Hasboro | HAS | Long at $66.00Hasboro $NASDAQ:HAS. Bouncing in an out of the historical simple moving average (SMA). While it may take a bit for it to spring out and continue its upward trend, it looks poised to do so. However, there is a small price gap that was never closed in the $40's that investors should stay cautious of if the downward trend continues. But a "confirmation" of a reversal will be either a continued move up or a retest of the lower historical SMA band (to close the recent price gaps) followed by a further move up. Fundamentally, NASDAQ:HAS has a high level of debt, but earnings growth is forecasted in its future. At $66.00, $ NASDAQ:HAS is in a personal buy zone, but patient investors may wish to wait for further confirmation of a reversal.

Target #1 = $73.00

Target #2 = $81.00

Target #3 = $87.00

Target #4 = $119.00 (very long-term...)

MAT

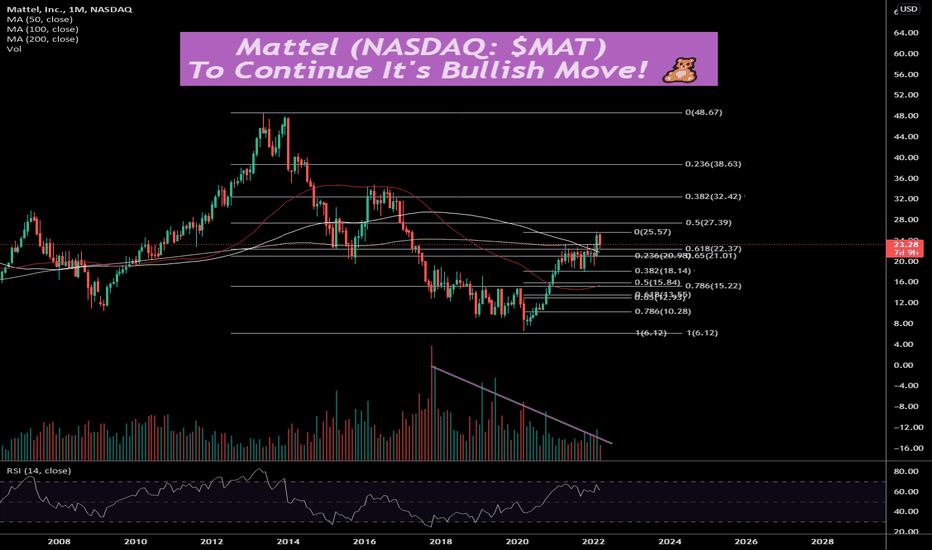

Mattel (NASDAQ: $MAT) To Continue It's Bullish Move! 🧸Mattel, Inc., a children's entertainment company, designs and produces toys and consumer products worldwide. The company operates through North America, International, and American Girl segments. It offers dolls and accessories, as well as content, gaming, and lifestyle products for children under the Barbie, Monster High, American Girl, Polly Pocket, Spirit, and Enchantimals brands; dolls and books under the American Girl brand name; die-cast vehicles, tracks, playsets, and accessories for kids of all ages, and collectors under the Hot Wheels, Monster Trucks, Matchbox, CARS, and Mario Kart brand names; and infant, toddler, and preschool products comprising content, toys, live events, and other lifestyle products under the Fisher-Price and Thomas & Friends, Power wheels, and Fireman Sam brands. The company also provides action figures, building sets, and games under the Masters of the Universe, MEGA, UNO, Lightyear, Jurassic World, WWE, and Star Wars brands; and licensor partner brands, including Disney, NBCUniversal, WWE, Microsoft, Nickelodeon, Warner Bros, and Sanrio. It sells its products directly to consumers through its catalog, website, and proprietary retail stores; retailers, including discount and free-standing toy stores, chain stores, department stores, and other retail outlets; and wholesalers, as well as through agents and distributors. Mattel, Inc. was founded in 1945 and is headquartered in El Segundo, California.

MAT strong buyHey folks, I hope you are all doing well!

MAT seems to be a really good buy both technically and fundamentally. The stock has been beating earnings and technical wise, it meets all of Mark Minervini's criteria for a bullish stock trade (on the weekly timeframe). We also see that the stock price has bounced from a long term resistance that's now support, so it seems like a really strong buy right now.

MAT big winner?MAT looks like it has been consolidating for awhile now and with the recent put sweep and selloff in the markets, it looks ready for lower. The $9 puts for 17Apr have 43k oi and look very good if we reach our final put target, as long as this stays in the box we should be good to go lower.

The Worst Looks To Be Over For $MAT$MAT is trading higher after delivering strong Q3 earnings and putting its accounting issue behind it. Here are the highlights from Q3:

Dolls sales were up 5% during the quarter off a double-digit jump in the Barbie business, while the vehicles category saw a 13% gain off a stellar quarter for Hot Wheels.

The company's adjusted gross margin rate improved 390 bps to 46.9% of sales to smash the consensus estimate of 42.6%.

Mattel (NASDAQ:MAT): Q3 Non-GAAP EPS of $0.26 beats by $0.07; GAAP EPS of $0.20 beats by $0.02.

Revenue of $1.48B (+2.8% Y/Y) beats by $40M.

On the accounting issue:

The positive news from Mattel is that the accounting investigation didn't find any fraud and the company is now free to go back to the debt market. During the earnings call, Mattel stated that it intends to refinance $250M worth of senior notes in a move that should lower costs.

As always, trade with caution and use protective stops.

Good luck to all!

TRADE IDEA: MAT APRIL 18TH 15/15/17 BIG LIZARDMetrics:

Max Profit: $223/contract ($56 at 25% max)

Max Theoretical Loss/Buying Power Effect: $1277 (stock goes to 0); $1277 cash secured; ~$300 on margin.

Break Even: 12.77/share (7.6% discount over current price if assigned on the 15 short put); no upside risk

Delta: 43.26 (bullish assumption)

Theta: 1.09

Notes: I wasn't happy with what my screener was showing me for things to play this coming week, so figured I'd scrounge around for a few underlyings with high implied volatility that have earnings in the rear view mirror. One of these is MAT (50/58), which got taken to the wood shed last week.

Pictured here is a "Big Lizard" (Who comes up with these names?) that consists of a short straddle and a long call where the width of the short call vertical aspect (the short call + the long call) is less than the total credit received for the entire setup. Put another way, the risk associated with the short call vertical aspect ($200, since it's a 2-wide) is less than the total credit received ($223) so that if the underlying takes off like a poo rocket and breaks through the long call, you can still make money to the extent that the total credit exceeds the width of the spread (2.23 - 2.00 = .23). Ideally, however, you want price to remain between your break even of 12.77 and the short straddle at 15.00.

Obvious alternative plays:

The April 18th 13 short put, .62 credit, break even of 12.37 (a discount of 10.5% over current price), delta 33.95, theta .81.

The April 18th 15 short straddle, 2.56 credit, break evens of 12.44/17.56 (a discount of 10% over current price if assigned on the 15), delta 22.67, theta 1.8.

MAT - Good Short SignalThere was a good short signal, after breaking through the resistance line and 200MA, and fastening below its level.

Such signals as this one are very strong in nature.

The GAP, which breaks through the resistance level of the channel and in addition opens below 200MA, is one of the strongest signals for shorts:

Given the general picture of this action, I see no reason to skip this signal.

Good Luck!

THE WEEK AHEAD: COST, BBRY, TEVA, MATEarnings

COST announces earnings on Thursday after market close. With a background implied volatility of 21%, it doesn't meet my basic earnings play sniff test, but naturally that can increase running into earnings, so it may be worth keeping an eye on.

Preliminarily, the Oct 20th 158/170 short strangle currently pays 2.21 at the mid with break evens around the 1 standard deviation line for both sides. The defined risk version of that play, a 155/158/170/173 iron condor, brings in 1.00, with break evens wide of the expected on both sides. (I looked at using the Oct 13th expiry to take maximum advantage of any vol contraction post-earnings, but strikes where I would want to set up my tent were less than ideal).

Non-Earnings

Post-earnings, BBRY implied volatility remains fairly high at 46.25%, placing it in the upper one quarter of the where it's been over the past 52 weeks. Given the size of the underlying, the only play that makes sense from a nondirectional standpoint is a Nov 17th 11 short straddle, which is paying 1.24 at the mid with break evens at 9.75 and 12.25.

The generic drug maker TEVA's implied is at 51.31%, which is around the middle of its range over the past 52. It's not quite where I'd like to see it, and the Nov 17th 15/20 short strangle is only paying .80 at the mid with break evens short of the 1 standard deviation line In contrast, the Nov 17th 17.5 short straddle is paying 2.46 with break evens wide of the expected on both sides, but the comparable iron fly -- a Nov 17th 12.5/17.5/17.5/22.5 only pays 2.20, short of the one-quarter of the width of the longs I like to get out of those. For those looking to strategically acquire shares or to just sell directional premium, the 30 delta Nov 10th 16 short put is paying .52 at the mid with a break even of 15.48.

Toy maker MAT has the right rank/implied metrics here, but with earnings a mere 17 days out, the preference is wait to put on a play shortly before earnings to take maximum advantage of vol contraction.

Exchange-Traded Funds

These are my bread and butter trades, but there's little bread and no butter here. The highest implied volatility exchange traded fund is EWZ at 31.43%, but it's in the lower one-fourth of where it's been over the past year. GDXJ follows with 29.93%; XOP, 25.96%; GDX, 23.25%; and OIH, 24.21%, all at the bottom end of their ranges and, in any event, below 35% implied generally.

VIX et al.

VIX finished Friday at sub-10 levels and its "little buddies" (VXX, UVXY, SVXY) continue to be cannibalized by contango. Sit on your hands for any VIX "Term Structure" trade (the first /VX future trading at >16 is in April) and wait for a VXST/VIX ratio pop to greater than 1.15 (Friday finish: 83.6) to put on plays in VXX, UVXY, and/or SVXY.

Continuing MATTEL's growthWith the formation of local and continuing long trend there are 2 potential buying signals:

1. Flag

2. Volume divergence

Recommendation is to buy

Entry point 33.00 (breakout of top flag's line)

Stop-loss: less risky 30.00 (turning to this support level breaks long-vision)

more risky 32.20 (-6 tics 32.26 current flag's low point)

Target pirice 40.00 (according to sizing and Elliot's waves methods of target prognosis)

JAKK - expecting rally on earnings releaseJAKK has very decent fundamentals. The whole industry seems to be doing okay, leaving JAKK lagging behind.

If we look at all earnings releases in the past 3 years, they work the same way:

1) if there's a strong prior move up, the stock crashes on earnings release (even if it beats expectations 6-20%)

2) If there's a strong prior move down, the stock rallies on earnings release (again, almost regardless of hit/miss on estimates)

The Q2 earnings release had a scenario very similar to what's happening right before Monday's Q3 release - long rally up, sharp retracement, then flat and big rally on earnings release. As you can see in the chart, it's in the same setup and if they print a decent number, we should be going up.

Mattel, Inc. (NASDAQ:MAT) Gets Frozen By Disney (NYSE:DIS)Since the beginning of the year, Mattel, Inc. (NASDAQ:MAT) one of the largest manufacturers of toys has seen its stock price decline from the highs of $47.00, to a closing print this past Friday of $30.81. Mattel's recent earnings report was not well received by Wall Street. Over the past few days the decline accelerated after Mattel, Inc. (NASDAQ:MAT) lost Licensing Rights to The Walt Disney Company (NYSE:DIS) popular movie Frozen to Hasbro, Inc. (NASDAQ:HAS). This fall represents a decline of over 30% for Mattel, Inc. (NASDAQ:MAT). Making it a clear under performer, and sending investors running for the exit. But like any other equity there is always opportunity for a trade.

Let's take a look at the charts as they will reveal the best place to enter this trade...

Mattel, Inc. (NASDAQ:MAT) is nearing a key level of technical support, in an oversold condition. As technical traders, it is our job to isolate and identify these levels before anyone else. Doing so will enable us to be positioned on the right side of the trade before anyone else.

I have isolated the $29.00 level for a long play on Mattel, Inc. (NASDAQ:MAT), however, this is only a third of the job. Next, we will need to align Pattern and Time with this price level, to make it a high rate of success trade. I will be monitoring this equity over the coming week. As soon as the time is right to enter this trade, I will issue an alert to our Elite Round Table members for what could be a rebound of over 7% in shares of Mattel, Inc. (NASDAQ:MAT). Be ready for the action!

Kiliam Lopez

Elite Round Table

@kiliamLopez