Bumble | BMBL | Long at $8.34Arguably, Bumble NASDAQ:BMBL , Match NASDAQ:MTCH , and Grindr NYSE:GRND have an enormous amount of *highly* valuable data on its past and current users. Like any industry, it often simply takes time for this recognition by market makers to occur before price aligns with the "true" future value. If you are an AGI company looking to enhance user companionship with machines and AI bots, these companies hold the keys.

NASDAQ:BMBL has low debt, paying users are still growing (caution if recession begins), and revenue is rising. Personally, the value is in the company's data.

From a technical analysis perspective, my historical simple moving average lines are working their way toward the price. Often, this means a rise in price as the lines flatten and then inevitably rise with the trend reversal. However, I would not be surprised if there were some shakeouts in the near-term if the price suddenly dropped near $5 post-earnings, etc. Regardless, it will personally likely be an opportunity to gather more shares. Thus, at $8.34, NASDAQ:BMBL is in a personal buy-zone.

Target #1 = $12.00

Target #2 = $15.00

Target #3 = $22.00

Match

Match Group | MTCH | Long at $32.00Match Group NASDAQ:MTCH is finally at an attractive valuation with ~13 P/E after a stunning rise that started in 2017. The amount of data this company has on its users in such a particular niche will be highly valuable as the world moves toward AI and AI matchmaking. Once large investors realize this, I (personally) feel this stock will 3x or more in the coming 2-5 years. However, it could be a bumpy road to get there since right now earnings growth is stagnant.

From a technical analysis perspective, the price was approaching its historical overall simple moving average (SMA, green and white lines). Typically, the closer the price gets to this SMA, there a jump to touch it and consolidate. After the most recent earnings drop, I believe it may be priming / consolidating itself further for a move up (although a dip to $25-$26 wouldn't surprise me). Thus, at $32.00, NASDAQ:MTCH is in a personal buy zone.

Target #1 - $37.00

Target #2 - $43.00

Target #3 - $50.00

Target #4 - $62.00

Match Group Faces Gen Z Challenge Stock up by 3%Match Group (NASDAQ: NASDAQ:MTCH ) finds itself at a pivotal juncture as it grapples with the shifting dynamics of the dating scene, particularly among Generation Z. Analysts at Raymond James suggest that Match ( NASDAQ:MTCH ) must adapt its strategies to resonate with Gen Z's preferences, a demographic known for its distinct approach to relationships and social interactions.

Catering to Gen Z Preferences:

With the emergence of Generation Z, characterized by a penchant for meaningful connections over casual encounters, Match Group ( NASDAQ:MTCH ) must realign its offerings to cater to evolving preferences. While Tinder soared to prominence with its swipe-based mechanics, Gen Z favors a slower-paced approach to dating, often seeking connections within their existing social circles. Match's Hinge app, with its focus on fostering deeper relationships, appears better poised to resonate with Gen Z, offering a potential avenue for growth in this demographic.

Challenges of Brand Identity and AI Threats:

Despite efforts to refresh Tinder's brand and features, Match Group ( NASDAQ:MTCH ) faces challenges in altering the entrenched identity of the app. Furthermore, the rise of artificial intelligence poses a threat through the proliferation of fake profiles and scams, necessitating vigilance and investment in platform monitoring to safeguard user experience and mitigate churn rates.

Changing Dating Landscape and Lower Engagement Trends:

Recent surveys highlight shifting attitudes toward dating among Gen Z, with a significant percentage prioritizing other commitments over romantic relationships. Factors such as digital entertainment preferences and a preference for real-life connections over online encounters contribute to lower engagement levels in the dating sphere.

Technical Outlook:

Despite the challenges, Match Group ( NASDAQ:MTCH ) continues to demonstrate resilience by surging 3.11% in Tuesday market trading with a Relative Strength Index (RSI) of 49.69. indicating no overbought position. NASDAQ:MTCH three-month chart shows signs of a Symmetrical Triangle pattern about to surge to a new resistance level.

Match Group (NASDAQ: $MTCH): Love The Dating Brand's Setup! 🏹 Match Group, Inc. provides dating products worldwide. The company's portfolio of brands includes Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime, as well as a various other brands. The company was incorporated in 1986 and is based in Dallas, Texas.

Interesting view on MOMOI picked the timeframe of the superior uptrend and downtrend of Momo and draw the same sideways formation before the big jump 2015-16.

And what a surprise, there are similarities about the price action.

1. IPO prices sinks

2. Rises back

…and so on

Momo is a free social search and instant messaging mobile app for Millions of Chinese people. The app allows users to chat with nearby friends and strangers. You could compare them with the dating platform Tinder (Match Group inc.) the only bigger difference would be that they are not really profitable.

I still believe that Chinese stocks are very risky. But if this goes as it is indicating us, it is a worth a shot.

MTCH: SETTING UP for a breakMATCH is at an attractive level for a short.

BUT

- be patient for a set up.

- there has been signs of exhaustion, first on April 27, second on May 8, and third on may 22, however,

- the first one has been reversed May 5

- the second one has been reversed on May 18

- and the third one has not been coupled with the RIGHT price action, and was above the important support level.

- the first two were actionable, meaning that I would have traded them, but I hadn't been closely watching until the third sign.

- If I had, it would have been a very small loss, but I would consider them good trades.

The current price has reached a strong resistance, but this should never be the sole reason to short.

I am waiting for a sign of exhaustion to short, may it be a divergence, a price action, or my custom indicator.

But there is no need to get involved just yet.

Swedish Match needs a breatherI expect $SWMA to retrace quite a bit, it looks exhausted.

The steep rise from dec lows in correlation to world indices was coupled with low volume, looking for support at green zone.

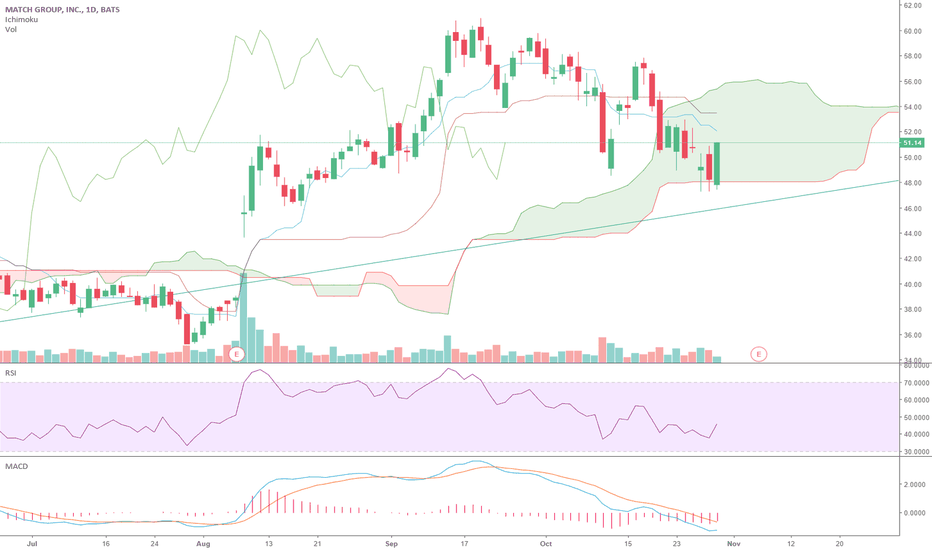

Short, Medium & Long Term $MTCH Long$MTCH is in a new channel between $48 and $60\

Powerful moving stock with alot of growth potential, one of the highest returning stocks the last 2 years, averaging 100% growth per year

MACD is beginning to Cross from a relatively low position with RSI in its mid range.

A similar setup was before the spike of $38 to $50 and then its range in the $50s

Short Term target of $58

Long term this stock has alot of room to grow, with a MCAP of only $16B and it seeming like a large CAP company in the making

Dangers to watch out for is compition from FB new dating service, yet i dont think this will pose a great risk as i dont think people would want to mix their facebook and dating profiles.

Strong support at $48

STOP LOSS $46

TARGET 1 $55 (30%)

TARGET 2 $58 (20 %)

LEAVE REMAINING 50% TO RIDE POTENTIAL LARGE CAP GROWTH

MTCH: Online Dating leader setting up long entry after FB scareMTCH: Online Dating leader Match.com took a nosedive with the announcement that Facebook will begin competing in its space. The technicals suggest a good buying opportunity is setting up as the major correction of the high degree 3 completes.