EPS) also saw a remarkable rise in June, climbing to $13.39 (LTM) from $12.14 (LTM) in March 2024, which is a significant jump of 36% compared to $9.83 (LTM) in the same quarter last year.

◉ Valuation

● P/E Ratio

➖ Visa stands at a P/E ratio of 29.1x.

➖ Mastercard is at a P/E ratio of 38.7x.

➖ American Express shows a P/E ratio of 20.6x.

➖ When we analyze these figures, it becomes clear that American Express appears significantly undervalued compared to its peers.

● P/B Ratio

➖ Visa has a P/B ratio of 14.3x.

➖ Mastercard's P/B ratio is a staggering 64x.

➖ American Express, however, has a P/B ratio of just 6.8x.

This further reinforces the notion that American Express is currently undervalued in the market.

● PEG Ratio

➖ Visa's PEG ratio is 1.56.

➖ Mastercard's PEG stands at 1.71.

➖ American Express shines with a PEG ratio of just 0.56.

➖ This metric also highlights American Express's superior value proposition compared to its peers.

◉ Cash Flow Analysis

➖ Visa's operating cash flow for the fiscal year 2023 has risen to $20.8 billion, marking a notable increase from $18.8 billion in fiscal year 2022.

➖ Similarly, Mastercard has experienced growth in its operating cash flow, which has reached $12 billion in fiscal year 2023, up from $11.2 billion in the previous year.

➖ In contrast, American Express has reported a significant decline in its operating cash flow, decreasing from $21.1 billion in fiscal year 2022 to $18.6 billion in fiscal year 2023.

◉ Debt Analysis

1. Visa

● Debt to Equity Ratio: Approximately 0.52 as of June 2024, indicating a stable financial structure with moderate leverage.

● Total Debt: About $20.6 billion.

● Total Shareholder Equity: $39.7 billion.

● Analysis: Visa's ratio reflects a cautious debt approach, balancing equity and debt financing, with net debt well-supported by operating cash flow, enhancing financial stability.

2. Mastercard

● Debt to Equity Ratio: Approximately 2.10, indicating a higher reliance on debt compared to Visa 5.

● Total Debt: $15.6 billion.

● Total Shareholder Equity: $7.5 billion.

● Analysis: Mastercard’s higher ratio suggests it is more aggressive in leveraging debt for growth initiatives compared to Visa. This strategy may lead to greater volatility in earnings due to interest obligations.

3. American Express

● Debt to Equity Ratio: Approximately 1.80, indicating a significant level of debt relative to equity 5.

● Total Debt: $53.2 billion.

● Total Shareholder Equity: $29.54 billion.

● Analysis: American Express’s ratio shows a strong reliance on debt financing, which can enhance growth but also introduces risks related to interest payments and market conditions.

◉ Top Shareholders

1. Visa

● The Vanguard Group has notably boosted its investment in Visa, now commanding a remarkable 7.52% share, reflecting a 0.62% increase since the close of the March quarter.

● In contrast, Blackrock maintains a stake of approximately 6.7% in the firm.

2. Mastercard

● When it comes to Mastercard, Vanguard has also made strides, raising its ownership to an impressive 8.27%, which is a 1.02% uptick since the end of March.

● Blackrock, on the other hand, has a substantial 7.56% stake, showing a 1.17% growth from the same period.

3. American Express

● As for American Express, Warren Buffet’s Berkshire Hathaway boasts a significant 21.3% stake in the company.

● Meanwhile, Vanguard holds a 6.36% interest, while Blackrock has a 5.89% share.

◉ Conclusion

After a thorough analysis of both technical and financial indicators, we find that American Express offers a compelling valuation opportunity that is likely to attract investors. Nonetheless, it is important to recognize the significant debt load the company carries, a concern that also extends to Mastercard.

● From a technical standpoint, the chart for American Express seems to be stretched thin. Investors might want to hold off for a corrective dip to secure a more advantageous entry point.

● Mastercard's financial results reflect solid performance, though it carries a high level of debt. The technical chart indicates a slight overvaluation. Savvy investors might look to build their positions during times of price stabilization.

● Visa presents a well-rounded synergy between its technical and fundamental metrics. Its chart reveals a remarkable rebound, approaching previous all-time highs after a notable decline. The company's valuation and growth potential make it a compelling investment choice.

Mastercard May Rise to 519.00 - 526.00 (READ DESCRIPTION)Mastercard May Rise to 519.00 - 526.00

Pivot Point: 482

The pivot point at 482 is a crucial support level for Mastercard. As long as the stock price remains above this level, the outlook is bullish, indicating potential for upward movement. A drop below this level would signify a change in sentiment and a potential shift toward bearish pressure.

Primary Strategy (Our Preference):

Entry Point: Look for long positions as long as the price holds above the pivot point of 482.

Target Levels:

519.00: This target indicates a significant potential gain, suggesting that bullish momentum is strong enough to push prices higher. Achieving this target would reflect positive market sentiment towards Mastercard.

526.00: The next target represents further upside potential, reinforcing the bullish outlook if the stock can sustain its momentum.

Alternative Scenario:

If the stock falls below the pivot point at 482, traders should consider short positions.

Entry Point: Initiate short positions if the price breaks and remains below 482.

Target Levels:

470.00: This level marks the first downside target, indicating potential bearish momentum if selling pressure increases.

464.00: The next target level suggests a further decline, highlighting risks if the stock continues to trend downward.

Technical Outlook:

RSI Indicator: The RSI is above its neutral level at 50, indicating that bullish momentum is in play, as buying pressure exceeds selling pressure.

MACD Indicator: The MACD is positive but below its signal line, suggesting that while the current trend is bullish, there may be a potential retracement or consolidation in the short term.

Moving Averages: Mastercard is trading above both its 20-day and 50-day moving averages (respectively at 493.93 and 477.84), further confirming the positive outlook and suggesting the stock is in a bullish trend.

Market Dynamics:

As long as Mastercard holds above the pivot point of 482, there is significant potential for upward movement toward the target levels of 519.00 and 526.00.

If the price falls below the pivot, market sentiment could shift, leading to potential declines toward support levels of 470.00 and 464.00.

The pivot point at 482 is critical for maintaining a bullish outlook for Mastercard. Holding above this level opens the possibility for price increases toward 519.00 and 526.00.

Current technical indicators support the bullish sentiment, but traders should remain cautious for any signs of retracement, especially if the price breaches the pivot support.

MASTERCARD short-term weakness is a buy opportunity. Target $515Mastercard (MA) gave us an excellent sell signal on our last call (April 02, see chart below), reaching our exact Target ($440.00) before turning sideways and reach this way a Higher Low:

That Higher Low was a bottom on the 2-year Channel Up pattern that has been dominating the long-term price action of the stock. As you can see it hit the 1D MA200 (orange trend-line) and the 0.382 Fibonacci retracement level and has rebounded since, which is similar to the March 16 2023 Low.

The similarities are evident on this chart between the Bullish and Bearish Legs of the Channel Up and the Sine Waves help at giving us a sense of Highs and Lows. The 1D RSI sequences between the two main fractals are also similar and this shows that probably we are at a similar symmetrical level as on July 14 2023.

As a result, we expect a short-term pull-back towards the 1D MA50 (blue trend-line) and then final rally towards the elections for a Higher High around $515.00, which will be just below the -0.236 Fibonacci extension (similar to the September 14 2023 High). Then we expect the stock to yet again seek the bottom of the Channel Up near the 1W MA100 (red trend-line) at $460.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Looking Bullish Immediately on Mastercard!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

MA Mastercard Incorporated Options Ahead of EarningsIf you haven`t bought MA before the previous earnings:

Then analyzing the options chain and the chart patterns of MA Mastercard Incorporated prior to the earnings report this week,

I would consider purchasing the 457.5usd strike price Puts with

an expiration date of 2024-5-3,

for a premium of approximately $5.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Mastercard Adjusts Full-Year Revenue Forecast Stock Down 1.16%Mastercard Inc. ( NYSE:MA ) has revised its outlook for full-year revenue growth downwards, citing foreign exchange challenges as a primary factor impacting its projections. The payments giant anticipates net revenue growth to now align with the lower end of low double digits for 2024, a shift from its previous guidance targeting growth at the higher end of this range.

Chief Financial Officer Sachin Mehra highlighted the impact of foreign exchange dynamics, particularly the recent strengthening of the US dollar, as a significant headwind affecting the company's revenue outlook. Despite this adjustment, the outlook for net revenue growth on a currency-neutral basis, excluding acquisitions, remains consistent with prior forecasts, aiming for growth at the high end of low double digits.

Although shares of the company had shown resilience, climbing 5.8% year-to-date, they experienced a dip OF 1.33% following the announcement, reflecting investor concerns over the revised revenue forecast. Total network spending volume for the first quarter fell short of estimates, coming in at $2.29 trillion, below the expected $2.32 trillion.

However, Mastercard's ( NYSE:MA ) first-quarter adjusted earnings exceeded expectations, reaching $3.31 per share, surpassing the Bloomberg survey's average estimate of $3.23 per share. CEO Michael Miebach emphasized the company's positive momentum, driven by robust consumer spending, substantial cross-border volume growth, and successful deal wins across regions.

Mastercard's ( NYSE:MA ) performance mirrors that of its competitor Visa Inc., which also beat earnings estimates in the first quarter, reporting strong spending growth. Meanwhile, American Express Co. witnessed an 11% revenue jump during the same period.

One notable development during the quarter was Mastercard ( NYSE:MA ) and Visa's landmark antitrust settlement, which promises to cap credit card interchange fees and provide relief to merchants. This agreement, subject to court approval, is expected to yield significant savings for merchants over the coming years.

Mastercard Strategic Restructuring to Drive Innovation & GrowthIn a bold move aimed at fortifying its position as a global leader in payments technology, Mastercard ( NYSE:MA ) has announced a comprehensive reorganization of its internal structure. The company’s CEO, Michael Miebach, unveiled the ambitious plan, outlining a strategic vision that promises to revolutionize the way Mastercard operates and innovates in the ever-evolving landscape of digital transactions.

The cornerstone of this reorganization lies in the creation of three distinct but interconnected units, each helmed by seasoned industry veterans handpicked to lead Mastercard into its next phase of growth and diversification.

At the heart of this restructuring is the Core Payments unit, described by Mastercard as the very foundation of the company. Under the stewardship of Jorn Lambert, Mastercard’s chief digital officer, who assumes the role of chief product officer (CPO), this division will spearhead the evolution of core payments, leveraging cutting-edge technologies to enhance existing products and introduce groundbreaking solutions to meet the evolving needs of consumers and businesses alike.

In a strategic coup, Mastercard ( NYSE:MA ) has enlisted the expertise of former BlackRock executive Raj Seshadri to head up the Commercial and New Payment Flows unit. Elevated to the position of chief commercial payments officer, Seshadri will lead efforts to drive innovation in remittances, B2B transactions, and non-carded bill payments, while also focusing on expanding Mastercard’s footprint in key sectors such as healthcare.

Meanwhile, Craig Vosburg, who has served as Mastercard’s CPO for the past three years, will take the reins of the Services unit as chief services officer. Tasked with integrating Mastercard’s Cyber and Intelligence, Data and Services, and Open Banking teams, Vosburg’s mandate is clear: to fortify Mastercard’s defenses against fraud, mitigate risks, and bolster cybersecurity in an increasingly digital world.

But the company’s ambitions don’t stop there. In a testament to its commitment to harnessing the power of data and artificial intelligence (AI), Mastercard has established a dedicated Data and AI team. Under the leadership of Greg Ulrich, appointed as chief AI and data officer, this team will leverage AI and data analytics to drive innovation both internally and externally, with a focus on commercializing these technologies to unlock new revenue streams and propel Mastercard ( NYSE:MA ) into the future.

However, amidst the excitement of these transformative changes, Mastercard ( NYSE:MA ) bids farewell to one of its stalwarts. After more than three decades of service, Ajay Bhalla, President of Cyber and Intelligence, will retire, leaving behind a legacy of innovation and leadership that has shaped Mastercard’s cybersecurity efforts and positioned the company as a trailblazer in the fight against digital threats.

As Mastercard ( NYSE:MA ) prepares to embark on this journey of transformation, the stage is set for a new era of innovation, growth, and leadership in the world of payments technology.

MASTERCARD Short-term pull-back has begunLast time (August 23 2023, see chart below) we looked at Mastercard (MA) the 1D MA50 (blue trend-line) gave us a solid buy opportunity, which easily hit our 415.00 Target:

The price is now starting to pull-back after marginally breaking the top (Higher Highs trend-line) of the 1.5 year Channel Up (blue). It already broke below the medium-term (dotted) Channel Up and is headed towards the 1D MA50 (blue trend-line).

With the 1D RSI already on Lower Highs (i.e. a Bearish Divergence against the stock's Higher Highs), we believe this is an early Sell Signal on the short-term. The March 13 2023 Target was the 0.382 Fibonacci retracement level, so we are currently aiming for $440.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇